Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Companies increasingly recognize that one of the greatest stresses for their employees is financial wellness. Even at innovative tech startups, people typically bump up against the limits of how much they know about wealth management pretty fast.

But providing financial education to a workforce, which has become increasingly common, is largely useless as most employees will tell you. The information can be hard to navigate, and it’s often not personalized in a way that addresses an employee’s circumstance and goals, which change over time depending on whether they are a recent graduate, getting married or even eyeing retirement.

It’s why so many employed people look to outside apps that promise to help them to not only understand their financial picture but actually manage it. It’s also a missed opportunity, according to a growing number of founders who are working to convince employers to move beyond education and instead offering automated financial planning (with a dash of human involvement) as an employee perk.

Their understandable argument: While offering benefits around fertility, family planning, and mental health are wonderful, companies are missing out on the chance to address the very top priority for their employees, which is how to avoid financial trouble.

Origin, a year-old San Francisco-based company led by Matt Watson — whose last company was acquired in December — is among the newest entrants to make the case.

Freshly backed by $12 million in funding led by Felicis Ventures, with participation from General Catalyst, Founders Fund and early Stripe employee Lachy Groom, among others, Origin wants to become the place where employees can track financial milestones, get professional advice from licensed financial planners, and take action, whether it be paying down student debt, building emergency savings or finding the right home and automotive insurance.

Currently staffed by 32 employees, six are financial planners, and they can handle the unique circumstances of “mid thousands of people,” says Watson, who notes that after an employee initially sets up a plan, much can be automated until a life event changes the picture.

“If you use just the tech, you’re only getting limited information,” he says, adding that access to Origin’s planners is “unlimited.”

The company already has 15 customers with between 250 and 5,000 employees, including the social network NextDoor; the cloud communications and collaboration software platform Fuze; and Therabody, whose Theragun therapy tool is used by pro athletes and trainers to pulverize their aching muscles.

All are paying $6 per employee per month because it doesn’t matter how much employees are making, says Watson. “The thing about financial stress is that it impacts everyone pretty evenly. The greater your income, the more stuff you buy.”

Considering that employees spend an estimated two to four hours each week dealing with their personal finances, an offering like Origin’s seems like a no-brainer for employers looking to both improve employee productivity and employee retention.

Indeed, the only thing holding back such offerings earlier in time were the kind of open banking APIs that exist today.

Now, the biggest challenge for Origin is to capture employers’ attention ahead of the competition. For example, another startup that’s also developing financial planning services as an employee perk is Northstar, founded by Red Swan Ventures investor Will Peng. More established players like Betterment that have long catered to individual investors are also focusing more on building up ties to employers that can use their offerings as an employee resource.

Either way, the trend is a positive one for employees, who are right now living through an economic roller coaster and could more generally use a lot more help with both staying afloat and saving for the future.

“Everyone struggles with finances,” says Watson, who worked in high-yield credit trading at Citi in New York before moving to San Francisco to start his last company. “I’m supposed to understand this stuff, and it’s complicated for me.”

Powered by WPeMatico

As schools stay closed and summer camp seems more like a germscape than an escape, students are staying at home for the foreseeable future and have shifted learning to their living rooms. Now, Norwegian educational gaming company Kahoot — the popular platform with 1.3 billion active users and over 100 million games (most created by users themselves) — has raised a new round of funding of $28 million to keep up with demand.

The Oslo-based startup, which started to list some of its shares on Oslo’s Merkur Market in October 2019, raised the $28 million in a private placement, and said it also raised a further $62 million in secondary shares. The new equity investment included participation from Northzone, an existing backer of the startup, and CEO Eilert Hanoa. While it’s not a traditional privately held startup in the traditional sense, at the market close today, the company’s valuation was $1.39 billion (or 13.389 billion Norwegian krone).

Existing investors in the company include Disney and Microsoft, and the company has raised $110 million to date.

Kahoot launched in 2013 and got its start and picked up most of its traction in the world of education through its use in schools, where teachers have leaned on it as a way to provide more engaging content to students to complement more traditional (and often drier) curriculum-based lessons. Alongside that, the company has developed a lucrative line of online training for enterprise users as well.

The global health pandemic has changed all of that for Kahoot, as it has for many other companies that built models based on classroom use. In the last few months, the company has boosted its content for home learning, finding an audience of users who are parents and employers looking for ways to keep students and employees more engaged.

The company says that in the last 12 months it had active users in 200 countries, with more than 50% of K-12 students using Kahoot in a school year in that footprint. On top of that, it is also used in some 87% of “top 500” universities around the world, and that 97% of Fortune 500 companies are also using it, although it doesn’t discuss what kind of penetration it has in that segment.

It seems that the coronavirus outbreak has not impacted business as much as it has in some sectors. According to the midyear report it released earlier this week, Q2 revenue is expected to be $9 million, 290% growth compared to last year and 40% growth compared to the previous quarter, and for the full year 2020, it expects revenue between $32 million and $38 million, with a full IPO expected for 2021.

As it has been doing even prior to the coronavirus outbreak, Kahoot has also continued to invest in inorganic growth to fuel its expansion. In May, it acquired math app maker DragonBox for $18 million in cash and shares. The company also runs an accelerator, Kahoot Ignite, to spur more development on its platform.

However, Hanoa said that Kahoot is shifting its focus to now also work with more mature edtech businesses.

“When we started out, we were primarily receiving requests on early stage products,” he said. “Now we have the opportunity to consider mature services for either integration or corporation. It’s a different focus.”

Update: A previous version of this story said that DragonBox was acquired in March. It was acquired in May. The story has been updated to reflect this change.

Powered by WPeMatico

As companies struggle to find ways to control costs in today’s economy, understanding what you are spending on SaaS tools is paramount. That’s precisely what early-stage startup Quolum is attempting to do, and today it announced a $2.75 million seed round.

Surge (a division of Sequoia Capital India) and Nexus Venture Partners led the round, with help from a dozen unnamed angel investors.

Company founder Indus Khaitan says that he launched the company last summer pre-COVID, when he recognized that companies were spending tons of money on SaaS subscriptions and he wanted to build a product to give greater visibility into that spending.

This tool is aimed at finance departments, which might not know about the utility of a specific SaaS tool like PagerDuty, but look at the bills every month. The idea is to give them data about usage as well as cost to make sure they aren’t paying for something they aren’t using.

“Our goal is to give finance a better set of tools, not just to put a dollar amount on [the subscription costs], but also the utilization, as in who’s using it, how much are they using it and is it effective? Do I need to know more about it? Those are the questions that we are helping finance answer,” Khaitan explained.

Eventually, he says he also wants to give that data directly to lines of business, but for starters he is focusing on finance. The product works by connecting to the billing or expense software to give insight into the costs of the services. It takes that data and combines it with usage data in a dashboard to give a single view of the SaaS spending in one place.

While Khaitan acknowledges there are other similar tools in the marketplace, such as Blissfully, Intello and others, he believes the problem is big enough for multiple vendors to do well. “Our differentiator is being end-to-end. We are not just looking at the dollars, or stopping at how many times you’ve logged in, but we’re going deep into consumption. So for every dollar that you’ve spent, how many units of that software you have consumed,” he said.

He says that he raised the money last fall and admits that it probably would have been tougher today, and he would have likely raised on a lower valuation.

Today the company consists of a six-person development team in Bangalore in India and Khaitan in the U.S. After the company generates some revenue he will be hiring a few people to help with marketing, sales and engineering.

When it comes to building a diverse company, he points out that he himself is an immigrant founder, and he sees the ability to work from anywhere, an idea amplified by COVID-19, helping result in a more diverse workforce. As he builds his company, and adds employees, he can hire people across the world, regardless of location.

Powered by WPeMatico

APIs provide a way to build connections to a set of disparate applications and data sources, and can help simplify a lot of the complex integration issues companies face. Postman has built an enterprise API platform and today it got rewarded with a $150 million Series C investment on a whopping $2 billion valuation — all during a pandemic.

Insight Partners led the round with help from existing investors CRV and Nexus Venture Partners. Today’s investment brings the total raised to $207 million, according to the company. That includes a $50 million Series B from a year ago, making it $200 million raised in just a year. That’s a lot of cash.

Abhinav Asthana, CEO and co-founder at Postman, says that what’s attracting all that dough is an end-to-end platform for building APIs. “We help developers, QA, DevOps — anybody who is in the business of building APIs — work on the same platform. They can use our tools for designing, documentation, testing and monitoring to build high-quality APIs, and they do that faster,” Asthana told TechCrunch.

He says that he was not actively looking for funding before this round came together. In fact, he says that investors approached him after the pandemic shut everything down in California in March, and he sees it as a form of validation for the startup.

“We think it shows the strength of the company. We have phenomenal adoption across developers and enterprises and the pandemic has [not had much of an impact on us]. The company has been receiving crazy inbound interest [from investors],” he said.

He didn’t want to touch the question of going public just yet, but he feels the hefty valuation sends a message to the market that this is a solid company that is going to be around for the long term.

Jeff Horing, co-founder and managing director at lead investor Insight Partners, certainly sees it that way. “The combination of the market opportunity, the management team and Postman’s proven track record of success shows that they are ready to become the software industry’s next great success,” he said in a statement.

Today the company has around 250 employees divided between the U.S. and Bangalore in India, and he sees doubling that number in the next year. One thing the pandemic has shown him is that his employees can work from anywhere and he intends to hire people across the world to take advantage of the most diverse talent pool possible.

“Looking for diverse talent as part of our large community as we build this workforce up is going to be a key way in which we want to solve this. Along with that, we are bringing people from diverse communities into our events and making sure that we are constantly in touch with those communities, which should help us build up a very strong diverse kind of hiring function,” he said.

He added, “We want to be deliberate about that, and over the coming months we will also shed more light on what specifically we are doing.”

Powered by WPeMatico

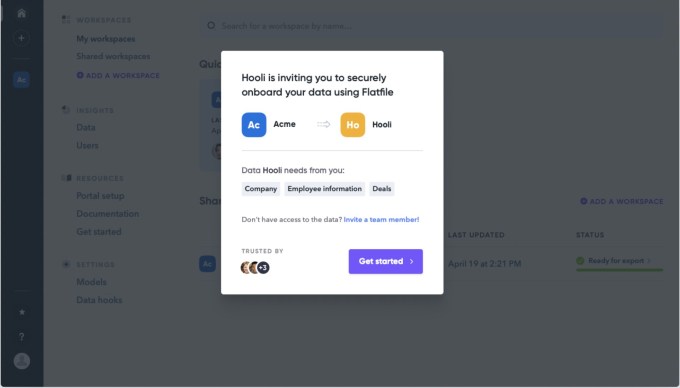

One of the huge challenges companies like enterprise SaaS vendors face with new customers is getting customer data into their service. It’s a problem that Flatfile founders faced firsthand in their jobs, and they decided to solve it. Today, the company announced a healthy $7.6 million seed investment to expand on that vision.

The company also announced the release of its latest product, called Concierge.

Two Sigma Ventures led the investment, with participation from previous investors Afore Capital, Designer Fund and Gradient Ventures (Google’s AI-focused venture fund).

Company CEO David Boskovic says he and co-founder Eric Crane recognized that this is a problem just about every company faces. Let’s say you sign up for a CRM tool like HubSpot (which is a Flatfile customer). Your first step is to get your customer data into the new service.

As Boskovic points out, if you have thousands of existing customers that can be a real problem, often involving days or even weeks to prepare the data, depending on the size of your customer base. It typically includes importing your data from an existing source, then manually moving it to an Excel spreadsheet.

“What we’re trying to solve for at Flatfile is automating that entire process. You can drop in any data that you have and get it into a new product, and what that solves from a market perspective is the speed of adopting new software,” Boskovic told TechCrunch.

Image Credit: Flatfile

He says they have automated the process to the point it usually takes just a few minutes to process the data, If there are problems that Flatfile can’t solve, it presents the issue to the user who can fix it and move on.

The founders realized that not every use case is going to involve a simple one-to-one data transfer, so they created their new product called Concierge to help companies manage more complex data integration scenarios for their customers.

“What we do is we provide a bridge between disparate data formats that are a little bit more complex and let our customers collaborate with their new customers that they are onboarding to bring the data to the right state to use it in the new system,” Boskovic explained.

Whatever they are doing, it seems to be working. The company launched in 2018 and today has 160 customers with 300 sitting on a waiting list. It has increased that customer count by 5x since the beginning of the year in the middle of a pandemic.

Any product that reduces labor and increases efficiency and collaboration in a digital context is going to get the attention of customers right now, and Flatfile is seeing a huge spike in interest in spite of the current economy. “We’re helping onboard customers quickly and more efficiently. And our Concierge service can also help reduce in-person touch points by reducing this long, typical data onboarding process,” Boskovic said.

The company has not had to change the way it has worked because of the pandemic, as it has been a distributed workforce from day one. In fact, Boskovic is in Denver and co-founder Eric Crane is based in Atlanta. The startup currently has 14 employees, but plans to fill at least 10 roles this year.

“We’ve got a pretty aggressive hiring map. Our pipeline is bigger than we can handle from a sales perspective,” he said. That means they will be looking to fill sales, marketing and product jobs.

Powered by WPeMatico

A Swiss startup called HMCARE, spun out of the École polytechnique fédérale de Lausanne, has raised a million Swiss Francs (equivalent to about $105 million) to commercialize its transparent and relatively eco-friendly surgical masks.

The founders were inspired by healthcare workers in the 2015 Ebola outbreak and at children’s hospitals around the world working closely with patients but unable to show their faces. Likewise parents and relatives of immunocompromised people who must make a human connection with two-thirds of their face covered.

There were technically transparent masks available, but they were just regular masks with a plastic window in them, which can fog up and isn’t breathable. Thierry Pelet, now CEO of the company, approached his EPFL colleagues with a prototype of a transparent mask material meeting the rigorous demands of a medical environment. It must permit air through but not viruses or bacteria, and so on.

The team worked with Swiss materials center Empa to create a new type of textile. Using biomass-derived transparent fibers placed 100 nanometers apart to form sheets and then triple-layered, they made a flexible, breathable material that’s also nearly transparent — a bit like lightly frosted glass. They call it the HelloMask.

The material can be made in bulk and formed into mask shapes just like normal cloth, but there is the matter of spinning up manufacturing for it. Fortunately, the world is desperate for masks, and the idea of a transparent one was clearly catnip for investors. HMCARE easily raised a million-franc seed round, the R&D work having been done using nonprofit donations and grants.

While the HelloMasks could launch as early as the start of 2021, they’ll be primarily for the medical community, though public availability is certainly a possibility.

Powered by WPeMatico

Grow Credit, the startup that launched last year to help customers build out their credit scores by providing a credit line for online subscriptions like Spotify and Netflix, has added Mucker Labs as an investor and closed its seed round with $2 million in total commitments.

The Los Angeles startup founded by serial entrepreneur Joe Bayen, had been bootstrapped initially and then received funding from a clutch of core angel investors before signing a deal with Mucker earlier this month, according to Bayen.

Using the Marqeta platform, Grow Credit can extend a loan to customers to expand their subscription services. Using the Mastercard network for payments, and Marqeta’s tools to restrict payment access, Grow offers credit facilities to its customers to pay for their monthly subscriptions. By using Grow Credit for those payments, users can improve their credit scores by as much as 61 points in a nine-month span, says Bayen.

The company doesn’t charge any fees for its loans, but users can upgrade their service. The initial tier is free for access to $15 of credit, once a user connects their bank account. For a $4.99 monthly fee, customers can get up to $50 of subscriptions covered by the service. For $9.99 that credit line increases to $150, Bayen said.

Increases to a user’s credit score can make a significant dent in their costs for things like lease agreements for cars, mortgages for houses and better rates on other credit cards, said Bayen.

“Everything is cheaper, you can get access to a credit card with lower interest rates and better rewards,” he said. “We’re looking at ourselves as the single best route to getting access to an Apple card.”

Additional capital for the new round came from individual investors like DraftKings chief executive, Jason Robins; former National Football League player and hall of famer Ronnie Lott; and Sebastien Deguy, VP of 3D at Adobe.

Coming up, Grow Credit said it has a deal in the works with one very large consumer bank in the U.S. and will be launching the Android version of its app in a few weeks.

Powered by WPeMatico

Axiom, a startup that helps companies deal with their internal data, has secured a new $4 million seed round led by U.K.-based Crane Venture Partners, with participation from LocalGlobe, Fly VC and Mango Capital. Notable angel investors include former Xamarin founder and current GitHub CEO Nat Friedman and Heroku co-founder Adam Wiggins. The company is also emerging from a relative stealth mode to reveal that is has now raised $7 million in funding since it was founded in 2017.

The company says it is also launching with an enterprise-grade solution to manage and analyze machine data “at any scale, across any type of infrastructure.” Axiom gives DevOps teams a cloud-native, enterprise-grade solution to store and query their data all the time in one interface — without the overhead of maintaining and scaling data infrastructure.

DevOps teams have spent a great deal of time and money managing their infrastructure, but often without being able to own and analyze their machine data. Despite all the tools at hand, managing and analyzing critical data has been difficult, slow and resource-intensive, taking up far too much money and time for organizations. This is what Axiom is addressing with its platform to manage machine data and surface insights, more cheaply, they say, than other solutions.

Co-founder and CEO Neil Jagdish Patel told TechCrunch: “DevOps teams are stuck under the pressure of that, because it’s up to them to deliver a solution to that problem. And the solutions that existed are quite, well, they’re very complex. They’re very expensive to run and time-consuming. So with Axiom, our goal is to try and reduce the time to solve data problems, but also allow businesses to store more data to query at whenever they want.”

Why did they work with Crane? “We needed to figure out how enterprise sales work and how to take this product to market in a way that makes sense for the people who need it. We spoke to different investors, but when I sat down with Crane they just understood where we were. They have this razor-sharp focus on how they get you to market and how you make sure your sales process and marketing is a success. It’s been beneficial to us as were three engineers, so you need that,” said Patel.

Commenting, Scott Sage, founder and partner at Crane Venture Partners added: “Neil, Seif and Gord are a proven team that have created successful products that millions of developers use. We are proud to invest in Axiom to allow them to build a business helping DevOps teams turn logging challenges from a resource-intense problem to a business advantage.”

Axiom co-founders Neil Jagdish Patel, Seif Lotfy and Gord Allott previously created Xamarin Insights that enabled developers to monitor and analyse mobile app performance in real time for Xamarin, the open-source cross-platform app development framework. Xamarin was acquired by Microsoft for between $400 and $500 million in 2016. Before working at Xamarin, the co-founders also worked together at Canonical, the private commercial company behind the Ubuntu Project.

Powered by WPeMatico

South Africa-based renewable energy startup Sun Exchange has raised $3 million to close its Series A funding round totaling $4 million.

The company operates a peer-to-peer, crypto-enabled business that allows individuals anywhere in the world to invest in solar infrastructure in Africa.

How’s that all work?

“You as an individual are selling electricity to a school in South Africa, via a solar panel you bought through the Sun Exchange,” explained Abe Cambridge, the startup’s founder and CEO.

“Our platform meters the electricity production of your solar panel. Arranges for the purchasing of that electricity with your chosen energy consumer, collects that money and then returns it to your Sun Exchange wallet.”

It costs roughly $5 a solar cell to get in and transactions occur in South African Rand or Bitcoin.

“The reason why we chose Bitcoin is we needed one universal payment system that enables micro transactions down to a millionth of a U.S. cent,” Cambridge told TechCrunch on a call.

He co-founded the Cape Town-headquartered startup in 2015 to advance renewable energy infrastructure in Africa. “I realized the opportunity for solar was enormous, not just for South Africa, but for the whole of the African continent,” said Cambridge.

“What was required was a new mechanism to get Africa solar powered.”

Sub-Saharan Africa has a population of roughly 1 billion people across a massive landmass and only about half of that population has access to electricity, according to the International Energy Agency.

Recently, Sun Exchange’s main market South Africa — which boasts some of the best infrastructure in the region — has suffered from blackouts and power outages.

Image Credits: Sun Exchange

Sun Exchange has members in 162 countries who have invested in solar power projects for schools, businesses and organizations throughout South Africa, according to company data.

The $3 million — which closed Sun Exchange’s $4 million Series A — came from the Africa Renewable Power Fund of London’s ARCH Emerging Markets Partners.

With the capital, the startup plans to enter new markets. “We’re going to expand into other Sub-Saharan African countries. We’ve got some clear opportunities on our roadmap,” Cambridge said, referencing Nigeria as one of the markets Sun Exchange has researched.

There are several well-funded solar energy startups operating in Africa’s top economic and tech hubs, such as Kenya and Nigeria. In East Africa, M-Kopa sells solar hardware kits to households on credit, then allows installment payments via mobile phone using M-Pesa mobile money. The venture is backed by $161 million from investors including Steve Case and Richard Branson.

In Nigeria, Rensource shifted from a residential hardware model to building solar-powered micro utilities for large markets and other commercial structures.

Sun Exchange operates as an asset free model and operates differently than companies that install or manufacture solar panels.

“We’re completely supplier agnostic. We are approached by solar installers who operate on the African continent. And then we partner with the best ones,” said Cambridge — who presented the startup’s model at TechCrunch Startup Battlefield in Berlin in 2017.

“We’re the marketplace that connects together the user of the solar panel to the owner of the solar panel to the installer of the solar panel.”

Abe Cambridge, Image Credits: TechCrunch

Sun Exchange generates revenues by earning margins on sales of solar panels and fees on purchases and kilowatt hours generated, according to Cambridge.

In addition to expanding in Africa, the startup looks to expand in the medium to long-term to Latin America and Southeast Asia.

“Those are also places that would really benefit from from solar energy, from the speed in which it could be deployed and the environmental improvements that going solar leads to,” said Cambridge.

Powered by WPeMatico

While most air travel continues to be ground to a halt, a German startup working on what it hopes will be a major breakthrough in flying has raised more funds to continue building its service. Lilium, which is designing an all-electric vertical take-off and landing aircraft that it plans to build into a taxi-style fleet to ferry passengers within and between cities, has picked up an additional $35 million in funding.

The capital is an extension to a $240 million round Lilium announced just in March of this year, and notably brings in a new, high-profile investor to the startup’s cap table: Baillie Gifford, the storied Scottish VC that has backed the likes of Tesla and SpaceX, Spotify and Airbnb, among others. (As we reported in March, the previous $240 million came from existing investors, which include the likes of Tencent, Atomico, Freigeist and LGT.)

Dr Remo Gerber, Lilium’s chief commercial officer, confirmed in an interview that Lilium is in talks to add more to the round. That would be in line with what sources told us last year, when we reported that Lilium was looking to raise more like $400 million-plus.

So far, it brings the total raised by Lilium to more than $375 million, at a valuation that sources very close to the company confirm is now over $1 billion, making it one of the most highly capitalised, and most valuable, of the next-generation aviation hopefuls.

The extra funding is coming at a key time for Lilium, which is playing a long game but also facing a number of immediate-term challenges.

After a technical stumble earlier this year that saw an older prototype burst into flames while some maintenance was being carried out, leading to a pause while the company figured out what happened, Gerber says the company remains on track for its first commercial services. But those will not be for another five years, in 2025. (The plan is for these to be flown by humans, with autonomous “flying vehicles” coming online about a decade later.)

In the meantime, many are bracing themselves for a big hit to the global economy as a result of the coronavirus pandemic, which is slowing down or halting altogether a number of industries, including three key ones that Lilium touches: aviation, manufacturing and travel.

Gerber said that this latest funding injection was both opportunistic and practical: he pointed out that it’s great to have Baillie Gifford as an investor, but it also helps the company shore up its finances for whatever might come next in this period of uncertainty.

“The two are not mutually exclusive,” he said.

The company now employs 450 employees and has seen no layoffs at a time when millions have lost jobs globally, he added. With many on the design side working at home, Lilium also has large spaces, he said, well equipped for socially distanced manufacturing to handle the next phase of the company’s development.

In the meantime, there remain a number of would-be competitors that are also chasing the same opportunity in flying vehicles, aimed at replacing cars in traffic-clogged cities as well as trains and other vehicles both in congested commuter corridors and routes that are uneconomical for other forms of transport.

They include another German startup, Volocopter, which is also designing a new kind of flying taxi-style vehicle and service, and also closed a $94 million round in February; as well as Kitty Hawk, eHang, Joby and Uber, in addition to Blade and Skyryse, air taxi services of sorts that offer more conventional helicopters and other vessels in limited launches for those willing to spend the money.

Kitty Hawk just last week ended its moonshot Flyer program to focus more resources and attention on its autonomous flying project, pointing to heightened activity in the space.

Safety issues and designing reliable and efficient vessels have been preoccupations not just for the companies building them, but for regulators. There are signs, however, that there may be more advances on that front too.

In the U.K. for example, the government last month announced a new initiative to back more companies building new and novel forms of air transport, part of its bid to support innovative industries and build more sustainable modes of transport for the future. Those are not green lights for services, of course, but are the first steps in that direction, indications that the government is keen to encourage and explore and support getting these ideas off the ground (so to speak).

Lilium sees opportunities both in the U.K. — buffered by Baillie Gifford’s backing out of Edinburgh in Scotland — as well as across Europe and beyond.

“We are delighted to support the remarkable team at Lilium in their ambition of developing a new mode of transport,” said Michael Pye, investment manager at Baillie Gifford, in a statement. “While still at an early stage, we believe this technology could have profound and far-reaching benefits in a low-carbon future and we are excited to watch Lilium’s progress in the years ahead.”

Powered by WPeMatico