Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

The Not Company, Latin America’s leading contender in the plant-based meat and dairy substitute market, is about to close on an $85 million round of funding that would value it at $250 million, according to sources familiar with the company’s plans.

The latest round of funding comes on the heels of a series of successes for the Santiago-based business. In the two years since NotCo launched on the global stage, the company has expanded beyond its mayonnaise product into milk, ice cream and hamburgers. Other products, including a chicken meat substitute, are also on the product roadmap, according to people familiar with the company.

NotCo is already selling several products in Chile, Argentina and Latin America’s largest market — Brazil — and has signed a blockbuster deal with Burger King to be the chain’s supplier of plant-based burgers. It’s in this Burger King deal that NotCo’s approach to protein formulation is paying dividends, sources said. The company is responsible for selling 48 sandwiches per store per day in the locations where it’s supplying its products, according to one person familiar with the data. That figure outperforms Impossible Foods per-store sales, the person said.

NotCo is also now selling its burgers in grocery stores in Argentina and Chile. And while the company is not break-even yet, sources said that by December 2021 it could be — or potentially even cash flow positive.

NotCo co-founders Karim Pichara, Matias Muchnick and Pablo Zamora. Image Credit: The Not Company

With the growth both in sales and its diversification into new products, it’s little wonder that investors have taken note.

Sources said that the consumer brand-focused private equity firm L Catterton Partners and the Biz Stone-backed Future Positive were likely investors in the new financing round for the company. Previous investors in NotCo include Bezos Expeditions, the personal investment firm of Amazon founder Jeff Bezos; the London-based CPG investment firm, The Craftory; IndieBio; and SOS Ventures.

Alternatives to animal products are a huge (and still growing) category for venture investors. Earlier this month Perfect Day closed on a second tranche of $160 million for that company’s latest round of financing, bringing that company’s total capital raised to $361.5 million, according to Crunchbase. Perfect Day then turned around and launched a consumer food business called the Urgent Company.

These recent rounds confirm our reporting in Extra Crunch about where investors are focusing their time as they try to create a more sustainable future for the food industry. Read more about the path they’re charting.

Meanwhile, large food chains continue to experiment with plant-based menu items and push even further afield into cell-based meat using cultures from animals. KFC recently announced that it would be expanding its experiment with Beyond Meat’s chicken substitute in the U.S. — and would also be experimenting with cultured meat in Moscow.

Behind all of this activity is an acknowledgement that consumer tastes are changing, interest in plant-based diets are growing, and animal agriculture is having profound effects on the world’s climate.

As the website ClimateNexus notes, animal agriculture is the second-largest contributor to human-made greenhouse gas emissions after fossil fuels. It’s also a leading cause of deforestation, water and air pollution and biodiversity loss.

There are 70 billion animals raised annually for human consumption, which occupy one-third of the planet’s arable and habitable land surface, and consume 16% of the world’s freshwater supply. Reducing meat consumption in the world’s diet could have huge implications for reducing greenhouse gas emissions. If Americans were to replace beef with plant-based substitutes, some studies suggest it would reduce emissions by 1,911 pounds of carbon dioxide.

Powered by WPeMatico

The last few years haven’t proven too friendly to hardware companies in the augmented reality world. Enterprise-centric efforts like ODG, Daqri and Meta flared out, Magic Leap raised massive amounts of cash only to scale back its dreams this year in the face of looming disaster and just about every other hardware player has suffered some form of an identity crisis. As someone who covers the space closely, this has led me to keep an eye on companies I’ve covered that seem to have been a bit quiet.

Over the past three years, every few months or so, I’d check in on the AR startup Mira just to see if they had any updates. I met with them in 2017 after they announced they’d raised funding from Sequoia, notable as one of that firms few public AR/VR investments. Back then, Mira pitched its device as a Google Cardboard for AR, something that could give people a lightweight introduction to the world of augmented reality. They teased both workplace and at-home use cases, but there was an early skew toward approaching developers building consumer apps.

Over on Extra Crunch, read about why the first wave of AR hardware companies died and what the next generation of startups need to do to succeed.

The company has been keeping a pretty low profile since it publicly launched in 2017, but they’re finally ready to give some updates.

Mira now tells TechCrunch that they’ve raised about $10 million worth of funding over a few top-ups, which the team is collectively deeming as a seed extension round. Sequoia and SF-based Happiness Ventures led these financings, of which the startup did not break out the specific terms. The team has now raised just under $13 million to date. Mira has used this cash to refocus its business and refine its hardware.

By late-2018, the founders had decided to move their focus solely toward industrial rollouts of their headset.

“As we looked across the consumer landscape, as we looked across the industrial landscape, as we looked across government, it became very clear that where that value-driven use case is ripe today is much more in the industrial landscape,” Mira co-founder and COO Matt Stern told TechCrunch in an interview.

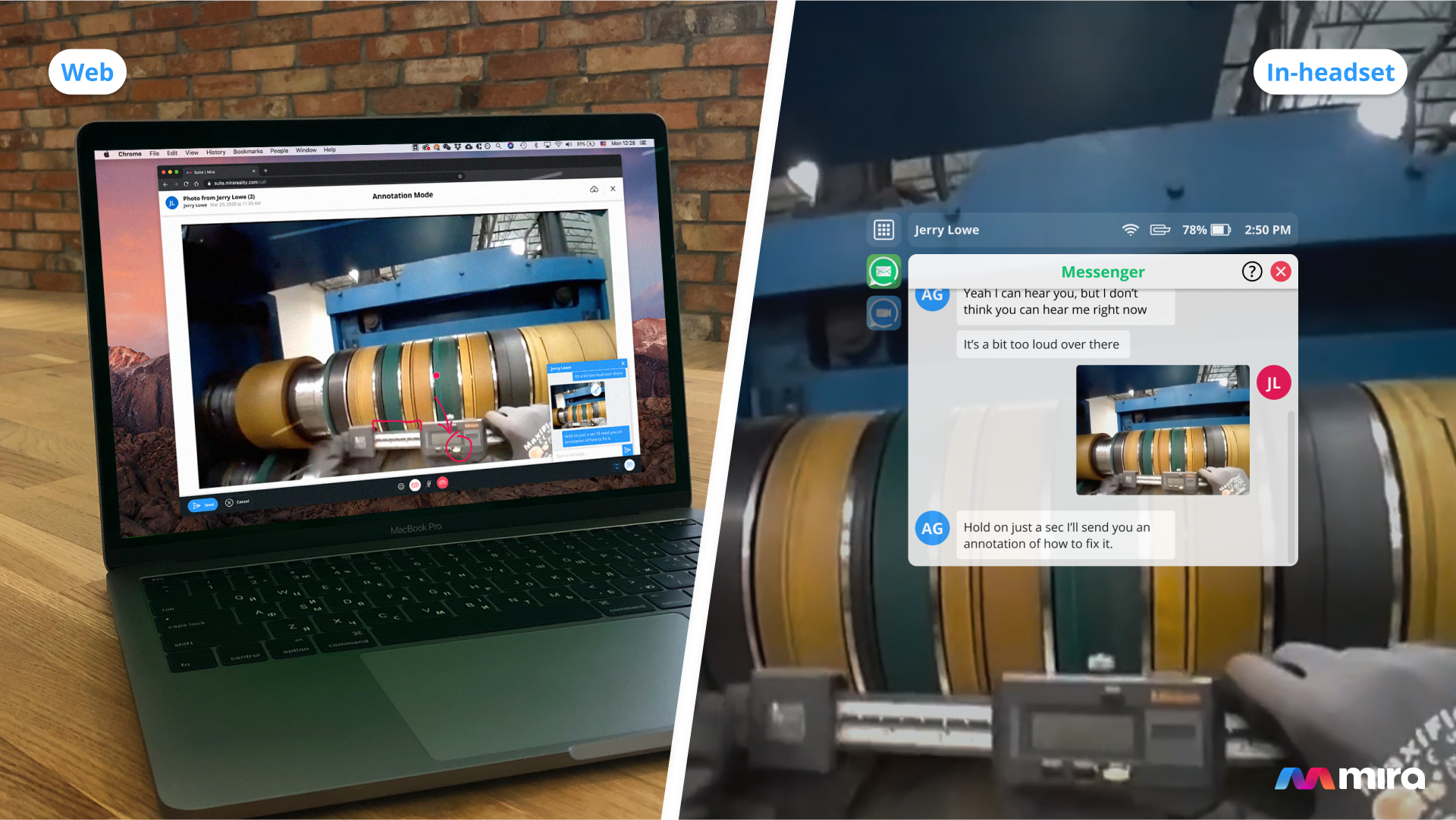

Photo via Mira.

The company’s Prism Pro headset sidesteps the technical complexity that has been a major stumbling block for previous entrants in the space that have struggled with their devices holding up in the field. Mira’s device is about as simple as the task requires, integrating a slot-in design for users to pop in an older-generation iPhone and physically connect it to a head-mounted camera that allows workers to scan items and markers. There are a number of advantages to this type of device. It’s cheaper, it’s simpler to operate and it’s easier to integrate into a company’s enterprise device management structure.

Compared to the experience a worker might get with a HoloLens, there’s a much lower ceiling to the capabilities of these devices. The Prism Pro hardware eschews what some consider “true AR” capabilities, dumping spatial tracking and mapping, and opting instead to augment your vision with a heads-up display window. The added camera is for scanning items, not generating depth maps so that holograms can be projected onto a space’s geometry, i.e. there are no floating whales to be had here. This isn’t a dramatic rethinking of the future of work so much as it’s a rethinking of form factors already being used; it’s a tablet for your face that you can control with taps and your gaze.

The AR world is still certainly a rough place to be building a startup, but Mira’s founders feel good about where the company has ended up after refocusing on manufacturing, especially within the competitive landscape.

“I can’t confirm this because I don’t work at Magic Leap, but we have literally onboarded more customers to our platform that are using our device every single day than companies like Magic Leap that have raised literally hundreds of times our funding,” CEO Ben Taft tells TechCrunch. “And it’s just been by trying to grow a business in a conservative manner and actually keeping up with the rate of adoption.”

Powered by WPeMatico

As we move deeper into the pandemic, companies are looking for ways to digitize processes that previously required in-person meetings with manual approaches. Investors appear to be rewarding companies that can achieve this. IObeya, a French company that helps digitize management planning processes like lean and agile, announced a $17 million Series A today.

Red River West led the round with help from Atlantic Bridge Capital and Fortino Capital Partners. It has now raised a total of $20 million, according to the company.

Tim McCracken, who heads up the company’s U.S. operations, says the name comes from the Japanese word for the large room where companies did all their planning. Many companies gather a group of people in a conference room and line the walls with sticky notes and white boards with their plans for the coming weeks and months.

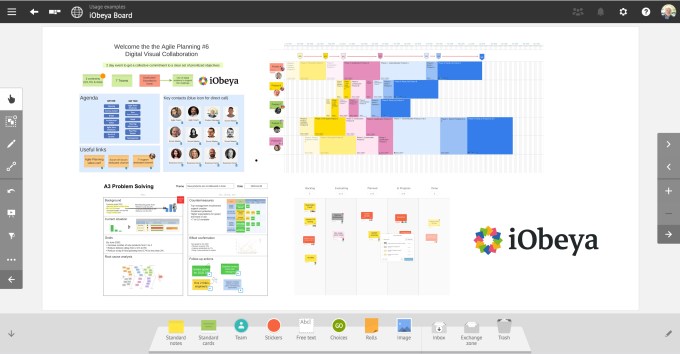

Even before the pandemic struck, it wasn’t the most effective way to record this valuable business content, and iObeya has developed a service to put it in the digital realm. “And so one of the things that they did with those obeya rooms was they had lots of different visual management boards with Post-it notes and with different types of indicators that they would use to manage their business. And so what iObeya does is digitize that type of visual management, so that you can access it from multiple locations and share it amongst teams and basically eliminate the need for doing it on paper and on walls,” McCracken explained.

This involves digitizing four main areas that include lean management, factory floor management, agile programming and, finally, what they call the digital workplace, which includes design thinking, virtual whiteboarding and brainstorming. All of these approaches have lots of planning associated with them and could benefit from being moved online.

Image Credits: iObeya

They are approaching 100 employees, with the majority in France right now, with a small office in the U.S. (in Seattle), but they will be using this money to expand with plans to add 50 more people. He says the company has always looked at diversity when it comes to its hiring practices.

“We want to try to attract, not only experienced salespeople, as well as the support organization around them, but also really do as much outreach in the local community to see how we can ensure that our workforce reflects the community,” he said.

As the company had to shut down offices due to COVID-19, McCracken says their own software helped them make that transition more smoothly. “We actually use our own software to manage business so we had very little disruption to our actual work. At the same time, the volume of work increased probably four to five fold, simply because of increased demand for the software. So we had to manage not only moving from working in an office to work at home, but also the increased workload,” he said.

The company was founded near Paris in 2011. They plan to use the money to expand operations in the U.S. and build awareness of the company through greater sales and marketing spend.

Powered by WPeMatico

The wider field of cybersecurity — not just defending networks, but identifying fraudulent activity — has seen a big boost in activity in the last few months, and that’s no surprise. The global health pandemic has led to more interactions and transactions moving online, and the contractions we’re feeling across the economy and society have led some to take more desperate and illegal actions, using digital challenges to do it.

Today, a U.K. company called Quantexa — which has built a machine learning platform branded “Contextual Decision Intelligence” (CDI) that analyses disparate data points to get better insight into nefarious activity, as well as to (more productively) build better profiles of a company’s entire customer base — is raising a growth round of funding to address that opportunity.

The London-based startup has picked up $64.7 million, a Series C it will be using to continue building out both its tools and the use cases for applying them, as well as expanding geographically, specifically in North America, Asia-Pacific and more European territories.

The mission, said Vishal Marria, Quantexa’s founder and CEO, is to “connect the dots to make better business decisions.”

The startup built its business on the back of doing work for major banks and others in the financial services sector, and Marria added that the plan will be to continue enhancing tools for that vertical while also expanding into two growing opportunities: working with insurance and government/public sector organizations.

The backers in this round speak to how Quantexa positions itself in the market, and the traction it’s seen to date for its business. It’s being led by Evolution Equity Partners — a VC that specialises in innovative cybersecurity startups — with participation also from previous backers Dawn Capital, AlbionVC, HSBC and Accenture, as well as new backers ABN AMRO Ventures. HSBC, Accenture and ABN AMRO are all strategic investors working directly with the startup in their businesses.

Altogether, Quantexa has “thousands of users” across 70+ countries, it said, with additional large enterprises, including Standard Chartered, OFX and Dunn & Bradstreet.

The company has now raised some $90 million to date, and reliable sources close to the company tell us that the valuation is “well north” of $250 million — which to me sounds like it’s between $250 million and $300 million.

Marria said in an interview that he initially got the idea for Quantexa — which I believe may be a creative portmanteau of “quantum” and “context” — when he was working as an executive director at Ernst & Young and saw “many challenges with investigations” in the financial services industry.

“Is this a money launderer?” is the basic question that investigators aim to answer, but they were going about it, “using just a sliver of information,” he said. “I thought to myself, this is bonkers. There must be a better way.”

That better way, as built by Quantexa, is to solve it in the classic approach of tapping big data and building AI algorithms that help, in Marria’s words, connect the dots.

As an example, typically, an investigation needs to do significantly more than just track the activity of one individual or one shell company, and you need to seek out the most unlikely connections between a number of actions in order to build up an accurate picture. When you think about it, trying to identify, track, shut down and catch a large money launderer (a typical use case for Quantexa’s software) is a classic big data problem.

While there is a lot of attention these days on data protection and security breaches that leak sensitive customer information, Quantexa’s approach, Marria said, is to sell software, not ingest proprietary data into its engine to provide insights. He said that these days deployments typically either are done on premises or within private clouds, rather than using public cloud infrastructure, and that when Quantexa provides data to complement its customers’ data, it comes from publicly available sources (for example, Companies House filings in the U.K.).

There are a number of companies offering services in the same general area as Quantexa. They include those that present themselves more as business intelligence platforms that help detect fraud (such as Looker) through to those that are secretive and present themselves as AI businesses working behind the scenes for enterprises and governments to solve tough challenges, such as Palantir, through to others focusing specifically on some of the use cases for the technology, such as ComplyAdvantage and its focus on financial fraud detection.

Marria says that it has a few key differentiators from these. First is how its software works at scale: “It comes back to entity resolution that [calculations] can be done in real time and at batch,” he said. “And this is a platform, software that is easily deployed and configured at a much lower total cost of ownership. It is tech and that’s quite important in the current climate.”

And that is what has resonated with investors.

“Quantexa’s proprietary platform heralds a new generation of decision intelligence technology that uses a single contextual view of customers to profoundly improve operational decision making and overcome big data challenges,” said Richard Seewald, founding and managing partner of Evolution, in a statement. “Its impressive rapid growth, renowned client base and potential to build further value across so many sectors make Quantexa a fantastic partner whose team I look forward to working with.” Seewald is joining the board with this round.

Powered by WPeMatico

When you need a loan, the cost and speed of getting it can be as critical to get right as the financing itself, a principle that might be even more relevant today in our shaky pandemic-hit economy than ever before. Today, a company that proposes to cut both the time and price for securing financing, with a platform, initially aimed at SMBs, that lets business owners put up their home property as collateral to get the loan, is announcing a funding round to expand its business.

Selina Finance, which provides loans to small and medium businesses in the form of flexible credit facilities — you pay back only what you borrow, and you do that over time, rather than in one lump sum — that are backed by the value of your personal home, is today announcing that it has raised £42 million ($53 million) — £12 million in equity and £30 million in debt to distribute as loans. The company says it plans to raise significantly more debt in the coming months as its business expands.

The funding is coming from several investors, including Picus Capital and Global Founders Capital — two firms that are tied in part to the Samwer brothers, which built the Rocket Internet e-commerce incubator in Berlin. The company’s valuation is not being disclosed.

London-based Selina plans to use the funding in a couple of areas: first, to continue growing its business in the UK, which was founded by Andrea Olivari, Hubert Fenwick and Leonard Benning and launched in June 2019; and second, to start the process of opening up to other markets in Europe.

Selina today focuses on SMEs whose applications qualify as “prime” (as opposed to sub-prime). They can borrow up to £1 million in funds — the average amount is significantly less, £150,000, says Olivari — with interest rates starting at 4.95% APR. That undercuts the rates on typical unsecured loans. Selina is also in the process of getting a license to expand its offering to consumer borrowers, too.

We’ve moved on from the days when property investing was so stable that “safe as houses” was a common expression to mean absolute reliability. But for most people, their properties continue to represent the single-biggest asset that they own and thus become a key part of how a person might construct their wider financial profile when it comes to borrowing money.

Selina’s tech essentially operates a kind of two-sided marketplace: on one hand, its algorithms process details about your property to determine its market value and how that will appreciate (or depreciate), and on the other, it’s evaluating the health of the SME business, and the purpose of the loan, to determine whether the borrower will be good for it. It’s only a year old and so it’s hard to say whether this is a strong record, but Benning notes that so far, no customers have defaulted on loans.

“We have the security of the home, yes,” he said, “but we only take credit-worthy customers to make sure the default scenario doesn’t happen. It’s something that we avoid at any cost. Technically there is a long process that leads to that outcome, but it almost never happens.” He noted that Selina has people on its team who have worked for sub-prime lenders, which gives them experience in helping to determine prime opportunities.

More generally, the idea of leveraging your property to raise capital — say, through a remortgage or loan against its value — are not new concepts: banks have been offering and distributing this kind of financing for years. The issue that Selina is addressing is that typically these deals come with high interest rates and commissions, and might take six to eight weeks from application to approval and finally loan. Selina’s pitch is that it can bring that down to five days, or possibly less.

“It’s critical that we can make a loan in five days to be be nimble and accurate, because this is one area where banks break down,” said Fenwick. “It can take two weeks to arrange for someone to walk around on behalf of a bank to make a valuation. It’s just a backwards and archaic process. We can use big data and tap different areas and dynamics all that into a model to assess the valuation of a property with a low margin of error.”

Selina is not the only tech company tackling this opportunity — specifically, Figure, the startup founded by Mike Cagney formerly of SoFi, is also providing loans to individuals against the value of their property, among other services. And for those who have followed other commerce startups financed by the Samwers, you could even say that there is a hint of cloning going on here, with even the sites of the two bearing some similarities. But for now at least Selina seems to be the only one of its kind in the UK, and for now that spells opportunity.

“Selina Finance is bringing much-needed innovation to the UK lending space by allowing customers to access the equity locked up in their residential property, seamlessly and on flexible terms,” said Robin Godenrath, MD at Picus Capital, in a statement. “The team impressed us with their strong focus on building a fully digital customer experience and have already achieved great product-market fit with their business loan use case. We’re excited and confident that Selina’s consumer proposition will also become an attractive alternative in the consumer lending space.”

Powered by WPeMatico

Back in 2016, Mobalytics wowed the judges at Disrupt SF with its data-based coach for the exploding competitive gaming world, winning the Startup Battlefield. The company is building on the success of the past few years with a new funding round and a compelling new collaboration with Tobii that uses eye-tracking to provide powerful insights into gamers’ skills.

Mobalytics began with the idea that, by leveraging the in-game data of a competitive esport like League of Legends (LoL), they could provide objective feedback to players along the lines of how fast or effective they are in different situations. Quantifying things like survivability or teamplay provides an analogue to similar measures in physical sports.

“On an athlete you have all these measurements, like pulse oximeters, ECGs, the 40-yard dash,” said Amine Issa, co-founder and “Warchief of Science.” Not so much with PC games. Their challenge at that time was to take the LoL API provided by Riot and transform it into actionable feedback, which the company’s success in the years since suggests they managed to do.

But Issa had always wanted to use another, more direct and objective measurement of a gamer’s mental processes: eye tracking. And last year they began an internal project to evaluate doing just that, in partnership with eye-tracking hardware maker Tobii.

“If you know where someone is looking, it’s the closest thing to knowing what they’re thinking,” Issa said. “When you combine that with the larger picture you can put together something to help them along. So we spent six months conducting research, taking players of different levels and roles and studying their eye tracking data to find some metrics we could organize the platform around.”

Not surprisingly, there are characteristics of the highly skilled (and practiced) that set them apart, and the team was able to collect them into a set of characteristics that any player can relate to.

Well, the gif compression isn’t so hot, but you get the idea — the purple square indicates attention. Image Credits: Mobalytics

“We had to think about how to build a product that people want to use. One thing we learned after TechCrunch is that even a simple score from 0-100 doesn’t work for everyone. You need to provide the context for that. So with something like eye tracking, you’re getting 30 data points per second — how do you break that down in a way that players understand it?”

Talking to professional gamers and coaches during the study helped them form the main categories that Mobalytics now tracks with the aid of a Tobii device, like information processing, map awareness and tunnel vision.

“It’s important to be able to tell a narrative to people. Say you get ganked a lot,” said Issa, referring to the unfortunate occurrence of being picked off by enemy players while alone. “Why are you getting ganked? If your vision score is high but map awareness is low, that’s one thing. Did you know all the information and go in arrogantly, or were you not aware? League is a very complicated game, so players want to know, in this specific fight, what did I do wrong, and what should I have done instead?”

That second question is a tougher one (though perhaps AI MOBA players may have something to say about it), but the metrics are powerful in and of themselves. “Pros are fascinated by this technology,” Issa said. “There’s a lot of ‘I had no idea’ moments. Coaches have said, these are my fastest players but it’s cool to see that as a quantifiable variable.”

Tobii’s head of gaming, Martin Lindgren, echoed this feeling: “Pro teams aren’t interested in being told what to do. They want the data so they can draw their own conclusions.”

Tobii now has a gaming-focused eye-tracker and integrates with a number of AAA games, like Rise of the Tomb Raider, where it can be used in place of fiddly aiming using the analog sticks. As someone who’s bad at specifically that part of games, this is attractive to me, and Lindgren said opportunities like that are only increasing as gaming companies embrace both accessibility and try to stand out in a crowded market.

The companies have worked together to improve the eye-tracking coaching, for instance lowering the number of games a user must play before the system can accurately track their in-game actions; Lindgren said the collaboration with Mobalytics is ongoing — “definitely a long-term partnership” — in fact Tobii’s relationship with the founders predates their startup.

The ultimate goal of Mobalytics is to have a gaming assistant that adapts itself to your playing and preferences, making intelligent suggestions to improve your skills. That’s a ways off, but the company is getting the hang of it. Its first product, the LoL assistant, took a year to build, Issa said. A more recent one, for Legends of Runeterra, took three months. Teamfight Tactics took three weeks.

Admittedly it was more difficult to design one for Valorant, which, being a first-person shooter, is wildly different from the other games — but now that it’s done, a lot of that work could be applied to an assistant for Counter-Strike or Overwatch.

Expansion to other games and genres is the reason for raising an $11 million Series A, led by Almaz Capital and Cabra VC, with HP Tech Ventures, General Catalyst, GGV Capital, RRE Ventures, Axiomatic and T1 Esports participating.

“It was a very different experience from the post-TechCrunch one, where you’re in the spotlight and everyone’s throwing money your way,” said Issa. “But we’ve built a successful product on LoL, expanded to four games, today we have more than seven million monthly active users… Our plan is to double down on what’s worked for us and create the ultimate gaming companion.”

Powered by WPeMatico

SaaS is hot in 2020. Tooling that helps facilitate remote work is hot in 2020. And we all know that anything related to video chatting in particular is on fire this year. In the midst of all three trends is Kudo, which just raised $6 million in a round led by Felicis.

But Kudo’s video chatting and conferencing tool with built-in support for translators and multiple audio streams wasn’t initially constructed for the COVID-19 era. It got started back in 2016, so let’s talk about how it got to where it is today before we talk about how much the pandemic and ensuing remote-work boom accelerated its growth by what the company described in a release as 3,500%.

TechCrunch spoke to Fardad Zabetian, Kudo’s founder and CEO, earlier this week to learn about how his company got started. According to the executive, he started working on Kudo back in 2016 after feeling the need to add language support to what he calls decentralized meetings.

After getting a proof of concept (could interactive audio and video be compiled for remote participants with less than 500 milliseconds of latency?) in place, the company itself launched in 2017, and after more work its product was put into the market in September, 2018.

During that time, Kudo put together angel and friends-and-family money that Zabetian described as less than $1 million, meaning that the startup got a lot done without spending a lot. (In my experience, talking to founders over the last decade or so, that’s a good sign.)

All that work paid off this year when COVID-19 shook up the world, forcing companies to cancel business travel and instead lean on video conferencing solutions. Given the international nature of modern business — globalization is a fact, regardless of what nationalists want — the change in the world’s meeting landscape scooted demand toward Kudo.

Here’s how it works: Kudo provides a self-serve SaaS video conferencing solution, allowing any company to spin up meetings as they need. It also has a translator pool, and can supply humans to fill out a meeting’s needs if a customer wants. Or, customers can bring their own translators.

So, Kudo is SaaS with an optional services component, though given the lower margins inherent to services over software, I’d hazard that we should think of its services revenue as a helper to its SaaS incomes. There’s no need to fret about their impact on Kudo’s blended gross margins, in other words.

According to Zabetian, about three-quarters of its customers bring their own translators, while about a fourth hire them through Kudo’s cadre.

As noted, Kudo got into the market back in 2018, which means it was already selling its software in the pre-pandemic days. Lead investor Niki Pezeshki told TechCrunch that Kudo has “stepped up in a big way for its customers during the pandemic,” but that while COVID “has certainly accelerated Kudo’s growth, we think they are enabling a longer-term shift in the market by showing customers that it is possible to effectively run multilingual conferences and meetings without the hassle of international travel and all the planning that goes into it.”

Kudo was already right about where the world was going, then, even if the pandemic provided a boost.

That tailwind is evident in its round size, notably. Kudo’s CEO said that he set out to raise $2 million, not $6 million; the $4 million delta is indicative of a company that has become a competitive asset for the venture class to fight over.

And Kudo’s growth has brought with it notable financial benefits, including several months of cash flow positivity — something nearly unheard of amongst startups of its age and size. But the company will spend from its $6 million and push that line-item negative, it said. Kudo has 30 open positions today that it expects to fill in the next few quarters, including building out its sales and marketing functions, which to date it has not invested in (another good sign among startups is how long they can grow attractively without needing to spend heavily on sales and marketing). That won’t come cheap, in the short-term.

So that’s Kudo and its round. What we want to know next is its H1 2020 year-over-year revenue growth. Do write in if you know that number.

Powered by WPeMatico

For the first few months it was operating, Shelf Engine, the Seattle-based company that optimizes the process of stocking store shelves for supermarkets and groceries, didn’t have a name.

Co-founders Stefan Kalb and Bede Jordan were on a ski trip outside of Salt Lake City about four years ago when they began discussing what, exactly, could be done about the problem of food waste in the U.S.

Kalb is a serial entrepreneur whose first business was a food distribution company called Molly’s, which was sold to a company called HomeGrown back in 2019.

A graduate of Western Washington University with a degree in actuarial science, Kalb says he started his food company to make a difference in the world. While Molly’s did, indeed, promote healthy eating, the problem that Kalb and Bede, a former Microsoft engineer, are tackling at Shelf Engine may have even more of an impact.

Food waste isn’t just bad for its inefficiency in the face of a massive problem in the U.S. with food insecurity for citizens, it’s also bad for the environment.

Shelf Engine proposes to tackle the problem by providing demand forecasting for perishable food items. The idea is to wring inefficiencies out of the ordering system. Typically about a third of food gets thrown out of the bakery section and other highly perishable goods stocked on store shelves. Shelf Engine guarantees sales for the store, and any items that remain unsold the company will pay for.

Image: OstapenkoOlena/iStock

Shelf Engine gets information about how much sales a store typically sees for particular items and can then predict how much demand for a particular product there will be. The company makes money off of the arbitrage between how much it pays for goods from vendors and how much it sells to grocers.

It allows groceries to lower the food waste and have a broader variety of products on shelves for customers.

Shelf Engine initially went to market with a product that it was hoping to sell to groceries, but found more traction by becoming a marketplace and perfecting its models on how much of a particular item needs to go on store shelves.

The next item on the agenda for Bede and Kalb is to get insights into secondary sources like imperfect produce resellers or other grocery stores that work as an outlet.

The business model is already showing results at around 400 stores in the Northwest, according to Kalb, and it now has another $12 million in financing to go to market.

The funds came from Garry Tan’s Initialized and GGV (and GGV managing director Hans Tung has a seat on the company’s board). Other investors in the company include Foundation Capital, Bain Capital, 1984 and Correlation Ventures .

Kalb said the money from the round will be used to scale up the engineering team and its sales and acquisition process.

The investment in Shelf Engine is part of a wave of new technology applications coming to the grocery store, as Sunny Dhillon, a partner at Signia Ventures, wrote in a piece for TechCrunch’s Extra Crunch (membership required).

“Grocery margins will always be razor thin, and the difference between a profitable and unprofitable grocer is often just cents on the dollar,” Dhillon wrote. “Thus, as the adoption of e-grocery becomes more commonplace, retailers must not only optimize their fulfillment operations (e.g. MFCs), but also the logistics of delivery to a customer’s doorstep to ensure speed and quality (e.g. darkstores).”

Beyond Dhillon’s version of a delivery-only grocery network with mobile fulfillment centers and dark stores, there’s a lot of room for chains with existing real estate and bespoke shopping options to increase their margins on perishable goods, as well.

Powered by WPeMatico

After Wisam Dakka and André Madeira left Snap in 2018, the two longtime product developers and coders cast about for a new app to build.

Looking around they realized there was no financial product that spoke to the generation of consumers they’d spent the last bit of their professional lives working to build for, so they decided it would be their next project.

“Our insight is that an individual’s relationship with money is a delicate and an emotional one. Most financial apps are not adopted by the masses because they are strict, lack empathy, and are unconsciously perceived as judgmental, which is why they are often downloaded and then ignored,” said Madeira, in a statement.

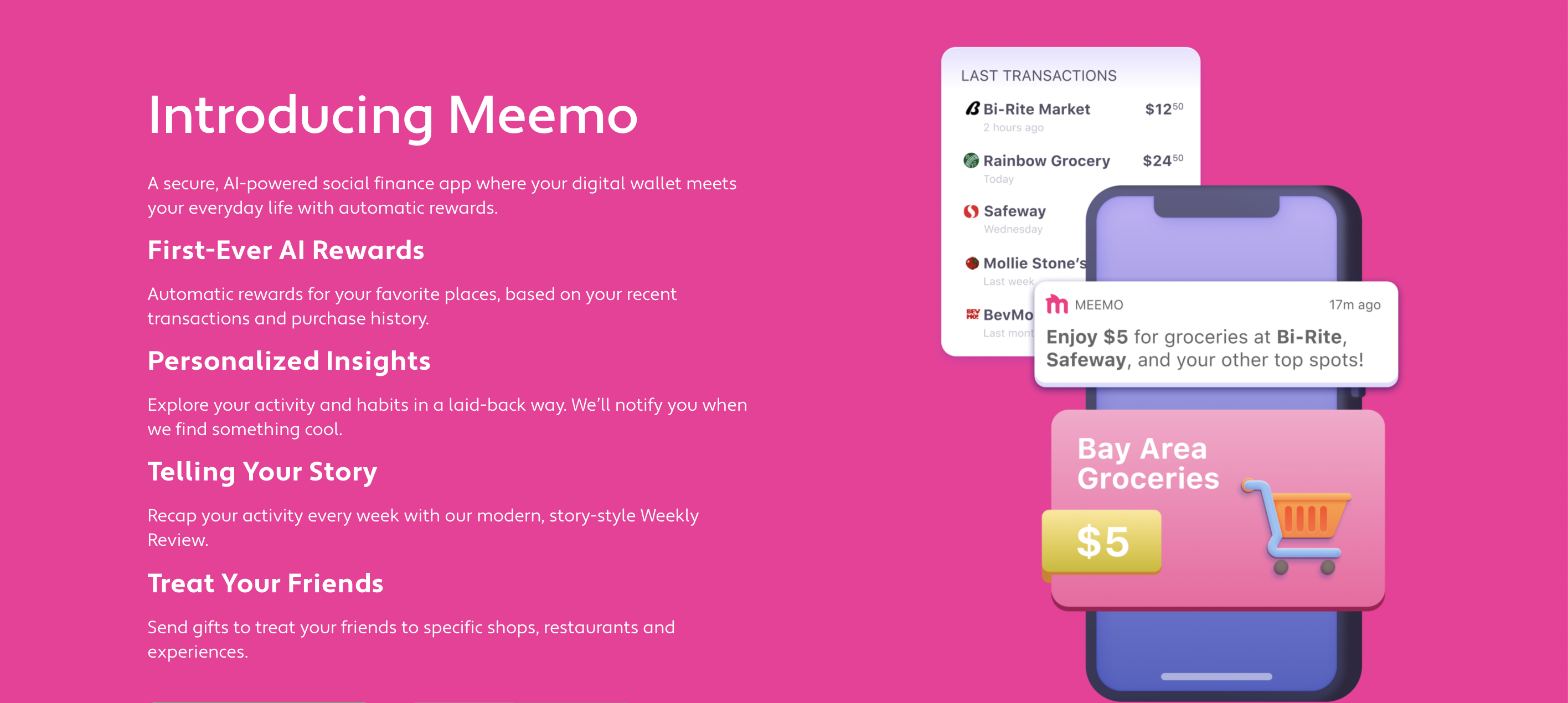

Their solution, launching today, is Meemo .

It’s a combination of a personal financial monitoring, rewards and gifting, and social shopping app all rolled into one.

“One of the things we learned at Snap, if you want to reach the masses you need to change how you create an app. It has to be effortlessly,” said Madeira. “It has to be automatic and social as well so we want to build an app that is all of that combined.”

Once a user downloads Meemo and connects their main bank account or credit card to the app, Meemo will give that person insights into their spending history and potential rewards.

For most users, the initial experience will be through a gift card. Gifting, it turns out is what Dakka and Madeira think will be the secret sauce for the company’s growth (although getting people to use something if they’re being given money or free stuff is hardly rocket science).

There’s also the social element, which the two men think will be a draw as well. Meemo provides recommendations and social validation from friends by harvesting their buying history and sharing it with you.

Once a user downloads Meemo and has the history of their transactions, the app will surface the places where users spend the most money. They can then send gift cards to their friends for their favorite restaurants. The goal, eventually, is to get restaurants to subsidize the gifting portion and have their shoppers act as a direct marketing channel.

Image Credits: Meemo (opens in a new window)

Shops won’t be able to see who’s getting the gifts until they come into the store. What Meemo hopes to do is gather a profile of a user’s shopping behavior based on their purchases and offer them discounts to places that they may not frequent as often, but match their consumer profile.

Backing the company are investors including Saama Capital, Greycroft, monashees and Sierra Ventures, along with individual investors Amit Singhal, Hans Tung and serial entrepreneurs and the co-founders’ colleagues from Google and Snap.

Madeira and Dakka first met working on Google Search and went on to found Snap’s San Francisco office. The team is rounded out by long-time friends like Robson Araújo and Ranveer Kunal.

“We are very excited to back Dakka and Madeira in their creation of a new age finance app at Meemo that will combine improved financial management with deeper social engagement for today’s generation,” said Ash Lilani, managing partner at Saama Capital, in a statement. “With Dakka and Madeira’s past experience of assembling talented teams and building viral products, we believe Meemo has an opportunity to become a leader in this space.”

The company’s name is taken from a Portuguese word “mimo,” which means an affectionate treat, according to a statement. It’s available to download on iOS and Android.

Powered by WPeMatico

Think back to the last time you onboarded at a new job. Was it a mishmash of documents and calendar invites and calls and, generally speaking, a mess?

Probably. That’s likely because onboarding is a process that often depends on disparate, unconnected HR tools. Sora, a startup that today announced $5.3 million in collected fundraising, wants to shake up the HR software world with a low-code service that helps companies connect their tooling and automate their HR processes. The startup might be able to make things like onboarding better for employees and companies alike.

Startups looking to bring low, and no-code tooling to non-engineering teams have become a trend in recent quarters. TechCrunch recently covered a $2.2 million round for no-code text analysis and machine-learning shop MonkeyLearn, for example. There have been hundreds of millions of dollars raised by low, and no-code tools in 2020 alone.

By building tools to assist non-engineers do more, faster without developer help — be it analysis, or visual programming — some technology upstarts are helping non-technical teams do what only technical teams were able to in previous years.

Sora fits into the trend because its service allows non-developers to create workflows, to use a term that the startup’s co-founder and CEO Laura Del Beccaro employed when she walked TechCrunch through her company’s product.

The Sora workflows can be built from templates, and employ triggers to fire off various processes (sending emails, pulling in data from other apps and services, that sort of thing), allowing non-engineers to create visual logic flows. The Sora system is “like a no-code workflow builder,” Del Beccaro said in an interview, allowing users to “add tasks where you have to tell someone to do something, and automate the follow-up. That’s actually one of our biggest pain point relievers. A lot of HR teams right now are manually tracking people down: Did you set up this laptop yet? Did you set up this new hire launch for these three people?”

Sora CEO Laura Del Beccaro, via the company.

The Sora workflow system is slick in practice, allowing, for example, customization around a single employee. Del Beccaro explained that her startup’s software can do things like ask a manager who a new hire’s work-buddy might be, and then send that person an email later saying that the hire has arrived.

According to Del Beccaro, Sora, wants to help “democratize your [HR] processes.” Today’s HR denizens are too dependent on data analysts for “people analytics reporting” she said, adding that once a company has all its HR “data in one place, which again, is our core offering, you can set up all these automations that you want by yourself, you don’t have to go to IT or engineering.”

And because Sora can handle swapping out different providers as needed, Sora should help HR teams at growing companies lower the “risk of changing systems,” helping them “stay flexible no matter what [their] processes look like.”

It’s a neat tool.

Sora has raised $5.3 million in capital to date, a funding total that includes a pre-seed round from September, 2018. First Round and Elad Gil led its most recent round, which makes up a majority of its capital raised thus far.

With 11 employees today, Sora has around “25 people on [its] cap table,” the CEO said, telling TechCrunch that it was “pretty important to [her] to have a relatively diverse set of investors.” Del Beccaro provided this publication with a full list, which we’ve included below.

Sticking to the subject of money, after Mixpanel served as an early customer, Sora opened to more customers earlier this year. The CEO said that its customers are on one or two-year contracts, and charges per-employee, per-month, which seems reasonable. With its new cash, Sora has around 2.5 years of runway she said.

First Round’s Bill Trenchard liked Sora’s approach to building its service, saying in an email that the company was “never interested in scaling for the sake of scaling,” highlighting its work in concert with “a development partner to make sure what they were working on was actually solving real HR pain points before they took it to the market” as evidence of its “thoughtful and intentional” product approach.

Today, thanks to that method, in his view “what’s compelling about Sora is their sales momentum this year after launching,” the investor said. The next question for Sora, then, is how fast it can grow now that it has more capital in the bank than it has likely ever had before.

For fun, here’s the full investor list that Del Beccaro provided, which I’m including as it’s rare to get a full cap table:

- Sarah Adams (Plaid)

- Shan Aggarwal (Coinbase, Greycroft)

- Scott Belsky (Adobe)

- Mathilde Collin (Front)

- Cooley Investment Fund

- David Del Beccaro & Arleen Armstrong (Music Choice/Legal)

- Viviana Faga (Emergence Capital)

- Avichal Garg (Electric Capital)

- Elad Gil

- Kent Goldman (Upside VC)

- Jonah Greenberger (Bright)

- Daniel Gross (Pioneer, YC)

- Charles Hudson (Precursor Ventures)

- Todd Jackson (First Round Capital)

- Oliver Jay (Asana)

- Nimi Katragadda (BoxGroup)

- Nicky Khurana (Facebook)

- Brianne Kimmel (Work Life Ventures)

- David King (Curious Endeavors)

- Fritz Lanman (ClassPass)

- Lisa & Mat Lori (Perfect Provenance/New Mountain Capital)

- Shrav Mehta (SecureFrame)

- Sean Mendy (Concrete Rose)

- Jana Messerschmidt (#ANGELS, Lightspeed)

- Katie Stanton (Katie Stanton, #ANGELS, Moxxie Ventures)

- Erik Torenberg (Village Global)

- Bill Trenchard (First Round Capital)

- Jeannette zu Fürstenberg (La Famiglia VC)

Powered by WPeMatico