real estate

Auto Added by WPeMatico

Auto Added by WPeMatico

Hammock, a U.K. fintech/proptech helping landlords and property manages gain better oversight on the financial health of their rental properties, has raised £1 million in seed funding as it readies the launch of a current account.

Backing comes from Fuel Ventures and Ascension Ventures, joining existing investors that include Founders Factory and various unnamed angels. Hammock was incubated within Founders Factory Studio, and in the last 12 months has on-boarded onto its platform more than 1,700 managed properties, tracking over £7 million in rent.

“At a practical level, we want to save landlords time and money,” explains Hammock founder and CEO Manoj Varsani. “As a landlord, I know too well how time-consuming and inefficient it is to manage your properties with spreadsheets, paper notes and to collate data from multiple bank accounts. As a fintech expert, I realised that landlords and letting agents often rely on archaic technology and haven’t experienced the benefits of new-generation tech solutions.”

Varsani says that most of the data needed by landlords to manage their property finances is already available on various banking and budgeting apps, but argues it isn’t accessible in “an easy and understandable” format. “We aim to solve these problems by streamlining property finances management,” he adds.

As it exists currently, Hammock plugs into a landlord’s bank accounts, via open banking, and automatically monitors rent collection, tracks payments and expenses and provides live analytical reporting on the well-being of each rental house or flat. However, next on the roadmap, to be launched in the coming weeks, is an FCA-regulated current account designed specifically for landlords and property managers — thus setting up the company to launch future financial services for rental property owners.

“Landlords who use Hammock get real-time notifications about all income and expenses, so rent collection and cash flow management are easier to keep an eye on,” says Varsani. “They also get the tools they need to reconcile transactions as they happen, so they always know where they stand in terms of profit and loss. This means that compiling their tax statement goes from taking hours to taking minutes. Landlords can already get our functionalities if they connect their bank accounts via open banking. In September we’ll launch our own current account, so all functionalities will be natively integrated and the whole experience will be even more seamless.”

Direct Hammock customers span professional landlords with large portfolios (e.g. more than 50 properties) as well as part-time landlords who manage only 1 or 2 properties. The startup also serves B2B customers, such as letting agents, property managers and build to rent companies, and works with accountants who act as a customer acquisition funnel by recommending the service to their landlord clients.

Meanwhile, the business model is simple enough. Customers pay a monthly subscription to use the platform based on the number of properties managed, with the vast majority paying £9.99 per month.

Powered by WPeMatico

On a Wednesday at 4 p.m. in June 2017, I was in a small, packed office in midtown Manhattan.

The overcrowded conference room, with at least five more people than any fire marshal would recommend, was stacked comically high with paperwork and an eclectic collection of cheap pens. As I neared the end of the third hour and the ink of my seventh pen, I realized the mortgage closing process may be somewhat antiquated.

After closing on my first home, it was inconceivable to me that every other expense in my life has gone digital, but the most significant purchase I’ve ever made required hundreds of signatures and several handwritten checks delivered in person. By comparison, I have been able to repay my student loans, comparable in magnitude to a down payment, exclusively through online portals.

The COVID-19 pandemic has changed nearly every facet of our lives. One potential silver lining for the real estate world may be a forced reckoning with the mortgage closing process. Technological advances like e-closings are accelerating this arduous process into the digital age. The U.S. Census Bureau released figures in July citing the rise in homeownership across the country as the pandemic fuels the demand for single-family properties outside of urban areas. This is confirmed by the significant spike in mortgage applications seen in the second quarter of 2020.

The first signs of digitization of the mortgage origination process were seen in mid-2010 when lenders began adopting digital disclosures. Despite the availability of technology, the market has been slower to fully embrace digital closings that enable the full loan package to be electronically reviewed, recorded, signed and notarized. A true e-closing includes a digital promissory note (“eNote”), a virtual closing appointment and the electronic transfer and recording of documents by the county, all of which can be remotely coordinated and executed by the parties involved. The market started to pick up pace in recent years, and we’ve seen the number of e-mortgages increase by more than 450% from 2018 to 2019.

Powered by WPeMatico

Mashroom, the London proptech that offers an “end-to-end” lettings and property management service, has raised £4 million in new funding.

Backing comes from existing unnamed private investors and matched funding from the U.K. taxpayer-funded Future Fund. It brings total funding to date for the company to £7 million.

Pitching itself as going “beyond the tenant-finding service” to include the entire rental journey — from property advertising, arranging viewings, credit history checks and maintenance to end of tenancy and dispute resolution — the self-service platform lets landlords list their property, which tenants can then rent easily.

This includes digital credit and reference checks and the signing of rental agreements and tenancy renewals. In addition, open banking is employed to collect rental payments and provide real-time payment information to landlords.

“Letting and renting is, for the most part, still a fragmented, bricks-and-mortar industry,” says Mashroom founder and ex-venture capitalist Stepan Dobrovolskiy. “The experience as a landlord or tenant normally still involves a traditional estate agent who acts as intermediary and charges a hefty fee. While plenty of new players have come along with tech to solve certain points in the experience, we are the first to look at the entire process from end to end.”

Over on Extra Crunch, learn more about the opportunities within property tech with A/O PropTech, the European VC disrupting the €230 trillion real estate industry.

Dobrovolskiy says this sees Mashroom digitise about “98%” of the rental journey, although he maintains that some human interaction is, and perhaps always will be, necessary. “Unlike most traditional agents, we are also still there to help after tenants move in — things like maintenance requests, insuring contents, moving out or extending contracts at the end of the tenancy. We fundamentally believe that automation and tech should augment rather than replace human interactions in this market, and a big part of our brand is to create better relationships between landlords and tenants,” he says.

As an example, Mashroom incentivises tenants to help landlords with viewings at the end of their tenancy by offering a week’s worth of rent as a reward. “No one knows a property better than people who actually live in it, and it removes a lot of friction to have current tenants schedule and host viewings at times that suit them,” explains Dobrovolskiy. “This costs less than 2% of annual rent for landlords, compared to paying 10%+ to an estate agent for finding a new tenant. So we are unlocking financial benefits for landlords and tenants at the same time as giving them more flexibility.”

Mashroom has also developed a “Deposit Replacement Product” as an alternative to the traditional deposit. In partnership with insurer Arch Capital, it lets tenants pay one week’s rent while offering landlords more protection than a regular deposit — up to 12 weeks compared to the typical five weeks.

Noteworthy, the basic Mashroom service is free for tenants and landlords, with the proptech startup generating revenue via its financial products offering, which, along with deposit replacement, includes rent guarantee and other insurance products. The startup also operates its own in-house mortgage brokerage for buy-to-let mortgages and refinancing for landlords.

Powered by WPeMatico

When you need a loan, the cost and speed of getting it can be as critical to get right as the financing itself, a principle that might be even more relevant today in our shaky pandemic-hit economy than ever before. Today, a company that proposes to cut both the time and price for securing financing, with a platform, initially aimed at SMBs, that lets business owners put up their home property as collateral to get the loan, is announcing a funding round to expand its business.

Selina Finance, which provides loans to small and medium businesses in the form of flexible credit facilities — you pay back only what you borrow, and you do that over time, rather than in one lump sum — that are backed by the value of your personal home, is today announcing that it has raised £42 million ($53 million) — £12 million in equity and £30 million in debt to distribute as loans. The company says it plans to raise significantly more debt in the coming months as its business expands.

The funding is coming from several investors, including Picus Capital and Global Founders Capital — two firms that are tied in part to the Samwer brothers, which built the Rocket Internet e-commerce incubator in Berlin. The company’s valuation is not being disclosed.

London-based Selina plans to use the funding in a couple of areas: first, to continue growing its business in the UK, which was founded by Andrea Olivari, Hubert Fenwick and Leonard Benning and launched in June 2019; and second, to start the process of opening up to other markets in Europe.

Selina today focuses on SMEs whose applications qualify as “prime” (as opposed to sub-prime). They can borrow up to £1 million in funds — the average amount is significantly less, £150,000, says Olivari — with interest rates starting at 4.95% APR. That undercuts the rates on typical unsecured loans. Selina is also in the process of getting a license to expand its offering to consumer borrowers, too.

We’ve moved on from the days when property investing was so stable that “safe as houses” was a common expression to mean absolute reliability. But for most people, their properties continue to represent the single-biggest asset that they own and thus become a key part of how a person might construct their wider financial profile when it comes to borrowing money.

Selina’s tech essentially operates a kind of two-sided marketplace: on one hand, its algorithms process details about your property to determine its market value and how that will appreciate (or depreciate), and on the other, it’s evaluating the health of the SME business, and the purpose of the loan, to determine whether the borrower will be good for it. It’s only a year old and so it’s hard to say whether this is a strong record, but Benning notes that so far, no customers have defaulted on loans.

“We have the security of the home, yes,” he said, “but we only take credit-worthy customers to make sure the default scenario doesn’t happen. It’s something that we avoid at any cost. Technically there is a long process that leads to that outcome, but it almost never happens.” He noted that Selina has people on its team who have worked for sub-prime lenders, which gives them experience in helping to determine prime opportunities.

More generally, the idea of leveraging your property to raise capital — say, through a remortgage or loan against its value — are not new concepts: banks have been offering and distributing this kind of financing for years. The issue that Selina is addressing is that typically these deals come with high interest rates and commissions, and might take six to eight weeks from application to approval and finally loan. Selina’s pitch is that it can bring that down to five days, or possibly less.

“It’s critical that we can make a loan in five days to be be nimble and accurate, because this is one area where banks break down,” said Fenwick. “It can take two weeks to arrange for someone to walk around on behalf of a bank to make a valuation. It’s just a backwards and archaic process. We can use big data and tap different areas and dynamics all that into a model to assess the valuation of a property with a low margin of error.”

Selina is not the only tech company tackling this opportunity — specifically, Figure, the startup founded by Mike Cagney formerly of SoFi, is also providing loans to individuals against the value of their property, among other services. And for those who have followed other commerce startups financed by the Samwers, you could even say that there is a hint of cloning going on here, with even the sites of the two bearing some similarities. But for now at least Selina seems to be the only one of its kind in the UK, and for now that spells opportunity.

“Selina Finance is bringing much-needed innovation to the UK lending space by allowing customers to access the equity locked up in their residential property, seamlessly and on flexible terms,” said Robin Godenrath, MD at Picus Capital, in a statement. “The team impressed us with their strong focus on building a fully digital customer experience and have already achieved great product-market fit with their business loan use case. We’re excited and confident that Selina’s consumer proposition will also become an attractive alternative in the consumer lending space.”

Powered by WPeMatico

For the first few months it was operating, Shelf Engine, the Seattle-based company that optimizes the process of stocking store shelves for supermarkets and groceries, didn’t have a name.

Co-founders Stefan Kalb and Bede Jordan were on a ski trip outside of Salt Lake City about four years ago when they began discussing what, exactly, could be done about the problem of food waste in the U.S.

Kalb is a serial entrepreneur whose first business was a food distribution company called Molly’s, which was sold to a company called HomeGrown back in 2019.

A graduate of Western Washington University with a degree in actuarial science, Kalb says he started his food company to make a difference in the world. While Molly’s did, indeed, promote healthy eating, the problem that Kalb and Bede, a former Microsoft engineer, are tackling at Shelf Engine may have even more of an impact.

Food waste isn’t just bad for its inefficiency in the face of a massive problem in the U.S. with food insecurity for citizens, it’s also bad for the environment.

Shelf Engine proposes to tackle the problem by providing demand forecasting for perishable food items. The idea is to wring inefficiencies out of the ordering system. Typically about a third of food gets thrown out of the bakery section and other highly perishable goods stocked on store shelves. Shelf Engine guarantees sales for the store, and any items that remain unsold the company will pay for.

Image: OstapenkoOlena/iStock

Shelf Engine gets information about how much sales a store typically sees for particular items and can then predict how much demand for a particular product there will be. The company makes money off of the arbitrage between how much it pays for goods from vendors and how much it sells to grocers.

It allows groceries to lower the food waste and have a broader variety of products on shelves for customers.

Shelf Engine initially went to market with a product that it was hoping to sell to groceries, but found more traction by becoming a marketplace and perfecting its models on how much of a particular item needs to go on store shelves.

The next item on the agenda for Bede and Kalb is to get insights into secondary sources like imperfect produce resellers or other grocery stores that work as an outlet.

The business model is already showing results at around 400 stores in the Northwest, according to Kalb, and it now has another $12 million in financing to go to market.

The funds came from Garry Tan’s Initialized and GGV (and GGV managing director Hans Tung has a seat on the company’s board). Other investors in the company include Foundation Capital, Bain Capital, 1984 and Correlation Ventures .

Kalb said the money from the round will be used to scale up the engineering team and its sales and acquisition process.

The investment in Shelf Engine is part of a wave of new technology applications coming to the grocery store, as Sunny Dhillon, a partner at Signia Ventures, wrote in a piece for TechCrunch’s Extra Crunch (membership required).

“Grocery margins will always be razor thin, and the difference between a profitable and unprofitable grocer is often just cents on the dollar,” Dhillon wrote. “Thus, as the adoption of e-grocery becomes more commonplace, retailers must not only optimize their fulfillment operations (e.g. MFCs), but also the logistics of delivery to a customer’s doorstep to ensure speed and quality (e.g. darkstores).”

Beyond Dhillon’s version of a delivery-only grocery network with mobile fulfillment centers and dark stores, there’s a lot of room for chains with existing real estate and bespoke shopping options to increase their margins on perishable goods, as well.

Powered by WPeMatico

If you have bought a house in the last decade, you likely started the process online. Perhaps you browsed for your future dream home on a website like Zillow or Realtor, and you may have been surprised by how quickly things moved from seeing a property to making an offer.

When you reached the closing stage, however, things slowed to a crawl. Some of those roadblocks were anticipated, such as the process of getting a mortgage, but one likely wasn’t: the tedious and time-consuming process of obtaining title insurance — that is, insurance that protects your claim to home ownership should any claims arise against it after sale.

For a product that is all but required to purchase a home, title insurance isn’t something many people know about until they have to pay for it and then wait up to two months to get.

Now, finally, a handful of startups are taking on the title insurance industry, hoping to make the process of buying a policy easier, cheaper and more transparent. These startups, including Spruce, States Title, JetClosing, Qualia, Modus and Endpoint, enable part or all of the title insurance buying process. Whether these startups can finally topple the title insurance monopoly remains to be seen, but they are already causing cracks in the system.

To that end, we’ve outlined what’s broken about today’s title industry; recent developments in technology and government that are priming the industry for change; and a synthesis of some key trends we’ve observed in the space, as entrepreneurs begin to capitalize on a tipping point in a century-old, $14 billion business.

To understand how startups are beginning to challenge title insurance incumbents, we need to first understand what title insurance is and what title companies do.

Title insurance is unique from other types of insurance, which require ongoing payments and protect a buyer against future incidents. Instead, title insurance is a one-time payment that protects a buyer from what has already happened — namely errors in the public record, liens against the property, claims of inheritance and fraud. When you buy a home, title insurance companies research your property’s history, contained in public archives, to make sure no such claims are attached to it, then correct any issues before granting a title insurance policy.

Powered by WPeMatico

Housing has been constructed for millennia, and while clearly our modern abodes are ever so slightly better than the elk tents we used to live in, the construction techniques behind housing today haven’t progressed all that much. What has progressed are prices — it’s more expensive than ever to build a modern unit, and that’s just for housing — head over to commercial real estate and the numbers don’t look much better.

For Martin Diz and his team, that’s a problem. Diz is not exactly a lifelong builder — in fact, he was building proverbial rockets as an aerospace engineering PhD researcher several years ago. As he was talking to his roommate back then, who was studying structural engineering, he realized that some of the techniques that his roommate’s field was trying to pioneer had already been discovered by the aerospace folks decades ago.

His roommate was trying to simulate an earthquake to model how the tremors would affect objects like a table inside a building. As Diz recalled, he said “Hey dude, did you know that in aerospace engineering, we did the same thing for the space station 50 years ago? … I learned this in grad school, you know, in our basic course because it’s a very old technique.”

Diz is legitimately a nice chap, and totally not the kind of aerospace engineer who goes around talking about how aerospace solved everything a century ago (okay, maybe just a tad of that). But the interaction and followup conversation got him thinking about what aerospace as a field had solved, and whether some of those techniques could be used in other domains.

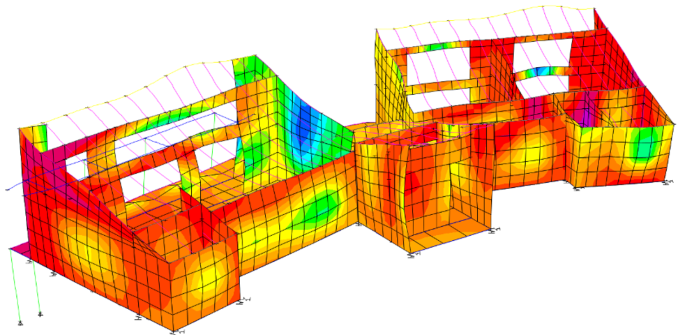

Diz and his roommate kept talking over the years, and eventually, the two formed Tango Builder. Tango’s main premise is to bring more sophisticated engineering techniques to construction, improving performance and quality while lowering costs. It’s part of the current YC batch, and previously raised a small seed round, which included participation from Tracy Young, co-founder and CEO of PlanGrid.

The two, plus one employee, have already worked on a handful of projects, with some early promising results. Tango helped to design a hospital for COVID-19 patients in Ecuador that saw total savings of $1 million by lowering structural costs by a third. They consulted on the creation of a justice center in Mexico, and were able to reduce the required steel in the project by 40%. And they used their platform to optimize wall thickness in a masonry home to bring total cost down by 15%. All numbers are reported by the company and have not been independently verified.

A look at Tango’s masonry home project. Photo from Tango Builder.

A look at Tango’s masonry home project. Photo from Tango Builder.

There is a heavy focus on structural integrity (as there should be in construction), but Tango particularly shines around seismic modeling. While earthquakes are perhaps most pronounced in places like California and Mexico, both of which suffered major tremors this past week, earthquakes are a lingering threat throughout the world, and buildings need to be designed to handle them even if they are rare.

Diz and his team want to give designers better tools to model what happens in different scenarios while understanding the trade-offs of various building materials and designs. “You’re building with steel stock, but it’s much more expensive now, so it’s up to the user or the owner to decide which of the paths he wants to take,” he said. Safety is always important, but how much steel do you place in a building that might see an earthquake once a century? That’s what Tango wants to help answer.

Beyond improving structural modeling, Tango’s big ambition is to find additional efficiencies in the construction process by helping everyone involved with construction work together through a better workflow. “Each person has benefits from the platform, the architect will get the approvals … faster, the engineer can focus on the creative side of things, the contractor” can bid earlier knowing what design is coming, Diz explained. Saving time in all these processes ultimately translates directly to a project’s bottom line.

It’s very early days of course, with just Diz, his co-founder Juan Aleman, and one employee “working extremely hard.” The hope though is that melding some aerospace engineering techniques with a much more robust and technical platform will help push construction to better quality while saving costs as well. After all, aerospace did all this a century ago.

Powered by WPeMatico

Homebuilding is not for the faint of heart, particularly those who want to build something custom. Selecting the right architect and designer, the myriad contractors, the complexity of building codes and siting, the regulatory approvals from local authorities. It’s a full-time job — and you don’t even have a roof built over your head.

Atmos wants to massively simplify homebuilding, and in the process, democratize customization to more and more homeowners.

The startup, which is in the current Y Combinator batch, wants to take both the big decisions and the sundries of construction and combine them onto one platform where selecting a design and moving forward is as simple as clicking through a Shopify shopping cart.

It’s a vision that has already piqued the attention of investors. The company disclosed that it has already raised $2 million, according to CEO and co-founder Nick Donahue, from Sam Altman, former YC president and now head of OpenAI, and Adam Nash, former president and CEO of Wealthfront, along with a bunch of other angels.

It’s also a vision that is a radical turn from where Atmos was before, which was centered in virtual reality.

Donahue comes from a line of homebuilders — his father built home subdivisions as a profession — but his interests initially turned toward the virtual. He dropped out of college after realizing process engineering wasn’t all that exciting (who can blame him?) and headed out to the Valley, where he built projects like “a Burning Man art installation and [an] open-source VR headset.” That headset attracted the attention of angels, who funded its development.

The concept at the heart of the headset was around what the team dubbed the “spatial web.” Donahue explained that the idea was that “the concept of the web would one day flow from the 2D into the 3D and that physical spaces would function more like websites.” The headset he was developing would act as a sort of “browser” to navigate these spaces.

Of course, the limitations around VR hit his company as much as the rest of the industry, including limits on computation performance to build these 3D environments and the lack of scaling in the sector so far.

The thinking around changing physical spaces though got Donahue pondering about what the future of the home would look like. “We think the next kind of wave of this is going to be an introduction to compute,” he said, arguing that “every home will have like a brain to it.” Homes will be digital, controllable and customizable, and that will revolutionize the definition of the home that has remained stagnant for generations.

The big vision for Atmos going forward then is to capture that trend, but for today at least, the company is focused on making housing customization easier.

To use the platform, a user inputs the location for a new home and a floor plan for the site, and Atmos will find builders that best match the plan and coordinate the rest of the tasks to get the home built. It’s targeting homes in the $400,000-$800,000 range, and its focus cities are Raleigh-Durham, Charlotte, Atlanta, Denver and Austin.

It’s very much early stages for the company — Donahue says that the company has its first few projects underway in the Raleigh-Durham area and is working to partner and scale up with larger homebuilders.

Image Credits: KentWeakley / Getty Images

Will it work? That’s the big question with anything that touches construction. Customization is great — everyone loves to have their own pad — but the traditional challenge for construction is that the only way to bring down the cost of housing is to make it as uniform as possible. That’s why you get “cookie-cutter” subdivisions and rows of identical apartment buildings. The sameness allows a builder to find scale. Work crews can move from one lot to the next in synchronicity saving labor costs and time while building materials can be bought in bulk to save costs.

With better technology and some controls, Atmos might be able to find synergies between its customers, particularly if it gets market penetration in individual cities. Yet, I find the longer-term vision ultimately more compelling for the company. Redefining the home may not have made much sense three months ago, but as more people work from home and connect with virtual worlds, how should our homes be redesigned to accommodate these activities? If Atmos can find an answer, it is sitting on a gold mine.

Atmos team pic (minus two). Image Credits: Atmos

In addition to Altman and Nash, Mark Goldberg, JLL Spark, Shrug Capital, Daniel Gross’ Pioneer, Venture Hacks, Yuri Sagalov, Brian Norgard and others participated in the company’s angel/seed round.

Powered by WPeMatico

The alchemy for a successful startup can be hard to parse. Sometimes, it’s who you know. Sometimes it’s where you go to school. And sometimes it’s what you do. In the case of La Haus, a startup that wants to bring U.S. tech-enabled real estate services to the Latin American real estate market, it’s all three.

The company was founded by Jerónimo Uribe and Rodrigo Sánchez Ríos, both graduates of Stanford University who previously founded and ran Jaguar Capital, a Colombian real estate development firm that had built over $350 million worth of retail and residential projects in the country.

Uribe, the son of the controversial Colombian President Daniel Uribe (who has been accused of financing paramilitary forces during Colombia’s long-running civil war and wire-tapping journalists and negotiators during the peace talks to end the conflict) and Sánchez Ríos, a former private equity professional at the multi-billion-dollar firm Lindsay Goldberg, were exposed to the perils and promise of real estate development with their former firm.

Now the two entrepreneurs are using their know-how, connections and a new technology stack to streamline the home-buying process.

It’s that ambition that caught the attention of Pete Flint, the founder of Trulia and now an investor at the venture capital firm NFX. Flint, an early investor in La Haus, saw the potential in La Haus to help the Latin American real estate market leapfrog the services available in the U.S. Spencer Rascoff, the co-founder of Zillow, also invested in the company.

“Latin America is very early on in its infancy of having really professional agents and really professional brokerages,” said Flint.

La Haus guides home buyers through every stage of the process, with its own agents and salespeople selling properties sourced from the company’s developer connections.

“The average home in the U.S. sells in six weeks or less,” said La Haus chief financial officer Sánchez Ríos in an interview. “That timing in Latin America is 14 months. That’s the dramatic difference. There is no infrastructure in Latin America as a whole.”

La Haus began by reaching out to the founders’ old colleagues in the real estate development industry and started listing new developments on its service. Now the company has a mix of existing and new properties for sale on its site and an expanded geographic footprint in both Colombia and Mexico.

“We have a portal… that acts as a lead-generating machine,” said Sánchez Ríos. “We aggregate listings, we vet them. We focus on new developers.”

The company has about 500 developers using the service to list properties in Colombia and another 200 in Mexico. So far, the company has facilitated more than 2,000 transactions through its platform in three years.

“Real estate now is turning fully digital and also in this market professionalizing,” said Flint. “The publicly traded online real estate companies are approaching all-time highs. People are just prizing the space that they spend their time in… the technologies from VR and digital walkthroughs to digital closes become not just a nice to have but a necessity. “

Capitalizing on the open field in the market, La Haus recently closed on $10 million in financing led by Kaszek Ventures, one of the leading funds in Latin America. That funding will be used to accelerate the company’s geographic expansion in response to increasing demand for digital solutions in response to the COVID-19 epidemic.

“Because of Covid-19, consumers’ willingness to conduct real estate transactions online has gone through the roof,” said Sánchez Ríos, in a statement. “Fortunately we were in the position to enable that, and we expect to see a permanent shift online in how people conduct all, or at least most, of the home-buying process. This funding gives us ample runway to build the end-to-end real estate experience for the post-Covid Latin America.”

Joining NFX, Rascoff, and Kaszek Ventures are a slew of investors, including Acrew Capital, IMO Ventures and Beresford Ventures. Entrepreneurs like Nubank founder David Velez; Brian Requarth, the founder of Vivareal (now GrupoZap); and Hadi Partovi, CEO and founder of Code.org, also participated in the financing.

“We backed La Haus because we saw many of the same ingredients that resulted in a fantastic outcome for many of our successful companies: A world-class team with complementary skills; a huge addressable market; and an almost religious zeal by the founders to solve a big problem with technology,” said Hernan Kazah, co-founder and managing partner of Kaszek Ventures.

Powered by WPeMatico

When this editor first met Jeremy Conrad, it was in 2014, at the 8,000-square-foot former fish factory that was home to Lemnos, a hardware-focused venture firm that Conrad had co-founded three years earlier.

Conrad — who as a mechanical engineering undergrad at MIT worked on self-driving cars, drones and satellites — was still excited about investing in hardware startups, having just closed a small new fund even while hardware was very unfashionable (and remains challenging). One investment his team made around that time was in Airware, a company that made subscription-based software for drones and attracted meaningful buzz and $118 million in venture funding before shutting down in 2018.

By then, Conrad had already moved on — though not from his love of hardware. He instead decided in late 2017 that a nascent team that was camping out at Lemnos was onto a big idea relating to the future of construction. Conrad didn’t have a background in real estate or, at the time, a burning passion for the industry. But the “more I learned about it — not dissimilar to when I started Lemnos — it felt like there was a gap in the market, an opportunity that people were missing,” says Conrad from his home in San Francisco, where he has hunkered down throughout the COVID-19 crisis.

Enter Quartz, Conrad’s now 1.5-year-old, 14-person company, which quietly announced $7.75 million in Series A funding earlier this month, led by Baseline Ventures, with Felicis Ventures, Lemnos and Bloomberg Beta also participating.

What it’s selling to real estate developers, project managers and construction supervisors is really two things, which is safety and information.

Here’s how it works: Using off-the-shelf hardware components that are reassembled in San Francisco and hardened (meaning secured to reduce vulnerabilities), the company incorporates its machine-learning software into this camera-based platform, then mounts the system onto cranes at construction sites. From there, the system streams 4K live feeds of what’s happening on the ground, while also making sense of the action.

Say dozens of concrete-pouring trucks are expected on a construction site. The cameras, with their persistent view, can convey through a dashboard system whether and when the trucks have arrived and how many, says Conrad. It can determine how many people on are on a job site, and whether other deliveries have been made, even if not with a high degree of specificity.

“We can’t say [to project managers] that 1,000 screws were delivered, but we can let them know whether the boxes they were expecting were delivered and where they were left,” he explains.

It’s an especially appealing proposition in the age of coronavirus, as the technology can help convey information that’s happening at a site that’s been shut down, or even how closely employees are gathered.

Conrad says the technology also saves on time by providing information to those who might not otherwise be able to access it. Think of the developer on the 50th floor of the skyscraper that he or she is building, or even the crane operator who is perhaps moving a two-ton object and has to rely on someone on the ground to deliver directions but can enjoy far more visibility with the aid of a multi-camera set-up.

Quartz, which today operates in California but is embarking on a nationwide rollout, was largely inspired by what Conrad was seeing in the world of self-driving. From sensors to self-perception systems, he knew the technologies would be even easier to deploy at construction sites, and he believed it could make them safer, too. Indeed, like cars, construction sites are highly dangerous. According to the Occupational Safety and Health Administration, of the worker fatalities in private industry in 2018, more than 20% were in construction.

Conrad also saw an opportunity to take on established companies like Trimble, a 42-year-old, publicly traded, Sunnyvale, Calif.-based company that sells a portfolio of tools to the construction industry and charges top dollar for them. Quartz is meanwhile charging $2,000 per month per crane for its series of cameras, their installation, a live stream and “lookback” data, though this may well rise as its adds features.

It’s a big enough opportunity that, perhaps unsurprisingly, Quartz is not alone in chasing it. Last summer, for example, Versatile, an Israeli-based startup with offices in San Francisco and New York City, raised $5.5 million in seed funding from Germany’s Robert Bosch Venture Capital and several other investors for a very similar platform, though it uses sensors mounted under the hook of a crane to provide information about what’s happening below. Construction Dive, a media property that’s dedicated to the industry, highlights many other, similar and competitive startups in the space, too.

Still, Quartz has Conrad, who isn’t just any founding CEO. Not only does he have that background in engineering, but having launched a venture firm and spent years as an investor may also serve him well. He thinks a lot about the payback period on its hardware, for example.

Unlike a lot of founders, he even says he loves the fundraising process. “I get the highest-quality feedback from some of the smartest people I know, which really helps focus your vision,” says Conrad, who says that Quartz, which operates in California today, is now embarking on a nationwide rollout.

“When you talk with great VCs, they ask great questions. For me, it’s the best free consulting you can get.”

Powered by WPeMatico