real estate

Auto Added by WPeMatico

Auto Added by WPeMatico

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry is as hot as ever, with a record 218 billion downloads and $143 billion in global consumer spend in 2020.

Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year.

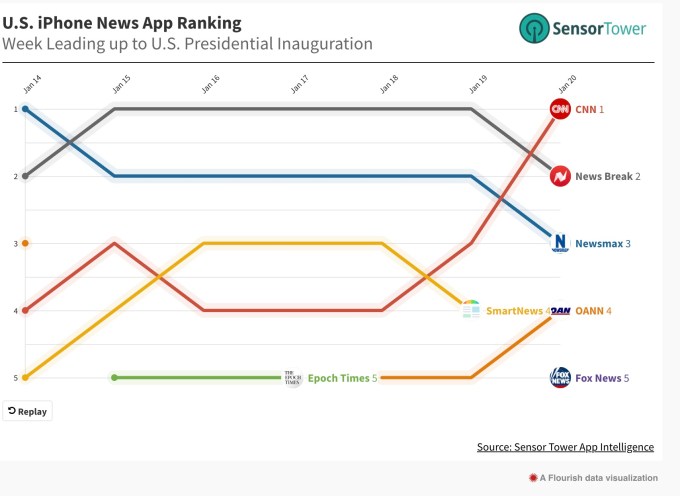

This week, we’re looking into how President Biden’s inauguration impacted news apps, the latest in the Parler lawsuit, and how TikTok’s app continues to shape culture, among other things.

Logos for AWS (Amazon Web Services) and Parler. Image Credits: TechCrunch

U.S. District Judge Barbara Rothstein in Seattle this week ruled that Amazon won’t be required to restore access to web services to Parler. As you may recall, Parler sued Amazon for booting it from AWS’ infrastructure, effectively forcing it offline. Like Apple and Google before it, Amazon had decided that the calls for violence that were being spread on Parler violated its terms of service. It also said that Parler showed an “unwillingness and inability” to remove dangerous posts that called for the rape, torture and assassination of politicians, tech executives and many others, the AP reported.

Amazon’s decision shouldn’t have been a surprise for Parler. Amazon had reported 98 examples of Parler posts that incited violence over the past several weeks before its decision. It told Parler these were clear violations of the terms of service.

Parler’s lawsuit against Amazon, however, went on to claim breach of contract and even made antitrust allegations.

The judge shot down Parler’s claims that Amazon and Twitter were colluding over the decision to kick the app off AWS. Parler’s claims over breach of contract were denied, too, as the contract had never said Amazon had to give Parler 30 days to fix things. (Not to mention the fact that Parler breached the contract on its side, too.) It also said Parler had fallen short in demonstrating the need for an injunction to restore access to Amazon’s web services.

The ruling only blocks Parler from forcing Amazon to again host it as the lawsuit proceeds, but is not the final ruling in the overall case, which is continuing.

@livbedumb♬ drivers license – Olivia Rodrigo

We already knew TikTok was playing a large role in influencing music charts and listening behavior. For example, Billboard last year noted how TikTok drove hits from Sony artists like Doja Cat (“Say So”) and 24kGoldn (“Mood”), and helped Sony discover new talent. Columbia also signed viral TikTok artists like Lil Nas X, Powfu, StaySolidRocky, Jawsh 685, Arizona Zervas and 24kGoldn. Meanwhile, Nielsen has said that no other app had helped break more songs in 2020 than TikTok.

This month, we’ve witnessed yet another example of this phenomenon. Olivia Rodrigo, the 17-year-old star of Disney+’s “High School Musical: The Musical: the Series” released her latest song, “Drivers License” on January 8. The pop ballad and breakup anthem is believed to be referencing the actress’ relationship with co-star Joshua Bassett, which gave the song even more appeal to fans.

Upon its release the song was heavily streamed by TikTok users, which helped make it an overnight sensation of sorts. According to a report by The WSJ, Billboard counted 76.1 million streams and 38,000 downloads in the U.S. during the week of its release. It also made a historic debut at No. 1 on the Hot 100, becoming the first smash hit of 2021.

On January 11, “Drivers License” broke Spotify’s record for most streams per day (for a non-holiday song) with 15.17 million global streams. On TikTok, meanwhile, the number of videos featuring the song and the views they received doubled every day, The WSJ said.

Charli D’Amelio’s dance to it on the app has now generated 5 million “Likes” across nearly 33 million views, as of the time of writing.

@charlidamelio♬ drivers license – Olivia Rodrigo

Of course, other TikTok hits have broken out in the past, too — even reaching No. 1 like “Blinding Lights” (The Weeknd) and “Mood” (24kGoldn). But the success of “Drivers License” may be in part due to the way it focuses on a subject that’s more relevant to TikTok’s young, teenage user base. It talks about first loves and being dumped for the other girl. And its title and opening refer to a time many adults have forgotten: the momentous day when you get your driver’s license. It’s highly relatable to the TikTok crowd who fully embraced it and made it a hit.

Image Credits: Bodyguard

A French content moderation app called Bodyguard, detailed here by TechCrunch, has brought its service to the English-speaking market. The app allows you to choose the level of content moderation you want to see on top social networks, like Twitter, YouTube, Instagram and Twitch. You can choose to hide toxic content across a range of categories, like insults, body shaming, moral harassment, sexual harassment, racism and homophobia and indicate whether the content is a low or high priority to block.

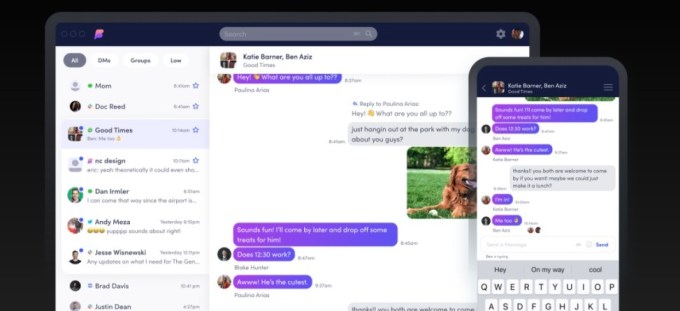

Image Credits: Beeper

Pebble’s founder and current YC Partner Eric Migicovsky has launched a new app, Beeper, that aims to centralize in one interface 15 different chat apps, including iMessage. The app relies on an open-source federated, encrypted messaging protocol called Matrix that uses “bridges” to connect to the various networks to move the messages. However, iMessage support is more wonky, as the company actually ships you an old iPhone to make the connection to the network. But this system allows you to access Beeper on non-Apple devices, the company says. The app is slowly onboarding new users due to initial demand. The app works across MacOS, Windows, Linux, iOS and Android and charges $10/mo for the service.

Powered by WPeMatico

At Battery, a central part of our consumer investing practice involves tracking the evolution of where and how consumers find and purchase goods and services. From our annual Battery Marketplace Index, we’ve seen seismic shifts in how consumer purchasing behavior has changed over the years, starting with the move to the web and, more recently, to mobile and on-demand via smartphones.

The evolution looks like this in a nutshell: In the early days, listing sites like Craigslist, Angie’s List* and Yelp effectively put the Yellow Pages online — you could find a new restaurant or plumber on the web, but the process of contacting them was largely still offline. As consumers grew more comfortable with the web, marketplaces like eBay, Etsy, Expedia and Wayfair* emerged, enabling historically offline transactions to occur online.

More recently, and spurred in large part by mobile, on-demand use cases, managed marketplaces like Uber, DoorDash, Instacart and StockX* have taken online consumer purchasing a step further. They play a greater role in the operations of the marketplace, from automatically matching demand with supply, to verifying the supply side for quality, to dynamic pricing.

The key purpose of being end-to-end is to deliver an even better value proposition to consumers relative to incumbent alternatives.

Each stage of this evolution unlocked billions of dollars in value, and many of the names listed above remain the largest consumer internet companies today.

At their core, these companies are facilitators, matching consumer demand with existing supply of a product or service. While there is no doubt these companies play a hugely valuable role in our lives, we increasingly believe that simply facilitating a transaction or service isn’t enough. Particularly in industries where supply is scarce, or in old-guard industries where innovation in the underlying product or service is slow, a digitized marketplace — even when managed — can produce underwhelming experiences for consumers.

In these instances, starting from the ground up is what is really required to deliver an optimal consumer experience. Back in 2014, Chris Dixon wrote a bit about this phenomenon in his post on “Full stack startups.” Fast forward several years, and more startups than ever are “full stack” or as we call it, “end-to-end operators.”

These businesses are fundamentally reimagining their product experience by owning the entire value chain, from end to end, thereby creating a step-functionally better experience for consumers. Owning more in the stack of operations gives these companies better control over quality, customer service, delivery, pricing and more — which gives consumers a better, faster and cheaper experience.

It’s worth noting that these end-to-end models typically require more capital to reach scale, as greater upfront investment is necessary to get them off the ground than other, more narrowly focused marketplaces. But in our experience, the additional capital required is often outweighed by the value captured from owning the entire experience.

Many of these businesses have reached meaningful scale across industries:

Image Credits: Battery Ventures (opens in a new window)

All of these companies have recognized they can deliver more value to consumers by “owning” every aspect of the underlying product or service — from the bike to the workout content in Peloton’s case, or the bank account to the credit card in Chime’s case. They have reinvented and reimagined the entire consumer experience, from end to end.

As investors, we’ve had the privilege of meeting with many of these next-generation end-to-end operators over the years and found that those with the greatest success tend to exhibit the five key elements below:

The end-to-end approach makes the most sense when disrupting very large markets. In the graphic above, notice that most of these companies play in the largest, but notoriously archaic industries like banking, insurance, real estate, healthcare, etc. Incumbents in these industries are very large and entrenched, but they are legacy players, making them slow to adopt new technology. For the most part, they have failed to meet the needs of our digital-native, mobile-savvy generation and their experiences lag behind consumer expectations of today (evidenced by low, or sometimes even negative, NPS scores). Rebuilding the experience from the ground up is sometimes the only way to satisfy today’s consumers in these massive markets.

Powered by WPeMatico

Only a few weeks after its SPAC IPO, Porch today announced that it has made four acquisitions, worth a total of $122 million. The most important here is probably the acquisition of Homeowners of America for $100 million, which gets Porch deeper into the home insurance space. In addition, Porch is also acquiring mover marketing and data platform V12 for $22 million, as well as home inspection service Palm-Tech and iRoofing, a SaaS application for roofing contractors. Porch did not disclose the acquisition prices for the latter two companies.

You may still think of Porch as a marketplace for home improvement and repair services — and that’s what it started out as when it launched about seven years ago. Yet while it still offers those services, a couple of years after its 2013 launch, the company pivoted to building what it now calls a “vertical software platform for the home.” Through a number of acquisitions, the Porch Group now includes Porch.com, as well as services like HireAHelper, Inspection Support Network for home inspectors, Kandela for providing services around moving and an insurance broker in the form of the Elite Insurance Group. In some form or another, Porch’s tools are now used — either directly or indirectly — by two-thirds of U.S. homebuyers every month.

As Porch founder and CEO Matt Ehrlichman told me, he had originally planned to take his company public through a traditional IPO. He noted that going the increasingly popular SPAC route, though, allowed him to push his timeline up by a year, which in turn now enables the company to make the acquisitions it announced today.

“In total, we had a $323 million fundraise that allows us now to not only be a public company with public currency, but to be very well capitalized. And picking up that year allows us to be able to go and pursue acquisitions that we think make really good fits for Porch,” Ehrlichman told me. While Porch’s guidance for its 2021 revenue was previously $120 million, it’s now updating that guidance to $170 million based on these acquisitions. That would mean Porch would grow its revenue by about 134% year-over-year between 2020 and 2021.

As the company had previously laid out in its public documents, the plan for 2021 was always to get deeper into insurance. Indeed, as Ehrlichman noted, Porch these days tends to think of itself as a vertical software company that layers insurtech on top of its services in order to be able to create a recurring revenue stream. And because Porch offers such a wide range of services already, its customer acquisition costs are essentially zero for these services.

Porch was already a licensed insurance brokerage. With Homeowners of America, it is acquiring a company that is both an insurance carrier as well as a managing general agent..

“We’re able to capture all of the economic value from the consumer as we help them get insurance set up with their new home and we can really control that experience to delight them. As we wrap all the technology we’ve invested in around that experience we can make it super simple and instant to be able to get the right insurance at the right price for your new home. And because we have all of this data about the home that nobody else has — from the inspection we know if the roof is old, we know if the hot water system is gonna break soon and all the appliances — we know all of this data and so it just gives us a really big advantage in insurance.”

Data, indeed, is what a lot of these acquisitions are about. Because Porch knows so much about so many customers, it is able to provide the companies it acquires with access to relevant data, which in turn helps them offer additional services and make smarter decisions.

Homeowners of America is currently operating in six states (Texas, Arizona, North Carolina, South Carolina, Virginia and Georgia) and licensed in 31. It has a network of more than 800 agencies so far and Porch expects to expand the company’s network and geographic reach in the coming months. “Because we have [customer acquisition cost]-free demand all across the country, one of the opportunities for us is simply just to expand that across the nation,” Ehrlichman explained.

As for V12, Porch’s focus is on that company’s mover marketing and data platform. The acquisition should help it reach its medium-term goal of building a $200 million revenue stream in this area. V12 offers services across multiple verticals, though, including in the automotive space, and will continue to do so. The platform’s overall focus is to help brands identify the right time to reach out to a given consumer — maybe before they decide to buy a new car or move. With Porch’s existing data layered on top of V12’s existing capabilities, the company expects that it will be able to expand these features and it will also allow Porch to not offer mover marketing but what Ehrlichman called “pro-mover” services, as well.

“V12 anchors what we call our marketing software division. A key focus of that is mover marketing. That’s where it’s going to have, long term, tremendous differentiation. But there are a number of other things that they’re working on that are going to have really nice growth vectors, and they’ll continue to push those,” said Ehrlichman.

As for the two smaller acquisitions of iRoofing and Palm-Tech, these are more akin to some of the previous acquisitions the company made in the contractor and inspection verticals. Like with those previous acquisitions, the plan is to help them grow faster, in part through integrating them into the overall Porch group’s family of products.

“Our business is and continues to be highly recurring or reoccurring in nature,” said Porch CFO Marty Heimbigner. “Nearly all of our revenues, including that of these new acquisitions, is consistent and predictable. This repeat revenue is also high margin with less than 20% cost of revenue and is expected to grow more than 30% per year on our platform. So, we believe these deals are highly accretive for our shareholders.”

Powered by WPeMatico

The busy year in M&A continued this weekend when private equity firm Thoma Bravo announced it was acquiring RealPage for $10.2 billion.

In RealPage, Thoma Bravo is getting a full-service property management platform with services like renter portals, site management, expense management and financial analysis for building and property owners. Orlando Bravo, founder and a managing partner of Thoma Bravo, sees a company that they can work with and build on its previous track record.

“RealPage’s industry leading platform is critical to the real estate ecosystem and has tremendous potential going forward,” Bravo said in a statement.

As for RealPage, company CEO Steve Winn, who will remain with the company, sees the deal as a big win for stock holders, while giving them the ability to keep investing in the product. “This will enhance our ability to focus on executing our long-term strategy and delivering even better products and services to our clients and partners,” Winn said in a statement.

RealPage, which was founded in 1998 and went public in 2010, is a typical kind of mature platform that a private equity firm like Thoma Bravo is attracted to. It has a strong customer base with more than 12,000 customers, and respectable revenue, growing at a modest pace. In its most recent earnings statement, the company announced $298.1 million in revenue, up 17% year over year. That puts it on a run rate of more than $1 billion.

Under the terms of the deal, Thoma Bravo will pay RealPage stockholders $88.75 in cash per share. That is a premium of more 30% over the $67.83 closing price on December 18th. The transaction is subject to standard regulatory review, and the RealPage board will have a 45-day “go shop” window to see if it can find a better price. Given the premium pricing on this deal, that isn’t likely, but it will have the opportunity to try.

Powered by WPeMatico

We’ve seen a big wave of proptech startups emerge to reimagine how houses are bought and sold, with some tapping into the opportunity with distressed property, and others exploring the “iBuyer” model where houses are bought and fixed up by a single startup and resold to homeowners who don’t want to invest in a fixer-upper. But the vast majority of homes are still sold the traditional way, by way of a real estate agent working via a broker.

Today, a startup is announcing that it has raised seed funding not to disrupt, but improve that basic model with a more flexible approach that can help agents work in a more modern way, and to ultimately scale out the number of people working as agents in the market.

Avenue 8, which describes itself as a “mobile-first residential real estate brokerage” — providing a new set of tools for agents to source, list and sell homes, and handle the other aspects of the process that fall between those — has raised $4 million. This is a seed round, and Avenue 8 plans to use it to expand further in the cities where it is already active — it’s been in beta thus far in the San Francisco and Los Angeles areas — as well as grow to several more.

The funding is notable because of the backers that the startup has attracted early on. It’s being led by Craft Ventures — the firm co-founded by David Sacks and Bill Lee that has amassed a prolific and impressive portfolio of companies — with Zigg Capital and Good Friends (an early-stage fund from the founders of Warby Parker, Harry’s and Allbirds) also participating.

There has been at least $18 billion in funding raised by proptech companies in the last decade, and with that no shortage of efforts to take the lessons of tech — from cloud computing and mobile technology, through to artificial intelligence, data science and innovations in e-commerce — and apply them to the real estate market.

Michael Martin, who co-founded Avenue 8 with Justin Fichelson, believes that this pace of change, in fact, means that one has to continually consider new approaches.

“It’s important to remember that Compass’s growth strategy was to roll out its technology to traditional brokerages,” he said of one of the big juggernauts in the space (which itself has seen its own challenges). “But if you built it today, it would be fundamentally different.”

And he believes that “different” would look not unlike Avenue 8.

The startup is based around a subscription model for a start, rather than a classic 30/70 split on the sales commissions that respectively (and typically) exist between brokers and agents.

Around that basic model, Avenue 8 has built a set of tools that provides agents with an intuitive way to use newer kinds of marketing and analytics tools both to get the word out about their properties across multiple channels; analytics to measure how their efforts are doing, in order to improve future listings; and access to wider market data to help them make more informed decisions on valuations and sales. It also provides a marketplace of people — valets — who can help stage and photograph properties for listing, and Avenue 8 doesn’t require payments to be made to those partners unless a home sells.

It also provides all of this via a mobile platform — key for people in a profession that often has them on the move.

Targeting agents that have in the past relied essentially on using whatever tools the brokers use — which often were simply their own sites plus some aggregating portals — Avenue 8’s pitch is not just better returns but a better process to get there.

“We’ve heard time and time again that agents struggle to identify and leverage the technology and tools to successfully manage their relationships and properties. Changing buyer/seller expectations have accelerated the digital transformation of most agents’ workflows,” said Ryan Orley, partner at Zigg Capital, in a statement. “Avenue 8 is building and integrating the right software and resources for our new reality.”

What’s also interesting about Avenue 8 is how it can open the door to a wider pool of agents in the longer run.

The real estate market has been noticeably resilient throughout the pandemic, with lower interest rates, a generally lower overall home inventory and people spending more time at home (and wanting a better space) creating a high level of demand. With a number of other industries feeling the pinch, a flexible platform like Avenue 8’s creates a way for people — who have taken and passed the certifications needed to become agents — to register and flexibly work as an agent as much or as little as they choose, creating a kind of “Uber for real estate agents,” as it were.

That scaling opportunity is likely one of the reasons why this has potentially caught the eye of investors.

“Avenue 8’s organic growth is clear evidence that the market demands a mobile-first, digital platform,” said Jeff Fluhr, general partner at Craft Ventures, in a statement. “Michael and Justin have a clear vision for modernizing real estate while keeping agents at the center. Avenue 8’s model helps agents take home more even in today’s environment where commissions are compressing.”

Interestingly, just as Uber’s changed the way that on-demand transportation is ordered and delivered, Avenue 8 is starting to see some interesting traction in terms of its place in the real estate market. Although it was originally targeted at agents with the pitch of being like “a better broker” — providing the services brokers are regulated to provide, but with a more modern wrapper around it — it’s also in some cases attracting brokerages, too. Martin said that it’s already working with a few smaller ones, and ultimately might consider ways of providing its tools to larger ones to manage their businesses better.

Powered by WPeMatico

The U.S. economy may be in a precarious state right now, with a presidential election looming on the horizon and the country still in the grips of the coronavirus pandemic. But partly thanks to lower interest rates, the housing market continues to rise, and today a startup that has built technology to help it run more efficiently is announcing a major growth round of funding.

Snapdocs, which is used by some 130,000 real estate professionals to digitally manage the mortgage process and other paperwork and stages related to buying a home, has raised $60 million in new equity funding on the heels of a few bullish months of business.

In August 2020 — a peak in home sales in the U.S., reaching their highest level in 14 years — the startup saw 170,000 home sales, totaling some $50 million in transactions, closed on its platform. This accounted for almost 15% of all deals done that month in the U.S. Snapdocs is now on track to close 1.5 million deals this year, double its 2019 volume.

On top of this, the startup’s platform is being used by more than 70% of settlement agents nationally, with customers including Bell Bank, LeaderOne Financial Corporation, Googain and Georgia United Credit Union among its customers.

The Series C is being led by YC Continuity (Snapdocs was part of Y Combinator’s Winter 2014 cohort), with existing investors Sequoia Capital, F-Prime Capital and Founders Fund, and new backers Lachy Groom (formerly of Stripe and now a prolific investor) and DocuSign, a strategic backer, also participating.

“Like us they are on a mission to defragment an ecosystem,” King said, referring to it as a “perfect complement” to Snapdocs’ own efforts.

Snapdocs is not talking about its valuation. Aaron King, the founder and CEO, said in an interview that he believes disclosing it is nothing more than “grandstanding” — which is interesting considering that the industry he focuses on, real estate, is all about public disclosures of valuation — but he noted that most of the $103 million that the startup has raised to date is still in the bank, which says something about the company’s overall financial health.

And for some further context, according to PitchBook data estimates, Snapdocs was valued at $200 million in its last round, in October 2019.

Snapdocs’ central premise is that buying a house requires not just a lot of paperwork but also a lot of different parties to be on the same page, so to speak, to set the wheels in motion and get a deal done. There is not just the mortgage (with its multiple parties) to settle; you also have real estate brokers and agents, the home sellers, inspectors and appraisers, the insurance company, the title company and more — some 15 parties in all.

The complexity of all of them working together in a quick and efficient way often means the process of buying and selling a house can be long and costly. And that’s before the pandemic — with the problems associated with social distancing and remote working — hit us.

Snapdocs’ solution has been to build one platform in the cloud that helps to manage the documents needed by all of these different parties, providing access to data and the ability to flag or approve things remotely, to speed the process along. It also has built a number of features, using AI technology and analytics, to also help identify what might be potential issues early on and get them fixed.

King is not your typical tech startup entrepreneur. He began working in mortgages as a notary when he was still in high school — he’s effectively been in the industry for 23 years, he said — and his earliest startup efforts were focused on one aspect of the complexities that he knew first-hand: he saw an opportunity to lean on technology to get notarized signatures sorted out in a legal, orderly and quicker way.

He then got deeper into identifying the possibilities of how tech could be used to improve the larger process, and that is how Snapdocs came into existence.

Given how big the real estate market is — it’s the largest asset class in the world, by many estimates — and how many other industries tech has “disrupted” over the years, it’s interesting that there have been so few attempting to solve it. One of the reasons, it seems, is that there hasn’t been enough of a crossover between tech experts and mortgage experts, and Snapdocs is a testament to the virtues of building a startup specifically around a hard problem that you happen to know really well.

“Most people have identified this as a tech problem, and a lot of the tech — such as e-signatures — has existed for 20 years, but the fragmentation of real estate is the issue,” he said. “We’re talking about a mass constellation of companies and workflow. But we’re obsessed about the workflow of all of these constituents.”

That’s a position that has helped Snapdocs build its standing with the industry, as well as with investors.

“I’ve known the Snapdocs team for many years and have always been amazed by their focus and execution toward bringing each stakeholder in the mortgage process online,” said Anu Hariharan, partner at YC Continuity, in a statement. “In 2013, Snapdocs began as a notary marketplace before expanding horizontally to service title companies and, more recently, lenders. By connecting the numerous parties involved in a mortgage on a single platform, Snapdocs is quickly becoming the “operating system” for mortgage closings. Mortgages, much like commerce, will shift online, bringing improved efficiency and a far better customer experience to the outdated home-closing process.” Hariharan has real estate experience herself and is joining the board with this round.

There have been a number of companies taking new, tech-based approaches to the market to find new and faster ways of doing things, and to open up new kinds of value in the market.

Opendoor, for example, has rethought the whole process of selling and buying houses, taking on a role as a middleman in the process both to take on a lot of the harder work of fixing up a home, and handling all of the difficult stages in the sales process: it’s a role that has recently seen the company catapult to a valuation of $4.8 billion by way of a SPAC-based public listing. An interesting idea, King said, but still only accounting for a small sliver of house sales.

Others, like Orchard, Reonomy and Zumper, have all also raised large rounds on the back of a lot of promise of the market continuing to grow and the opportunity to take part in that process through new approaches. It’s a sign that “safe as houses” still has a place in the market, even with all the other unknowns in play.

“Over the next five years the real estate industry will be completely digitized, so a lot of companies are trying to figure out what their place are, and how to provide value,” King said.

Powered by WPeMatico

India continues to crack down on Chinese apps, Microsoft launches a deepfake detector and Google offers a personalized news podcast. This is your Daily Crunch for September 2, 2020.

The big story: India bans PUBG and other Chinese apps

The Indian government continues its purge of apps created by or linked to Chinese companies. It already banned 59 Chinese apps back in June, including TikTok.

India’s IT Ministry justified the decision as “a targeted move to ensure safety, security, and sovereignty of Indian cyberspace.” The apps banned today include search engine Baidu, business collaboration suite WeChat Work, cloud storage service Tencent Weiyun and the game Rise of Kingdoms. But PUBG is the most popular, with more than 40 million monthly active users.

The tech giants

Microsoft launches a deepfake detector tool ahead of US election — The Video Authenticator tool will provide a confidence score that a given piece of media has been artificially manipulated.

Google’s personalized audio news feature, Your News Update, comes to Google Podcasts — That means you’ll be able to get a personalized podcast of the latest headlines.

Twitch launches Watch Parties to all creators worldwide — Twitch is doubling down on becoming more than just a place for live-streamed gaming videos.

Startups, funding and venture capital

Indonesian insurtech startup PasarPolis gets $54 million Series B from investors including LeapFrog and SBI — The startup’s goal is to reach people who have never purchased insurance before with products like inexpensive “micro-policies” that cover broken device screens.

XRobotics is keeping the dream of pizza robots alive — XRobotics’ offering resembles an industrial 3D printer, in terms of size and form factor.

India’s online learning platform Unacademy raises $150 million at $1.45 billion valuation — India has a new startup unicorn.

Advice and analysis from Extra Crunch

The IPO parade continues as Wish files, Bumble targets an eventual debut — Alex Wilhelm looks at the latest IPO news, including Bumble planning to go public at a $6 to $8 billion valuation.

3 ways COVID-19 has affected the property investment market — COVID-19 has stirred up the long-settled dust on real estate investing.

Deep Science: Dog detectors, Mars mappers and AI-scrambling sweaters — Devin Coldewey kicks off a new feature in which he gets you all caught up on the most recent research papers and scientific discoveries.

(Reminder: Extra Crunch is our subscription membership program, which aims to democratize information about startups. You can sign up here.)

Everything else

‘The Mandalorian’ launches its second season on Oct. 30 — The show finished shooting its second season right before the pandemic shut down production everywhere.

GM, Ford wrap up ventilator production and shift back to auto business — Both automakers said they’d completed their contracts with the Department of Health and Human Services.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Powered by WPeMatico

When Brynne McNulty Rojas moved to Bogotá, Colombia four years ago, she encountered a fragmented real estate industry that lacked a central database for consumers to find or compare homes. Rojas was struck by the magnitude of the problem; she was also inspired by the opportunity.

Rojas and business partner Sebastian Noguera homed in on some of the biggest issues in the city’s real estate market, particularly for middle class buyers. They found a market where the average home took 14 months to sell; that figure drops to 10 months for middle class homes. It was a market that lacked price transparency and where sellers used analog tactics like posting a sign in the neighborhood in a futile attempt to attract buyers.

From these problems, Rojas and Noguera founded Habi, a property tech startup with a two-fold approach. The startup founders built a centralized database of residential real estate prices and trends — essentially a multiple listing service — and then used that information to create an automated pricing algorithm to buy and sell homes quickly and efficiently. The company buys, renovates and then sells homes, generating revenue off the margin. It also offers a tool that lets sellers estimate the value of their homes and a database that buyers can use to search for listings. The foundation of its business is its automated pricing technology, which was built using data from its real estate, financial and government partners.

“You can think of it as an MLS plus Opendoor model,” Rojas said in a recent interview. (Opendoor is the U.S.-based property tech startup backed by SoftBank.)

The Bogotá-based startup has now raised $10 million in a Series A round led by Inspired Capital, with participation from 8VC, Clocktower, Homebrew, Vine Ventures and Zigg. The round included angel investments from Flatiron Health and Looker. The company has raised $15.5 million to date.

Habi co-founders Brynne McNulty Rojas and Sebastian Noguera. Rojas is CEO and Noguera is president of the Bogota-based real estate startup. Image Credits: Habi

Since launching in fall 2019, Habi has scaled rapidly — and has even picked up speed during the city’s strict lockdown during the COVID-19 pandemic. Transaction volume has increased threefold since March, Rojas noted.

Rojas said its data-driven approach works, allowing the company to sell a home three times faster than the market average.

The company currently covers all of Bogotá. It plans to use this fresh injection of capital to expand to Medellin this month and eventually to other Latin American markets, according to Noguera, who previously ran the digital transformation at Banco de Bogota and co-founded Marqueo.

The founders also intend to eventually expand Habi’s services to become a “one-stop shop for everything related to the home,” Rojas said. In the long term, this might mean connecting consumers with moving, storage, furnishings and other services.

Powered by WPeMatico

As we race toward Disrupt 2020, we’re keeping the Extra Crunch Live train rolling with a big entry next week as Twilio CEO and co-founder Jeff Lawson joins us for a chat.

Lawson is well-known in the tech industry for helping institutionalize API -delivered digital services, a business model variant that has become increasingly popular in recent years. Twilio has become a giant in and of itself, worth more than $37 billion today after going public in 2016.

As always, we’ll take some questions from the audience, so bring your best material.

Considering Twilio, it’s position in the mind of API-focused startups everywhere is notable. You tend to hear API-powered startups mention Twilio and Stripe as the two companies that they are mimicking, albeit usually with a different focus: “We’re building the Twilio for X.”

The power of API-driven startups with usage-based pricing and nearly SaaS-like gross margins is something private investors have certainly noticed and are betting on.

But there’s more to Twilio and Lawson than just that one topic, so we’ll also spend time riffing on when is the right time for a private company to go public, how his life has changed since the IPO, and what advice he might have for the super-late-stage startups who can’t seem to get out of the wings and onto the public markets. And, why, odd duck amongst most of the tech-famous, he doesn’t appear to make many angel investments.

Details follow for Extra Crunch members. If you aren’t one yet, sign up today so you can join our conversation.

Powered by WPeMatico

The United States is currently in the middle of an affordable housing crisis that’s putting the nation’s most economically insecure citizens at risk of becoming homeless even as a pandemic continues to spread across the country.

But one Atlanta startup called PadSplit is using the same model that Airbnb created (which ultimately drove up rental and housing prices across the country) to bring down costs for subsidized housing and provide relief for some of the people most at risk.

America’s second housing crisis

Twelve years after the last housing crisis in the United States caused a global economic meltdown, the U.S. is once again on the brink of another real estate-related economic disaster.

This time, it’s not speculators and investors that will carry the weight of the coming collapse, but low-income renters faced with still sky-high housing costs and no income thanks to historic unemployment caused by the nation’s COVID-19 epidemic, as Vox reported.

Before COVID-19 swept across the world, half of U.S. renters were spending roughly 30% of their income on apartments and homes. One-fifth of the population actually spent over half of their income on rent, and now, with roughly 10% of the country unemployed, that population faces eviction and the prospect of homelessness.

One-third of American families failed to make rent in June, and by September more than 20 million renters could be evicted by landlords.

Can an Airbnb model provide relief?

To solve the problem of housing insecurity, PadSplit borrows a page from the Airbnb playbook by creating a marketplace where homeowners can list rooms for rent for long-term stays.

Currently, the company manages 1,000 units in the Atlanta area and has expanded its presence into Maryland. The company’s renters include teachers, grocery store employees, restaurant workers — all people whose services are considered essential during the COVID-19 epidemic. “Forty percent of our population has been functionally homeless,” said company founder, Atticus LeBlanc. “The average income [for our renters] is $25,000 per year.”

The average age of an occupant in a PadSplit room is 39, but renters have been as young as 19 or as old as 77, according to the company.

A quick scan of PadSplit rates in the Atlanta area shows rents of roughly $140 to $250 per week for rooms in existing homes. “We are focused on longer-term stays for lower income,” said LeBlanc.

The company screens tenants and landlords, including criminal background checks and employment verification. “We sit between a hotel provider and a longer-term apartment,” said Leblanc. “Where we need to both be an immediate housing provider for people who are in difficult situations while also underwriting that [person].” Owners looking to rent on PadSplit also need to prove that they haven’t been convicted of a felony within the last seven years.

Image Credits: luismmolina (opens in a new window) / Getty Images

Launching PadSplit

LeBlanc, a New Orleans native turned Atlanta entrepreneur was named for Atticus Finch, the fictional lawyer whose fight for social justice in “To Kill a Mockingbird” is a staple of schoolroom lit assignments, and a model for white liberal southern gentry.

“My mother… said she wanted to give me someone to live up to,” says LeBlanc.

With a degree in architecture from Yale University, LeBlanc has run a real estate development and construction business in Atlanta for over 12 years. He launched PadSplit in 2017 after writing up the idea for the business in response to a competition from the Atlanta housing nonprofit House ATL and the nonprofit Enterprise Community Partners.

LeBlanc’s plan was selected as one of the finalists and he received a small grant from the organization and the JPMorgan Chase foundation to pursue the business.

With the help of John O’Bryan, a serial entrepreneur who had built businesses in the vacation rental industry, LeBlanc built up the marketplace that would become PadSplit, starting first in Atlanta and moving out to surrounding suburbs and into Maryland. LeBlanc later brought in Frank Furman, a Naval Academy graduate, U.S. Marine Corps veteran and former McKinsey consultant, to help grow the business.

Now the company, a Techstars accelerator graduate, has $10 million in new financing from Core Innovation Capital, Alate Partners, the Citi Impact Fund, Kapor Capital, Impact Engine and Cox Enterprises to expand PadSplit into Texas, starting with Houston, and quickly ramp up hiring.

“PadSplit provides a truly unique solution to a complicated national problem that’s becoming more dire each day,” said Arjan Schütte, founder and managing partner of Core Innovation Capital, in a statement. “We’re proud to support Atticus and the PadSplit team as they expand into new markets and introduce critical housing supply at a time when so many require affordable housing.”

Making money in affordable housing

According to LeBlanc, affordable housing is built around two things. One is the subsidy owners receive from the federal government and the second is a percentage of the cost of rentals. To convince owners that being in the affordable housing market was a good idea, LeBlanc just proved to them that they could get higher risk-adjusted returns versus other long-term rentals.

So far, that’s been proven out, he says. Through its model of fixed costs and weekly rent payments, PadSplit occupants have been able to save roughly $516 per month, according to data supplied by the company. Lowering rent has also allowed tenants to build credit, move into their own apartments and buy vehicles — or even, in some cases, houses of their own.

The company estimates it has also saved taxpayers over $203 million in subsidies by eliminating the need to build subsidized housing units. Property owners have also benefited, the company said, increasing revenues on properties by more than 60%.

And LeBlanc isn’t just the founder of PadSplit, he’s also a customer. “I rent a room downstairs in my personal home,” he said.

Ultimately, LeBlanc sees housing stability and a path to home ownership as one of the key tenets of economic equality in the United States.

“Every zoning law in America was based on a system that had no racial equity. We’re still battling those vestiges that exist in almost every jurisdiction,” he says.

And for LeBlanc the problem goes back to nearly 100 years. “If you acknowledge that racial inequality led to income stratification where it was impossible for returning Black GIs to get access to the same wealth-building opportunities that white returning GIs had… it’s no surprise that you have lower incomes by a substantial margin for African Americans as you do for whites.”

LeBlanc sees his business providing an additional revenue stream for the owners who rent properties, and an on-ramp to the financial system for people who are at risk or historically disenfranchised.

“We wanted to create a value proposition that is valuable to anyone in the housing space,” said LeBlanc.

Powered by WPeMatico