Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Kentaro Kawamori and Jason Offerman, the co-founders of new startup Persefoni, which aims to make carbon reporting easier for large corporations, know a few things about carbon emissions.

The two men met at Chesapeake Energy Corp., an Oklahoma City-based energy company focused on oil and gas extraction that ranks as one of the biggest polluters in the world.

Kawamori, whose colorful career includes no more than two-year stints at companies including Accenture, Insight, SoftwareONE and Major League Gaming before ascending to the chief digital officer role at Chesapeake Energy, met Offerman at the energy company just as the company was helping the U.S. assume a dominant position in the oil and gas energy world.

Offerman, a longtime employee of the energy company, had spent 30 years in operations and enterprise resource planning before finding himself working under Kawamori. Together, the two men left to pursue entrepreneurial opportunities and linked up with a family office called Rice Investment Group, in late 2019.

Their timing proved to be fortuitous, as Chesapeake Energy was forced to declare bankruptcy less than a year later. But even as Chesapeake was hitting hard times, Offerman and Kawamori were ramping up their work on Persofoni, which was officially incorporated in January.

The company provides businesses with the equivalent of enterprise resource planning software to set up the scope of their carbon reporting based on established guidelines and provide a window into a company’s emissions profile.

While many companies have tried to pitch similar products in the past, they were working to overcome institutional inertia that had many companies convinced they could ignore their environmental impact. In the current business climate, that attitude is no longer acceptable to some of the major investors that companies rely on for liquidity in stock markets.

“Institutional investors are getting aggressive on requiring companies to disclose their sustainability metrics,” said Kawamori, who serves as Persefoni’s chief executive.

It’s not only institutional investors that are getting more stringent with their reporting requirements around sustainability. Kawamori expects that the European Union will pass tough regulations similar to the privacy requirements under GDPR to mandate clear reporting around emissions.

Investors backing the company include the Rice Investment Group, which led the round, with participation from Carnrite Ventures and some undisclosed angel investors. Daniel Rice, a co-founder and partner at Rice Investment Group, and a former oil and gas executive at Rice Energy, has joined the company’s board of directors.

While Persefoni uses standardized reporting metrics, the company’s software only enables reporting based on the criteria that companies establish for their metrics. These self-reporting mechanisms could obscure more than they reveal if company’s aren’t transparent about how they decide to measure their emissions profiles and what data they’re actually including in those measurements.

“Ultimately, Persefoni wants to make measuring and tracking every organization’s carbon footprint as ubiquitous as managing their financial performance,” Kawamori said in a statement. “Financial ERP systems did that for financial data decades ago and the same need to manage carbon inventories and transactions has emerged for organizations.”

Powered by WPeMatico

Buildkite, a Melbourne-based company that provides a hybrid continuous integration and continuous delivery (CI/CD) platform for software developers, announced today that it has raised AUD $28 million (about USD $20.2 million) in Series A funding, bringing its valuation to more than AUD $200 million (about USD $145 million).

The funding was led by OpenView, an investment firm that focuses on growth-stage enterprise software companies, with participation from General Catalyst.

This round is the company’s first since Buildkite raised about AUD $200,000 in seed funding when it was founded in 2013.

Co-founder and chief executive officer Lachlan Donald told TechCrunch that Buildkite didn’t seek more funding earlier because it was growing profitably. In fact, the company turned away interested investors “because we wanted to focus on sustainable growth and maintain control of our destiny.”

But Donald said they were open to investment from OpenView and General Catalyst because they see the two investors as “true partners as we enter and define this next generation of CI/CD.”

Buildkite’s team is small, with just 26 employees. “We’re a lean, focused team, so their expert advice and guidance will help more software teams around the world discover Buildkite,” Donald said. He added that part of the funding round will be used to give 42X returns to early investors and shareholders, and the rest will be used on product development.

In a statement about the funding, OpenView partner Mackey Craven said, “The global pandemic and the resulting economic uncertainty underlines the importance for companies to maximize efficiencies and build for growth. As the world continues to build digital-first applications, we believe Buildkite’s unique approach will be the new enterprise standard of CI/CD and we’re excited to be supporting them in realizing this ambition.”

Continuous integration gives software teams an automated way to develop and test applications, making collaboration more efficient, while continuous delivery refers to the process of pushing code to environments for further testing by other teams, or deploying it to customers. CI/CD platforms make it easier for fast-growing tech companies to test and deliver software. Buildkite says it now has more than 1,000 customers, including Shopify, Pinterest and Wayfair.

As part of the round, Jean-Michel Lemieux, Shopify’s chief technology officer, and Ashley Smith, chief revenue officer at Gatsby and OpenView venture partner, will join Buildkite’s board.

The increased use of online applications caused by the COVID-19 pandemic means there is more demand for CI/CD platform, since engineering teams need to work more quickly.

“A good example is Shopify, one of our longstanding partners. They came to us after they outgrew their previous hosted CI provider,” Donald said. “Their challenge is one we see across all of customers — they needed to reduce build time and scale their team across multiple time zones. Once they wrapped Buildkite into their development flow, they saw a 75% reduction in build wait times. They grew their team by 300% and have still been able to keep build time under 10 minutes.”

Other CI platforms available include Jenkins, CircleCI, Travis, Codeship and GitLab. Co-founder and chief technology officer Keith Pitt said one of the ways that BuildKite differentiates from its rivals is its focus on security, which prompted his interest in building the platform in the first place.

“Back in 2013, my then-employer asked that I stop using a cloud-based CI/CD platform due to security concerns, but I found the self-hosted alternatives to be incredibly outdated,” Pitt said. “I realized a hybrid approach was the solution for testing and deploying software at scale without compromising security or performance, but was surprised to find a hybrid CI/CD tool didn’t exist yet. I decided to create it myself, and Buildkite was born.”

Powered by WPeMatico

Movable Ink, a company that helps businesses deliver more personalized and relevant email marketing, is announcing that it has raised $30 million in Series C funding.

The company will be 10 years old in October, and founder and CEO Vivek Sharma told me that it’s always been “capital efficient” — even with the new round, Movable Ink has only raised a total of $39 million.

However, Sharma noted that with COVID-19, it felt like “a good idea to have some dry powder on our balance sheet … if things turned south.”

At the same time, he suggested that the pandemic’s impact has been more limited than he anticipated, and has been “really focused” on a few sectors like travel, hospitality and “old line retailers.”

“Those who are adopting to e-commerce really quickly have done well, financial services has done well, media has done well,” he said.

The company’s senior vice president of strategy Alison Lindland added that clients using Movable Ink were able to move much more quickly, with campaigns that would normally take months launching in just a few days.

“We really saw those huge, wholesale digital transformations in a time of duress,” Lindland said. “Obviously, large Fortune 500 companies were making difficult decisions, were putting vendors on hold, but email marketers are always the last people furloughed themselves, because of how critical email marketing is to their businesses. We were just as critical to their operations.”

Image Credits: Movable Ink

The company said it now works with more than 700 brands, and in the run up to the 2020 election, its customers include the Democratic National Committee.

The new funding comes from Contour Venture Partners, Intel Capital and Silver Lake Waterman. Sharma said the money will be spent on three broad categories: “Platforms, partners and people.”

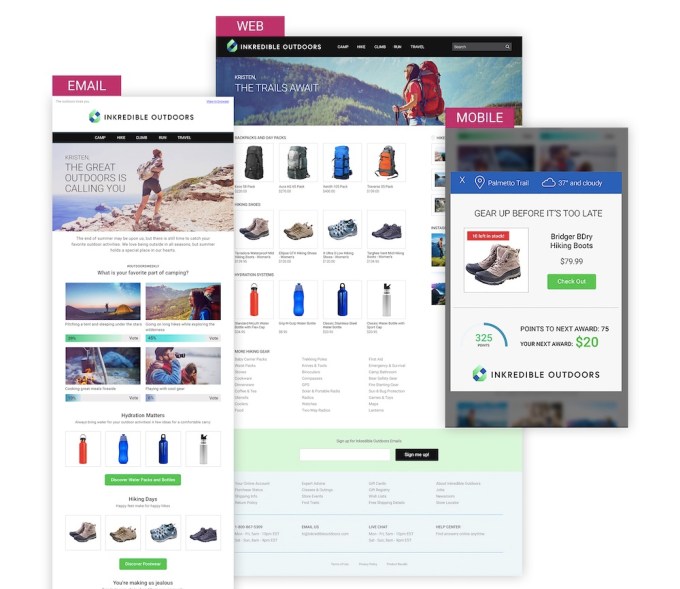

On the platform side, that means continuing to develop Movable Ink’s technology and expanding into new channels. He estimated that around 95% of Movable Ink’s revenue comes from email marketing, but he sees a big opportunity to grow the web and mobile side of the business.

“We take any data the brand has available to it and activate and translate it into really engaging creative,” he said, arguing that this approach is applicable in “every other channel where there’s pixels in front of the consumer’s eyes.”

The company also plans to make major investments into AI. Sharma said it’s too early to share details about those plans, but he pointed to the recent hire of Ashutosh Malaviya as the company’s vice president of artificial intelligence.

As for partners, the company has launched the Movable Ink Exchange, a marketplace for integrations with data partners like Oracle Commerce Cloud, MessageGears Engage, Trustpilot and Yopto.

And Movable Ink plans to expand its team, both through hiring and potential acquisitions. To that end, it has hired Katy Huber as its senior vice president of people.

Sharma also said that in light of the recent conversations about racial justice and diversity, the company has been looking at its own hiring practices and putting more formal measures in place to track its progress.

“We use OKRs to track other areas of the business, so if we don’t incorporate [diversity] into our business objectives, we’re only paying lip service,” he said. “For us, it was really important to not just have a big spike of interest, and instead save some of that energy so that it’s sustained into the future.”

Powered by WPeMatico

Coronavirus stay-home orders have sparked an unprecedented demand for grocery delivery around the world. Now investors are clamoring to bet on promising players in the field.

That includes DST Global, the investment firm helmed by Israeli-Russian billionaire Yuri Milner. Most recently, it poured $35 million into Weee!, a California-based startup that from its own warehouses delivers to major cities across the U.S. Asian groceries like fresh kimchi and Japanese desserts. The funding boosted the five-year-old startup’s total raise since launch to more than $100 million.

Weee! declined to share its post-money valuation, but the figure likely surpasses $500 million, given it’s widely known that DST Global does not generally back companies whose valuation is less than $500 million.

Online grocery is a capital-intensive business with thin profit margins, so it’s unsurprising to see many contenders — in both China and the U.S. — operating in the red. Against the odds, Weee! turned profitable earlier this year and went cash-flow positive.

That means the startup was in no rush to fundraise, probably giving it more bargaining power in negotiating terms with a storied investor like DST Global, whose portfolio spans Spotify, Twitter, Airbnb, Slack, Didi and Gojek, just to name a few.

Weee! certainly matches DST Global’s investment target as a high-growth startup. In June, the company recorded 700% year-over-year growth in revenue and was on course to generate revenue in the lower hundreds of millions of dollars in 2020, it told TechCrunch at the time.

Since the U.S. began winding down lockdowns and people returned to supermarkets, some grocery delivery services have seen their revenue growth slow. Weee!, however, is currently growing 15-20% more than its March peak. CEO Larry Liu explained the sustained boom stems from the service’s product differentiation: Asian specialties that one can’t even find in Chinatowns.

“People don’t want to pay extra if [an online grocery] only provides convenient delivery but no product differentiation,” said Han Shen, founding partner of iFly.vc, a California-based fund that backed Weee! in its Series A round.

In addition, Weee! tries to streamline every step of its operations, from product procurement, warehouse management, staff allocation, through to door-to-door delivery. The result is zero food waste thanks to fast inventory turnover.

“There is no secret tactic that we can’t talk about, nothing more than achieving efficiency throughout the entire process,” Shen observed.

In the meantime, Weee! works to keep prices down by cultivating direct relationships with suppliers like local farms and opting for next-day delivery rather than the more costly 30-minute standard expected in China, where he grew up. Earlier this year, former chief operations officer of Netflix Tom Dillon joined the board to help beef up Weee!’s operational efficiency.

With the new proceeds, the Asian e-grocer hopes to hire new talents and expand its delivery service from eight key regions to 13-14 cities across the U.S. by the end of this year.

Powered by WPeMatico

Hammock, a U.K. fintech/proptech helping landlords and property manages gain better oversight on the financial health of their rental properties, has raised £1 million in seed funding as it readies the launch of a current account.

Backing comes from Fuel Ventures and Ascension Ventures, joining existing investors that include Founders Factory and various unnamed angels. Hammock was incubated within Founders Factory Studio, and in the last 12 months has on-boarded onto its platform more than 1,700 managed properties, tracking over £7 million in rent.

“At a practical level, we want to save landlords time and money,” explains Hammock founder and CEO Manoj Varsani. “As a landlord, I know too well how time-consuming and inefficient it is to manage your properties with spreadsheets, paper notes and to collate data from multiple bank accounts. As a fintech expert, I realised that landlords and letting agents often rely on archaic technology and haven’t experienced the benefits of new-generation tech solutions.”

Varsani says that most of the data needed by landlords to manage their property finances is already available on various banking and budgeting apps, but argues it isn’t accessible in “an easy and understandable” format. “We aim to solve these problems by streamlining property finances management,” he adds.

As it exists currently, Hammock plugs into a landlord’s bank accounts, via open banking, and automatically monitors rent collection, tracks payments and expenses and provides live analytical reporting on the well-being of each rental house or flat. However, next on the roadmap, to be launched in the coming weeks, is an FCA-regulated current account designed specifically for landlords and property managers — thus setting up the company to launch future financial services for rental property owners.

“Landlords who use Hammock get real-time notifications about all income and expenses, so rent collection and cash flow management are easier to keep an eye on,” says Varsani. “They also get the tools they need to reconcile transactions as they happen, so they always know where they stand in terms of profit and loss. This means that compiling their tax statement goes from taking hours to taking minutes. Landlords can already get our functionalities if they connect their bank accounts via open banking. In September we’ll launch our own current account, so all functionalities will be natively integrated and the whole experience will be even more seamless.”

Direct Hammock customers span professional landlords with large portfolios (e.g. more than 50 properties) as well as part-time landlords who manage only 1 or 2 properties. The startup also serves B2B customers, such as letting agents, property managers and build to rent companies, and works with accountants who act as a customer acquisition funnel by recommending the service to their landlord clients.

Meanwhile, the business model is simple enough. Customers pay a monthly subscription to use the platform based on the number of properties managed, with the vast majority paying £9.99 per month.

Powered by WPeMatico

Thirty Madison, the New York-based startup developing a range of direct to consumer treatments for hair loss, migraines and chronic indigestion, has raised $47 million in new financing.

After last week’s nearly $19 billion merger between Teladoc and Livongo, remote therapies and virtual care companies are all the rage among the healthcare industry, and Thirty Madison’s business is no exception.

An indicator of just how important these companies are to the future of the healthcare business can be seen in the presence of Johnson & Johnson Innovation – JJDC, Inc. (JJDC) in the latest round for Thirty Madison.

Existing investors Maveron and Northzone also returned to back the company in a deal led by Polaris Partners. Thirty Madison has raised a total of $70 million so far.

Founded just three years ago by Steven Gutentag and Demetri Karagas, Thirty Madison expanded from treating hair loss with its Keeps brand in 2018 to migraine treatments in early 2019 with Cove, and launched Evens (the company’s acid reflux treatment service) later that year.

Thirty Madison has just begun offering urgent care consultations for users on a pay-what-you-will model.

And the company’s founders differentiate Thirty Madison’s business from their better-funded competitors like Hims and Ro by emphasizing that their company provides continuing care after a diagnosis and offers a range of treatment options for the conditions that the company treats. That, coupled with the more narrow focus on a few specific conditions, distinguish Thirty Madison from its peers in the industry.

“Over 59% of Americans suffer from at least one chronic condition, but few resources exist to help them connect the dots of their care,” said Amy Schulman, a partner with Polaris Partners and new director on the Thirty Madison board.

Powered by WPeMatico

Impossible Foods has raised $200 million more for its meat replacements.

The new round values the company at a Whopper-sized $4 billion valuation, according to the data tracker PrimeUnicorn Index.

The new round was led by Coatue, a technology-focused hedge fund; another New York-based hedge fund, XN, also participated in the round.

Since its launch the company has raised $1.5 billion from investors, including Mirae Asset Global Investments and Temasek. The presence of these new public/private investment firms on Impossible Foods’ cap table could mean that the company is readying itself for an initial public offering, but that’s just speculation.

Impossible previously raised money from investment firms including Horizon Ventures and Khosla Ventures, as well as some of the biggest celebrities in the U.S., like: Jay Brown, Common, Kirk Cousins, Paul George, Peter Jackson, Jay-Z, Mindy Kaling, Trevor Noah, Alexis Ohanian, Kal Penn, Katy Perry, Questlove, Ruby Rose, Phil Rosenthal, Jaden Smith, Serena Williams, will.i.am and Zedd.

The most recent price per share is $16.15, an up round from Series F at $15.4139, according to PrimeUnicorn.

The company said it would use the funding to increase its research and development efforts and work on new products like pork, steak and milk, as well as expand its internationalization efforts and build out its manufacturing capacity.

“The use of animals to make food is the most destructive technology on Earth, a leading driver of climate change and the primary cause of a catastrophic global collapse of wildlife populations and biodiversity,” said the incredibly credentialed Dr. Patrick O. Brown, MD, PhD, CEO and founder of Impossible Foods, in a statement. “Impossible Foods’ mission is to replace that archaic system by making the most delicious, nutritious and sustainable meats in the world, directly from plants. To do that, Impossible Foods needs to sustain our exponential growth in production and sales, and invest significantly in R&D. Our investors believe in our mission to transform the global food system — and they recognize an extraordinary economic opportunity.”

Powered by WPeMatico

California-based startup Mission Bio has raised a new $70 million Series C funding round, led by Novo Growth and including participation from Soleus Capital and existing investors Mayfield, Cota and Agilent. Mission Bio will use the funding to scale its Tapestri Platform, which uses the company’s work in single-cell multi-omics technology to help optimize clinical trials for targeted, precision cancer therapies.

Mission Bio’s single-cell multi-omics platform is unique in the therapeutic industry. What it allows is the ability to zero in on a single cell, observing both genotype (fully genetic) and phenotype (observable traits influenced by genetics and other factors) impact resulting from use of various therapies during clinical trials. Mission’s Tapestri can detect both DNA and protein changes within the same single cell, which is key in determining effectiveness of targeted therapies because it can help rule out the effect of other factors not under control when analyzing in bulk (i.e. across groups of cells).

Founded in 2012 as a spin-out of research work conducted at UCSF, Mission Bio has raised a total of $120 million to date. The company’s tech has been used by a number of large pharmaceutical and therapeutic companies, including Agios, LabCorp and Onconova Therapeutics, as well as at cancer research centers including UCSF, Stanford and the Memorial Sloan Kettering Cancer Center.

In addition to helping with the optimization of clinical trials for treatments of blood cancers and tumors, Mission’s tech can be used to validate genome editing — a large potential market that could see a lot of growth over the next few years with the rise of CRISPR-based therapeutic applications.

Powered by WPeMatico

You could Zoom call into your science class, or you could conduct a lab experiment in virtual reality. During the coronavirus pandemic, the latter has never felt more full of potential.

The global need for learning solutions beyond Zoom is precisely why Labster, a Copenhagen-based startup that helps individuals engage in STEM lab scenarios using virtual reality, is growing rapidly. Since March, the usage of Labster’s VR product has increased 15X.

On the heels of this unprecedented momentum, Labster joins a chorus of edtech startups raising right now, and announced it has brought on $9 million in equity venture funding. The round was led by GGV, with participation from existing investors Owl Ventures, Balderton and Northzone.

“COVID-19 has been a great awareness builder of Labster, opening teachers’ eyes to the good sides of online learning as opposed to Zoom-only learning, which is largely failing,” CEO and co-founder Michael Jensen told TechCrunch.

Labster sells its e-learning solution to support and enhance in-person courses. Based on the subscription an institution chooses, participants can get differing degrees of access to a virtual laboratory. Imagine a range of experiments, from understanding bacterial growth and isolation to exploring the biodiversity of an exoplanet. Along with each simulation, Labster offers 3D animations for certain concepts, re-plays of simulations, quiz questions and a virtual learning assistant.

Photo credit: Labster.

While the majority of Labster’s customers are private institutions, the company landed a deal with all of California’s community colleges during the pandemic. The partnership added 2.1 million students to Labster’s customer base, which Jensen said has been bolstered by a broader growth in annual license deals and partnerships.

With GGV on board, Labster is looking to strengthen position in Asia. Breaking into new markets often requires a strategic investor with eyes on the ground on how that market works, thinks and, most importantly, learns. Asian markets are specifically lucrative for edtech companies because consumer spend is higher compared to the North American market.

Jenny Lee, a Shanghai-based partner with GGV, will take a board seat at Labster.

Lee has expressed interest in how automation, virtual and AI-based teachers can help bridge the gap between K-12 markets and lack of good-quality teachers everywhere.

Jensen said that the capital will also be used to bolster the company’s mobile offering, since Asian markets have high mobile usage compared to North American and European markets.

The round is significantly smaller than Labster’s previous $21 million Series B, closed in April of 2019. And it contrasts sharply to the momentum that has benefited edtech companies like MasterClass, Coursera and, reportedly, Udemy into raising nine-figure rounds.

So naturally, I asked Jensen: why the conservative raise?

Jensen says that the $9 million check was a strategic growth check to bring on GGV (all existing investors in Labster also participated in the round). Since being founded in 2012, the company has been relatively conservative in raising cash. To date, inclusive of this round, Labster has raised $40 million in venture capital.

He argues the new money, thus, is offensive capital instead of defensive capital. It’s a strategic check to open a global door.

This isn’t the first time an edtech company has raised a smaller round than expected during the coronavirus pandemic. In April, edtech unicorn Duolingo raised a short $10 million to expand into Asia and bring on General Atlantic as an investor to expand into global markets.

Duolingo, however, is cash-flow positive. Jensen did not comment on if Labster has turned a profit, but adds that it was a “significant up round” that brought the company’s valuation to above $100 million.

“Our primary objectives continue to be rapid growth and global impact, not profits,” he told TechCrunch.

Powered by WPeMatico

Merico, a startup that gives companies deeper insights into their developers’ productivity and code quality, today announced that it has raised a $4.1 million seed round led by GGV Capital, with participation from Legend Star and previous investor Polychain Capital. The company was originally funded by the open source-centric firm OSS Capital.

Merico head of business development Maxim Wheatley tells me that the company plans to use the new funding to enhance and expand its existing technology and marketing efforts. As a remote-first startup, Merico already has team members in the U.S., Brazil, France, Canada, India and China.

“In keeping with our roots and mission in open source, we will be focusing some of these new resources to engage more collaboratively with open-source foundations, contributors and maintainers,” he added.

The idea behind Merico was born out of two key observations, Wheatley said. First of all, the team wanted to create a better way to analyze developer productivity and the quality of the code they generate. Some companies still simply use the number of lines of code generated by a developer to allocate bonuses for their teams, for example, which isn’t a great metric by any means. In addition, the team also wanted to find ways to better allocate income and recognition to the community members of open-source projects based on the quality of their contributions.

The company’s tool is systems agnostic because it bases its analysis on the codebase and workflow tools instead of looking at lines of codes or commit counts, for example.

“Merico evaluates the actual code, in addition to related processes, and places productivity in the context of quality and impact,” said Merico CTO Hezheng Yin . “In this process, we evaluate impact leveraging dependency relationships and examine fundamental indicators of quality including bug density, redundancy, modularity, test-coverage, documentation-coverage, code-smell and more. By compiling these signals into a single point of truth, Merico can determine the quality and the productivity of a developer or a team in a manner that more accurately reflects the nature of the work.”

As of now, Merico supports code written in Java, JavaScript (Vue.js and React.js), TypeScript, Go, C, C++, Ruby and Python, with support for other languages coming later.

“Merico’s technology delivers the most advanced code analytics that we’ve seen on the market,” said GGV’s Jenny Lee . “With the Merico team, we saw an opportunity to empower the organizations of tomorrow with insight. In this era of remote transformation, there’s never been a more critical time to bring this visibility to the enterprise and to open source; we can’t wait to see how this technology drives innovation in both technology and management.”

Powered by WPeMatico