Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Most sales teams earn a commission after a sale closes, but nothing prior to that. Yet there are a variety of signals along the way that indicate the sales process is progressing, and SetSail, a startup from some former Google engineers, is using machine learning to figure out what those signals are, and how to compensate salespeople as they move along the path to a sale, not just after they close the deal.

Today, the startup announced a $7 million investment led by Wing Venture Capital with help from Operator Collective and Team8. Under the terms of the deal, Leyla Seka from Operator will be joining the board. Today’s investment brings the total raised to $11 million, according to the company.

CEO and co-founder Haggai Levi says his company is based on the idea that commission alone is not a good way to measure sales success, and that it is in fact a lagging indicator. “We came up with a different approach. We use machine learning to create progress-based incentives,” Levi explained.

To do that they rely on machine learning to discover the signals that are coming from the customer that indicate that the deal is moving forward, and using a points system, companies can begin compensating reps on hitting these milestones, even before the sale closes.

The seeds for the idea behind SetSail were planted years ago when the three founders were working at Google tinkering with ways to motivate sales reps beyond pure commission. From a behavioral perspective, Levi and his co-founders found that reps were taking fewer risks with a pure commission approach and they wanted to find a way to change that. The incremental compensation system achieves that.

“If I’m closing the deal, I’m getting my commission. If I’m not closing the deal, I’m getting nothing. That means from a behavioral point of view, I would take the shortest path to win a deal, and I would take the minimum risk possible. So if there’s a competitive situation I will try to avoid that,” he said.

They look at things like appointments, emails and call transcripts. The signals will vary by customer. One may find an appointment with CIO is a good signal a deal is on the right trajectory, but to avoid having reps gaming the system by filling the CRM with the kinds of positive signals the company is looking for, they only rely on objective data, rather than any kind of self-reporting information from reps themselves.

The team eventually built a system like this inside Google, and in 2018, left to build a solution for the rest of the world that does something similar.

As the company grows, Levi says he is building a diverse team, not only because it’s the right thing to do, but because it simply makes good business sense. “The reality is that we’re building a product for a diverse audience, and if we don’t have a diverse team we would never be able to build the right product,” he explained.

The company’s unique approach to sales compensation is resonating with customers like Dropbox, Lyft and Pendo, who are looking for new ways to motivate sales teams, especially during a pandemic when there may be a longer sales cycle. This kind of system provides a way to compensate sales teams more incrementally and reward positive approaches that have proven to result in sales.

Powered by WPeMatico

Karma Automotive has raised a $100 million lifeline from outside investors, as reported by Bloomberg, with the struggling electric vehicle maker’s fortunes likely buoyed by the current market optimism on other EV companies, including Tesla. Karma is the reincarnated version of Fisker Automotive, which previously faced bankruptcy before being acquired by Wanxiang Group in 2014.

Karma Automotive has made more progress than Fisker ever did, including actually delivering around 500 of its inaugural Revero electric sport sedan in 2019. The company will be continuing to sell the Revero, which retails starting at around $140,000, and will also be looking to add a high-horsepower GTE version, as well as a supercar for an even higher-tier customer.

The automaker also says that it’s in discussions with a partner for a commercial delivery truck, which it intends to develop in prototype form by year’s end. There are a number of different companies pursuing delivery vans for use by courier companies, including UPS and FedEx, and the increase in e-commerce spending presents an opportunity for multiple players to succeed in this category, even as there is a rush on in terms of entrants.

Karma will also seek to leverage and extend the benefits of its fresh investment by shopping around its EV platform to other automakers and OEMs, the company says, and also will eventually expand beyond pure EVs to hybrid fuel vehicles. In short, it sounds like Karma is willing to try just about everything and anything to chart a path toward profitability, but time will tell if that’s intelligent opportunism, or scattershot desperation.

Powered by WPeMatico

Entrepreneurs Roundtable Accelerator -backed Nayya is on a mission to simplify choosing and managing employee benefits through machine learning and data transparency.

The company has raised $2.7 million in seed funding led by Social Leverage, with participation from Guardian Strategic Ventures, Cameron Ventures, Soma Capital, as well as other strategic angels.

The process of choosing an employer-provided healthcare plan and understanding that plan can be tedious at best and incredibly confusing at worst. And that doesn’t even include all of the supplemental plans and benefits associated with these programs.

Co-founded by Sina Chehrazi and Akash Magoon, Nayya tries to solve this problem. When enrollment starts, employers send out an email that includes a link to Nayya’s Companion, the company’s flagship product.

Companion helps employees find the plan that is right for them. The software first asks a series of questions about lifestyle, location, etc. For example, Nayya co-founder and CEO Chehrazi explained that people who bike to work, as opposed to driving in a car, walking or taking public transportation, are 20 times more likely to get into an accident and need emergency services.

Companion asks questions in this vein, as well as questions around whether you take medication regularly or if you expect your healthcare costs to go up or down over the next year, without getting into the specifics of chronic ailments or diseases or particular issues.

Taking that data into account, Nayya then looks at the various plans provided by the employer to show you which one matches the user’s particular lifestyle and budget best.

Nayya doesn’t just pull information directly from the insurance company directory listings, as nearly 40% of those listings have at least one error or are out of date. It pulls from a broad variety of data sources, including the Centers for Medicare and Medicaid Services (CMS), to get the cleanest, most precise data around which doctors are in network and the usual costs associated with visiting those doctors.

Alongside Companion, Nayya also provides a product called “Edison,” which it has dubbed the Alexa for Helathcare. Users can ask Edison questions like “What is my deductible?” or “Is Dr. So-and-So in my network and what would it cost to go see her?”

The company helps individual users find the right provider for them with the ability to compare costs, location and other factors involved. Nayya even puts a badge on listings for providers where another employee at the company has gone and had a great experience, giving another layer of validation to that choice.

As the healthtech industry looks to provide easier-to-use healthcare and insurance, the idea of “personalization” has been left behind in many respects. Nayya focuses first and foremost on the end-user and aims to ensure that their own personal healthcare journey is as simple and straightforward as possible, believing that the other pieces of the puzzle will fall into place when the customer is taken care of.

Nayya plans on using the funding to expand the team across engineering, data science, product management and marketing, as well as doubling down on the amount of data the company is purchasing, ingesting and cleaning.

Alongside charging employers on a per seat, per month basis, Nayya is also looking to start going straight to insurance companies with its product.

“The greatest challenge is educating an entire ecosystem and convincing that ecosystem to believe that where the consumer wins, everyone wins,” said Chehrazi. “How to finance and understand your healthcare has never been more important than it is right now, and there is a huge need to provide that education in a data driven way to people. That’s where I want to spend the next I don’t know how many years of my life to drive that change.”

Nayya has five full-time employees currently and 80% of the team comes from racially diverse backgrounds.

Powered by WPeMatico

Replenysh has been kicking since 2016, but up til now, the Orange County, California startup hasn’t done much press. That changes today, as the company announces that it has raised a $2 million seed round with the fairly lofty goal of transforming recycling in the U.S.

A press release outlining Replenysh’s plans offers up plenty of information about what’s wrong with recycling here in the States. Among some of the key figures are the fact that it can be up to 3x more expensive to recycle a ton of material rather than simply dropping it off in a landfill. Outside of the positive press around sustainability and the rare instance of corporate altruism, that’s a rather large fiscal penalty for doing the right thing.

For its part, the Replenysh team says it’s “building this new digital supply chain.” What that means in less buzzwordy terms is that the company is working to provide software solutions designed to benefit both those selling recycled goods and companies looking to acquire the materials. That latter bit is hotter market than you’re likely aware, as big corporations have set commitments to adopt recycled materials as part of larger pledges for sustainability.

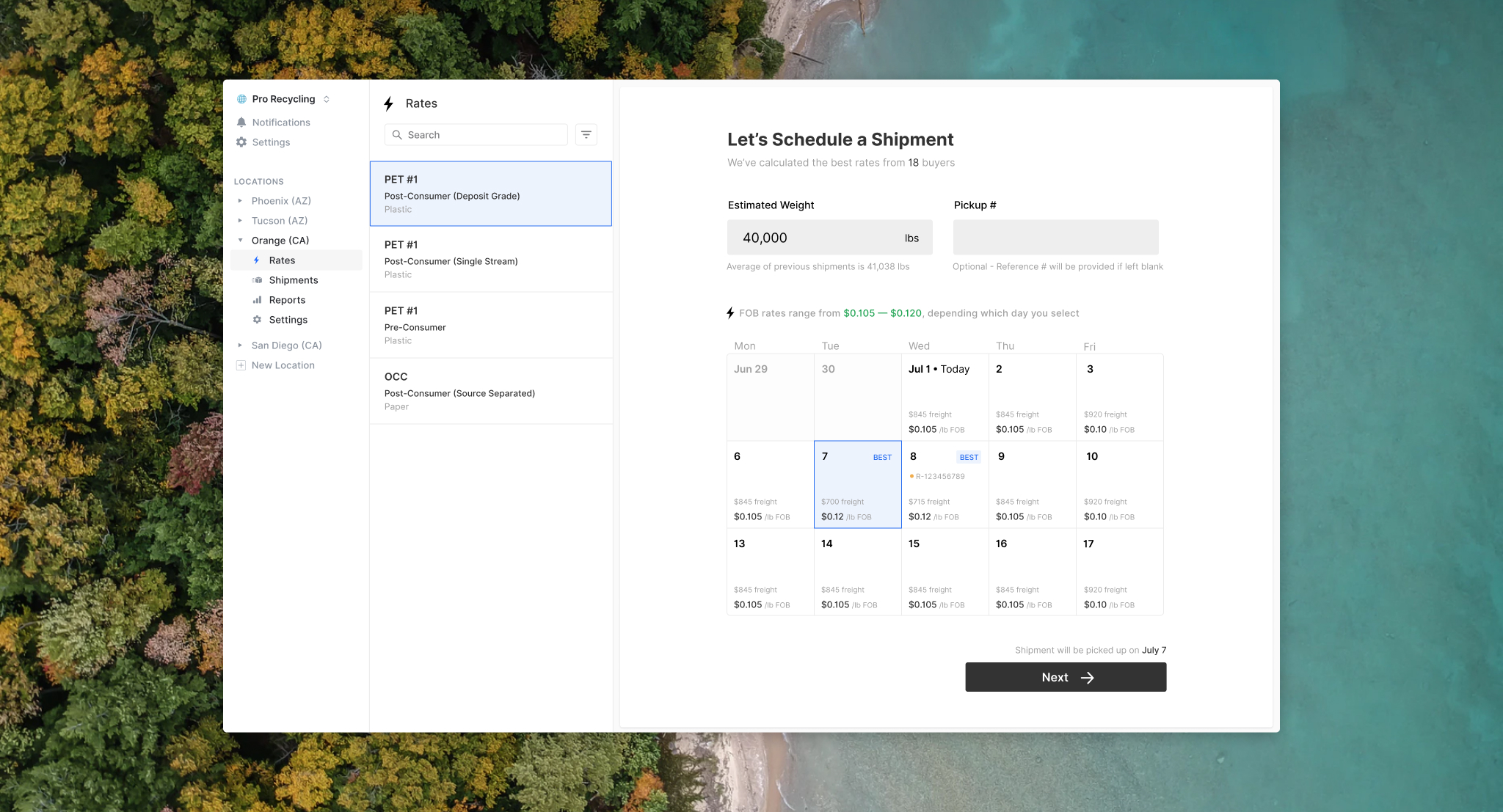

Image Credits: Replenysh

The company’s primary value comes by way of its interfacing with the owners and employees at the thousands of recycling centers based in the U.S. Replenysh has developed a software dashboard that allows the centers to find the best price for materials and schedule shipments. On the buyer side, the company also offers means by which brands can find sufficient materials and foster relationships with the aforementioned recycling centers. The company says it already has relationships with hundreds of recycling centers it has helped connect with buyers from large retailers and big brands (though it’s not yet disclosing the names of either).

“The response to our technology and services has been exciting,” founder Mark Armen told TechCrunch. “Recycling centers benefit from our rate discovery, price transparency, and workflow automation tools – and we are just getting started. We envision a world where all materials circulate through an intelligent system of continual reuse, which brands, recycling centers, and collectors can tap into and propel. The result will be a regenerative economy that restores ecosystems, relationships, and value.”

Replenysh is still a lean team, with an eight-person headcount (plus one intern). While it was founded and began working on pilots way back in 2016, the company says it really began work in earnest when it incorporated last year. The $2 million seed round is led by Kindred Ventures, Floodgate Fund and 122WEST, with plans to further build out the technologies and Replenysh’s network.

Powered by WPeMatico

Athlane, the YC-backed company from the Summer ’19 cohort, is today ready to launch with a fresh $3.3 million in capital. Investors include Y Combinator, Jonathan Kraft (New England Patriots), Michael Gordon (President of Fenway Sports Group, which owns the Red Sox and Liverpool Football Club), Global Founders Capital, Romulus Capital, Seabed VC and more.

The startup originally positioned itself as the “NCAA of esports” but, after some time in stealth, has taken a new approach. Athlane is looking to be the connective fiber between streamers and brands, facilitating sponsorship and endorsement deals with more transparent data and analytics and a streamlined communications flow.

Athlane has products for both brands and streamers.

Brands can use the Athlane Terminal to manage their sponsorships. The Insights Hub uses proprietary data to help brands understand which streamers are followed by their target demographic, and whether or not the products will resonate with that fan base. Insights also allow brands to see when a streamer’s viewership is growing.

From there, brands can send out sponsorship deals to streamers directly through the Athlane Terminal, and then track the ROI on that sponsorship deal throughout the campaign.

On the streamer side, the company has built out a platform called Athlane Pro, which lets streamers manage each task from their sponsors individually. Streamers can also use Athlane Pro to counter-offer inbound sponsorship deals or negotiate terms.

Streamers can also use Athlane’s machine learning algorithm to get clearer insights on their stream performance, such as whether their YouTube viewership overlaps with their Twitch viewership, or see which videos do better based on title or thumbnail. But more importantly, the Athlane Content Hub gives streamers the opportunity to understand if their fan base specifically aligns with this or that brand, and gives them the tools to reach out directly to that brand to solicit a sponsorship.

Athlane has also built out a Shop tool that lets streamers build out a no-code storefront for their fans, which they can link to on their Twitch, Twitter, Instagram, etc. This storefront can be a repository for all the products that streamer is endorsing, allowing fans to see products from multiple brands in a single place.

“We have a number of proprietary partnerships with data providers including companies like Twitter,” said co-founder Faisal Younus. “For example, we have a partnership with the leading manufacturer of apparel in esports, which ties back into our system so we can look at how merchandise is moving.”

That data, when paired with the data provided when a streamer signs in and integrates with the platform, becomes very precise, according to the company.

The startup charges brands using a tiered SaaS model, and streamers can do their first sponsorship for free on the platform. After the first sponsorship, streamers are charged a fee between $10 and $20 per deal. Athlane has also started working with agencies that represent brands and charges a discovery fee for talent those agencies find on the platform.

“COVID-19 has brought on very rapid growth on the viewership side, and because of that we’ve seen an intense interest from a number of brands while conventional entertainment is shut down,” said Younus. “A lot of media spend is going to go unspent, but there is also a higher risk appetite for spending a little bit in esports, and our challenge is making sure this industry growth is sustained.”

He added that helping brands understand the true ROI of that spend will be key.

Powered by WPeMatico

OwnBackup has made a name for itself primarily as a backup and disaster recovery system for the Salesforce ecosystem, and today the company announced a $50 million investment.

Insight Partners led the round, with participation from Salesforce Ventures and Vertex Ventures. This chunk of money comes on top of a $23 million round from a year ago, and brings the total raised to more than $100 million, according to the company.

It shouldn’t come as a surprise that Salesforce Ventures chipped in when the majority of the company’s backup and recovery business involves the Salesforce ecosystem, although the company will be looking to expand beyond that with the new money.

“We’ve seen such growth over the last two and a half years around the Salesforce ecosystem, and the other ISV partners like Veeva and nCino that we’ve remained focused within the Salesforce space. But with this funding, we will expand over the next 12 months into a few new ecosystems,” company CEO Sam Gutmann told TechCrunch.

In spite of the pandemic, the company continues to grow, adding 250 new customers last quarter, bringing it to over 2,000 customers and 250 employees, according to Gutmann.

He says that raising the round, which closed at the beginning of May, had some hairy moments as the pandemic began to take hold across the world and worsen in the U.S. For a time, he began talking to new investors in case his existing ones got cold feet. As it turned out, when the quarterly numbers came in strong, the existing ones came back and the round was oversubscribed, Gutmann said.

“Q2 frankly was a record quarter for us, adding over 250 new accounts, and we’re seeing companies start to really understand how critical this is,” he said.

The company plans to continue hiring through the pandemic, although he says it might not be quite as aggressively as they once thought. Like many companies, even though they plan to hire, they are continually assessing the market. At this point, he foresees growing the workforce by about another 50 people this year, but that’s about as far as he can look ahead right now.

Gutmann says he is working with his management team to make sure he has a diverse workforce right up to the executive level, but he says it’s challenging. “I think our lower ranks are actually quite diverse, but as you get up into the leadership team, you can see on the website unfortunately we’re not there yet,” he said.

They are instructing their recruiting teams to look for diverse candidates whether by gender or ethnicity, and employees have formed a diversity and inclusion task force with internal training, particularly for managers around interviewing techniques.

He says going remote has been difficult, and he misses seeing his employees in the office. He hopes to have at least some come back before the end of the summer and slowly add more as we get into the fall, but that will depend on how things go.

Powered by WPeMatico

When the inventor of AWS Lambda, Tim Wagner, and the former head of blockchain at AWS, Shruthi Rao, co-found a startup, it’s probably worth paying attention. Vendia, as the new venture is called, combines the best of serverless and blockchain to help build a truly multicloud serverless platform for better data and code sharing.

Today, the Vendia team announced that it has raised a $5.1 million seed funding round, led by Neotribe’s Swaroop ‘Kittu’ Kolluri. Correlation Ventures, WestWave Capital, HWVP, Firebolt Ventures, Floodgate and FuturePerfect Ventures also participated in this oversubscribed round.

Seeing Wagner at the helm of a blockchain-centric startup isn’t exactly a surprise. After building Lambda at AWS, he spent some time as VP of engineering at Coinbase, where he left about a year ago to build Vendia.

“One day, Coinbase approached me and said, ‘Hey, maybe we could do for the financial system what you’ve been doing over there for the cloud system,’” he told me. “And so I got interested in that. We had some conversations. I ended up going to Coinbase and spent a little over a year there as the VP of Engineering, helping them to set the stage for some of that platform work and tripling the size of the team.” He noted that Coinbase may be one of the few companies where distributed ledgers are actually mission-critical to their business, yet even Coinbase had a hard time scaling its Ethereum fleet, for example, and there was no cloud-based service available to help it do so.

“The thing that came to me as I was working there was why don’t we bring these two things together? Nobody’s thinking about how would you build a distributed ledger or blockchain as if it were a cloud service, with all the things that we’ve learned over the course of the last 10 years building out the public cloud and learning how to do it at scale,” he said.

Wagner then joined forces with Rao, who spent a lot of time in her role at AWS talking to blockchain customers. One thing she noticed was that while it makes a lot of sense to use blockchain to establish trust in a public setting, that’s really not an issue for enterprise.

“After the 500th customer, it started to make sense,” she said. “These customers had made quite a bit of investment in IoT and edge devices. They were gathering massive amounts of data. They also made investments on the other side, with AI and ML and analytics. And they said, ‘Well, there’s a lot of data and I want to push all of this data through these intelligent systems. I need a mechanism to get this data.’” But the majority of that data often comes from third-party services. At the same time, most blockchain proof of concepts weren’t moving into any real production usage because the process was often far too complex, especially enterprises that maybe wanted to connect their systems to those of their partners.

“We are asking these partners to spin up Kubernetes clusters and install blockchain nodes. Why is that? That’s because for blockchain to bring trust into a system to ensure trust, you have to own your own data. And to own your own data, you need your own node. So we’re solving fundamentally the wrong problem,” she explained.

The first product Vendia is bringing to market is Vendia Share, a way for businesses to share data with partners (and across clouds) in real-time, all without giving up control over that data. As Wagner noted, businesses often want to share large data sets but they also want to ensure they can control who has access to that data. For those users, Vendia is essentially a virtual data lake with provenance tracking and tamper-proofing built in.

The company, which mostly raised this round after the coronavirus pandemic took hold in the U.S., is already working with a couple of design partners in multiple industries to test out its ideas, and plans to use the new funding to expand its engineering team to build out its tools.

“At Neotribe Ventures, we invest in breakthrough technologies that stretch the imagination and partner with companies that have category creation potential built upon a deep-tech platform,” said Neotribe founder and managing director Kolluri. “When we heard the Vendia story, it was a no-brainer for us. The size of the market for multiparty, multicloud data and code aggregation is enormous and only grows larger as companies capture every last bit of data. Vendia’s serverless-based technology offers benefits such as ease of experimentation, no operational heavy lifting and a pay-as-you-go pricing model, making it both very consumable and highly disruptive. Given both Tim and Shruthi’s backgrounds, we know we’ve found an ideal ‘Founder fit’ to solve this problem! We are very excited to be the lead investors and be a part of their journey.”

Powered by WPeMatico

Sex education in the United States is complicated.

One example: For decades, the United States invested billions into abstinence-only programs. Eventually, schools rejected government funding for these programs and pushed a more comprehensive and medically accurate agenda. Even with progress, schools across the country continue to reckon with a legacy of inaccuracy. And the government is still funding abstinence-only programs.

It’s bad news for students, and for founder of Lessonbee Reva McPollom, a change is long overdue. She can personally vouch for how non-comprehensive education in health classes can isolate students.

As a child, McPollom said she was called a tomboy and felt confused because she identified as a female. There was no lesson teaching the danger of gender stereotypes and norms.

“I felt wrong for liking sports, for wanting to play drums, I felt wrong for everything that I loved or liked or attached myself too as part of my identity,” she said.

The silent suffering, she says, continued through high school: “If you look at my senior yearbook, like I’m not even in it, I just totally erased myself by that point.”

Reva McPollom, the founder of Lessonbee (Image Source: Lessonbee)

After working as a journalist, digital marketer and a software engineer, McPollom returned to her past with a new idea. She founded Lessonbee, a more comprehensive health education curriculum provider to express diverse scenarios in schools. The company’s goal is to help students avoid what she had to go through: missing out on the joy of education and feeling worthy enough to learn.

The company sells a curriculum that covers a range of topics, from sex education to race to mental health, that integrates into existing K-12 school districts as a separate standalone course. The topics themselves then break down into smaller focus areas. For example, with the race unit launching soon Lessonbee will tackle the effects of race and ethnicity on quality of care, maternal health and food insecurity.

Lessonbee has hundreds of educational videos and interactive lessons created by teachers and the company, updated regularly. Each lesson also comes with a downloadable guide that describes content, objectives and recommendations for homework and quizzes. Lessonbee gives a guide for how to create culturally inclusive education, in line with standards put out by National Health Education and National Sexuality Education.

Image Source: Lessonbee

“It needs to meet all types of kids, regardless of where they’re at,” McPollom said.

One example scenario in the curriculum includes a student who starts having sex and then misses her period. Learners are then responsible for choosing what to do next, who to talk to and what they should do next time. It’s a “choose your adventure”-style learning experience.

Students can log onto the platform and take self-paced classes on different health units, ranging from sex education to mental health and racism. The lessons are taught through text-message scenarios or gamified situations to make sure students are actively engaging with the content, McPollom tells TechCrunch.

Image Source: Lessonbee

State policy regarding education is often a nightmare of intricacies and politics. This is part of the reason so few startups try to solve it. If Lessonbee were to pull off its goal, it would initiate bigger conversations around racism and health into a kid’s day-to-day.

McPollom is currently pitching the service to school districts, which have tight budgets, and venture capitalists, who say they are open for business. So far, the company has 600 registered schools on its platform.

“It’s a non-core academic subject so it’s the last priority, and there’s just inequity all over the place,” she said. “There’s a mismatch of privacy policies across the United States handled differently and it kind of dictates the quality of health education that you’re going to receive.”

Lessonbee subscription is priced low to be more accessible, starting at $16 per learner annually. Individual courses start at $8 per learner annually.

Today, McPollom announced that she has raised $920,000 in financing.

As for the future, McPollom views her go-to market health class strategy as Lessonbee’s “Trojan horse.” She wants to integrate the culturally diverse curriculum into social studies or science classes, and cover how interconnected the subjects are and their ties to inequity and health.

McPollam says the team is developing an anti-racism course to introduce for the fall in the wake of the recent protests against police brutality. Topics in the anti-racism course include the effect of race and ethnicity on quality of care, ways racism impacts maternal health and structural racism and food insecurity.

“We’re hoping to evolve to this idea of health across the curriculum,” she said. “For health to be effective, for you to actually move the needle, health needs to be holistic.”

Powered by WPeMatico

All founders love “free” money, but with the pandemic going on, the necessity of free money has taken on a whole new meaning this year. First, there was the scramble to secure PPP loans a few weeks back for U.S.-based startups, and then the second wave of PPP loans when Congress offered a second tranche of funding. Two weeks ago, I covered a company called MainStreet, which is helping startups apply for local economic development credits that cities offer to businesses relocating to their regions.

In the same vein, neo.tax wants to help startups secure R&D research credits from the federal government — which tend to be fairly easy to acquire for most software-based startups given the current IRS rules for what qualifies as “research.”

The free money is good, but what sets this startup apart is its ambitious vision to bring machine learning to company accounting — making it easier to track expenses and ultimately save on costs.

It’s a vision that has attracted top seed investors to the startup. Neo.tax announced today that it raised $3 million in seed funding from Andy McLoughlin at Uncork Capital and Mike Maples at Floodgate, with Michael Ma at Liquid 2 Ventures and Deena Shakir at Lux Capital participating. The round closed last week.

Neo.tax was founded by Firas Abuzaid, who spent the past few years focused on a Ph.D in computer science from Stanford, where he conducted research in machine learning. He’s joined by Ahmad Ibrahim, who most recently was at Intuit launching small business accounting products; and Stephen Yarbrough, who was head of tax at Kruze Consulting, a popular consultancy for startups on accounting and financial issues. Leonardo De La Rocha, who was creative director of Facebook Ads for nearly five years and currently works at Intuit, is an official advisor to the company.

Neo.tax’s co-founders Stephen Yarbrough, Firas Abuzaid and Ahmad Ibrahim. Image Credits: Neo.tax

Or in short, a perfect quad of folks to tackle small business accounting issues.

Neo.tax wants to automate everything about accounting, and that requires careful application of ML techniques to an absolutely byzantine problem. Abuzaid explained that AI is in some ways a perfect fit for these challenges. “There’s a very clearly defined data model, there’s a large set of constraints that are also clearly defined. There’s an obvious objective function, and there’s a finite search space,” he said. “But if you wanted to develop a machine-learning-based solution to automate this, you have to make sure you collect the right data, and you have to make sure that you can handle all of the numerous edge cases that are going to pop up in the 80,000 page U.S. tax code.“

That’s where neo.tax’s approach comes in. The software product is designed to ingest data about accounting, payroll and other financial functions within an organization and starts to categorize and pattern match transactions in a bid to take out much of the drudgery of modern-day accounting.

One insight is that rather than creating a single model for all small businesses, neo.tax tries to match similar businesses with each other, specializing its AI system to the particular client using it. “For example, let’s train a model that can target early-stage startups and then another model that can target Shopify businesses, another one that can target restaurants using Clover, or pizzerias or nail salons, or ice cream parlors,” Abuzaid said. “The idea here is that you can specialize to a particular domain and train a cascade of models that handle these different, individual subdomains that makes it a much more scalable solution.”

While neo.tax has a big vision long term to make accounting effortless, it wanted to find a beachhead that would allow it to work with small businesses and start to solve their problems for them. The team eventually settled on the R&D tax credit.

“That data from the R&D credit basically gives us the beginnings of the training data for building tax automation,” Ibrahim explained. “Automating tax vertical-by-vertical basically allows us to be this data layer for small businesses, and you can build lots of really great products and services on top of that data layer.“

So it’s a big long-term vision, with a focused upfront product to get there that launched about two months ago.

For startups that make less than $5 million in revenue (i.e., all early-stage startups), the R&D tax credit offers up to a quarter million dollars per year in refunds from the government for startups who either apply by July 15 (the new tax date this year due to the novel coronavirus) or who apply for an extension.

Neo.tax will take a 5% cut of the tax value generated from its product, which it will only take when the refund is actually received from the government. In this way, the team believes that it is better incentive-aligned with founders and business owners than traditional accounting firms, which charge professional services fees up front and often take a higher percentage of the rebate.

Ibrahim said that the company made about $100,000 in revenue in its first month after launch.

The startup is entering what has become a quickly crowded field led by the likes of Pilot, which has raised tens of millions of dollars from prominent investors to use a human and AI hybrid approach to bookkeeping. Pilot was last valued at $355 million when it announced its round in April 2019, although it has almost certainly raised more funding in the interim.

Ultimately, neo.tax is betting that a deeper technical infrastructure and a hyperfocus on artificial intelligence will allow it to catch up and compete with both Pilot and incumbent accounting firms, given the speed and ease of accounting and tax preparation when everything is automated.

Powered by WPeMatico

Bay Area-based robotics startup RIOS is coming out of stealth today to announce $5 million in funding. The round is being led by Valley Capital Partners and Morpheus Ventures, with participation from a long list of investors, including Grit Ventures, Motus Ventures, MicroVentures, Alumni Ventures Group, Fuji Corporation and NGK Spark Plug Co.

The move comes during a time of increased interest in factory automation. A number of different startups have received massive funding of late, including Berkshire Grey’s massive $263 million raise in January. RIOS’s raise is considerably smaller, of course, but the young company has more to prove.

Even so, investors are clearly eyeing automation with great interest amid an ongoing global pandemic that has both screeched many industries to a halt and led many to look to alternative production elements that remove the human element of virus transmission.

RIOS was founded in 2018, as a spin-out of Stanford University, with help from a number of Xerox PARC engineers. The startup has operated in stealth for the past year and a half while testing its technologies with a select group of partners.

The company’s first product is DX-1, a robot designed for a variety of industrial tasks, including static bin picking and conveyor belt operations. The system is powered by the company’s AI stack, including a perception system and a variety of tactile sensors mounted on the robotic hand.

The plan is to charge a monthly fee for the robotic system that includes a variety of services, including programming, maintenance, monitoring and regular updates.

Powered by WPeMatico