Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Chinese electric vehicle startup Xpeng Inc. raised $1.5 billion through an initial public offering in the U.S. as investor interest in EVs and clean energy outstripped concerns over escalating tensions between the U.S. and China.

The automaker, which is headquartered in Guangzhou, China and has offices in Silicon Valley and San Diego, said in a filing that it sold 99.7 million shares for $15 each, raising about $1.5 billion. The automaker had originally planned to sell 85 million shares with a price guidance of between $11 and $13.

Shares of Xpeng began trading Thursday on the New York Stock Exchange under the ticker symbol XPEV.

Xpeng had raised a total of $1.7 billion from investors, including Chinese e-commerce giant Alibaba and Xiaomi Corp, prior to its Wall Street debut. In July, the company said it had raised around $500 million in a Series C+ round to further develop electric vehicle models aimed at China’s tech-savvy middle-class consumers.

Moving to the public market gives Xpeng access to a far bigger pool of capital, which it will need to compete against an increasingly crowded EV marketplace in China. Xpeng faces competition from Li Auto, Nio, WM Motor and notably, Tesla, which began producing Model 3 sedans at its new Shanghai factory in December 2019.

SHANGHAI, CHINA – 2019/08/25: Customers experiencing a new car at the Chinese automobile manufacturer Xpeng or Xiaopeng Motors store in Shanghai. (Photo by Alex Tai/SOPA Images/LightRocket via Getty Images)

Xpeng has two electric vehicles on the market, the G3 SUV and the P7 sedan. Production of the G3 began in November 2018. As of July 31, Xpeng said it had delivered 18,741 G3 SUVs to customers.

Deliveries of the P7 began in May 2020. The company has delivered 1,966 P7 sedans — a direct competitor to the Tesla Model 3 — as of July 31. Xpeng is also planning a third electric vehicle, which will be another sedan, that will come to market in 2021.

Powered by WPeMatico

Billion-dollar natural disasters are on the rise in the United States, according to CNBC. Even as I write, a hurricane is making landfall in Louisiana while wild fires rage in northern California. And those are just the big disasters.

There were more than 1.3 million fires in the United States in 2018, and nearly three out of every five deaths related to a house fire happened in a house where there was no smoke alarm or it didn’t function properly.

Harbor, a company that just closed on a $5 million seed round, wants to make users more prepared.

The product, which will launch in October, aims to gamify the process of doing everyday preparation for disasters. Using publicly available data from agencies like NOAA, FEMA and USGS, as well as land maps and building codes to pinpoint individual household risk, Harbor takes a look at the user’s location and the general state of their home to determine types of risks to that individual user and their property.

From there, the platform curates a weekly checklist for the user to stay prepared, whether it’s keeping track of the amount of water on hand (for those in the path of hurricane season) or checking the battery levels and functionality of a smoke alarm.

“For us, it’s not about buying a go bag,” said CEO Dan Kessler. “It’s about doing the things you need to be prepared. Your plan is a heck of a lot more important than your bag. Your bag is also important, but without the planning it’s completely pointless. The problem is a lot of people, especially right now with the wildfires happening are saying ‘I don’t have a go bag,’ and they buy one for $50 on Amazon. But they are not any more prepared at that moment as they were before they bought the bag.”

Not only does harbor want to help users prepare for disasters, including curated product recommendations around preparedness equipment, but also help guide them through the disaster itself and the aftermath, offering step by step instructions based on the specific situation.

Though harbor hasn’t launched the product publicly, the company is prepared with a two-fold business model which includes e-commerce and a freemium subscription plan for the app itself.

The sole investor in the $5 million round was 25madison, a New York-based venture studio that incubates and funds companies from inception. 25madison brought on Dan Kessler, a former Headspace executive, as CEO in January. Kessler brought on Eduardo Fonseca as chief technology officer, who previously served as CTO of GoodRx.

In total, harbor is made up of a team of 10 employees, and the company declined to share any stats around diversity and inclusion on the team, saying “Dan and the team are very proud that the makeup of women and underrepresented groups is above tech industry averages, including the advisory board.”

The advisory board includes a number of notable experts in the disaster space, including former administrator of FEMA Brock Long, current senior fellow for climate change policy at the Council on Foreign relations Alice Hill, and professor at Harvard’s Kennedy School of Government and CNN national security analyst (who served as Assistant Secretary at the DHS) Juliette Kayyem, among others.

Powered by WPeMatico

Warby Parker, the optical e-commerce giant, has today announced the close of a $245 million funding round from D1 Capital Partners, Durable Capital Partners, T. Rowe Price and Baillie Gifford.

A source familiar with the company’s finances confirmed to TechCrunch that this brings Warby Parker’s valuation to $3 billion.

The fresh $245 million comes as a combination of a Series F round ($125 million led by Durable Capital Partners in Q2 of this year) and a Series G round ($120 million led by D1 Capital in Q3 of this year). Neither of the two rounds was previously announced.

In the midst of COVID-19, Warby has also pivoted a few facets of its business. For one, the company’s Buy A Pair, Give A Pair program, which has focused on vision services across the globe, pivoted to stopping the spread of COVID-19 in high-risk countries. The company also used their Optical Lab in New York as a distribution center to facilitate the donation of N95 masks to healthcare workers.

The company has also launched a telehealth service for New York customers, allowing them to extend an existing glasses or contacts prescription through a virtual visit with a Warby Parker OD, and expanded its Prescription Check app to new states.

Warby Parker was founded 10 years ago to sell prescription glasses online. At the time, e-commerce was still relatively nascent and the idea of direct-to-consumer glasses was novel, to say the least. By cutting out the cost of physical stores, and competing with an incumbent who had for years enjoyed the luxury of overpricing the product, Warby was able to sell prescription glasses for less than $100/frame.

Of course, it wasn’t as simple as throwing up a few pictures of frames on a website and watching the orders pour in. The company developed a process where customers could order five potential frames to be delivered to their home, try them on, and send them back once they made a selection.

Since, the company has expanded into new product lines, including sunglasses and children’s frames, as well as expanding its footprint with physical stores. In fact, the company has 125 stores across the U.S. and in parts of Canada.

Warby also developed the prescription check app in 2017 to allow users to extend their prescription through a telehealth check up.

In 2019, Warby launched a virtual try-on feature that uses AR to allow customers to see their selected frames on their own face.

The D2C giant, in its 10 years of existence, has balanced its technological innovation with its physical expansion, which could explain its newfound triple-unicorn status. These latest rounds bring Warby Parker’s total funding to $535.5 million.

Powered by WPeMatico

Narrative has raised $8.5 million in Series A funding and is launching a new product designed to further simplify the process of buying and selling data.

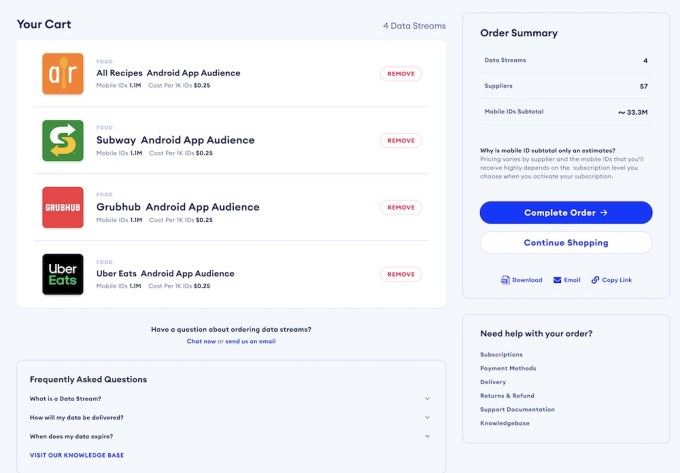

I’ve already written about the company’s existing marketplace and software for managing data transactions. With the new Data Streams Marketplace, the process should be simpler than ever — not much different than buying products on Amazon.

“Essentially, the idea was to take the best parts of the e-commerce and search models and apply that to a non-consumer offering to find, discover and ultimately buy data,” founder and CEO Nick Jordan (pictured above on the left) told me. “The premise is make it as easy to buy data as it is to buy stuff online.”

For example, Jordan showed me how a marketer could browse and search for different types of data in the marketplace. Once they find something they want to purchase (say, the mobile IDs of people who have the Uber Driver app installed on their phones, or the Zoom app) at a price they’re willing to pay (usually via subscription), they can just add the data set to their shopping cart, enter their credit card information, accept the terms of service and check out.

In Jordan’s view, this approach has become more attractive in recent months, because with all the uncertainty, companies need more data, and they need it quickly. For example, he suggested that a large company spending tens of millions of dollars on advertising “needs a way to find and buy the data almost programmatically and have the whole thing take five minutes instead of five months — those are the orders of magnitude we’re talking about here.”

Image Credits: Narrative

This data is generally sold by third-party sellers who are vetted by Narrative before they join the platform. Jordan also said the marketplace allows buyers to learn more about who they’re buying data from and even to establish a direct relationship — something that could be important for understanding things like regulatory compliance and data quality.

Although Narrative works to “deeply understand [sellers’] data collection methodologies,” Jordan warned, “There’s not necessarily a silver bullet for things being safe from a regulatory perspective.”

Similarly, he said that Narrative isn’t going to be grading the quality of the data sold on the platform. He argued, “Data quality is in the eye of the beholder. Someone’s signal is someone else’s noise.”

The goal with both of these issues is to provide transparency and allow buyers to do more research when necessary. Jordan also said Narrative is building out a marketplace of third-party applications — and that could include applications that score the quality of a data set.

“In the long run, I can imagine a number of use cases that’s almost infinite,” he said.

Narrative had previously raised $5.3 million in funding, according to Crunchbase. The Series A was led by G20 Ventures, with additional funding from existing investors Glasswing Ventures, MathCapital, Revel Partners, Tuhaye Venture Partners and XSeed Capital.

Jordan said the new round will allow the company to hire in areas like product, engineering, sales and marketing. He also noted that Narrative has long prioritized hiring team members from across North America, and recently it’s been placing a bigger focus on outreach and hiring from underrepresented groups.

“It’s easier said than done,” he acknowledged. “Any company that’s doing it well has to make it a priority and not just something they hope happens.”

Powered by WPeMatico

Fronted, the new London-based startup aiming to make life easier for renters, including lending the cash needed for a deposit, has picked up seed investment from Passion Capital. The investment showed up in a recent regulatory filing for the company.

The exact cheque size isn’t yet disclosed, but what we do know is that Passion Capital partner Eileen Burbidge has joined Fronted’s board. That’s unsurprising, given that Fronted co-founder Simon Vans-Colina was an early and important employee of Monzo, the challenger bank that counts Passion Capital and Burbidge as original backers.

Confirming Passion Capital’s investment, Fronted co-founder and CEO Jamie Campbell gave TechCrunch the following statement:

“Like a lot of businesses we have been finding our feet in post-pandemic world, we are grateful to have supporting investors like Passion Capital who have supported us from the very beginning and who believe in our vision to help renters move.”

The company, founded late last year by Campbell, Vans-Colina and Anthony Mann — former employees at Bud, Monzo and Apple, respectively — is planning to launch later this year with a fintech product to help renters finance their rental deposits.

The nascent company is currently in the FCA “sandbox” program (run by the U.K. financial services regulator) to begin lending cash that can only be used for a rental deposit.

By using open banking and other financial technology, and offering a credit product designed to finance deposits directly, Fronted believes it can lend more cheaply than existing options — such as credit cards, pay-day lenders and overdrafts, or insurance-backed membership schemes — and at lower risk.

Late last year, Campbell and Vans-Colina explained that renters that apply to use the Fronted service will be asked to link their bank using open banking, therefore sharing their recent transaction data, and provide details of the property they wish to rent. Then, once Fronted has run the required checks and agreed to provide credit, the startup will send the money directly to the estate agent to be placed in the U.K.’s Deposit Protection Scheme, meaning that the loan never touches the renter’s hands (or wallet).

Renters will then pay back the loan over a set schedule, or they can pay it off entirely when they have the money to do so. There is also a planned “holiday mode” that will allow borrowers to temporarily reduce their monthly payments in order to help avoid falling into financial difficulty.

Fronted paused operations as the coronavirus pandemic took hold and at the height of uncertainty, but with the initial product built and money in the bank, a launch doesn’t look too far off.

“We are in the final stage [of regulatory approval] and once we are authorised we can launch,” adds Campbell.

Powered by WPeMatico

When Brynne McNulty Rojas moved to Bogotá, Colombia four years ago, she encountered a fragmented real estate industry that lacked a central database for consumers to find or compare homes. Rojas was struck by the magnitude of the problem; she was also inspired by the opportunity.

Rojas and business partner Sebastian Noguera homed in on some of the biggest issues in the city’s real estate market, particularly for middle class buyers. They found a market where the average home took 14 months to sell; that figure drops to 10 months for middle class homes. It was a market that lacked price transparency and where sellers used analog tactics like posting a sign in the neighborhood in a futile attempt to attract buyers.

From these problems, Rojas and Noguera founded Habi, a property tech startup with a two-fold approach. The startup founders built a centralized database of residential real estate prices and trends — essentially a multiple listing service — and then used that information to create an automated pricing algorithm to buy and sell homes quickly and efficiently. The company buys, renovates and then sells homes, generating revenue off the margin. It also offers a tool that lets sellers estimate the value of their homes and a database that buyers can use to search for listings. The foundation of its business is its automated pricing technology, which was built using data from its real estate, financial and government partners.

“You can think of it as an MLS plus Opendoor model,” Rojas said in a recent interview. (Opendoor is the U.S.-based property tech startup backed by SoftBank.)

The Bogotá-based startup has now raised $10 million in a Series A round led by Inspired Capital, with participation from 8VC, Clocktower, Homebrew, Vine Ventures and Zigg. The round included angel investments from Flatiron Health and Looker. The company has raised $15.5 million to date.

Habi co-founders Brynne McNulty Rojas and Sebastian Noguera. Rojas is CEO and Noguera is president of the Bogota-based real estate startup. Image Credits: Habi

Since launching in fall 2019, Habi has scaled rapidly — and has even picked up speed during the city’s strict lockdown during the COVID-19 pandemic. Transaction volume has increased threefold since March, Rojas noted.

Rojas said its data-driven approach works, allowing the company to sell a home three times faster than the market average.

The company currently covers all of Bogotá. It plans to use this fresh injection of capital to expand to Medellin this month and eventually to other Latin American markets, according to Noguera, who previously ran the digital transformation at Banco de Bogota and co-founded Marqueo.

The founders also intend to eventually expand Habi’s services to become a “one-stop shop for everything related to the home,” Rojas said. In the long term, this might mean connecting consumers with moving, storage, furnishings and other services.

Powered by WPeMatico

Like any successful founder, Andrew Grauer had bright, long-term ambitions for Course Hero from the moment he launched it in 2006.

He started the business to create a place where students could ask questions and get answers similar to Chegg, which launched 15 months before Course Hero . But as he slowly built it, he was tempted by a larger question: “What would a university look like if it was built by the internet?”

And so, the Redwood City-based startup itched at that nebulous goal throughout the years. Course Hero tested and failed products: free curated e-courses, in-person tutoring and teacher advice and ratings.

Clarity only came when Grauer realized that the core goal Course Hero launched with — giving students a place to ask and answer questions — wasn’t simply one product that should be fit into a broader suite of services. Instead, it was a thesis around which to build products. So, the startup began looking for different ways and formats to organize knowledge and questions and answers.

“That was a breakthrough insight,” Grauer said. The startup stopped launching other business verticals and decided to stick to Q&A as its core — and only — business. It sells Netflix -like subscriptions to students looking for access to learning and teaching content. Teachers and publishers can put course-specific study content on the platform.

Image Credits: Getty Images/manopjk

In 2020, Course Hero is a profitable business with annual run revenue upward of $100 million.

Today, Course Hero tells TechCrunch that it has raised a new tranche of capital in a Series B extension round of $70 million. The round is now totaling $80 million, bringing Course Hero’s total known venture capital to date to $95 million.

Its $80 million Series B round is one of the largest U.S. funding deals of 2020, and brings Course Hero’s valuation to $1.1 billion.

From a high level, the new raise is not surprising. Other edtech companies have also recently added on more capital to their balance sheets to meet remote learning demand amid the coronavirus pandemic.

But in Course Hero’s case, the new capital comes as a stark contrast to how the business functioned before 2020. After launching, the startup waited eight years to raise a $15 million Series A. Now, after going another nearly six years without raising venture capital, Course Hero has closed two rounds in this year alone.

Grauer tells TechCrunch that the capital will be used for operations, product innovation and feature development. It also plans to use the capital for future acquisitions (in 2012, Course Hero bought an in-person tutoring business).

Course Hero’s change of heart with venture capital boils down to the company meeting new scale demands. Last year, it passed 1 million subscribers on the platform. Now, it is eyeing “many millions” of students, the co-founder says.

Paraphrasing Bill Gates, Grauer said, “We do overestimate what we can do in just three years. And we dramatically underestimate what we can do closer to 10 years.”

Any edtech company that raises money off of current momentum in remote education will have to face the reality of what it is like to grow when remote learning is no longer a necessity. In other words, when the coronavirus pandemic ends, will these same platforms still find surges in usage?

“That’s the risk and reward of raising capital,” Grauer said. He added that “if you raise too much money early on, you can get misaligned expectations based on different time horizons set up by different terms of incoming shareholders or investors.”

Course Hero sees tailwinds in a dynamic that has been brewing since before the pandemic and will likely grow during and after: the growth of “nontraditional students” enrolling in and participating in higher education. Grauer noted that more than 40% of students work 30 hours or more per week. Over a quarter of students are parents, and of that quarter, over 70% are single moms.

“Because that’s the reality, and because we can make an affordable subscription and the economics can work, Course Hero is aligned to serving the majority, the real majority, and that’s the beauty of opportunity,” he said. There is a freemium model, but on an annual plan, a subscription costs $9.95 per month. On a monthly plan, a subscription costs $39.99 per month.

It’s not an opportunity the company hopes to expand into, it’s a reality of its diverse customer base. An internal data analytics survey of Course Hero shows that 58% of students that subscribe work at least part time. Over 25% of subscribers are 35 years old or older, and 22% of subscribers are parents.

Looking ahead, Course Hero hopes to continue to broaden its multisided marketplace.

In July, the business announced it is launching Educator Exchange, which allows college faculty to make money by uploading study materials for fellow teachers or students.

The “direct-to-faculty” relationship could pacify earlier tensions between the platform and teachers by giving the latter a way to monetize on how Course Hero “open sources” creative content on the point of copyright infringement.

Grauer compares Course Hero’s long-term vision to that of Google Maps, in that the platform can make recommendations of content based on other people’s usage.

But we’re not talking recommendations for the closest gas station. Based on how a user learns, Course Hero can recommend a specific professor who has a specific syllabus on a topic in which the user is interested.

“We’ve seen that specificity level differentiates us from others,” he said. “It helps students when they’re doing their real work, that one homework, that studying for one test. And I think that’s where the magic is for us.”

Powered by WPeMatico

LaunchNotes, a startup founded by the team behind Statuspage (which Atlassian later acquired) and the former head of marketing for Jira, today announced that it has raised a $1.8 million seed round co-led by Cowboy Ventures and Bull City Ventures. In addition, Tim Chen (general partner, Essence Ventures), Eric Wittman (chief growth officer, JLL Technologies), Kamakshi Sivaramakrishnan (VP Product, LinkedIn), Scot Wingo (co-founder and CEO, Spiffy), Lin-Hua Wu (chief communications officer, Dropbox) and Steve Klein (co-founder, Statuspage) are participating in this round.

The general idea behind LaunchNotes is to help businesses communicate their software updates to internal and external customers, something that has become increasingly important as the speed of software developments — and launches — has increased.

In addition to announcing the new funding round, LaunchNotes also today said that it will revamp its free tier to include the ability to communicate updates externally through public embeds as well. Previously, users needed to be on a paid plan to do so. The team also now allows businesses to customize the look and feel of these public streams more and it did away with subscriber limits.

“The reason we’re doing this is largely because [ … ] our long-term goal is to drive this shift in how release communications is done,” LaunchNotes co-founder Jake Brereton told me. “And the easiest way we can do that and get as many teams on board as possible is to lower the barrier to entry. Right now, that barrier to entry is asking users to pay for it.”

As Brereton told me, the company gained about 100 active users since it launched three months ago.

“I think, more than anything, our original thesis has been validated much more than I expected,” co-founder and CEO Tyler Davis added. “This problem really does scale with team size and in a very linear way and the interest that we’ve had has largely been on the much larger, enterprise team side. It’s just become very clear that that specific problem — while it is an issue for smaller teams — is much more of a critical problem as you grow and as you scale out into multiple teams and multiple business units.”

It’s maybe no surprise then that many of the next items on the team’s roadmap include features that large companies would want from a tool like this, including integrations with issue trackers, starting with Jira, single sign-on solutions and better team management tools.

“With that initial cohort being on the larger team size and more toward enterprise, issue tracker integration is a natural first step into our integrations platform, because a lot of change status currently lives in all these different tools and all these different processes and LaunchNotes is kind of the layer on top of that,” explained co-founder Tony Ramirez. “There are other integrations with things like feature flagging systems or git tools, where we want LaunchNotes to be the one place where people can go. And for these larger teams, that pain is more acute.”

The fact that LaunchNotes is essentially trying to create a system of record for product teams was also part of what attracted Cowboy Ventures founder Aileen Lee to the company.

“One of the things that I thought was kind of exciting is that this is potentially a new system of record for product people to use that kind of lives in different places right now — you might have some of it in Jira and some in Trello, or Asana, and some of that in Sheets and some of it in Airtable or Slack,” she said. She also believes that LaunchNotes will make a useful tool when bringing on new team members or handing off a product to another developer.

She also noted that the founding team, which she believes has the ideal background for building this product, was quite upfront about the fact that it needs to bring more diversity to the company. “They recognized, even in the first meeting, ‘Hey, we understand we’re three guys, and it’s really important to us to actually build out [diversity] on our cap table and in our investing team, but then also in all of our future hires so that we are setting our company up to be able to attract all kinds of people,” she said.

Powered by WPeMatico

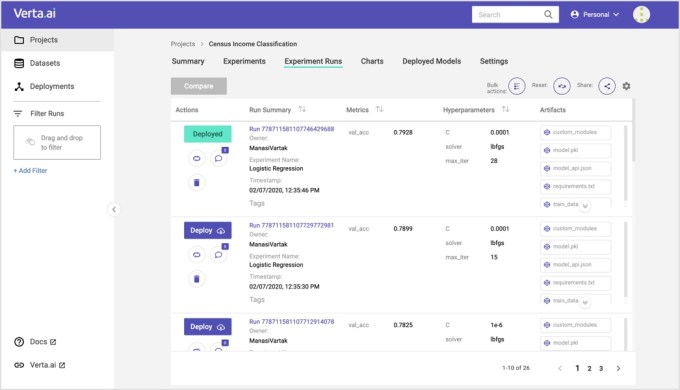

Manasi Vartak, founder and CEO of Verta, conceived of the idea of the open-source project ModelDB database as a way to track versions of machine models while she was still in grad school at MIT. After she graduated, she decided to expand on that vision to build a product that could not only track model versions, but provide a way to operationalize them — and Verta was born.

Today, that company emerged from stealth with a $10 million Series A led by Intel Capital with participation from General Catalyst, which also led the company’s $1.7 million seed round.

Beyond providing a place to track model versioning, which ModelDB gave users, Vartak wanted to build a platform for data scientists to deploy those models into production, which has been difficult to do for many companies. She also wanted to make sure that once in production, they were still accurately reflecting the current data and not working with yesterday’s playbook.

“Verta can track if models are still valid and send out alarms when model performance changes unexpectedly,” the company explained.

Image Credits: Verta

Vartak says having that open-source project helped sell the company to investors early on, and acts as a way to attract possible customers now. “So for our seed round, it was definitely different because I was raising as a solo founder, a first-time founder right out of school, and that’s where having the open-source project was a huge win,” she said.

Certainly Mark Rostick, VP and senior managing director at lead investor Intel Capital, recognized that Verta was trying to solve a fundamental problem around machine learning model production. “Verta is addressing one of the key challenges companies face when adopting AI — bridging the gap between data scientists and developers to accelerate the deployment of machine learning models,” Rostick said.

While Vartak wasn’t ready to talk about how many customers she has just yet at this early stage of the company, she did say there were companies using the platform and getting models into production much faster.

Today, the company has 9 employees, and even at this early stage, she is taking diversity very seriously. In fact, her current employee makeup includes four Indian, three Caucasian, one Latino and one Asian, for a highly diverse mix. Her goal is to continue on this path as she builds the company. She is looking at getting to 15 employees this year, then doubling that by next year.

One thing Vartak also wants to do is have a 50/50 gender split, something she was able to achieve while at MIT in her various projects, and she wants to carry on with her company. She is also working with a third party, Sweat Equity Ventures, to help with recruiting diverse candidates.

She says that she likes to work iteratively to build the platform, while experimenting with new features, even with her small team. Right now, that involves interoperability with different machine learning tools out there like Amazon SageMaker or Kubeflow, the open-source machine learning pipeline tool.

“We realized that we need to meet customers where they are at their level of maturity. So we focused a lot the last couple of quarters on building a system that was interoperable so you can pick and choose the components kind of like Lego blocks and have a system that works end to end seamlessly.”

Powered by WPeMatico

Bolt Bikes, the electric bike platform marketed to gig economy delivery workers, has a new name and a fresh injection of $11 million in capital from a Series A funding round led by Australian Clean Energy Finance Corporation.

The round also included equity from Hana Ventures and existing investors Maniv Mobility and Contrarian Ventures, together with venture debt from OneVentures and Viola Credit.

The Sydney, Australia-based startup that launched in 2017 is now called Zoomo, a change that aims to better reflect a customer base that has expanded beyond gig economy workers to include corporate clients and everyday consumers. Mina Nada, co-founder and CEO of the newly named Zoomo, also told TechCrunch that he wanted to ensure the company wouldn’t be confused by other similarly named businesses.

“When we set up Bolt back in 2017, the name was fine in Australia, but as we’ve gone international we’ve come up against at least three other companies called Bolt, two of them in the mobility space,” Nada explained. On-demand transportation company Taxify rebranded as Bolt in May 2020. Another company known as Bolt Mobility provides shared-scooter services.

Zoomo, which has operations in Australia, the U.K., New York and soon in Los Angeles, sells its electric bikes or offers them as a subscription. Its primary business has been subscriptions for commercial use, which includes the electric bike, fleet management software, financing and servicing. Subscribers get 24-hour access to the bike. A battery charger, phone holder, phone USB port, secure U-Lock and safety induction is included.

Zoomo has sales and service centers in the markets where it offers subscriptions, which includes Sydney, New York and the U.K. The company plans to use the new funding to expand its subscription footprint — which means adding physical sales and service centers — to Los Angeles and Brisbane as well as within New York.

The company’s strategy is to slowly expand where its subscription service is offered, while ramping up direct sales. The need for physical locations limits how quickly Zoomo can expand its subscription product. Selling the bikes to corporations and other users allows the company to generate more revenue, grow its geographic reach and build brand recognition as it slowly expands its more capitally intensive subscription service.

Zoomo also plans to use the funding to add new corporate categories such as parcel, mail and grocery deliveries that its bikes can be used for as well as other models better suited for individual consumers.

Powered by WPeMatico