real estate

Auto Added by WPeMatico

Auto Added by WPeMatico

Commercial real estate tenants and property managers have to abide by strict liability rules that any vendor entering the property must have insurance certificates and meet other requirements. The approval process for this currently can take days and is still largely done on paper.

Enter Jones. The New York-based commercial real estate startup is curating a marketplace of pre-approved vendors for tenants and property managers to find and hire the people they need in a compliant way.

To continue advancing its network, the company announced Monday it raised $12.5 million in Series A funding led by JLL Spark and Khosla Ventures that also included strategic investors Camber Creek, Rudin Management, DivcoWest and Sage Realty. This new investment brings Jones’ total raised to $20 million, according to Crunchbase data.

Jones, founded in 2017, also manages certifications and approvals, moving the whole process online. Its technology can process an insurance certificate in less than an hour and reduce the overall vendor approval time to 2.5 days — from 12 days — with 99.9% accuracy, co-founder and CEO Omri Stern told TechCrunch.

The accuracy portion is key. With much of the work being done by hand, current accuracy is at about 30%, he added. In addition, the certifications are lengthy, and it is typically up to property managers to parse through the insurance documents to identify what is missing rather than spending time with tenants.

“In the consumer world, a homeowner expects to go on a marketplace and find a service and hire them,” Stern said. “Office managers and tenants can’t get their preferred vendors through the approval process, so we want to provide a similar digital experience that they can consume and use in real estate.”

He says Jones’ differentiator from competitors is that all of the stakeholders are in place: a group of high-profile real estate customers, including Lincoln Property Co., Prologis, DivcoWest, Rudin Management, Sage Realty and JLL.

Yishai Lerner, co-CEO of JLL Spark, agrees, telling TechCrunch that commercial real estate is one of the largest and last asset classes that is undergoing a technology transformation, similar to what fintech was 20 years ago.

He estimates the U.S. market to be $16 trillion, of which technology could unlock a lot of the value. That opportunity was one of the drivers for JLL to create JLL Spark, where Jones is one of the first investments.

Though Lerner spent time with property management teams on the ground, he became up close and personal with the problem when his wife, while moving offices, found out her vendors were not allowed in the building because they didn’t have the right insurance.

“We learned that property managers spend half of their time just working to verify the compliance of vendors coming into their building,” Lerner said. “We wondered why there wasn’t technology for this. Jones was doing construction at the time, and we brought them into commercial real estate because they had an example of how technology could solve the problem.”

Meanwhile, the Series A comes at a time when Stern is seeing Jones’s SaaS tool take off in the past 10 months. He would not get specific with growth metrics, but did say that what is driving growth is “competing against the status quo” as companies are searching for and adapting workflow solutions.

The company intends to use the new funds on product development in both quicker and easier approvals and bringing on new vendors. Jones already works with tens of thousands of vendors. It will also focus on integration, offering an API that could be used in other industry verticals where compliance is necessary.

Stern would also like to continue building the team. Having brought in real estate experts, he is now also looking for people with backgrounds in fintech, cybersecurity and insurtech to bring in additional perspectives.

“We are building an incredible company with the opportunity to be the next big digital marketplace,” he added.

Powered by WPeMatico

The need for more affordable housing has never been more urgent as a shortage in the U.S. housing market persists.

Startups attempting to help address the shortage in a variety of ways abound. One such startup, Abodu, has raised $20 million in a Series A funding round led by Norwest Venture Partners. Previous backer Initialized Capital also participated in the financing, along with Redfin CEO Glenn Kelman, former Stockton, California Mayor Michael Tubbs, GGV investor Hans Tung and Paradox Capital’s Kyle Tibbitts.

The California legislature changed laws in 2017 to make it easier to build Accessory Dwelling Units (ADUs). Then on January 1, 2020, the state of California made it dramatically easier to add extra housing units to single-family home sites. Cities and local agencies have to quickly approve or deny ADU projects within 60 days of receiving a permit application. The state also now prevents cities from imposing minimum lot size requirements, maximum ADU dimensions or off-street parking requirements.

Redwood City, California-based Abodu, which builds prefabricated ADUs, was founded in 2018 to serve as a “one-stop shop” for building an ADU, or as some describe it, a home in a backyard.

Image Credits: Co-founders John Geary and Eric McInerney / Abodu

What sets the company apart from others in the space, its execs claim, is that it not only builds and installs the units, it helps homeowners with the painful process of getting permits. Abodu says it pre-approves its structural engineering with California state-level agencies to ensure its units can be built statewide and works with local agencies to pre-approve its foundation systems to ensure projects can proceed on predictable timelines.

It also claims to offer a cheaper and faster process than if one were to build an ADU from start to finish. Specifically, the startup claims that one of its backyard homes can be installed in just 10% of the time it would take for a traditional ADU to be built.

Abodu has been active in the market, selling and building its ADUs since the fall of 2019. Since then, it has put “dozens and dozens” of units in the ground, and has multiple dozen units in production on top of that, according to CEO and co-founder John Geary. So far, it’s operating in the Bay Area, Los Angeles and Seattle. The company claims it can deliver an ADU in as little as 30 days in San Jose and Los Angeles thanks to the cities’ pre-approval process. In other cities in California and Washington, turnaround is “as little as 12 weeks.” But a standard bespoke project takes 4-5 months from start to finish, according to Geary.

The startup’s three products include a 340-square foot studio; a 500-square foot one bedroom, one bath, and a 610-square foot two bedroom unit. All have kitchens and living space.

Pricing starts at $190,000, but the average project cost across all sizes is around $230,000, Geary said, inclusive of permits and site work.

There are a variety of use cases for ADUs, the most popular of which is to house family and for rental income.

“During the pandemic, multigenerational living has been at an all-time high. There are acute family needs that people are trying to solve for,” Geary said. “In addition, folks are earning extra money by renting them out to members of the community such as teachers or fireman, a single person or younger couple.”

Next, Abodu is eyeing the San Diego market.

Earlier this week, we covered the recent raise of Mighty Buildings, another Bay Area-based startup building ADUs and other housing. The biggest difference between the two companies, according to Geary, is that Mighty Buildings is focused on innovation in construction with its 3D-printed method.

“We decided early on that we didn’t want to reinvent the wheel from the construction standpoint,” Geary said. “Instead, we looked at ‘how can we solve for speed and ease?’ ”

Abodu operates with an asset-light model, and doesn’t own any factories. Instead, it has built a network of factory “partners” across the Western U.S. that builds its units depending on how their capacities look at any given time.

Naturally, the company’s investors are bullish on the company’s business model.

Jeff Crowe, managing partner of Norwest Venture Partners, believes that Abodu’s “beautifully crafted units” are just one of the company’s selling points.

“John, Eric, and their team manage the end-to-end process of permitting, building, and installing on behalf of their customers,” he told TechCrunch. “And with the expedited permitting that Abodu has been granted in over two dozen cities, it has faster time-to-installation than other ADU market participants. The result has been very high levels of customer satisfaction and rapid growth.”

Former Stockton Mayor Tubbs said Abodu is tackling two of California’s most consequential issues: the statewide housing shortage and its impacts on racial and economic segregation in our neighborhoods.

“By making it fast and accessible for normal homeowners to build high-quality backyard housing units, Abodu’s success will mean integrating options for both renters and homeowners in the same neighborhoods, while supporting small landlords and property owners in building equity in their homes,” he wrote via email.

Powered by WPeMatico

Oakland-based Mighty Buildings, which is on a quest to build homes using 3D printing, robotics and automation, has raised a $22 million extension to its Series B round of funding.

The additional capital builds upon a $40 million raise the company announced earlier this year, bringing its total funding since its 2017 inception to $100 million.

Mighty Building’s self-proclaimed mission is to create “beautiful, sustainable and affordable” homes.

The company claims to be able to 3D print structures “two times as quickly with 95% less labor hours and 10-times less waste” than conventional construction. For example, it says it can 3D print a 350-square-foot studio apartment in just 24 hours.

Execs say the new capital will go toward making supply chain improvements and moving up research and development timelines. The money will also go toward helping it achieve a new goal of achieving Net-Zero carbon neutrality by 2028 — which it says is 22 years ahead of the construction industry overall.

“As a founding team, we have long been passionate about solving productivity for construction in a sustainable way,” said co-founder and CEO Slava Solonitsyn. “We have spent four years figuring out what it takes to achieve that. We believe that we have a master plan now that can work.”

Since its launch, the company has produced and installed a number of accessory dwelling units (ADUs).

Sam Ruben, co-founder and chief sustainability officer of Mighty Buildings, said the new funds will also go toward kicking off development of the startup’s multistory offering. The multistory efforts will likely initially focus on two to three-story single family homes and townhouses with an eye toward expanding into low-rise apartment buildings. The company hopes to have at least a prototype multistory offering in late 2022 or early 2023, according to Ruben.

“Along with the sustainability improvements already captured by our new formula, this will allow us to develop our next-generation material to get us even closer to our goal of being carbon neutral by 2028,” Ruben said. “It will also give us opportunities to implement improvements in our existing design by reducing the impact of our foundations and other, nonprinted elements.”

Specifically, Mighty Buildings plans to speed up its carbon neutrality roadmap by building “high-throughput, sustainable” micro factories, forming strategic supply chain partnerships, accelerating “blue skies” technology research and developing new composite materials produced from recycled or bio-based feedstock.

The micro factories, according to the company, will be able to produce 200 to 300 homes per year in locations where housing gaps exist. Mighty Buildings plans to create single-family residential developments with its panelized “Mighty Kit System.”

Mighty Buildings has seen quarter over quarter growth in sales, Ruben said, with the company seeing a record of over $7 million in total contracted revenue in the second quarter.

The company is also excited about its new fiber-reinforced printing material, which is currently undergoing testing with certification expected to be completed later this year. Mighty Buildings claims that its new formula shows “over 50% improvement” in embodied carbon from its original material and a strength profile similar to reinforced concrete, with more than four times less weight.

The round extension was supported by a few new and existing investors including ArcTern Ventures, Core Innovation Capital, Decacorn Capital, Gaingels, Khosla Ventures, Klaff Realty, MicroVentures, Modern Venture Partners, Polyvalent Capital, Vibrato Capital and others.

Powered by WPeMatico

Jake Rothstein is the co-founder of Papa, a Miami-based company that offers care and companionship to seniors. The business, which pairs elderly Americans with uncertified-yet-vetted pals, helps offer casual services, such as technology support, grocery delivery or even a fun conversation. It has raised upwards of $91 million in venture capital to date.

While Rothstein left day to day responsibilities at Papa in 2017, his experience there gave him a deeper look into the priorities of older adults and families as they go through the aging journey. While Papa was about meeting the elderly where they are, the co-founder began to think of a more complex question: What if “where they are” isn’t as supportive as it should be 24/7?

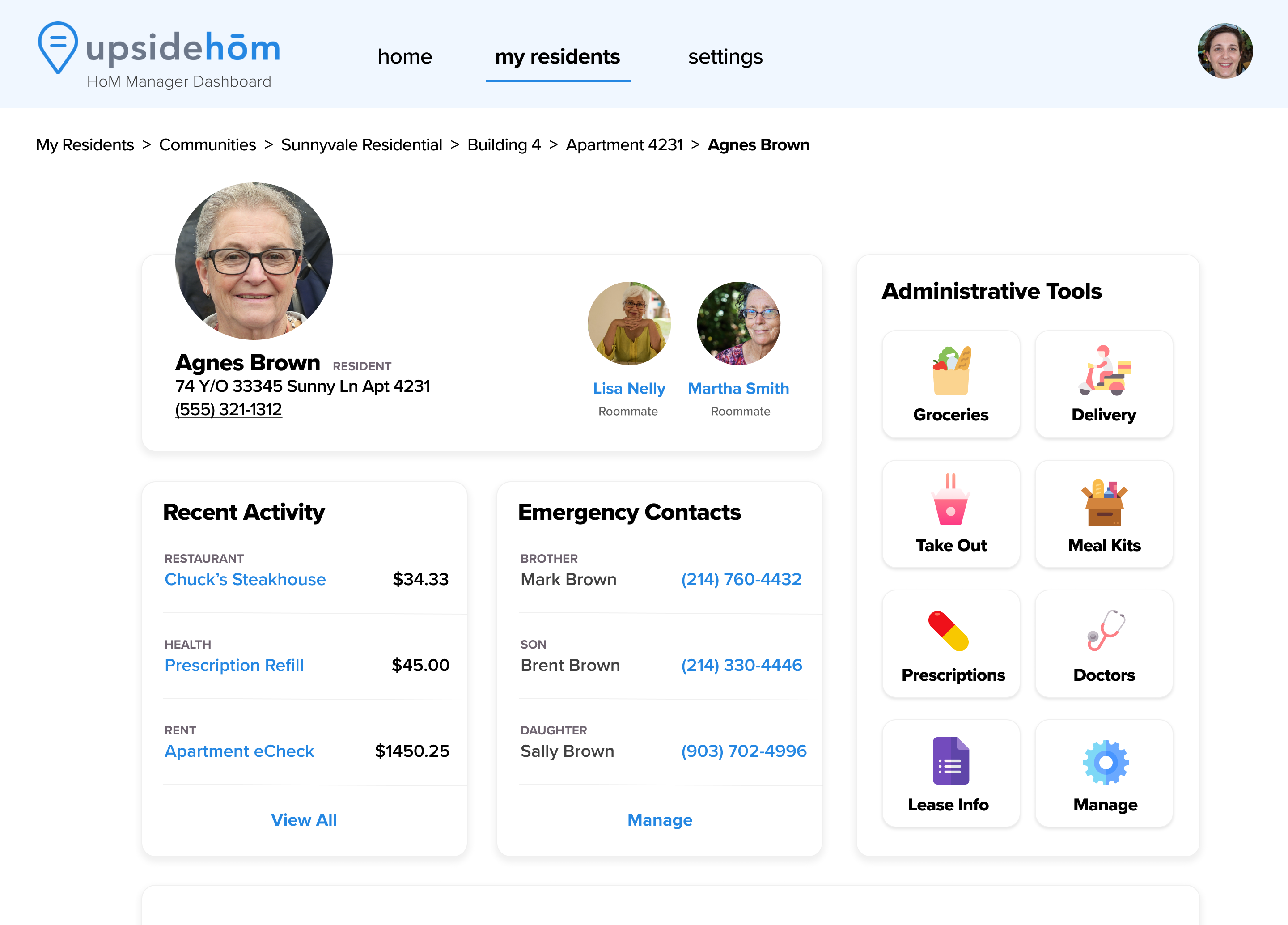

After a stint at another tech company, Rothstein launched a more modern take on senior living communities in January 2020, alongside co-worker turned co-founder Peter Badgley. UpsideHōM is a fully managed, tech-enabled living space for older adults in the United States. After a year of beta testing, the duo announced today that they have raised a $2.25 million seed round for UpsideHōM, led by Triple Impact Capital and Freestyle Capital, with participation from Techstars.

Alongside the funding, UpsideHōM announced its next big bet, dubbed a relaunch, that will sit atop furnished and furnished apartments that sit throughout Raleigh, Atlanta, Jacksonville, Tampa and South Florida: a software platform to take out all the clutter from move-in and maintenance. The platform will give residents one spot to chat with their house manager, pay bills and access perks such as on-demand tech support, house-keeping and companion visits thanks to a partnership with Papa. The company also offers add-on services and amenities, including freshly prepared meals, grocery delivery, fitness programming and accompanied transportation.

Image Credits: UpsideHōM

Part of UpsideHōM’s focus is in creating personalized solutions. Elders are diverse in age, needs and financial circumstances — which means the turnkey solution needs to be easily adaptable to service needs when they pop up. The company needs to be careful though: It can’t offer traditional caregiver services due to state by state compliance; instead Rothstein describes the offerings as supportive services, not in replacement of health assistant caregivers.

Image Credits: UpsideHoM

When the company first launched, it was betting on a more unconventional idea.

“I thought, let’s solve loneliness even more completely than what Papa is doing by building in companionship,” Rothstein said, instead of letting people order it on demand. The company decided to offer roommate matching services for elders as one of its core services, alongside the aforementioned supported living characteristics. It didn’t fully stick. Over half of inbound participants responded to the marketing efforts by saying that they liked the idea, but didn’t want to share the space. Today, 50% of UpsideHōM’s business covers individuals or people with spouses or significant others; the other half covers those looking to share units.

The synergies between UpsideHōM and Papa, Rothstein’s previous company, are clear beyond an overlapping customer base. Papa offered up to and almost including actual care, stopping at traditional care-giving services, which require their own vetting and compliance measures. UpsideHōM offers up to and almost including traditional senior living services, but gives supportive services instead of assisted living services, which similarly have their own logistic hurdles to figure out.

As for why Rothstein didn’t just launch supportive living services as a new product vertical within his earlier company, he chalked it up to the “tremendous” opportunity in the former, which warranted it’s own company. He also said that customer acquisition looks different between the two companies.

“At Papa, what we found was that acquiring customers in this space was incredibly challenging [so we went through] the Medicare Advantage route,” he said. “But senior living is a completely different segment.”

The millions in new venture capital money are coming as UpsideHōM prepares for aggressive growth. While the company did not disclose revenue or total residents, it did say it has hit 1,000% in new resident headcount in the first half of 2021 as a vague proxy. As the startup prepares for its next phase of growth, the co-founders will need to focus heavily on sustainable customer acquisition.

Rothstein thinks that downsizing elders into homes that work for them is a simple argument to make.

“You can age in place for as long as it’s practical, but there’s going to be a day and time when it’s not [going to] be practical,” Rothstein said. “Why would you want to make this decision after you’ve broken your hip, after you run out of money or after your spouse died?”

Editor’s note: A previous version of this story wrote that Rothstein had spent six years scaling Papa. This is incorrect. He left in 2017 but remains an investor in the company.

Powered by WPeMatico

Yesterday, China ordered ride-hailing company Didi to stop signing up new customers after regulators announced a cybersecurity review of the company’s operations.

As of this writing, Didi’s stock price is down 5.3%. In today’s edition of The Exchange, Alex Wilhelm suggested that the move wasn’t a complete surprise, but it still “puts a bad taste in our mouths,” since the company went public days ago.

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

When Didi filed to go public, it listed several potential pitfalls facing Chinese companies that go public in the U.S., including “numerous legal and regulatory risks” and “extensive government regulation and oversight in its F-1.”

What does this news signify for other Chinese companies that are hoping for stateside IPOs?

We’ll be off on Monday, July 5 in observance of Independence Day. Thanks very much for reading, and I hope you have an excellent weekend.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: NeONBRAND/Unsplash (opens in a new window)

Did you hear about the CEO who made misleading claims about a funding round and got sued? How about that pharmaceutical executive whose taunts to a former Secretary of State led to a 4.4% decline in the Nasdaq Biotechnology Index?

In case it isn’t clear: Startup executives are held to a higher standard when it comes to what they post on social media.

“Reputation and goodwill take a long time to build and are difficult to maintain, but it only takes one tweet to destroy it all,” says Lisa W. Liu, a senior partner at The Mitzel Group, a San Francisco-based law practice that serves many startups.

To help her clients (and Extra Crunch readers) Liu has six basic questions for tech execs with itchy Twitter fingers.

And if the answer to any of them is “I don’t know,” don’t post.

Image Credits: Kari Shea/Unsplash (opens in a new window)

A report from Brighteye Ventures on Europe’s edtech scene shows that this year’s deal flow is on pace to meet or surpass 2020, when remote instruction exploded.

According to Brighteye’s head of Research, Rhys Spence, the average deal size is now $9.4 million, a threefold increase from last year. Still, “It’s interesting that we are not seeing enormous increases in deal count,” he noted.

Image Credits: TechCrunch

Trading platform Robinhood has attracted enough users and activity to change the conversation around retail investing — economists will likely be discussing the 2021 GameStop saga for years to come.

After the company filed to go public yesterday, Alex Wilhelm sorted through Robinhood’s main income statement to better understand how it scaled year-ago revenue from $127.6 million to $522.2 million in Q1.

“Those are numbers that we frankly do not see often amongst companies going public,” says Alex. “300% growth is a pre-Series A metric, usually.”

So: where is all that revenue coming from?

Image Credits: Nigel Sussman (opens in a new window)

Given the valuation gap between U.S. tech markets and those overseas, it’s easy to see why some foreign startups would head to our shores when it’s time to go public.

But Anna Heim and Alex Wilhelm found that a record increase in European venture capital activity is picking up the pace of IPOs this year, and many of these companies are content to go public in their native markets.

To gain some insight into where European investors believe they have an advantage, Anna and Alex interviewed:

Image Credits: Diana Ilieva (opens in a new window) / Getty Images

In a recent private equity survey, 80% of respondents said their co-investments with people outside traditional VC firms outperformed their PE fund investments.

Alternative investors are highly motivated, and because they’re seeking higher returns than are generally available in public markets, they are less daunted by risk. In return, they benefit from less expensive fee structures and develop close ties with VCs, enlarging the talent pool as they build investment skills.

These relationships have direct benefits for VCs as well, such as more flexibility with diversification and consolidated decision-making power.

“With the right deal structure, deal selection and deal investigation, co-investors can significantly increase their returns,” says C5 Capital Managing Partner William Kilmer, who wrote an Extra Crunch post for VCs considering an alternative path.

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

My husband and I are both U.S. permanent residents.

Given what we’ve gone through this past year being isolated from loved ones during the pandemic, we’d like to bring my parents and my sister to the U.S. to be close to our family and help out with our children.

Is that possible?

— Symbiotic in Sunnyvale

Image Credits: Andreus (opens in a new window) / Getty Images

Smart-building products include everything from connecting landlords with tenants to managing construction sites.

Given their widespread impact on the enterprise — and the novel nature of much of this new technology, selecting the right digital building platform (DBP) is a challenge for most organizations.

Brian Turner, LEED-AP BD&C, has created a matrix intended to help decision-makers identify the fundamental functions and desired outcomes for stakeholders.

“When it comes to the built environment, creating those comfortable, healthy and enjoyable places requires new tools,” says Turner. “Selecting a solid DBP is one of the most important decisions to be made.”

Image Credits: Octavian Iolu / EyeEm (opens in a new window)/ Getty Images

One perennial problem inside startups: Because no one on the founding team has significant marketing experience, growth-related efforts are pro forma and generally unlikely to move the needle.

Everyone wants higher click-through rates, but creating ads that “stand out” is a risky strategy, especially when you don’t know what you’re doing. This guest post by Demand Curve offers seven strategies for boosting CTR that you can clone and deploy today inside your own startup.

Here’s one: If customers are talking about you online, reach out to ask if you can add a screenshot of their reviews to your advertising. Testimonials are a form of social proof that boost conversions, and they’re particularly effective when used in retargeting ads.

Earlier this week, we ran another post about optimizing email marketing for early-stage startups.

We’ll have more expert growth advice coming soon, so stay tuned.

Image Credits: Jose Fontano/Unsplash (opens in a new window)

Locking down data centers and networks against intruders is just one aspect of an organization’s security responsibilities; cloud services, collaboration tools and APIs extend security perimeters even farther. What’s more, the systems created to prevent the misuse and mishandling of sensitive data often depend heavily on someone’s better angels.

According to Sid Trivedi, a partner at Foundation Capital, and seven-time CIO Mark Settle, IT managers need to replace existing DLP frameworks with a new one that centers on DMP — data misuse protection.

These solutions “will provide data assets with more sophisticated self-defense mechanisms instead of relying on the surveillance of traditional security perimeters,” and many startups are already competing in this space.

Powered by WPeMatico

Everyone from investors to casual LinkedIn observers has more reasons than ever to look at buildings and wonder what’s going on inside. The property industry is known for moving slowly when it comes to adopting new technologies, but novel concepts and products are now entering this market at a dizzying pace.

However, this ever-growing array of smart-building products has made it confusing for professionals who seek to implement digital building platform (DBP) technologies in their spaces, let alone across their entire enterprise. The waters get even murkier when it comes to cloud platforms and their impact on ROI with regard to energy usage and day-to-day operations.

Breaking down technology decisions into bite-sized pieces, starting with fundamental functions, is the most straightforward way to cut through the promotional haze.

Facility managers, energy professionals and building operators are increasingly hit with daily requests to review the latest platform for managing and operating their buildings. Here are a few tips to help decision-makers clear through the marketing fluff and put DBP platforms to the test.

Breaking down technology decisions into bite-sized pieces, starting with fundamental functions, is the most straightforward way to cut through the promotional haze. Ask two simple questions: Who on your team will use this technology and what problem will it solve for them? Answers to these questions will help you maintain your key objectives, making it easier to narrow down the hundreds of options to a handful.

Another way to prioritize problems and solutions when sourcing smart-building technology is to identify your use cases. If you don’t know why you need a technology platform for your smart building, you’ll find it difficult to tell which option is better. Further, once you have chosen one, you’ll be hard put to determine if it has been successful. We find use cases draw the most direct line from why to how and what.

For example, let’s examine the why, how and what questions for a real estate developer planning to construct or modernize a commercial office building:

This last question is often the hardest to answer and is usually left until the last possible moment. For building systems integrators, this is where the real work begins.

When various stakeholder groups begin their investigations of the technology, it is crucial to define the outcomes everyone hopes to achieve for each use case. When evaluating specific products, it helps to categorize them at high levels.

Several high-level outcomes, such as digital twin enablement, data normalization and data storage are expected across multiple categories of systems. However, only an enterprise building management system includes the most expected outcomes. Integration platform as a service, bespoke reports and dashboarding, analytics as a service and energy-optimization platforms have various enabled and optional outcomes.

The following table breaks down a list of high-level outcomes and aligns them to a category of smart-building platforms available in the market. Expanded definitions of each item are included at the end of this article.

Powered by WPeMatico

Side, a real estate technology company that works to turn agents and independent brokerages into boutique brands and businesses, has raised “$50 million-plus” in a funding round that more than doubles its valuation to $2.5 billion.

The latest financing comes just three months after the San Francisco-based startup raised $150 million in a Series D funding round led by Coatue Management at a $1 billion valuation. Tiger Global Management led the latest investment, which also included participation from ICONIQ Capital and D1 Capital Partners. With the latest capital infusion, Side’s total raised since its 2017 inception now totals over $250 million. Matrix Partners, Sapphire Ventures, Trinity Ventures and 8VC led its earlier rounds.

Side says that it is now “backed by the three top technology initial public offering (IPO) underwriters” and that the latest funding “sets the stage for a future IPO.”

The startup pulled in between “$30 million and $50 million in revenue” in 2020 (a wide range, we know), and expects to double revenue this year. In 2019, Side represented over $5 billion in annual home sales across all of its partners. Today, the company’s community of agent partners represents over $15 billion in annual production volume. And it’s predicting that by the end of 2021, it will have closed over $20 billion in home sales, positioning the company “as a top 10 national brokerage by volume.”

Today, Side supports more than 1,800 partner agents across California, Texas and Florida. It says it’s seen a 200% year-over-year increase in agent-represented home sales across its three operating markets of California, Texas and Florida. The company plans to enter 15 new states by year’s end.

Guy Gal, Edward Wu and Hilary Saunders founded Side on the premise that most real estate agents are “underserved and under-appreciated” by traditional brokerage models.

CEO Gal said existing brokerages are designed to support “average” agents and, as such, the top-producing agents end up having to do “all of the heavy lifting.”

Side’s white label model works with agents and teams by exclusively marketing their boutique brand, while also providing the required technology and support needed on the back end. The goal is to help partner agents “predictably grow” their businesses and improve their productivity.

“The way to think about Side is the way you think about what Shopify does for e-commerce […] When partnering with Side, top-producing agents, teams and independent brokerages, for the first time in history, gain full ownership of their own brand and business without having to operate a brokerage,” Gal told me at the time of the company’s last raise. “When you spend years solving the problems of this very specific community of agents, you are able to use software to drive enormous efficiency for them in a way that has never been done before.”

Existing brokerages, he argues, actively discourage agents from becoming top producers and teams, because agents who serve fewer clients can be forced into paying much higher commission fees on every transaction, which means the incentives between brokerages and top agents and teams are misaligned.

“Top producers want to grow and differentiate, and brokerages want them to do less business at higher fees and be one more of the same under the same brand,” Gal said. “Side, rather than discouraging and competing with top-producing agents and teams, enables them to grow and scale their own business and brand.”

This story was updated post-publication with an updated valuation figure.

Powered by WPeMatico

Lower, an Ohio-based home finance platform, announced today it has raised $100 million in a Series A funding round led by Accel.

This round is notable for a number of reasons. First off, it’s a large Series A even by today’s standards. The financing also marks the previously bootstrapped Lower’s first external round of funding in its seven-year history. Lower is also something that is kind of rare these days in the startup world: profitable. Silicon Valley-based Accel has a history of backing profitable, bootstrapped companies, having also led large Series A rounds for the likes of 1Password, Atlassian, Qualtrics, Webflow, Tenable and Galileo (which went on to be acquired by SoFi).

In fact, Galileo founder Clay Wilkes introduced the VC firm to Dan Snyder, Lower’s founder and CEO. The two companies have a few things in common besides being profitable: they were both bootstrapped for years before taking institutional capital and both have headquarters outside of Silicon Valley.

“We were immediately intrigued because Ohio-based Lower echoes both of these themes,” said Accel partner John Locke, who led the firm’s investment in Lower and is taking a seat on the company’s board as part of the investment. “Like Galileo, Lower will be one of the most successful bootstrapped fintech companies globally. The combination of a company built in a nontraditional region across the globe and a bootstrapped company reminds us of [other] companies we have partnered with for a large Series A.”

There were other unnamed participants in the round, but Accel provided the “majority” of the investment, according to Lower.

Snyder co-founded Lower in 2014 with the goal of making the home-buying process simpler for consumers. The company launched with Homeside, its retail brand that Snyder describes as “a tech-leveraged retail mortgage bank” that works with realtors and builders, among others.

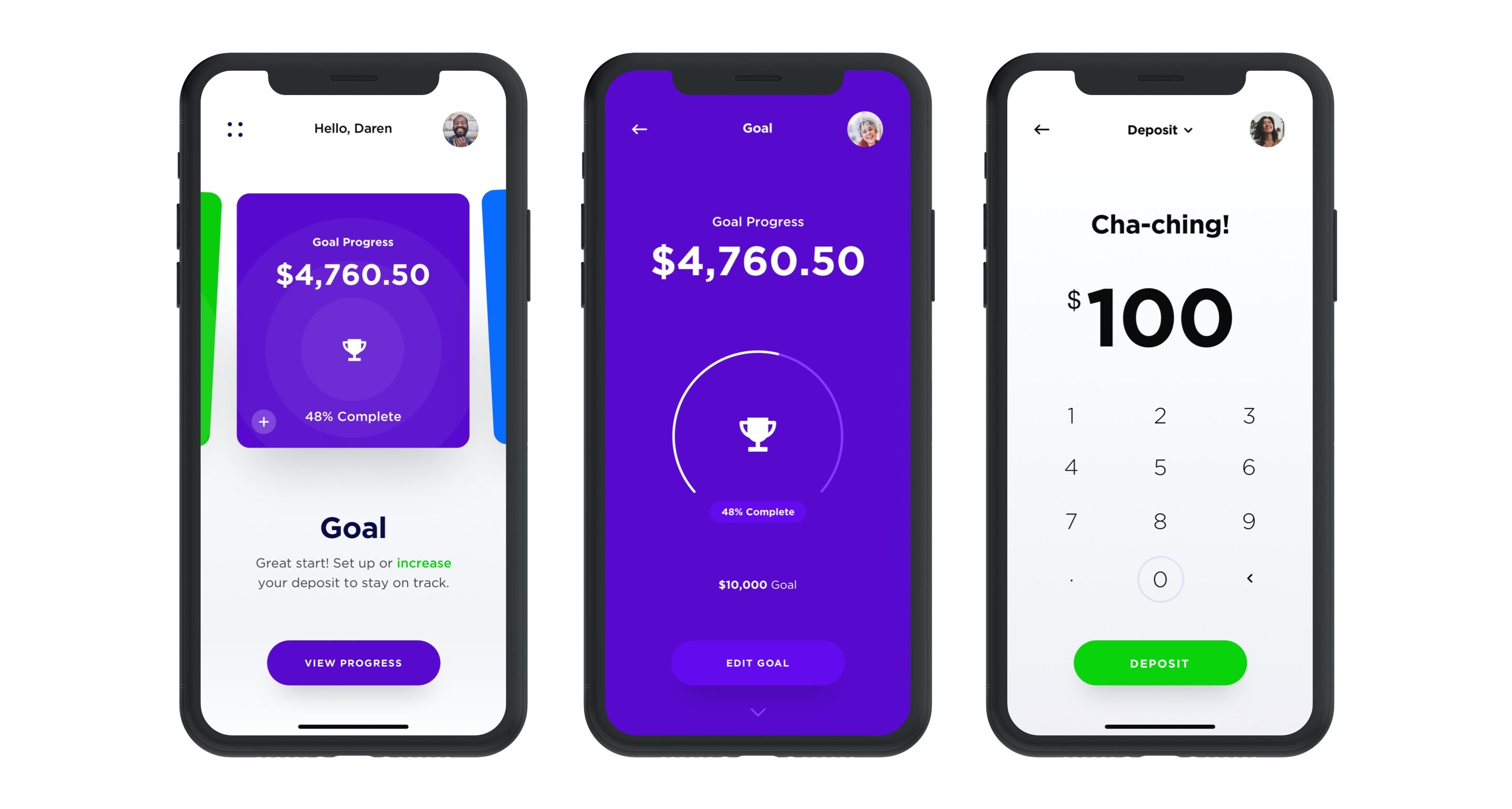

In 2018, the company launched the website for Lower, its direct-to-consumer digital lending brand with the mission of making its platform a one-stop shop where consumers can go online to save for a home, obtain or refinance a mortgage and get insurance through its marketplace. This year, it launched the Lower mobile app with a savings account.

Sitting (L to R): Co-founders Dan Snyder, Grayson Hanes

Standing (L to R): Co-founders Mike Baynes, Chris Miller

Not pictured: Robert Tyson; Image credit: Lower

Over the years, Lower has funded billions of dollars in loans and notched an impressive $300 million in revenue in 2020 after doubling revenue every year, according to Snyder.

“Our history is maybe a little atypical of fintech companies today,” he told TechCrunch. “We’ve had a view going back to the start of the company that we wanted to run it profitably. That’s been one of our pillars, so that’s what we’ve done. Also, we all grew up in the mortgage industry, so we saw firsthand the size of the market, but also how broken it was, so we wanted to change it.”

In launching the direct-to-consumer digital lending brand, the company was working to make the homebuying process more “digital, transparent and easier for consumers to access,” Snyder said.

At the same time, the company didn’t want to lose the human touch.

“We tried to design the app flow in a way where you can get as far along as you can in the application but if you want, at any point in time, to talk or chat with someone, we’re available,” Snyder added.

Image Credits: Lower

Lower’s typical customer is the millennial and now Gen Z who’s aspiring to own their first home, according to Snyder.

“They might be thinking, ‘OK, I might be living in an apartment now, but in the next few years I’m going to meet someone and/or have a child and I want to unlock the investment that is a home,’” he told TechCrunch. “And we’ll help them on that journey.”

Lower’s recently launched new app offers a deposit account it’s dubbed “HomeFund.” The interest-bearing, FDIC-insured deposit account offers a 0.75% Annual Percentage Yield and is designed to help consumers save for a home with a “dollar-for-dollar match in rewards” up to the first $1,000 saved, Snyder said.

Lower works with more than 35 major insurance carriers nationally, including Nationwide, Liberty Mutual and Allstate. It has more than 1,600 employees, about half of which are based in Lower’s home state. That’s up from about 650 employees in June of 2020.

Looking ahead, the company plans to add more services and has an “aggressive roadmap” for adding new features to its platform. Today, for example, Lower sells primarily to Fannie Mae and Freddie Mac. And while it services the majority of its loans, like many large lenders, it uses a subservicer. That will change, however, in early 2022, when Lower intends to launch its own native servicing platform.

And while the company intends to continue to run profitably, Snyder said he and his co-founders “think the time is now to gain share.”

“We want to become a global brand, raise money and gain market share,” he added. “We’re going to continue to double down on product and build out our capabilities. We are the best-kept secret in fintech and plan to change that with smart branding, advertising and sponsorships.”

And last but not least, Lower is eyeing the public markets as part of its longer-term roadmap.

“Ultimately, we know we can build a great public company,” Snyder told TechCrunch. “We’re of the scale to be a public company right now, but we’re going to keep our heads down and we’re going to keep building for the next few years and then I think we can be in a spot to be a strong public business.”

Accel’s Locke points out that in the U.S., mortgage and home finance are among the largest financial service markets, and they have primarily been handled by large banks.

“For most consumers, getting a mortgage through these banks continues to be an overly complex, slow-moving process,” Locke told TechCrunch. “We believe by providing consumers a great mobile experience, Lower will gain share from incumbent banks, in the same way that companies like Monzo have in banking or Venmo in payments or Trade Republic and Robinhood in stock trading.”

Powered by WPeMatico

Amid a recent tear in residential real estate investment, venture capitalists are looking to get a piece of homebuying startup Flyhomes.

The five-year-old startup announced today that they’ve closed a $150 million Series C round co-led by Norwest Venture Partners and Battery Ventures. Fifth Wall, Camber Creek, Balyasny Asset Management, Zillow’s Spencer Rascoff and existing investors Andreessen Horowitz and Canvas Partners also participated in the round. Norwest’s Lisa Wu and Battery’s Roger Lee are joining Flyhomes’ board as part of the deal.

The end-to-end residential real estate startup says they handle “every step of the homebuying process, from brokerage to mortgage,” building financial tools that customers need throughout the process. The company has now raised some $310 million in total.

The startup is well-positioned during a historic run-up of home prices in the U.S. that has made deals more competitive than ever for prospective buyers. A recent report by Redfin notes that more than half of U.S. homes are selling above their asking price right now, up from one in four a year ago. A Zillow report notes that nearly half of U.S. homes are selling within one week of going on the market.

Flyhomes’s Cash Offer lending product allows consumers purchasing homes to make more attractive all-cash offers to sellers, with the company noting that even if a buyer ends up backing out of the deal, Flyhomes will still buy the home themselves. Central to the startup’s business is sellers being more amenable to all-cash offers, allowing consumers making them to win deals even when they aren’t the highest bidders.

The company says it has bought and sold more than $2.6 billion worth of homes since launching in 2016.

Powered by WPeMatico

Early-stage startups are increasingly looking for alternative ways to access capital, meaning not every company wants to raise money from VCs or take on debt.

In recent years, a flurry of startups have emerged to give companies other options. (Think Pipe, for example.)

And today, San Francisco-based Architect Capital is a new firm that is launching with over $100 million in funds to serve as an “asset-based lender” to “high-growth,” early-stage tech companies. Specifically, the new firm aims to provide non-dilutive or less-dilutive financing options to asset-rich fintech, e-commerce and SaaS companies in the U.S. and Latin America, but with an emphasis on the latter. The region, Architect maintains, does not have a plethora of institutional financing available against assets.

The firm is not out to replace traditional venture capital or venture debt, emphasizes founder and CEO James Sagan, but rather to offer asset-based products that will complement them.

For some context, Sagan is no stranger to the startup world, having co-founded and served as managing partner of Arc Labs, an early-stage credit fund focused on lending to technology-enabled businesses. He’s been investing in Latin America for years, and recognized the need for new forms of financing to fund “novel and underappreciated assets.”

Also, he believes the region is home to “the most prominent fintech ecosystem in the world.”

To Sagan, traditional forms of equity and debt financing in the venture world are vital for things like growing headcount, but he believes they are “not engineered to support the growth of a company’s underlying financial products.”

“VC is highly dilutive and should be used for ROI activities such as hiring engineers and building great teams,” Sagan told TechCrunch. “It’s expensive to use equity to fund assets. Equity should not be put in a loan book. We’ll fund the loan book.”

Image Credits: Architect Capital founder James Sagan / Architect Capital

Architect’s goal is to provide “tailored and less dilutive funding,” especially to companies that produce repeatable revenues, such as SaaS and subscription businesses.

Sagan said he first discovered the strategy in 2015 when he was working for a multifamily office that was lending against a bunch of traditional assets.

“A colleague and good friend of mine started a business and raised some equity and venture debt, but he couldn’t find the asset-specific financing for the receivables he was generating,” Sagan recalls. “He was lending to small businesses and needed asset-specific financing against those receivables.”

Venture debt doesn’t really work for receivables-based lending because venture debt shops typically are underwriting assets, or rather, underwriting the quality of the investors in the company, Sagan believes.

“So we really tailor our underwriting towards those assets themselves right and those assets range from unsecured consumer receivables to secure small business receivables to real estate,” he told TechCrunch. “Essentially, we’re providing an additional instrument for asset-heavy businesses that will allow them to scale in a way that venture debt will not.”

Architect’s LPs are mostly large institutions, as opposed to traditional high net worth individuals. The firm’s average check size will land at around $10 million to $15 million.

“Our portfolio allocation is more concentrated in general,” Sagan said. “We expect to grow our AUM (assets under management) pretty precipitously.”

Architect Capital has invested in six companies since inception, including PayJoy, a company that delivers consumer financing and smartphone technology to customers in emerging markets; Forum Brands, a U.S.-based e-commerce marketplace aggregator; and ADDI, a fintech that aims to give Colombian consumers access to fair and affordable credit through point-of-sale-financing that recently raised $65 million.

Powered by WPeMatico