real estate

Auto Added by WPeMatico

Auto Added by WPeMatico

Southeast Asian real estate portal 99.co has agreed to form a joint venture with iProperty. As part of the deal, iProperty owner REA Group will invest $8 million of working capital into the venture, expected to be finalized by the second quarter of 2020.

99.co and REA Group, a real estate-focused digital advertising conglomerate that is listed on the Australian Securities Exchange (ASX), say that the joint venture immediately makes 99.co the market leader in Indonesia and positions it to take the top spot in Singapore, as well. The deal also makes 99.co a more formidable rival to PropertyGuru. Backed by TPG Capital and KKR, PropertyGuru is expected to raise up to AUD $380.2 million (about USD $255.9 million) in an IPO on the ASX this month.

The joint venture is expected to be finalized by the second quarter of 2020 and 99.co will assume full control of REA Group brands iProperty.com.sg in Singapore and Rumah123.com in Indonesia. The joint venture will be led by 99.co’s management team, including co-founder and CEO Darius Cheung.

99.co’s last round of funding was a $15.2 million Series B, announced in August, that the company says took its valuation to over $100 million.

In a press statement, Cheung said, “We are coming for market leadership. This is a key milestone that positions us instantly as number one in Indonesia, and well on our way to that in Singapore. Our innovative DNA plus REA’s unrivaled experience and resources makes this partnership a lethal combination Southeast Asia has not seen before.”

The company’s existing shareholders, including Facebook co-founder Eduardo Saverin, Sequoia Capital, MindWorks Ventures, Allianz X, East Ventures and 500 Startups, will have a combined stake of 73%, with REA Group holding the remaining 27%.

Launched in 2014, 99.co was created to make real estate listings more navigable for renters and buyers in Singapore and other Southeast Asian markets. REA Group owns portals in Malaysia, Hong Kong, Indonesia, Singapore and China, and a property review site in Thailand. It is also a stakeholder in Move, the American real estate site, and Indian property portal PropTiger.

Powered by WPeMatico

Missing out on a month’s rent because you can’t find a tenant is a huge loss. Searching for someone to fill a home takes work, while property managers are incentivized to price your place too high, leading to costly vacancies.

But new startup Doorstead wants to take on the risk and the work for you. It acts as a property manager for single-family homes, but guarantees you rent at a specific rate starting in a certain number of days, even if it can’t fill the house or apartment. It also handles all the algorithmic pricing, advertising, tenant interviews, repairs, maintenance, leases and online payments in exchange for 8% of rent. Owners just sit back and receive the money, making it much easier to profit off of distant real estate. The startup claims to earn users 3% to 9% more than other property management models.

Doorstead’s approach to the hot sector of “iRenting” has attracted a $3.3 million seed round co-led by M13 and Silicon Valley Data Capital, and joined by Venture Reality Fund and SOMA Capital. They’re betting on co-founders Jennifer Bronzo, whose parents ran a construction and property management firm, and Ryan Waliany, who worked in product at Uber after his recipe platform Kitchenbowl was acqui-hired.

Doorstead co-founders (from left): Jennifer Bronzo and Ryan Waliany

“I grew up going to job sites and learning about construction,” Bronzo says. “In the recent decade, my family purchased a lot of properties in the Bay and they needed help filling capacity. I saw so many opportunities in property management because of how antiquated the industry is.” Doorstead is now operating in five cities around the San Francisco Bay Area.

As consumers grow accustomed to zero-friction services, that approach is branching into bigger and bigger sectors like the trillions paid for long-term rentals. Waliany, Doorstead’s CEO, tells me, “We’re in the process of Uber’izing each step of the property management life cycle.” The startup is hoping to become the OpenDoor of rentals.

First, property owners contact Doorstead and provide some basic information on the home they want to rent out. They receive a preliminary offer before the startup does an inspection and takes professional marketing photos while digging through reams of data on local pricing, availability and demand to pick a rate its algorithm believes it can fill the home for quickly. Owners then receive a final offer agreement saying they’ll be paid $X per month starting in Y number of days (typically 21 to 45 days), with Doorstead absorbing all the risk if it can’t find a tenant.

First, property owners contact Doorstead and provide some basic information on the home they want to rent out. They receive a preliminary offer before the startup does an inspection and takes professional marketing photos while digging through reams of data on local pricing, availability and demand to pick a rate its algorithm believes it can fill the home for quickly. Owners then receive a final offer agreement saying they’ll be paid $X per month starting in Y number of days (typically 21 to 45 days), with Doorstead absorbing all the risk if it can’t find a tenant.

From there, the startup does approved maintenance and cleaning as necessary, and then methodically lists the home on all the top rental platforms. It handles open house walk-throughs and runs background checks on potential tenants to find who will most reliably pay rent. Doorstead prepares a lease and gets it signed by a tenant, but even if it doesn’t, owners still get their guaranteed payments. Rent is collected online, and if a move-out or eviction is necessary, Doorstead takes care of the transition to finding a new tenant.

There’s plenty of margin for Doorstead to earn if it can consistently fill homes faster. Most property managers charge at least 50% of the first month’s rent, but instead, Doorstead keeps all the rent of any extra days if it fills the spot before the guaranteed due date. From there, it charges 8% of monthly rent with no tenant placement fee, which is close to or under the common 10% fee on single-family home property management. And if it manages to secure a higher rate from tenants than its guarantee, it gives 70% to the owner.

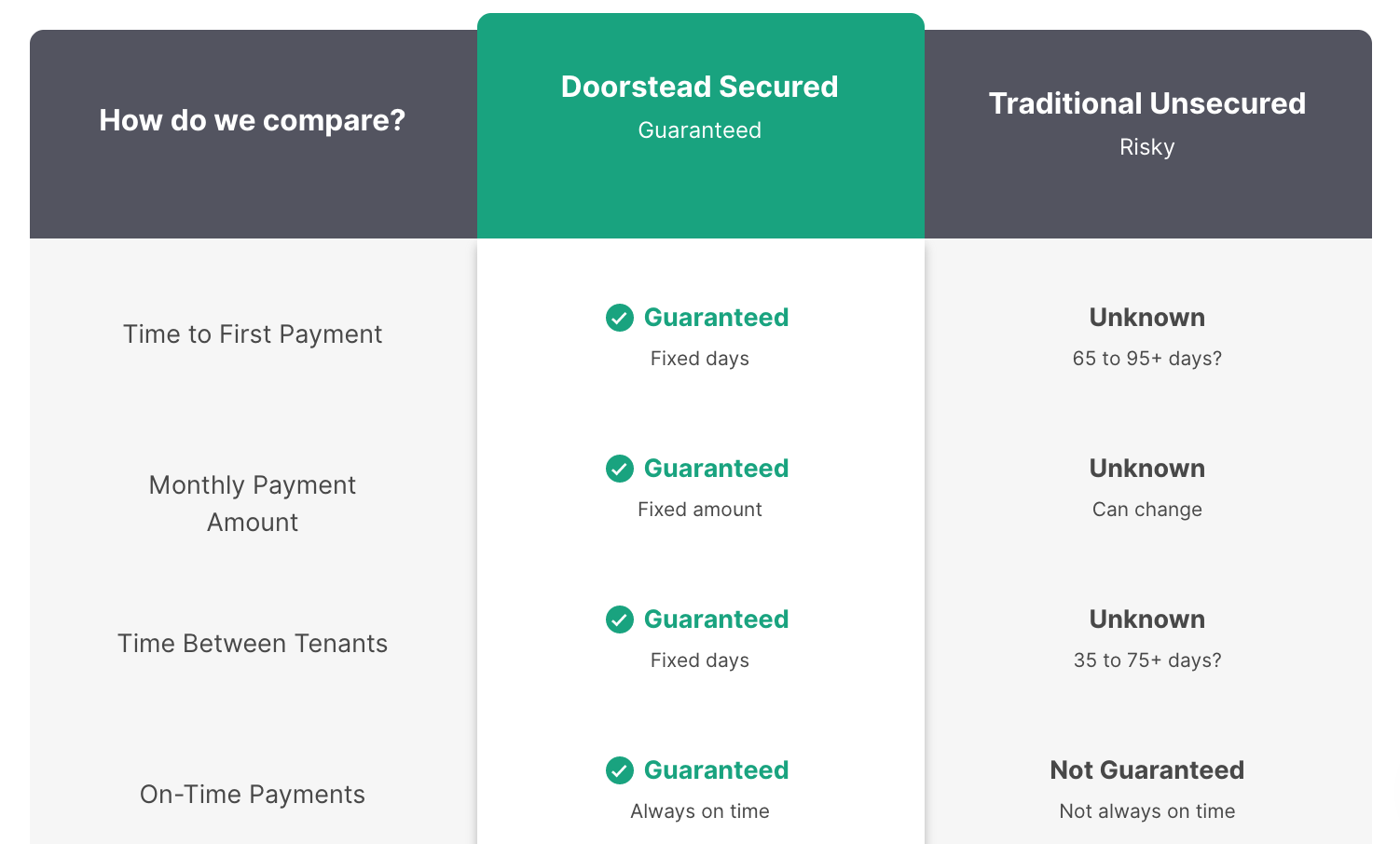

Doorstead claims to be less risky than alternatives

“Property management incumbents have a 43-day vacancy average which leads to $86 billion in economic waste in the U.S. alone,” Waliany tells TechCrunch. “This means that landlords could earn the same money and lower rents by 12% for tenants with an efficient market.”

With Doorstead, even if the owner lives far away, the turn-key service lets them efficiently rent their home. That’s not only important to them, but to overcrowded cities like San Francisco that often see apartments left vacant by overseas owners because they’re too much effort to rent out. To date, Doorstead’s algorithm has allowed it to recoup 100% of its guarantees and it’s shooting to stay above 90%, while maintaining its NPS of 80.

But if the startup is working that well, it’s only a matter of time until incumbents try to barge in.

“It would be a no brainer for Airbnb to enter this market and Zillow to open this,” Waliany admits, given their existing pricing algorithms and popularity as rental destinations. But Bronzo says “the biggest barrier is the operations piece that an Airbnb and Zillow haven’t stepped into.” It would be a big departure from their lean software-based marketplaces. Other property management startups like Mynd, OneRent and BelongHome only offer guaranteed rent once tenants are found, absolving themselves of most of the risk. They’d have to take on a more precarious business model.

What about Zeus, Sonder and Lyric, which offer property management of homes they then use for corporate housing or as boutique hotels? “An owner of ours considered Zeus versus Doorstead and went with Doorstead because: 1) our offer was ~12% higher, and 2) they didn’t want the wear-and-tear that comes with having people move in and out of the property every few days or few months,” Waliany explains. “Sonder and Lyric have 300 move-in and move-outs over a six-year period. Doorstead has ~4 move ins/outs and that results in significantly less wear-and-tear and a much easier operations to manage. Not only that, the long-term rental market is 42x larger and has 12x more addressable revenue.” Doorstead will have to build a brand and product moat to defend against inevitable direct competition.

As iRenting is still a fresh concept, Waliany warns that “with any new business model, there will inevitably be ‘unknown unknowns’ that we cannot predict, black swan events and things that we might only be able to learn through calculated bets.” Luckily, because it doesn’t hold the leases for very long, and home rentals typically increase in an economic downturn, Doorstead’s liability is manageable in the event of a recession or other crisis.

“There are three large trillion-dollar industries — food, transportation and housing. At Doorstead, we have an opportunity to completely redefine the housing value chain by creating a new class of property management that eliminates unnecessary vacancies. In the end, this redefinition of the value chain allows ourselves to become the Blackstone of the future,” Waliany concludes. “It seems like we’re giving everyone free money.” That will prove either the startup’s downfall or a powerful growth tactic.

Powered by WPeMatico

According to a new WSJ report, certain members of WeWork’s seven-person board, which includes cofounder and CEO Adam Neumann, are planning to pressure Neumann to step down and instead become We’s non-executive chairman. The move, says the outlet, “would allow him to stay stay at the company he built into one of the country’s most valuable startups, but inject fresh leadership to pursue an IPO that would bring We the cash it needs to keep up its torrid growth.”

The WSJ and Bloomberg are reporting that it is SoftBank specifically that wants Neumann to step down. Neither WeWork nor SoftBank is commenting publicly.

It’s a fascinating development, the kind we saw when Uber’s board successfully forced cofounder and longtime CEO Travis Kalanick to abandon his role as CEO. Still, we’d caution against drawing too close a comparison. While the venture firm Benchmark, which spearheaded Kalanick’s ouster, stood to lose billions of dollars if Kalanick dragged down Uber and continued to push off an IPO, Benchmark was not in a do-or-die situation because of its Uber investment.

SoftBank appears to be in more dire straights, making this standoff a particularly meaningful one.

Let’s back up a minute first, though, and consider who is involved and which way this could potentially go. A few days ago, Business Insider put together a useful cheat sheet about WeWork’s board members that may hint at their allegiance.

1.) Ronald Fisher — who is vice chairman at SoftBank Group after founding SoftBank Capital, a U.S. venture arm of SoftBank — joined SoftBank’s board last year. He oversees 114 class A shares, each of which carries one vote. Obviously, he’s going to side with SoftBank.

2.) Lewis Frankfort — the chairman of a fitness studio chain called Flywheel Sports — has been a board member of WeWork for roughly five years, and BI says WeWork once loaned him $6.3 million, which he repaid with interest earlier this year. We have to think he’d stick with Neumann out of loyalty. At the same time, he doesn’t wield much power unless he has the right to block significant actions at the company (some shareholders get these blocking rights; some don’t.) What he know: he controls 2 million shares, and 750,000 of them are Class B shares that carry 10 votes each.

3.) Benchmark, which first backed WeWork in 2012, is represented on the board by Bruce Dunlevie, the founding partner of the venture firm. Benchmark owns 32.6 million Class A shares, and could go either way, seemingly. On the one hand, Benchmark doesn’t want to establish a reputation for pushing out founders after the Kalanick debacle, and if it supports SoftBank over Neumann, it risks this exact thing happening. On the other hand, Benchmark might not want to battle with SoftBank if it thinks it has staying power or it’s concerned (suddenly) that it allowed Neumann to amass too much control.

4.) Harvard Business School professor Frances Frei was brought in roughly a minute ago to add a much-need sprinkling of gender diversity to WeWork’s all-male board. Frei’s name first came to be more broadly recognized when she was hired to help address Uber’s battered culture, so presumably she has ties to Benchmark. We’d guess she’ll side with Dunlevie, meaning that we have no idea whose side she will take.

5.) Steven Langman, the cofounder of private equity firm Rhône Group, has ties that go back a ways with Neumann, and he has benefited richly from the association. According to an April story in the WSJ, Langman met Neumann through a shared rabbi in its earlier days and joined the board in 2012. He also invested in the company (he owns 2.28 million shares, according to a bond filing). Langman is on both the company’s compensation committee and its succession committee. He also runs a real-estate investment vehicle in partnership with We that buys and develops buildings to then lease back to the co-working company, despite that it raises conflict-of-interest questions. We’d guess he’s on Team Neumann.

6.) John Zhao is the chairman and CEO of Hony Capital, which partnered with SoftBank and WeWork to create a standalone entity called WeWork China back in 2017, and Hony has subsequently poured more capital into that subsidiary. We’re not sure how close Zhao is to SoftBank, but if SoftBank brought Hony into WeWork, we’re guessing he will back the Japanese conglomerate on this one. Hony doesn’t own 5 percent or more of WeWork’s parent company so its share holdings aren’t listed publicly.

Neumann, it’s very worth noting, is himself is far more powerful than any of these six individuals. Even after the company recently revised Neumann’s supervoting rights, which gave him 20 times the voting power of ordinary shareholders and now give him 10, he could fire the entire board if he so chooses, notes the WSJ.

Naturally, that wouldn’t be a good look for Neumann, who is already battling growing public perception that, among other negatives for a public company CEO, he smokes a whole lot of pot and that he may be delusional. (A WSJ piece last week reported that Neumann likes to smoke marijuana with friends and while airborne. It also said that Neumann has confided to different people his interest in becoming Israel’s prime minister and president of the world.)

All that said, SoftBank is also fast-losing credibility. While its CEO, Masayoshi Son, has been long revered as a visionary, a growing number of sources we’ve spoken to question the viability of his entire Vision Fund operation. They see WeWork’s ever-soaring valuation on the private market, from $20 billion to, more recently, $47 billion — which was almost single-handedly SoftBank’s doing — as just one in a costly string of poor calls.

Indeed, despite the roughly $10 billion that SoftBank has sunk into WeWork, the financial loss it would take if WeWork falls apart would pale in comparison to the reputational hit Son would suffer, and you can bet there will be ripple effects.

Our suspicion: given the Vision Fund’s impact on the startup industry over the last few years, there’s a lot more riding on what happens with WeWork than meets the eye. Stay tuned.

Powered by WPeMatico

The We Company, parent company of the short-term real estate property management and development company WeWork and other We-related subsidiaries, is reportedly shelving its plans for an initial public offering.

The company’s plans for a public offering have been hampered by questions about its corporate governance and the ultimate value of a company that private investors once thought was worth nearly $50 billion.

Public investors were balking at that sky-high valuation and the company’s questionable governance practices under chief executive officer and co-founder, Adam Neumann, according to The Wall Street Journal, which first reported the news that The We Company would put its offering on hold.

Over the past few weeks, The We Company has made several moves to allay investors’ concerns. The company unwound some particularly egregious transactions with Neumann and added new directors. It also moved to limit Neumann’s power at the company.

Last week, the company amended its prospectus to include the appointment of an independent lead director. It also slashed the strength of Class B and Class C shares so Neumann would not have 20 times the voting power of other shareholders, and removed Neumann’s wife from succession planning at the company.

Even these steps were not enough to comfort Wall Street investors, apparently. Not even the attempts to slash the company’s valuation to below $10 billion could attract enough investor interest to the public offering. And the opacity of The We Company’s reporting and metrics likely did nothing to help matters in the eyes of the investing public.

Now that The We Company is likely to pull its public offering… and with Uber and Lyft underperforming in their first year as public companies, perhaps venture capital firms will rethink the sky-high valuations they’d placed on their portfolio companies. Perhaps it’s time to relearn the lesson that greed may not actually be good.

We have reached out to The We Company for comment and will update with their response.

This story is developing.

Powered by WPeMatico

Home ownership has long been touted as the American dream. But rising rates of mortgage debt and student loan debt are making the pursuit of home ownership a nightmare. Debt-burdened individuals or those with inconsistent or tight cash flow can not only struggle to get credit loan approval when buying a home but also struggle to satisfy monthly mortgage payments even after purchase.

Patch Homes is hoping to keep the proverbial American dream alive. Patch looks to provide homeowners with cash flow and liquidity by allowing them to monetize their homes without taking on debt, interest or burdensome monthly payments.

Today, Patch took another big step in making its vision a far-reaching reality. The company has announced it has raised a $5 million Series A round led by Union Square Ventures (USV), with participation by from Tribe Capital and previous investors Techstars Ventures, Breega Capital and Greg Schroy.

Patch Home looks to partner with homeowners by investing up to $250,000 (with an average investment of ~$100,000) for an equity stake in the home’s value, generally in the 5% to 20% range. Homeowners aren’t subject to any interest or recurring payments and have 10 years to pay back Patch’s investment. Upon doing so, the only incremental money Patch receives is its portion of the change in the home’s value over the course of the 10-year period. If the value of the home goes down in value, Patch willingly takes a loss on its investment.

According to Patch Homes CEO and co-founder Sahil Gupta, one of the major motivations behind the company’s model is to align Patch’s incentives with the homeowners’, allowing both parties to think of each other as trusted partners even after financing. After Patch’s investment, the company provides a number of ancillary services to homeowners, such as credit score monitoring, as well as home value and property tax tracking.

In one instance recounted by Gupta in an interview with TechCrunch, Patch even covered three months of an owner’s mortgage during a liquidity crunch for his small business, allowing him to maintain his home and credit score. Patch is incentivized to provide all services that can help ensure an increase in home value, benefiting both Patch and the homeowner, with the homeowner earning the majority of the asset’s appreciated value.

Additionally, since Patch’s model isn’t focused on a homeowner’s ability to pay back a loan, interest or periodic payments, Patch is able to provide financing to more people. Patch is able to help those with more variable qualifications that struggle to get traditional loans — such as a 1099 contracted worker — monetize their illiquid assets with less harsh or restrictive terms and without increasing their debt burden. Gupta described this as solving the core problem of providing liquidity to asset-rich but cash-flow sensitive people.

Patch is not only looking to provide easier liquidity to more homeowners, but they’re trying to do so faster than traditional lenders. Interested customers can first receive a free estimate of whether Patch will invest in their home or not, how much it’s willing to invest and what percentage equity it will take — primarily based on Patch’s machine learning models that focus on asset, market and location-level attributes.

After the initial estimate, a Patch home advisor will educate the customer on the product and start a formal application process, which includes your standard income and credit score verification, which takes 5-10 days. All-in, homeowners have the ability to get money in as little as 14 days, a significantly shorter timeline than your standard home credit process. Once the investment is made, owners have full freedom with how they use the money.

According to Patch, while its customers come from a diverse set of backgrounds, many either with accumulated debt have to pay down the net or may struggle making monthly payments. The average Patch homeowner uses 40% of the investment to eliminate debt, adds 40% to their savings account or passive income and invests 20% into home improvements.

To date, Patch has raised a total of $6 million and believes the latest round of funding will help scale its operations as they team up with advisors like USV that have experience scaling fintech companies (such as a Lending Club or Carta). The funds will be used to invest in product and Patch’s clearing technology in order to further expedite Patch’s lending process.

Patch also hopes to use the investment to help them gradually expand their footprint, with the goal of eventually having a presence all 50 states. (Patch is currently available in 11 regional markets within California and Washington and expects to be in 18 regional markets by the end of the year including those in Utah, Colorado and Oregon.)

Image via Patch Homes

What makes home ownership so galvanizing for the Patch team? Patch CEO Sahil Gupta spent years putting his Carnegie Mellon financial engineering degree to work in banking and finance, as well as in financial products and strategy positions at fintech startups backed by heavy hitters such as YC and Goldman Sachs.

After realizing the majority of the U.S. population are homeowners, but were struggling to make monthly payments or save for the future, Sahil wanted to figure out to take an illiquid asset like a home and make it easily accessible.

Around the same time, Sahil’s co-founder Sundeep Ambati was working as a contractor on a new business venture of his and was struggling to get a home equity loan. While these circumstances ultimately led Sahil and Sundeep to found Patch Homes in 2016 out of the Techstars New York accelerator program, the deeper motivation behind Patch can be traced back nearly 30 years when Sahil’s father made an equity-sharing agreement with his brother as they were building his family’s home in India.

With a growing family and a pregnant wife, Sunil’s father was adamant about living debt-free, so his brother provided an investment in exchange for an equity stake in the house. According to Sahil, the home is still in the family and has appreciated substantially in value to the benefit of both Sahil’s father and his brother. Longer-term, Patch wants to be the preferred partner for home ownership, helping reduce cash-tight owners’ financial anxiety without the debilitating weight of debt.

“Some companies want to help people buy or sell homes, but home ownership really begins after that point. Patch is built to be inside the home with you and everything that comes thereafter,” Gupta told TechCrunch.

“Patch was created to partner with homeowners to help them unlock their home equity so they can achieve their financial goals along every step of their home ownership journey.

Powered by WPeMatico

Yesterday at TechCrunch’s Enterprise event in San Francisco, we sat down with three venture capitalists who spend a lot of their time thinking about enterprise startups. We wanted to ask what trends they are seeing, what concerns they might have about the state of the market and, of course, how startups might persuade them to write out a check.

We covered a lot of ground with the investors — Jason Green of Emergence Capital, Rebecca Lynn of Canvas Ventures and Maha Ibrahim of Canaan Partners — who told us, among other things, that startups shouldn’t expect a big M&A event right now, that there’s no first-mover advantage in the enterprise realm and why grit may be the quality that ends up keeping a startup afloat.

Jason Green: When we started Emergence 15 years ago, we saw maybe a few hundred startups a year, and we funded about five or six. Today, we see over 1,000 a year; we probably do deep diligence on 25.

Powered by WPeMatico

Flat has raised one of Mexico’s largest pre-seed rounds to take the Opendoor real estate marketplace model across the Rio Grande.

The company snagged a $4.5 million pre-seed round to expand its business helping homeowners quickly sell their properties in Mexico. The round was led by ALLVP, an active early-stage fund in Mexico. California-based Liquid 2 Ventures (for which Hall of Fame quarterback Joe Montana is a GP), NextBillion and a few angels supported the round, as well.

At the time of writing, Flat’s raise is the largest pre-seed funding round for a Mexican startup aside from the scooter company, Grin, which was backed by Y Combinator and later went on to raise a $45 million Series A and consolidate with Brazil’s bike-sharing startup, Yellow.

While this ‘i-buying’ business model was initially pioneered by Opendoor in the U.S., the same need to efficiently sell property exists for consumers in other growing markets around the world. That’s why co-founders Victor Noguera and Bernardo Cordero founded Flat.

Bucking a trend that has seen many new Latin American founders hailing from Stanford University, Cordero and Noguera met at the University of California, Berkeley — just across the bay.

The founders estimate the total value of the 40 million homes in Mexico to be a $1.6 trillion total addressable market. They equate the value of homes sold per year to $25 billion. Let’s not forget the elephant in the room — SoftBank is undoubtedly eyeing Mexico with its $5 billion LatAm commitment.

Flat says it’s solving a few problems in the local home-buying market in Mexico. Firstly, anyone interested in selling their property lacks information about how much their home is actually worth. In the U.S., sellers can reference Zillow — but no such centralized database of real estate pricing information for the market of Mexico exists.

Then there’s the operational piece of transferring ownership of the property, which Flat says can take up to eight months and is a notarized process — making the overall experience incredibly illiquid.

Flat’s actual product is a marketplace focused on helping the seller sell quickly. Flat visits your home, takes measurements, documents how many bathrooms and bedrooms exist in the property and determines how much your home is worth. From there, they manage renovations and transfer ownership of the property. The seller is paid within 72 hours.

International expansion has been difficult for many startups operating in Latin America as every country has its own regulatory barriers. That’s why when it comes to growth, Flat says it’s more focused on growing out their product within other verticals of property management to only serve a Mexican market, rather than expand to other Spanish-language countries in the LatAm region.

Powered by WPeMatico

The day of reckoning for the “flexible office space as a startup” is coming, and it’s coming up fast. WeWork’s IPO filing has fired the starting gun on the race to become the game-changer both in the future of property and real estate but also the future of how we live and work. As Churchill once said, “we shape our buildings and afterwards our buildings shape us.”

Until recently, WeWork was the ruler by which other flexible-space startups were measured, but questions are now being asked if it deserves its valuation. The profitable IWG plc, formerly Regus, has been a business providing serviced offices, virtual offices, meeting rooms and the rest, for years, and yet WeWork is valued by 10 times more.

That’s not to mention how it exposes landlords to $40 billion in rent commitments, something which a few of them are starting to feel rather nervous about.

Some analysts even say WeWork’s IPO is a “masterpiece of obfuscation.”

Powered by WPeMatico

Brick & Mortar Ventures, a young, San Francisco-based venture firm that’s focused on startups innovating in or around architecture, engineering, construction and facilities management, has closed with $97.2 million in capital commitments.

The fund is one in a sea of debut funds that have swung open their doors in recent years, though it’s also interesting for numerous reasons, beginning with its founder, Darren Bechtel, who knows a thing or two about the building industry. He’s a scion of the family that built the 120-year-old, privately held company Bechtel into one of the largest construction and engineering firms in the world. In fact, his brother, Brendan, who was named CEO in 2016, represents the fifth generation of Bechtels to lead the company. (Their sister, Katherine, is a project controls manager with the powerhouse outfit.)

Brick & Mortar’s investors are just as notable. They aren’t the typical pension funds and university endowments that many VCs try hard to lock down. Instead, they comprise a long list of companies that are part of the “construction value chain” and so have an interest in the latest and greatest developments in their respective industries. Among the firm’s backers, for example, is the special materials maker Ardex; the software giant Autodesk; the building materials company CEMEX; Ferguson Ventures, which is the venture arm of a huge U.S distributor of plumbing supplies; FMI, a management consulting company to the engineering and construction industry; Obayashi, a major Japanese construction company; Sidewalk Labs, which is Alphabet’s urban innovation organization; and United Rentals, one of the world’s largest equipment rental companies.

Brick & Mortar isn’t the first venture firm to focus on the so-called built world. Other firms that focus largely, if not exclusively, around the same themes include Fifth Wall Ventures, Navitas Capital, Corigin Ventures, Camber Creek, MetaProp, Starwood Capital and Tamarisc Ventures.

In fact, Darren Bechtel has ties to and is an individual investor in Fifth Wall, an LA-based firm that stormed onto the scene in 2017 with an equally impressive, and very different, roster of limited partners in the real estate industry, from which it has already amassed more than $700 million in capital commitments across two funds.

As Bechtel told us on a call late last week, he was going to go into business with Fifth Wall’s founders initially, but they wanted to raise a lot of money, and Bechtel was thinking more conservatively — for a reason. “I’d done five deals on AngelList with [Fifth Wall co-founder] Brendan [Wallace] and we’d started putting together a pitch deck, and as we were thinking through ideal fund structure and size, Brendan said $500 million and I said $50 million,” says Bechtel.

Wallace was thinking big, says Bechtel, because “hospitality already had some massive players — Airbnb, WeWork. It was a far more mature landscape, and Brendan thought that if we were going to own a category, we needed the capital to secure a leadership position in the right deals.”

Bechtel thinks Wallace was right, too. He says he just came to realize that construction tech — which is what really interested him — was in its own league, and it was in its infancy. Though the construction software company PlanGrid took off like gangbusters — Bechtel wrote the largest check during the company’s seed round — it wasn’t so long ago that “there were great, billion-dollar ideas being formed but the rounds were small and the valuations were small,” says Bechtel. Because the “investment community didn’t understand what it was looking at, I had concerns about our ability to generate returns if we had too large a fund.”

In the end, the friends and former Stanford MBA classmates decided to split their respective focus on real estate and hospitality (Fifth Wall) and the actual construction of buildings (Brick & Mortar), and things seem to have gone well since. As Fifth Wall has gained traction, so too has Brick & Mortar, which is now a couple of years in the making. Indeed, though Bechtel is announcing the close of Brick & Mortar’s first fund today, he already works with two principals and two associates, and they’ve collectively sourced and funded 16 startups to date with capital they’ve been raising from investors along the way.

One of those checks went to Fieldwire, a maker of field management software for construction teams. They’ve also backed Serious Labs, which trains workers how to use heavy equipment and tools via virtual reality software, and Curbio, a real estate technology startup that orchestrates turnkey renovations for home sellers, then gets paid back once the home is sold.

Brick & Mortar even has an exit already, having helped fund the construction software platform BuildingConnected, which sold last December to Autodesk. (Bechtel’s earlier investment in PlanGrid, which also sold to Autodesk last year, was a personal investment, one of roughly 40 he made before setting out to create a traditional venture firm.)

As for whether Brick & Mortar ever hunts for companies that Bechtel — the firm founded by Darren’s great-great-grandfather — might like to acquire or otherwise partner with, Darren is quick to note that the firm is not an investor in his venture fund or any or its portfolio companies, and he doesn’t have his finger on the pulse of what’s happening there.

“I don’t work at Bechtel or pretend to know what their intentions are, though my brother is CEO, so you could say I know a guy there.”

More, he notes, he doesn’t think it would make sense to fund a company that “a user would want to acquire. If one user buys [a startup’s tools] because they want exclusivity, they’re limiting the exit value of that company.” To underscore his point, he notes that “Bechtel does around $30 billion a year, but the construction market is an $11 trillion market.” In the end, he says, it’s “better to have a preferred relationship. Maybe you get the next year’s model released early; maybe you get custom colors.” But if you’ve developed a winning product, you want to make it accessible to everyone. “You benefit the most by having a technology adopted by the whole industry.”

Above, the Brick & Mortar Ventures team. From left to right: Austin Yount, senior associate; Alice Leung, associate; Curtis Rodgers, principal; Darren Bechtel, general partner; and Kaustubh Pandya, principal.

Powered by WPeMatico

Vacasa, a provider of vacation rental management services akin to Airbnb, has agreed to acquire Wyndham Vacation Rentals from Wyndham Destinations.

Portland-based Vacasa will pay Wyndham a total of $162 million, including at least $45 million in cash at closing and upwards of $30 million in Vacasa equity.

Vacasa, founded in 2009, has raised $207.5 million in venture capital funding to date from investors such as Assurant Growth Investing and NewSpring Capital.

Its acquisition of Wyndham Vacation Rentals will bring a number of brands, including ResortQuest, Kaiser Realty and Vacation Palm Springs, under its ownership and will expand its portfolio to include 9,000 new properties.

“We are excited to partner with the pioneering company in the short-term rental industry that helped make vacation homes popular for so many families around the world,” Vacasa founder and chief executive officer Eric Breon said in a statement. “Combining Wyndham Vacation Rentals’ decades of operational excellence with Vacasa’s next-generation technology will deliver the industry’s best vacation rental experiences.”

The deal comes amid a period of growth for the Oregon business, which says it expects to bring in more than $1 billion in gross bookings and roughly $500 million in net revenue in the next year.

The acquisition, announced this morning, is projected to close this fall.

Powered by WPeMatico