Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

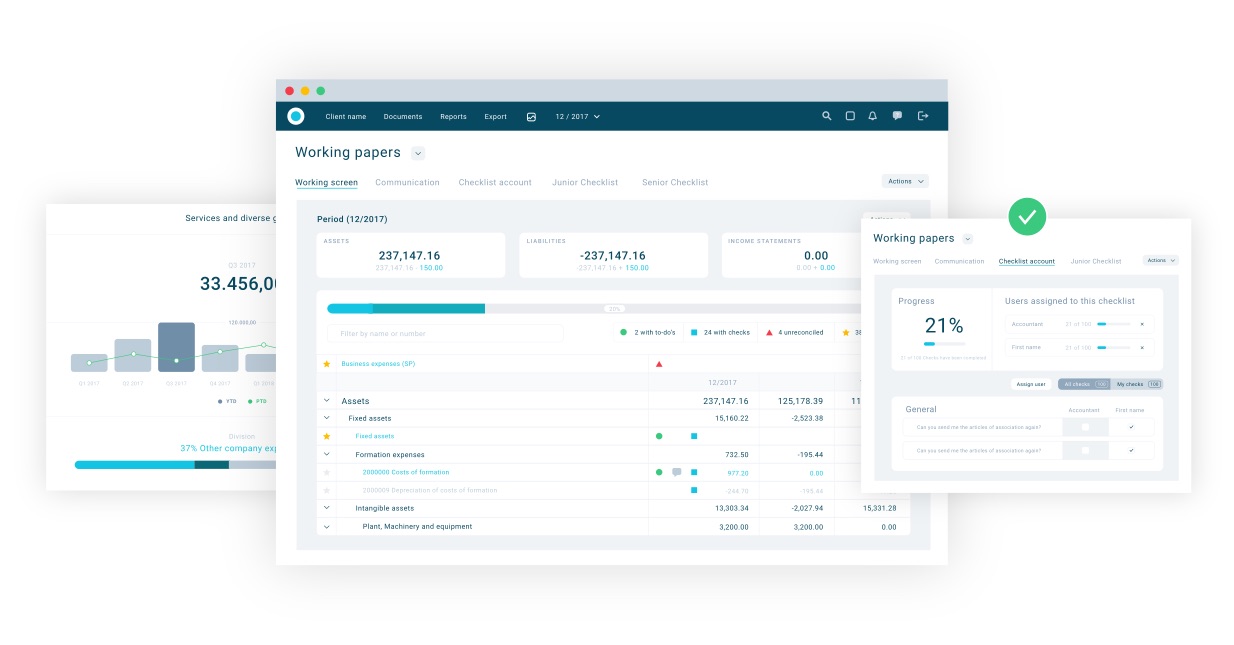

Meet Silverfin, a startup focused on accounting software. This isn’t about helping small startups handle accounting tasks themselves. Silverfin wants to build the cloud service for small and big accounting firms — Salesforce, but for accounting.

The startup just raised a Series B funding round led by Hg — Index Ventures led the previous Series A round. While terms of the deal are undisclosed, a source told me the round is worth approximately $30 million.

In order to improve productivity, Silverfin tries to automate the most time-consuming aspect of accounting — data collection. The company helps you connect with your clients’ accounting software directly to import their data, such as Xero, QuickBooks, Sage and SAP.

After that, Silverfin standardizes your data set and lets you add data manually so the platform can become the main data repository.

Once your data is in the system, you need to process it. Silverfin lets you configure automated workflows and templates so that anybody in the accounting firm can enrich data and check for compliance issues. Like Salesforce and other software-as-a-service products, multiple people can communicate on the service and look at all past edits and changes.

You can then visualize financial data, generate reports and statements. It opens up new possibilities for accounting firms. They can charge advisory services thanks to analytics tools and an alert system.

The startup was founded in Ghent, Belgium, but it has now expanded to London, Amsterdam and Copenhagen. Silverfin has attracted 650 customers, including big accounting firms in Europe and North America.

By targeting the most demanding customers first, Silverfin doesn’t need to replace Xero or QuickBooks altogether. It can integrate with those existing software solutions first. There’s an opportunity to go downmarket later and convince smaller companies that don’t necessarily have a big accounting team.

Powered by WPeMatico

If you own your home, how much do you pay for property taxes? Too much? Sounds about right.

If you disagree with how much you’re paying in property taxes, you can appeal the assessment. Most people don’t, though — perhaps because they are unaware they can, or because they just don’t have the time to deal with the lawyers and paperwork.

TaxProper, a company out of Y Combinator’s Summer 2019 batch, has raised $2 million to simplify the process. The round was led by Khosla Ventures, backed by Global Founders Capital, Clocktower Ventures and a handful of angel investors.

Once you’ve punched in your address, TaxProper’s algorithm looks at the assessments of similar homes in your surrounding area, looking at things like size, number of rooms, construction materials, etc.

If the algorithm determines that you’re paying more than your share, they generate the required paperwork and send it off to the county. The company estimates that their part of the process takes 3-5 minutes (after which you’re waiting on the county’s response, which they say takes 6-8 weeks).

They’re offering up two different pricing models, charging either a $149 up-front fee or 30% of total first-year tax savings. If their algorithm says your taxes can’t be lowered, you don’t pay — nor do you pay if the appeal gets denied. The company tells me they’re currently seeing an average per customer savings of around $700.

TaxProper’s two co-founders have a good bit of experience in the space of taxes and government. Geoff Segal was previously an actuarial statistician and research analyst for State Farm, while Thomas Dowling was a municipal finance advisor for Chicago Mayor Lori Lightfoot.

One thing to note: TaxProper is only up and running in select areas right now, as the company tests different strategies and makes sure they’re doing everything right region-by-region. It’s currently available in Chicago and the surrounding Cook County area, with plans to roll out “in the coming months” in New York and Texas.

Powered by WPeMatico

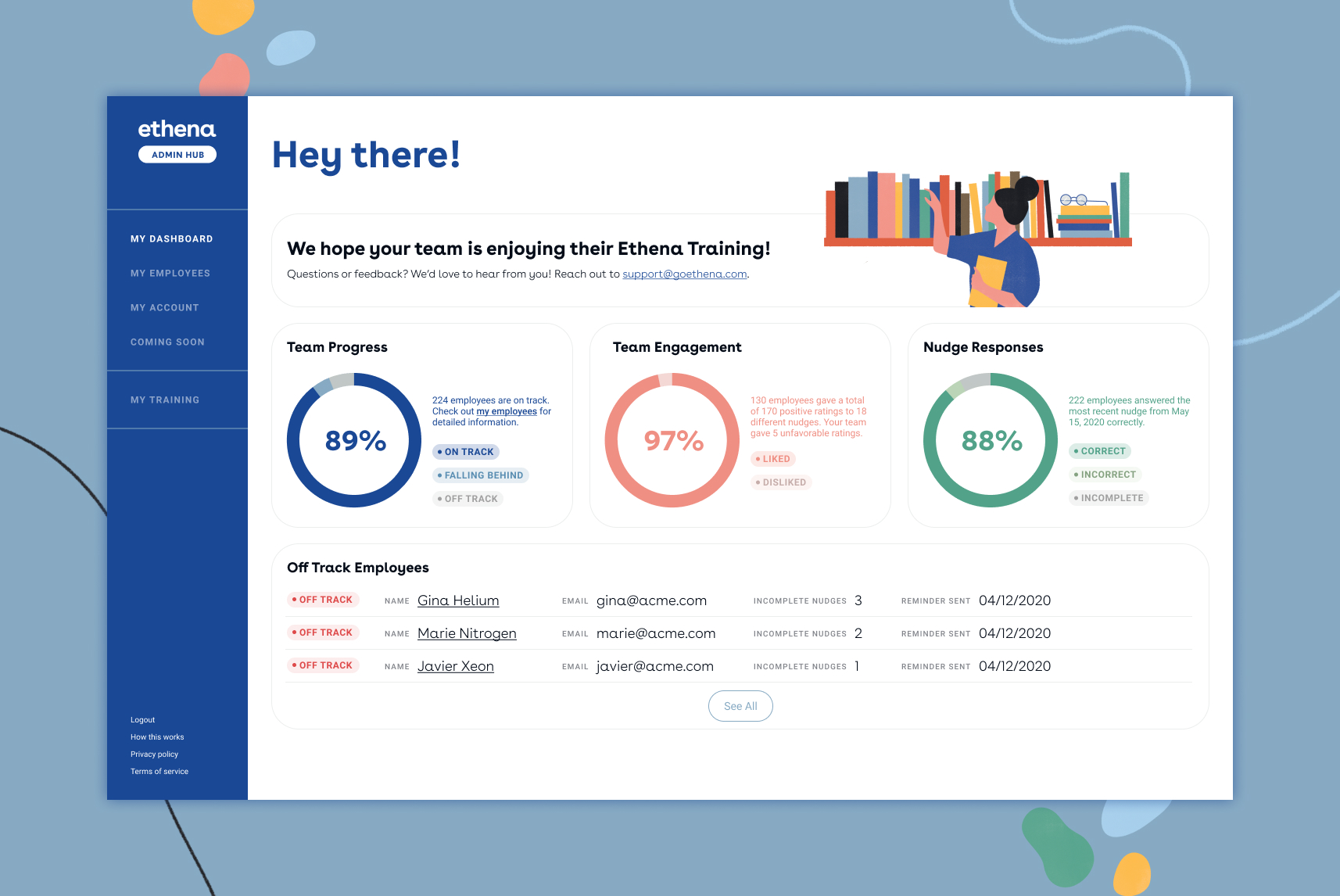

Corporate harassment training is often defined by mandatory annual workshops, stock photo-ridden curricula and, often, outdated scenarios. Harvard graduates Roxanne Petraeus and Anne Solmssen think there’s a business in doing better than that.

The duo co-founded Ethena, a software-as-a-service startup that sells anti-harassment training software that is more comprehensive and flexible than the status quo.

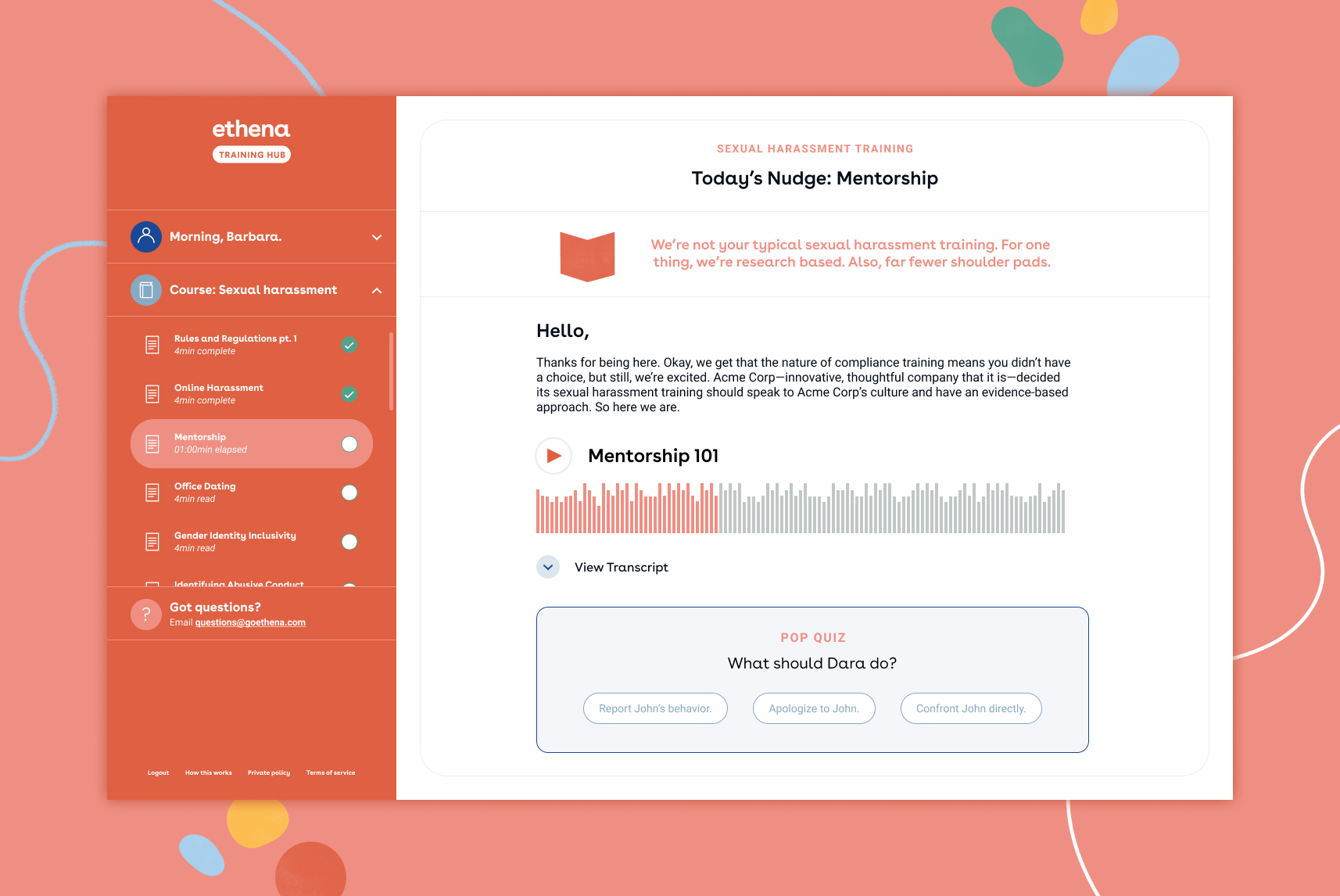

Ethena sends “nudges,” or personalized short-form bits of training content, to employees throughout the year. One nudge could be about office dating, and a few weeks later, another nudge could be about mentorship.

Each month a user would get either an e-mail or Slack notification saying it is time to train. Then the user would go to a browser-based app and take a lesson, which depends on your managerial status, state of residence and other factors. The sessions would then be five to 10 minutes.

The distributed approach takes away the ability for an employee to front-load hours of training on their first week. Instead, Ethena’s consistent check-ins are aiming at a difficult metric to track: comprehension within compliance training.

“The reason we do that is because in the adult learning base it is pretty emphatic that repetition is crucial,” Petraeus said.

This format also gives the company a chance to adapt its content to the world users are living in. Ethena’s content has to follow a certain curriculum based on state law, but, it can add its own flavor. For example, when COVID-19 became a serious threat, Ethena was able to send users training in regards to online harassment and cyberbullying. Old curricula might not account for what Zoom harassment might look like.

Petraeus said of the examples users see in the software, “it makes no sense to have Jim and Jan go to a bar if that’s not the environment we are in.”

Ethena also works as a replacement for in-person anti-harassment workshops during COVID-19 and resulting shelter-in-place orders. As offices continue to remain shut down, companies need to find new ways to talk about issues that are not going away.

Efficacy of anti-harassment training is hard to track with numbers. If a company tried to measure Ethena’s efficacy with data around the number of harassment reports filed before and after the software was used, it presumes that victims are choosing to report in the first place. Victims, for a variety of reasons, often don’t report due to fear of retaliation or inaction.

For the co-founders, a lack of hard data about whether their software works meant that they had to find another way to pitch to customers.

“It would be really irresponsible to just kind of bank on ‘everyone will believe in this mission with us,’ ” said Petraeus. “We read the newspaper; that will not happen.”

Instead, the co-founders think that sweeping training regulations and legal obligations might be what force companies to onboard more intensive software.

“We keep companies in a legally, very safe position because their employees are always sort of ahead of what they need to stay compliant with state regulations,” Solmssen said. “We’re able to become a part of the fabric of everyday thinking and behavior for employees.”

Long term, Ethena is working with a peer-reviewed journal to see if effective anti-harassment training can be related to higher retention rates in companies.

The company envisions early adopters to be small companies that are scaling. It charges companies per seat, which comes out to $4 per employee per month, and $48 per employee per year.

Petraeus and Solmssen piloted the program in November 2019 and launched in January. Today, the startup told TechCrunch they have raised $2 million in seed funding led by GSV, with participation from Homebrew, Village Global and more. It has 50 customers.

Powered by WPeMatico

It was perhaps not until the COVID-19 pandemic hit the planet that most of us had ever heard or uttered the phrase “supply chain.” But in a global economy that had become drunk and lazy on “just in time ordering” and similar, the threat to supply chains of things like, oh, food, from that pesky virus has become real and visceral. That’s why automation of “the supply chain” has become such a huge issue. So it’s not a huge surprise that startups aimed at tackling this are suddenly thrust into the limelight.

Step forward, Cork, Ireland-based Keelvar, strategic sourcing software company, which today announces that it has raised $18 million in Series A funding led by Elephant Ventures and Mosaic Ventures, with participation from Paua Ventures, enabling the company to further expand into enterprise markets.

The investment will support Keelvar’s expansion plans for Europe and the U.S., amid the rapidly growing need for supply chain automation solutions, which has been further accelerated by the recent COVID-19 pandemic.

Keelvar provides large enterprises with “Advanced Sourcing Optimization” software and “Intelligent Sourcing Automation” that uses AI to fully automate tactical buying processes.

It competes with Coupa and Jaggaer in terms of all three offering sophisticated e-sourcing software. Keelvar says its key competitive advantage is that it provides intelligent bots to autopilot the sourcing projects, thus making the whole process easier, faster and cheaper.

It also currently manages more than $90 billion in spend annually for enterprises in all major industries. Customers include Siemens, Coca-Cola, Novartis, BMW and Samsung.

With COVID-19 disrupting supply chains globally, Keelvar expects the demand for automation to further increase.

In a statement, Alan Holland, CEO of Keelvar, said: “The Future of Work in procurement is changing quickly, with COVID19 acting as a catalyst. We have witnessed an escalation in demand from enterprises seeking intelligent systems to automate complex processes as teams became overburdened with disrupted supply chains. Keelvar has proven that Sourcing Bots can relieve that burden enormously. Now it’s time to hit the accelerator and scale-up.”

Speaking about the investment, Peter Fallon, partner at Elephant noted: “Keelvar’s sourcing optimization and automation software delivers meaningful ROI to enterprise sourcing and procurement organizations globally. We are excited to partner with Alan Holland and the team at Keelvar as the company continues to emerge as a leader in this market.”

Private sector companies alone spend trillions annually buying from third-party suppliers. External sourcing is usually the largest expense category and on average it is 43% of total costs (Bain & Company). The global procurement software market is currently growing at a CAGR of 9.1%, and expected to reach $7.3 billion by 2022 (IDC).

Speaking about the funding, Toby Coppel, co-founder, and partner at Mosaic Ventures said: “Keelvar is a brilliant example of machine learning in action, giving superpower to procurement teams in every large enterprise. With COVID-19 pushing businesses to embrace these new technologies, we’re excited to partner with Keelvar on the next phase of growth.”

Powered by WPeMatico

Searchable.ai is an early-stage startup in the alpha phase of testing its initial product, but it has an idea compelling enough to attract investment, even during a pandemic. Today the company announced an additional $4 million in seed capital to continue building its AI-driven search solution.

Susquehanna International Group and Omicron Media co-led the round, with participation by Defy Partners, NextView Ventures and a group of unnamed angel investors. Today’s investment comes on top of the $2 million in seed money the startup announced in October.

Company co-founder and CEO Brian Shin said that when he presented to his investors in early March at the last event he attended before everything shut down, they approached him about additional money, and given the economic uncertainty, he decided to take it.

“Honestly we probably would not have taken additional money if it was not for the uncertainty around the macro environment right now,” he told TechCrunch.

The company is trying to solve enterprise search and, being pre-revenue, Shin recognized that having additional capital would give them more room to build the product and get it to market.

“We are trying to solve this problem where people just can’t find information that they need in order to do their jobs. When you look within the workplace, this problem is just getting worse and worse with the proliferation of different formats and people storing their information in many different places, local networks, cloud repositories, email and Slack,” he explained.

They have a few thousand people in the alpha program right now testing a personal desktop version of the application that helps individual users find their content wherever it happens to be. The plan is to open that up to a wider group soon.

The road map calls for a teams version, where groups of employees can search among their different individual repositories; a developer version to build the search technology into other operations; and eventually an enterprise tool. They also want to add voice search starting with an Alexa skill, with the general belief that we need to move beyond keyword searches to more natural language approaches.

“We believe that there’ll be a whole new category of search, search companies and search products that are more conversational. […] Being able to interact with your information more naturally, more and more conversationally, that’s where we think the market is going,” he said.

The company now has more money in the bank to help achieve that vision.

Powered by WPeMatico

A lot of the attention in medical technology today has been focused on tools and innovations that might help the world better fight the COVID-19 global health pandemic. Today comes news of another startup that is taking on some funding for a disruptive innovation that has the potential to make both COVID-19 as well as other kinds of clinical assessments more accessible.

Nanox, a startup out of Israel that has developed a small, low-cost scanning system and “medical screening as a service” to replace the costly and large machines and corresponding software typically used for X-rays, CAT scans, PET scans and other body imaging services, is today announcing that it has raised $20 million from a strategic investor, South Korean carrier SK Telecom.

SK Telecom in turn plans to help distribute physical scanners equipped with Nanox technology as well as resell the pay-per-scan imaging service, branded Nanox.Cloud, and corresponding 5G wireless network capacity to operate them. Nanox currently licenses its tech to big names in the imaging space, like FujiFilm, and Foxconn is also manufacturing its donut-shaped Nanox.Arc scanners.

The funding is technically an extension of Nanox’s previous round, which was announced earlier this year at $26 million with backing from Foxconn, FujiFilm and more. Nanox says that the full round is now closed off at $51 million, with the company having raised $80 million since launching almost a decade ago, in 2011.

Nanox’s valuation is not being publicly disclosed, but a news report in the Israeli press from December said that one option the startup was considering was an IPO at a $500 million valuation. We understand from sources that the valuation is about $100 million higher now.

The Nanox system is based around proprietary technology related to digital X-rays. Digital radiography is a relatively new area in the world of imaging that relies on digital scans rather than X-ray plates to capture and process images.

Nanox says the ARC comes in at 70 kg versus 2,000 kg for the average CT scanner, and production costs are around $10,000 compared to $1-3 million for the CT scanner.

But in addition to being smaller (and thus cheaper) machines with much of the processing of images done in the cloud, the Nanox system, according to CEO and founder Ran Poliakine, can make its images in a tiny fraction of a second, making them significantly safer in terms of radiation exposure compared to existing methods.

Imaging has been in the news a lot of late because it has so far been one of the most accurate methods for detecting the progress of COVID-19 in patients or would-be patients in terms of how it is affecting patients’ lungs and other organs. While the dissemination of equipment like Nanox’s definitely could play a role in handling those cases better, the ultimate goal of the startup is much wider than that.

Ultimately, the company hopes to make its devices and cloud-based scanning service ubiquitous enough that it would be possible to run early detection, preventative scans for a much wider proportion of the population.

“What is the best way to fight cancer today? Early detection. But with two-thirds of the world without access to imaging, you may need to wait weeks and months for those scans today,” said Poliakine.

The startup’s mission is to distribute some 15,000 of its machines over the next several years to bridge that gap, and it’s getting there through partnerships. In addition to the SK Telecom deal it’s announcing today, last March, Nanox inked a $174 million deal to distribute 1,000 machines across Australia, New Zealand and Norway in partnership with a company called the Gateway Group.

The SK Telecom investment is an interesting development that underscores how carriers see 5G as an opportunity to revisit what kinds of services they resell and offer to businesses and individuals, and SK Telecom specifically has singled out healthcare as one obvious and big opportunity.

“Telecoms carriers are looking for opportunities around how to sell 5G,” said Ilung Kim, SK Telecom’s president, in an interview. “Now you can imagine a scanner of this size being used in an ambulance, using 5G data. It’s a game changer for the industry.”

Looking ahead, Nanox will continue to ink partnerships for distributing its hardware and reselling its cloud-based services for processing the scans, but Poliakine said it does not plan to develop its own technology beyond that to gain insights from the raw data. For that, it’s working with third parties — currently three AI companies — that plug into its APIs, and it plans to add more to the ecosystem over time.

Powered by WPeMatico

Automation is the name of the game in enterprise IT at the moment: We now have a plethora of solutions on the market to speed up your workflow, simplify a process and perform more repetitive tasks without humans getting involved. Now, a startup that is helping non-technical people get more directly involved in how to make automation work better for their tasks is announcing some funding to seize the opportunity.

Bryter — a no-code platform based in Berlin that lets workers in departments like accounting, legal, compliance and marketing who do not have any special technical or developer skills build tools like chatbots, trigger automated database and document actions and risk assessors — is today announcing that it has raised $16 million. This is a Series A round being co-led by Accel and Dawn Capital, with Notion Capital and Chalfen Ventures also participating.

The funding comes less than a year after Bryter raised a seed round — $6 million in November 2019 — and it was oversubscribed, with term sheets coming in from many of the bigger VCs in Europe and the U.S. With this funding, the company has now raised around $25 million, and while the valuation is considerably up on the last round, Bryter is not disclosing what it is.

Michael Grupp, the CEO who co-founded the company with Micha-Manuel Bues and Michael Hübl (pictured below), said that the whole Series A process took no more than a month to initiate and close, an impressive turnaround considering the chilling effect that the COVID-19 health pandemic has had on dealmaking.

Part of the reason for the enthusiasm is because of the traction that Bryter has had since launching in 2018. Its 50 enterprise customers include the likes of McDonald’s, Telefónica, banks, healthcare and industrial companies, and professional services firms PwC, KPMG and Deloitte (who in turn use it for themselves as well as for clients). (Note: Because of its target users being large enterprises, the company doesn’t publish per-person pricing on its site as such.)

Bryter’s been seeing a lot of attention from customers and investors because its platform speaks to a big opportunity within the wider world of software today.

Enterprise IT has long been thought of as the less-fun end of technology: It’s all about getting work done, and a lot of the software used in a business environment is complex and often requires technical knowledge to implement, use, fix and adapt in any way.

This may still the case for a lot of it, especially for the most sophisticated tools, but at the same time we have seen a lot of “consumerization” come into IT, where user-friendly hardware and software built for consumers — specifically non-technical consumers — either inspires new enterprise services, or are simply directly imported into the workplace environment.

No-code software — like automation, another big trend in enterprise IT right now — plays a big role in how enterprise tools are becoming more user-friendly. One of the biggest roadblocks in a lot of office environments is that when workers identify things that don’t work, or could work much better than they do, they need to file tickets and get IT teams — also often overworked — to do the fixing for them. No-code platforms can help circumvent some of that work — so long as the roadblock of IT approves the use, that is.

Bryter’s conception and existence comes out of the no-code trend. It plays on the same ideas as IFTTT or Zapier but is very firmly aimed at users who might use pieces of enterprise software as part of their jobs, but have never had to delve into figuring out how they actually work.

There are already a lot of “low-code” (minimal coding) and other no-code platforms on the market today for business (not consumer) use cases. They include Blender.io, Zapier, Tray.io (a London-founded startup that itself raised a big round last autumn), n8n (also German, backed by Sequoia), and also biggies like MuleSoft (acquired by Salesforce in 2018 at a $6.5 billion valuation).

Bryter’s contention is that many of these actually need more technical know-how than they initially claim. Grupp pointed out that the earliest automation tools for enterprise have been around for decades at this point, but even most of the very modern descendants of those “will require some coding.” Bryter’s toolbox essentially lets users create dialogues with users — which they can program based on the expertise that they will have in their particular fields — which then sources data they can then plug into other software via the Bryter platform in order to “perform” different tasks more quickly.

Grupp’s contention is that while these kinds of tools have long been used, they will be in even more demand going forward.

“After COVID-19, workers will be even more distributed,” he said. “Teams and individuals will need to access information in a faster way, and the only way for big organizations to distribute that knowledge is through more digital tools.” The idea is that Bryter can essentially help bridge those gaps in a more efficient way.

Bryter’s target user and its approach underscores why investors like Accel see accessible, no-code solutions as a big opportunity.

“No-code software is really reducing the barriers of adoption,” Luca Bocchio, a partner at Accel, said in an interview. “If people like you and I can use the software, then that means demand can multiply by big numbers.” That’s in contrast to a lot of enterprise software today, which is very limited in how it can grow, he added. “Plus, enterprises these days want to see more future visibility in terms of the products they adopt. They want to make sure something will stick around, and so they tend not to want to work with super young startups. But it’s happening for Bryter, and the is a testament to Bryter and to the market potential.”

Powered by WPeMatico

RiskIQ, a startup providing application security, risk assessment and vulnerability management services, has added National Grid Partners as a strategic investor.

The funding from the investment arm of National Grid, a multinational energy provider, is part of a $15 million new round of financing designed to take the company’s technology into critical industrial infrastructure — with National Grid as a point of entry.

More than 6,000 companies use the company’s services, and the roster list and technology on offer has attracted some of the biggest names in investing, including Summit Partners, Battery Ventures, Georgian Partners and MassMutual Ventures.

“We view NGP’s show of support as an incredible opportunity to help customers in new markets thrive as their attack surfaces expand outside the firewall, especially now amid the COVID-19 pandemic,” RiskIQ chief executive Lou Manousos said in a statement.

RiskIQ has spent the past 10 years spidering the internet looking for all of the exploits that hackers use to penetrate networks and have built that into a database of threats. This inventory gives the company an ability to identify which assets within a company present the most obvious threats. Its automated services constantly scan third-party code, internet-connected devices and mobile applications for potential vulnerabilities, the company said.

“As a staple platform in their core security environment, our cyber threat analysts use RiskIQ regularly to enrich and identify incoming threats,” said Lisa Lambert, president of National Grid Partners and chief technology and innovation officer of National Grid, in a statement.

National Grid’s investment is a piece of a deeper partnership that will see NGP providing strategic advice for the security company as it looks to expand its commercial operations among industrial and utility customers.

Powered by WPeMatico

Remote work has changed the tools offices need for communicating asynchronously across meetings and chat, but not all collaboration takes place in neat little chat bubbles.

Anvil is a San Francisco startup that’s aiming to transform how businesses collaborate around the humble PDF. Anvil’s automation platform levels up Google Forms and allows customers to digitize tiresome PDFs through dynamic forms that unify processes customers might have typically needed to use several pieces of software to access previously. Users can leverage the platform to create, share, fill in, sign and download completed docs without picking up a pen.

Anvil announced today that it had raised $5 million in a seed funding round led by Google’s Gradient Ventures .

The startup is competing directly with rivals like DocuSign, a product that Anvil CEO Mang-Git Ng believes is “great for completing and executing a document,” but is “lacking when it comes to actually creating the document.” Anvil integrates directly with DocuSign for customers that have already integrated the service into their workflows, but Anvil is also replicating some of the service’s functionality as they look to build out an end-to-end solution for document automation.

Anvil is focusing early efforts on courting customers in the wealth and banking space. On the pricing side, they have both per-project and subscription plans, which start at $99 per month.

Anvil’s team

The startup recently tested their own abilities to get up-and-running quickly as they partnered with a bank to create an online portal for filling out applications for the Paycheck Protection Program (PPP). Ng says the startup helped Sunrise Bank customers apply for $127 million worth of PPP loans. “It was a whirlwind experience for us. We pretty much went from first conversation to deploying with them in six days,” Ng told TechCrunch.

As the COVID-19 pandemic has accelerated the digitization of paper processes, Ng says that the company has seen a bump in interest as more companies have gone remote and discovered new needs around making paperwork more collaborative and more digital-friendly, especially when it comes to areas like onboarding, compliance and internal applications.

“The overall trend that we’ve been seeing is that people in these industries are thinking about going more digital, but generally speaking, the people who are at the forefront of that tend to be in larger organizations where squeezing a little bit more operational efficiency will save a ton of money,” Ng says. “But as we’ve gone into lockdown, everybody has to figure out how to do things remotely and the solutions that help people do things remotely are definitely pushing to the forefront.”

Citi Ventures, Menlo Ventures, Financial Venture Studio and 122 West also participated in Anvil’s seed round.

Powered by WPeMatico

COVID-19 has transformed the global business landscape.

So much so that in a matter of weeks after the onset of the pandemic in the United States, Congress provided more than $1.1 trillion in fiscal stimulus directly to businesses and distressed industries — four times more than was distributed during the 2008-09 financial crisis.

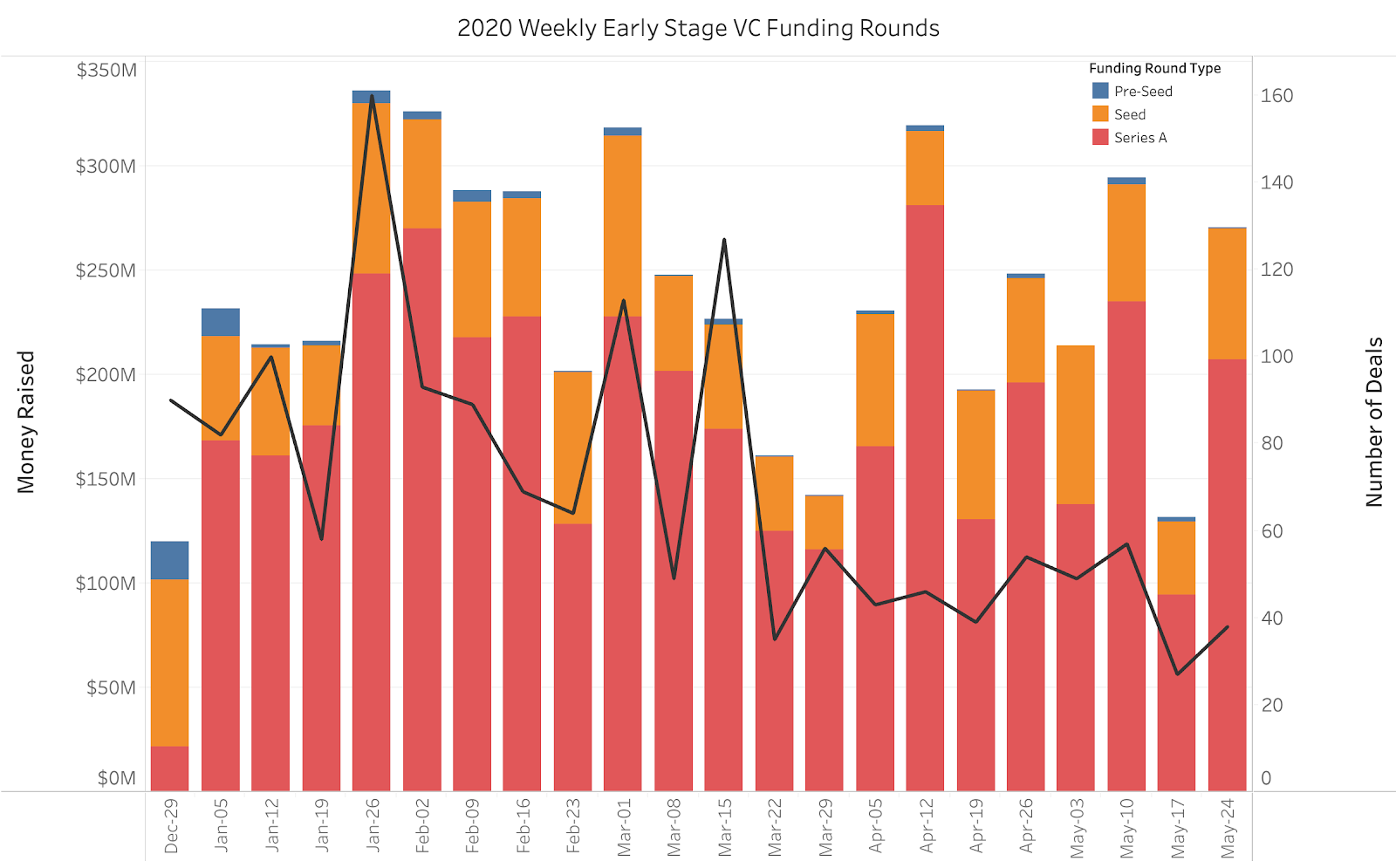

It came as no surprise when, at the start of COVID-19, venture capital investors largely went pencils-down for several weeks and shifted their focus to their existing portfolio companies. Extending company runways, preparing for longer funding cycles and managing operations in a novel business environment became the crux of company resilience. Now, moving into May, we can see this shift reflected in both the decline in number of early-stage companies funded and total capital invested.

As investors begin acclimating to this new normal, they have begun wading into new opportunities in time-proven, healthy industries and new emerging industries that are positioned to succeed during the pandemic. While we are seeing lower valuations, we believe certain B2B technology companies may be uniquely poised to thrive, and are pursuing investment opportunities in this space with a renewed focus.

Image Credits: Crunchbase Data via Tableau Public

*Excluding Biotech & Pharmaceuticals (Source: Crunchbase Data via Tableau Public)

Prior to COVID-19, early-stage B2B investors wanted to see strong growth and healthy unit economics; 3X year-over-year sales growth or 10% monthly growth was the gold standard. An LTV-to-CAC ratio over 3X signified a healthy payback cycle. There was less focus on capital efficiency; for every $1 million invested, investors were happy with $500,000 in generated revenues. Get to these numbers and your next funding round was guaranteed — but no longer.

During COVID, and likely beyond, company expectations and goalposts have been adjusted; 2X year-over-year growth may be the new 3X. While growth and unit economics are important, there are now new health indicators that will determine if a B2B company will thrive in a post-COVID world. With that in mind, we have put together a COVID reslience test that startups can use as a north star to grow their business in this new world.

This COVID-19 test is meant to be a gated checklist that will indicate where efforts should be focused, whether it be sales, product or finance. Before we leave you to your own devices, we wanted to walk through a couple of these new post-COVID questions that you should try to answer (and why they are relevant).

Powered by WPeMatico