real estate

Auto Added by WPeMatico

Auto Added by WPeMatico

Another proptech is considering raising capital through the public arena.

Knock confirmed Monday that it is considering going public, although CEO Sean Black did not specify whether the company would do so via a traditional IPO, SPAC merger or direct listing.

“We are considering all of our options,” Black told TechCrunch. “We pioneered the real estate transaction revolution over five years ago and our priority is to build a war chest to dramatically widen the already cavernous gap between us and any unoriginal knock-offs.”

Bloomberg reported earlier today that the company had hired Goldman Sachs to advise on such a bid, which Knock also confirmed.

According to Bloomberg, Knock is potentially seeking to raise $400 million to $500 million through an IPO, according to “people familiar with the matter,” at a valuation of about $2 billion. The company declined to comment on valuation.

Black and Knock COO Jamie Glenn are no strangers to the proptech game, having both been on the founding team of Trulia, which went public in 2012 and was acquired by Zillow for $3.5 billion in 2014. The pair started Knock in 2015, and have since raised over $430 million in venture funding and another $170 million or so in debt.

Knock started out as a real estate brokerage business until last July, when the company announced a major shift in strategy and said it was becoming a lender. At the time, Knock unveiled its Home Swap program, under which Knock serves as the lender to help a homeowner buy a new home before selling their old house. It previously worked with lending partners but has now become a licensed lender itself.

In other words, the company now offers integrated financing — the mortgage and an interest-free bridge loan — with the goal of helping consumers make strong non-contingent offers on a new home before repairing and listing their old home for sale on the open market.

With that move, Knock eliminated its Home Trade-In program, where it helped consumers buy before selling by using its own money to purchase the new home on behalf of the consumer before prepping and listing the consumer’s old house on the open market. Under that trade-in model, the homeowner used the proceeds from selling their old home to buy the new home from Knock and pay the company back for any repairs it did to prep the house for sale.

At that time, Black told me that Knock had decided to move away from its trade-in program in part because it was capital-intensive and required the closing of a house to take place twice.

“It added friction to the experience,” he said. “And now, especially during COVID, it can be inconvenient to try and sell a house at the same time as buying one. This is about making something possible that isn’t possible with any other traditional lender. We’re able to lend some money before an owner’s [old] house is even listed on the market.”

To sum up what Knock does today, Black said the company aims to offer a full service technology platform that includes everything “from pre-funding the homebuyers to make non-contingent offers and win bidding wars, to getting their old home ready for market with our contractor network to selling their old home quickly at the highest price and empowers them to have their own agent working with them in the app through the entire process.”

Demand for the Home Swap, he added, has “exceeded all expectations.”

Knock is headquartered in New York and San Francisco. The company launched the Home Swap in three markets in July 2020, and today it is in 27 markets in nine states, including Texas, California and North Carolina.

“Our original plan was to be in 21 markets by the end of 2021,” Black said. “At our current growth rate, we expect to end the year at 45 markets and be in 100 by 2023.”

Knock began 2021 with 100 employees and now has 150. Its plan is to have at least 400 employees by year’s end.

Other proptech startups that have recently announced plans to go public include Compass and Doma (formerly States Title).

Powered by WPeMatico

Since the pandemic began, I have been pushing the limits of my imagination to try to picture what cities will look and feel like in the coming years.

If your town looks like San Francisco, where I live, it’s a pressing question: Our once-bustling financial district is a ghost town, but even in outer neighborhoods, the number of vacant storefronts is unsettling. People are starting to emerge after sheltering in place for a year, but we are a long way from fully restoring our shared spaces.

What’s going to happen to those semi-vacant office towers, some of which are still under construction? There’s been renewed talk of converting some skyscrapers into residential housing, but there are real economic/logistic hurdles to clear before that can be broadly applied. Scores of restaurants have closed in recent months; who will take over those spaces? I spend a lot of time walking around, and it’s been a long time since I’ve noticed a “Grand Opening” sign.

Seeking answers, Managing Editor Eric Eldon interviewed 10 VCs who are active in proptech and found that most were generally “optimistic.”

Several expressed genuine uncertainty about the future of offices, but most were bullish about prospects for remote work, the rebirth of physical retail and the emergence of “third spaces” that will fill the gap between work and home.

In a companion article on TechCrunch, Eric explores these broader shifts, concluding, “you can start to see a world emerging that sounds a lot more like the fantasies of a New Urbanist than the world before the pandemic.”

Here’s who he interviewed:

Thanks very much for reading Extra Crunch this week. Have a great weekend!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

Image Credits: Jon Feingersh Photography Inc / Getty Images

Ideally, BI transforms raw data into actionable information, but according to Charles Caldwell, VP of product management at Logi Analytics, “a gap exists between the functionalities provided by current BI and data discovery tools and what users want and need.”

Few BI tools actually integrate with existing workflows and most offer clunky user experiences, “leaving many individuals feeling like they need an advanced computer science degree to actually be able to pull insights out.”

Instead of requiring workers to abandon workflow applications to access data, embedded analytics are more efficient and easier to use, says Caldwell.

In short, “it’s time to abandon BI — at least as we currently know it.”

Image Credits: nadia_bormotova / Getty Images

Amid the pandemic, investors became laser-focused on sections of the pitch deck that address monetization and business viability — signs that founders need to come to the table with better-defined businesses in order to succeed.

Investors’ heightened expectations for monetization potential and a company’s positioning within its competitive landscape are unlikely to lessen in the years to come, even in a post-COVID economy.

Image Credits: Rafael Henrique/SOPA Images/LightRocket via Getty Images

Clubhouse’s hockey-stick growth is something most startups would kill for.

However, it also means that UX problems can only be addressed while in “full flight” — and that changes to the user experience will be felt at scale rather under the cover of a small, loyal and (usually) forgiving user base.

We’re not investors, so we’re not pretending to sort the unicorns from the goats.

But TechCrunch reporters spend a lot of time talking with startups, hearing pitches and telling their stories; if you’re curious about which companies stood out from Y Combinator’s W21 Demo Day, read on.

Image Credits: Nigel Sussman (opens in a new window)

There’s a lot going on: The venture capital market is redlining its engines while public markets remain sympathetic to growing, unprofitable companies.

Let’s round up IPO news from DigitalOcean, Kaltura, Robinhood and Zymergen, and big rounds for Lattice and goPuff.

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie:

I’m a startup founder looking to expand in the U.S. I was originally looking at opening an office in Silicon Valley to be close to software engineers and investors, but then … COVID-19 🙂

A lot has changed over the last year — can I still come?

— Hopeful in Hungary

Image Credits: Aleksei Naumov / Getty Images

Aside from improved SEO, small business websites optimizing for Google’s new Core Web Vitals will reap the rewards of an improved user experience for their site visitors.

While many are looking at the Core Web Vitals as a big hoop to jump through to please the search powers that be, others are seeing — and seizing — the opportunities that come along with this change.

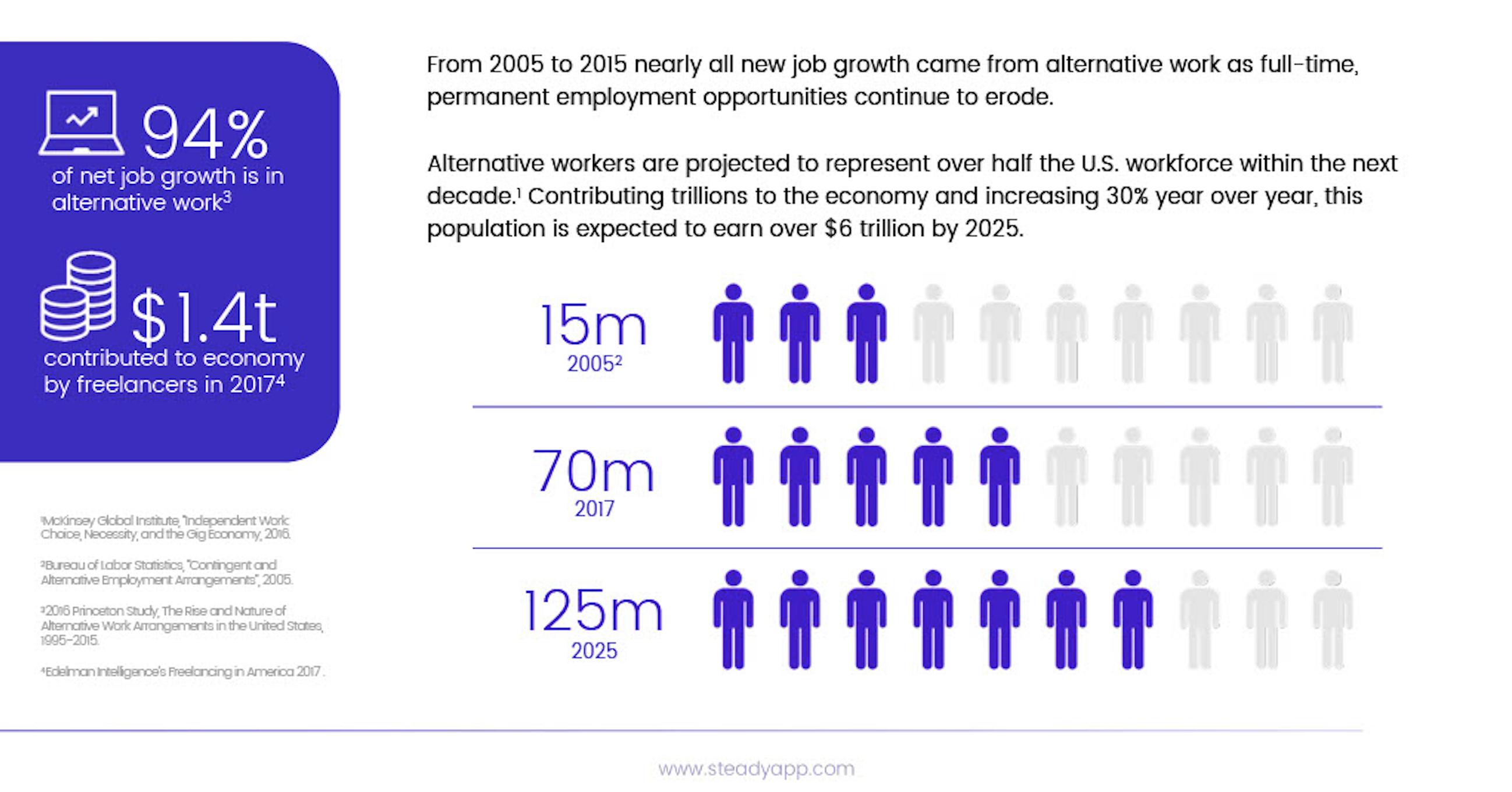

Image Credits: Steady

When it comes to Steady — the platform that helps hourly workers manage and maximize their income and access deals on things like benefits and financial services — the strengths of the business are clear.

But it took time for founder and CEO Adam Roseman to clearly define and communicate each of them in his quest for fundraising.

Image Credits: Nigel Sussman (opens in a new window)

Alex Wilhelm dug into Discord’s possible $10 billion exit to Microsoft and explored IPO price ranges for real estate tech company Compass and Intermedia Cloud Communications, a unified-communications-as-a-service company.

“It’s a lot,” he noted, “but if we don’t get through it all now, we’ll fall behind and feel silly later.”

Image Credits: Nigel Sussman (opens in a new window)

The consumer trading frenzy could be slowing.

What would happen to Robinhood and its cohorts if the apparent cooling in consumer trading demand continues?

Image Credits: Miguel Navarro (opens in a new window) / Getty Images (Image has been modified)

Almost every private equity and venture capital investor now advertises that they have a platform to support their portfolio companies, “however, most of us don’t have the budget of an Andreessen Horowitz to support almost every major need” for each startup they’ve bet on, says Versatile VC founder David Teten.

If you’re prioritizing a platform buildout for your firm, consider using the framework he’s outlined.

Image Credits: Bryce Durbin

Despite all of the pomp and promises about the potential for AR and VR, there isn’t a clear understanding of market demand for bringing the technology to cars, trucks and passenger vans.

Estimates of the global market range from $14 billion by 2027 to as much as $673 billion by 2025, showing just how nascent the market currently is and how much opportunity is present.

Image Credits: phototechno / Getty Images

The Middle East is a promising region with growing digital advertising solutions despite locals’ attachment to traditional means of advertising.

In recent years, there has been a shift to the active use of social media and online shopping, meaning the Middle East embodies great potential for adtech startups.

Image Credits: Getty Images

Social+ products are seeing mass adoption because they marry community with functionality.

This applies even to fintech companies as taboos around money fall away.

Image Credits: Mironov Konstantin / Getty Images

It took Christine Tao, founder of Sounding Board, just over three years to recognize the value of executive coaching and get her company to a Series A.

Here’s how she did it.

Image Credits: Amber J. Dickinson (opens in a new window)

Music companies, celebrities and fashion brands are some of the latest entities to dip a toe into the burgeoning NFT market.

In part two of a three-part series, we take a look at why NFTs are “the next chapter of digital art history.”

Image Credits: Charday Penn (opens in a new window) / Getty Images

The pandemic-induced growth of e-commerce is, by now, well documented.

What is happening in the app ecosystem that supports e-commerce? Is it growing, or are we more likely to see consolidations and IPOs?

Let’s explore.

Image Credits: Nigel Sussman (opens in a new window)

You’ll want to pay attention to this one: Israel’s ironSource, an app-monetization startup, is going public via a SPAC.

It’s the second SPAC-led debut from an Israeli company in recent weeks worth more than $10 billion, and ironSource is actually a pretty darn interesting company from a financial perspective.

Image Credits: Bryce Durbin / TechCrunch

The market views Coursera’s edtech business warmly ahead of its impending public offering.

Coursera is being valued as a software company, likely a breathe-easy moment for still-private edtech companies, since the debut could be an industry bellwether.

Powered by WPeMatico

When the world shifted toward virtual one year ago, one service in particular saw heated demand: remote online notarization.

The ability to get a document notarized without leaving one’s home suddenly became more of a necessity than a luxury. Pat Kinsel, founder and CEO of Boston-based Notarize, worked to get appropriate legislation passed across the country to make it possible for more people in more states to get documents notarized digitally.

That hard work has paid off. Today, Notarize has announced $130 million in Series D funding led by fintech-focused VC firm Canapi Ventures after experiencing 600% year over year revenue growth. The round values Notarize at $760 million, which is triple its valuation at the time of its $35 million Series C in March of 2020. This latest round is larger than the sum of all of the company’s previous rounds to date, and brings Notarize’s total raised to $213 million since its 2015 inception.

A slew of other investors participated in the round, including Alphabet’s independent growth fund CapitalG, Citi Ventures, Wells Fargo, True Bridge Capital Partners and existing backers Camber Creek, Ludlow Ventures, NAR’s Second Century Ventures and Fifth Wall Ventures.

Notarize insists that it “isn’t just a notary company.” Rather, Canapi Ventures partner Neil Underwood described it as the “last mile” of businesses (such as iBuyers, for example).

The company has also evolved to “also bring trust and identity verification” into those businesses’ processes.

Over the past year, Notarize has seen a massive increase in transactions and inked new partnerships with companies such as Adobe, Dropbox, Stripe and Zillow Group, among others. It’s seen big spikes in demand from the real estate, financial services, retail and automotive sectors.

“In 2020, the world rushed to digitize. Online commerce ballooned, and businesses in almost every industry needed to transition to digital basically overnight so they could continue uninterrupted,” Kinsel said. “Notarize was there to help them safely close these deals with trust and convenience.”

The company plans to use its new capital to expand its platform and product and scale “to serve enterprises of all sizes.” It also plans to double down on hiring in the next year.

“Notarize is disrupting outdated business models and technologies, and there’s massive potential, particularly in the financial services space, as more companies will need to offer secure digital alternatives to in-person transactions,” Canapi’s Underwood said.

Notarize’s success comes after a difficult 2019, when the company saw “critical financing” fall through and had to lay off staff, according to Kinsel. Talk about a turnaround story.

Powered by WPeMatico

It’s demo day for the current Y Combinator class, so we’ll have a largely early-stage focus at TechCrunch today. But there’s also a host of late- and super-late-stage news this morning that matters.

Let’s get to all of it before we start to talk accelerators, overheated pre-seed valuations and the like.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

There are three things to discuss. First, the possible $10 billion exit of Discord to Microsoft. Discord is a well-financed unicorn that has raised oodles of capital and reportedly sports rapidly expanding revenues. Our goal will be to vet whether the price tag in question makes any sense, or if it is too low.

Second: Real estate tech company Compass has set an IPO price range we need to explore. Is its resulting valuation strong? Does it line up with its recent financial performance?

And, third, Intermedia Cloud Communications has priced its IPO. We’re behind on this entire debut, so we’ll take a second to riff on what the company does and what it is worth.

And, third, Intermedia Cloud Communications has priced its IPO. We’re behind on this entire debut, so we’ll take a second to riff on what the company does and what it is worth.

It’s a lot. But if we don’t get through it all now, we’ll fall behind and feel silly later. Let’s get to work!

Microsoft might be getting good at community, which is an odd thing to say about the enterprise software and cloud computing giant. The company’s Xbox gaming ecosystem has survived the test of time, Github is doing fine under Microsoft’s auspices, and Minecraft seems unharmed by Redmond’s stewardship.

That means gamers, developers and kids are all content to hang with Satya Nadella and company. Adding Discord to the mix might give Microsoft even more tooling to augment its existing communities, or perhaps tie them more closely together. But that’s all product news, which isn’t our remit. Let’s talk numbers.

The New York Times reported that Discord has “held deal talks with Microsoft for a transaction that could top $10 billion.” That figure has been widely reported, so we’ll use it for our work.

With a possible valuation in hand, we need revenue numbers to figure out if the possible sale price makes any sense. Happily, we have somewhat fresh numbers: The Wall Street Journal reported earlier this month that Discord “generated $130 million in revenue [in 2020], up from nearly $45 million in 2019.”

Powered by WPeMatico

Sometimes the smallest innovations can have the biggest impacts on the world’s efforts to stop global climate change. Arguably, one of the biggest contributors in the fight against climate change to date has been the switch to the humble LED light, which has slashed hundreds of millions of tons of carbon dioxide emissions simply by reducing energy consumption in buildings.

And now firms backed by Robert Downey Jr. and Bill Gates are joining investors like Amazon and iPod inventor Tony Fadell to pour money into a company called Turntide Technologies that believes it has the next great innovation in the world’s efforts to slow global climate change — a better electric motor.

It’s not as flashy as an arc reactor, but like light bulbs, motors are a ubiquitous and wholly unglamorous technology that have been operating basically the same way since the nineteenth century. And, like the light bulb, they’re due for an upgrade.

“Turntide’s technology and approach to restoring our planet will directly reduce energy consumption,” said Steve Levin, the co-founder (along with Downey Jr. ) of FootPrint Coalition.

The operation of buildings is responsible for 40% of CO2 emissions worldwide, Turntide noted in a statement. And, according to the U.S. Department of Energy (DOE), one-third of energy used in commercial buildings is wasted. Smart building technology adds an intelligent layer to eliminate this waste and inefficiency by automatically controlling lighting, air conditioning, heating, ventilation and other essential systems and Turntide’s electric motors can add additional savings.

That’s why investors have put over $100 million into Turntide in just the last six months.

PARIS, FRANCE – JUNE 16: Tony Fadell, inventor of the iPod and founder and former CEO of Nest, attends a conference during Viva Technology at Parc des Expositions Porte de Versailles on June 16, 2017 in Paris, France. Viva Technology is a fair that brings together, for the second year, major groups and startups around all the themes of innovation. (Photo by Christophe Morin/IP3/Getty Images)

The company, led by chief executive and chairman Ryan Morris, is commercializing technology that was developed initially at the Illinois Institute of Technology.

Turntide’s basic innovation is a software-controlled motor, or switch reluctance motor, that uses precise pulses of energy instead of a constant flow of electricity. “In a conventional motor you are continuously driving current into the motor whatever speed you want to run it at,” Morris said. “We’re pulsing in precise amounts of current just at the times when you need the torque… It’s software-defined hardware.”

The technology spent 11 years under development, in part because the computing power didn’t exist to make the system work, according to Morris.

Morris was initially part of an investment firm called Meson Capital that acquired the technology back in 2013, and it was another four years of development before the motors were actually able to function in pilots, he said. The company spent the last three years developing the commercialization strategy and proving the value in its initial market — retrofitting the heating ventilation and cooling systems in buildings that are the main factor in the built environment’s 28% contribution to carbon dioxide emissions that are leading to global climate change.

“Our mission is to replace all of the motors in the world,” Morris said.

He estimates that the technology is applicable to 95% of where electric motors are used today, but the initial focus will be on smart buildings because it’s the easiest place to start and can have some of the largest immediate impact on energy usage.

“The carbon impact of what we’re doing is pretty massive,” Morris told me last year. “The average energy reduction [in buildings] has been a 64% reduction. If we can replace all the motors in buildings in the U.S. that’s the carbon equivalent of adding over 300 million tons of carbon sequestration per year.”

That’s why Downey Jr.’s Footprint Coalition, and Bill Gates’ Breakthrough Energy Ventures and the real estate and construction-focused venture firm Fifth Wall Ventures have joined the Amazon Climate Fund, Tony Fadell’s Future Shape, BMW’s iVentures fund and a host of other investors in backing the company.

The company has raised roughly $180 million in financing, including the disclosure today of an $80 million investment round, which closed in October.

Buildings are clearly the current focus for Turntide, which only yesterday announced the acquisition of a small Santa Barbara, California-based building management software developer called Riptide IO. But there’s also an application in another massive industry — electric vehicles.

“Two years from now we will definitely be in electric vehicles,” Morris said.

“Our technology has huge advantages for the electric vehicle industry. There’s no rare earth minerals. Every EV uses rare earth minerals to get better performance of their electric motors,” he continued. “They’re expensive, destructive to mine and China controls 95% of the global supply chain for them. We do not use any exotic materials, rare earth minerals or magnets… We’re replacing that with very advanced software and computation. It’s the first time Moore’s law applies to the motor.”

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, legal, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included in each for audience questions and discussion.

Powered by WPeMatico

Real estate tech startup Doma, formerly known as States Title, announced Tuesday it will go public through a merger with SPAC Capitol Investment Corp. V in a deal valued at $3 billion, including debt.

SPACs, often called blank-check companies, are increasingly common. They exist as publicly traded entities in search of a private company to combine with, taking the private entity public without the hassle of an IPO.

When it floats later this year, Doma will trade on the New York Stock Exchange under the ticker symbol DOMA. The transaction is expected to provide up to $645 million in cash proceeds, including a fully committed PIPE of $300 million and up to $345 million of cash held in the trust account of Capitol Investment Corp. V.

CEO Max Simkoff founded San Francisco-based Doma in September 2016 with the aim of creating a technology-driven solution for “closing mortgages instantly.” While it initially was founded to instantly underwrite title insurance, the company has expanded that same approach to handle “every aspect” of closing and escrow.

Doma has developed patented machine learning technology that it says reduces title processing time from five days to “as little as one minute” and cuts down the entire mortgage closing process “from a 50+ day ordeal to less than a week.” The startup has facilitated over 800,000 real estate closings for lenders such as Chase, Homepoint, Sierra Pacific Mortgage and others.

The name change is designed to more accurately reflect its intention to expand “well beyond” title into areas such as appraisals and home warranties.

Its goal with going public is to be able to “continue to invest in growth, market expansion and new products.”

Anchoring the PIPE include funds and accounts managed by BlackRock, Fidelity Management & Research Company LLC, SB Management (a subsidiary of SoftBank Group), Gores, Hedosophia, and Wells Capital. Existing Doma shareholder Lennar has also committed to the PIPE and Spencer Rascoff, co-founder and former CEO of Zillow Group, has committed a personal investment to the PIPE.

Up to approximately $510 million of cash proceeds are expected to be retained by Doma, and existing Doma shareholders will own no less than approximately 80 percent of the equity of the new combined company, subject to redemptions by the public stockholders of Capitol and payment of transaction expenses.

In mid-February, Doma announced it had closed on $150 million in debt financing from HSCM Bermuda, which had previously invested in the company. And last May, it announced a massive $123 million Series C round of funding at a valuation of $623 million.

The company posted modest growth from 2019 to 2020, seeing its GAAP revenues rise from $358.1 million to $409.8 million. After removing premiums paid to agents, its revenues (“retained premiums and fees”) decreased to $179.8 million in 2019 and $189.7 million in 2020. (For this section we’re leaning on the reported 2020 numbers that are caveated with an “estimated” tag. As it is March, we expect the final 2020 numbers to come in close enough to what was reported as to make us comfortable citing them.)

In 2021 the company also anticipates modest growth, with GAAP revenues estimated at $416.4 million, and its retained revenue figure landing at $226.4 million. More expansive growth is anticipated and sketched out for 2022 and 2023, though as those figures are far in the future we can discount them for now.

Doma also expects its economics to worsen in 2021, with its adjusted gross profit as a percentage of its retained premiums and fees falling from 48.3% last year to 39.5% this year. Of course we’re so far off the GAAP ranch with that metric as to be lost, but it’s worth noting what the company is telling the street about its impending financial performance.

Other metrics are also pointed in a negative direction, with Doma expecting its adjusted EBITDA to fall from -$19.0 million to -$66.6 million in 2021. The company does predict a rosy 2023 adjusted EBITDA number, for whatever stock you want to put in that.

Without discounting costs, Doma’s 2020 net loss of $35.1 million is expected to expand to $103.1 million this year. Still, as with many entities pursuing a public debut via a SPAC, Doma is debuting while it is still sorting out elements of its business as the pandemic starts to diminish in light of increasingly readily available vaccines. It certainly has high hopes for its future.

Doma joins the growing number of proptech companies going the public route. On Monday, Compass, the real-estate brokerage startup backed by roughly $1.6 billion in venture funding, filed its S-1.

In 2020, Social Capital Hedosophia II, the blank-check company associated with investor Chamath Palihapitiya, announced that it would merge with Opendoor, taking the private real estate startup public in the process.

Porch.com also went public in a SPAC deal in December. And, SoftBank-backed View, a Silicon Valley-based smart window company, will complete a recent SPAC merger to be publicly listed on the NASDAQ stock exchange on March 9. The company is expected to debut trading with a market value of $1.6 billion.

Powered by WPeMatico

Real estate tech startup Sunroom Rentals, which leases units on behalf of property managers and apartment owners, has raised $11 million in a Series A round of funding led by Gigafund.

Ben Doherty and Zachary Maurais, former founders of the delivery app Favor, launched Sunroom in May 2018 with the mission of “boosting the profitability” of mid-size property managers and apartment owners by giving them a way to outsource their leasing operations.

The pair sold Favor to Texas grocer H-E-B in 2018 and soon after shifted their focus on building out Sunroom. The Austin-based company has developed an app that it says gives renters a way to tour, apply for and lease a unit “entirely online.” COVID-19 has led to more renters wanting virtual ways to explore and secure rental units. Mobile-first, Maurais noted, is particularly appealing to millennials and Gen Zers.

“Personally, we love to create products that fulfill consumer’s most basic needs,” said Maurais, the company’s president. “With food under our belt, we decided to focus on housing.”

While one might wonder what the parallels between food delivery and housing might be beyond fulfilling consumers’ needs, CEO Doherty said the rental market in 2021 looks a lot like the food delivery market in 2013.

“In 2013, Grubhub had successfully put many restaurant menus online, but most of the transactions and delivery process was still offline,” he told TechCrunch. “We’re in a similar position with the rental market, as the majority of rental listings are online, but touring, applying or leasing units is still done offline.”

Since its launch, Sunroom Rentals has signed more than 2,000 leases and had over 100,000 renters sign up for its services in fast-growing Austin, where it focused its initial efforts.

“According to the U.S. Census, that represents roughly 10% of renters in the greater Austin metro,” Maurais said. “Instead of going shallow and wide nationally, we decided to go deep in markets, in an effort to gain network effects, which was a strategy that worked well for us at Favor.”

Sunroom Rentals claims that it’s leasing units five days faster than the market average. This benefits property managers, Doherty said, because they can grow quicker “while improving leasing performance.”

Looking ahead, the company will use the funding to expand across Texas, including in Houston, San Antonio and Dallas. It will also invest in its partner portal, which aims to give owners and property managers a way to view real-time data on leasing performance.

Sunroom Rentals currently has 18 employees with the goal of more than doubling its headcount this year. It’s in particular looking to hire across its engineering, product and sales departments.

As mentioned above, Gigafund led the Series A financing, which included participation from NextGen Venture Partners, Calpoly Ventures and a slew of angel investors, including Gokul Rajaram (Google & Square) and Homeward’s Tim Heyl, among others. Existing backers include Founders Fund Seed, Draper Associates, Boost VC and Capital Factory (among many others). The round marked Sunroom’s first “priced” round, meaning the first time it’s given up stock.

Jonathan Basset, managing partner at NextGen Venture Partners, believes Sunroom was essentially in the right place at the right time and “on trend with touchless leasing even before COVID hit.”

“I watched them build a profitable consumer marketplace in a competitive market with Favor and was impressed with them as operators,” he said. “These businesses have a surprising amount of similarities and I’m confident they can rise to the challenge.

Last week, TechCrunch reported on the raise of another startup operating in this increasingly crowded space. Seattle-based Knock — a company that has developed tools to give property management companies a competitive edge — raised $20 million in a growth funding round led by Fifth Wall Ventures.

Knock’s goal is to provide CRM tools to modernize front office operations for these companies so they can do things like offer virtual tours and communicate with renters via text, email or social media from “a single conversation screen.” For renters, it offers an easier way to communicate and engage with landlords.

Maurais said the two differ in that Knock is a CRM built for leasing agents with a SAAS model where as Sunroom is a marketplace, where renters match, tour and apply with partnered properties.

“Sunroom also provides a suite of leasing & analytics software to its partners and generates both transactional and subscription revenues,” he added.

Powered by WPeMatico

What is working in the office going to look like in a post-COVID-19 world?

That’s something one startup hopes to help companies figure out.

Saltmine, which has developed a web-based workplace design platform, has raised $20 million in a Series A funding round.

Existing backers Jungle Ventures and Xplorer Capital led the financing, which also included participation from JLL Spark, the strategic investment arm of commercial real estate brokerage JLL.

Notably, JLL is not only investing in Saltmine, but is also partnering with the San Francisco-based startup to sell its service directly to its clients — opening up a whole new revenue stream for the four-year-old company.

Saltmine claims its cloud-based technology does for corporate real estate heads what Salesforce did for CROs in digitizing and streamlining the office design process. It saw an 80% spike in ARR (annual recurring revenue) last year while doubling the number of companies it works with, according to CEO and founder Shagufta Anurag. Its more than 35 customers include PG&E, Snowflake, Fidelity and Workday, among others. Its mission, put simply, is to help companies “create the best possible workplaces for their employees.”

Saltmine claims to have a 95% customer retention rate and in 2020 saw 350% year over year growth in monthly active users of its SaaS platform. So far, the square footage of all the office real estate properties designed and analyzed by customers on Saltmine totals 50 million square feet across 1,500 projects.

Saltmine says it offers companies tools to do things like establish social distancing measures in the office. Its platform, the company says, houses all workplace data — including strategy, design, pricing and portfolio analytics — in one place. It combines and analyzes floor plans with project requirements with real-time behavioral data (aggregated through a combination of utilization sensors and employee feedback) to identify companies’ design needs. Besides aiming to improve the workplace design process, Saltmine claims to be able to help companies “optimize their real estate portfolios.”

The pandemic has dramatically increased the need for a digital transformation of how workplaces are designed and reimagined, according to Anurag.

“Given the need for social distancing capabilities and a greater emphasis on work-life balance in many office settings, few workers expect a complete ‘return to normal,’ ” she said. “There is now enormous pressure on corporate heads of real estate to adapt and modify their workplaces.”

Once companies identify their new needs, Saltmine uses “immersive” digital 3D renderings to help them visualize the necessary changes to their real estate properties.

Singapore-based Anurag has previous experience in the design world, having founded Space Matrix, a large interior design firm in Asia, as well as Livspace, a digital home interior design company.

“I saw the same pain points and unmet needs in office real estate that I did in the residential market,” she said. “Real estate is the second-largest cost for companies and has a direct impact on their largest cost — their people.”

Looking ahead, Saltmine plans to use its new capital to (naturally) do some hiring and continue to acquire customers — in particular, seeking to expand its portfolio of Global 2000 companies.

Saltmine has about 125 employees in five offices across Asia, Europe and North America. It expects to have 170 employees by year’s end and to be profitable by the end of fiscal year 2021.

The company’s initial focus has been in North America, but it is now beginning to expand into APAC and Australia.

JLL Technologies’ co-CEO Yishai Lerner said JLL Spark was drawn to Saltmine’s approach of making data and analytics accessible in one place.

“Having a single source of truth for data also facilitates collaboration across teams, which is important, for example, in workspace planning,” he told TechCrunch. “This reduces inefficiencies and improves workflows in today’s fragmented design, build and fit-out market.”

JLL Spark invests in companies that it believes can benefit from its distribution and network — hence the firm’s agreement to sell Saltmine’s software directly to its customers.

“As JLL tenants and clients continue to embrace the future of work, they are seeking technology solutions that keep their buildings running efficiently and effectively,” Lerner said. “Saltmine’s platform checks all of the boxes by streamlining stakeholder collaboration, increasing transparency and simplifying data management.”

Powered by WPeMatico

Typically when we talk about tech and security, the mind naturally jumps to cybersecurity. But equally important, especially for global companies with large, multinational organizations, is physical security — a key function at most medium-to-large enterprises, and yet one that to date, hasn’t really done much to take advantage of recent advances in technology. Enter Base Operations, a startup founded by risk management professional Cory Siskind in 2018. Base Operations just closed their $2.2 million seed funding round and will use the money to capitalize on its recent launch of a street-level threat mapping platform for use in supporting enterprise security operations.

The funding, led by Good Growth Capital and including investors like Magma Partners, First In Capital, Gaingels and First Round Capital founder Howard Morgan, will be used primarily for hiring, as Base Operations looks to continue its team growth after doubling its employe base this past month. It’ll also be put to use extending and improving the company’s product and growing the startup’s global footprint. I talked to Siskind about her company’s plans on the heels of this round, as well as the wider opportunity and how her company is serving the market in a novel way.

“What we do at Base Operations is help companies keep their people in operation secure with ‘Micro Intelligence,’ which is street-level threat assessments that facilitate a variety of routine security tasks in the travel security, real estate and supply chain security buckets,” Siskind explained. “Anything that the chief security officer would be in charge of, but not cyber — so anything that intersects with the physical world.”

Siskind has firsthand experience about the complexity and challenges that enter into enterprise security since she began her career working for global strategic risk consultancy firm Control Risks in Mexico City. Because of her time in the industry, she’s keenly aware of just how far physical and political security operations lag behind their cybersecurity counterparts. It’s an often overlooked aspect of corporate risk management, particularly since in the past it’s been something that most employees at North American companies only ever encounter periodically when their roles involve frequent travel. The events of the past couple of years have changed that, however.

“This was the last bastion of a company that hadn’t been optimized by a SaaS platform, basically, so there was some resistance and some allegiance to legacy players,” Siskind told me. “However, the events of 2020 sort of turned everything on its head, and companies realized that the security department, and what happens in the physical world, is not just about compliance — it’s actually a strategic advantage to invest in those sort of services, because it helps you maintain business continuity.”

The COVID-19 pandemic, increased frequency and severity of natural disasters, and global political unrest all had significant impact on businesses worldwide in 2020, and Siskind says that this has proven a watershed moment in how enterprises consider physical security in their overall risk profile and strategic planning cycles.

“[Companies] have just realized that if you don’t invest [in] how to keep your operations running smoothly in the face of rising catastrophic events, you’re never going to achieve the profits that you need, because it’s too choppy, and you have all sorts of problems,” she said.

Base Operations addresses this problem by taking available data from a range of sources and pulling it together to inform threat profiles. Their technology is all about making sense of the myriad stream of information we encounter daily — taking the wash of news that we sometimes associate with “doom-scrolling” on social media, for instance, and combining it with other sources using machine learning to extrapolate actionable insights.

Those sources of information include “government statistics, social media, local news, data from partnerships, like NGOs and universities,” Siskind said. That data set powers their Micro Intelligence platform, and while the startup’s focus today is on helping enterprises keep people safe, while maintaining their operations, you can easily see how the same information could power everything from planning future geographical expansion, to tailoring product development to address specific markets.

Siskind saw there was a need for this kind of approach to an aspect of business that’s essential, but that has been relatively slow to adopt new technologies. From her vantage point two years ago, however, she couldn’t have anticipated just how urgent the need for better, more scalable enterprise security solutions would arise, and Base Operations now seems perfectly positioned to help with that need.

Powered by WPeMatico

This week, flexible workspace operator (and one-time unicorn) Knotel announced it had filed for bankruptcy and that its assets were being acquired by investor and commercial real estate brokerage Newmark for a reported $70 million.

Knotel designed, built and ran custom headquarters for companies. It then managed the spaces with “flexible” terms. In March 2020, it was reportedly valued at $1.6 billion.

At first glance, one might think that the WeWork rival, which had raised about $560 million since its 2016 inception, was another casualty of the COVID-19 pandemic.

But New York-based Knotel was reportedly in trouble — facing a number of lawsuits and evictions — before the pandemic had even hit, according to multiple reports, such as this one in The Real Deal.

Jonathan Pasternak, a partner in the bankruptcy, restructuring and creditor rights group at New York-based Davidoff Hutcher & Citron, believes the company’s Chapter 11 filing was inevitable despite it reaching unicorn status after raising $400 million in Series C funding in August 2019.

“In addition to being grossly overvalued on the market, the company overextended itself with long term leases and lavish build-outs, leaving the company in significant debt while failing to ever turn a profit,” Pasternak wrote via email. “The pandemic exacerbated their vacancy situation, resulting in more than 35% vacancies in their 2.4 million square-foot NYC portfolio. The company overextended and likely ran out of cash.”

Newmark’s purchase of Knotel’s assets is an effort to recoup some of its investment, according to Pasternak.

Anytime a company that has raised more than half a billion dollars basically implodes, it’s worth taking a look at the roller coaster ride it was on before it got to that point.

Virgin Mobile co-founder Amol Sarva and former VC Edward Shenderovich founded Knotel, essentially reversing the WeWork model. There’s hype around the company in its early days.

Knotel raised a Series A round of $25 million in February from investors such as Peak State Ventures, Invest AG, Bloomberg Beta and 500 startups. It marketed its offering as “headquarters as a service” — or a flexible office space that could be customized for each tenant while also growing or shrinking as needed.

In April, Knotel announced the close of a $70 million Series B financing led by Newmark Knight Frank and The Sapir Organization. In August, the company told me that it was operating over 1 million square feet across 60 locations in New York, London, San Francisco and Berlin, and that it was on track to reach 2.5 million square feet and $100 million in revenue by year’s end. Revenue growth had increased by 300% year over year, according to the company. Customers and users and clients ranged from VC-backed startups Stash and HotelTonight to enterprise customers such as The Body Shop.

“What they’re doing is different,” said Barry Gosin, CEO of Newmark Knight Frank, in a press release, at the time of the round. “It’s a new category the industry hasn’t seen and is rapidly adopting. We’ve watched their ascent from a distance and are now thrilled to join them on the journey. It marks a shift in how owners and tenants are coming together.”

In August, Knotel announced the completion of a $400 million financing, led by Wafra, an investment arm of the Sovereign Wealth Fund of Kuwait. With the round, the company had achieved unicorn status and was being touted as a formidable WeWork competitor. At the time, Knotel said it operated more than 4 million square feet across more than 200 locations in New York, San Francisco, London, Los Angeles, Washington, D.C., Paris, Berlin, Toronto, Boston, São Paulo and Rio de Janeiro.

In a statement at the time, CEO Sarva said: “Knotel is building the future of the workplace, and we are excited to welcome a group of investors who believe passionately in our product, vision and ability to execute. Wafra will help us continue our rapid global expansion and solidify our position as the leader in a fast-growing, trillion-dollar flexible office market.”

In late March, Forbes reported that Knotel had laid off 30% of its workforce and furloughed another 20%, due to the impact of the coronavirus. At the time, it was valued at about $1.6 billion.

The company had started the year with about 500 employees. By the third week of March, it had a headcount of 400. With the cuts, about 200 employees remained with the other 200 having either lost their jobs or on unpaid leave, according to Forbes.

“Business as usual is over,” Amol Sarva, Knotel’s CEO and co-founder, said in a statement to Forbes. “Knotel has decided to take sharp action to prepare for the worst case — a long health and economic crisis.”

In the second quarter, Knotel’s revenue slipped by about 20% to about $59 million compared to the first quarter, reported Forbes. Multiple landlords had filed lawsuits against the company.

By July, Forbes had reported that Knotel was attempting to raise as much as $100 million, according to various sources “familiar with the matter.”

Knotel files for bankruptcy, agrees to sell assets to investor Newmark for a reported $70 million after being valued at $1.6 billion less than one year prior.

“Newmark’s commitment offers a path forward amidst this challenging climate,” CEO Sarva said in a statement. “We are optimistic that, through a successful restructuring, we can refocus on our mission of providing state-of-the-art, tailored flex space in key U.S. and international markets.”

To facilitate the transaction under Section 363 of the United States Bankruptcy Code, an affiliate of Newmark agreed to provide Knotel with about $20 million in cash as DIP financing to support Knotel through the bankruptcy process.

Just as the startup and VC world watched as WeWork lost a significant amount of value over the past two years, we’re paying attention to the demise of Knotel and wondering what this means for the flexible workspace sector. As much of the world continues to work from home and office buildings remain mostly vacant as this pandemic rages, our guess is that things will only get worse before they get better.

Powered by WPeMatico