Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

This morning, Mux, a startup that provides API-based video streaming tooling and analytics, announced that it has closed a $37 million Series C round of capital.

Andreessen Horowitz led the round, which included participation from Accel and Cobalt. Prior to this funding round, Mux most recently raised a roughly $20 million round in mid-2019. In total, the company had raised a hair under $32 million before its Series C, according to PitchBook data.

The Mux round lands amidst a number of trends that we’re tracking here at TechCrunch, namely API-based startups, which are hot as a group at the moment, and startups that are serving an accelerating digital transformation.

Let’s explore a bit of Mux’s history, and then dig into how the startup’s current pace of revenue growth explains its fresh infusion of capital.

TechCrunch spoke with Mux’s founder Jon Dahl about the round, curious about how the company came to be. Dahl was a co-founder of Zencoder back in the early 2010s, which sold to Brightcove. When Zencoder launched, TechCrunch said that it wanted “to be the Amazon Web Services of video encoding.” It wound up selling for $30 million, a figure that stood a bit taller in 2012, when the transaction was announced.

Dahl stuck around Brightcove for a few years while angel investing. Then in late 2015 he founded Mux. The new startup first built an analytics tool called Mux Data. Dahl said the analytics product was needed because more conventional tooling like Google Analytics don’t work well with online video.

Mux Data is a SaaS product. But what made Mux even more interesting is its on-demand infra play, namely Mux Video.

Mux Video is delivered via an API, supporting both live and on-demand video for other companies. The startup likes to argue that it’s doing for video what Stripe has done for payments, namely take a bundle of complexity and headache, wrestle it into shape, then offer it via a developer-friendly hook.

Delivering video, we’ve seen via the bootstrapped growth of Cloudinary and recent Daily.co round, is growing work in 2020.

That fact shows up in Mux’s numbers, which are somewhat bonkers. The company’s aggregate revenue numbers are growing at a pace that Dahl described as 4x, while Mux Video’s revenues are growing at a pace of 8x, he said. Dahl shared a few other metrics — startups: if you want folks to care about your funding round, follow this example — including that Mux Video’s LTV/CAC ratio is somewhere around 5x-6x, and that its net retention is around 160%.

The collected performance data that Mux shared explain why a16z wanted to put its capital into the company.

But to better understand that all the same, I caught up with Kristina Shen, a general partner at the venture firm. Shen stressed that Mux was heading in the right direction before the pandemic, but that COVID has accelerated the importance of video in how humans interact with one another — an accelerating secular shift for Mux to surf, in other words.

COVID has bolstered Mux, with a release regarding its new investment, noting that its “social media customers [have seen] an increase of 118% in video streaming since mid-February while fitness and health streaming surged by 162%, e-learning grew by 230% and religious streams jumped nearly 3 orders of magnitude.”

Shen said during our call that Mux is one of the fastest-growing enterprise SaaS companies that her firm has seen.

Finally, when asked about Mux’s gross margins, Shen said the company would eventually look similarly to other companies in the infra space, like Twilio and Stripe. This matches what Dahl told this publication, though the founder included a fun wrinkle. Remember Mux Data, the analytics product? Its margins more closely resembles SaaS economics, while Mux Video is more similar to other API, infra plays. So Mux has a bit of SaaS and a bit of infra in it, which should give it a super interesting blended gross margin profile.

Fun. The next time we talk to the firm we’ll be curious to see how far into the double-digit millions it can stretch its run rate.

Powered by WPeMatico

Skillshare CEO Matt Cooper said 2020 has been a year of rapid growth — even before the pandemic forced large swaths of the population to stay home and turn to online learning for entertainment and enrichment.

Cooper (who became CEO in 2017) told me that the company decided last year to “focus on our strength,” leading to a “brand relaunch” in January 2020 to emphasize the richness of its creativity-themed content. At the same time, Cooper said the company defines creativity very broadly, with classes divided into categories like animation, design, illustration, photography, filmmaking and writing.

“It’s not Bob Ross,” he said. “And I love Bob Ross, but that’s a very narrow definition of creativity. Creativity can come in lots of different forms — art, design, journaling, creative writing, it can be culinary, it can be crafts.”

Cooper added that daily usage was already up significantly by mid-March, when the pandemic led to widespread social distancing orders across the United States. That created some challenges, particularly for the more polished Skillshare Originals that the company offers alongside its user-taught classes. (For example, Originals include a color masterclass taught by Victo Ngai, a class on “discovering your creative voice” taught by Shantell Martin and a creative nonfiction class by Susan Orlean.)

But of course the pandemic also meant that, as Cooper put it, “A lot more people had a lot more free time at home and were looking for a constructive way to spend it.” In fact, the company said that since its rebranding, new membership sign-ups have tripled, with existing members watching three times the number of lessons.

And Skillshare has continued producing Originals by sending instructors “a huge box of gear” and then supervising the shoot remotely. In fact, Cooper suggested that this has “opened up a whole new world” for the Originals team, allowing them to “look at parts of the world where we probably weren’t going to fly a camera crew to go shoot.”

The company now has 12 million registered members, 8,000 teachers and 30,000 classes — all accessible for $99 a year or $19 a month. And it’s announcing that it has raised $66 million in new funding led by OMERS Growth Equity, with managing director Saar Pikar joining the board of directors. Previous investors Union Square Ventures, Amasia, Burda Principal Investments and Spero Ventures also participated.

“Skillshare serves the needs of professional creatives and everyday creative hobbyists alike, which presents a highly-innovative value proposition for the online learning market,” Pikar said in a statement. “We look forward to deepening our partnership with Skillshare, and our fellow investors, in order to help Matt Cooper and his team scale up the company’s international reach – and help Skillshare achieve the full potential of its unique approach to online learning.”

Cooper added that the company (which had previously raised $42 million) was cash-flow positive for the first half of 2020, so it raised the new round to invest in growth — particularly in the Skillshare for Teams enterprise product, which allows customers like GM Financial, Vice, AWS, Lululemon, American Crafts and Benefit to offer Skillshare as a perk for their employees.

Cooper is also hoping to expand internationally. Apparently two-thirds of new member sign-ups are coming from outside the United States, with India as Skillshare’s fastest growing market, and that’s with “no local language content, no local language teachers.” While Cooper plans to remain focused on English content for the near future, he noted there are other steps Skillshare can take to encourage global viewership, like accepting payments in different currencies and supporting subtitles in different languages.

“Just by making it a little easier for those international users to get value from the platform, we expect to see dramatic growth in these international markets,” he said.

Powered by WPeMatico

CakeResume is a startup creating an alternative for the tech industry to job search platforms like LinkedIn. The Taipei-based company, founded in 2016, announced today that it has raised $900,000 in seed funding from Mynavi, one of the largest staffing and public relations companies in Japan. The round will be used to expand CakeResume’s operations in other countries, including Japan and India.

Founder and chief executive officer Trantor Liu, who was a full-stack web developer at Codementor before launching CakeResume, said the startup’s goal is to have the biggest pool of tech talent in Asia. The platform currently has about 500,000 resumes in its database, 75% of which were created by job seekers in Taiwan. More than 3,000 employers, ranging from startups like Appier to large companies like Amazon Web Services, TSMC, Nvidia and Tesla, use it for recruitment.

The other 25% of resumes come from countries including India, Indonesia and the United States. CakeResume plans to expand in Japan with the help of Mynavi, a strategic investor, and is also seeking partnerships in Southeast and South Asia with recruiters. Liu said CakeResume has a particularly high conversion rate in India, and its goal is to build a pool of at least 100,000 resumes there.

In a statement about its decision to invest in CakeResume, a Mynavi representative said, “The global shortage of IT engineers is becoming more apparent and we are focusing on services related to IT talent in Asia. Among them, CakeResume’s service is excellent in product design, and the service is already used by many talent in the country,” adding that it expects the platform to become “the largest IT talent pool in Asia in the near future.”

In Taiwan, CakeResume’s main rivals are LinkedIn and job search site 104.com.tw. It also competes against other job sites like AngelList, Indeed and Glassdoor.

CakeResume differentiates by giving tech professionals more ways to show off their skills, since many tech companies want more in-depth resumes than the traditional one-pagers used in other fields. The startup was named because its resume builder enables job seekers to add more layers of information, like assembling a cake. For example, CakeResume’s template allows engineers to embed projects from GitHub, while designers can add data visualizations, instead of just including links to them.

“We aren’t just providing a form to fill in that you can then download as a formatted PDF resume. We want to allow you to be more creative,” said Liu. “You can easily embed project images and add descriptions, which makes it easier for HR to understand what you can contribute.”

Another difference between CakeResume and its competitors is that most people who create a profile are actively seeking new positions, instead of professional networking opportunities. Because it is also tailored for the tech industry, recruiters have a higher chance of getting responses from interested candidates, Liu said.

“We recently got a review from one of our clients, and they said when they used our platform to contact talent, they got about a 50% reply rate, but on LinkedIn it might be less than 10%,” he added.

Before the COVID-19 pandemic, many job seekers were willing to relocate, but chief operating officer Wei-Cheng Hsieh said CakeResume is now focusing more on helping people find remote jobs. More tech companies, including Facebook and Google, are extending their work from home policies until at least summer 2021.

Though many job postings still specify a location, Liu said CakeResume’s team anticipates this will change as companies continue adapting to the pandemic. While CakeResume will remain focused on matching applicants to jobs instead of networking, it also is also testing some social features to help workers around the world connect with companies and each other.

Powered by WPeMatico

Clean.io, a startup that helps digital publishers protect themselves from malicious ads, recently announced that it has raised $5 million in Series A funding.

The Baltimore-based company isn’t the only organization promising to fight malvertising (such as ads that force visitors to redirect to another website). But as co-founder Seth Demsey told me last year, Clean.io provides “granular control over who gets to load JavaScript.”

CEO Matt Gillis told me via email this week that the challenge will “always” be evolving.”

“Just like an antivirus company needs to constantly be updating their definitions and improving their protections, we always need to be alert to the fact that bad actors will constantly try to evade detection and get over and around the walls that you put in front of them,” Gillis wrote.

The company says its technology is now used on more than 7 million websites for customers including WarnerMedia’s Xandr (formerly AppNexus), The Boston Globe and Imgur.

Image Credits: Clean.io

Clean.io has now raised a total of $7.5 million. The Series A was led by Tribeca Venture Partners, with participation from Real Ventures, Inner Loop Capital and Grit Capital Partners.

Gillis said he’d initially planned to fundraise at the end of February, but he had to put those plans on hold due to COVID-19. He ended up doing all his pitching via Zoom (“I saw more than my fair share of small NY apartments”) and he praised Tribeca’s Chip Meakem (whose previous investments include AppNexus) as “a world-class partner.”

Of course, the pandemic’s impact on digital advertising goes far beyond pausing Gillis’ fundraising process. And when it comes to malicious ads, he said that with the cost of digital advertising declining precipitously in late March, “bad actors capitalized on this opportunity.”

“We saw a pretty constant surge in threat levels from mid-March until early May,” Gillis continued. “Demand for our solutions have remained strong due to the increased level of attacks brought on by the pandemic. Now more than ever, publishers need to protect their user experience and their revenue.”

Powered by WPeMatico

Mashroom, the London proptech that offers an “end-to-end” lettings and property management service, has raised £4 million in new funding.

Backing comes from existing unnamed private investors and matched funding from the U.K. taxpayer-funded Future Fund. It brings total funding to date for the company to £7 million.

Pitching itself as going “beyond the tenant-finding service” to include the entire rental journey — from property advertising, arranging viewings, credit history checks and maintenance to end of tenancy and dispute resolution — the self-service platform lets landlords list their property, which tenants can then rent easily.

This includes digital credit and reference checks and the signing of rental agreements and tenancy renewals. In addition, open banking is employed to collect rental payments and provide real-time payment information to landlords.

“Letting and renting is, for the most part, still a fragmented, bricks-and-mortar industry,” says Mashroom founder and ex-venture capitalist Stepan Dobrovolskiy. “The experience as a landlord or tenant normally still involves a traditional estate agent who acts as intermediary and charges a hefty fee. While plenty of new players have come along with tech to solve certain points in the experience, we are the first to look at the entire process from end to end.”

Over on Extra Crunch, learn more about the opportunities within property tech with A/O PropTech, the European VC disrupting the €230 trillion real estate industry.

Dobrovolskiy says this sees Mashroom digitise about “98%” of the rental journey, although he maintains that some human interaction is, and perhaps always will be, necessary. “Unlike most traditional agents, we are also still there to help after tenants move in — things like maintenance requests, insuring contents, moving out or extending contracts at the end of the tenancy. We fundamentally believe that automation and tech should augment rather than replace human interactions in this market, and a big part of our brand is to create better relationships between landlords and tenants,” he says.

As an example, Mashroom incentivises tenants to help landlords with viewings at the end of their tenancy by offering a week’s worth of rent as a reward. “No one knows a property better than people who actually live in it, and it removes a lot of friction to have current tenants schedule and host viewings at times that suit them,” explains Dobrovolskiy. “This costs less than 2% of annual rent for landlords, compared to paying 10%+ to an estate agent for finding a new tenant. So we are unlocking financial benefits for landlords and tenants at the same time as giving them more flexibility.”

Mashroom has also developed a “Deposit Replacement Product” as an alternative to the traditional deposit. In partnership with insurer Arch Capital, it lets tenants pay one week’s rent while offering landlords more protection than a regular deposit — up to 12 weeks compared to the typical five weeks.

Noteworthy, the basic Mashroom service is free for tenants and landlords, with the proptech startup generating revenue via its financial products offering, which, along with deposit replacement, includes rent guarantee and other insurance products. The startup also operates its own in-house mortgage brokerage for buy-to-let mortgages and refinancing for landlords.

Powered by WPeMatico

Ginger, a provider of on-demand mental healthcare services, has raised $50 million in a new round of funding.

The new capital comes as interest and investment in mental health and wellness has emerged as the next big area of interest for investors in new technology and healthcare services companies.

Mental health startups saw record deal volumes in the second quarter of 2020 on the heels of rising demand caused by the COVID-19 epidemic, according to the data analysis firm CB Insights. More than 55 companies raised rounds of funding over the quarter, even though deal amounts declined 15%, to $491 million. That’s still nearly half a billion dollars invested into mental health in one quarter alone.

What started in 2011 as a research-based company spun out of work from the Massachusetts Institute of Technology has become one of the largest providers of mental health services primarily through employer-operated health insurance plans.

Through Ginger’s services, patients have access to a care coordinator that is the first point of entry into the company’s mental health plans. That person is a trained behavioral health coach — typically someone with a master’s degree in psychology with a behavioral health coaching certificate from schools like Duke, UCLA, Michigan or Columbia and 200 hours of training provided by Ginger itself.

These health coaches provide the majority of care that Ginger’s patients receive. For more serious conditions, Ginger will bring in specialists to coordinate care or provide access to medications to alleviate the condition, according to the company’s chief executive officer, Russell Glass.

Ginger began offering its on-demand care services in 2016 and counts tens of thousands of active users on the platform. The company charges companies a fee for access to its services on a per-employee, per-month basis and provides access to mental health services to hundreds of thousands of employees through corporate benefit plans, Glass said.

More than 200 companies, including Delta Air Lines, Sanofi, Chegg, Domino’s, SurveyMonkey and Sephora, pay Ginger to cost-efficiently provide employees with high-quality mental healthcare. Ginger members can access virtual therapy and psychiatry sessions as an in-network benefit through the company’s relationships with leading regional and national health plans, including Optum Behavioral Health, Anthem California and Aetna Resources for Living, according to a statement.

“Our entire mission here is to break the supply/demand imbalance and provide far more care,” said Glass in an interview. “Ultimately we want Ginger to be available to help anybody who has a need. Being accessible to anybody, anywhere, is an important part of the strategy. That means direct-to-consumer will be a direction we head in.”

For now, the company will use the money to build out its partner ecosystem with companies like Cigna, an investor in the company’s latest $50 million round. Ginger will also look to getting government payers to reach more people. Eventually direct-to-consumer could become a larger piece of the business as the company drives down costs of care.

It’s also investing in automation and natural language processing to automate care pathways and personalizing patient care using machine learning.

The company’s $50 million Series D round was co-led by Advance Venture Partners and Bessemer Venture Partners, with additional participation from Cigna Ventures and existing investors such as Jeff Weiner, executive chairman of LinkedIn, and Kaiser Permanente Ventures. To date, Ginger has raised roughly $120 million.

Even as Ginger is working through the existing network of employer benefit plans and standalone insurance providers to offer its mental health services, other startups are raising money to offer employer-provided mental health and wellness plans. SonderMind is working to make it easier for independent mental health professionals to bill insurers, AbleTo helps employers screen for undiagnosed mental health conditions and SilverLight Health partners with organizations to digitally monitor and manage mental health care.

Meanwhile, other startups are going direct-to-consumer with a flood of offerings around mental health. Well-financed, billion-dollar-valued companies like Ro and Hims are offering mental health and wellness packages to customers, while Headspace has both a consumer-facing and employer benefit offering. And upstart companies like Real are focusing on providing care specifically for women.

With its funding round, Ginger is adding David ibnAle, a founding partner at Advance Venture Partners (AVP), which is the investment firm behind S.I. Newhouse’s family-owned media and technology holding company, Advance; and the digital health investment guru Steve Kraus from Bessemer Venture Partners.

“AVP invests in companies that are using technology to tackle large-scale, global challenges and transform traditional businesses and business models,” said David ibnAle, founding partner of Advance Venture Partners. “Ginger is doing just that. We are excited to partner with an exceptional team to help make high-quality, on-demand mental health care a reality for millions of more people around the world.”

Powered by WPeMatico

Data science is the name of the game these days for companies that want to improve their decision making by tapping the information they are already amassing in their apps and other systems. And today, a startup called Mode Analytics, which has built a platform incorporating machine learning, business intelligence and big data analytics to help data scientists fulfill that task, is announcing $33 million in funding to continue making its platform ever more sophisticated.

Most recently, for example, the company has started to introduce tools (including SQL and Python tutorials) for less technical users, specifically those in product teams, so that they can structure queries that data scientists can subsequently execute faster and with more complete responses — important for the many follow-up questions that arise when a business intelligence process has been run. Mode claims that its tools can help produce answers to data queries in minutes.

This Series D is being led by SaaS specialist investor H.I.G. Growth Partners, with previous investors Valor Equity Partners, Foundation Capital, REV Venture Partners and Switch Ventures all participating. Valor led Mode’s Series C in February 2019, while Foundation and REV respectively led its A and B rounds.

Mode is not disclosing its valuation, but co-founder and CEO Derek Steer confirmed in an interview that it was “absolutely” an up-round.

For some context, PitchBook notes that last year its valuation was $106 million. The company now has a customer list that it says covers 52% of the Forbes 500, including Anheuser-Busch, Zillow, Lyft, Bloomberg, Capital One, VMware and Conde Nast. It says that to date it has processed 830 million query runs and 170 million notebook cell runs for 300,000 users. (Pricing is based on a freemium model, with a free “Studio” tier and Business and Enterprise tiers priced based on size and use.)

Mode has been around since 2013, when it was co-founded by Steer, Benn Stancil (Mode’s current president) and Josh Ferguson (initially the CTO and now chief architect).

Steer said the impetus for the startup came out of gaps in the market that the three had found through years of experience at other companies.

Specifically, when all three were working together at Yammer (they were early employees and stayed on after the Microsoft acquisition), they were part of a larger team building custom data analytics tools for Yammer. At the time, Steer said Yammer was paying $1 million per year to subscribe to Vertica (acquired by HP in 2011) to run it.

They saw an opportunity to build a platform that could provide similar kinds of tools — encompassing things like SQL Editors, Notebooks and reporting tools and dashboards — to a wider set of users.

“We and other companies like Facebook and Google were building analytics internally,” Steer recalled, “and we knew that the world wanted to work more like these tech companies. That’s why we started Mode.”

All the same, he added, “people were not clear exactly about what a data scientist even was.”

Indeed, Mode’s growth so far has mirrored that of the rise of data science overall, as the discipline of data science, and the business case for employing data scientists to help figure out what is “going on” beyond the day to day, getting answers by tapping all the data that’s being amassed in the process of just doing business. That means Mode’s addressable market has also been growing.

But even if the trove of potential buyers of Mode’s products has been growing, so has the opportunity overall. There has been a big swing in data science and big data analytics in the last several years, with a number of tech companies building tools to help those who are less technical “become data scientists” by introducing more intuitive interfaces like drag-and-drop features and natural language queries.

They include the likes of Sisense (which has been growing its analytics power with acquisitions like Periscope Data), Eigen (focusing on specific verticals like financial and legal queries), Looker (acquired by Google) and Tableau (acquired by Salesforce).

Mode’s approach up to now has been closer to that of another competitor, Alteryx, focusing on building tools that are still aimed primarily at helping data scientists themselves. You have any number of database tools on the market today, Steer noted, “Snowflake, Redshift, BigQuery, Databricks, take your pick.” The key now is in providing tools to those using those databases to do their work faster and better.

That pitch and the success of how it executes on it is what has given the company success both with customers and investors.

“Mode goes beyond traditional Business Intelligence by making data faster, more flexible and more customized,” said Scott Hilleboe, managing director, H.I.G. Growth Partners, in a statement. “The Mode data platform speeds up answers to complex business problems and makes the process more collaborative, so that everyone can build on the work of data analysts. We believe the company’s innovations in data analytics uniquely position it to take the lead in the Decision Science marketplace.”

Steer said that fundraising was planned long before the coronavirus outbreak to start in February, which meant that it was timed as badly as it could have been. Mode still raised what it wanted to in a couple of months — “a good raise by any standard,” he noted — even if it’s likely that the valuation suffered a bit in the process. “Pitching while the stock market is tanking was terrifying and not something I would repeat,” he added.

Given how many acquisitions there have been in this space, Steer confirmed that Mode too has been approached a number of times, but it’s staying put for now. (And no, he wouldn’t tell me who has been knocking, except to say that it’s large companies for whom analytics is an “adjacency” to bigger businesses, which is to say, the very large tech companies have approached Mode.)

“The reason we haven’t considered any acquisition offers is because there is just so much room,” Steer said. “I feel like this market is just getting started, and I would only consider an exit if I felt like we were handicapped by being on our own. But I think we have a lot more growing to do.”

Powered by WPeMatico

Special is a new startup offering online video creators a way to move beyond advertising for their income.

The service was created by the team behind tech consulting and development firm Triple Tree Software. Special’s co-founder and CEO Sam Lucas told me that the team had already “scrapped our way from nothing to a seven-figure annual revenue,” but when the founders met with Next Frontier Capital (Next Frontier, like Special, is based in Bozeman, Montana) they pitched a bigger idea — an app where creators charge a subscription fee for access to premium content.

While Triple Tree started in the service business, Lucas explained the goal was always to create “a product company that we could sell for $100 million.” Now Special is announcing it has raised $2.26 million in seed funding from Next Frontier and other investors.

It’s also built an initial version of the product that’s being tested by friends, family and a handful of creators, with plans for a broader beta release in October.

With online advertising slowing dramatically during the COVID-19 pandemic, YouTube recently highlighted the fact that 80,000 of its channels are earning money from non-ad sources, and that the number of creators who receive the majority of their income from those sources grew 40% between January and May.

One of the main ways that creators can ask their viewers for money is through Patreon. Lucas acknowledged Patreon as a “very big inspiration” for Special, but he said that conversations with creators pointed to a few key ways that the service falls short.

Image Credits: Special

For one thing, he argued while contributions on Patreon are framed as “donations” or “support,” Special allows creators to emphasize the value of their premium content by putting it behind a subscription paywall. Patreon supports paywalls as well, but that leads to Lucas’ next point — it was built for creators of all kinds, while Special is focused specifically on video, and it has built a high-quality video player into the experience.

In fact, Lucas described Special’s spin on the idea of a white-labeled product as “silver label.” The goal is to create “the perfect balance between a platform and a custom app” — creators get their own customizable channels that emphasize their brand identity (rather than Special’s), while still getting the distribution and exposure benefits of being part of a larger platform, with their content searchable and viewable on web, mobile and smart TVs.

Creators also retain ownership of their content, and they get to decide how much they want to charge subscribers — Lucas said it can be anywhere between “$1 or $999” per month, with Special taking a 10% fee. He added that the team has plans to build a bundling option that would allow creators to team up and offer a joint subscription.

Lucas’ pitch reminded me of startups like Vessel (acquired and shut down by TechCrunch’s parent company Verizon in 2016), which previously hoped to bring online creators together for a subscription offering. In Lucas’ view, Vessel was similar to newer apps like Quibi, in that they directly funded creators to produce exclusive content.

“It’s a billion-dollar arms race, with what used to be a technology play but is now a production studio play,” he said. Special doesn’t have the funding to compete at that level, but Lucas suggested that a studio model also provides the wrong incentives to creators, who say “Hell yeah, keep those checks coming in,” but disappear “the moment the checks stop.”

“I almost think it’s an egotistical play,” Lucas added. “The company thinks they know best what a creator should produce for an audience that doesn’t exist yet. We say: Let them do it on Special. Do whatever you want, as long as you follow our terms of service, and own your creative vision.”

It might also seem like a big challenge to recruit creators while based in Montana, but Lucas replied that Special has more access than you might think, especially since the town has become “such a hotspot for extremely wealthy people to buy their third home.”

More broadly, he suggested that the distance from Hollywood and Silicon Valley “allows us to not follow the trends of every new streaming platform and [instead] truly find those independent creators underneath the woodworks.”

Powered by WPeMatico

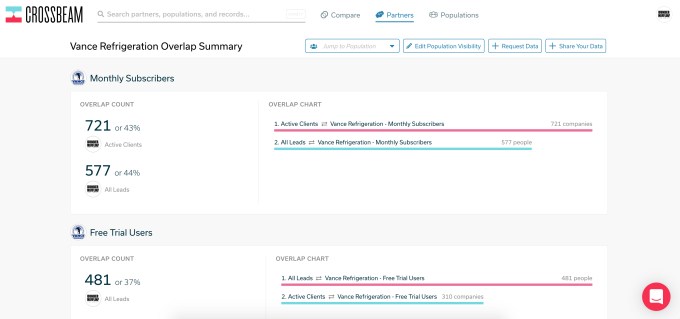

As sales teams partner with other companies, they go through a process called account mapping to find common customers and prospects. This is usually a highly manual activity tracked in spreadsheets. Crossbeam, a Philadelphia startup, has come up with a way to automate partnership data integration. Today the company announced a $25 million Series B investment.

Redpoint Ventures led the round with help from existing investors FirstMark Capital, Salesforce Ventures, Slack Fund and Uncork Capital, along with new investors Okta Ventures and Partnership Leaders, a partnership industry association. All in all, an interesting mix of traditional VCs and strategic investors that Crossbeam could potentially partner with as they grow the business.

The funding comes on the heels of a $3.5 million seed round in 2018 and a $12.5 million Series A a year ago. The startup has now raised a total of $41 million.

Crossbeam has been growing steadily, and that attracted the attention of investors, whom CEO and co-founder Bob Moore says approached him. He was actually not thinking about fundraising until next year, but when the opportunity presented itself, he decided to seize it.

The platform has a natural networking effect built into it with over 900 companies using it so far. As new companies come on, they invite partners, who can join and invite more partners, and that creates a constant sales motion for them without much effort at all.

“We didn’t go out fundraising. We caught the eye of Redpoint because they could see the virality of the product and the extent to which it was being used by many of their portfolio companies and companies out in the market […],” Moore told TechCrunch.

Image Credits: Crossbeam

To accelerate interest in the product, the company also announced a new free tier, which replaces the limited free trial and a starter level that previously cost $500 per month. Prior to this move, if you didn’t move to the starter tier, you would lose your data when the trial was over.

“The idea here is what we’ve seen in the data is that we can create a whole lot of value for people and demonstrate really strong ROI once they get in the door and actually have access to that data, and they don’t have to worry about a free trial where the data is going away,” Moore explained.

Moore says they currently have 28 employees and have ambitious plans to add new people to the mix in the coming months, expecting to reach 50 employees by early 2021. As the company revs up on the personnel side, Moore says diversity is front and center of their plans.

“As far as Crossbeam specifically goes, we’ve made sure that diversity, equity and inclusion is part of our entire recruiting process and also the cultural experience that we create for people that are at the company,” he said. Although he didn’t discuss specific numbers, he said the company was making progress, particularly in the latest round of hires.

While the company has an office in Philly, even before COVID hit, it was a remote first organization with about half of the employees working from home. “I think a lot of our culture was kind of built to make sure that remote team members are first-class citizens in every respect in the company. So we already had all the controls, technology and practices in place, and when we shut the office, it was about as smooth as could be,” he said.

Powered by WPeMatico

Krisp’s smart noise suppression tech, which silences ambient sounds and isolates your voice for calls, arrived just in time. The company got out in front of the global shift to virtual presence, turning early niche traction into real customers and attracting a shiny new $5 million Series A funding round to expand and diversify its timely offering.

We first met Krisp back in 2018 when it emerged from UC Berkeley’s Skydeck accelerator. The company was an early one in the big surge of AI startups, but with a straightforward use case and obviously effective tech it was hard to be skeptical about.

Krisp applies a machine learning system to audio in real time that has been trained on what is and isn’t the human voice. What isn’t a voice gets carefully removed even during speech, and what remains sounds clearer. That’s pretty much it! There’s very little latency (15 milliseconds is the claim) and a modest computational overhead, meaning it can work on practically any device, especially ones with AI acceleration units like most modern smartphones.

The company began by offering its standalone software for free, with a paid tier that removed time limits. It also shipped integrated into popular social chat app Discord. But the real business is, unsurprisingly, in enterprise.

“Early on our revenue was all pro, but in December we started onboarding enterprises. COVID has really accelerated that plan,” explained Davit Baghdasaryan, co-founder and CEO of Krisp. “In March, our biggest customer was a large tech company with 2,000 employees — and they bought 2,000 licenses, because everyone is remote. Gradually enterprise is taking over, because we’re signing up banks, call centers and so on. But we think Krisp will still be consumer-first, because everyone needs that, right?”

Now even more large companies have signed on, including one call center with some 40,000 employees. Baghdasaryan says the company went from 0 to 600 paying enterprises, and $0 to $4 million annual recurring revenue, in a single year, which probably makes the investment — by Storm Ventures, Sierra Ventures, TechNexus and Hive Ventures — look like a pretty safe one.

It’s a big win for the Krisp team, which is split between the U.S. and Armenia, where the company was founded, and a validation of a global approach to staffing — world-class talent isn’t just to be found in California, New York, Berlin and other tech centers, but in smaller countries that don’t have the benefit of local hype and investment infrastructure.

Funding is another story, of course, but having raised money the company is now working to expand its products and team. Krisp’s next move is essentially to monitor and present the metadata of conversation.

“The next iteration will tell you not just about noise, but give you real time feedback on how you are performing as a speaker,” Baghdasaryan explained. Not in the toastmasters sense, exactly, but haven’t you ever wondered about how much you actually spoke during some call, or whether you interrupted or were interrupted by others, and so on?

“Speaking is a skill that people can improve. Think Grammar.ly for voice and video,” Baghdasaryan ventured. “It’s going to be subtle about how it gives that feedback to you. When someone is speaking they may not necessarily want to see that. But over time we’ll analyze what you say, give you hints about vocabulary, how to improve your speaking abilities.”

Since architecturally Krisp is privy to all audio going in and out, it can fairly easily collect this data. But don’t worry — like the company’s other products, this will be entirely private and on-device. No cloud required.

“We’re very opinionated here: Ours is a company that never sends data to its servers,” said Baghdasaryan. “We’re never exposed to it. We take extra steps to create and optimize our tech so the audio never leaves the device.”

That should be reassuring for privacy wonks who are suspicious of sending all their conversations through a third party to be analyzed. But after all, the type of advice Krisp is considering can be done without really “understanding” what is said, which also limits its scope. It won’t be coaching you into a modern Cicero, but it might help you speak more consistently or let you know when you’re taking up too much time.

For the immediate future, though, Krisp is still focused on improving its noise-suppression software, which you can download for free here.

Powered by WPeMatico