Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Athletic coaching is a massive, multi-billion-dollar industry. No surprise, really, given the massive revenue some top athletes are able to generate. Mustard is working to supplant — or at least augment — some of that pricey coaching with the launch of a new mobile app designed to analyze an athlete’s mechanics and offer corrective tips to help them improve.

The company was co-founded by Tom House, a former reliever whose coaching career has earned him the reputation as one of the “father[s] of modern pitching mechanics.”

“Too many kids miss out on the power of play and the many physical and mental benefits of sports—studies show that 70% of kids stop playing sports by the age of 13 due to cost and lack of access to quality coaching. Mustard offers every kid access to the same coaching programs and extensive biomechanical analysis used by the best athletes in the world, and the same personalized training protocols that I use with the Hall of Famers I see in person,” House says in a release tied to the news. “We want to make elite personalized coaching accessible to all.”

Mustard announced this week that it has raised $1.7 million to improve its tool, led by Shasta Ventures and Intersect VC, along with a number of angel investors, including David Novak and Mike Dixon, and all-star athletes Nolan Ryan and Drew Brees. Ryan, in fact, has become one of the main faces of the company, gracing its home page, along with a color scheme that appears inspired by his days with the Astros.

The name isn’t great. It’s a reference to the phrase “put some mustard on it” — which refers to the act of adding a bit of an edge to a throw.

The app is opening up for a limited, free public beta, focused solely on baseball to start. “The product will be entirely free at first,” CEO Rocky Collis tells TechCrunch. “Over time, we will add premium features for a low monthly subscription. Even when premium features are added, we plan to continue to offer a free version of the app that offers tremendous value to users.”

The system relies on the smartphone’s camera and then uses proprietary AI algorithms to monitor the player’s motion and approximate human athletic coaching. For the baseball side of things, the company has employed engineers from Major League Baseball Advanced Media (MLBAM). Future sports will be added at some point down the road.

Powered by WPeMatico

Nreal, one of the most-watched mixed reality startups in China, just secured $40 million from a group of high-profile investors in a Series B round that could potentially bring more adoption to its portable augmented headsets.

Kuaishou, the archrival to TikTok’s Chinese version Douyin, led the round, marking yet another video platform to establish links with Nreal, following existing investor iQiyi, China’s own Netflix. Like other major video streaming sites around the world, Kuaishou and iQiyi have dabbled in making augmented reality content, and securing a hardware partner will no doubt be instrumental to their early experiments.

Other backers in the round with plentiful industry resources include GP Capital, which counts state-owned financial holding group Shanghai International Group and major Chinese movie studio Hengdian Group as investors; CCEIF Fund, set up by state-owned telecom equipment maker China Electronics Corporation and state-backed investment bank China International Capital Corporation; GL Ventures, the early-stage fund set up by prominent private equity firm Hillhouse Capital; and Sequoia Capital China.

In early 2019, Nreal brought onboard Xiaomi founder’s venture fund Shunwei Capital for its $15 million Series A funding. As I wrote at the time, AR, VR, MR, XR — whichever marketing coinage you prefer — will certainly be a key piece in Xiaomi’s Internet of Things empire. It’s not hard to see the phone titan sourcing smart glasses from Nreal down the road.

The other key partner of Nreal, a three-year-old company, is Qualcomm . The chipmaker has played an active part in China’s 5G rollout, powering major Chinese phone makers’ next-gen handsets. It supplies Nreal with its Snapdragon processors, allowing the startup’s lightweight mixed reality glasses to easily plug into an Android phone.

“Its closer partnership with Qualcomm will allow it to access Qualcomm’s network of customers, including telecoms companies,” Seewan Toong, an industry consultant on AR and VR, told TechCrunch.

Indeed, the mixed reality developer has already signed a deal with Japanese telco KDDI and in Korea, it’s working with LG’s cellular carrier LG Uplus Corp.

The latest round brings Nreal’s total raise to more than $70 million and will accelerate mass adoption of its mixed reality technology in the 5G era, the company said.

It remains to be seen how Nreal will live up to its promise, secure users at scale and move beyond being a mere poster child for tech giants’ mixed reality ambitions. So far its deals with big telcos are in a way reminiscent of that of Magic Leap, which has been in a legal spat with Nreal, though the Chinese company appears to burn through less cash so far. The troubled American company is currently pivoting to relying on enterprise customers after failing to crack the consumer market.

“Nreal is patient and not in a rush to show they can start selling high volume. It’s trying to prove that there’s a user scenario for its technology,” said Toong.

Powered by WPeMatico

Avo, a startup that helps businesses better manage their data quality across teams, today announced that it has raised a $3 million seed round led by GGV Capital, with participation from Heavybit, Y Combinator and others.

The company’s founder, Stefania Olafsdóttir, who is currently based in Iceland, was previously the head of data science at QuizUp, which at some point had 100 million users around the world. “I had the opportunity to build up the Data Science Division, and that meant the cultural aspect of helping people ask and answer the right questions — and get them curious about data — but it also meant the technical part of setting up the infrastructure and tools and pipelines, so people can get the right answers when they need it,” she told me. “We were early adopters of self-serve product analytics and culture — and we struggled immensely with data reliability and data trust.”

As companies collect more data across products and teams, the process tends to become unwieldy and different teams end up using different methods (or just simply different tags), which creates inefficiencies and issues across the data pipeline.

“At first, that unreliable data just slowed down decision making, because people were just like, didn’t understand the data and needed to ask questions,” Olafsdóttir said about her time at QuizUp. “But then it caused us to actually launch bad product updates based on incorrect data.” Over time, that problem only became more apparent.

“Once organizations realize how big this issue is — that they’re effectively flying blind because of unreliable data, while their competition might be like taking the lead on the market — the default is to patch together a bunch of clunky processes and tools that partially increase the level of liability,” she said. And that clunky process typically involves a product manager and a spreadsheet today.

At its core, the Avo team set out to build a better process around this, and after a few detours and other product ideas, Olafsdóttir and her co-founders regrouped to focus on exactly this problem during their time in the Y Combinator program.

Avo gives developers, data scientists and product managers a shared workspace to develop and optimize their data pipelines. “Good product analytics is the product of collaboration between these cross-functional groups of stakeholders,” Olafsdóttir argues, and the goal of Avo is to give these groups a platform for their analytics planning and governance — and to set company-wide standards for how they create their analytics events.

Once that is done, Avo provides developers with typesafe analytics code and debuggers that allows them to take those snippets and add them to their code within minutes. For some companies, this new process can help them go from spending 10 hours on fixing a specific analytics issue to an hour or less.

Most companies, the team argues, know — deep down — that they can’t fully trust their data. But they also often don’t know how to fix this problem. To help them with this, Avo also today released its Inspector product. This tool processes event streams for a company, visualizes them and then highlights potential errors. These could be type mismatches, missing properties or other discrepancies. In many ways, that’s obviously a great sales tool for a service that aims to avoid exactly these problems.

One of Avo’s early customers is Rappi, the Latin American delivery service. “This year we scaled to meet the demand of 100,000 new customers digitizing their deliveries and curbside pickups. The problem with every new software release was that we’d break analytics. It represented 25% of our Jira tickets,” said Rappi’s head of Engineering, Damian Sima. “With Avo we create analytics schemas upfront, identify analytics issues fast, add consistency over time and ensure data reliability as we help customers serve the 12+ million monthly users their businesses attract.”

As most startups at this stage, Avo plans to use the new funding to build out its team and continue to develop its product.

“The next trillion-dollar software market will be driven from the ground up, with developers deciding the tools they use to create digital transformation across every industry. Avo offers engineers ease of implementation while still retaining schemas and analytics governance for product leaders,” said GGV Capital Managing Partner Glenn Solomon. “Our investment in Avo is an investment in software developers as the new kingmakers and product leaders as the new oracles.”

Powered by WPeMatico

Process automation startup Hypatos has raised a €10 million (~$11.8 million) seed round of funding from investors including Blackfin Tech, Grazia Equity, UVC Partners and Plug & Play Ventures.

The Germany and Poland-based company was spun out of AI for accounting startup Smacc at the back end of 2018 to apply deep learning tech to power a wider range of back-office automation, with a focus on industries with heavy financial document processing needs, such as the financial and insurance sectors.

Hypatos is applying language processing AI and computer vision tech to speed up financial document processing for business use cases such as invoices, travel and expense management, loan application validation and insurance claims handling via — touting a training data set of more than 10 million annotated data entities.

It says the new seed funding will go on R&D to expand its portfolio of AI models so it can automate business processing for more types of documents, as well as for fueling growth in Europe, North American and Asia. Its customer base at this point includes Fortune 500 companies, major accounting firms and more than 300 software companies.

While there are plenty of business process automation plays, Hypatos says its use of deep learning tech supports an “in-depth understanding” of document content — which in turn allows it to offer customers a “soup to nuts” automation menu that covers document classification, information capturing, content validation and data enrichment.

It dubs its approach “cognitive process automation” (CPA) versus more basic applications of business process automation with software robots (RPA), which it argues aren’t so contextually savvy — thereby claiming an edge.

As well as document processing solutions, it has developed machine learning modules for enhancing customers’ existing systems (e.g. ECM, ERP, CRM, RPA); and offers APIs for software providers to draw on its machine learning tech for their own applications.

“All offerings include machine learning pipeline software for continuous model training in the cloud or in on-premise deployments,” it notes in a press release.

“We have deep knowledge of how financial documents are processed and millions of data entities in our training data,” says chief commercial officer Cem Dilmegani, discussing where Hypatos fits in the business process automation landscape. “We get compared to RPA companies like UiPath, enterprise content management (ECM) companies like Kofax Readsoft as well as generalist ML document automation companies like Hyperscience. However, we are quite different.

“We focus on end-to-end automation, we don’t only help companies capture data, we help them process it using our deep domain understanding, enabling higher rates of automation. For example, to automate incoming invoice processing (A/P automation) we apply our document understanding AI to capture all data, classify the document, identify the specific goods and services, validate for internal/external compliance and assign financial accounts, cost centers, cost categories etc. to automate all processing tasks.

“Finally, we offer this technology as components easily accessible via APIs. This allows RPA or ECM users to leverage our technology and increase their level of automation.”

Hypatos claims it’s seeing uplift as a result of the coronavirus pandemic — noting it’s providing a service to more than a dozen Fortune 500 companies to help with in-shoring efforts, which it says are accelerating as a result of COVID-19 putting pressure on the traditional business process outsourcing model as offshore workforce productivity in lower wage regions is affected by coronavirus lockdowns.

“We believe that we are in a pivotal moment of machine learning adoption in large organizations,” adds Andreas Unseld, partner at UVC Partners, in a supporting statement. “Hypatos’ technology provides ample opportunity to transform many core business processes. We’re impressed by the Hypatos machine learning technology and see the team in a perfect position to take a leading role in the machine learning revolution to come.”

Powered by WPeMatico

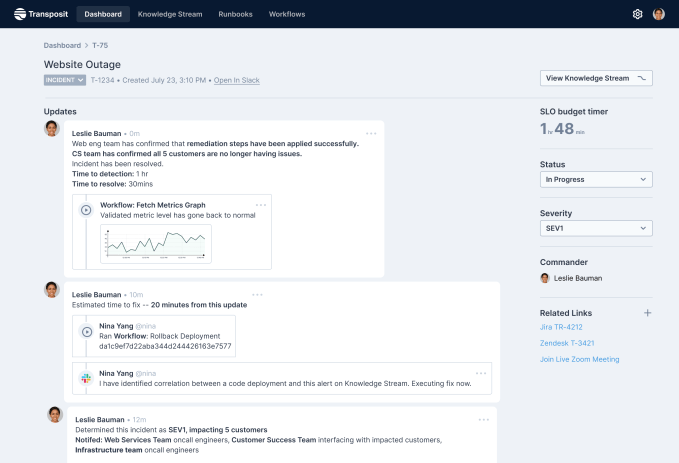

Transposit is a company built by engineers to help engineers, and one big way to help them is to get systems up and running faster when things go wrong — as they always will at some point. Transposit has come up with a way to build runbooks for faster disaster recovery, while using data to update them in an automated fashion.

Today, the company announced a $35 million Series B investment led by Altimeter Capital, with participation from existing investors Sutter Hill Ventures, SignalFire and Unusual Ventures. Today’s investment brings the total raised to $50.4 million, according to the company.

Company CEO Divanny Lamas and CTO and founder Tina Huang see technology issues as less an engineering problem and more as a human problem, because it’s humans who have to clean up the messes when things go wrong. Huang says forgetting the human side of things is where she thinks technology has gone astray.

“We know that the real superpower of the product is that we focus on the human and the user side of things. And as a result, we’re building an engineering culture that I think is somewhat differentiated,” Huang told TechCrunch.

Transposit is a platform that at its core helps manage APIs, connections to other programs, so it starts with a basic understanding of how various underlying technologies work together inside a company. This is essential for a tool that is trying to help engineers in a moment of panic figure out how to get back to a working state.

When it comes to disaster recovery, there are essentially two pieces: getting the systems working again, then figuring out what happened. For the first piece, the company is building data-driven runbooks. By being data-driven, they aren’t static documents. Instead, the underlying machine learning algorithms can look at how the engineers recovered and adjust accordingly.

Image Credits: Transposit

“We realized that no one was focusing on what we realize is the root problem here, which is how do I have access to the right set of data to make it easier to reconstruct that timeline, and understand what happened? We took those two pieces together, this notion that runbooks are a critical piece of how you spread knowledge and spread process, and this other piece, which is the data, is critical,” Huang said.

Today the company has 26 employees, including Huang and Lamas, who Huang brought on board from Splunk last year to be CEO. The company is somewhat unique having two women running the organization, and they are trying to build a diverse workforce as they build their company to 50 people in the next 12 months.

The current make-up is 47% female engineers, and the goal is to remain diverse as they build the company, something that Lamas admits is challenging to do. “I wish I had a magic answer, or that Tina had a magic answer. The reality is that we’re just very demanding on recruiters. And we are very insistent that we have a diverse pipeline of candidates, and are constantly looking at our numbers and looking at how we’re doing,” Lamas said.

She says being diverse actually makes it easier to recruit good candidates. “People want to work at diverse companies. And so it gives us a real edge from a kind of culture perspective, and we find that we get really amazing candidates that are just tired of the status quo. They’re tired of the old way of doing things and they want to work in a company that reflects the world that they want to live in,” she said.

The company, which launched in 2016, took a few years to build the first piece, the underlying API platform. This year it added the disaster recovery piece on top of that platform, and has been running its beta since the beginning of the summer. They hope to add additional beta customers before making it generally available later this year.

Powered by WPeMatico

As Slack ramps up its investment in Asia, Toss Lab, the South Korea-based creator of enterprise collaboration platform JANDI, is preparing to become a more formidable rival. The startup announced today that it has raised a $13 million Series B led by SoftBank Ventures Asia, the early-stage venture arm of SoftBank Group. Participating investors also included SV Investment, Atinum Investment, Must Asset Management, Shinhan Capital, SparkLabs and T Investment.

Founded in 2014, Toss Lab said the round means it is the first Korean company in the collaboration space to raise over $20 million to date. The company says JANDI is the top collaboration platform in Japan and Taiwan. It serves companies ranging from small to mid-sized businesses to large enterprises with thousands of employees. Its clients include LG CNS (the Korean conglomerate’s IT services subsidiary), Korean tire manufacturer Nexen Tire and Lexus. Toss Labs says its revenue has grown more than 100% over the past three years.

Matthew Kim, chief executive of Toss Lab, told TechCrunch that the Series B will be used for global expansion and to increase the company’s headcount by 20% to 25%.

JANDI has seen a 80% increase in the number of users acquired during the COVID-19 pandemic across its Asian markets. To serve remote workers, JANDI added integration with Zoom, enhanced its security and developed an advanced admin dashboard.

The platform currently supports English, Chinese, Japanese, Korean and Vietnamese, and plans to grow its operations in Japan, Taiwan, Malaysia, Vietnam and the Middle East.

Last October, Slack said it was planning to increase its investment in Asia, including new data regions in Japan and Australia.

But Kim said JANDI’s biggest rival isn’t Slack. Instead, it is competing against popular messaging apps, like Line, Kakao, WhatsApp, Zalo and Facebook Messenger, which Kim said the majority of workers in Asia still rely on for workplace communication. While Slack is used by some startups and tech companies in Asia, Chatwork and Base.vn are the top collaboration platforms in Japan and Vietnam, respectively, while JANDI is the leader in South Korea and Taiwan.

One of JANDI’s advantages is that “we are currently integrating with the legacy systems that are unique in each region and we have the local onboarding support team for enterprise,” said Kim. He added that Japan and Taiwan have the most growth potential in the near-term, followed by the United Arab Emirates, Malaysia and Indonesia.

Like other collaboration platforms, JANDI offers messaging and group chats. But it also features collaboration tools that the company says is geared toward work culture in its Asian markets. These include organization charts to help people find colleagues by department; a “board view” for company announcements and reports; video calls that can support up to 300 participants at a time; read receipts; and a secure file manager for storing confidential team documents.

As part of the funding, Toss Labs also added four new board directors: Ticket Monster founder Daniel Shin and former Kakao chief strategy officer Joon-yeol Kang, the founders of Bass Investment; SoftBank Ventures Asia CEO JP Lee; and SBI Investment Korea CEO Joon-hyo Lee. Sendbird CEO John S. Kim and Bespin Global founder HanJoo Lee are joining as advisors to Toss Labs.

Powered by WPeMatico

We’re seeing a gradual expansion of national regulations that require data from SaaS applications to be stored locally in the country where it’s sourced and used. Today a startup that’s built a service around that need — specifically, data residency-as-a-service — is announcing some funding to continue building out its company amid strong demand.

InCountry, which provides a set of solutions — comprising software as well as some consultancy — that helps companies comply with local regulations when adopting SaaS products, has raised $18 million in funding.

This is technically an extension to its Series A, but in keeping with the growth of its business, it comes with a big bump to its valuation: the startup is now valued at “north” of $150 million. Founder and CEO Peter Yared said this is more than double the valuation of its previous round a little over a year ago.

The money is coming from a mix of strategic and financial investors. It’s being led by Caffeinated Capital and Abu Dhabi’s Mubadala, with participation from new investor Accenture Ventures and previous investors Arbor Ventures, Felicis, Ridge Ventures, Bloomberg Beta and Team Builder Ventures. Accenture is one of InCountry’s key channel partners, reselling the software as part of bigger data management and integration contracts, Yared tells me.

The company has seen a decent bump in its business in the last year, expanding to 90 countries from 65, where it provides guidance and services to store and use data in compliance with legal requirements. Alongside that it has an increasingly long list of software packages that it covers with its products. The list currently includes Salesforce, ServiceNow, Twilio, Mambu and Segment, with customers including a large list of enterprises including stock exchanges, banks and pharmaceutical companies.

“This company was based off a crazy thesis,” Yared said with an almost incredulous laugh (he has a very jocular way of talking, even when he’s being serious). “Now it’s 20 months old, and our customers are banks, pharma giants, stock exchanges. We are proud that large institutions can trust us.”

A big bump in its business in recent times has been in Asia Pacific and the Middle East, which are two main regions when it comes to data residency regulations and therefore ripe ground for winning new customers — one reason why Mubadala is part of this round, Yared said.

“At Mubadala we are committed to backing visionary founders whose innovations fuel economies,” said Ibrahim Ajami, head of Ventures at Mubadala Capital. “Since day one, InCountry’s cloud solution has addressed a massive challenge in this era of regulation by giving businesses the tools to grow internationally while remaining compliant with data residency regulations. We’re doubling down on our investment and are supporting InCountry’s expansion into the MENA region because we believe they are the best team to help drive global business forward.”

Partly due to the growing ubiquity, flexibility and relatively cheap cost of cloud computing, software as a service has been on a fast growth trajectory for years now. But even within that trend, it has had a huge boost in 2020 as a result of the global health pandemic.

COVID-19 has given the need for remote computing, and being able to access data wherever you happen to be — which in many cases today is no longer in your usual office space. On top of that, we have a lot more “wiggle room” in business, with organizations quickly scaling up and down with demand.

The knock-on effect has been a big boost for SaaS. But that growth has come with some caveats, and one of the biggest alongside security has been around data protection, and specifically national requirements in how data is stored and used. Arguably, SaaS companies have been more concerned with scaling their software and business funnels than they have been with how data is handled and how that has changed in keeping with local regulations, and that’s the opportunity that InCountry has stepped in to fill.

It provides not just a set of software to store and handle data in a secure way, but also an extensive list of legal advisors with expertise at the local level to help companies get their data policies in order. It’s an interesting model: While InCountry’s been an early mover in identifying this market opportunity and building technology to address it, it’s buffered its competitive position not with a sole focus on technology, but an extensive amount of human capital to get each implementation right.

That can prove to be a costly thing to get wrong. In the EU in July, the Court of Justice of the European Union (CJEU) put down the EU-US Privacy Shield — a framework that let businesses transfer personal data between the European Union and the United States while ensuring compliance with data protection regulations. This has impacted some 5,000 companies, which now have to rethink how they handle their data. The fine for not complying with storing data locally means that they can be fined up to 4% of their revenues.

Yared tells me that for now, the main competitor to something like InCountry has been companies building their own policies in house. Some of those solutions would have been done completely in house and some in partnership with integrators, but all of them were hard to scale and were painful to maintain, one reason why companies and their business partners are turning to working with his startup.

“Accenture Ventures is pleased to support InCountry as it continues to expand globally,” said Tom Lounibos, managing director, Accenture Ventures, in a statement. “InCountry’s software solutions are helping companies address the critical issue of becoming and remaining compliant with a multitude of data residency laws. This expansion will help support enterprises as they unlock their business across borders.”

Powered by WPeMatico

Data protection and data privacy have gone from niche concerns to mainstream issues in the last several years, thanks to new regulations and a cascade of costly breaches that have laid bare the problems that arise when information and data security are treated haphazardly.

Yet that swing has also thrown up a whole series of issues for organisations and business functions that depend on sharing and exchanging data in order to work. Today, a startup that has built a new way of exchanging data while still keeping privacy in mind — starting first by applying the concept to the “marketing industrial complex” — is announcing a round of funding as it continues to pick up momentum.

InfoSum, a London startup that has built a way for organizations to share their data with each other without passing it on to each other — by way of a federated, decentralized architecture that uses mathematical representations to organise, “read” and query the data — is today announcing that it has raised $15.1 million.

Data may be the new oil, but according to founder and CEO Nick Halstead, that just means “it’s sticky and gets all over the place.” That is to say, InfoSum is looking for a new way to use data that is less messy, and less prone to leakage, and ultimately devaluation.

The Series A is being co-led by Upfront Ventures and IA Ventures. A number of strategics using InfoSum — Ascential, Akamai, Experian, British broadcaster ITV and AT&T’s Xandr — are also participating in the round. The startup has raised $23 million to date.

Nicholas Halstead, the founder and CEO who previously had founded and led another big data company, DataSift (the startup that gained early fame as a middleman for Twitter’s firehose of data, until Twitter called time on that relationship to push its own business strategy), said in an interview that the plan is to use the funding to continue fueling its growth, with a specific focus on the U.S. market.

To that end, Brian Lesser — the founder and former CEO of Xandr (AT&T’s adtech business that is now a part of AT&T’s WarnerMedia), and previous to that the North American CEO of GroupM — is joining the company as executive chairman. Lesser had originally led Xandr’s investment into InfoSum and had previously been on the board of the startup.

InfoSum got its start several years ago as CognitiveLogic, founded at a time when Halstead was first starting to get his head around the problems that were becoming increasingly urgent in how data was being used by companies, and how newer information architecture models using data warehousing and cloud computing could help solve that.

“I saw the opportunity for data collaboration in a more private way, helping enable companies to work together when it came to customer data,” he said. This eventually led to the company releasing its first product two years ago.

In the interim, and since then, that trend, he noted, has only gained momentum, spurred by the rise of companies like Snowflake that have disrupted the world of data warehousing, cookies have started to increasingly go out of style (and some believe will disappear altogether over time) and the concept of federated architecture has become much more ubiquitous, applied to identity management and other areas.

All of this means that InfoSum’s solution today may be aimed at martech, but it is something that affects a number of industries. Indeed, the decision to focus on marketing technology, he said, was partly because that is the industry that Halstead worked most closely with at DataSift, although the plan is to expand to other verticals as well.

“We’ve done a lot of work to change the marketing industrial complex,” said Lesser, “but its bigger use cases are in areas like finance and healthcare.”

Powered by WPeMatico

The global legal services industry was worth $849 billion in 2017 and is expected to become a trillion-dollar industry by the end of next year. Little wonder that Steno, an LA-based startup, wants a piece.

Like most legal services outfits, what it offers are ways for law practices to run more smoothly, including in a world where fewer people are meeting in conference rooms and courthouses and operating instead from disparate locations.

Steno first launched with an offering that centers on court reporting. It lines up court reporters, as well as pays them, removing both potential headaches from lawyers’ to-do lists.

More recently, the startup has added offerings like a remote deposition videoconferencing platform that it insists is not only secure but can manage exhibit handling and other details in ways meant to meet specific legal needs.

It also, very notably, has a lending product that enables lawyers to take depositions without paying until a case is resolved, which can take a year or two. The idea is to free attorneys’ financial resources — including so they can take on other clients — until there’s a payout. Of course, the product is also a potentially lucrative one for Steno, as are most lending products.

We talked earlier this week with the company, which just closed on a $3.5 million seed round led by First Round Capital (it has now raised $5 million altogether).

Unsurprisingly, one of its founders is a lawyer named Dylan Ruga who works as a trial attorney at an LA-based law group and knows first-hand the biggest pain points for his peers.

More surprising is his co-founder, Gregory Hong, who previously co-founded the restaurant reservation platform Reserve, which was acquired by Resy, which was acquired by American Express. How did Hong make the leap from one industry to a seemingly very different one?

Hong says he might not have gravitated to the idea if not for Ruga, who was Resy’s trademark attorney and who happened to send Hong the pitch behind Steno to get Hong’s advice. He looked it over as a favor, then he asked to get involved. “I just thought, ‘This is a unique and interesting opportunity,’ and said, ‘Dylan, let me run this.’ ”

Today the 19-month-old startup has 20 full-time employees and another 10 part-time staffers. One major accelerant to the business has been the pandemic, suggests Hong. Turns out tech-enabled legal support services become even more attractive when lawyers and everyone else in the ecosystem is socially distancing.

Hong suggests that Steno’s idea to marry its services with financing is gaining adherents, too, including amid law groups like JML Law and Simon Law Group, both of which focus largely on personal injury cases.

Indeed, Steno charges — and provides financing — on a per-transaction basis right now, even while its revenue is “somewhat recurring,” in that its customers constantly have court cases.

Still, a subscription product is being considered, says Hong. So are other uses for its videoconferencing platform. In the meantime, says Hong, Steno’s tech is “built very well” for legal services, and that’s where it plans to remain focused.

Powered by WPeMatico

Berbix, an ID verification startup that was founded by former members of the Airbnb Trust and Safety team, today announced that it has raised a $9 million Series A round led by Mayfield. Existing investors, including Initialized Capital, Y Combinator and Fika Ventures, also participated in this round.

Founded in 2018, Berbix helps companies verify the identity of its users, with an emphasis on the cannabis industry, but it’s clearly not limited to this use case. Integrating the service to help online services scan and validate IDs only takes a few lines of code. In that respect, it’s not that different from payment services like Stripe, for example. Pricing starts at $99 per month with 100 included ID checks. Developers can choose a standard ID check (for $0.99 per check after the basic allotment runs out), as well as additional selfie and optional liveness checks, which ask users to show an emotion or move their head to ensure somebody isn’t simply trying to trick the system with a photo.

While ID verification may not be the first thing you think about in the context of the COVID-19 pandemic, the company is actually seeing increasing demand for its solution now that in-person ID verification has become much harder. Berbix CEO and co-founder Steve Kirkham notes that the company now processes the same number of verifications in a day that it used to do monthly only a year ago.

“The inability to conduct traditional identity checks in person has forced organizations to move online for innumerable use cases,” he says in today’s announcement. “One example is the Family Independence Initiative, a nonprofit that trusts and invests in families’ own efforts to escape poverty. Our software has enabled them to eliminate fraudulent applications and focus on the families who have been economically affected by COVID.”

Berbix co-founder Eric Levine tells me the company plans to use the new funding to expand its team, especially the product and sales department. He also noted that the team is investing heavily in localization, as well as the technical foundation of the service. In addition, it’s obviously also investing in new technologies to detect new types of fraud. Scammers never sleep, after all.

Powered by WPeMatico