Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

DroneBase, a Los Angeles-based provider of drone pilots for industrial services companies, has raised $7.5 million during the pandemic to double down on its work with renewable energy companies.

While chief executive Dan Burton acknowledged that the company was fundraising prior to the pandemic, the industrial lockdown actually accelerated demand for the company’s services.

Even with the increased demand, the company had to make some changes. It laid off six employees and refocused its business.

“In the past three months it’s become clear that this is a moment for drones as an industry,” Burton said. “We were really pushing hard as a company, certainly on revenue growth and harvesting all the investments we made in technology and having a clear, near-term view to profitability.”

The new round, which closed in May, was a slight down round, according to people familiar with the company’s business.

“We see raising a growth round later this year,” Burton said.

New investors in the company included Valor Equity Partners and Razi Ventures, who joined Union Square Ventures, Upfront Ventures, Hearst Ventures, Pritzker Group Venture Capital and DJI.

In all, DroneBase has raised nearly $32 million in financing, according to a company statement.

The new round will enable the company to focus on its data and analytics services that it has been developing around its core drone pilot provisioning technology — and gives DroneBase more financial wherewithal to expand its European operations under DroneBase Europe, which operates out of Germany.

“DroneBase’s expansion into renewable energy reflects our belief in the growth potential of wind and solar energy industries,” said Burton in a statement. “Since many energy companies have both wind and solar assets, we are well positioned to leverage our DroneBase Insights platform to grow our global market share in renewable energy.”

The key application for DroneBase has been allowing wind power companies to monitor and manage their turbines, improving uptimes and spotting problems before they effect operations, the company said.

For solar power companies, DroneBase offers a network of pilots trained in infrared imaging to detect anomalies like defects or hot spots on solar panels, the company said.

“DroneBase has established themselves as the drone leader in the commercial market, and its new work in renewables will have a lasting impact on the future of energy by keeping infrastructure operational for generations,” says Sam Teller, partner at Valor Equity Partners, in a statement. “We believe DroneBase will continue to be a valuable partner in drone operations and data analysis across a multitude of industries globally.”

Powered by WPeMatico

The alchemy for a successful startup can be hard to parse. Sometimes, it’s who you know. Sometimes it’s where you go to school. And sometimes it’s what you do. In the case of La Haus, a startup that wants to bring U.S. tech-enabled real estate services to the Latin American real estate market, it’s all three.

The company was founded by Jerónimo Uribe and Rodrigo Sánchez Ríos, both graduates of Stanford University who previously founded and ran Jaguar Capital, a Colombian real estate development firm that had built over $350 million worth of retail and residential projects in the country.

Uribe, the son of the controversial Colombian President Daniel Uribe (who has been accused of financing paramilitary forces during Colombia’s long-running civil war and wire-tapping journalists and negotiators during the peace talks to end the conflict) and Sánchez Ríos, a former private equity professional at the multi-billion-dollar firm Lindsay Goldberg, were exposed to the perils and promise of real estate development with their former firm.

Now the two entrepreneurs are using their know-how, connections and a new technology stack to streamline the home-buying process.

It’s that ambition that caught the attention of Pete Flint, the founder of Trulia and now an investor at the venture capital firm NFX. Flint, an early investor in La Haus, saw the potential in La Haus to help the Latin American real estate market leapfrog the services available in the U.S. Spencer Rascoff, the co-founder of Zillow, also invested in the company.

“Latin America is very early on in its infancy of having really professional agents and really professional brokerages,” said Flint.

La Haus guides home buyers through every stage of the process, with its own agents and salespeople selling properties sourced from the company’s developer connections.

“The average home in the U.S. sells in six weeks or less,” said La Haus chief financial officer Sánchez Ríos in an interview. “That timing in Latin America is 14 months. That’s the dramatic difference. There is no infrastructure in Latin America as a whole.”

La Haus began by reaching out to the founders’ old colleagues in the real estate development industry and started listing new developments on its service. Now the company has a mix of existing and new properties for sale on its site and an expanded geographic footprint in both Colombia and Mexico.

“We have a portal… that acts as a lead-generating machine,” said Sánchez Ríos. “We aggregate listings, we vet them. We focus on new developers.”

The company has about 500 developers using the service to list properties in Colombia and another 200 in Mexico. So far, the company has facilitated more than 2,000 transactions through its platform in three years.

“Real estate now is turning fully digital and also in this market professionalizing,” said Flint. “The publicly traded online real estate companies are approaching all-time highs. People are just prizing the space that they spend their time in… the technologies from VR and digital walkthroughs to digital closes become not just a nice to have but a necessity. “

Capitalizing on the open field in the market, La Haus recently closed on $10 million in financing led by Kaszek Ventures, one of the leading funds in Latin America. That funding will be used to accelerate the company’s geographic expansion in response to increasing demand for digital solutions in response to the COVID-19 epidemic.

“Because of Covid-19, consumers’ willingness to conduct real estate transactions online has gone through the roof,” said Sánchez Ríos, in a statement. “Fortunately we were in the position to enable that, and we expect to see a permanent shift online in how people conduct all, or at least most, of the home-buying process. This funding gives us ample runway to build the end-to-end real estate experience for the post-Covid Latin America.”

Joining NFX, Rascoff, and Kaszek Ventures are a slew of investors, including Acrew Capital, IMO Ventures and Beresford Ventures. Entrepreneurs like Nubank founder David Velez; Brian Requarth, the founder of Vivareal (now GrupoZap); and Hadi Partovi, CEO and founder of Code.org, also participated in the financing.

“We backed La Haus because we saw many of the same ingredients that resulted in a fantastic outcome for many of our successful companies: A world-class team with complementary skills; a huge addressable market; and an almost religious zeal by the founders to solve a big problem with technology,” said Hernan Kazah, co-founder and managing partner of Kaszek Ventures.

Powered by WPeMatico

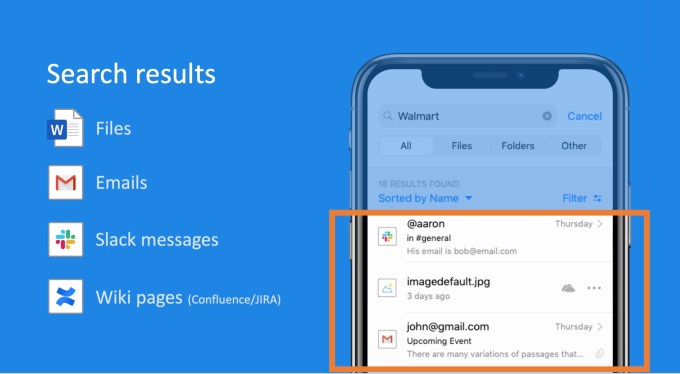

Finding somewhere in a Slack conversation, or stored in Box, Dropbox, Google Docs or Office 365, that one document you want to attach to an email is a huge challenge as we find ourselves spreading our content across a variety of cloud services. It’s one challenge that Cloudtenna has been trying to solve, and today the company announced a $2.5 million funding round along with the release of a new mobile search tool.

The funding comes from a variety of unnamed investors, along with Blazar Ventures, and brings the total raised to $6.5 million, according to the company.

Cloudtenna co-founder Aaron Ganek says that by using AI and document metadata, his company can find content wherever it lives. “What we’re really focused on is helping companies bring order to file chaos. Files are scattered everywhere across the cloud, and we have developed AI-powered applications that help users find files, no matter where they’re stored,” he said.

The company introduced a desktop search application in 2018 and today it’s announcing a mobile search tool called Workspace to go with it. Ganek says they built this app from the ground up to take advantage of the mobile context.

“Today, we’re bringing the search technology to smartphones and tablets. And just to be clear, this is not just a mobile version of our desktop product, but a complete case study in how people collaborate on the go,” he said.

Image Credit: Cloudtenna

The AI component helps find files wherever they are based on your user history, who you tend to collaborate with and so forth. That helps the tool find the files that are most relevant to you, regardless of where they happen to be stored.

He says that raising money during a pandemic was certainly interesting, but the company has seen an uptick in usage due to the general increase in SaaS usage during this time, and investors saw that too, he said.

The company launched in 2016 and currently has nine employees, but Ganek said there aren’t any plans to expand on that number at this time, or at least any number he was ready to discuss.

Powered by WPeMatico

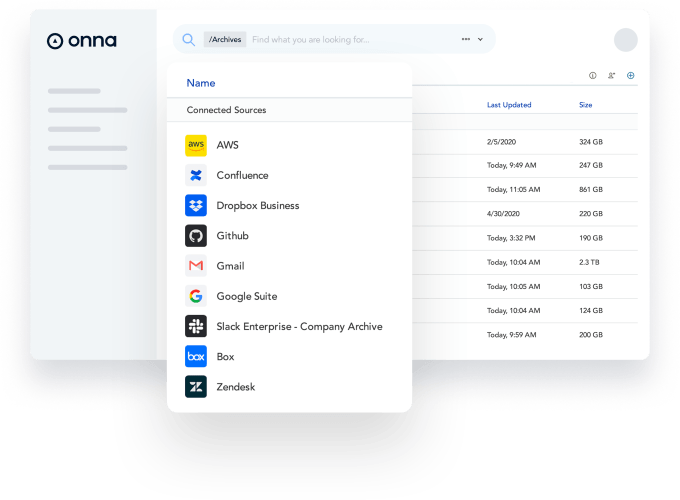

Onna, the “knowledge integration platform” (KIP) that counts Dropbox and Slack as backers, has raised $27 million in Series B funding.

Leading the round is Atomico, with participation from Glynn Capital. Previous investors Dawn Capital, Nauta Capital and Slack Fund also followed on.

Founded in 2015, Barcelona and New York-based Onna integrates with a plethora of workplace apps, including Slack, Dropbox, G Suite, Microsoft 365 and Salesforce, to help unlock the proprietary knowledge stored in a company’s various cloud and on-premise software. Typical applications for a KIP include compliance, governance, archiving and “eDiscovery.”

From communication apps to cloud storage to HR platforms, the idea is to unify all of this data and make it searchable but in a way that is secure and protects existing permissions and privacy. In fact, another way to think of Onna is like Apple’s Spotlight functionality but for the enterprise. However, pitched as a platform not just a feature, Onna also offers an API of its own so that various use cases can be built on top of this “single source of truth.”

“Onna’s knowledge integration platform is a centralised, searchable and secure hub that connects company data wherever it resides and makes it easier and faster to make informed decisions,” Onna founder and CEO Salim Elkhou tells TechCrunch. “It is a productivity tool built for the way businesses work today… something that didn’t exist before, creating a new industry standard which benefits all companies within the ecosystem.”

“Onna’s knowledge integration platform is a centralised, searchable and secure hub that connects company data wherever it resides and makes it easier and faster to make informed decisions,” Onna founder and CEO Salim Elkhou tells TechCrunch. “It is a productivity tool built for the way businesses work today… something that didn’t exist before, creating a new industry standard which benefits all companies within the ecosystem.”

Citing a report by single sign-in provider Okta, Elkhou notes that companies today use an average of 88 different apps across their workforce, a 21% increase from three years ago.

“The reason apps have become so popular is that they’re very effective for tackling specific challenges, or even a broad range of tasks. But the problem large organisations were coming up against is that their knowledge was spread across a wide range of apps that weren’t necessarily designed to work together.”

For example, a legal counsel could be looking to find contracts company-wide to assess a company’s exposure. The problem is that contracts may be saved in Salesforce, sent by email, shared over Slack or even saved on desktops. “Your company may have acquired another company, which has its own ways of saving information, so now the simple task of finding contracts can be a heavy lifting exercise, involving everyone’s time. With Onna, being the connective tissue across these applications, this search would take a split second,” claims Elkhou.

But the potential power of a KIP goes well beyond search alone. Elkhou says a more ambitious use case is unifying knowledge across apps and using Onna as infrastructure. “We believe that the next generation of workplace apps will be built on top of a knowledge integration platform like Onna,” he explains. “Due to our plug and play integrations with most enterprise apps and our open API, you can now build your own bespoke workflows on top of your company’s knowledge. More importantly, we handle all the heavy lifting on the back end when it comes to processing the right contextual information across multiple systems securely, which means you can get on with creatively building a more efficient workplace.”

“In Onna, we saw a product in a new and complementary category, providing a solution not at the data level but at the ‘knowledge level,’ ” adds Atomico’s Ben Blume, who has also joined the Onna board. “Onna’s core solution integrates with any tools in an organisation where knowledge resides, [and] ingests, indexes and classifies the knowledge inside, enabling it to power applications in many areas.”

Blume also points to the belief that some of the cloud tools vendors themselves have in Onna, with both Slack and Dropbox “investing, using and promoting” Onna’s solution. “As they look to grow their own penetration in organisations with a wider range of needs and demands, we saw partnering with Onna as a recognition of its best in class nature to their customers,” he says.

Meanwhile, I understand the new round of funding was done remotely due to lockdown, even though Atomico and Onna had already met and stayed in touch after the VC firm ended up not participating in the startup’s Series A.

Recalls Elkhou: “We had met with our investors in person over a year ago, and have had many video calls since and prior to the pandemic. However, soon after the lockdowns took effect, the need for remote collaboration tools skyrocketed which only accelerated the critical role Onna has in helping people within organisations access and share knowledge that was spread across an ever growing number of apps. If anything, it brought new urgency to the problem we were solving, because workplace serendipity no longer existed. You couldn’t answer questions over a coffee or by the water cooler, but these new remote workers still needed to access knowledge and share it securely.”

Powered by WPeMatico

Every company today is struggling to deal with security and understanding what is happening on their systems. This is even more pronounced as companies have had to move their employees to work from home. Uptycs, a Boston-area security analytics startup, announced a $30 million Series B today to help companies detect and understand breaches when they happen.

Sapphire Ventures led the round with help from Comcast Ventures and ForgePoint Capital. The startup has now raised a total of $43 million, according to the company. Under the terms of today’s deal, Sapphire Ventures’ president and managing director Jai Das will be joining the company’s board.

Company co-founder and CEO Ganesh Pai says he and his co-founders previously worked at Akamai, where they observed Akamai’s debugging and diagnostic tools, which were designed to work at massive scale. The founders believed they could use a similar approach to building a security analytics platform, and in 2016 the group launched Uptycs .

“We help people to solve intrusion detection, compliance and audit and incident investigation. These are table stakes requirements [for security solutions] that most large scale organizations have, and of course with their scale the challenges vary. What we at Uptycs do is provide a solution for that,” Pai told TechCrunch.

The company uses a flight recorder approach to security, giving security operations teams the ability to sift through the data and review exactly how a detection happened and how the intruder got through the company’s defenses.

He recognizes his company is fortunate to get a round this large right now, but he says the solution has attracted a number of customers signing seven-digit contracts and this in turn got the attention of investors. “That customer engagement, their experience and this commitment from our customers led to this substantial round of funding,” he said.

The company currently has 65 employees spread across offices in Waltham, a Boston suburb, as well as two offices in India. Pai says the plan is to double that number in the next 12 months. “Between the cash flow from our existing customers and the pipeline for us and the funding, we are planning to grow in a meaningful way. If everything aligns with our expectation we will double our team size in the next 12 months,” he said.

As he grows his company in this way, Pai says they are talking to their investors about how to build a diverse workforce. “We’ve thought long and hard about it, both in terms of diversity and inclusion. It is a lot harder to execute because at the end of the day, there is a finite talent pool, but we are having conversations with our investors, who have seen patterns of success in terms of implementing such plans from growth stage ventures,” he said.

He added, “And of course we are a very early-stage company, but we are extremely cognizant, and given the current circumstances are acutely aware that we need to do our very best and make a difference.”

As the company has moved to work from home across its operations, he says it has benefited from working in the cloud from the start. “As an organization we are very fortunate that we built our organization so that everything runs in the cloud and everyone has been able to remain very productive,” he said.

Powered by WPeMatico

Adtech startup Admix is announcing that it has raised $7 million in Series A funding.

The London-based company was founded by CEO Samuel Huber (previously owner of an indie gaming studio) and COO Joe Bachle-Morris (who previously worked in the ad agency world). The company is working to bring ads to games, esports, virtual reality and augmented reality.

In-game advertising is already a huge market, but Admix says it’s differentiated by focusing on building a product that supports game advertising at scale, where advertisers can bid programmatically through traditional ad-buying platforms, rather than relying on an ad agency model.

For developers, Admix offers an SDK for the Unity and Unreal game engines, allowing them to drag and drop into their games ad formats like billboards, posters and 3D spaces. The startup says it’s working with more than 200 developers and is running campaigns from more than 500 advertisers each month, with past advertisers including National Geographic, Uber and State Farm.

“The concept of putting ads in games is obviously not new, but the scalability of our solution is what is revolutionary, delivering instant and consistent revenue to game makers, or streaming platforms,” Huber said in a statement. “This coupled with the fact that 1.5B people play games globally every day, means that gaming is becoming a truly mainstream advertising channel.”

Admix previously raised $2.1 million, according to Crunchbase. The Series A was led by U.K.-based Force Over Mass, with the participation from Speedinvest, Sure Valley Ventures and Nigel Morris (a former Dentsu Aegis executive), as well as other angel investors.

Powered by WPeMatico

Headless CMS company Contentful today announced that it has raised an $80 million Series E funding round led by Sapphire Ventures, with participation from General Catalyst, Salesforce Ventures and a number of other new and existing investors. With this, the company has now raised a total of $158.3 million and a Contentful spokesperson tells me that it is approaching a $1 billion valuation.

In addition, the company also today announced that it has hired Bridget Perry as its CMO. She previously led Adobe’s marketing efforts across Europe, the Middle East and Africa.

Currently, 28% of the Fortune 500 use Contentful to manage their content across platforms. The company says it has a total of 2,200 paying customers right now and these include the likes of Spotify, ITV, the British Museum, Telus and Urban Outfitters.

Steve Sloan, the company’s CEO who joined the company late last year, attributes its success to the fact that virtually every business today is in the process of figuring out how to become digital and serve its customers across platforms — and that’s a process that has only been accelerated by the coronavirus pandemic.

“Ten or 15 years ago, when these content platforms or content management systems were created, they were a) really built for a web-only world and b) where the website was a complement to some other business,” he said. “Today, the mobile app, the mobile web experience is the front door to every business on the planet. And that’s never been any more clear than in this recent COVID crisis, where we’ve seen many, many businesses — even those that are very traditional businesses — realize that the dominant and, in some cases, only way their customers can interact with them is through that digital experience.”

But as they are looking at their options, many decide that they don’t just want to take an off-the-shelf product, Sloan argues, because it doesn’t allow them to build a differentiated offering.

Perry also noted that this is something she saw at Adobe, too, as it built its digital experience business. “Leading marketing at Adobe, we used it ourselves,” she said. “And so the challenge that we heard from customers in the market was how complex it was in some cases to implement, to organize around it, to build those experiences fast and see value and impact on the business. And part of that challenge, I think, stemmed from the kind of monolithic, all-in-one type of suite that Adobe offered. Even as a marketer at Adobe, we had challenges with that kind of time to market and agility. And so what’s really interesting to me — and one of the reasons why I joined Contentful — is that Contentful approaches this in a very different way.”

Sloan noted that putting the round together was a bit of an adventure. Contentful’s existing investors approached the company around the holidays because they wanted to make a bigger investment in the company to fuel its long-term growth. But at the time, the company wasn’t ready to raise new capital yet.

“And then in January and February, we had inbound interest from people who weren’t yet investors, who came to us and said, ‘hey, we really want to invest in this company, we’ve seen the trend and we really believe in it.’ So we went back to our insiders and said, ‘hey, we’re going to think about actually moving in our timeline for raising capital,” Sloan told me. “And then, right about that time is when COVID really broke out, particularly in Western Europe in North America.”

That didn’t faze Contentful’s investors, though.

“One of the things that really stood out about our investors — and particularly our lead investor for this round Sapphire — is that when everybody else was really, really frightened, they were really clear about the opportunity, about their belief in the team and about their understanding of the progress we had already made. And they were really unflinching in terms of their support,” Sloan said.

Unsurprisingly, the company plans to use the new funding to expand its go-to-market efforts (that’s why it hired Perry, after all), but Sloan also noted that Contentful plans to invest quite a bit into R&D, as well, as it looks to help its customers solve more adjacent problems.

Powered by WPeMatico

CRM software has become a critical piece of IT when it comes to getting business done, and today a startup focusing on one specific aspect of that stack — sales automation — is announcing a growth round of funding underscoring its own momentum. Outreach, which has built a popular suite of tools used by salespeople to help identify and reach out to prospects and improve their relationships en route to closing deals, has raised $50 million in a Series F round of funding that values the company at $1.33 billion.

The funding will be used to continue expanding geographically — headquartered in Seattle, Outreach also has an office in London and wants to do more in Europe and eventually Asia — as well as to invest in product development.

The platform today essentially integrates with a company’s existing CRM, be it Salesforce, or Microsoft’s, or Kustomer, or something else — and provides an SaaS-based set of tools for helping to source and track meetings, have to-hand information on sales targets, and a communications manager that helps with outreach calls and other communication in real time. It will be investing in more AI around the product, such as its newest product Kaia (an acronym for “knowledge AI assistant”), and it has also hired a new CFO, Melissa Fisher, from Qualys, possibly a sign of where it hopes to go next as a business.

Sands Capital — an investor out of Virginia that also backs the likes of UiPath and DoorDash — is leading the round, Outreach noted, with “strong participation” also from strategic backer Salesforce Ventures. Other investors include Operator Collective (a new backer that launched last year and focuses on B2B) and previous backers Lone Pine Capital, Spark Capital, Meritech Capital Partners, Trinity Ventures, Mayfield and Sapphire Ventures.

Outreach has raised $289 million to date, and for some more context, this is definitely an up round: the startup was last valued at $1.1 billion when it raised a Series E in April 2019.

The funding comes on the heels of strong growth for the company: More than 4,000 businesses now use its tools, including Adobe, Tableau, DoorDash, Splunk, DocuSign and SAP, making Outreach the biggest player in a field that also includes Salesloft (which also raised a significant round last year on the heels of Outreach’s), Clari, Chorus.ai, Gong, Conversica and Afiniti. Its sweet spot has been working with technology-led businesses and that sector continues to expand its sales operations, even as much of the economy has contracted in recent months.

“You are seeing a cambric explosion of B2B startups happening everywhere,” Manny Medina, CEO and co-founder of Outreach, said in a phone interview this week. “It means that sales roles are being created as we speak.” And that translates to a growing pool of potential customers for Outreach.

It wasn’t always this way.

When Outreach was first founded in 2011 in Seattle, it wasn’t a sales automation company. It was a recruitment startup called GroupTalent working on software to help source and hire talent, aimed at tech companies. That business was rolling along, until it wasn’t: In 2015, the startup found itself with only two months of runway left, with little hope of raising more.

“We were not hitting our stride, and growth was hard. We didn’t make the numbers in 2014 and then had two months of cash left and no prospects of raising more,” Medina recalled. “So I sat down with my co-founders,” — Gordon Hempton, Andrew Kinzer and Wes Hather, none of whom are at the company anymore — “and we decided to sell our way out of it. We thought that if we generated more meetings we could gain more opportunities to try to sell our recruitment software.

“So we built the engine to do that, and we saw that we were getting 40% reply rates to our own outreaching emails. It was so successful we had a 10x increase in productivity. But we ran out of sales capacity, so we started selling the meetings we had managed to secure with potential talent directly to the tech companies themselves,” in other words, the other side of its marketplace, those looking to fill vacancies.

That quickly tipped over into a business opportunity of its own. “Companies were saying to us, ‘I don’t want to buy the recruitment software. I need that sales engine!” The company never looked back, and changed its name to work for the pivot.

Fast-forward to 2020, and times are challenging in a completely different way, defined as we are by a global health pandemic that affects what we do every day, where we go, how we work, how we interact with people and much more.

Medina says the impact of the novel coronavirus has been a significant one for the company and its customers, in part because it fits well with two main types of usage cases that have emerged in the world of sales in the time of COVID-19.

“Older sellers now working from home are accomplished and don’t need to be babysat,” he said, but added they can’t rely on their traditional touchpoints “like meetings, dinners and bar mitzvahs” anymore to seal deals. “They don’t have the tools to get over the line. So our product is being called in to help them.”

Another group at the other end of the spectrum, he said, are “younger and less experienced salespeople who don’t have the physical environment [many live in smaller places with roommates] nor experience to sell well alone. For them it’s been challenging not to come into an office because especially in smaller companies, they rely on each other to train, to listen to others on calls to learn how to sell.”

That’s the other scenario where Outreach is finding some traction: They’re using Outreach’s tools as a proxy for physically sitting alongside and learning from more experienced colleagues, and using it as a supplement to learning the ropes in the old way.

“Outreach’s leadership position in the market, clear mission, and value-added approach make the company a natural investment choice for us,” said Michael Clarke, partner at Sands Capital’s Global Innovation Fund, in a statement. “Now more than ever, companies need an AI-powered sales engagement platform like Outreach. Enterprise sales teams are rapidly adopting sales engagement platforms and Outreach’s rapid growth reflects this.”

Like a lot of sales tools that are powered by AI, Outreach in part is taking on some of the more mundane jobs of salespeople.

But Medina doesn’t believe that this will play out in the “man versus machine” scenario we often ponder when we think about human obsolescence in the face of technological efficiency. In other words, he doesn’t think we’re close to replacing the humans in the mix, even at a time when we’re seeing so many layoffs.

“We are at the early innings,” he said. “There are 6.8 million sales people and we only have north of 100,000 users, not even 2% of the market. There may be a redefinition of the role, but not a reduction.”

Powered by WPeMatico

Sherman Ye founded VESoft in 2018 when he saw a growing demand for graph databases in China. Its predecessors, like Neo4j and TigerGraph, had already been growing aggressively in the West for a few years, while China was just getting to know the technology that leverages graph structures to store data sets and depict their relationships, such as those used for social media analysis, e-commerce recommendations and financial risk management.

VESoft is ready for further growth after closing an $8 million funding round led by Redpoint China Ventures, an investment firm launched by Silicon Valley-based Redpoint Ventures in 2005. Existing investor Matrix Partners China also participated in the Series pre-A round. The new capital will allow the startup to develop products and expand to markets in North America, Europe and other parts of Asia.

The 30-people team is comprised of former employees from Alibaba, Facebook, Huawei and IBM. It’s based in Hangzhou, a scenic city known for its rich history and housing Alibaba and its financial affiliate Ant Financial, where Ye previously worked as a senior engineer after his four-year stint with Facebook in California. From 2017 to 2018, the entrepreneur noticed that Ant Financial’s customers were increasingly interested in adopting graph databases as an alternative to relational databases, a model that had been popular since the 80s and normally organizes data into tables.

“While relational databases are capable of achieving many functions carried out by graph databases… they deteriorate in performance as the quantity of data grows,” Ye told TechCrunch during an interview. “We didn’t use to have so much data.”

Information explosion is one reason why Chinese companies are turning to graph databases, which can handle millions of transactions to discover patterns within scattered data. The technology’s rise is also a response to new forms of online businesses that depend more on relationships.

“Take recommendations for example. The old model recommends content based purely on user profiles, but the problem of relying on personal browsing history is it fails to recommend new things. That was fine for a long time as the Chinese [internet] market was big enough to accommodate many players. But as the industry becomes saturated and crowded… companies need to ponder how to retain existing users, lengthen their time spent, and win users from rivals.”

The key lies in serving people content and products they find appealing. Graph databases come in handy, suggested Ye, when services try to predict users’ interest or behavior as the model uncovers what their friends or people within their social circles like. “That’s a lot more effective than feeding them what’s trending.”

Neo4j compares relational and graph databases (Link)

The company has made its software open source, which the founder believed can help cultivate a community of graph database users and educate the market in China. It will also allow VESoft to reach more engineers in the English-speaking world who are well-acquainted with the open-source culture.

“There is no such thing as being ‘international’ or ‘domestic’ for a technology-driven company. There are no boundaries between countries in the open-source world,” reckoned Ye.

When it comes to generating income, the startup plans to launch a paid version for enterprises, which will come with customized plug-ins and host services.

The Nebula Graph, the brand of VESoft’s database product, is now serving 20 enterprise clients from areas across social media, e-commerce and finance, including big names like food delivery giant Meituan, popular social commerce app Xiaohongshu and e-commerce leader JD.com. A number of overseas companies are also trialing Nebula.

The time is ripe for enterprise-facing startups with a technological moat in China as the market for consumers has been divided by incumbents like Tencent and Alibaba. This makes fundraising relatively easy for VESoft. The founder is confident that Chinese companies are rapidly catching up with their Western counterparts in the space, for the gargantuan amount of data and the myriad of ways data is used in the country “will propel the technology forward.”

Powered by WPeMatico

Asynchronous chat apps like Slack have done their best to kill email, but maybe the key to chat replacing email is just making email look like chat? That’s the idea of Spike, a productivity startup that has built an email app that organizes emails into chat bubbles with an interface that encourages users to keep it short and simple.

Spike’s software began with a focus solely on re-skinning the email experience, but today they’re also launching support for collaborative notes and tasks into their interface as they look to provide a cohesive solution for productivity. The company is fitting an awful lot of functionality into one window, but they hope that streamlining these apps together can leave users spending less time tabbing through separate windows and more time getting stuff done.

“Email is a collection of your tasks, so why should it be separated from where your other tasks are?” asks CEO Dvir Ben-Aroya.

The new functionality widens the ambitions of the software but also refocuses the app on a more complete business use case. Ben-Aroya admits that the company hasn’t pushed monetization very hard in the past, instead looking to scale up its base of free users in an effort to eventually scale up inside organizations. As the app looks to bring small businesses and larger enterprises onboard, the app is keeping its free tier, but to get past limits on message history and note/task creation users are going to have to upgrade to a $7.99 per month per user plan ($5.99 per month when billed annually).

Alongside its product news, the startup also shared today that it has raised $8 million in a Series A round led by Insight Partners . Wix, NFX and Koa Labs also participated in the round. The company plans to use the cash to aggressively scale hiring and double its team this year.

“[W]e see a massive addressable market for centralized communication hubs to connect disparate messaging channels,” Insight Partners VP Daniel Aronovitz said in a statement. “The current climate and associated macro-tailwinds behind remote teamwork have only strengthened our belief that there is a sizable and growing demand for digital collaboration tools.”

The company’s platform is compatible with most email services and the app is available on Android, iOS, Mac and Windows.

Email startups are often privy to some of a user’s most sensitive data and can receive a lot of inquiries regarding privacy. As a result, Ben-Aroya believes his company is far ahead of competitors when it comes to safety. “Unlike many other available email clients, we’re never touching, manipulating, using, reusing or selling any part of the user data,” he says.

Spike has raised $16 million in funding to date.

Powered by WPeMatico