real estate

Auto Added by WPeMatico

Auto Added by WPeMatico

The open office plan was intended to help collaboration and productivity across employees and teams while better utilizing less square feet per person. But the results haven’t always proven to be very successful, based on years of analysis.

Yet it is still the norm for tech companies of all sizes, and will likely stay that way.

Based on my years of experience working with hundreds of companies, I’ll lay out a basic framework below to help you think through how to adapt an open-office situation to best meet your needs.

I’ll also walk you through the example of a growing venture-backed startup that’s staffing up in one of the tougher office markets in the world: Manhattan.

But first, take a look at the data. Studies have shown that open floor plans can inhibit productivity and health. Open office workers take 62% more sick days than those in private offices, and a mere three hours of steady noise can cause measurable distress and a decrease in motivation. Face-to-face communication has been observed to actually decrease in open plan environments, with a measurable negative impact on productivity.

Considering that 70% of Americans today work in an open office, the issue of constant noise and distraction is ubiquitous across the country. The result is a bad rap—one doesn’t need to look very far to find one of the many articles online criticizing the design.

Powered by WPeMatico

Adam Neumann, the co-founder and chief executive of the international real estate co-working startup WeWork has reportedly cashed out of more than $700 million from his company ahead of its initial public offering.

The size and timing of the payouts, made through a mix of stock sales and loans secured by his equity in the company, is unusual, considering that founders typically wait until after a company holds its public offering to liquidate their holdings.

Despite the loans and sales of stock, first reported by The Wall Street Journal, Neumann remains the single largest shareholder in the company.

According to the Journal’s reporting, Neumann has already set up a family office to invest the proceeds and begun to hire financial professionals to run it.

He’s also made significant investments in real estate in New York and San Francisco, including four homes in the greater New York metropolitan area, and a $21 million, 13,000-square-foot house in the Bay Area, complete with a guitar-shaped room (I guess a fiddle would be too on the nose). In all, Neumann reportedly spent $80 million on real estate.

Neumann has also invested in commercial real estate (the kind that WeWork leases to provide work space with more flexible leases for companies and entrepreneurs), including properties in San Jose, Calif. and New York. Indeed, four of Neumann’s properties are leased to WeWork — to the tune of several million dollars in rent. According to the Journal, Neumann will transfer those property holdings to a WeWork-controlled fund.

The WeWork chief executive has also invested in startups in recent years. He’s got an equity stake in seven companies: Hometalk, Intercure, EquityBee, Selina, Tunity, Feature.fm and Pins, according to CrunchBase.

The rewards that Neumann is reaping from the loans and stock sales are among the highest recorded by a private company executive. In recent years, Evan Spiegel sold $8 million in stock and borrowed $20 million from Snap before its 2017 public offering, and Slack Technologies chief executive Stewart Butterfield sold $3.2 million of stock before Slack’s public offering in June.

The only liquidation of stock and other payouts that have been disclosed that come close to Neumann’s payouts are the $300 million that Groupn co-founder Eric Lefkofsky sold before his company’s IPO and the over $100 million that Mark Pincus took off the table ahead of Zynga’s offering.

WeWork declined to comment for this article.

Powered by WPeMatico

Rent the Backyard is one of the rare startups with a name that perfectly suits what it does.

The company, which is part of Y Combinator’s current batch, builds studio apartments in homeowners’ backyards, which are then rented out for income.

Of course, if you already own a house with a yard, you could theoretically do this for yourself, without getting a startup involved, but co-founder Brian Bakerman told me, “The goal is to have no headaches for the homeowners.”

That means Rent the Backyard works with a partner to build the apartment, finances the construction, lists the property, selects the tenant, collects the rent and serves as the landlord. In exchange for all that, it has an ownership stake in the unit and keeps 50% of the rent.

The startup also handles the permitting, which co-founder Spencer Burleigh said has become much easier with recent changes in California law. In fact, he pointed to stories about how these changes have led to skyrocketing applications (16 in 2016, 350 in 2018) to build “in-law” units in San Jose, which is where the startup is focused for now.

Bakerman said that many homeowners simply can’t afford the upfront cost of building these units, so by providing the financing, Rent the Backyard can unlock new income and make home ownership more affordable. At the same time, it’s also helping renters by creating more apartments.

Of course, for a homeowner, that means giving up a big piece of your backyard (which must be at least 30 feet by 30 feet in size), but Bakerman said that many yards are “underutilized” anyway.

“In places like the Bay Area … people are spending a ridiculous amount on their homes,” he added. “They often can’t afford those lifestyles, but everyone wants to attain home ownership.”

The company’s website includes a calculator of how much rental income you might earn, and it says that most owners will be able to make more than $10,000 of additional income each year.

Over time, Rent the Backyard will give the homeowner an increasing share of equity in the apartment, until they own it completely after 30 years. Homeowners also can buy out the startup’s equity and take full ownership at any time (which they’ll need to do if they sell their home and move out).

To be clear, Rent the Backyard hasn’t actually built any apartments yet, but it’s already signed up construction partners, and the goal is to get 10 units permitted and ready for construction by the end of the summer.

“It’s a pretty fast process,” Bakerman said. “It could just be a handful of weeks before we’re able to start building” — and because the units use prefabricated construction methods, the actual building could take as little as a week and a half.

Powered by WPeMatico

It’s a cautionary tale we hear far too often: Company A, hiring staff and growing rapidly, finalized a 10-year lease for office space. One week after move-in they had filled their space to the brim, with engineers sitting on top of sales staff, interns working in the hallways and the CEO operating out of a small conference room.

Company A had backed themselves into a corner, in desperate need for more room with no easy solution to the problem, and looking to swiftly dispose of their inadequate space.

In the startup environment, everything moves at a breakneck pace. Raising venture capital, hiring staff, assembling a board, etc. – all while working day-in and day-out to refine a product or service meant to disrupt the world. With senior staff pulled in different directions, there is little time for a strategic analysis of office space needs.

My team at Colliers specializes in working with technology companies at all stages, from pre-seed to IPO and beyond. We have advised dozens of companies literally from their first day of operations, to others whose market caps are well into the multi-billion dollar range.

We have developed some metrics and strategies that help our clients to grow without having to worry about scheduling an hourly team huddle at the downstairs Starbucks .

We have extensive experience working with companies with offices around the U.S. and world, but a majority of our work is in the New York City area. The analytics and strategy formation for each company is different dependent on a multitude of factors: budget, concrete or tentative headcount projections, timing, etc. – but there are a few baseline rules that can help jumpstart the education process and conversation.

From working with hundreds of technology companies in various states of flux (capital infusion, rapid growth, headcount reduction), we’ve become experts on which office may be the best fit for a company, from a month-to-month WeWork licensing agreement to a long-term lease.

Rarely in the commercial real estate world are issues black-and-white; and strategies are unique to each company. But there are several basic questions that need to be answered when evaluating office space:

Powered by WPeMatico

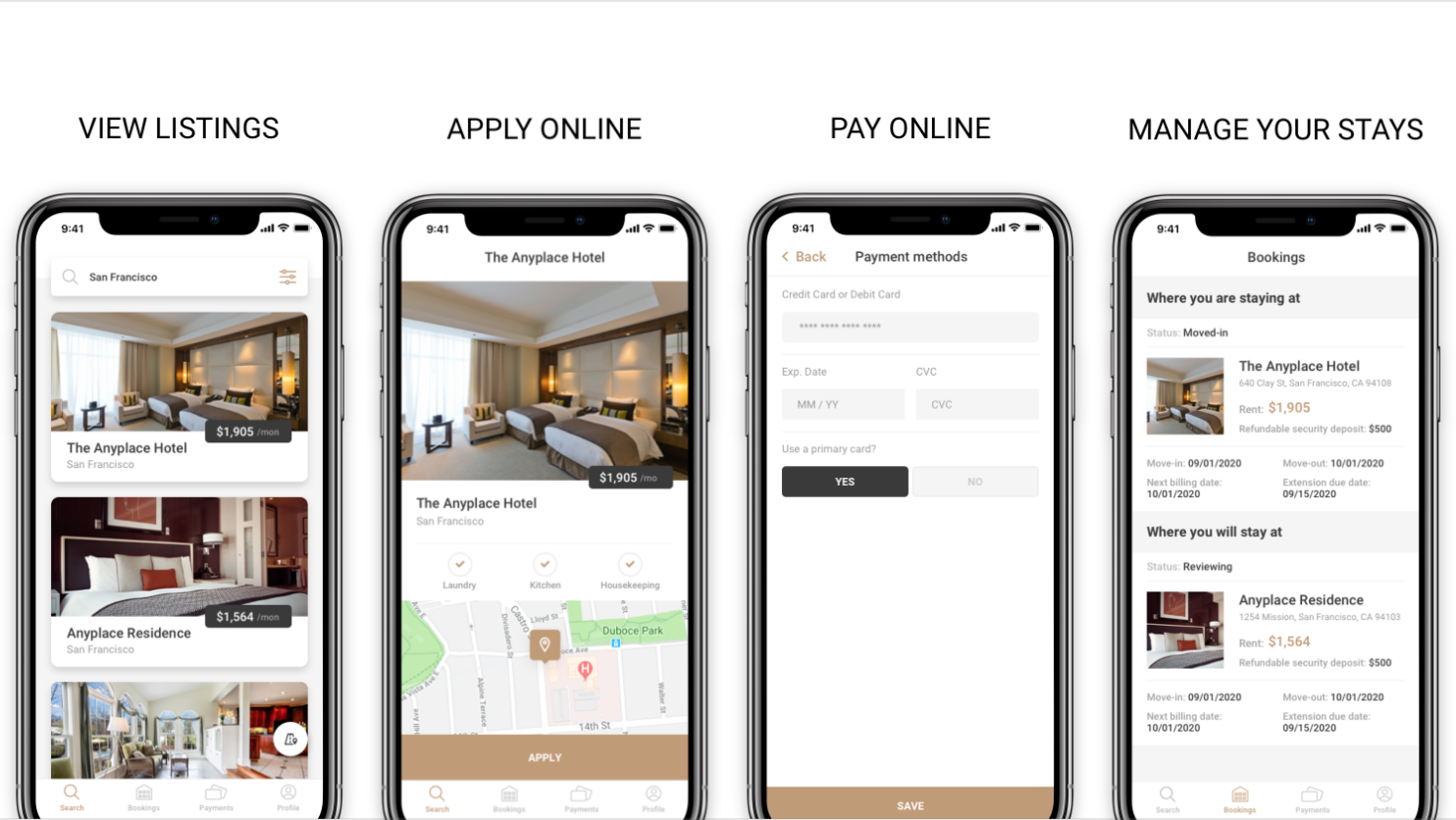

Anyplace, a startup offering furnished rooms and apartments to anyone who’s not interested in signing a long-term lease, is announcing that it has raised $2.5 million in seed funding.

CEO Satoru Steve Naito said he co-founded the company to meet his own needs as a “digital nomad” who likes to move from city to city every few months.

“I wanted this product for myself: I hate to commit to a long-term contract, and I want utilities and wifi taken care of when I secure a room,” Naito said.

For him, that meant moving into a hotel, where he said the rooms are “easy-to-book and fully furnished.” And while Naito’s far from the first person to call a hotel room home (I did it myself for a summer journalism internship back in 2006), with Anyplace, he’s created an online marketplace where you can rent hotel rooms and other furnished housing on a month-to-month basis.

Naito said Anyplace normally negotiates a 30% to 50% discount with the hotels. (Checking the Anyplace website this morning, it looks like monthly prices in New York range from $1,331 to $4,157.) Those hotels then get a new source of monthly revenue, which may be particularly important as they try to compete with services like Airbnb.

And while the pitch might sound similar to a serviced apartment or a co-living space, Naito noted that Anyplace functions purely as an online marketplace, without operating any properties of its own. So it actually partners with apartments and co-living companies to bring them more renters.

Anyplace handles the booking and payment process, in return for collecting a 10 percent commission. It also reduces the risk for the hotel or property owner by performing basic background checks, and Naito also plans to introduce insurance that will cover eviction costs for up to $10,000.

And there are new features for renters in the works, including a “nomad loyalty program” that rewards frequent customers with things like airplane ticket discounts, and an online community to help you find friends when you’re in a new city.

“We don’t want to become boring housing rental marketplace,” Naito said. “We are not a housing business, we are a freedom business.”

When Naito and I met to discuss the funding, he estimated that there were around 100 people currently staying in Anyplace properties. He also said the service generated $1.3 million in bookings last year.

He acknowledged that while digital nomadism sounds appealing, it’s “a very niche and small group,” so Anyplace is also designed to serve anyone in need of temporary housing, whether they’re relocating for a new job, taking an extended business trip or moving somewhere for an internship.

The startup’s seed funding comes from Jason Calacanis, FundersClub, UpHonest Capital, East Ventures, Keisuke Honda, Kenji Kasahara Bora Uygun and Global Brain.

Powered by WPeMatico

The real estate industry is experiencing a bit of a rejuvenation. After years resisting the influence of tech, the industry is now feeling the entrance of e-buyers, as well as a variety of software to streamline the process. One such tech company looking to infiltrate real estate is FlareAgent, which launches today out of Y Combinator.

FlareAgent was founded by Abhi CVK and Rashid Aziz. The duo, who just graduated out of NYU, first built FlareAgent when Rashid’s dad, a real estate agent, was asked by his boss (Mr. Brown) about finding software that might speed up the process of completing a transaction.

Abhi and Rashid built something that ended up helping grow the real estate firm from 20 deals per month to more than 100 deals/month. How?

FlareAgent lets all parties collaborate on a transaction from the comfort of their own home or office. From purchase offers to escrow documents to the closing agreement, FlareAgent allows brokers and clients to view and interact with various documents to speed up the time to close.

This used to be done manually by brokers, who’d have to fax or mail or hand-deliver documents to and from various parties in the transaction. If changes take place to the paperwork, this process may start over from scratch.

With FlareAgent, all the time spent changing and sharing documents manually can be done online.

To be clear, a transaction doesn’t actually go through FlareAgent. In other words, the money changing hands from buyer to seller doesn’t flow through the FlareAgent platform. But all the documents that need to be reviewed, amended and signed can be handled on FlareAgent.

To make money, the company charges a monthly subscription to brokers using the platform.

Thus far, FlareAgent says it has around 100 active agents on the platform and has processed more than 2,500 transactions (worth $550 million in property value) since its inception.

Powered by WPeMatico

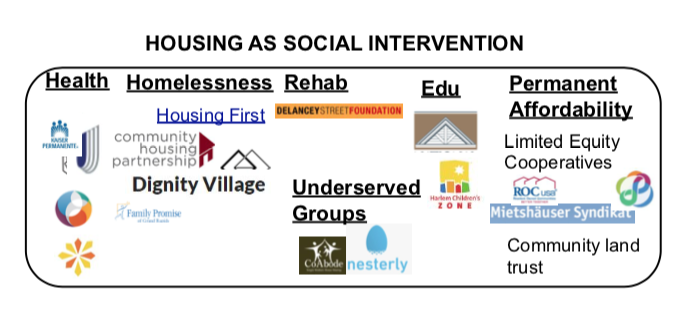

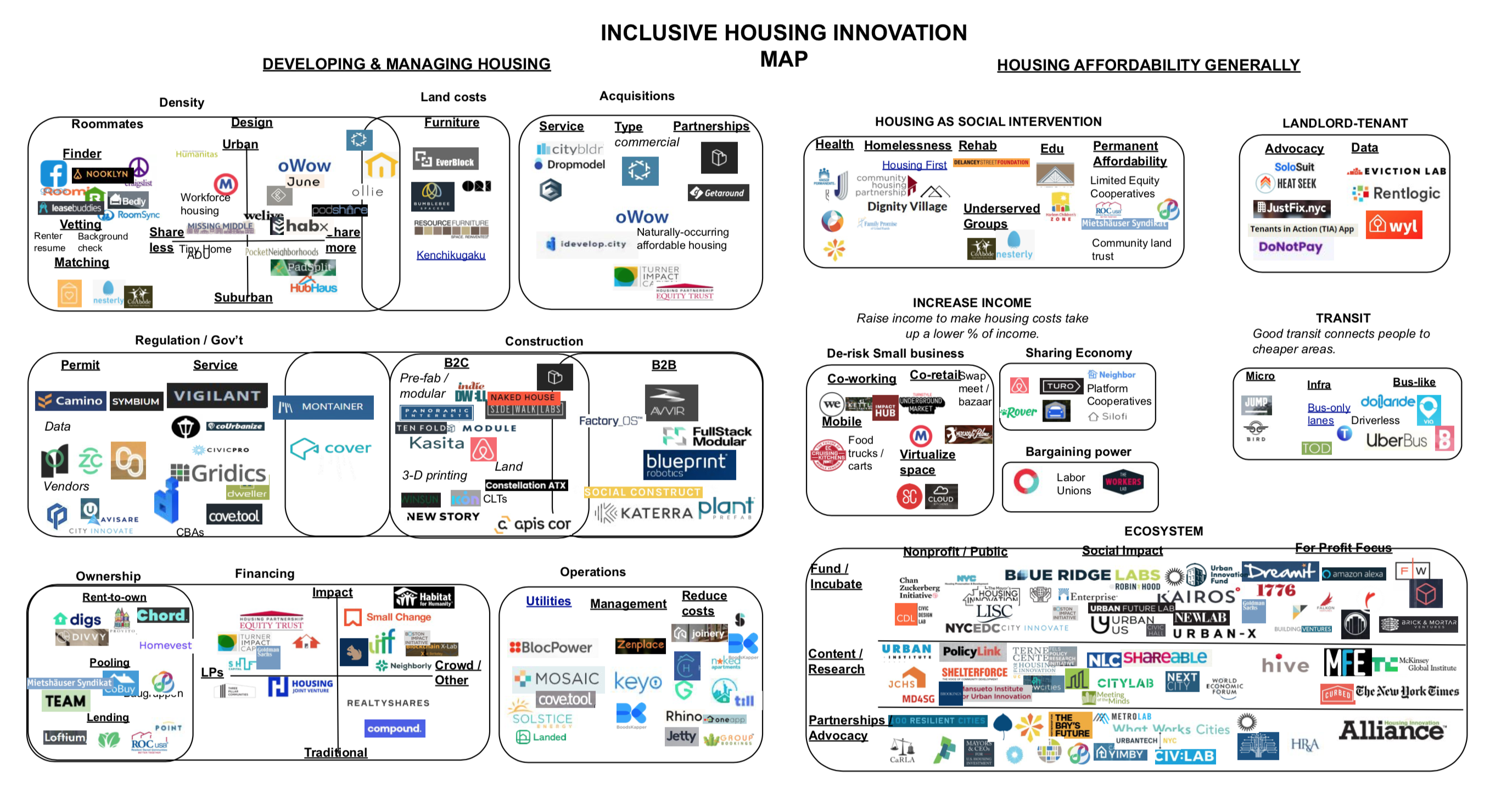

This week on Extra Crunch, I am exploring innovations in inclusive housing, looking at how 200+ companies are creating more access and affordability. Yesterday, I focused on startups trying to lower the costs of housing, from property acquisition to management and operations.

Today, I want to focus on innovations that improve housing inclusion more generally, such as efforts to pair housing with transit, small business creation, and mental rehabilitation. These include social impact-focused interventions, interventions that increase income and mobility, and ecosystem-builders in housing innovation.

Nonprofits and social enterprises lead many of these innovations. Yet because these areas are perceived to be not as lucrative, fewer technologists and other professionals have entered them. New business models and technologies have the opportunity to scale many of these alternative institutions — and create tremendous social value. Social impact is increasingly important to millennials, with brands like Patagonia having created loyal fan bases through purpose-driven leadership.

While each of these sections could be their own market map, this overall market map serves as an initial guide to each of these spaces.

These innovations address:

Powered by WPeMatico

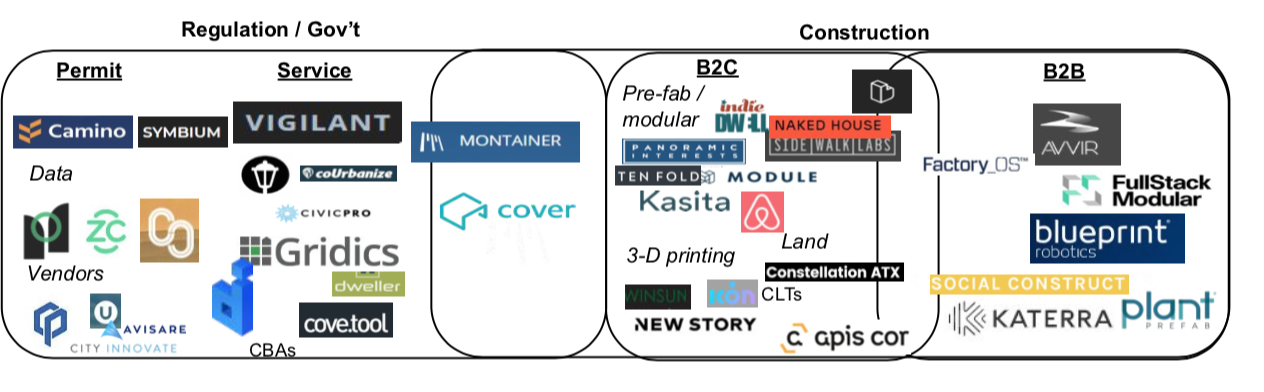

In this section of my exploration into innovation in inclusive housing, I am digging into the 200+ companies impacting the key phases of developing and managing housing.

Innovations have reduced costs in the most expensive phases of the housing development and management process. I explore innovations in each of these phases, including construction, land, regulatory, financing, and operational costs.

This is one of the top three challenges developers face, exacerbated by rising building material costs and labor shortages.

Powered by WPeMatico

Housing is big money. The industry has trillions under management and hundreds of billions under development.

And investors have noticed the potential. Opendoor raised nearly $1.3 billion to help homeowners buy and sell houses more quickly. Katerra raised $1.2 billion to optimize building development and construction, and Compass raised the same amount to help brokers sell real estate better. Even Amazon and Airbnb have entered the fray with high-profile investments.

Amidst this frenetic growth is the seed of the next wave of innovation in the sector. The housing industry — and its affordability problem — is only likely to balloon. By 2030, 84% of the population of developed countries will live in cities.

Yet innovation in housing lags compared to other industries. In construction, a major aspect of housing development, players spend less than 1% of their revenues on research and development. Technology companies, like the Amazons of the world, spend nearly 10% on average.

Innovations in older, highly regulated industries, like housing and real estate, are part of what Steve Case calls the “third wave” of technology. VCs like Case’s Revolution Fund and the SoftBank Vision Fund are investing billions into what they believe is the future.

These innovations are far from silver bullets, especially if they lack involvement from underrepresented communities, avoid policy and ignore distributive questions about who gets to benefit from more housing.

Yet there are hundreds of interventions reworking housing that cannot be ignored. To help entrepreneurs, investors and job seekers interested in creating better housing, I mapped these innovations in this package of articles.

To make sense of this broad field, I categorize innovations into two main groups, which I detail in two separate pieces on Extra Crunch. The first (Part 1) identifies the key phases of developing and managing housing. The second (Part 2) section identifies interventions that contribute to housing inclusion more generally, such as efforts to pair housing with transit, small business creation and mental rehabilitation.

Unfortunately, many of these tools don’t guarantee more affordability. Lowering acquisition costs, for instance, doesn’t mean that renters or homeowners will necessarily benefit from those savings. As a result, some tools likely need to be paired with others to ensure cost savings that benefit end users — and promote long-term affordability. I detail efforts here so that mission-driven advocates as well as startup founders can adopt them for their own efforts.

Today:

Coming Tomorrow:

Please feel free to let me know what else is exciting by adding a note to your LinkedIn invite here.

If you’re excited about this topic, feel free to subscribe to my future of inclusive housing newsletter by viewing a past issue here.

Powered by WPeMatico

With news that the We Company (formerly known as WeWork) has officially filed to go public confidentially with the SEC today, there’s a big question on everyone’s mind: Is this the next massive startup win or a house of cards waiting to be toppled by the glare of the public markets?

No company I follow has as much polarized opinion as the We Company. And while the company will have to reveal at least some of its hand in its official S-1, my guess is that the polarization around the company will not be alleviated until well after it goes public, if ever.

The challenge with understanding its business is how much the details of each of its leases, real estate markets and tenants matter to its bottom line. We already know the top line numbers: the company had revenue of $1.8 billion in 2018, and a net loss of $1.9 billion that year. That led to the received opinion that the company has an extraordinarily weak business. As Crunchbase News editor Alex Wilhelm put it:

Powered by WPeMatico