real estate

Auto Added by WPeMatico

Auto Added by WPeMatico

Opendoor, a four year-old, San Francisco-based company, has from the outset intended to make it possible to buy and sell residential real estate with a few key strokes. It seemingly gets closer to that audacious vision by the day. The company closed on $325 million in new funding in June in a round that brought its total equity funding to $645 million to date — and its valuation to more than $2 billion. The company has also raised $1.75 billion in debt, and two sources tell us more funding from SoftBank is imminent.

Opendoor’s cofounder and CEO, Eric Wu, who previously cofounded two other companies, won’t answer questions about SoftBank when asked. But there’s no question the company is one of the most capital-intensive startups on the scene currently. Opendoor bids on homes sight unseen, agrees to buy them, then — contingent on an inspection to verify the quality of the home (“sometimes customers aren’t aware of things like foundation issues,” explains Wu) — it sells them, charging a fee of “about 6 percent,” he says. (Recent reports claim this number can reach as high as 13 percent.)

To date, the company has largely been working with people who need to sell their homes quickly because of a new job or other life event. By using Opendoor, goes the pitch, they don’t get stuck paying for two mortgages when they can’t afford it. Yet Opendoor increasingly wants to help them buy that next house, too. Toward that end, the company has just acquired Open Listings, a four-year-old, L.A.-based startup that has aimed to make it easier and cheaper for buyers to purchase homes by automating much of what an agent would do, thus reducing the fee an agent would traditionally take.

Opendoor isn’t saying what it’s paying for Open Listings, which had raised $7.6 million from investors over the years, including Y Combinator, Matrix Partners, Arena Ventures, and Initialized Capital. But all of Open Listings’ 45 employees will join the 900 employees of Opendoor, and the move gets Opendoor into a handful of new cities in which it wasn’t already operating, including San Francisco, Seattle, Austin, L.A., and Chicago.

The deal was also a very natural fit, suggests Wu. He says he met Open Listings cofounder and CEO Judd Schoenholtz in 2015, when Schoenholtz — through YC’s alumni network — approached Wu, whose last company had passed through YC’s program. Schoenholtz “reached out and wanted to share what they were trying to solve in real estate, so we met up and talked about problems we saw and our respective approaches . . . Judd was starting with the buyer side, and we were starting with the sales side, and we continued to share notes on how we were solving both.”

The acquisition is the very first for Opendoor, though one senses it’s just the beginning of similar tie-ups. In a call yesterday, Wu referred to other initiatives that Opendoors is exploring, including a kind of financing business, which Wu has been talking about for years but that sounds closer now to fruition. “We’re doing some things around mortgages that will integrated into the shopping experience,” says Wu, without wanting to elaborate further. Home improvement loans may also be on the horizon. (Wu says Opendoor “also wants to enable home buyers to personalize their experience.”)

Opendoor is also working more closely with developers, forming partnerships with “19 of the 25 largest home builders in the country over the last 18 months,” says Wu. The idea is for Opendoor’s customers to put down a deposit on a new home, with Opendoor operating quietly in the background to both help choose a closing date, as well as to sell those customers’ previous homes.

The big question, as always, is what Opendoor does in a sustained market downturn. The company is reportedly on pace to spend more than $2.5 billion on home purchases over the next year. Yet buying homes is a complicated affair. For starters, after Opendoor acquires each home, it has to ensure the home is up to code in order to resell it. Indeed, though the company is willing to buy homes built after 1960, Wu says a growing amount of its inventory was built no earlier than 1990.

Hanging on to its inventory, which Opendoor does for 90 days on average, would seem to pose an equally big risk, particularly given that the housing market is highly sensitive to interest rates and other macroeconomic factors that could prompt a market cool-off. We may even be seeing early signs of one right now.

Wu doesn’t seem concerned, focused as he is on creating a kind of virtuous cycle of home buying. Asked about housing market slowdowns, he shrugs off the question. Maybe he needs to operate that way, given the ambitious vision of Opendoor.

Says Wu when talk turns to rising mortgage rates and growing new home inventory, “We have a world-class pricing team to track data on a national and subdivision level that informs [what we do].” As for the condition of the housing market, “we aren’t commenting,” he says.

Pictured above, left to right: Eric Wu and Judd Schoenholtz.

Powered by WPeMatico

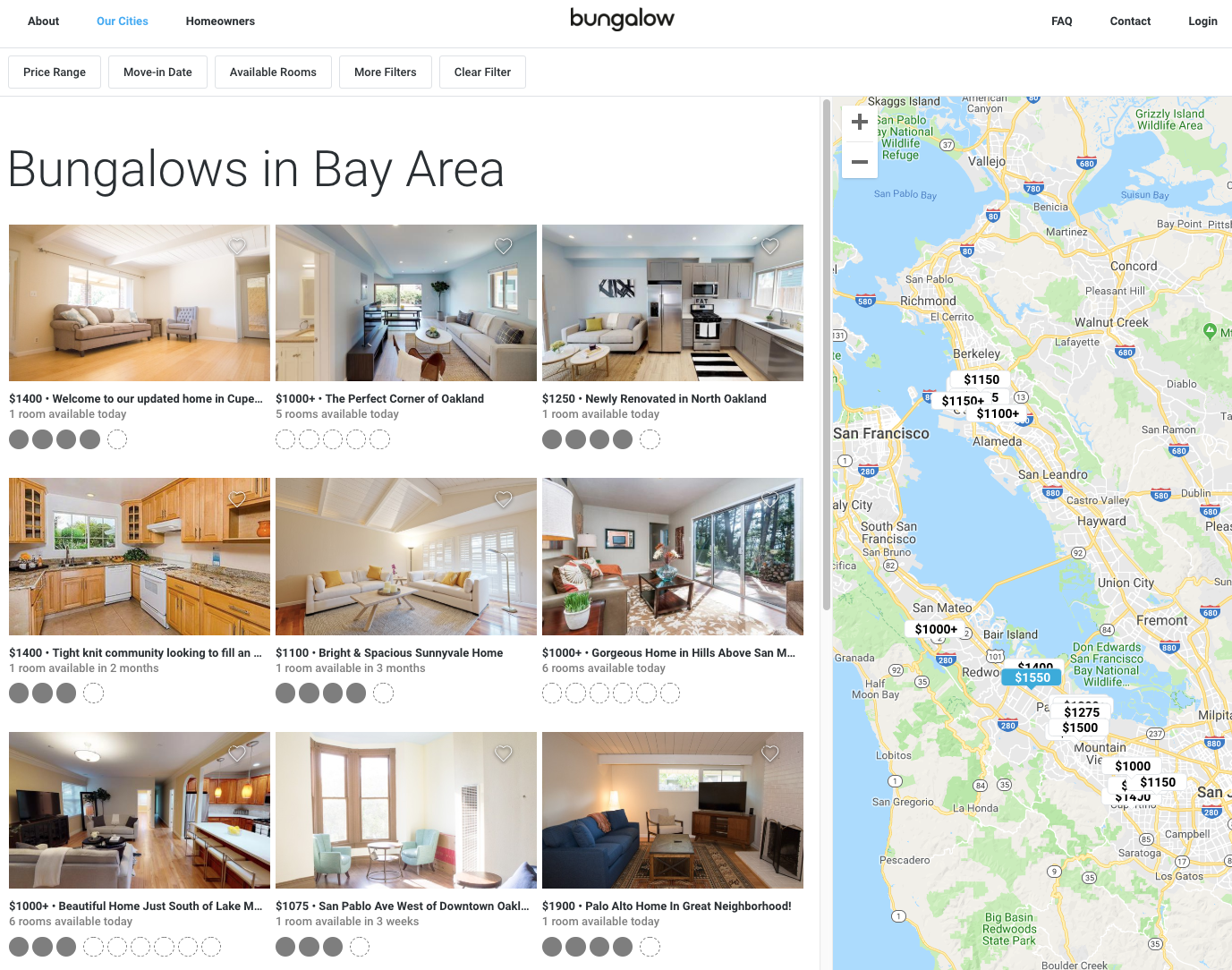

Moving to a new city can be tough for a number of reasons, but what’s arguably hardest about moving is a competitive and expensive housing market, and lack of a pre-existing social support network. That’s the problem startup Bungalow is trying to solve.

Bungalow, which just raised a $14 million Series A round led by Khosla Ventures with participation from Founders Fund, Atomic VC, Cherubic Ventures and Wing Ventures, offers people relatively affordable places to live with others who have been vetted by Bungalow’s platform. As part of the round, Keith Rabois of Khosla will join Bungalow’s board of directors. Bungalow also raised a $50 million debt facility to fuel its home growth costs. Bungalow had previously raised a $7 million seed round.

Bungalow, which joins the likes of WeLive, OpenDoor, Common, Roam and so many others, aims to be cheaper than getting your own studio or one-bedroom apartment, and offer a better experience than finding a roommate via Craigslist. Bungalow works with homeowners to lease their homes as the master tenant for three years at time. From there, Bungalow rents out the property on a room-by-room basis while guaranteeing occupancy to the homeowners.

“There aren’t as many families that are looking for these four, five, six-bedroom homes and so the incremental additional cost for those additional bedrooms is not commensurate with the individual rate at which we can lease out those individual bedrooms,” Bungalow co-founder and CEO Andrew Collins told me. “And so we were able to therefore basically create value out of that and then with scale that margin that we’re able to create within those given homes in an incredibly profitable and exciting coupling.”

For the renter, Bungalow says it’s about 30-40 percent cheaper than a studio. Depending on the market, of course, the prices can vary. Bungalow also furnishes shared common spaces, provides utilities, Wi-Fi and housekeeping in the monthly rental cost. In addition to what’s provided inside the space, Bungalow hosts monthly events for members in its properties to meet each other within a given market.

Bungalow currently operates 200 properties across seven markets, including the San Francisco Bay Area, Los Angeles, New York City, Portland, San Diego, Seattle and Washington, D.C. In total, there are 750 people residing in a Bungalow-leased property. All residents first must go through credit and background checks, as well as interviews with any existing residents before moving in. But that process can happen very fast, the company said. Some people have moved in same-day, but on average people look about 10 to 20 days ahead of when they’re trying to move.

While Bungalow’s current model is leasing assets from homeowners, it’s set up to operate any type of asset, Collins said, whether that’s a joint-venture or independently owned by Bungalow. Within the next six to 12 months, Bungalow is looking to launch in up to 12 new markets in the U.S. Next year, Bungalow hopes to expand its offering outside of the U.S.

Powered by WPeMatico

Lyvly, a London-based startup that offers what might best be described as a members-based shared living and rental service, has raised $4.6 million in Series A funding. Leading the round is Mosaic Ventures, while Greg Marsh, who co-founded Onefinestay, has joined the burgeoning company as chairman and investor.

The latest take on how to improve the experience for “generation rent” in sprawling cities like London, Lyvly is at its most basic a two-sided marketplace that helps renters find high-quality shared living accommodations and landlords find good tenants. However, it goes far beyond simply matching supply and demand for house shares.

Not only are properties fully managed — including providing tenant services such as managing household bills, replacing consumables and cleaning — but at the heart of it all is the Lyvly community platform, which treats Lyvly renters as members within a network of “like-minded individuals who share a passion for shared living.” And, as wishy-washy as that sounds, there is no doubt that city living is often devoid of community, and in London especially it can be difficult to meet new people.

“Renting is often not a pleasant experience, and living in cities can be lonely and stressful,” says co-founder and CEO Philip Laney. “Moving into your new apartment, sorting out furniture and utilities, and then trying to connect with busy people around you all whilst working long hours in a transient economy are frustrations many of us have experienced. We are confronting three problems for renters in the city: their desire for community, convenience and affordability.”

Laney says the current way people rent shared accommodations is also painful for landlords, who don’t have consistency and control over the quality of their tenants, and often pay high fees to a middle-person and struggle with vacancy rates. “We provide them guaranteed income with no voids and no fees, and a genuinely positive social impact,” he says.

For renters, Lyvly operates a little like a members club. Once you’ve applied to join the community, you have a call with a member of the Lyvly team to learn more about your “life stage and values.” “We are people, not property first. So we establish what you’re seeking from your Lyvly move and whether you are keen to actively participate in the Lyvly community and share your life, not just spaces,” says Laney.

Next, you are given profiles of the members (and prospective housemates) you will be meeting with, and they are sent your profile and an overview as to why you are well-matched. You then meet each other, and if you like each other, you can apply online to the membership committee, which is made up of the most active Lyvly members and the team. This includes submitting your bio and stating why you want to be part of Lyvly, and what you would bring to the community.

Adds Laney: “Once you’re in, we then guide you through the whole moving process, taking care of everything and removing any usual stresses that come from moving to a new place in London. You are introduced to other members in the area who have similar interests and values and other members reach out to you directly to invite you to other activities they’re hosting. We also regularly host events and actively support members to engage with each other and give value to the community.”

Lyvly’s target tenants are 25-35-year-olds who are looking for single occupancy. Laney says that’s because they are at similar life stages to each other and this is where the startup can make a meaningful difference. “We really care about being something to someone, rather than everything to no one. In time however, we will be able to expand Lyvly into different community groups,” he says.

Landlords using the platform range from individuals who are first-time owners to some of London’s biggest property companies.

Asked who Lyvly competes with, he cites the grey and black economy of shared housing and “dodgy landlords.” Technically the company is also competing with estate agents, although it is open to working with them to help find better tenants for their landlords.

Meanwhile, don’t confuse the startup for co-living, build-to-rent developers who “put property first” and aim to profit from the development of assets. In contrast, Lyvly makes money from the managed services it provides and is not developing new property but renting out existing housing stock.

“We believe people like living in existing houses and apartments and what we need to do is create a community around that. It’s not the configuration of the spaces that need changing, but how people interact inside and outside of them,” says Laney, adding that the use of existing housing infrastructure also means that Lyvly is potentially a lot more scalable.

Along with Laney, the startup’s other co-founders are Dario Favoino and Siraj Khaliq. Both Laney and Favoino have a 10-year background in real estate investment and property management at Deutsche Bank and Realstar. And in case you aren’t keeping up, Khaliq is a partner at London VC firm Atomico and was previously CTO and co-founder of Silicon Valley startup Climate Corporation, which exited in 2013 for more than $1.1 billion.

Powered by WPeMatico

A company called Rentlogic has raised $2.4 million to take the guesswork out of determining whether that cheap, beautiful New York apartment is actually a deathtrap wrapped in a brownstone’s clothing.

Renting in New York is murder already, but using Rentlogic, apartment hunters can figure out if their new housing situation could actually kill them (or put them at significant risk of bodily or property harm… or even minor inconveniences).

Investors in the company’s seed round include the Urban-X accelerator (which is a partnership between Urban.US and Mini); Urban.Us, an investor in urban technologies; the millennial-entrepreneur-focused investment firm, Kairos; and Seagram beverage company scion Edgar Bronfman, Jr.

Rentlogic already provides a grade for every building in New York — more than 1 million properties — but has added an inspection feature that it charges landlords for so that they can display a rating outside of their building. It’s like the city’s scoring grades for restaurants in neighborhoods.

“We grade every single property in New York,” says Yale Fox, the company’s founder and chief executive. “We have inspected 103 properties. Everybody is really happy with it and everybody is going to re-sign and we’re going to start scaling this out to every property in New York.”

Rentlogic scores buildings on a combination of around 150 different variables, including the ability to provide continuous heat and hot water, and whether or not a building has evidence of bed bugs or rodents.

The looks of the building doesn’t matter, Fox says. It’s more about the conditions of the building.

“It’s the same way a building would get LEED-certified,” says Fox. “It’s a good way for one landlord to differentiate their property as higher quality than a competitor’s in the same neighborhood.”

Launched initially in 2013, Rentlogic was born out of Fox’s own tragic experience as a new renter in New York. The Canadian transplant (and the son of a family of real estate professionals and small scale landlords) had come to the city for a new job and was looking at an apartment in the West Village.

After shelling out a $12,000 deposit for first month’s rent, last month’s rent and a security deposit, Fox settled into his abode in the tree-lined luxury of one of Manhattan’s most sought-after neighborhoods. The love affair with the building didn’t last long.

Unexpectedly, Fox started to become sick. Several visits to the doctor couldn’t identify a cause for his illness, until, finally, his physician suggested a mold-related illness.

“I asked the landlord to fix it and I wound up having to take the landlord to court,” says Fox.

By the time the court date arrived, Fox had paid to fix the mold problem himself and had little in the way of solid evidence to show a judge. So he built an app that would track the public complaints filed against the landlord and the public assessments that had been done on the building.

“I went to court and I showed the judge this model that I had put together and he said, ‘Welcome to New York and I’m sorry this happened to you… and you should definitely build an app, because New York City needs this.’”

Rentlogic founder Yale Fox

Fox, already enrolled in the TED Fellows program, built the app, initially called “RentCheck” and began marketing it to landlords and renters. “It was just a hobby because I was so angry about how things had happened to me,” says Fox. “We didn’t want to charge renters fees to the site. We thought having equal access to information could prevent this from happening in the future.”

Things continued as a nonprofit for a while until last year Fox hit on a business model. He designed a ratings card for the building based on the data his company had collected and showed it to his current landlord. “She said, ‘How much would you charge for it?’” Fox recalled.

Thus RentCheck became Rentlogic and a business was born. Fox charges landlords for assessments and to display a ratings placard that indicates the building’s grade.

Renters are willing to pay up to an additional $45 per month, according to a white paper, to sign a lease in a building that’s been independently certified. “People are willing to pay a little bit more just to not deal with the constant headaches that happen in certain kinds of buildings,” he said.

Fox appears to have launched Rentlogic at the right time. The market for housing in New York has softened as luxury apartments flood the market and demand softens, meaning that rents are coming down across the board.

But beyond being more competitive there’s a defensive aspect to getting rated in a market filled with demanding, complaint-prone consumers that have no qualms savaging any business, from landlords to local restaurants (although oftentimes the landlords and restaurants deserve it).

“A lot of times landlords are purchasing this because there’s no way to prove they’re not a one-star landlord,” Fox says. “This is accessible for big landlords and small landlords. In a zero-transparency and low-accountability marketplace, there’s no incentive for bad actors to improve their behavior, but with Rentlogic there is.”

The company is already making institutional moves. Fox has inked a deal with Blackstone about providing ratings for their $5.5 billion Stuyvesant Town acquisition on the Lower East Side, according to Fox. In addition, the company has partnered with a number of real estate brokers and roommate-hunting services like Nooklyn and Roomi to use its ratings.

While Rentlogic is scrupulous about using data to train its algorithm, it’s also transparent about how the algorithm works, according to Fox.

“Algorithms control so much what’s going on in the world and people just don’t understand them,” he says. So in the interest of full transparency, the company is putting together a building simulator where users can add problems and see how it affects a building’s rating on the Rentlogic site. The company also has an algorithmic review committee that reviews the results coming from the building assessments.

And while Rentlogic is starting in New York, the company has plans to use its machine learning system to hoover up publicly available data and provide grades for real estate across the United States.

Ultimately, Fox just wants to help improve the tenant-landlord relationship, he says. “I was in a terrible situation with a landlord who went to jail… I launched this site so no one would have to go through what I went through.”

Powered by WPeMatico

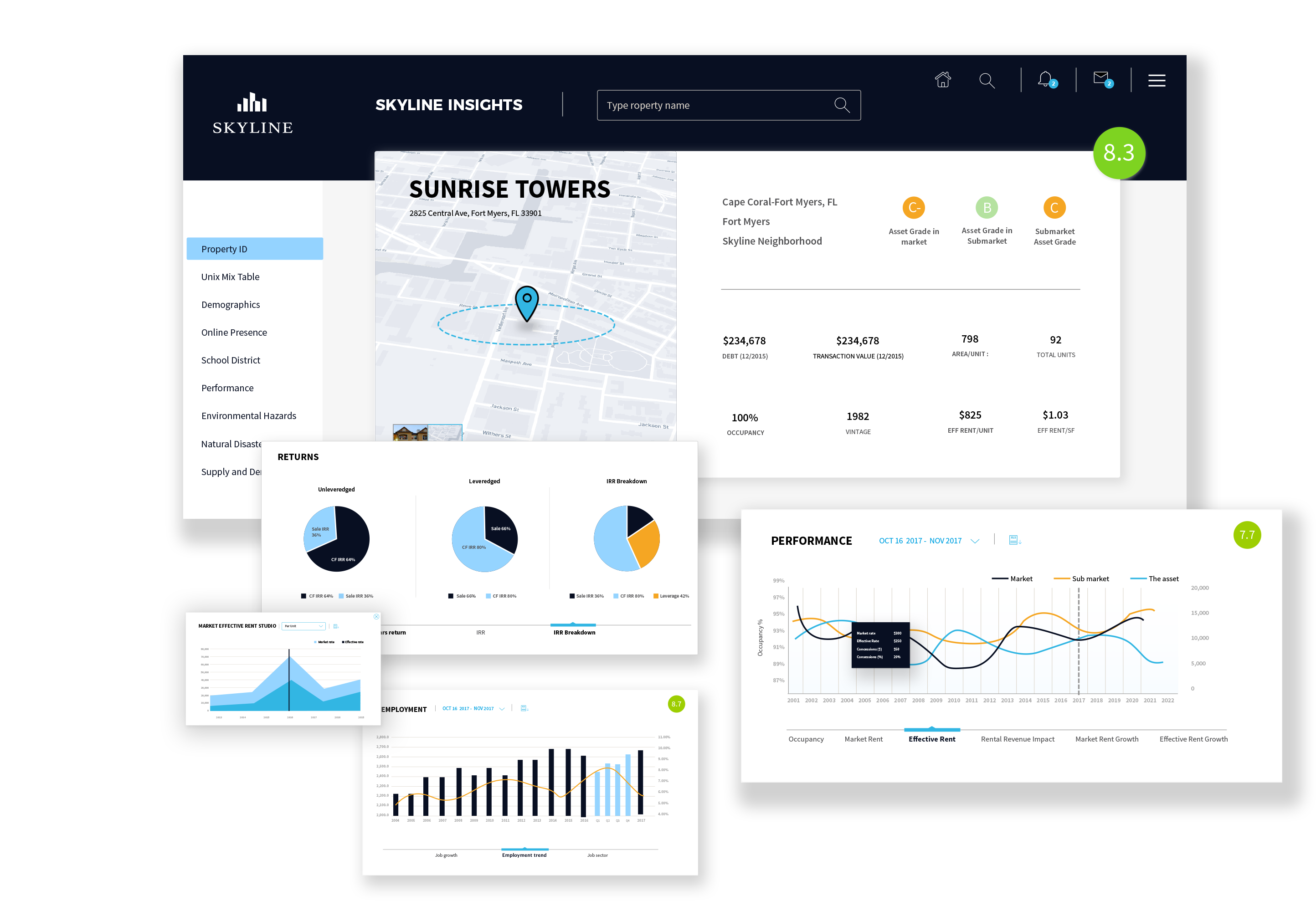

Skyline AI founders Iri Amirav, Or Hiltch, Guy Zipori and Amir Leitersdorf

A mere four months after coming out of stealth mode with $3 million in seed funding, real estate investment startup Skyline AI announced that it has raised an $18 million Series A. The round was led by Sequoia Capital, a returning investor, and TLV Partners, with participation from JLL Spark, a division of real estate investment management firm JLL. The strategic funding will allow Skyline AI to add more asset classes to its platform, which uses data science and machine learning algorithms to help institutional investors make better decisions about properties.

Skyline AI says its technology is trained on what it claims is the most comprehensive data set in the industry, drawing from more than 100 sources, with market information covering the last 50 years. Its technology is meant to provide faster and more accurate analysis than traditional methods, so investors can react more quickly to changes in the real estate market.

Co-founder and CEO Guy Zipori told TechCrunch in an email that the startup decided to raise its Series A so soon after coming out of sleath because of positive response from investors, adding that the round was oversubscribed. “The timing of the round also worked out perfectly with our current deal flow and expansion plans. The round was significant, putting us in a great position to move forward,” he said.

Skyline AI has had a busy few months since emerging from stealth. In June, it teamed up with an unnamed partner in the U.S. to acquire two residential complexes in Philadelphia for $26 million. Zipori said they decided to make an unsolicited offer after Skyline AI’s platforms determined the properties were being mismanaged. Then in July, Skyline AI announced a partnership with Greystone, a real estate lending, investment and advisory firm, to collaborate on improving the dealmaking and loan underwriting processes.

JLL and other strategic investors in Skyline AI’s Series A will allow the startup to add analysis and underwriting for new asset classes, including industrial, retail and office properties, to its platform. “This in turn will enable us to deepen and strengthen cooperation with the leading commercial real estate investment firms across the U.S.,” said Zipori. Some of the capital will also be spent on growing its research and development, data science and AI teams in Tel Aviv, and its recently opened sales and real estate office in New York.

In a press statement, Sequoia Capital partner Haim Sadger said “Over the last few years, we’ve seen AI disrupt a number of traditional industries and the real estate market should be no different. The power of Skyline AI technology to understand vast amounts of data that affect real estate transactions, will unlock billions of dollars in untapped value.”

Powered by WPeMatico

Another day, another blockchain project. This time sources are reporting that Knotel – an office space rental service in Manhattan – has acquired 42Floors, a commercial real estate search engine in order to, according to founder Amol Sarva, get “access to data and technology on over 10 billion square feet of office space, driving further liquidity to Knotel’s marketplace while also accelerating its plans for a blockchain platform.”

The deal is not yet complete.

Knotel is building the Agile HQ platform, a way to rent office space for a few hours or a few months without getting stuck in a lease. The company has 1 million square feet of space in New York, San Francisco, London, and Berlin and it raised $100 million in funding. The company claims it has more has more buildings in New York than WeWork.

“42Floors built a powerful tool to organize a dark market that hasn’t changed in a hundred years,” said Amol Sarva, CEO of Knotel. “It’s still backroom and bilateral while the rest of the world is becoming digital and standardized. This is what leads to transactions that take months to close with a dozen middlemen – no reliable information. You can buy a house faster than you can rent a floor. Partnering together will help give owners and customers what they both want: truth.”

The reported 42Floors acquisition enables the company to bring new properties onto its platform and could let non-blockchain-based contracts move to the blockchain.

UPDATE – Text changed to reflect the type of business and ICO plans.

Powered by WPeMatico

Real estate platform Nestio is getting new funding as it continues to expand its footprint beyond New York City into other large U.S. markets. The startup’s software gives real estate owners and managers a hub to handle things like leasing and marketing.

The round, which they announced today, was led by Camber Creek and Trinity Ventures, with participation from other real estate firms, including Rudin Ventures, Currency M, The Durst Organization, LeFrak Ventures and Torch Venture Capital. The startup has raised around $16 million to date.

Nestio is building up its unit count in new markets, including Boston, Chicago, Houston and Dallas, and is seeking to expand operations with existing customers in NYC. The startup says that it’s grown the amount of units on its platform by 250 percent in the past 12 months.

“We now have hundreds of thousands of listings on the platform that people are now managing,” Nestio CEO Caren Maio told TechCrunch. “Part of that growth is net new logos, but also expansion. So we’ve seen a lot of growth — particularly in New York — although I think the same behavior will replicate itself once we have some longevity in some of those other cities.”

The company says they will use this new capital and strategic partnerships to “deliver advanced leasing and marketing solutions even faster.”

Powered by WPeMatico

b8ta, the retail-as-a-service startup, has closed a $19 million Series B round led by Macy’s, with participation from Sound Ventures, Palm Drive Capital, Capitaland, Graphene Ventures, Khosla Ventures and Plug and Play Ventures. This round brings b8ta’s total funding to $39 million.

Macy’s decision to lead this round comes in light of its recent partnership with b8ta to enhance the retailer’s experiential-based concept called The Market. Macy’s is also expanding its partnership with b8ta to launch The Market in a larger space, entirely powered by Built by b8ta, which functions as a retail-as-a-service platform for brands that want a physical presence. b8ta’s software solution includes checkout, inventory, point of sale, inventory management, staff scheduling services and more.

“Testing a shop with them in their store and having really good success made us feel bullish that this model would work well for them,” b8ta CEO Vibhu Norby told TechCrunch.

To the outsider, there’s this idea that Macy’s is struggling — in light of a bunch of store closures. That was a conversation b8ta had internally, Norby said.

“As an example, our board was initially not certain we should do something with them, but I felt like it was worth a shot,” Norby told me. “For us to get comfortable, we spent a lot of time trying to understand their business. What we found was that perception in the media didn’t really meet the reality for us. The reality is Macy’s is one of the most important companies in the country.”

Macy’s, Norby said, is also one of the largest real estate companies in the world and owns “so much real estate in all of the best places.”

He added, “it’s not that retail itself is dying, it’s just that it’s changing. The way people want to shop is changing and we have a shared alignment on bringing that next generation of a company into the space.”

In addition to the expanded partnership with Macy’s, b8ta is opening new flagship stores in Chicago and Tysons Corner, Va. b8ta currently has more than 78 flagship stores across the country to let consumers experience tech gadgets in real life.

Powered by WPeMatico

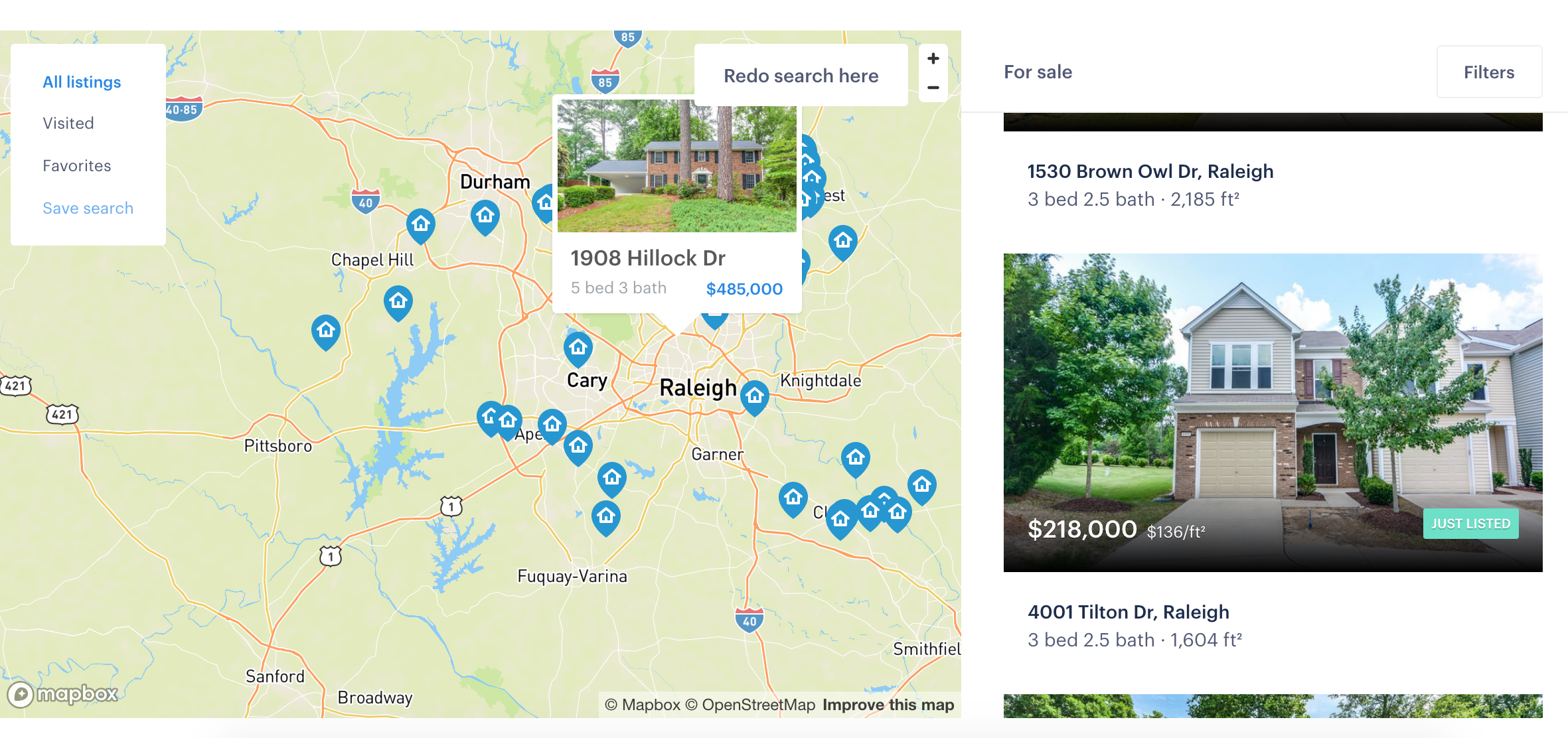

Investors are placing another huge bet on a startup looking to reinvent a decades-old process into something that’s near instant, this time pouring $325 million into Opendoor — a company that wants to bring the complex operation of buying or selling a home down to something similarly as simple as hailing a Lyft.

The idea of Opendoor is one not so dissimilar from a consumer theory that’s blossomed into companies worth tens of billions of dollars — consumers hate complex processes and are willing to hand off those processes to technology companies if they can make it even a little simpler. Home-buying and selling can be one of the more intense ones, requiring a lot of moving pieces and coordinating multiple time tables and schedules. Opendoor’s theory is that it can create a sizable business by dropping that time and energy cost to zero and effectively create a new technology-powered business model in the process, just like Uber or Airbnb.

Opendoor says it hopes to expand to 50 markets by the end of 2020 with this additional financing. It is in 10 markets right now, and also says it now purchases more than $2.5 billion in homes on an annual run rate. The company says it has raised a $325 million financing round co-led by General Atlantic, Access Technology Ventures and Lennar Corporation. Andreessen Horowitz, Coatue Management, 10100 Fund and Invitation Homes also participated, as well as existing investors Norwest Venture Partners, Lakestar, GGV Capital, NEA and Khosla Ventures. Opendoor has in total raised $645 million in equity and $1.5 billion in debt.

“What I realized was that there’s a lot of tailwinds with people wanting to transact with their mobile device,” CEO Eric Wu said. “We see this with Uber and Lyft and Amazon. I believe the future of real estate will be on demand and that’s the centerpiece of Opendoor’s thesis, making the transaction real time and instant. I realized there were going to be tailwinds, and that real estate was in need of being transformed.”

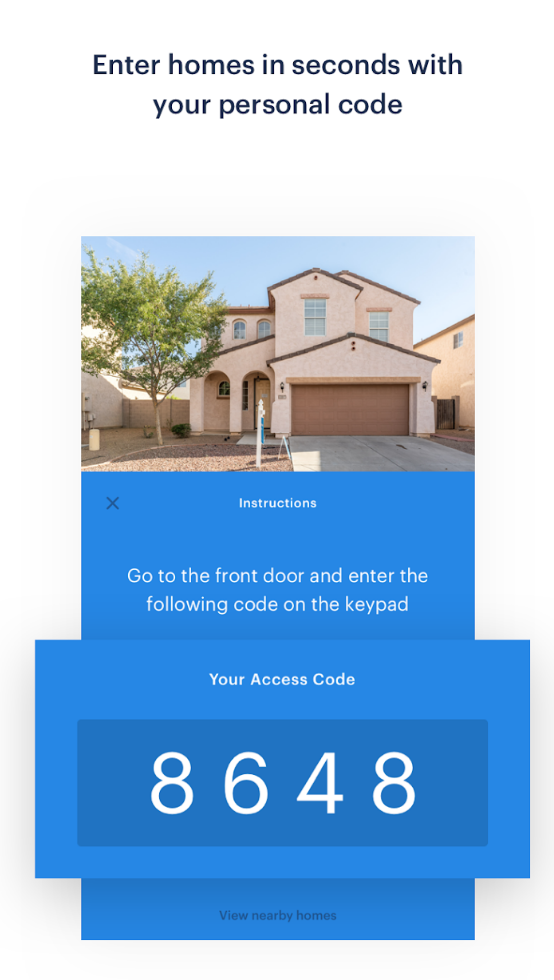

Opendoor has also sought to expand its efforts to make viewing those homes just as seamless. The company enables potential customers to check out a home by opening it with the app seven days a week. Wu said that most potential buyers go to the house each of the seven days up to the transaction, and then seven days after the transaction happens. Given that it’s such a significant step for any home owner, it makes sense that a lot of planning and consideration would go into the process. The next step is to create a sort of trade-up system, where Opendoor works to create a streamlined way to turn around an existing home for a new home.

Still, buying (or selling) a home is one of the single-largest transactions a consumer can do — especially if they are in a major metropolitan area where houses can quickly hit the $1 million-plus range. So it’s still a hurdle to convince consumers that they should press a few buttons to make a transaction in the hundreds of thousands of dollars. Wu said that the challenge there was to build enough trust with customers that they realize the process should be as seamless and powered by transparent data.

“It’s something we faced early on when we launched the service,” Wu said. “We were asking sellers to sell their home online to a tech company. A lot of the things we’ve done — such as lowering the fees and being transparent about pricing — which helped us build trust. Since it’s one of the largest financial transactions anyone makes, we had to build a world-class pricing model, be transparent about how we got to the quote, make it a low-fee service, and provide a certainty around the process.”

To try to do all this, Opendoor says it’s built a robust data set that will help best model potential prices for homes and be more transparent about that information. Wu said Opendoor currently employs around 650 people and hopes to double that by the end of next year, and the company is investing a significant amount of capital in growing out its data science team. The challenge is to understand the dynamics of the housing market — and any potential chaos — in order to best assess how to buy and sell those homes. Opendoor acquires some risk by purchasing some homes and holding them for a period of time, so ensuring that the company knows how the market performs will be one of its biggest challenges.

Opendoor is certainly not the only player in this area, as some competitors like Knock and OfferPad are starting to raise additional capital. Knock picked up $32 million in January last year with a similar bet: simplify the home-buying process and handle all of the details behind the scenes. If anything, it’s shown that there’s an appetite among the venture community (especially one where the numbers just keep getting bigger) for models that look to tap the same consumer demand of simplifying overly complex processes to just a few inputs on a smart app powered by data science.

Powered by WPeMatico

Macy’s has partnered with b8ta, the retail-as-a-service startup that originally started as a way to let people try out new tech products. Macy’s has acquired a minority stake in b8ta and will use the startup to enhance The Market, an experiential-based retail concept at Macy’s. By partnering with b8ta, Macy’s envisions being able to scale its Market concept faster, Macy’s president Hal Lawton said in a statement. For b8ta, this is an additional source of revenue.

“At b8ta, we believe physical retail will thrive as a platform for discovering new products and brands,” b8ta CEO Vibhu Norby said in a statement. “Macy’s was the best partner for b8ta to scale our pioneering retail-as-a-service model to a breadth of categories like apparel, beauty, home, and more. With b8ta’s software platform and business model, product makers can go from solely selling online to launching their products with Macy’s in a few clicks. Our platform makes it easy for makers to deploy, manage, analyze, and scale amazing offline retail experiences.”

Earlier this year, b8ta unveiled a Shopify-like solution for retail stores. Called “Built by b8ta,” the solution functions as a retail-as-a-service platform for brands that want a physical presence. b8ta’s software solution includes checkout, inventory, point of sale, inventory management, staff scheduling services and more. Netgear was the first customer to launch a Built by b8ta store this June in Silicon Valley’s Santana Row, and b8ta has plans to deploy additional stores for other brands in that area.

In April, Norby told me there were a handful of other brands that b8ta would announce soon. This year, b8ta expects anywhere from 10 to 15 companies to launch stores built by b8ta across cosmetics, apparel and furniture. It seems that Macy’s was one of those companies.

b8ta initially launched as a store that showcased products like the Gi Flybike, a folding electric bicycle, and Thync, a wearable for achieving mindfulness and boosting energy, into physical stores to enable customers to have real, tactile experiences with them.

Powered by WPeMatico