Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Bonusly, a platform that involves the entire organization in recognizing employees and rewarding them, closed on a $9 million Series A financing round led by Access Venture Partners. Next Frontier Capital, Operator Partners and existing investor FirstMark Capital also participated in the round.

Bonusly launched in 2013 when co-founder and CEO Raphael Crawford-Marks saw the opportunity to reinvent the way employers and colleagues recognize and reward their employees/coworkers.

“I knew that, in order to be successful, companies would be shifting their approach to employee experience and I thought software could enable that shift,” said Crawford-Marks. “Bonusly was this elegant idea of empowering employees to give each other timely, frequent and meaningful recognition that would not only benefit employees because they would feel recognized but also surface previously hidden information to the entire company about who was working with whom and on what and what strengths they were bringing to the workplace.”

Most employers use year-end bonuses and performance reviews to motivate workers, with some employers providing some physical rewards.

Bonusly thinks recognition should happen year-round. The platform works with the employers on their overall budget for recognition and rewards, and breaks that down into “points” that are allotted to all employees at the organization.

These employees can give out points to other co-workers, whether they’re direct reports or managers or peers, at any time throughout the year. Those points translate to a monetary value that can be redeemed by the employee at any time, whether it’s through PayPal as a cash reward or with one of Bonusly’s vendor partners, including Amazon, Tango Card and Cadooz. Bonusly also partners with nonprofit organizations to let employees redeem their points via charitable donation.

In fact, Crawford-Marks noted that Bonusly users just crossed the $500,000 mark for total donations, and have donated more than $100,000 to the WHO in six weeks.

Bonusly integrates with several collaboration platforms, including Gmail and Slack, to give users the flexibility to give points in whatever venue they choose. Bonusly also has a feed, not unlike social media sites like Twitter, that shows in real time employees who have received recognition.

The company has also built in some technical features to help with usability. For example, Bonusly understands the social organization of a company, surfacing the most relevant folks in the point feed based on who employees have given or received points to/from in the past. In a company with tens of thousands of employees, this keeps Bonusly relevant.

Bonusly has also incorporated tools for employers, including an auto-scale button for employers with workers in multiple jurisdictions or companies. The button allows employers to scale up or down the point allotments in different geographies based on cost of living.

There are also privacy controls on Bonusly that allow high-level employees and leadership to give each other recognition for projects that may not be widely known about at the company yet, like say for an acquisition that was completed.

Bonusly says that peer-to-peer recognition is more powerful than manager-only recognition, saying it’s nearly 36% more likely to have better financial outcomes.

The company also cites research that says that a happy workforce raises business productivity by more than 30%.

Bonusly competes with Kazoo and Motivocity, and Crawford-Marks says that the biggest differentiation factor is participation.

“We set a very high bar for how we measure participation and engagement in the platform,” he said. “You’ll see other companies claiming really high participation rates, but typically if you dig into that they’re talking about getting recognition every six months or every year or just logging in, rather than giving recognition every single month, month over month.”

He noted that 75% of employees on average give recognition in the first month of deployment with an organization, and that number gradually increases over time. By the two-year mark, 80% of employees are giving recognition every month.

Bonusly has raised a total of nearly $14 million in funding since inception.

Powered by WPeMatico

When this editor first met Jeremy Conrad, it was in 2014, at the 8,000-square-foot former fish factory that was home to Lemnos, a hardware-focused venture firm that Conrad had co-founded three years earlier.

Conrad — who as a mechanical engineering undergrad at MIT worked on self-driving cars, drones and satellites — was still excited about investing in hardware startups, having just closed a small new fund even while hardware was very unfashionable (and remains challenging). One investment his team made around that time was in Airware, a company that made subscription-based software for drones and attracted meaningful buzz and $118 million in venture funding before shutting down in 2018.

By then, Conrad had already moved on — though not from his love of hardware. He instead decided in late 2017 that a nascent team that was camping out at Lemnos was onto a big idea relating to the future of construction. Conrad didn’t have a background in real estate or, at the time, a burning passion for the industry. But the “more I learned about it — not dissimilar to when I started Lemnos — it felt like there was a gap in the market, an opportunity that people were missing,” says Conrad from his home in San Francisco, where he has hunkered down throughout the COVID-19 crisis.

Enter Quartz, Conrad’s now 1.5-year-old, 14-person company, which quietly announced $7.75 million in Series A funding earlier this month, led by Baseline Ventures, with Felicis Ventures, Lemnos and Bloomberg Beta also participating.

What it’s selling to real estate developers, project managers and construction supervisors is really two things, which is safety and information.

Here’s how it works: Using off-the-shelf hardware components that are reassembled in San Francisco and hardened (meaning secured to reduce vulnerabilities), the company incorporates its machine-learning software into this camera-based platform, then mounts the system onto cranes at construction sites. From there, the system streams 4K live feeds of what’s happening on the ground, while also making sense of the action.

Say dozens of concrete-pouring trucks are expected on a construction site. The cameras, with their persistent view, can convey through a dashboard system whether and when the trucks have arrived and how many, says Conrad. It can determine how many people on are on a job site, and whether other deliveries have been made, even if not with a high degree of specificity.

“We can’t say [to project managers] that 1,000 screws were delivered, but we can let them know whether the boxes they were expecting were delivered and where they were left,” he explains.

It’s an especially appealing proposition in the age of coronavirus, as the technology can help convey information that’s happening at a site that’s been shut down, or even how closely employees are gathered.

Conrad says the technology also saves on time by providing information to those who might not otherwise be able to access it. Think of the developer on the 50th floor of the skyscraper that he or she is building, or even the crane operator who is perhaps moving a two-ton object and has to rely on someone on the ground to deliver directions but can enjoy far more visibility with the aid of a multi-camera set-up.

Quartz, which today operates in California but is embarking on a nationwide rollout, was largely inspired by what Conrad was seeing in the world of self-driving. From sensors to self-perception systems, he knew the technologies would be even easier to deploy at construction sites, and he believed it could make them safer, too. Indeed, like cars, construction sites are highly dangerous. According to the Occupational Safety and Health Administration, of the worker fatalities in private industry in 2018, more than 20% were in construction.

Conrad also saw an opportunity to take on established companies like Trimble, a 42-year-old, publicly traded, Sunnyvale, Calif.-based company that sells a portfolio of tools to the construction industry and charges top dollar for them. Quartz is meanwhile charging $2,000 per month per crane for its series of cameras, their installation, a live stream and “lookback” data, though this may well rise as its adds features.

It’s a big enough opportunity that, perhaps unsurprisingly, Quartz is not alone in chasing it. Last summer, for example, Versatile, an Israeli-based startup with offices in San Francisco and New York City, raised $5.5 million in seed funding from Germany’s Robert Bosch Venture Capital and several other investors for a very similar platform, though it uses sensors mounted under the hook of a crane to provide information about what’s happening below. Construction Dive, a media property that’s dedicated to the industry, highlights many other, similar and competitive startups in the space, too.

Still, Quartz has Conrad, who isn’t just any founding CEO. Not only does he have that background in engineering, but having launched a venture firm and spent years as an investor may also serve him well. He thinks a lot about the payback period on its hardware, for example.

Unlike a lot of founders, he even says he loves the fundraising process. “I get the highest-quality feedback from some of the smartest people I know, which really helps focus your vision,” says Conrad, who says that Quartz, which operates in California today, is now embarking on a nationwide rollout.

“When you talk with great VCs, they ask great questions. For me, it’s the best free consulting you can get.”

Powered by WPeMatico

Edtech is booming, but a short while ago, many companies in the category were struggling to break through as mainstream offerings. Now, it seems like everyone is clamoring to get into the next seed-stage startup that has the phrase “remote learning” on its About page.

And so begins the normal cycle that occurs when a sector gets overheated — boom, bust and a reckoning. While we’re still in the early days of edtech’s revitalization, it isn’t a gold mine all around the world. Today, in the spirit of balance and history, I’ll present three bearish takes I’ve heard on edtech’s future.

Quizlet’s CEO Matthew Glotzbach says that when students go back to school, the technology that “sticks” during this time of massive experimentation might not be bountiful.

“I think the dividing line there will be there are companies that have been around, that are a little more entrenched, and have good financial runway and can probably survive this cycle,” he said. “They have credibility and will probably get picked [by schools].” The newer companies, he said, might get stuck with adoption because they are at a high degree of risk, and might be giving out free licenses beyond their financial runway right now.

Powered by WPeMatico

Vast monoculture farms outstripped the ability of bee populations to pollinate them naturally long ago, but the techniques that have arisen to fill that gap are neither precise nor modern. Israeli startup BeeHero aims to change that by treating hives both as living things and IoT devices, tracking health and pollination progress practically in real time. It just raised a $4 million seed round that should help expand its operations into U.S. agriculture.

Honeybees are used around the world to pollinate crops, and there has been growing demand for beekeepers who can provide lots of hives on short notice and move them wherever they need to be. But the process has been hamstrung by the threat of colony collapse, an increasingly common end to hives, often as the result of mite infestation.

Hives must be deployed and checked manually and regularly, entailing a great deal of labor by the beekeepers — it’s not something just anyone can do. They can only cover so much land over a given period, meaning a hive may go weeks between inspections — during which time it could have succumbed to colony collapse, perhaps dooming the acres it was intended to pollinate to a poor yield. It’s costly, time-consuming, and decidedly last-century.

So what’s the solution? As in so many other industries, it’s the so-called Internet of Things. But the way CEO and founder Omer Davidi explains it, it makes a lot of sense.

“This is a math game, a probabilistic game,” he said. “We’ve modeled the problem, and the main factors that affect it are, one, how do you get more efficient bees into the field, and two, what is the most efficient way to deploy them?”

Normally this would be determined ahead of time and monitored with the aforementioned manual checks. But off-the-shelf sensors can provide a window into the behavior and condition of a hive, monitoring both health and efficiency. You might say it puts the API in apiculture.

Normally this would be determined ahead of time and monitored with the aforementioned manual checks. But off-the-shelf sensors can provide a window into the behavior and condition of a hive, monitoring both health and efficiency. You might say it puts the API in apiculture.

“We collect temperature, humidity, sound, there’s an accelerometer. For pollination, we use pollen traps and computer vision to check the amount of pollen brought to the colony,” he said. “We combine this with microclimate stuff and other info, and the behaviors and patterns we see inside the hives correlate with other things. The stress level of the queen, for instance. We’ve tested this on thousands of hives; it’s almost like the bees are telling us, ‘we have a queen problem.’ ”

All this information goes straight to an online dashboard where trends can be assessed, dangerous conditions identified early and plans made for things like replacing or shifting less or more efficient hives.

The company claims that its readings are within a few percentage points of ground truth measurements made by beekeepers, but of course it can be done instantly and from home, saving everyone a lot of time, hassle and cost.

The results of better hive deployment and monitoring can be quite remarkable, though Davidi was quick to add that his company is building on a growing foundation of work in this increasingly important domain.

“We didn’t invent this process, it’s been researched for years by people much smarter than us. But we’ve seen increases in yield of 30-35% in soybeans, 70-100% in apples and cashews in South America,” he said. It may boggle the mind that such immense improvements can come from just better bee management, but the case studies they’ve run have borne it out. Even “self-pollinating” (i.e. by the wind or other measures) crops that don’t need pollinators show serious improvements.

The platform is more than a growth aid and labor saver. Colony collapse is killing honeybees at enormous rates, but if it can be detected early, it can be mitigated and the hive potentially saved. That’s hard to do when time from infection to collapse is a matter of days and you’re inspecting biweekly. BeeHero’s metrics can give early warning of mite infestations, giving beekeepers a head start on keeping their hives alive.

“We’ve seen cases where you can lower mortality by 20-25%,” said Davidi. “It’s good for the farmer to improve pollination, and it’s good for the beekeeper to lose less hives.”

“We’ve seen cases where you can lower mortality by 20-25%,” said Davidi. “It’s good for the farmer to improve pollination, and it’s good for the beekeeper to lose less hives.”

That’s part of the company’s aim to provide value up and down the chain, not just a tool for beekeepers to check the temperatures of their hives. “Helping the bees is good, but it doesn’t solve the whole problem. You want to help whole operations,” Davidi said. The aim is “to provide insights rather than raw data: whether the queen is in danger, if the quality of the pollination is different.”

Other startups have similar ideas, but Davidi noted that they’re generally working on a smaller scale, some focused on hobbyists who want to monitor honey production, or small businesses looking to monitor a few dozen hives versus his company’s nearly 20,000. BeeHero aims for scale both with robust but off-the-shelf hardware to keep costs low, and by focusing on an increasingly tech-savvy agriculture sector here in the States.

“The reason we’re focused on the U.S. is the adoption of precision agriculture is very high in this market, and I must say it’s a huge market,” Davidi said. “Eighty percent of the world’s almonds are grown in California, so you have a small area where you can have a big impact.”

The $4 million seed round’s investors include Rabo Food and Agri Innovation Fund, UpWest, iAngels, Plug and Play, and J-Ventures.

BeeHero is still very much also working on R&D, exploring other crops, improved metrics and partnerships with universities to use the hive data in academic studies. Expect to hear more as the market grows and the need for smart bee management starts sounding a little less weird and a lot more like a necessity for modern agriculture.

Powered by WPeMatico

We may be in the thick of a pandemic with all of the economic fallout that comes from that, but certain aspects of technology don’t change, no matter the external factors. Storage is one of them. In fact, we are generating more digital stuff than ever, and Wasabi, a Boston-based startup that has figured out a way to drive down the cost of cloud storage, is benefiting from that.

Today it announced a $30 million Series B led led by Forestay Capital, the technology innovation arm of Waypoint Capital, with help from previous investors. As with the previous round, Wasabi is going with home office investors, rather than traditional venture capital firms. Today’s round brings the total raised to $110 million, according to the company.

While founder and CEO David Friend wouldn’t discuss the specific valuation, he did say it was in the hundreds of millions of dollars.

Friend says the company needs the funds to keep up with the rapid growth. “We’ve got about 15,000 customers today, hundreds of petabytes of storage, 2,500 channel partners, 250 technology partners — so we’ve been busy,” he said.

He says that revenue continues to grow in spite of the impact of COVID-19 on other parts of the economy. “Revenue grew 5x last year. It’ll probably grow 3.5x this year. We haven’t seen any real slowdown from the coronavirus. Quarter over quarter growth will be in excess of 40% — this quarter over Q1 — so it’s just continuing on a torrid pace,” he said.

The challenge for a company like Wasabi, which is looking to capture a large chunk of the growing cloud storage market, is the infrastructure piece. It needs to keep building more to meet increasing demand, while keeping costs down, which remains its primary value proposition with customers.

The money will be used mostly to continue to expand its growing infrastructure requirements. The more they store, the more data centers they need, and that takes money. It will also help the company expand into new markets where countries have data sovereignty laws that require data to be stored in-country.

The company launched in 2015. It previously raised $68 million in 2018.

Note: This article originally stated this was a debt financing round. The company has clarified that it is an equity round.

Powered by WPeMatico

London-based Greyparrot, which uses computer vision AI to scale efficient processing of recycling, has bagged £1.825 million (~$2.2M) in seed funding, topping up the $1.2M in pre-seed funding it had raised previously. The latest round is led by early stage European industrial tech investor Speedinvest, with participation from UK-based early stage b2b investor, Force Over Mass.

The 2019 founded startup — and TechCrunch Disrupt SF battlefield alum — has trained a series of machine learning models to recognize different types of waste, such as glass, paper, cardboard, newspapers, cans and different types of plastics, in order to make sorting recycling more efficient, applying digitization and automation to the waste management industry.

Greyparrot points out that some 60% of the 2BN tonnes of solid waste produced globally each year ends up in open dumps and landfill, causing major environmental impact. While global recycling rates are just 14% — a consequence of inefficient recycling systems, rising labour costs, and strict quality requirements imposed on recycled material. Hence the major opportunity the team has lit on for applying waste recognition software to boost recycling efficiency, reduce impurities and support scalability.

By embedding their hardware agnostic software into industrial recycling processes Greyparrot says it can offer real-time analysis on all waste flows, thereby increasing efficiency while enabling a facility to provide quality guarantee to buyers, mitigating against risk.

Currently less than 1% of waste is monitored and audited, per the startup, given the expensive involved in doing those tasks manually. So this is an application of AI that’s not so much taking over a human job as doing something humans essentially don’t bother with, to the detriment of the environment and its resources.

Greyparrot’s first product is an Automated Waste Monitoring System which is currently deployed on moving conveyor belts in sorting facilities to measure large waste flows — automating the identification of different types of waste, as well as providing composition information and analytics to help facilities increase recycling rates.

It partnered with ACI, the largest recycling system integrator in South Korea, to work on early product-market fit. It says the new funding will be used to further develop its product and scale across global markets. It’s also collaborating with suppliers of next-gen systems such as smart bins and sorting robots to integrate its software.

“One of the key problems we are solving is the lack of data,” said Mikela Druckman, co-founder & CEO of Greyparrot in a statement. “We see increasing demand from consumers, brands, governments and waste managers for better insights to transition to a more circular economy. There is an urgent opportunity to optimise waste management with further digitisation and automation using deep learning.”

“Waste is not only a massive market — it builds up to a global crisis. With an increase in both world population and per capita consumption, waste management is critical to sustaining our way of living. Greyparrot’s solution has proven to bring down recycling costs and help plants recover more waste. Ultimately it unlocks the value of waste and creates a measurable impact for the environment,” added Marie-Hélène Ametsreiter, lead partner at Speedinvest Industry, in another statement.

Greyparrot is sitting pretty in another aspect — aligning with several strategic areas of focus for the European Union, which has made digitization of legacy industries, industrial data sharing, investment in AI, plus a green transition to a circular economy core planks of its policy plan for the next five+ years. Just yesterday the Commission announced a €750BN pan-EU support proposal to feed such transitions as part of a wider coronavirus recovery plan for the trading bloc.

Powered by WPeMatico

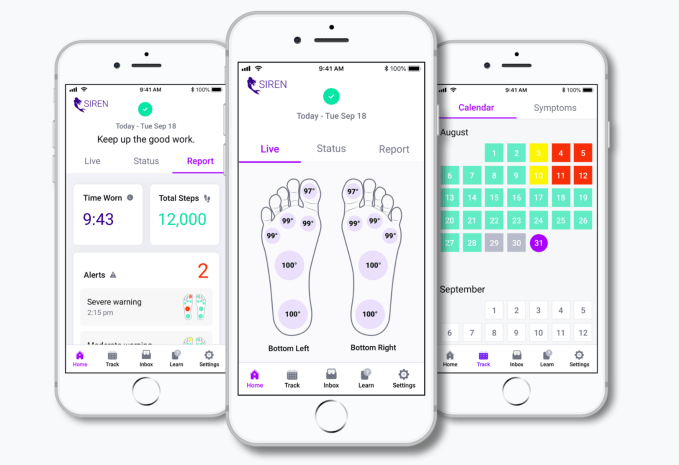

Can a pair of socks help those with diabetes avoid foot amputations?

That’s one of the ideas behind Siren, a company that’s building smart, washable fabric wearables — the first of which is a pair of socks meant to help those with diabetes monitor their foot health and detect dangerous injuries early. They’ve just raised an $11.8 million Series B to help get it done.

The round was led by Anathem Ventures, and backed by Khosla, DCM and Founders Fund. As part of the raise, DCM’s Jason Krikorian (co-founder of Slingbox maker Sling Media) will be joining Siren’s board.

Siren co-founder Ran Ma tells me that amputations in patients with diabetes are largely the result of injuries that go undetected for too long. Over time, diabetes can cause nerve damage; when this nerve damage impacts the feet, patients can develop injuries and ulcers without noticing — out of sight, out of mind. Left untreated, these injuries can grow worse or become infected to the point that amputation is required. Tens of thousands of these amputations occur each year in the U.S. alone.

Siren’s socks help detect injuries that might otherwise go unnoticed by monitoring the temperature of six regions of the wearer’s foot. If one region seems to be getting considerably warmer than those around it, it could indicate ongoing inflammation caused by an injury. The socks can connect to the patient’s phone via Bluetooth to help them keep an eye on their feet — and, importantly, that information is beamed to their doctors, who can keep an eye out for red flags.

That last bit is particularly key right now. With the ongoing COVID-19 pandemic, many are avoiding doctors offices and hospitals in fear of being exposed to the virus; meanwhile, many offices have been limiting their more routine/less urgent or “non-essential” appointments — including, in this case, routine foot exams. Siren’s socks let a patient’s doctors monitor their foot health from afar.

We first met Siren back in 2017 when the company won the TechCrunch Hardware Battlefield at CES. Since then, the company has raised around $22 million in funding; this $11.8 million Series B, a previously undisclosed $6.5 million Series A in 2018 and a $3.4 million seed round.

Ran Ma tells me that they’ve made Siren Socks available in 10 states so far, with plans to expand nationwide by the end of this year.

Powered by WPeMatico

Otrium has raised a $26 million Series B funding round (€24 million), with Eight Roads Ventures leading the round. Existing investors Index Ventures and Hans Veldhuizen also participated. Otrium works with clothing brands to help them sell items when they reach the end-of-season status.

Due to fast fashion, you have to regularly clear some space in your stores and recover inventory from third-party stores to release new items. But end-of-season sales aren’t enough. Brands end up with a lot of inventory on their hand. And those items often get destroyed.

Otrium wants to add another sales channel for those specific items — and it’s an online one, which should help when it comes to shelf space. Lockdowns around the world have also generated more excess inventory for the spring-summer 2020 collections.

Fashion brands don’t want to sell outdated items on their own site because scarcity creates value. First, customers should check regularly with their favorite fashion brand to see what they’re selling right now. Second, fashion brands don’t want you to see that you could wait a few months to get an item for cheap.

That’s why Otrium has created a marketplace and tries to be as friendly as possible with fashion brands. If you decide to sell end-of-season collections on Otrium, you can manage your own outlet, get in-depth analytics and enable a dynamic pricing engine to maximize revenue on those outdated items.

Two hundred brands have decided to partner with Otrium, such as Joseph, Reiss, G-Star, Asics, Puma, Vans, Pepe Jeans, Alexachung and Scotch & Soda. There are one million registered customers on Otrium.

The e-commerce website is currently live in the Netherlands, France and Germany. It just launched its site in the U.K. as well. With today’s funding round, you can expect more international expansions in the future.

Powered by WPeMatico

RudderStack, a startup that offers an open-source alternative to customer data management platforms like Segment, today announced that it has raised a $5 million seed round led by S28 Capital. Salil Deshpande of Uncorrelated Ventures and Mesosphere/D2iQ co-founder Florian Leibert (through 468 Capital) also participated in this round.

In addition, the company also today announced that it has acquired Blendo, an integration platform that helps businesses transform and move data from their data sources to databases.

Like its larger competitors, RudderStack helps businesses consolidate all of their customer data, which is now typically generated and managed in multiple places — and then extract value from this more holistic view. The company was founded by Soumyadeb Mitra, who has a Ph.D. in database systems and worked on similar problems previously when he was at 8×8 after his previous startup, MairinaIQ, was acquired by that company.

Mitra argues that RudderStack is different from its competitors thanks to its focus on developers, its privacy and security options and its focus on being a data warehouse first, without creating yet another data silo.

“Our competitors provide tools for analytics, audience segmentation, etc. on top of the data they keep,” he said. “That works well if you are a small startup, but larger enterprises have a ton of other data sources — at 8×8 we had our own internal billing system, for example — and you want to combine this internal data with the event stream data — that you collect via RudderStack or competitors — to create a 360-degree view of the customer and act on that. This becomes very difficult with the SaaS-hosted data model of our competitors — you won’t be sending all your internal data to these cloud vendors.”

Part of its appeal, of course, is the open-source nature of RudderStack, whose GitHub repository now has more than 1,700 stars for the main RudderStack server. Mitra credits getting on the front page of HackerNews for its first sale. On that day, it received over 500 GitHub stars, a few thousand clones and a lot of signups for its hosted app. “One of those signups turned out to be our first paid customer. They were already a competitor’s customer, but it wasn’t scaling up so were looking to build something in-house. That’s when they found us and started working with us,” he said.

Because it is open source, companies can run RudderStack anyway they want, but like most similar open-source companies, RudderStack offers multiple hosting options itself, too, that include cloud hosting, starting at $2,000 per month, with unlimited sources and destination.

Current users include IFTTT, Mattermost, MarineTraffic, Torpedo and Wynn Las Vegas.

As for the Blendo acquisition, it’s worth noting that the company only raised a small amount of money in its seed round. The two companies did not disclose the price of the acquisition.

“With Blendo, I had the opportunity to be part of a great team that executed on the vision of turning any company into a data-driven organization,” said Blendo founder Kostas Pardalis, who has joined RudderStack as head of Growth. “We’ve combined the talented Blendo and RudderStack teams together with the technology that both companies have created, at a time when the customer data market is ripe for the next wave of innovation. I’m excited to help drive RudderStack forward.”

Mitra tells me that RudderStack acquired Blendo instead of building its own version of this technology because “it is not a trivial technology to build — cloud sources are really complicated and have weird schemas and API challenges and it would have taken us a lot of time to figure it out. There are independent large companies doing the ETL piece.”

Powered by WPeMatico

Toro’s founders started at Uber helping monitor the data quality in the company’s vast data catalogs, and they wanted to put that experience to work for a more general audience. Today, the company announced a $4 million seed round.

The round was co-led by Costanoa Ventures and Point72 Ventures, with help from a number of individual investors.

Company co-founder and CEO Kyle Kirwan says the startup wanted to bring to data the kind of automated monitoring we have in applications performance monitoring products. Instead of getting an alert when the application is performing poorly, you would get an alert that there is an issue with the data.

“We’re building a monitoring platform that helps data teams find problems in their data content before that gets into dashboards and machine learning models and other places where problems in the data could cause a lot of damage,” Kirwan told TechCrunch.

When it comes to data, there are specific kinds of issues a product like Toro would be looking at. It might be a figure that falls outside of a specific dollar range that could be indicative of fraud, or it could be simply a mistake in how the data was labeled that is different from previous ways that could break a model.

The founders learned the lessons they used to build Toro while working on the data team at Uber. They had helped build tools there to find these kinds of problems, but in a way that was highly specific to Uber. When they started Toro, they needed to build a more general-purpose tool.

The product works by understanding what it’s looking at in terms of data, and what the normal thresholds are for a particular type of data. Anything that falls outside of the threshold for a particular data point would trigger an alert, and the data team would need to go to work to fix the problem.

Casey Aylward, vice president at Costanoa Ventures, likes the pedigree of this team and the problem it’s trying to solve. “Despite its importance, data quality has remained a challenge for many enterprise companies,” she said in a statement. She added, “[The co-founders] deep experience building several of Uber’s internal data tools makes them uniquely qualified to build the best solution.”

The company has been at this for just over a year and has been keeping it lean with four employees, including the two co-founders, but they do have plans to add a couple of data scientists in the coming year as they continue to build out the product.

Powered by WPeMatico