Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Couchbase, the Santa Clara-based company behind the eponymous NoSQL cloud database service, today announced that it has raised a $105 million all-equity Series G round “to expand product development and global go-to-market capabilities.”

The oversubscribed round was led by GPI Capital, with participation from existing investors Accel, Sorenson Capital, North Bridge Venture Partners, Glynn Capital, Adams Street Partners and Mayfield. With this, the company has now raised a total of $251 million, according to Crunchbase.

Back in 2016, Couchbase raised a $30 million down round, which at the time was meant to be the company’s last round before an IPO. That IPO hasn’t materialized, but the company continues to grow, with 30% of the Fortune 100 now using its database. Couchbase also today announced that, over the course of the last fiscal year, it saw 70% total contract value growth, more than 50% new business growth and over 35% growth in average subscription deal size. In total, Couchbase said today, it is now seeing almost $100 million in committed annual recurring revenue.

“To be competitive today, enterprises must transform digitally, and use technology to get closer to their customers and improve the productivity of their workforces,” Couchbase President and CEO Matt Cain said in today’s announcement. “To do so, they require a cloud-native database built specifically to support modern web, mobile and IoT applications. Application developers and enterprise architects rely on Couchbase to enable agile application development on a platform that performs at scale, from the public cloud to the edge, and provides operational simplicity and reliability. More and more, the largest companies in the world truly run their businesses on Couchbase, architecting their most business-critical applications on our platform.”

The company is playing in a large but competitive market, with the likes of MongoDB, DataStax and all the major cloud vendors vying for similar customers in the NoSQL space. One feature that has always made Couchbase stand out is Couchbase Mobile, which extends the service to the cloud. Like some of its competitors, the company has also recently placed its bets on the Kubernetes container orchestration tools with, for example the launch of its Autonomous Operator for Kubernetes 2.0. More importantly, though, the company also introduced its fully managed Couchbase Cloud Database-as-a-Service in February, which allows businesses to run the database within their own virtual private cloud on public clouds like AWS and Microsoft Azure.

“We are excited to partner with Couchbase and view Couchbase Server’s highly performant, distributed architecture as purpose-built to support mission-critical use cases at scale,” said Alex Migon, a partner at GPI Capital and a new member of the company’s board of directors. “Couchbase has developed a truly enterprise-grade product, with leading support for cutting-edge application development and deployment needs. We are thrilled to contribute to the next stage of the company’s growth.”

The company tells me that it plans to use the new funding to continue its “accelerated trajectory with investment in each of their three core pillars: sustained differentiation, profitable growth, and world class teams.” Of course, Couchbase will also continue to build new features for its NoSQL server, mobile platform and Couchbase Cloud — in addition, the company will continue to expand geographically to serve its global customer operations.

Powered by WPeMatico

Autonomous aviation startup Xwing locked in a $10 million funding round before COVID-19 hit. Now the San Francisco-based startup is using the capital to hire talent and scale the development of its software stack as it aims for commercial operations later this year — pending FAA approvals.

The company announced Wednesday its Series A funding round, which was led by R7 Partners, with participation from early-stage VC Alven, Eniac Ventures and Thales Corporate Ventures. Xwing has already hired several key executives with that fresh injection of capital, including Terrafugia’s former co-founder and COO Anna Dietrich, and Ed Lim, a Lockheed Martin and Aurora Flight Sciences veteran who more recently led guidance navigation and control for Uber’s autonomous car division as well as Zipline’s AV delivery drone.

Xwing is different from some of the other autonomous aviation startups that have popped up in recent years. The startup isn’t building autonomous helicopters and planes. Instead, it’s focused on the software stack that will enable pilotless flight of small passenger aircraft.

Xwing is also aircraft agnostic. The company’s engineers are focused on the key functions of autonomous flight, such as sensing, reasoning and control. The software stack, which is designed to work across different kinds of aircraft, is integrated into existing aerospace systems. That strategy of retrofitting existing aircraft will speed up deployment, while maintaining safety and keeping costs in check, according to founder and CEO Marc Piette. It also is a straighter path toward regulatory approval.

“It’s more effective for us to not constrain ourselves to a given vehicle and to develop technology that is considered more of an enabler— from a marketing perspective — than going full stack, Piette said when asked if Xwing would ever try to build an autonomous aircraft from the ground up.

Since Xwing’s last funding round — $4 million in summer 2018 — the company has been developing its tech and working with the FAA to receive flight certification for pilotless aircraft. Once approved, the company will seek to commercialize pilotless flights.

The startup hasn’t named any commercial partners yet. And Piette hasn’t provided details about its commercial strategy either, although he said to expect more announcements this year.

Xwing is already working with Bell for NASA’s Unmanned Aircraft Systems (UAS in the NAS) program, an initiative meant to mature the key remaining technologies that are needed to integrate unmanned aircraft in U.S. airspace. The program plans to hold demonstration flights this summer.

Powered by WPeMatico

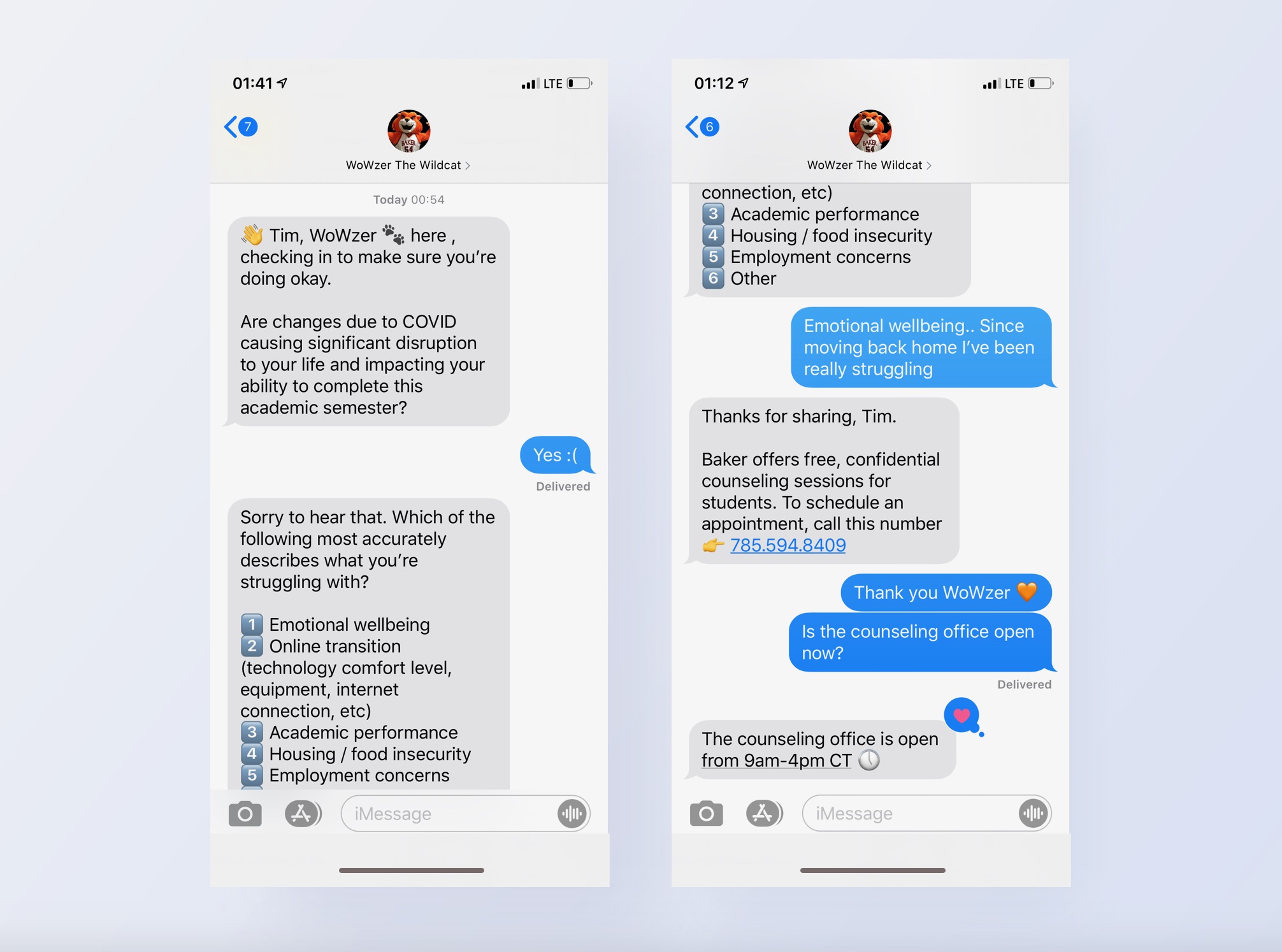

While the idea of baring your soul to a chatbot might seem uncomfortable, sisters Claudia and Carolina Recchi think that might be exactly what college students across the United States need right now.

The duo co-founded EdSights in 2017 to support high and medium-risk students to stay in school, and increase university retention rates.

EdSights uses a chatbot, branded under a school’s mascot, to send personalized questions and messages to students to understand their biggest stresses. It then connects them to university resources spanning areas like financial aid, food security and mental health.

As the pandemic has forced millions of students to move off campus and learn from home, the co-founders have found a spurt of growth from colleges looking for new ways to hold onto their students.

And the pandemic has added a new layer of honesty to the answers.

“There is just so much going on with the world, people losing jobs and barely being able to make ends meet. School hardly seems pressing at the moment,” one student wrote. “And yet, grades are still there, determining our future when we aren’t even sure what the future looks like.”

Another wrote, “My work is closed. I have no income.” One said, “Because I am not going out I can’t distract myself from all the things going on in my life.”

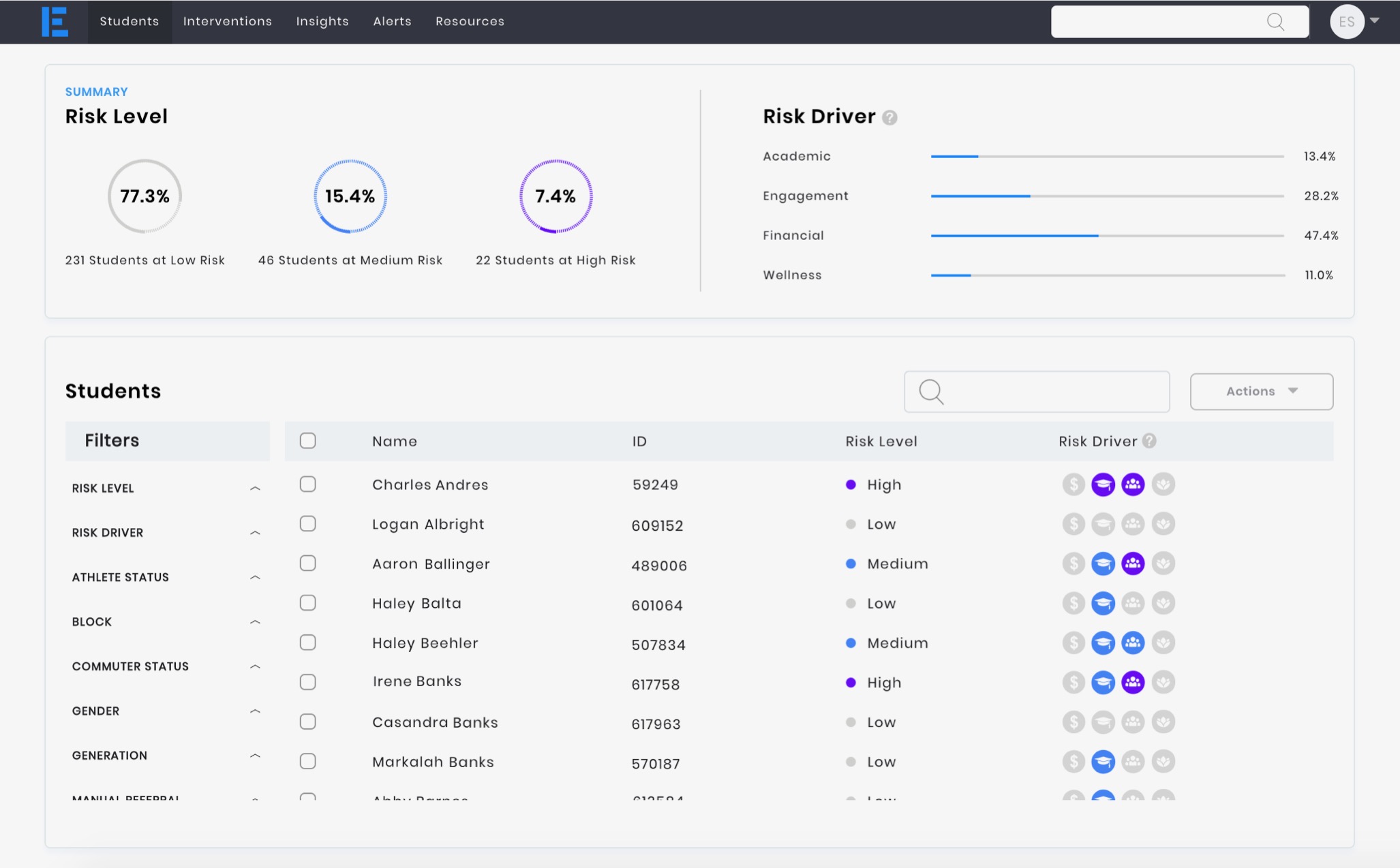

Beyond its chatbot, EdSights has a dashboard for administrators to see what percentage of their students are struggling with specific issues at the moment. The company deals with information on high-risk students and their biggest worries, so privacy is key to their platform. EdSights says it complies with both FERPA and GDPR regulation, and does not rent or sell data to third parties. Students also have the right to request an amendment of their records and receive a full log of it.

“Obviously, universities are also spooked that students won’t show up in the fall,” she said. “So they want to make sure that there’s a connectivity and they feel connected to the university, even if they can’t go to campus.”

The company took one year to scale to 16 customers, including Baker University, Missouri Western State, Bethel University, Culver Stockton College and Westminster College. On average its ARR has been growing by 66% month over month, and it has doubled its revenue since February.

EdSights charges colleges $15 to $25 per student. Most customers bring on their entire student body.

“Before this, we did see a lot of universities asking, ‘can I roll this out to freshmen or can I only roll it out to my first-generation students or maybe those that need additional support?’ ” said Carolina Recchi. “Now, colleges are not only asking us to help with all four years, but we’ve had some institutions ask us to roll it out to graduate students, which was new, because we had never done that before.”

This newfound momentum led the co-founders to raise $1.6 million in venture capital funding from a slew of high-profile investors. Investors from this round include Lakehouse VC, Kairos VC and The Fund.

The new raise also includes investments from Warby Parker, Harry’s, Allbirds, Bonobos and Rent the Runway founders.

The EdSights co-founders say COVID-19 played a part in their company receiving inbound interest from generalist investors, who have been historically skeptical about the space, versus solely getting term-sheets from specialist education firms. In fact, the duo had to turn down a number of investors, a stark difference between the chilling effect other founders claim has covered the entire fundraising scene.

EdSights new funding is another data point of how the pandemic is forcing the general public to be more nuanced in how it thinks about the intersection of education and technology.

In the time of a pandemic, a chatbot could be the only way to remotely support millions of students. Now, it’s just up to EdSights to prove that their technology is necessary in a world where schools start to reopen, whenever that is.

Powered by WPeMatico

Strapi, the company behind the popular open-source headless CMS also called Strapi, has raised a $10 million Series A round led by Index Ventures. The company previously raised a $4 million seed round led by Accel and Stride.vc in October 2019.

Strapi is a headless content management system, which means that the back end and the front end operate totally separately. You can run Strapi on your own server and write content and pages for your site by connecting to Strapi’s admin interface.

After that, the front-end part of your application can fetch content from your Strapi instance using an API and display it to your customers and readers.

There are many advantages in separating the front end from the back end. First, it gives you a ton of flexibility when it comes to displaying your content. You can use a popular front-end framework, such as React, Vue and Angular, or develop your own custom front end.

When you want to update the design of your site, you can just switch from one front end to another with Strapi running like usual behind the scene.

Similarly, it offers more flexibility when it comes to server architecture. For instance, you could also leverage Strapi to build static websites and distribute them using a content delivery network, such as Cloudflare or AWS CloudFront. You could imagine using Gatsby combined with a CDN to deploy your site on the edge. Most of your traffic will go through your CDN instead of hitting your servers directly.

Additionally, Strapi can be used to distribute content to different front ends. For instance, you could use a Strapi instance for the content of your website and your mobile app.

Strapi proves that eventually everything becomes an API. Sure, a headless CMS is probably overkill for most projects. But if you’re running a large-scale application, Strapi can fit nicely in your architecture. Companies using Strapi include IBM, NASA and Walmart.

Many well-known open-source business angels have also invested in Strapi, such as Augusto Marietti and Marco Palladino from Kong, David Cramer from Sentry, Florian Douetteau from Dataiku, Solomon Hykes from Docker, Guillermo Rauch from Cloudup, Socket.io, Next.js and Zeit.co, and Eli Collins from Cloudera.

Powered by WPeMatico

Brainbase, the rights management platform that’s helping Hollywood studios manage the licensing rights to their cultural icons, has picked up another $8 million in financing.

Behind every popular story is an attempt to make money off of it, and Brainbase helps Hollywood find new ways to make money off of consumer tastes.

The money came from new investors Bessemer Venture Partners and Nosara Capital, with participation from previous investors Alpha Edison, Struck Capital, Bonfire Ventures and FJ Labs. Individual investors include Spencer Lazar, Michael Stoppelman (the former senior vice president of engineering at Yelp), Jenny Fleiss (co-founder of Rent the Runway) and David Fraga (president of InVision).

The Los Angeles-based company said the new money would be used to build a payments feature to speed up the process of wringing payments from licensees and to continue building its Marketplace product that connects celebrities, athletes and social media stars of all stripes with new and emerging brands.

“We need to stay focused on building the best platform for brands that own and license their IP,” said Brainbase co-founder and CEO Nate Cavanaugh, in a statement. “With a strong bench of investors and advisors who believe in our vision to make the intellectual property industry more open, efficient and accessible, we are prepared for our next stage of growth. In 2020, Brainbase plans to nearly double in size, making key hires across sales, product, and engineering in the U.S. and Europe.”

The new financing comes as Brainbase brings new brands and spokespeople into the fold, including BuzzFeed, the model-turned-shopping network celebrity and brand ambassador extraordinaire Kathy Ireland, MDR Brand Management and Bonnier. These new branding megaliths join a roster that includes Sanrio, the owner of the ubiquitous Hello Kitty character.

“Brainbase is bringing the archaic, paper shuffling world of IP management into the 21st century. We’re thrilled to partner with this team as they help owners of IP assets capture more value while saving a boatload of time and effort,” stated Kent Bennett, partner at Bessemer Venture Partners.

Powered by WPeMatico

Directly, a startup whose mission is to help build better customer service chatbots by using experts in specific areas to train them, has raised more funding as it opens up a new front to grow its business: APIs and a partner ecosystem that can now also tap into its expert network. Today Directly is announcing that it has added $11 million to close out its Series B at $51 million (it raised $20 million back in January of this year, and another $20 million as part of the Series B back in 2018).

The funding is coming from Triangle Peak Partners and Toba Capital, while its previous investors in the round included strategic backers Samsung NEXT and Microsoft’s M12 Ventures (who are both customers, alongside companies like Airbnb), as well as Industry Ventures, True Ventures, Costanoa Ventures and Northgate. (As we reported when covering the initial close, Directly’s valuation at that time was at $110 million post-money, and so this would likely put it at $120 million or higher, given how the business has expanded.)

While chatbots have now been around for years, a key focus in the tech world has been how to help them work better, after initial efforts saw so many disappointing results that it was fair to ask whether they were even worth the trouble.

Directly’s premise is that the most important part of getting a chatbot to work well is to make sure that it’s trained correctly, and its approach to that is very practical: find experts both to troubleshoot questions and provide answers.

As we’ve described before, its platform helps businesses identify and reach out to “experts” in the business or product in question, collect knowledge from them, and then fold that into a company’s AI to help train it and answer questions more accurately. It also looks at data input and output into those AI systems to figure out what is working, and what is not, and how to fix that, too.

The information is typically collected by way of question-and-answer sessions. Directly compensates experts both for submitting information as well as to pay out royalties when their knowledge has been put to use, “just as you would in traditional copyright licensing in music,” its co-founder Antony Brydon explained to me earlier this year.

It can take as little as 100 experts, but potentially many more, to train a system, depending on how much the information needs to be updated over time. (Directly’s work for Xbox, for example, used 1,000 experts but has to date answered millions of questions.)

Directly’s pitch to customers is that building a better chatbot can help deflect more questions from actual live agents (and subsequently cut operational costs for a business). It claims that customer contacts can be reduced by up to 80%, with customer satisfaction by up to 20%, as a result.

What’s interesting is that now Directly sees an opportunity in expanding that expert ecosystem to a wider group of partners, some of which might have previously been seen as competitors. (Not unlike Amazon’s AI powering a multitude of other businesses, some of which might also be in the market of selling the same services that Amazon does).

The partner ecosystem, as Directly calls it, use APIs to link into Directly’s platform. Meya, Percept.ai, and SmartAction — which themselves provide a range of customer service automation tools — are three of the first users.

“The team at Directly have quickly proven to be trusted and invaluable partners,” said Erik Kalviainen, CEO at Meya, in a statement. “As a result of our collaboration, Meya is now able to take advantage of a whole new set of capabilities that will enable us to deliver automated solutions both faster and with higher resolution rates, without customers needing to deploy significant internal resources. That’s a powerful advantage at a time when scale and efficiency are key to any successful customer support operation.”

The prospect of a bigger business funnel beyond even what Directly was pulling in itself is likely what attracted the most recent investment.

“Directly has established itself as a true leader in helping customers thrive during these turbulent economic times,” said Tyler Peterson, Partner at Triangle Peak Partners, in a statement. “There is little doubt that automation will play a tremendous role in the future of customer support, but Directly is realizing that potential today. Their platform enables businesses to strike just the right balance between automation and human support, helping them adopt AI-powered solutions in a way that is practical, accessible, and demonstrably effective.”

In January, Mike de la Cruz, who took over as CEO at the time of the funding announcement, said the company was gearing up for a larger Series C in 2021. It’s not clear how and if that will be impacted by the current state of the world. But in the meantime, as more organizations are looking for ways to connect with customers outside of channels that might require people to physically visit stores, or for employees to sit in call centres, it presents a huge opportunity for companies like this one.

“At its core, our business is about helping customer support leaders resolve customer issues with the right mix of automation and human support,” said de la Cruz in a statement. “It’s one thing to deliver a great product today, but we’re committed to ensuring that our customers have the solutions they need over the long term. That means constantly investing in our platform and expanding our capabilities, so that we can keep up with the rapid pace of technological change and an unpredictable economic landscape. These new partnerships and this latest expansion of our recent funding round have positioned us to do just that. We’re excited to be collaborating with our new partners, and very thankful to all of our investors for their support.”

Powered by WPeMatico

When I spoke to Robert Ross, CEO and co-founder at FireHydrant, we had a technology adventure. First the audio wasn’t working correctly on Zoom, then Google Meet. Finally we used cell phones to complete the interview. It was like a case study in what FireHydrant is designed to do — help companies manage incidents and recover more quickly when things go wrong with their services.

Today the company announced an $8 million Series A from Menlo Ventures and Work-Bench. That brings the total raised to $9.5 million, including the $1.5 million seed round we reported on last April.

In the middle of a pandemic with certain services under unheard of pressure, understanding what to do when your systems crash has become increasingly important. FireHydrant has literally developed a playbook to help companies recover faster.

These run books are digital documents that are unique to each company and include what to do to help manage the recovery process. Some of that is administrative. For example, certain people have to be notified by email, a Jira ticket has to be generated and a Slack channel opened to provide a communications conduit for the team.

While Ross says you can’t define the exact recovery process itself because each incident tends to be unique, you can set up an organized response to an incident and that can help you get to work on the recovery much more quickly. That ability to manage an incident can be a difference maker when it comes to getting your system back to a steady state.

Ross is a former site reliability engineer (SRE) himself. He has experienced the kinds of problems his company is trying to solve, and that background was something that attracted investor Matt Murphy from Menlo Ventures.

“I love his authentic perspective, as a former SRE, on the problem and how to create something that would make the SRE function and processes better for all. That value prop really resonated with us in a time when the shift to online is accelerating and remote coordination between people tasked with identifying and fixing problems is at all time high in terms of its importance. Ultimately we’re headed toward more and more automation in problem resolution and FH helps pave the way,” Murphy told TechCrunch.

It’s not easy being an early-stage company in the current climate, but Ross believes his company has created something that will resonate, perhaps even more right now. As he says, every company has incidents, and how you react can define you as a company. Having tooling to help you manage that process helps give you structure at a time you need it most.

Powered by WPeMatico

Khatabook, a startup that is helping small businesses in India record financial transactions digitally and accept payments online with an app, has raised $60 million in a new financing round as it looks to gain more ground in the world’s second most populous nation.

The new financing round, Series B, was led by Facebook co-founder Eduardo Saverin’s B Capital. A range of other new and existing investors, including Sequoia India, Partners of DST Global, Tencent, GGV Capital, RTP Global, Hummingbird Ventures, Falcon Edge Capital, Rocketship.vc and Unilever Ventures, also participated in the round, as did Facebook’s Kevin Weil, Calm’s Alexander Will, CRED’s Kunal Shah and Snapdeal co-founders Kunal Bahl and Rohit Bansal.

The one-and-a-half-year-old startup, which closed its Series A financing round in October last year and has raised $87 million to date, is now valued between $275 million to $300 million, a person familiar with the matter told TechCrunch.

Hundreds of millions of Indians came online in the last decade, but most merchants — think of neighborhood stores — are still offline in the country. They continue to rely on long notebooks to keep a log of their financial transactions. The process is also time-consuming and prone to errors, which could result in substantial losses.

Khatabook, as well as a handful of young and established players in the country, is attempting to change that by using apps to allow merchants to digitize their bookkeeping and also accept payments.

Today more than 8 million merchants from over 700 districts actively use Khatabook, its co-founder and chief executive Ravish Naresh told TechCrunch in an interview.

“We spent most of last year growing our user base,” said Naresh. And that bet has worked for Khatabook, which today competes with Lightspeed -backed OkCredit, Ribbit Capital-backed BharatPe, Walmart’s PhonePe and Paytm, all of which have raised more money than Khatabook.

The Khatabook team poses for a picture (Khatabook)

According to mobile insight firm AppAnnie, Khatabook had more than 910,000 daily active users as of earlier this month, ahead of Paytm’s merchant app, which is used each day by about 520,000 users, OkCredit with 352,000 users, PhonePe with 231,000 users and BharatPe, with some 120,000 users.

All of these firms have seen a decline in their daily active users base in recent months as India enforced a stay-at-home order for all its citizens and shut most stores and public places. But most of the aforementioned firms have only seen about 10-20% decline in their usage, according to AppAnnie.

Because most of Khatabook’s merchants stay in smaller cities and towns that are away from large cities and operate in grocery stores or work in agritech — areas that are exempted from New Delhi’s stay-at-home orders, they have been less impacted by the coronavirus outbreak, said Naresh.

Naresh declined to comment on AppAnnie’s data, but said merchants on the platform were adding $200 million worth of transactions on the Khatabook app each day.

In a statement, Kabir Narang, a general partner at B Capital who also co-heads the firm’s Asia business, said, “we expect the number of digitally sophisticated MSMEs to double over the next three to five years. Small and medium-sized businesses will drive the Indian economy in the era of COVID-19 and they need digital tools to make their businesses efficient and to grow.”

Khatabook will deploy the new capital to expand the size of its technology team as it looks to build more products. One such product could be online lending for these merchants, Naresh said, with some others exploring to solve other challenges these small businesses face.

Amit Jain, former head of Uber in India and now a partner at Sequoia Capital, said more than 50% of these small businesses are yet to get online. According to government data, there are more than 60 million small and micro-sized businesses in India.

India’s payments market could reach $1 trillion by 2023, according to a report by Credit Suisse .

Powered by WPeMatico

One vote.

That’s all it needed for a bipartisan Senate amendment to pass that would have stopped federal authorities from further accessing millions of Americans’ browsing records. But it didn’t. One Republican was in quarantine, another was AWOL. Two Democratic senators — including former presidential hopeful Bernie Sanders — were nowhere to be seen and neither returned a request for comment.

It was one of several amendments offered up in the effort to reform and reauthorize the Foreign Intelligence Surveillance Act, the basis of U.S. spying laws. The law, signed in 1978, put restrictions on who intelligence agencies could target with their vast listening and collection stations. But after the Edward Snowden revelations in 2013, lawmakers champed at the bit to change the system to better protect Americans, who are largely protected from the spies within its borders.

One privacy-focused amendment, brought by Sens. Mike Lee and Patrick Leahy, passed — permits for more independent oversight to the secretive and typically one-sided Washington, D.C. court that authorizes government surveillance programs, the Foreign Intelligence Surveillance Court. That amendment all but guarantees the bill will bounce back to the House for further scrutiny.

Here’s more from the week.

A feature-length profile in Wired magazine looks at the life of Marcus Hutchins, one of the heroes who helped stop the world’s biggest cyberattack three years to the day.

The profile — a 14,000-word cover story — examines his part in halting the spread of the global WannaCry ransomware attack and how his early days led him into a criminal world that prompted him to plead guilty to felony hacking charges. Thanks in part to his efforts in saving the internet, he was sentenced to time served and walked free.

Powered by WPeMatico

With a large proportion of knowledge workers doing now doing their jobs from home, the need for tools to help them feel connected to their profession can be as important as tools to, more practically, keep them connected. Today, a company that helps do precisely that is announcing a growth round of funding after seeing engagement on its platform triple in the last month.

GO1.com, an online learning platform focused specifically on professional training courses (both those to enhance a worker’s skills as well as those needed for company compliance training), is today announcing that it has raised $40 million in funding, a Series C that it plans to use to continue expanding its business. The startup was founded in Brisbane, Australia and now has operations also based out of San Francisco — it was part of a Y Combinator cohort back in 2015 — and more specifically, it wants to continue growth in North America, and to continue expanding its partner network.

GO1 not disclosing its valuation but we are asking. It’s worth pointing out that not only has it seen engagement triple in the last month as companies turn to online learning to keep users connected to their professional lives even as they work among children and house pets, noisy neighbours, dirty laundry, sourdough starters, and the rest (and that’s before you count the harrowing health news we are hit with on a regular basis). But even beyond that, longer term GO1 has shown some strong signs that speak of its traction.

It counts the likes of the University of Oxford, Suzuki, Asahi and Thrifty among its 3,000+ customers, with more than 1.5 million users overall able to access over 170,000 courses and other resources provided by some 100 vetted content partners. Overall usage has grown five-fold over the last 12 months. (GO1 works both with in-house learning management systems or provides its own.)

“GO1’s growth over the last couple of months has been unprecedented and the use of online tools for training is now undergoing a structural shift,” said Andrew Barnes, CEO of GO1, in a statement. “It is gratifying to fill an important void right now as workers embrace online solutions. We are inspired about the future that we are building as we expand our platform with new mediums that reach millions of people every day with the content they need.”

The funding is coming from a very strong list of backers: it’s being co-led by Madrona Venture Group and SEEK — the online recruitment and course directory company that has backed a number of edtech startups, including FutureLearn and Coursera — with participation also from Microsoft’s venture arm M12; new backer Salesforce Ventures, the investing arm of the CRM giant; and another previous backer, Our Innovation Fund.

Microsoft is a strategic backer: GO1 integrated with Teams, so now users can access GO1 content directly via Microsoft’s enterprise-facing video and messaging platform.

“GO1 has been critical for business continuity as organizations navigate the remote realities of COVID-19,” said Nagraj Kashyap, Microsoft Corporate Vice President and Global Head of M12, in a statement. “The GO1 integration with Microsoft Teams offers a seamless learning experience at a time when 75 million people are using the application daily. We’re proud to invest in a solution helping keep employees learning and businesses growing through this time.”

Similarly, Salesforce is also coming in as a strategic, integrating this into its own online personal development products and initiatives.

“We are excited about partnering with GO1 as it looks to scale its online content hub globally. While the majority of corporate learning is done in person today, we believe the new digital imperative will see an acceleration in the shift to online learning tools. We believe GO1 fits well into the Trailhead ecosystem and our vision of creating the life-long learner journey,” said Rob Keith, Head of Australia, Salesforce Ventures, in a statement.

Working remotely has raised a whole new set of challenges for organizations, especially those whose employees typically have never before worked for days, weeks and months outside of the office.

Some of these have been challenges of a more basic IT nature: getting secure access to systems on the right kinds of machines and making sure people can communicate in the ways that they need to to get work done.

But others are more nuanced and long-term but actually just as important, such as making sure people remain in a healthy state of mind about work. Education is one way of getting them on the right track: professional development is not only useful for the person to do her or his job better, but it’s a way to motivate people, to focus their minds, and take a rest from their routines, but in a way that still remains relevant to work.

GO1 is absolutely not the only company pursuing this opportunity. Others include Udemy and Coursera, which have both come to enterprise after initially focusing more on traditional education plays. And LinkedIn Learning (which used to be known as Lynda, before LinkedIn acquired it and shifted the branding) was a trailblazer in this space.

For these, enterprise training sits in a different strategic place to GO1, which started out with compliance training and onboarding of employees before gravitating into a much wider set of topics that range from photography and design, through to Java, accounting, and even yoga and mindfulness training and everything in between.

It’s perhaps the directional approach, alongside its success, that have set GO1 apart from the competition and that has attracted the investment, which seems to have come ahead even of the current boost in usage.

“We met GO1 many months before COVID-19 was on the tip of everyone’s tongue and were impressed then with the growth of the platform and the ability of the team to expand their corporate training offering significantly in North America and Europe,” commented S. Somasegar, managing director, Madrona Venture Group, in a statement. “The global pandemic has only increased the need to both provide training and retraining – and also to do it remotely. GO1 is an important link in the chain of recovery.” As part of the funding Somasegar will join the GO1 board of directors.

Notably, GO1 is currently making all COVID-19 related learning resources available for free “to help teams continue to perform and feel supported during this time of disruption and change,” the company said.

Powered by WPeMatico