Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

During the COVID-19 pandemic, supply chains have suddenly become hot. Who knew that would ever happen? The race to secure PPE, ventilators and minor things like food was and still is an enormous issue. But perhaps, predictably, the world of “supply chain software” could use some updating. Most of the platforms are deployed “empty” and require the client to populate them with their own data, or “bring their own data.” The UIs can be outdated and still have to be juggled with manual and offline workflows. So startups working in this space are now attracting some timely attention.

Thus, Craft, the enterprise intelligence company, today announces it has closed a $10 million Series A financing round to build what it characterizes as a “supply chain intelligence platform.” With the new funding, Craft will expand its offices in San Francisco, London and Minsk, and grow remote teams across engineering, sales, marketing and operations in North America and Europe.

It competes with some large incumbents, such as Dun & Bradstreet, Bureau van Dijk and Thomson Reuters . These are traditional data providers focused primarily on providing financial data about public companies, rather than real-time data from data sources such as operating metrics, human capital and risk metrics.

The idea is to allow companies to monitor and optimize their supply chain and enterprise systems. The financing was led by High Alpha Capital, alongside Greycroft. Craft also has some high-flying angel investors, including Sam Palmisano, chairman of the Center for Global Enterprise and former CEO and chairman of IBM; Jim Moffatt, former CEO of Deloitte Consulting; Frederic Kerrest, executive vice chairman, COO and co-founder of Okta; and Uncork Capital, which previously led Craft’s seed financing. High Alpha partner Kristian Andersen is joining Craft’s board of directors.

The problem Craft is attacking is a lack of visibility into complex global supply chains. For obvious reasons, COVID-19 disrupted global supply chains, which tended to reveal a lot of risks, structural weaknesses across industries and a lack of intelligence about how it’s all holding together. Craft’s solution is a proprietary data platform, API and portal that integrates into existing enterprise workflows.

While many business intelligence products require clients to bring their own data, Craft’s data platform comes pre-deployed with data from thousands of financial and alternative sources, such as 300+ data points that are refreshed using both Machine Learning and human validation. Its open-to-the-web company profiles appear in 50 million search results, for instance.

Ilya Levtov, co-founder and CEO of Craft, said in a statement: “Today, we are focused on providing powerful tracking and visibility to enterprise supply chains, while our ultimate vision is to build the intelligence layer of the enterprise technology stack.”

Kristian Andersen, partner with High Alpha commented: “We have a deep conviction that supply chain management remains an underinvested and under-innovated category in enterprise software.”

In the first half of 2020, Craft claims its revenues have grown nearly threefold, with Fortune 100 companies, government and military agencies, and SMEs among its clients.

Powered by WPeMatico

Yalochat, a five-year-old, Mexico City-based conversational commerce platform that enables customers like Coca-Cola and Walmart to upsell, collect payments and provide better service to their own customers over WhatsApp, Facebook Messenger and WeChat in China, has closed on $15 million in Series B funding led by B Capital Group.

Sierra Ventures, which led a $10 million Series A financing for the company in early 2019, also participated.

The round isn’t so surprising if Yalochat’s numbers are to be believed. It says that since the beginning of the COVID-19 pandemic, its platform has seen a tenfold increase in volume, and a 650% increase of message volume as more large enterprises — especially outside of the U.S. — use messaging apps to manage some of their sales operations and much of their customer service.

Yalochat is chasing a fast-growing market, too. According to the 10-year-old, India-based market research company MarketsandMarkets, the conversational AI software market should see $4.8 billion in revenue this year and more than triple that amount by 2025.

Certainly, having conglomerates on board is speeding along the company’s growth.

“With Coca-Cola, we started in Brazil and we helped them run their commerce when it comes to talking with small mom-and-pop shops,” says Yalochat founder and CEO Javier Mata, a Columbia University grad who studied engineering and founded three other companies beginning in 2013 before launching Yalochat.

“They had such success running their ordering process that they then took us to Mexico and Colombia, and we’re talking with [them about entering into the] Philippines and India.” Says Mata, “You try to get fast success in one market, then the conglomerate takes you into other areas of business so they can optimize their workflows around sales and customer service in other countries.”

Mata makes the process sound awfully easy, particularly considering that dozens of startups are also focused on conversational commerce and also raising funding right now.

Still, he argues that if you build your product the right way, it becomes a no-brainer for customers.

In pitching companies like Walmart, for example, he says Yalochat would “start with something super simple but high value that they could launch in a week. We’d say, ‘That process for sales that it has taken you years [to organize], we can get it out for you by Friday.’ Then we’d just do it.

“It was low stakes for them to try us out, and as soon as they saw our conversion rates, we were introduced to other [units] with the corporation.” Says Mata, “I think why a lot of other companies haven’t been successful is that [their tech] is not simple or doesn’t really work. We made ours scalable, easy to launch and capable of running smoothly without passing that complexity to end users.”

B Capital is plainly buying what Yalochat is selling. Firm co-founder Eduardo Saverin — who famously co-founded Facebook — calls Mata and his team “phenomenally strong” and suggests there’s little to stop their trajectory right now. “Yalo is an example of a Latin American business that is already today in Asia. And if you’re building a conversational commerce enablement for large enterprises that redefines the way they touch customers — [meaning] messaging applications, the most engaging medium in the world today — should that really be confined to Latin America or Asia? Absolutely not.”

Saverin compares the startup to B Capital itself, which has offices in LA, San Francisco, New York and Singapore.

The firm has already made bets in the U.S., Europe and Asia, since getting off the ground in 2015. Now, with Yalo, it has its first investment that’s principally headquartered in Latin America, as well. “For us,” says Saverin, who grew up in Brazil, “we didn’t start investing everywhere on day one. But that’s the mission.”

Powered by WPeMatico

Vertical farming technology provider iFarm has bagged a $4 million seed round, led by Gagarin Capital, an earlier investor in the startup. Other investors in the round include Matrix Capital, Impulse VC, IMI.VC and several business angels.

The Finnish startup is focused on providing software that enables others to carry out vertical farming — targeting sales at food processing companies and FMCG giants, as well as farmers, university research centers and even large corporates with their own catering needs as a result of operating large physical office footprints.

Its software as a service platform automates crop care for plants such as salad greens, cherry tomatoes and berries grown in vertical stacks. The system involves a range of technologies to monitor and automate crop care, applying computer vision and machine learning and drawing on data on “thousands” of plants collected from a distributed network of farms, per iFarm .

At this stage it’s providing technology to around 50 projects in Europe and the Middle East — covering a total of 11,000 square meters of farm. Its platform is currently able to automate care for around 120 varieties of plants, with the goal of getting to 500 by 2025 (it says 10 new crop varieties are being added each month).

“iFarm started three years ago, with three founders. The goal is to build technology… for growing tasty and healthy food that we already eat,” says co-founder and CEO Max Chizhov, who notes the business has grown to 15 employees along the way.

“We started from a greenhouse. First year just looking for technologies — which kind of technologies to use. After one year of experiments we have some pilots and now we are focused on indoor farming, vertical farming.”

Vertical farming is an urban farming technique that involves stacking plants in dense layers in a highly controlled indoor environment, using LED lighting to replace sunlight to power all-year-round agriculture.

Furthermore, iFarm notes that the fully automated approach also means there’s no need for pesticides to grow a range of edible greens, herbs, fruits, flowers and vegetables. There are some natural limits on what can be grown within such systems — taller plants and trees obviously can’t be squeezed into stacks. Deep-root vegetables also aren’t suitable, although iFarm touts baby carrots among its product portfolio.

“We focus on profitable products,” says Chizhov. “Small crops, very fast growing crops, and easy to irrigate and easy to grow in many layers. Many layers is the advantage of indoor farms.”

Photo credit: iFarm

While there are now hundreds of vertical farming startups whose business model is fixed on selling the edible produce they grow, such as to supply supermarkets and other food retailers, iFarm is purely focused on developing technologies to support automated indoor agriculture.

So it might, for instance, be eyeing the likes of Infarm, Bowery and Plenty as potential customers for its vertical farming optimization technologies.

It says its systems can be applied to vertical farms of 20 to 20,000 square meters, supporting scalability.

“Our main advantage is we know how to grow and you don’t need any special technologies to know how to grow. All of our algorithms, all of the data, is based in our software,” says Chizhov, emphasizing the software is hardware agnostic — meaning customers don’t need to use iFarm’s kit for their vertical farms but just can apply its algorithms to their own set-ups.

The company has designed various bits of vertical farm hardware it can supply, or co-develop with customers, per Chizhov, such as fertilizer units and LED lighting. But the software as a service platform isn’t locked to any specific piece of kit.

“The main thing is the software that combines optimization systems like humidity, temperature, CO2 etc; and some business separations — like why, how, when we start growing, which clients,” he says, adding: “It’s like a CRM plus an ERP system that controls all the parameters.

“In this system we use computer vision systems. We use AI for increasing taste [of the edible produce], increasing yield parameters of our growing crops. We also use drones which fly in our farms and observe all of our greens and all of our plants. We optimize all of the processes in the farm using software and some [pieces of hardware] that use the software.”

Chizhov says the seed funding will be used to gradually expand the business into new regions — with a launch into the U.S. market on the cards in two years’ time — but the main priority now is to spend on further software development.

“The main goal is [adding] new type of crops,” he notes. “Research, development, new products.”

On the competitive front, iFarm is not the only technology provider seeking to sell to the burgeoning vertical farming sector. Chizhov says there are around 10 to 15 similar agtech startups. But he contends its tech and approach has the edge over the likes of U.K.-based Intelligent Growth Solutions, Belgium’s Urban Crop Solutions, Switzerland’s Growcer, U.S. “container farms” provider Freight Farms or China’s Alesca Life, to name-check a handful of other players in the space.

“There are some companies in this market that also provide solutions but with less optimization, with less software value and with less product mix/product line,” he argues. “The main difference is the type of crops; it’s software that we provide for our clients — because you don’t need to know how to grow; you don’t need to be a specialist in your company, you just push a button. And we provide excellent services for our clients. Design, installation, operation, help to sell the final product, etc.”

Chizhov also notes iFarm has filed patents to protect some of its technologies.

Photo credit: iFarm

Mikhail Taver, GP of Gagarin Capital, who is the lead investor in iFarm’s seed round, says the startup stood out on account of having a competitive advantage in the sector. Although he also notes that the fund’s agtech strategy is focused on indoor farming rather than mainstream outdoors — which again makes iFarm a good fit.

“We do see a large potential in the sector with the [world’s] rising population. We see the increasing demand for food — it’s only going to continue. We see global warming and general sustainability issues. And iFarm seems to be able to solve most of those,” Taver told TechCrunch.

“I don’t really see much competitors able to grow things other than greens,” he added, elaborating on the competitive edge claim. “You don’t normally get proper tomatoes or edible flowers and things like that grown in vertical farms. They mainly concentrate on a couple of salads at most.

“Plus most of our competitors they focus on competing with actual farmers, whereas we’re trying to augment them. We don’t try to force them off the market — we’re trying to help them get bigger. Which is a totally different approach and it should be working better. At least that’s what I believe.”

This article was updated with a correction: We were originally given the incorrect job title for Max Chizhov; he is in fact CEO, not CBDO.

Powered by WPeMatico

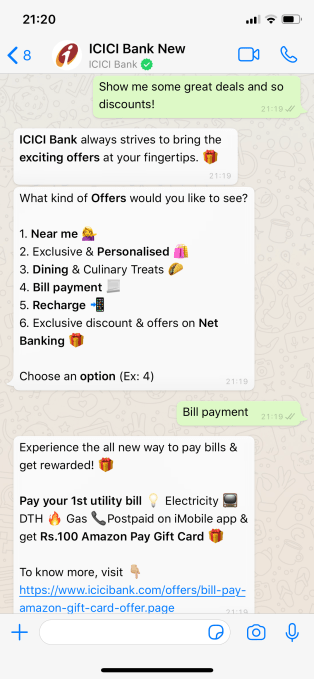

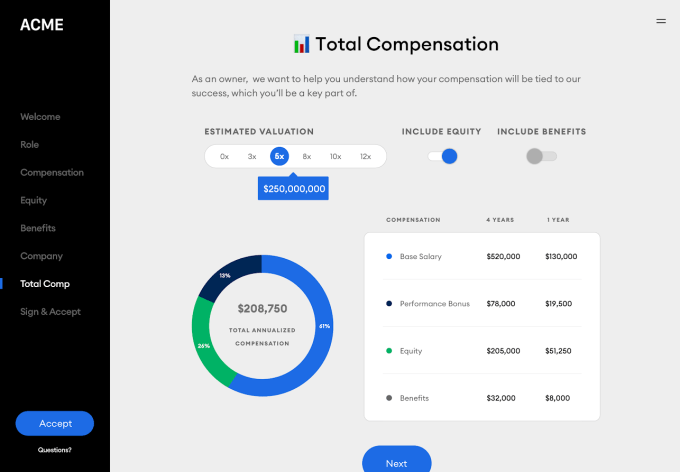

Thinking back to the last time I accepted a job, I can’t recall actually reading any of the material that was sent over. I think I skimmed some docs to make sure the numbers written down matched what I had been told over the phone, but after that it was a blur of digital signing and emailing and precisely no due diligence from myself.

Not great, really. I bet that your experience accepting new gigs has been somewhat similar. In startups, jobs are offered with exotic types of pay, chock full of startup stock options in all their 409A and vesting-period glory. Some folks might not really understand what is being offered. Like what the value of their full comp package really is, when performance pay and other sweeteners are stacked on top of base rates. With remote learning in the equation, it’s even more confusing.

This is the market space that Welcome, a startup that is announcing a $1.4 million fundraise, wants to fix. (Update: Forgot to add the capital sources, which include Ludlow Ventures, the Weekend Fund, Global Founders Capital, both Shrug and Basement, as well as a number of angels.)

The company told TechCrunch it is a “first offer management and closing platform.” Its service helps provide a clear picture of total comp to candidates, helping them accept or deny an offer that they can fully understand.

Here’s a screengrab from the candidate’s side of the employer-employee divide:

If “offer management and closing” sounds like a small niche to target, it both is and is not.

It is, in that if Welcome stayed in its current market-position forever it would have a smaller product target than most startups. But the company has plans to expand its product-set over time. For example, its co-founders Nick Gavronsky and Rick Pereira explained that Welcome wants to offer real-time salary data in the future, based on the information that will flow through its service.

Want to close an engineer in North Carolina with a high level of confidence in the offer? Welcome should be able to tell you, later on, what a comp package should look like if you want make sure the candidate will accept.

Gavronsky and Pereira have experience in product and people work, respectively, making their union at Welcome a good fit. The company’s team is currently just four folks, though the startup expects that it will double in size this year. The capital it raised in January, but is only talking about now, is making the hiring possible.

Now, the $1.4 million number is pretty dated. Normally I’d skip over a round so far from the past, but Welcome caught my eye, as I’ve recently written about another HR tech provider, Sora, and the Welcome deal felt like an illustrative event: This is how seed rounds are announced, long after the fact, which makes reporting on seed-stage trends really hard. Something to keep in mind.

Welcome is barking up a winsome tree with its product, not only because the offer/offer acceptance process is garbage today — let’s email some PDFs and hand a candidate off between departments! — but because it has seen strong early demand from potential customers. Its service is currently in a private alpha that was a bit oversubscribed, though the company is not yet charging for its service. (Welcome will be a SaaS play, priced on company size, which seems reasonable.)

Past all that, what’s exciting about Welcome is that if it can get a number of customers aboard when it makes it to beta or launch, the company will have placed itself in a position where it can expand in several directions. It could, for example, extend its feature set to help with pre-onboarding or onboarding itself, given that it already knows a new candidate and their new employer. Of course, the startup wants to talk more about what it’s building today, but it’s also fun to look ahead.

That’s enough on Welcome, we’ll chatter about them again when they formally launch, or share some neat growth metrics. Until then, good luck getting into the alpha.

Powered by WPeMatico

After yesterday’s look into the somewhat lackluster pace of investment into e-commerce-focused startups this year, a few VCs sent in notes that added useful context. So this morning let’s discuss why the pace of e-commerce startup fundraising has been so milquetoast in 2020.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

To frame the oddity of e-commerce startups not raising a flood of cash during what are historic boom times, we noted Walmart’s staggering online sales growth in Q2, which TechCrunch’s Sarah Perez broke out into a separate piece. Today, for a soupçon more, Target reported its Q2 earnings. Its results are similar to Walmart’s own, if even more extreme.

The American retailer reported that its “store comparable” sales were up 10.9% in the quarter, which was rather good. But Target also reported that its “digital comparable sales grew 195%,” which is staggering. Target’s revenue mix moved from 7.3% digital in its year-ago quarter to 17.2% in its most recent.

The American retailer reported that its “store comparable” sales were up 10.9% in the quarter, which was rather good. But Target also reported that its “digital comparable sales grew 195%,” which is staggering. Target’s revenue mix moved from 7.3% digital in its year-ago quarter to 17.2% in its most recent.

Damn.

If you’ve been around the internet lately, you can’t help but trip over more data detailing this extraordinary moment in e-commerce history — there are years of change happening in just a quarter’s time. For a taste, former Andreessen denizen Benedict Evans has some great data on U.S. and U.K. e-commerce growth, and here’s yet another great chart to chew on. It goes on and on.

So the e-commerce boom is real, and the startup funding funk is as well, per the data we ingested yesterday via CB Insights. What gives? GGV’s Jeff Richards had an idea, and we chatted with Canaan’s Byron Ling as well. We’ve also done a little digging into some of the largest, recent e-commerce rounds to get some flavor on who is raising in the space. Ready?

If you recall, our thesis yesterday was that, perhaps, the kill zone theory often posited concerning Amazon meant that the e-commerce space is less investable than we’d otherwise imagine and that because some things are “sorted” to a degree, there is less green space available in the sector for startups to tackle.

Bits of that might be right.

Powered by WPeMatico

Taiwanese startup iKala, which offers an artificial intelligence-based customer acquisition and engagement platform, will expand into new Southeast Asian markets after raising a $17 million Series B. The round was led by Wistron Digital Technology Holding Company, the investment arm of the electronics manufacturer, with participation from returning investors Hotung Investment Holdings Limited and Pacific Venture Partners. It brings iKala’s total raised so far to $30.3 million.

The new funding will be used to launch in Indonesia and Malaysia, and expand in markets where iKala already operates, including Singapore, Thailand, Hong Kong, the Philippines, Vietnam and Japan. Wistron Digital Technology Holding Company, which also offers big data analytics, will serve as a strategic investor, and this also marks the Taiwanese firm’s entry into Southeast Asia.

IKala’s products are targeted toward e-commerce companies, and include KOL Radar, for influencer marketing, and Shoplus, a social commerce service focused on Southeast Asian markets.

In a statement about the funding, iKala board member Lee-feng Chien, former managing director at Google Taiwan, said, “Taiwan has an excellent reputation for having some of the best high-tech talents in both hardware and software around the region. With Wistron as a strategic partner, iKala can become a major driving force for transforming Taiwan into an AI industry and talent hub in Asia.”

While Taiwan’s technology industry is best-known for hardware, especially semiconductor manufacturers like Foxconn and TSMC, a new crop of startups are helping the country establish a reputation for AI prowess.

In addition to iKala, these include Appier, which also provides a customer analytics, and enterprise translation platform WritePath. Big American tech companies, including Amazon, Google and Microsoft, have also set up AI-focused research and development centers in Taiwan, drawing on the country’s engineering talent and government programs.

Powered by WPeMatico

Bengaluru-based Pixxel is getting ready to launch its first Earth imaging satellite later this year, with a scheduled mission aboard a Soyuz rocket. The roughly one-and-a-half-year-old company is moving quickly, and today it’s announcing a $5 million seed funding round to help it accelerate even more. The funding is led by Blume Ventures, Lightspeed India Partners, and growX ventures, while a number of angel investors participated.

This isn’t Pixxel’s first outside funding: It raised $700,000 in pre-seed money from Techstars and others last year. But this is significantly more capital to invest in the business, and the startup plans to use it to grow its team, and to continue to fund the development of its Earth observation constellation.

The goal is to fully deploy said constellation, which will be made up of 30 satellites, by 2022. Once all of the company’s small satellites are on orbit, the Pixxel network will be able to provide globe-spanning imaging capabilities on a daily basis. The startup claims that its technology will be able to provide data that’s much higher quality when compared to today’s existing Earth-imaging satellites, along with analysis driven by PIxxel’s own deep learning models, which are designed to help identify and even potentially predict large problems and phenomena that can have impact on a global scale.

Pixxel’s technology also relies on very small satellites (basically the size of a beer fridge) that nonetheless provide a very high-quality image at a cadence that even large imaging satellite networks that already exist would have trouble delivering. The startup’s founders, Awais Ahmed and Kshitij Khandelwal, created the company while still in the process of finishing up the last year of their undergraduate studies. The founding team took part in Techstars’ Starburst Space Accelerator last year in LA.

Powered by WPeMatico

In recent years, China’s online shopping titans have been muscling into the prescription drug market. When JD.com, Alibaba’s archrival, realized the health market spans well beyond retail, it spun out its healthcare unit into a subsidiary last May for a potential initial public offering. That startup, JD Health, gained a staggering valuation of $7 billion fresh off its $1 billion Series A round in November.

In less than a year, another massive check is on its way as JD Health announced it has entered into a definitive agreement with private equity firm Hillhouse Capital, which plans to shell out over $830 million for the infant company’s Series B financing.

The deal with Hillhouse, an early backer in JD.com and an aggressive pursuer of opportunities in healthcare, is expected to occur in Q3 this year. JD.com will remain the majority shareholder upon the transaction.

JD Health is now a multifunctional health platform, providing everything from 30-minute pharmacy delivery, telemedicine service that saw surging usage during the COVID-19 pandemic, consumer-related health services such as genetic testing through to solutions to digitize hospital systems. The business “achieved profitability” last year, its chief executive Xin Lijun claimed.

The health unit is yet another effort from JD.com, the closest Amazon equivalent in China for its control over the supply chain, to branch out of online retail. JD.com also oversees an independent fintech subsidiary and a separate logistics business, both of which have plans to go public.

Alibaba has made a similar move into the healthcare sector with its part-owned Alibaba Health, a Hong Kong-listed firm with a current market cap of about $34 billion.

The company’s earnings report sheds some light on the breadth of its reach: annual active consumers of its online drugstore exceeded 190 million as of May, with recent growth sparked by the pandemic.

It’s unclear how many users JD Health has amassed for its online pharmacy, the “main business” of the company according to its CEO, but it has disclosed stats on other segments. Since the COVID-19 outbreak, more than 1.7 million patients have used its diagnosis service, which now sees over 100,000 inquiries every day. JD Health’s latest pledge, announced this week, is to construct an online family doctor service to target as many as 50 million Chinese families.

Powered by WPeMatico

Dutchie, a nearly three-year-old, Bend, Oregon-based software company focused on connecting consumers with cannabis dispensaries that pay it a monthly subscription fee to create and maintain their websites, process their orders and track what needs to be ready for pickup, has raised $35 million in Series B funding. The capital came both new investors Thrive Capital and Starbucks founder Howard Schultz, along with earlier backers, including Kevin Durant’s Thirty Five Ventures and the cannabis-focused fund Casa Verde Capital.

The money comes hot on the heels of Dutchie’s first major round of funding — $15 million that it closed last September — and suggests that the cannabis industry has fared better during the COVID-19 pandemic than people outside the industry might imagine.

We had a fast chat yesterday with the company’s co-founder and CEO, Ross Lipson, about the year that Dutchie is having.

TC: I’d seen recently that Dutchie has added contactless payments.

RL: Yes, when the pandemic hit, virtually all of our dispensaries shifted to a curbside pickup model. We built a solution that allows customers to select curbside at checkout, and also includes a way to notify the dispensary when they arrive and provides them information on how to locate their vehicle.

TC: A year ago, there were more than 30 states where cannabis was either medically legal or that had legalized the recreational use of marijuana. How has that changed?

RL: We now work with over 1,300 dispensaries in 32 markets. By comparison, a year ago we were only operating in 9 markets. Nationwide, 47 out of 50 states now allow some form of legal cannabis, and 2020 could bring full legalization in major markets such as New Jersey and Arizona.

TC. Can you put that into context? How many dispensaries are there in the U.S.?

RL: Dutchie processes 10% of all legal cannabis sales worldwide and powers over 25% of dispensaries. That’s more than 75,000 orders a day.

TC: You had 36 employees the last time we talked. What’s that number now?

RL: We currently have 102 employees and we aim to double our team by the end of 2021.

TC: Aside from helping dispensaries shift to a curbside model, how has the pandemic impacted your business?

RL: Virtually all states deemed cannabis dispensaries as essential businesses [once COVID took hold]. Many still had to comply with state laws and close their physical stores, though, leaving only one option for sales — online ordering. We saw dispensaries shift from about 30% of overall sales coming from Dutchie to upwards of 100%, and our business grew 600% in roughly one month.

Overall, we’ve seen a 700% surge in sales volume during the pandemic. We had to scale quickly to deal with six times the load on our technology.

TC: Think those numbers will shift around as some parts of the country open up?

RL: Dispensaries are poised to keep online ordering and e-commerce options available because it is part of what their customers now expect.

Pictured, left to right, above: Ross and Zach Lipson (Zach, Ross’s brother, is the company’s co-founder and chief product officer).

Powered by WPeMatico

The food blogging community in China is booming, and many creators have been cashing in big time by touting food products to loyal followers, a business model that has lured investors.

This week, Hong Kong-based startup DayDayCook announced that it has raised $20 million to expand its multifunctional food platform, whose users mainly come from mainland China. The company, founded by banker-turned food blogger and entrepreneur Norma Chu, offers a bit of everything: an app featuring recipes and food videos, cooking classes in upscale malls and a product line of its own branded food products sold online, which makes up 80% of its revenues.

London-based Talis Capital led the funding round, with participation from Hong Kong’s Ironfire Ventures. The eight-year-old startup has raised a total of $65 million to date from investors, including Alibaba Entrepreneurs Fund, the e-commerce giant’s not-for-profit effort to support young entrepreneurs in Hong Kong and Taiwan.

The selling point of DayDayCook products is their carefully crafted brand stories. Users first consume the content put out by the startup across social channels, and then they become customers of DayDayCook’s ready to eat or cook food packs, kitchenware and more.

“We really believe in the content-to-commerce model,” said Matus Maar, managing partner at Talis Capital .

He went on to explain that as content creation becomes easier thanks to an abundance of mobile editing tools, “even one person in rural China can make amazing content that creates a huge following.” He was referring to China’s reclusive influencer Li Ziqi who rose to stardom by posting videos on YouTube and domestic sites about her rural self-sufficiency.

“That goes hand in hand with people not wanting to see content that is super polished or comes out of mega agencies. People on the internet want to see authenticity. They want to see people doing real things,” suggested the investor.

While there is a legion of food influencers out there, not all are equipped to build a money-making venture. Matus believes DayDayCook has all the pieces in place: suppliers, distribution, logistics and shipment. By developing its private label products, the startup is also able to sell at higher margins.

Chu said her company has amassed 2.3 million registered users on its own app. Its paid users, ordering through e-commerce channels like JD.com and Alibaba’s Tmall, grew 12 times year-over-year to 2.2 million.

DayDayCook’s content has a wider reach, garnering 60 million followers across microblogging platform Weibo, TikTok’s Chinese edition Douyin, Tencent’s video site and more. That may not seem like a lot in the influencer era — Li Ziqi herself has nearly 12 million subscribers just on YouTube.

Powered by WPeMatico