Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

PandaDoc, the startup that provides a fully digital sales document workflow from proposal to electronic signature to collecting payment, announced a $30 million Series B extension today, making it the second such extension the company has taken since taking its original $15 million Series B in 2017. The total for the three B investments is $50 million.

Company co-founder and CEO Mikita Mikado says that he took this approach — taking the original money in 2017, then $5 million last year along with the money announced today — because it made more sense financially for the company than taking a huge chunk of money all at once.

“Basically when we do little chunks of cash frequently, [we found that] you dilute yourself less,” Mikado told TechCrunch. He said that they’ve grown comfortable with this approach because the business became more predictable once it passed 10,000 customers. In fact today it has 20,000.

“With a high-velocity in-bound sales model, you can predict what’s going to happen next month or [say] six months out. So you kind of have this luxury of raising as much money as you need when you need it, minimizing dilution just like public companies do,” he said.

While he wouldn’t discuss specifics in terms of valuations, he did say that the B1 had 2x the valuation of the original B round and the B2 had double the valuation of the B1.

For this round, One Peak led the investment, with participation from Microsoft’s Venture Fund (M12), Savano Capital Partners, Rembrandt Venture Partners and EBRD Venture Capital Investment Programme.

Part of the company’s growth strategy is using their eSignature tool to move people to the platform. They made that tool free in March just as the pandemic was hitting hard in the U.S., and it has proven to be what Mikado called “a lead magnet” to get more people familiar with the company.

Once they do that he says, they start to look at the broader set of tools and they can become paying customers. “This launch helped us validate that businesses need a broader workflow solution. Businesses used to think of the eSignature as the Holy Grail in getting a deal done. Now they are realizing that eSignature is just a moment in time. The full value is what happens before, during and after the eSignature in order to get deals done,” Mikado said.

The company currently has 334 employees with plans to hit 380 by year’s end and is aiming for 470 by next year. With the office in San Francisco, Belarus and Manila, it has geographic diversity built in, but Mikado says it’s something they are still working at and includes anti-bias programs and training and leadership programs to give more people a chance to be hired or promoted into management.

When it came to shutting down offices and working from home, Mikado admits it was a challenge, especially as some of the geographies they operate in might not have access to a good internet connection at home or face other challenges, but overall he says it has worked out in terms of maintaining productivity across the company. And he points out being geographically diverse, they have had to deal with online communications for some time.

Powered by WPeMatico

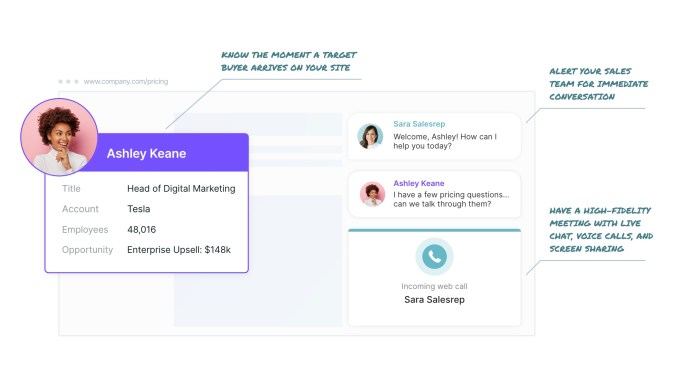

Qualified, a startup co-founded by former Salesforce executives Kraig Swensrud and Sean Whiteley, has raised $12 million in Series A funding.

Swensrud (Qualified’s CEO) said the startup is meant to solve a problem that he faced when he was CMO at Salesforce. Apparently he’d complain about being “blind,” because he knew so little about who was visiting the Salesforce website.

“There could be 10 or 100 or 100,000 people on my website right now, and I don’t know who they are, I don’t know what they’re interested in, my sales team has no idea that they’re even there,” he said.

Apparently, this is a big problem in business-to-business sales, where waiting five minutes after a lead leaves your website can result in a 10x decrease in the odds of making contact. But the solution currently adopted by many websites is just a chatbot that treats every visitor similarly.

Qualified, meanwhile, connects real-time website visitor information with a company’s Salesforce customer database. That means it can identify visitors from high-value accounts and route them to the correct salesperson while they’re still on the website, turning into a full-on sales meeting that can also include a phone call and screensharing.

Image Credits: Qualified

Of course, the amount of data Qualified has access to will differ from visitor to visitor. Some visitors may be purely incognito, while in other cases, the platform might simply know your city or where you work. In still others (say if you click on a link from marketing email), it can identify you individually.

That’s something I experienced myself, when I decided to take a look at the Qualified website this morning and was quickly greeted with a message that read, “ Welcome TechCrunch! We’re excited about our funding announcement…” It was a little creepy, but also much more effective than my visits to other marketing technology websites, where someone usually sends me a generic sales message.

Welcome TechCrunch! We’re excited about our funding announcement…” It was a little creepy, but also much more effective than my visits to other marketing technology websites, where someone usually sends me a generic sales message.

Swensrud acknowledged that using Qualified represents “a change to people’s selling processes,” as it requires sales to respond in real time to website visitors (as a last resort, Qualified can also use chatbots and schedule future calls), but he argued that it’s a necessary change.

“If you email them later, some percentage of those people, they ghost you, they get bored, they moved on to the competition,” he said. “This real-time approach, it forces organizations to think differently in terms of their process.”

And it’s an approach that seems to be working. Among Qualified’s customers, the company says ThoughtSpot increased conversations with its target accounts by 10x, Bitly grew its enterprise sales pipeline by 6x and Gamma drove over $2.5 million in new business pipeline.

The Series A brings Qualified’s total funding to $17 million. It was led by Norwest Venture Partners, with participation from existing investors including Redpoint Ventures and Salesforce Ventures. Norwest’s Scott Beechuk is joining Qualified’s board of directors.

“The conversational model is simply a better way to connect with new customers,” Beechuk said in a statement. “Buyers love the real-time engagement, sellers love the instant connections, and marketers have the confidence that every dollar spent on demand generation is maximized. The multi-billion-dollar market for Salesforce automation software is going to adopt this new model, and Qualified is perfectly positioned to capture that demand.”

Powered by WPeMatico

Big news today the world of IT startups targeting businesses. Rippling, the startup founded by Parker Conrad to take on the ambitious challenge of building a platform to manage all aspects of employee data, from payroll and benefits through to device management, has closed $145 million in funding — a monster Series B that catapults the company to a valuation of $1.35 billion.

Parker Conrad, the CEO who co-founded the company with Prasanna Sankar (the CTO), said in an interview that the plan will be to use the money to continue its own in-house product development (that is, bringing more tools into the Rippling mix organically, not by way of acquisition) but also to have it just in case, given everything else going on at the moment.

“We will double down on R&D but to be honest we’re trying not to change the formula too much,” Conrad said. “We want to have that discipline. This fundraising was opportunistic amid the larger macroeconomic risk at the moment. I was working at startups in 2008-2009 and the funding markets are strong right now, all things considered, and so we wanted to make sure we had the stockpile we needed in case things went bad.”

This latest round included Greenoaks Capital, Coatue Management and Bedrock Capital, as well as existing investors including Kleiner Perkins, Initialized Capital and Y Combinator. Founders Fund partner Napoleon Ta will join Rippling’s board of directors. Founders Fund had also backed Zenefits when Parker was at the helm, and from what we understand, this round was oversubscribed — also a big feat in the current market, working against a lot of factors, including a wobbling economy.

It is a big leap for the company: it was just a little over a year ago that it raised a Series A of $45 million at a valuation of $270 million.

This latest round is notable for a few reasons.

First is the business itself. HR and employee management software are two major areas of IT that have faced a lot of fragmentation over the years, with many businesses opting for a cocktail of services covering disparate areas like employee onboarding, payroll, benefits, device management, app provisioning and permissions and more. That’s been even more the case among smaller organizations in the 2-1,000 employee range that Rippling targets.

Rippling is approaching that bigger challenge as one that can be tackled by a single platform — the theory being that managing HR employee data is essentially part and parcel of good management of IT data permissions and device provision. This funding is a signal of how both investors and customers are buying into Rippling and its approach, even if right now the majority of customers don’t onboard with the full suite of services. (Some 75% are usually signing up with HR products, Conrad noted.)

“We like to think of ourselves as a Salesforce for employee data,” Conrad said, “and by that, we think that employee data is more than just HR. We want to manage access to all of your third-party business apps, your computer and other devices. It’s when you combine all that that you can manage employees well.”

The company is gradually adding more tools. Most recently, it’s been launching new tools to help with job costing, helping companies track where employees are spending time when working on different projects, a tool critical for IT, accounting and other companies where employees work across a number of clients. Other new tools include SMS communications for “desk-less” workers and more accounting integrations.

Second is the founder. You might recall that Conrad was ousted from his previous company, Zenefits (taking on a related, but smaller, challenge in payroll and benefits), over a controversy linked to compliance issues and also misleading investors. But if Zenefits was finished with Conrad, Conrad was not finished with Zenefits — or at least the problem it was tackling. This funding is a testament to how investors are putting a big bet on Conrad himself, who says that a lot of what he has been building at Rippling was what he would have done at Zenefits if he’d stayed there.

“Once you’re lucky, twice you’re good,” said Mamoon Hamid, a partner at Kleiner Perkins, in a separate statement. “Parker is a true product visionary, and he and his team are solving an enormous pain point for businesses everywhere. We’re thrilled to continue partnering with Rippling as demand for their platform dramatically increases in this era of remote work.”

“Rippling is not just a superior payroll company, but something much broader: they’ve built the system of record for all employee data, creating an entirely new software category. Rippling’s massive market opportunity is to streamline the employee life cycle, from software to payroll to benefits, and fundamentally improve the way businesses hire and manage their employees,” said Ta in a statement.

Third is the context in which this round is coming. We’re in the midst of an economic downturn caused in part by a global health pandemic, and that’s leading to a lot of companies curtailing budgets, reducing headcount and potentially shutting down altogether. Ironically, that force is also propelling companies like Rippling full steam ahead.

Its SaaS model — priced at a flat $8 per person per month — not only fits with how many businesses are being run at the moment (primarily remotely), but Rippling’s purpose is specifically geared to helping businesses both onboard and offboard employees more efficiently, the kind of software that companies need to have in place to fit how they are working right now.

Updated with commentary from an interview with Conrad.

Powered by WPeMatico

“Marketing cloud” has become an increasingly popular concept in the world of marketing technology — used by the likes of Salesforce, Adobe, Oracle and others to describe their digital tool sets for organizations to identify and connect with customers. Now, a startup that is building its own take on the idea aimed specifically at e-commerce companies is announcing some funding after seeing a surge of business in the last few months.

Yotpo, which provides a suite of tool to help direct-to-consumer and other e-commerce players build better relationships with customers, is today announcing that it has raised $75 million in funding, money it will use to continue growing its suite of products, as well as to acquire more customers and build out more integration partnerships.

The Series E included a number of Yotpo’s existing investors, namely Bessemer Venture Partners, Access industries (the owner of Warner Music Group, among a number of other holdings) and Vertex Ventures (a subsidiary of Temasek), new investor Hanaco (which focuses on Israeli startups — Yotpo is co-headquartered in Tel Aviv and New York) and other unnamed investors.

It brings the total raised by the startup to $176 million, and while it’s not disclosing valuation, its CEO Tomer Tagrin — who co-founded the company with COO Omri Cohen — describes it as “nearly a unicorn.”

“I like to call what we’re building a flamingo, which is also a rare and beautiful animal but also a real thing, and we are a proper business,” he said in an interview, adding that Yotpo is on target for ARR next year to be $100 million.

The company had its start as an app in Shopify’s App Store, providing tools to Shopify customers to help with customer engagement by way of user-generated content, and while it has outgrown that single relationship — it now has some 500 additional strategic partners, including Salesforce, Adobe, BigCommerce and others — Yotpo’s CEO still likes to describe his company in Shopify-ish terms.

“Just as Shopify manages your business, we manage your customers end to end,” Tagrin said. He said that while it’s great to see the bigger trend of consolidation around marketing clouds, it’s not a one-size-fits-all problem. He believes Yotpo’s e-commerce-specific approach to that stands apart from the pack because it addresses issues unique to D2C and other e-commerce companies.

Yotpo’s services today include SMS and visual marketing, loyalty and referral services and reviews and ratings, which are used by a range of e-commerce companies, spanning from newer direct-to-consumer brands like Third Love and Away, to more established names like Patagonia and 1-800-Flowers. Some of these have been built in-house, and some by way of acquisition — most recently, SMSBump, in January. The plan is to use some of the funding to continue that acquisition strategy.

“Since our first investment more than three years ago, Tomer and Omri have executed flawlessly, expanding the product suite, serving a wider range of customers, and continually hiring strong talent across the organization,” says Adam Fisher, a partner at BVP, in a statement. “Yotpo is singularly focused on helping direct-to-consumer eCommerce brands solve the dual challenge of engaging consumers and increasing revenue, and with their multi-product strategy and innovative edge, they are uniquely positioned to dominate the eCommerce industry for years to come.”

Yotpo is built as a freemium platform, with some 9,000 customers paying for services, and a further 280,000 customers on its free-usage tier. Customer count grew by 250% in the last year, Tagrin said.

The COVID-19 pandemic has had a well-documented impact on internet use, and specifically e-commerce, as people turned to digital channels in record numbers to procure things while complying with shelter-in-place orders, or trying to increase social distancing to slow down the spread of the coronavirus.

E-commerce has been on the rise for years, but the acceleration of that trend has been drastic since February, with revenue and spend both regularly exceeding baseline figures over the last several months, according to research from digital marketing agency Common Thread Collective.

That, in turn, had a big impact on companies that help enable those e-commerce enterprises operate in more direct and personable ways. Yotpo was a direct beneficiary: It said it had a surge of sign-ups of new customers, many taking paid services, working out to a 170% year-on-year ARR and lower customer churn.

The bigger picture, of course, is not completely rosy, with thousands of layoffs across the whole tech service, and a huge number of brick-and-mortar business closures. Those economic indicators could ultimately also have a knock-on effect not just in more business moving online, but also a slowdown in spending overall.

That will inevitably have an impact on startups like Yotpo, too, which is definitely on a rise now but will continue to think longer term about the impact and how it can continue to diversify its products to meet a wider set of customer use cases.

For example, today, the company addresses customer care needs by way of integrations with companies like Zendesk, but longer term it might consider how it can bring in services like this to continue to build out the touchpoints between D2C brands and their customers, and specifically running those through a bigger picture of the customer as profiled on Yotpo’s platform.

This is a big part of our product in our meetings and debates,” Tagrin said about product expansions.

“I do think any celebration of growth and funding comes to me with something else: we need to be internalising more what is going on,” he said. “The world is not back to normal and we shouldn’t act like it is.”

Powered by WPeMatico

Owning one brick-and-mortar business seems complicated enough. But running multiple locations? For many owners, that’s a constant juggling act of phone calls, check lists and driving back and forth from store to store. In the middle of a pandemic, it gets all the more complex.

Delightree, a company out of the previous Alchemist Accelerator class, has raised $3 million to build a tool hyper-focused on helping owners of franchise businesses (think hotels, gyms, restaurant chains, etc.) take their operations and workflows digital.

A big part of the idea with Delightree is to move much of what currently happens through pen-and-paper checklists over to smartphones, allowing franchise owners to know what’s going at their locations from afar. They digitize workflows like the daily store opening/closing procedures or maintenance routines, with employees checking boxes on their devices rather than a paper to-do list. If something gets missed along the way, Delightree can automatically ping the owner to let them know before it becomes an issue.

They’ll also help to automate and track things like onboarding new employees and staying prepared for inspections, while giving owners a centralized place to make team-wide announcements or contact employees.

Delightree evolved out of a previous company built by its co-founders, Madhulika Mukherjee and Tushar Mishra. They’d been working on Survaider, a tool that monitored customer feedback across social media, review sites, etc., and turned that feedback into actionable to-do lists.

“When we were piloting it, our customers started saying: ‘can we create our own tasks? Or can I tell something to my employees through this?’ ” Mishra told me. “It was just such an obvious problem, so we started building Delightree.”

Delightree co-founders Tushar Mishra and Madhulika Mukherjee

The team has also been working on a feature they call Delightcomply, which helps stores stay up to date on the latest CDC guidelines for businesses operating through the pandemic, and to automatically share compliance details with potential customers. A business could use Delightcomply to publicly outline the steps it’s taking to keep employees/customers safe, for example, with the listing automatically updated to show the status of each task.

Delightree is currently working directly with each new customer to help them through the initial setup — specifically, to help franchisees take the standard operating procedures they receive directly from the brand owners and turn them into Delightree workflows. They’re still working out their exact pricing model, but say that they charge on a per-location-per-month basis, with pricing varying depending on the size/complexity of the business. They’ve set up a waitlist for anyone interested.

This $3 million seed round was funded by Accel Partners, Emergent Ventures, Brainstorm Ventures, Axilor Ventures and Alchemist. As part of the deal, Emergent partner Anupam Rastogi has joined Delightree’s board of directors.

Powered by WPeMatico

Buildots, a Tel Aviv and London-based startup that is using computer vision to modernize the construction management industry, today announced that it has raised $16 million in total funding. This includes a $3 million seed round that was previously unreported and a $13 million Series A round, both led by TLV Partners. Other investors include Innogy Ventures, Tidhar Construction Group, Ziv Aviram (co-founder of Mobileye & OrCam), Magma Ventures head Zvika Limon, serial entrepreneurs Benny Schnaider and Avigdor Willenz, as well as Tidhar chairman Gil Geva.

The idea behind Buildots is pretty straightforward. The team is using hardhat-mounted 360-degree cameras to allow project managers at construction sites to get an overview of the state of a project and whether it remains on schedule. The company’s software creates a digital twin of the construction site, using the architectural plans and schedule as its basis, and then uses computer vision to compare what the plans say to the reality that its tools are seeing. With this, Buildots can immediately detect when there’s a power outlet missing in a room or whether there’s a sink that still needs to be installed in a kitchen, for example.

“Buildots have been able to solve a challenge that for many seemed unconquerable, delivering huge potential for changing the way we complete our projects,” said Tidhar’s Geva in a statement. “The combination of an ambitious vision, great team and strong execution abilities quickly led us from being a customer to joining as an investor to take part in their journey.”

The company was co-founded in 2018 by Roy Danon, Aviv Leibovici and Yakir Sundry. Like so many Israeli startups, the founders met during their time in the Israeli Defense Forces, where they graduated from the Talpiot unit.

“At some point, like many of our friends, we had the urge to do something together — to build a company, to start something from scratch,” said Danon, the company’s CEO. “For us, we like getting our hands dirty. We saw most of our friends going into the most standard industries like cloud and cyber and storage and things that obviously people like us feel more comfortable in, but for some reason we had like a bug that said, ‘we want to do something that is a bit harder, that has a bigger impact on the world.’ ”

So the team started looking into how it could bring technology to traditional industries like agriculture, finance and medicine, but then settled upon construction thanks to a chance meeting with a construction company. For the first six months, the team mostly did research in both Israel and London to understand where it could provide value.

Danon argues that the construction industry is essentially a manufacturing industry, but with very outdated control and process management systems that still often relies on Excel to track progress.

Construction sites obviously pose their own problems. There’s often no Wi-Fi, for example, so contractors generally still have to upload their videos manually to Buildots’ servers. They are also three dimensional, so the team had to develop systems to understand on what floor a video was taken, for example, and for large indoor spaces, GPS won’t work either.

The teams tells me that before the COVID-19 lockdowns, it was mostly focused on Israel and the U.K., but the pandemic actually accelerated its push into other geographies. It just started work on a large project in Poland and is scheduled to work on another one in Japan next month.

Because the construction industry is very project-driven, sales often start with getting one project manager on board. That project manager also usually owns the budget for the project, so they can often also sign the check, Danon noted. And once that works out, then the general contractor often wants to talk to the company about a larger enterprise deal.

As for the funding, the company’s Series A round came together just before the lockdowns started. The company managed to bring together an interesting mix of investors from both the construction and technology industries.

Now, the plan is to scale the company, which currently has 35 employees, and figure out even more ways to use the data the service collects and make it useful for its users. “We have a long journey to turn all the data we have into supporting all the workflows on a construction site,” said Danon. “There are so many more things to do and so many more roles to support.”

Powered by WPeMatico

Low-code is a hot category these days. It helps companies build workflows or simple applications without coding skills, freeing up valuable engineering resources for more important projects. Paragon, a member of the Y Combinator Winter 2020 cohort, announced a $2.5 million seed round today for its low-code application integration platform.

Investors include Y Combinator, Village Global, Global Founders Capital, Soma Capital and FundersClub.

“Paragon makes it easier for non-technical people to be able to build out integrations using our visual workflow editor. We essentially provide building blocks for things like API requests, interactions with third party APIs and conditional logic. And so users can drag and drop these building blocks to create workflows that describe business logic in their application,” says company co-founder Brandon Foo.

Foo acknowledges there are a lot of low-code workflow tools out there, but many like UIPath, Blue Prism and Automation Anywhere concentrate on robotic process automation (RPA) to automate certain tasks. He says he and co-founder Ishmael Samuel wanted to focus on developers.

“We’re really focused on how can we improve developer efficiency, and how can we bring the benefits of low code to product and engineering teams and make it easier to build products without writing manual code for every single integration, and really be able to streamline the product development process,” Foo told TechCrunch.

The way it works is you can drag and drop one of 1,200 predefined connectors for tools like Stripe, Slack and Google Drive into a workflow template, and build connectors very quickly to trigger some sort of action. The company is built on AWS serverless architecture, so you define the trigger action and subsequent actions, and Paragon handles all of the back-end infrastructure requirements for you.

It’s early days for the company. After launching in private beta in January, the company has 80 customers. It currently has six employees, including Foo, who previously co-founded Polymail, and Samuel, who was previously lead engineer at Uber. They plan to hire four more employees this year.

With both founders people of color, they definitely are looking to build a diverse team around them. “I think it’s already sort of built into our DNA. As a diverse founding team we have perhaps a broader viewpoint and perspective in terms of hiring the kind of people that we seek to work with. Of course, I think there’s always room for improvement, and so we’re always looking for new ways that we can be more inclusive in our hiring recruiting process [as we grow],” he said.

As far as raising during a pandemic, he says it’s been a crazy time, but he believes they are solving a real problem and that they can succeed in spite of the macro economic conditions of the moment.

Powered by WPeMatico

In a world with growing amounts of data, finding the right set for a particular machine learning model can be a challenge. Explorium has created a platform to make that an easier task, and today the startup announced a $31 million Series B.

The round was led by Zeev Ventures, with help from Dynamic Loop, Emerge, 01 Advisors and F2 Capital. Today’s investment brings the total raised to $50 million, according to the company.

CEO and co-founder Maor Shlomo says the company’s platform is designed to help people find the right data for their model. “The next frontier in analytics will not be about how you fine tune or improve a certain algorithm, it will be how do you find the right data to fit into those algorithms to make them as useful and impactful as possible,” he said.

He says that companies need this more than ever during the pandemic because this can help customers find more relevant data at a time when their historical data might not be useful to help build predictive models. For instance, if you’re a retailer, your historical shopping data won’t be relevant if you are in an area where you can no longer open your store, he says.

“There are so many environmental factors that are now influencing every business problem that organizations are trying to solve that Explorium is becoming this […] layer where you search for data to solve your business problems to fuel your predictive models,” he said.

When the pandemic hit in March, he worried about how it would affect his company, and he put a hold on hiring, but as he saw business increasing in April and May, he decided to accelerate again. The company currently has 87 employees between offices in Israel and the United States and he plans to be at 100 in the next couple of months.

When it comes to hiring, he says he doesn’t try to have hard and fast hiring rules like you have a certain degree or have gone to a certain school. “The only thing that’s important is getting good people hungry to succeed. The more diverse the culture is, the more diverse the group is, we find the more fun it is for people to discover each other and to discover different cultures,” Shlomo explained.

In terms of fundraising, while the company needs money to fuel its growth, at the same time it still had plenty of money in the bank from last year’s round. “We got into the pandemic and we didn’t know how long it’s going to last, and [early on] we didn’t yet know how it would impact the business. Existing investors were always bullish about the company. We decided to just go with that,” he said.

The company was founded in 2017 and previously raised a $19.1 million Series A round last year.

Powered by WPeMatico

The growth of digital banking has opened up a wealth of opportunities for making the world of finance more accessible and transparent to a greater number of people. But the darker underbelly is that it has also created more avenues for illicit activity to flourish, with some $2 trillion laundered annually but only 1-3% of that sum “caught.”

To help combat that, a London-based startup called ComplyAdvantage, which has built an AI platform and wider database of some 10 million entities to help identify and track those involved in financial crime, is today announcing a growth round of funding of $50 million to expand its reach and operations.

Specifically, the plan will be to use the funding for hiring, to invest in the tools it uses to detect entities and map the relationships between them and to bring on more clients.

“We’ve been focused on more granular analysis and being able to scale to hundreds of millions of searches across our database,” said Charles Delingpole, founder and CEO, said in an interview. “The next phase is more around the network of contacts and more enhanced diligence.” The company today has some 250 staff, mainly in the U.K. and Romania.

The Series C is being led by Ontario Teachers’ Pension Plan Board (Ontario Teachers’), a huge pension plan out of Canada (U.S. $155 billion) that is known as a prolific growth-stage tech investor. Previous backers Balderton and Index are also in the round. The company has raised $88 million to date, and while it’s not disclosing its valuation, for some context, it was last valued at around $141 million in its last round a year ago, per PitchBook data.

Today, ComplyAdvantage has more than 500 customers, primarily financial institutions using it to meet regulatory compliance requirements as well as to reduce their own exposure and risk, providing some automated services to complement (and potentially replace) some of the manual checks that they make to prove you are who you say you are.

It also has a growing business with other groups that are tracking fraud for their own ends, such as insurance companies trying to stem fraudulent claims and government entities. It also has a number of partners that access its database and use that as part of their own solutions (Quantexa, which announced a big funding round of its own last week, is one of those licensing partners).

“A lot of companies in the wider identity space are powered by our data, even if they don’t disclose it,” Delingpole said.

The company had its start originally focusing on the process of helping banks meet regulatory compliance around fraud detection by ingesting and analysing documents provided by customers ahead of opening accounts, initiating larger transactions with new entities and so on. That has taken on a more targeted purpose in recent years as ComplyAdvantage’s database has grown deeper.

Today the core of the business is based around a central database of known money launderers, human traffickers, terrorists, drug lords and others who exploit financial rails to run illegal operations and make a profit from them.

It’s formed, Delingpole said, by way of “automatically ingesting tens of thousands of data points, from websites, national warning lists, linked real-time databases of companies and various other applications on top of that.” That central database is still growing, and Delingpole believes that it’s not unrealistic for it to run to a much higher number in order to get the most accurate picture possible.

“Although we have 10 million today, we want to cover every company and person one day. We think the right number is 8 billion” — that is, the world’s population. “With that larger database we can solve other kinds of crimes too.”

The startup already has a straight channel through to government agencies, reporting connections and discoveries on behalf of their clients directly to them. And to be clear, although there are now strong data protection measures in place in Europe, when people are linked to illegal activity, that puts them on a list that supersedes that. When someone is suspected and is tipped to authorities, that information is kept private.

While all institutions will continue to have teams of people dedicated to risk analysis and investigations into activity, the idea here is to supercharge that work with more data that helps those investigators tackle the greater scale of data in the world today.

“Detecting financial crime in billions of transactions that take place around the globe has become nearly impossible without the application of data science and machine learning. It is this approach that has made ComplyAdvantage into a leader in the category, and the go-to partner for organizations that seek to automate what are still very often manual or inadequate processes,” said Jan Hammer, a partner at Index Ventures, in a statement.

The longer-term opportunity is to build out ComplyAdvantage’s customer base by leveraging information that the company is already surfacing that might be relevant to other verticals.

Insurance is a key example, Delingpole said. “We already see a mention of a person having defaulted on a loan then making an insurance claim,” he said. “We see credit, fraud and ownership data together.”

This, of course, puts the company into close competition not just with others building credit databases but those building strong AI platforms to leverage data to gain deeper insights into seemingly disparate digital actions and to build better pictures of activity on behalf of their clients. That includes not just partners like Quantexa, but others like Palantir.

The strength here, said Delingpole, is the sheer size of ComplyAdvantage’s database and its very specific focus on financial crime and how that sits for companies that need to police that, both for their own business health and for regulatory reasons. It’s that focus that has attracted investment.

“ComplyAdvantage offers mission-critical technology solutions for combating financial crime and keeping pace with an ever-evolving regulatory landscape,” said Olivia Steedman, senior managing director, TIP, at Ontario Teachers’. “The company is well-positioned to continue its rapid growth as its powerful technology platform transforms the compliance and risk management process for its clients.”

Powered by WPeMatico

The latest startup to see an uplift in inbound interest flowing from the remote work boom triggered by the coronavirus pandemic is Berlin-based Everphone, which sells a “mobile as a service” device rental package that caters to businesses needing to kit staff out with mobile hardware plus associated support.

Everphone is announcing a €34 million Series B funding round today, led by new investor signals Venture Capital. Other new investors joining the round include German carrier Deutsche Telekom — investing via its strategic investment fund, Telekom Innovation Pool — U.S.-based early-stage VC AlleyCorp and Dutch bank NIBC.

The Series B financing will go on expanding to meet rising demand, with the startup telling TechCrunch it’s expecting to see a 70-100% increase in sales volume versus the pre-crisis period, thanks to a doubling of inbound leads during the pandemic.

“The global pandemic has been a catalyst for growth in the field of digitization,” said CEO and co-founder, Jan Dzulko, in a statement. “We are currently experiencing a significant increase in demand at home and abroad, which is why we are aiming for European expansion with the funding.”

Everphone describes its offer as a one-stop shop, with the service covering not just the rental of (new or refurbished) smartphones and tablets but an administration and management wrapper that covers support needs, including handling repairs/replacements — with the promise of replacements within 24 hours if needed and less client risk from not having to wrangle traditional rental insurance fine print.

Other touted pluses of its “device as a service” approach include flexibility (users get to choose from a range of iOS and Android devices); lower cost (pricing depends on customer size, device choice and rental term but starts at €7,99 a month for a refurbished budget device, rising up to €49,99 a month for high-end kit with a 12-month upgrade); and rental bundles, which can include standard mobile device management software (such as Cortado and AirWatch) so customers can plug the rental hardware into their existing IT policies and processes.

Everphone reckons this service wrapper — which can also extend to include paid apps (such as Babbel for language learning) as an employee on-device perk/benefit in the bundle — differentiates its offer versus incumbent leasing providers, such as CHG-Meridian or De Lage Landen, and from wholesale distributors.

It also touts its global rollout capability as a customer draw, checking the scalability box.

Its investors (including German carrier, DT) are being fired up by the conviction that the COVID-19-induced shift away from the office to home working will create a boom in demand for well-managed and secured work phones to mitigate the risk of personal devices and personal data mingling improperly with work stuff. (On that front, Everphone’s website is replete with references to Europe’s data protection framework, GDPR, repurposed as scare marketing.)

“Everphone envisions that every employee will one day work via their smartphone,” added Marcus Polke, partner at signals Venture Capital, in a supporting statement. “With this employee-centric approach and integrated platform, everphone goes far beyond the mere outsourcing of a smartphone IT infrastructure.”

The 2016-founded startup has more than 400 customers signed up at this point, both SMEs and multinationals such as Ernst & Young. It caters to both ends of the market with an off-the-shelf package and self-service device management portal that’s intended for SMEs of between 100 and 1,500 employees — plus custom integrations for larger entities of up to 30,000 employees.

It says it’s able to offer “highly competitive” prices for renting new devices because it gives returned kit a second life, refurbishing and reselling devices on the consumer market. “Thanks to this profitable secondary lifespan, we are able to offer highly competitive prices and extensive service levels on our rental devices,” Everphone writes on its website.

The second-hand smartphone market has also been seeing regional growth. Swappie, a European e-commerce startup that sells refurbished iPhones, aligning with EU lawmakers’ push for a “‘right to repair” for electronics, raised its own ~$40 million Series B only last month, for example. Its second-hand marketplace is one potential outlet for Everphone’s rented and returned iPhones.

Powered by WPeMatico