real estate

Auto Added by WPeMatico

Auto Added by WPeMatico

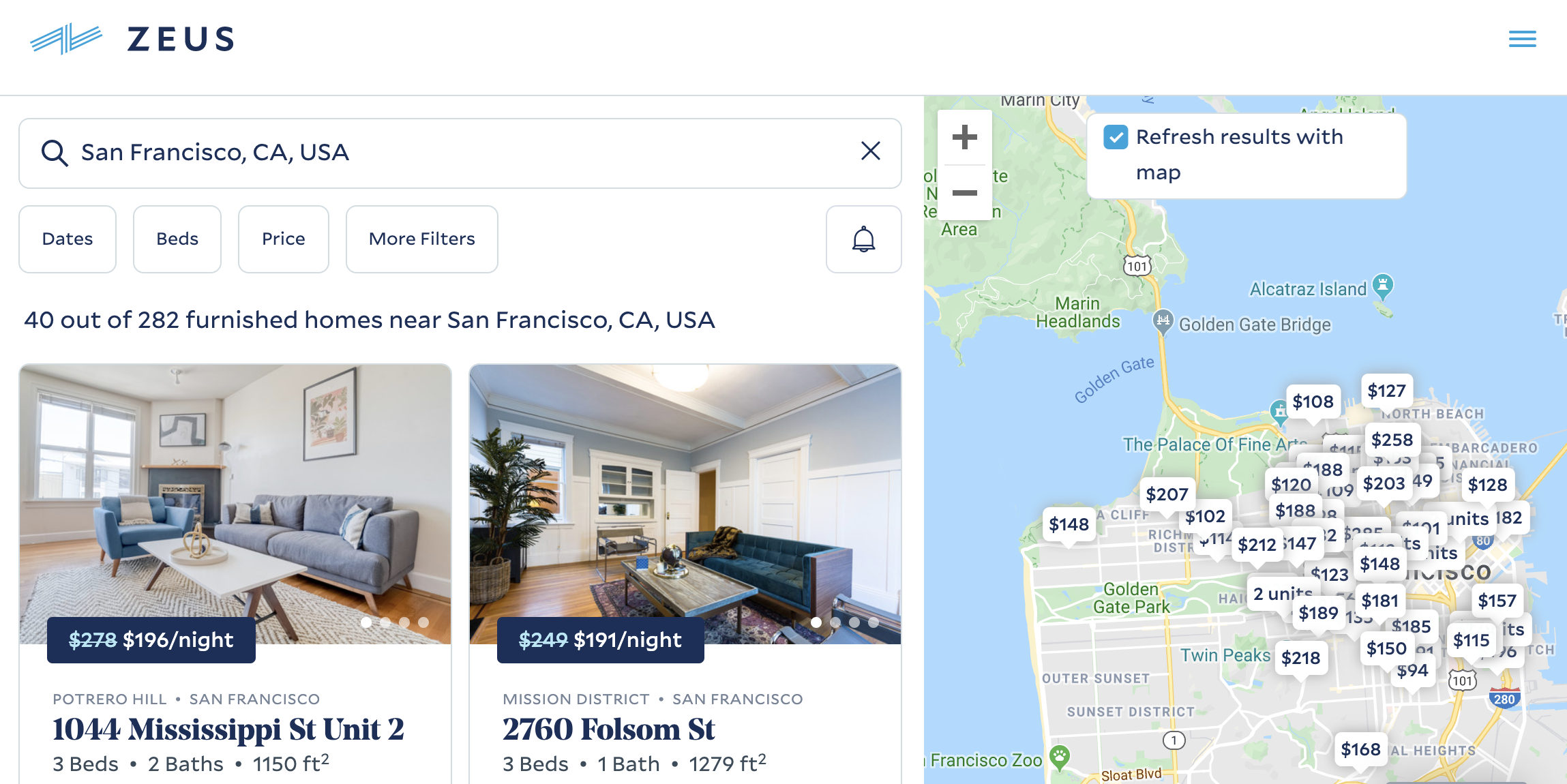

As Airbnb absorbs more and more of the demand for housing, it’s exploring how to monetize opportunities beyond vacation rentals. A marketplace for longer-term corporate housing could be a huge business, but rather than build that itself, Airbnb is making a strategic investment in one of the market leaders called Zeus Living, which will list its homes on the Airbnb site.

In just four years of redecorating landlords’ homes and renting them to relocated workers for 30-day stays (or longer), Zeus Living has grown to a $100 million revenue run rate. It boosted revenue 300% in 2019, and now has 250 employees and more than 2,000 homes under management. Zeus makes money by charging landlords one free month of usage, and marking up the rent charged to customers. It could rent out a $4,000 per month home for $5,000 plus take the extra month to earn $16,000 in a year.

Zeus CEO and co-founder Kulveer Taggar tells me, “I fundamentally believe that a lot of human potential is bound by location. At Zeus, we’re deeply committed to making it easier for people to live where opportunity takes them.” It’s already hosted 27,000 residents for a total of 650,000 nights.

Strong margins, swift momentum and that megatrend of more mobile workforces have earned Zeus Living a new $55 million Series B round it’s announcing on TechCrunch today. The funding comes from Airbnb, Comcast, CEAS Investments and TI Platform Management, plus existing investors Alumni Ventures Group, Initialized Capital, NFX and Spike Ventures. The funding comes at a $205 million post-money valuation.

“The opportunity here is huge, consumer spend is going toward housing and everyone needs to stay somewhere. But it’s Kulveer and Zeus’ go-to-market strategy that is impressive,” says Initialized co-founder and managing partner Garry Tan. “Zeus decided to start with corporate rentals, which we believe is the best go-to-market since it is the highest margin, and capital efficiency wins in a space with many competitors. Corporate needs are longer term, consistent and predictable, and partnering with Airbnb strengthens this approach as they expand to build a platform for every city.”

Zeus co-founder and CEO Kulveer Taggar

Zeus previously raised a $2.5 million seed and then an $11.5 million Series A led by Initialized, as well as $10 million in debt to cover taking on properties in the San Francisco Bay Area, Los Angeles, New York, Seattle and D.C. Now that it’s scaling up, Zeus could add a sizable debt facility to cover the risk of filling apartments with employees from clients like Brex, Disney, ServiceTitan and Samsara.

Instead of moving into a bland corporate housing block, struggling to find a place themselves or ending up in expensive long-term Airbnbs, workers moving to new cities can go to Zeus. It takes over apartments, handles maintenance and fills them with branded comforts like Parachute bedding and Helix mattresses that Zeus gets at bulk rates. The startup is betting that as workers move between jobs and cities more frequently, fewer will own furniture and instead look for furnished homes like those Zeus offers.

Thanks to the premium stays it provides, Zeus can charge clients a lucrative rate, while Taggar claims his service is still about half the price of standard corporate housing. For property owners, Zeus makes it easy to get a consistent rent paycheck with none of the traditional landlord work. Zeus takes care of cleaning and key exchanges so owners don’t need to do any chores like if they were running an Airbnb. Its goal is to get the first renters in within 10 days of taking on a property.

The new funding will help Zeus expand to more neighborhoods and cities while retaining a focus on breadth within each market so clients have plenty of homes from which to choose. The startup will be revamping its booking and invoicing tools for enterprise partners, and improving how it sources real estate. Meanwhile, it will be investing in customer care to maintain its high 70s NPS scores so relocated workers brag to their colleagues about how nice their new place is.

“Finding housing is stressful and time-consuming for both individuals and employers. As someone who has moved countries four times, I’ve lived through that tension,” says Taggar. “Zeus Living has built technology to remove complexity from housing, turning it into a service that enables a more mobile world.”

Taggar got into the real estate business early, remortgaging his mom’s house to buy a condo in Mumbai to rent out. After moving to the U.S., he built and sold Y Combinator-backed auction tool Auctomatic with co-founder and future Stripe starter Patrick Collison. It was while working on NFC-triggered task launcher Tagstand that Taggar recognized the hassle of both finding new corporate housing and reliably renting out one’s home. With Uber, Stripe and more startups growing huge by simplifying processes that move a lot of money around, he was inspired to do the same with Zeus Living.

“Modern professionals travel more frequently, stay longer and seek accommodations that feel like home. As more companies look to Airbnb for Work for extended-stay and relocation solutions, this segment remains a key focus for Airbnb,” says David Holyoke, global head of Airbnb for Work.

“We have great alignment with the Airbnb team in terms of serving the changing needs of business travelers that want the comforts of home when traveling for extended 30-day stays for work or a project,” Taggar follows. Airbnb can help Zeus drive demand thanks to all its inbound traffic, while Zeus offers Airbnb more supply for customers seeking longer stays.

Zeus Living’s co-founders

Zeus’ biggest threat is that it could get overextended, misjudge demand and end up on the hook to pay rent for two-year leases it can’t fill. And now with more funding, there will be added scrutiny regarding its margins, especially in the wake of the WeWork implosion.

Taggar recognizes these threats. “This is a business where we have to be focused on maximizing the gross profit we generate for the investments we make, with the least amount of risk. At Zeus Living, we’re continuously improving the ways we predict and secure demand.” He’s also building out teams on the ground in different markets to ensure regulatory compliance and push for more conducive laws around 30-day (or longer) rental stays.

Property tech has become a heated space, though, so Zeus will have heavy competition. There are traditional corporate housing providers, pure marketplaces that don’t deal with logistics and direct competitors like $66 million-funded Domio and juggernaut Sonder, which has raised a whopping $360 million. Zeus might also see its model copied abroad before it can get there. Over time, landlords and real estate investment trusts like Blackstone could force Zeus, Sonder and others to compete to pay them the most for leases, eating into all the startups’ margins.

At least with Airbnb as an investor, Zeus won’t have to fear a bitter battle with the tech giant over corporate housing. Instead, Airbnb could keep investing to coin off this adjacent market while listing Zeus properties, or potentially acquired the startup one day. For now though, Taggar just wants to prove startups can be accountable in the real world, acknowledging that taking over people’s homes is “a lot of responsibility! Our homes represent hundreds of millions of dollars of assets we manage and we take that very seriously.”

Powered by WPeMatico

The property industry — covering people and businesses that invest in, build, purchase or rent and maintain property — is hugely fragmented when it comes both to data sources and the companies that work within it. Today, a New York-based startup that is building a database that helps bring all of that together is raising a round of growth funding to help it expand outside of the U.S.

Reonomy — a startup that ingests some 100 sources of data, including multiple public and proprietary data feeds and crowdsourced information, and then uses artificial intelligence to crunch it to provide market intelligence that is used by developers, investors, acquirers and anyone else who works in the area of commercial property (otherwise known as commercial real estate, CRE, ranging from buildings zoned for business through to multi-dwelling units, but not single private homes) — has closed a Series D round of $60 million.

Today, the company has more than 100,000 customers — with single customers sometimes covering multiple users — along with a database covering some 50 million properties, accounting for some 99% of the commercial inventory in the country. In all, the database also has 80 million companies, 300 million people (those affiliated with the properties), 38 million mortgages and 68 million property sales.

It’s also continuing to add more data sources: along with this round, Reonomy is announcing new partnerships with CoreLogic, Black Knight and Dun & Bradstreet.

The money comes from a mix of financial and strategic backers — underscoring both the company’s potential, and also the calibre of its current customers. Led by Georgian Partners, the funding also included Wells Fargo Strategic Capital and Citi Ventures (both Reonomy users, as part of its property financing activities), Untitled Investments and previous investors Sapphire Ventures, Bain Capital and Primary Venture Partners.

Reonomy is not disclosing its valuation, but Rich Sarkis, the founder and CEO, said that it is “definitely an up round.” The startup, founded in 2013, has raised $128 million to date, and according to PitchBook data, it was valued at $153 million post-money in its last round (in 2018). This likely means the valuation is well above $200 million now.

The expression “safe as houses” was born out of the idea that property is a strong bet, because the price eventually always goes up. But the wider development of the market in modern times has shown that it can be a significantly more volatile area — where arcane algorithms created by quants, a lot of greed and a dose of corruption and world economics can have much stronger impacts, resulting in huge booms and crushing busts of global proportions.

In that context, Reonomy positions itself both as a tool not just to get a better picture of what is going on now, but to better predict what might happen. Given the many disparate sources of information that are compiled into its bigger database, the pitch is that this is a must-have, but the alternative way to get it — building on your own — might otherwise require many man-hours and dollars of investment to achieve and understand.

While some database platforms require technical knowledge to shape and query, the idea here is to “lead users to the water” and make the proposition very non-technical.

The potential usefulness of Reonomy’s insights can have many endpoints, Sarkis said. While one obvious area is in sales, it’s also just as used in areas of research and more. Its customers include not just mortgage lenders and property acquirers, but those who work in the property industry in a more hands-on way, such as roofers who might want to get a list of buildings developed in a certain range of years as a way of building a list of leads for properties that might need a roof replacement.

“What our customers have in common is that they are looking for a solution to understand something about the property market,” he said. “We take the mess of data out there and make sense of it, whether the person using Reonomy is an investor or a roofer or someone that is underwriting loans.”

The company today, Sarkis said, covers about 99% of all commercial real estate in the U.S., and the plan is now to take that concept to international markets, including Canada, Asia, Australia and the U.K. and Europe, markets that are more similar to the U.S. than they are different, he added.

“Reonomy has developed a powerful platform to integrate and resolve sources of commercial real estate data into a single, unique identifier for every CRE asset in the United States,” said Emily Walsh, principal at Georgian Partners, in a statement. “This unique identifier is being leveraged by some of the largest enterprises in the world to tie together their public, proprietary and 3rd party data sources and to create a level of visibility into real estate assets that was previously unattainable.”

Powered by WPeMatico

Following the death of five people at a Halloween party hosted at a California Airbnb rental, and a scathing Vice report outlining Airbnb’s failure to prevent nation-wide scams, the company says it will begin verifying all seven million of its listings.

Airbnb properties will soon be verified for accuracy of photos, addresses, listing details, cleanliness, safety and basic home amenities, according to a company-wide email sent by Airbnb co-founder and chief executive officer Brian Chesky on Wednesday. All rentals that meet the company’s new standards will be “clearly labeled” by December 15, 2020, he notes. Beginning next month, Airbnb will rebook or refund guests who check into rentals that do not meet the new accuracy standards.

The long-awaited updates to Airbnb’s security measures come months before the company plans to complete an initial public offering or direct listing and just days after Chesky announced the business would ban “party houses,” and work harder to combat unauthorized parties and abusive host and guest conduct.

“We believe that trust on the internet begins with verifying the accuracy of the information on internet platforms, and we believe that this is an important step for our industry,” Chesky said in the staff email.

Airbnb also will launch a 24/7 Neighbor Hotline, which will allow guests to reach a real Airbnb employee from any location at any time. The company will fully roll-out the service next year. Finally, Airbnb will expand its screening of potentially high-risk reservations globally next year.

The new efforts are led by Margaret Richardson, Airbnb’s vice president of trust, who Chesky tasked with rapidly formulating a response to the Halloween party massacre. The company has also tapped Charles Ramsey, former chief of the Philadelphia and Washington, D.C. police departments, and Ronald Davis, the former chief of the East Palo Alto police department, to advise the projects.

“More than eleven years after Joe, Nate, and I started Airbnb, I have been asked what has surprised me most about the world,” Chesky writes. “My answer is two things: that people are, in fact, fundamentally good, and that we are 99% the same. We still believe this, and with these changes, we hope to continue to demonstrate this to the world.”

Powered by WPeMatico

Software development companies tackling services for niche industries, like commercial real estate subcontracting, continue to find Los Angeles to be fertile ground for development.

The latest company to raise funding from a clutch of investors is BuildOps, which raised $5.8 million in seed financing from some big names in the Los Angeles tech ecosystem.

Led by Fika Ventures, with additional investments from MetaProp VC, Global Founders Capital, CrossCut Ventures, TenOneTen, IGSB, 1984 Ventures, L2 Ventures, GroundUp, NBA all-star Metta World Peace, Oberndorf Enterprises, Wolfson Group and scouts from Sequoia Capital, the new financing will be used to support the company’s continued growth.

BuildOps sells software that integrates scheduling, dispatching, inventory management, contracts, workflow and accounting into a single software package for commercial real estate contractors with staff ranging from a few dozen to several hundred employees.

Software for the service industry is nothing new for Los Angeles entrepreneurs. The unicorn ServiceTitan hails from the greater Los Angeles area and a number of other software as a service businesses are calling the greater Los Angeles area home.

It’s hard to argue with the size of the commercial construction market. Over the past three years, commercial construction spending grew from $626 billion to $807 billion, according to data provided by the company. And while most large vendors — architects, general contractors and property management companies — have some project management software, the fragmented group of subcontractors that provide services to those customers has remained resistant to adopting new technologies, the company said.

The firm was co-founded by former ServiceTitan developer Neeraj Mittal; Microsoft, Nextag, Swurv and Fundly former executive Steve Chew; and Alok Chanani, who previously founded a commercial real estate company and was a former commander of a transportation unit of the Army in Iraq.

“At BuildOps, we are on a mission to bring a true all-in-one solution on the latest technology to the people who keep America’s hospitals, power plants and commercial real estate running. We are privileged to be working closely with some of the country’s top commercial contractors,” said Chanani.

That sentiment is echoed by Liquid 2 Ventures managing partner and former National Football League superstar, Joe Montana .

“Liquid 2 Ventures has an investment thesis in supporting America’s working class and I just love the idea of making their lives far easier and better. You have one solution that does it all and talks seamlessly to every single part of their business from parts to ordering to inventory and more,” said Montana in a statement. “There are very few world-class technology solutions for commercial subcontractors like this and we believe in the founders.”

Powered by WPeMatico

The founders of Seattle-based Modus cold-emailed Pete Flint, the founder of Trulia and a current managing partner at the venture capital firm NFX, for months, to no avail. In a last-ditch effort, Alex Day, Jai Sim and Abbas Guvenilir sent one more message to the investor whose real estate listings tool sold to Zillow in 2014 for $3.5 billion. They were at a coffee shop below his San Francisco office, was he interested in meeting?

Fortunately for them, he was.

Modus co-founders Abbas Guvenilir (left), Jai Sim, Alex Day (right)

Modus, a real estate startup focused on title and escrow services, is today announcing a $12.5 million Series A financing co-led by NFX’s Flint and Niki Pezeshki of Felicis Ventures. Liquid 2 Ventures and existing backers, including Mucker Capital, Hustle Fund, 500 Startups, Rambleside and Cascadia Ventures, also participated in the round.

“The first revolution in online real estate was transforming the research experience, the next revolution in the industry is transforming the transaction,” Flint said in a statement.

Modus launched in 2018 with a focus on Washington (state) real estate opportunities. The startup, led by former employees of a nearly defunct lunch delivery company, Peach, has developed software to help both agents and home buyers navigate the home closing process, which, unlike many other real estate experiences, has yet to receive a boost of innovation from startups building in the sector. That’s why Modus started with an emphasis on escrow services, though the team’s long-term vision, they explain, is to power all real estate transactions.

“When you think about communication, you think of Gmail; when you think of traveling, you think of Uber. We want to be synonymous with home closing,” Sim, the company’s executive chairman, tells TechCrunch.

Day, Modus’ chief executive officer and former head of expansion at Peach, says Modus has ambitions of becoming a sort of operating system for real estate, or “like what Stripe is for payment processing, we want to become for real estate transactions.”

Since closing its Series A financing in May — the team waited until now to make its financing information public — Modus has increased its headcount to 50 employees across product, engineering and operations. Their goal now is to provide their software to home buyers in 15 to 20 states over the next two years. To support expansion efforts, Modus plans to raise a Series B in the second or third quarter of next year.

Modus previously raised $1.8 million in seed funding.

Powered by WPeMatico

WeWork co-founder Adam Neumann didn’t plan for his family’s control of WeWork to end at his death but instead expected to pass that control to future generations of Neumanns, too, says Business Insider.

The outlet reports that in a speech Neumann gave to employees in January of this year, footage of which it says it has viewed, Neumann is seen saying that WeWork isn’t “just controlled — we’re generationally controlled.” He reportedly goes on to say that while the five children he shares with wife Rebekah Neumann “don’t have to run the company,” they “do have to stay the moral compass of the company.”

According to BI, Neumann even invoked his future grandchildren, telling those gathered: “It’s important that one day, maybe in 100 years, maybe in 300 years, a great-great-granddaughter of mine will walk into that room and say, ‘Hey, you don’t know me; I actually control the place. The way you’re acting is not how we built it,’” he said.

These may sound like more outlandish proclamations from Neumann, who has a flair for the dramatic. (Talking to Fast Company earlier this year, he compared WeWork to a rare jewel, asking, “Do you know how long it takes a diamond to be created?”)

But before WeWork began coming apart at the seams, Neumann had every reason to believe that he could pass power down to his heirs. Though many public shareholders may not realize as much, a growing number of tech founders enjoy the kind of dual-class shares that Neumann had extracted from investors, shares that don’t merely give founders more voting power for a while after their companies go public or even throughout their lifetimes, but whose power can be passed down to their children, too.

We wrote about this very issue as a kind of hypothetical last month, quoting SEC Commissioner Robert Jackson, a longtime legal scholar and law professor, who told an audience last year that nearly half of companies that went public with dual-class shares between 2004 and 2018 gave corporate insiders “outsized voting rights in perpetuity.”

Warned Jackson, “Those companies are asking shareholders to trust management’s business judgment — not just for five years, or 10 years, or even 50 years. Forever.” Such perpetual dual-class ownership “asks them to trust that founder’s kids. And their kids’ kids. And their grandkid’s kids . . . It raises the prospect that control over our public companies, and ultimately of Main Street’s retirement savings, will be forever held by a small, elite group of corporate insiders — who will pass that power down to their heirs.”

You might argue that it’s senseless to worry, that the market will speak as it did in WeWork’s case. But not every company has such apparent flaws, and Neumann could have made himself a lot harder to shake than he did. In fact, the broader question the video raises is whether anyone will step in to stop the broader trend, or if public market investors will be living with the consequences down the road instead.

Neumann wasn’t insane to imagine the scenario that he did. That doesn’t mean it’s rational. Giving founders super-voting shares for some period after transitioning onto the public market, we can understand. Giving founders so much power that their kids call the shots of these publicly traded companies? Now that is crazy.

Powered by WPeMatico

Airbnb may be another overvalued “unicorn,” but it’s no WeWork.

The Information this morning reported new Airbnb financials — indicating a massive increase in operating losses — that immediately call Airbnb’s future into question. Precisely, Airbnb lost $306 million on operations on $839 million in revenue, namely as a result of marketing spend, in the first quarter of 2019. In total, Airbnb invested $367 million in sales and marketing, representing a 58% increase year-over-year, in Q1. The company is gearing up for a major liquidity event next year and is making a concerted effort to rake in new customers, as any soon-to-be-public business would.

Given WeWork’s sudden demise, coupled with Uber and Lyft’s lukewarm performances on the stock markets, many have wondered how Wall Street will respond to Airbnb’s eventual IPO prospectus. Will money managers have an appetite for another over-valued Silicon Valley darling? Or will the market compete like mad for shares in the massive home-sharing marketplace?

But Airbnb, again, is no WeWork, and I wager Wall Street will have a much friendlier approach to its offering. For one, Airbnb’s co-founder and chief executive officer Brian Chesky isn’t dropping $60 million on private jets — I don’t think. CEO behaviors aside, Airbnb has more capital in the bank than it has raised in its entire 11-year history, which is a whole lot of money. This is all according to a source who is familiar with Airbnb’s financials and shared this detail with TechCrunch following The Information’s Thursday morning report. As for Airbnb, the company told TechCrunch, “we can’t comment on the figures, but 2019 is a big investment year in support of our hosts and guests.”

Airbnb’s CEO Brian Chesky speaks at TechCrunch Disrupt SF 2014

Airbnb has attracted more than $3.5 billion in equity funding at a $31 billion valuation and has even more locked away in its bank account. Additionally, Airbnb has an untouched $1 billion credit line, the source said. Presumably, the referenced credit line is the 2016 $1 billion debt financing from JPMorgan, CitiGroup, Morgan Stanley and others.

Moreover, Airbnb has been “cumulatively” free cash flow positive for some time, meaning that it’s seen more money coming in than going out during recent quarters, according to our source. It has been reported that Airbnb surpassed $1 billion in revenue in the second quarter of 2019 and in the third quarter of 2018, but we’re guessing the business did not top $1 billion in Q4 of 2018 or Q1 of 2019 because it if had, that information would probably have been “leaked.”

Finally, Airbnb has been profitable on an EBITDA (earnings before interest, taxes, depreciation and amortization) basis for two consecutive years, the company announced in January. Gross bookings, meanwhile, are growing, as is Airbnb’s business offering and its experiences product.

Powered by WPeMatico

MyGate, a Bangalore-based startup that offers security management and convenience service for guard-gated premises, said today it has bagged more than $50 million in a new financing round as it looks to expand its footprint in the nation.

Chinese internet giant Tencent, Tiger Global, JS Capital and existing investor Prime Venture Partners funded the three-year-old startup’s $56 million Series B financing round. The new round pushes MyGate’s total fundraise to $67.5 million.

MyGate offers an eponymous mobile app that allows home residents to approve entries and exits, communicate with their neighbors, log attendance and pay society maintenance bills and daily help workers.

The startup says it is operational in 11 cities in India and has amassed over 1.2 million home customers. Its customer base is increasing by 20% each month, it claimed. The service is handling 60,000 requests each minute and clocking over 45 million check-in requests each month.

The idea of MyGate came after its co-founder and CEO, Vijay Arisetty, left the Indian armed force. In an interview with TechCrunch, he said his family was appalled to learn about the poor state of security across societies in India.

“This was also when e-commerce companies and food delivery firms were beginning to gain strong foothold in the nation. This meant that many people were entering a gated community each day,” he said.

MyGate has inked partnerships with many e-commerce players to create a system to offer a silent and secure delivery experience for its users. The startup also trains guards to understand the system.

According to industry estimates, more than 4.5 million people in India today live in gated communities, and that figure is growing by 13% each year. The private security industry in the country is a $15 billion market.

Arisetty says he believes the startup could significantly accelerate its growth as its solution understands the price-sensitive market. Using MyGate costs an apartment about Rs 20 (28 cents) per month. Even at that price, the startup says it is making a profit. “Today, we are seeing more demand than we can handle,” he said.

That’s where the new funding would come into play for the startup, which today employs about 700 people.

The startup plans to use the fresh capital to expand its technology infrastructure, its marketing and operations teams and build new features. The startup aims to reach 15 million homes in 40 Indian cities in the next 18 months.

In a statement, Sanjay Swamy, managing partner at Prime Venture Partners, said, “It’s been great to see a fledgling startup execute consistently and holistically, and grow into a category-creating market-leader.”

Powered by WPeMatico

Days out of Y Combinator, venture capitalists valued ZeroDown, a financial and real estate technology startup, at $150 million, the company has confirmed. The startup had the perfect match of experienced founders and eye-popping ambitions to carve a new path to home ownership.

“I think we will be known as a company that makes it easier to buy a home in every single aspect,” ZeroDown co-founder and chief executive officer Abhijeet Dwivedi tells TechCrunch.

The startup, which has raised $30 million in total equity funding and more than $110 million in debt financing to help Bay Area residents make down payments on homes, now plans to take on Zillow and Redfin with its new home search engine.

The business, founded by former Zenefits chief operating officer Dwivedi, Laks Srini, Zenefits’ former chief technology officer, and Hari Viswanathan, a former Zenefits staff engineer, was founded last year and quickly landed backing from Sam Altman, followed by consumer technology venture capital fund Goodwater Capital. Targeting those in the Bay Area, where costs of home ownership are amongst the highest in the country, ZeroDown charges $10,000 to purchase your home outright and front your entire down payment.

That is, however, if your home is priced between approximately $550,000 and $1,750,000 and you have an individual or combined salary of more than $200,000, stock options and some money put away (or some variation of this). If you meet these criteria, ZeroDown will purchase your home and lease it to you. The goal is to eliminate one of the largest pain points of home-buying, the down payment, and facilitate more real estate purchases.

The company says it intends to expand the service outside the greater San Francisco area to cities like Denver, Seattle and Austin, but given the $10,000 price tag and large population of wealthy tech workers in the Bay, the business could flourish in this area without expanding.

With the launch of its home search engine, Dwivedi says users will be able to learn about more than just the square footage of a home. The tool tells users whether a potential home is naturally lit, if it has a large backyard, if it has a decent commute to your work and to various schools and, most importantly, whether it’s dog friendly.

ZeroDown has also partnered with a number of San Francisco-based tech companies, including Pinterest, Postmates and Square, to provide their employees a rebate if they choose to purchase a home using ZeroDown.

“We know first-hand what companies need to support a great quality of life and keep their employees in the Bay Area,” Dwivedi said. “A part of that is loving where you live — feeling part of a local community.”

Powered by WPeMatico

Opendoor has named Gautam Gupta its chief financial officer and chief business officer, critical roles as the business continues to alter the way in which homes are bought and sold. Uber’s former head of finance, Gupta joined the $3.8 billion home-selling platform as its chief operating officer in 2017.

The company, which has raised more than $4 billion in debt and equity funding to date, is announcing several new hires this morning. Venrock’s Tom Willerer has joined as the company’s first-ever chief product officer. Willerer previously led product at Coursera and Netflix. He joined the Silicon Valley venture capital firm Venrock in 2017 and has since struck deals with edtech startups including Make School and Flockjay.

Opendoor has also hired Julie Todaro as its president of homes and services, another newly created role. Todaro, who spent more than a decade at Amazon, most recently as its vice president of consumer electronics, will oversee market operations, customer experience and home services.

Finally, Carrie Wheeler, a partner at TPG for 20 years, and Jason Kilar, the founding CEO of Hulu, have joined Opendoor’s board of directors.

Founded in 2014, San Francisco-based Opendoor is backed by General Atlantic, Hawk Equity, SoftBank, Access Technology Ventures, Lennar Corporation, Fifth Wall Ventures, SV Angel, Norwest Venture Partners, NEA, GGV Capital, Khosla Ventures, GV and more.

Powered by WPeMatico