real estate

Auto Added by WPeMatico

Auto Added by WPeMatico

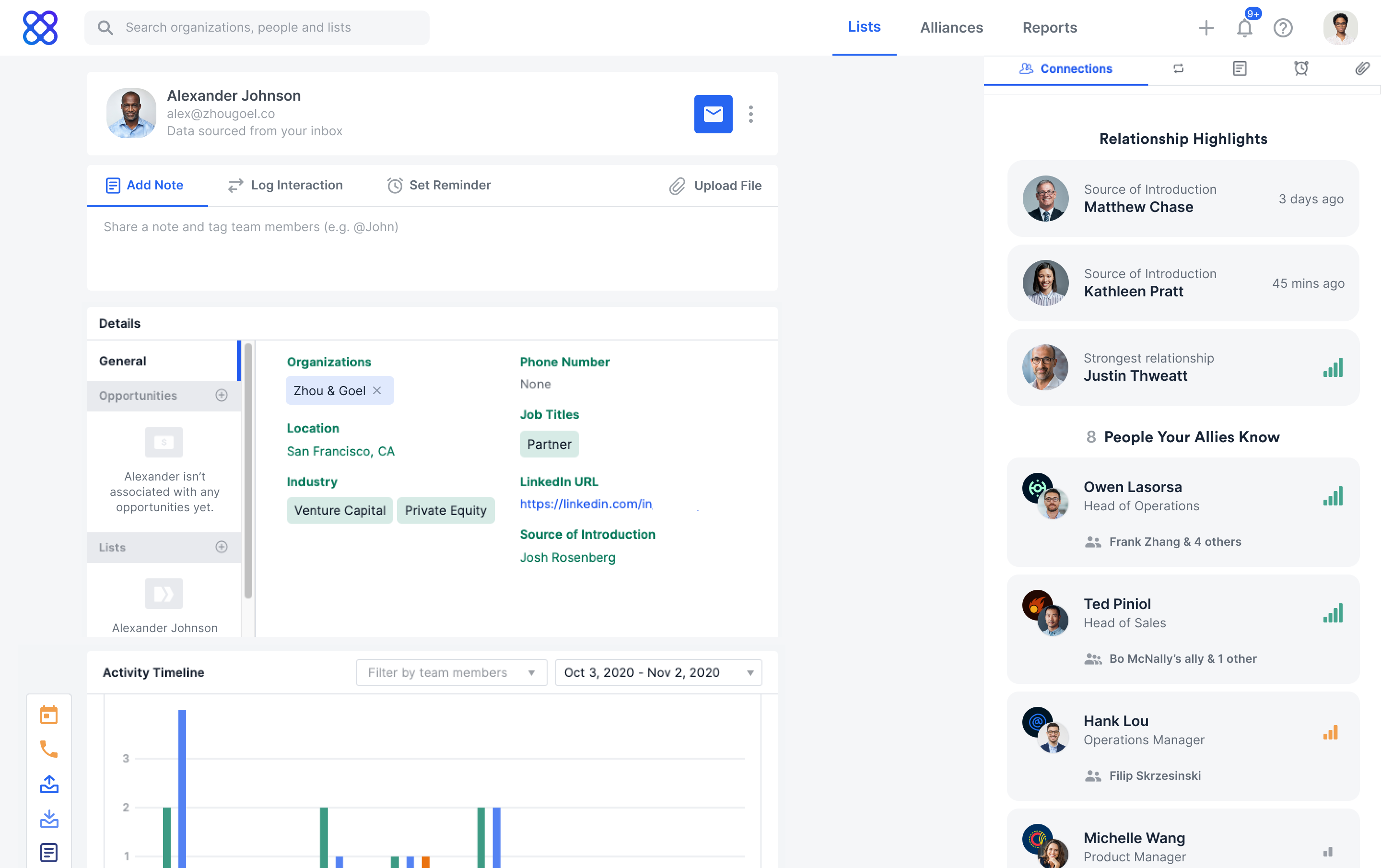

Relationships ultimately close deals, but long-term relationships come with a lot of baggage, i.e. email interactions, documents and meetings.

Affinity wants to take what Ray Zhou, co-founder and CEO, refers to as “data exhaust,” all of those daily interactions and communications, and apply machine learning analysis and provide insights on who in the organization has the best chance of getting that initial meeting and closing the deal.

Today, the company announced $80 million in Series C funding, led by Menlo Ventures, which was joined by Advance Venture Partners, Sprints Capital, Pear Ventures, Sway Ventures, MassMutual Ventures, Teamworthy and ECT Capital Partners’ Brian N. Sheth. The new funding gives the company $120 million in total funding since it was founded in 2014.

Affinity, based in San Francisco, is focused on industries like investment banking, private equity, venture capital, consulting and real estate, where Zhou told TechCrunch there aren’t customer relationship management systems or networking platforms that cater to the specific needs of the long-term relationship.

Stanford grads Zhou and co-founder Shubham Goel started the company after recognizing that while there was software for transactional relationships, there wasn’t a good option for the relationship journeys.

He cites data that show up to 90% of company profiles and contact information living in traditional CRM systems are incomplete or out of date. This comes as market researcher Gartner reported the global CRM software market grew 12.6% to $69 billion in 2020.

“It is almost bigger than sales,” Zhou said. “Our worldview is that relationships are the biggest industries in the world. Some would disagree, but relationships are an asset class, they are a currency that separates the winners from the losers.”

Instead, Affinity created “a new breed of CRM,” Zhou said, that automates the inputting of that data constantly and adds information, like revenue, staff size and funding from proprietary data sources, to assign a score to a potential opportunity and increase the chances of closing a deal.

Affinity people profile. Image Credits: Affinity

He intends to use the new funding to expand sales, marketing and engineering to support new products and customers. The company has 125 employees currently; Zhou expects to be over 200 by next year.

To date, the company’s platform has analyzed over 18 trillion emails and 213 million calendar events and currently drives over 500,000 new introductions and tracks 450,000 deals per month. It also has more than 1,700 customers in 70 countries, boasting a list that includes Bain Capital Ventures, Kleiner Perkins, SoftBank Group, Nike, Qualcomm and Twilio.

Tyler Sosin, partner at Menlo Ventures, said he met Zhou and Goel at a time when the firm was looking into CRM companies, but it wasn’t until years later that Affinity came up again when Menlo itself wanted to work with a more modern platform.

As a user of Affinity himself, Sosin said the platform gives him the data he cares about and “removes the manual drudgery of entry and friction in the process.” Affinity also built a product that was intuitive to navigate.

“We have always had an interest in getting CRMs to the next generation, and Affinity is defining itself in a new category of relationship intelligence and just crushing it in the private capital markets,” he said. “They are scaling at an impressive growth rate and solving a hard problem that we don’t see many other companies in the space doing.”

Powered by WPeMatico

When did indoor air become cold and clean?

Air conditioning is one of those inventions that have become so ubiquitous, that many in the developed world don’t even realize that less than a century ago, it didn’t exist. Indeed, it wasn’t so long ago that the air inside our buildings and the air outside of them were one and the same, with occupants powerless against their environment.

Eric Dean Wilson, in his just published book, “After Cooling: On Freon, Global Warming, and the Terrible Cost of Comfort,” dives deep into the history of this field. It took more than just inventing the air conditioner to make people want to buy it. In fact, whole social classes outright rejected the technology for years. It took hustle, marketing skill, and mass societal change to place air conditioning at the center of our built environment.

Wilson covers that history, but he has a more ambitious agenda: to get us to see how our everyday comforts affect other people. Our choice of frigid cooling emits flagrant quantities of greenhouse gas emissions, placing untold stress on our planet and civilization. Our pursuit of comfort ironically begets us more insecurity and ultimately, less comfort.

It’s a provocative book, and TechCrunch hosted Wilson for a discussion earlier this week on a Twitter Space. If you missed it, here are some selected highlights of our conversation.

This interview has been condensed and edited.

Danny Crichton: The framing story throughout the book is about your travels with your friend Sam, who works to collect Freon and destroy it. Why did you choose that narrative arc?

Eric Dean Wilson: Sam at the time was working for this green energy company, and they were trying to find a way to take on green projects that would turn a profit. They had found that they could do this by finding used Freon, specifically what’s called CFC-12. It’s not made anymore, thank goodness, but it was responsible in part for partially destroying the ozone layer, and production of it was banned by the 90s.

But use of it, and buying and selling it on the secondary market, is totally legal. This is sort of a loophole in the legality of this refrigerant, because the United States government and the people who signed the Montreal Protocol thought that when they stopped production of it that it would pretty much get rid of Freon by the year 2000. Well, that didn’t happen, which is kind of a mystery.

So Sam was driving around the United States, finding Freon on the internet, and meeting people (often people who are auto hobbyists or mechanics or something like that) who happened to have stockpiled Freon, and he was buying it from them in order to destroy it for carbon credits on California’s cap-and-trade system. And the interesting thing about this is that he was going to basically the 48 contiguous states, and meeting people that were often global warming deniers who were often hostile to the idea of the refrigerant being destroyed at all, so he often didn’t tell them upfront that he was destroying it.

What was really interesting to me is that, aside from a cast of colorful and strange characters, and sometimes violent characters actually as well, was the fact that sometimes after establishing a business relationship first, he was able to have really frank conversations about global warming with people who were otherwise not very open to it.

In a time in which we’re told that Americans are more divided than ever politically, that we’re not speaking to each other across ideological divides, I thought this was a curious story.

Crichton: And when it comes to greenhouse gases, Freon is among the worst, right?

Wilson: I should be really clear that the main global warming gases are carbon dioxide and methane and some other ones as well. But molecule for molecule, CFCs (chlorofluorocarbons) are thousands of times greater at absorbing and retaining heat, meaning that they’re just thousands of times worse for global warming, molecule for molecule. So even though there’s not that many of them in terms of parts per million in the atmosphere, there’s enough to really make a sizable contribution to global warming.

The irony is that the replacements of CFCs — HFCs (hydrofluorocarbons) — for the most part, don’t really do anything to destroy the ozone layer, which is great. But they’re also super global warming gases. So the ozone crisis was solved by replacing CFCs with refrigerant that exacerbated the global warming crisis.

Crichton: Now to get to the heart of the book, you focus on the rise of air conditioning, but you start by giving readers a wide view of what life was like before its invention. Why did you do that?

Wilson: This was a surprise — I did not go into the book thinking that I was going to find this. Before air conditioning really took off in the home, there was a really different sense of what we would call personal comfort, and something that I really argue in the book is that what we’ve come to think of as personal comfort, and specifically, thermal comfort, has changed. What I argue in the book is that it’s really in part a cultural construction.

Now, I want to be really careful that people don’t hear that I’m saying that it’s entirely a construction. Yes, when we get too hot or too cold, then we can die, for sure. But what’s really interesting to me is that there’s a lot of evidence to show that before air conditioning began at the beginning of the twentieth century, people weren’t really hungry for air conditioning.

There was this greater sense that you could deal with the heat. I put that really carefully, because I don’t want to say that they suffered through it. Certainly there were heat waves and summers that got too hot. But there was a real sense that you could manage the heat through analog ways, like sleeping outside, sleeping in parks, or designing buildings that incorporate passive cooling. The thing that really disturbed me was that through the twentieth century, we really kind of forgot all that, because we didn’t need that knowledge anymore because we had air conditioning. So modernist architecture began to kind of ignore the outside conditions, because you could construct whatever conditions you wanted inside.

I think the question that nobody really asked all along is, is this good for everyone? Should we have a homogenized standard of comfort? Nobody really asked that question. And there’s a lot of people that find that the kind of American model of an office or American model of comfort is not comfortable, both in the United States, and in other places.

Crichton: Even beyond a homogenized standard though, you want readers to understand how comfort connects all of us together.

Wilson: I think that one of the pernicious things about the American definition of comfort is that it has been defined as personal comfort. And the reason why I keep using that is because it’s defined as individual comfort. And so what would it mean to think about comfort as being always connected to somebody else, as more ethical that way? Because it’s true.

The truth is that our comfort is related to other people, and vice versa. It’s really asking us to think interdependently, instead of independently, which is how we’re often encouraged to think, and that’s a huge, huge ask. Actually, that’s a huge task and a huge paradigm shift. But I really think if we’re really trying to think ecologically, and not just sustainably, we have to think about how we’re all connected and how these infrastructures, how they influence other people in other parts of the world.

Crichton: Air conditioning didn’t take off right away. In fact, its inventors and customers really had to push hard to get people to want to use it.

Wilson: Air conditioning really got its start in the early twentieth century, in order to control the conditions in factories. I was surprised to find out that air conditioning was used in places to make things hotter, or more humid and slightly hotter in a place like a textile factory, where if it’s not humid enough, cotton threads can break.

Outside the factory, movie theaters were really the first time that thermal comfort was used as a commodity. There were all kinds of other commodifications of comfort, but this was really the first time that the public could go someplace to feel cooler. And the funny thing is is that most movie theaters in the 20s and 30s were freezing cold, they were not what I would call comfortable, because the people who were running them didn’t really understand that air conditioning works best when it’s noticed least, which is a hard sell. In the 20s, though, it was a novelty, and the way that you caught people’s attention on a summer day was to crank the AC up, which felt good for like five minutes, and then it was terribly uncomfortable and you had to shiver through an hour and a half of the rest of the movie.

Crichton: I’m jumping ahead, but what does the future look like as global warming persists and our cooling increases in line with that heat?

Wilson: In so many cooling situations, there are major alternatives, like redesigning our buildings so that they require way less energy and way less cooling. There are really amazing architects who are looking to things like termite mounds, because the colonies that they build sort of have brilliantly engineered rooms with different temperatures.

That said, I was surprised how much our opinion on comfort could change by simply understanding that it could change. I think that we have to make the world of tomorrow desirable, and we can take a nod from the commercial advertising industry. We have to sell this future as one that we actually want, not as something that we’re giving up. And I think the narrative is always like, “Oh, we have to stop doing this, we have to lower this, we have to give this up.” And that’s certainly true. But I think if we understand that as not something that we’re giving up, but actually something that we’re gaining, then it makes it a lot easier. For people, it makes it feel a lot more possible.

After Cooling: On Freon, Global Warming, and the Terrible Cost of Comfort by Eric Dean Wilson.

Simon & Schuster, 2021, 480 pages

Powered by WPeMatico

Wildfires are burning in countries all around the world. California is dealing with some of the worst wildfires in its history (a superlative that I use essentially every year now) with the Caldor fire and others blazing in the state’s north. Meanwhile, Greece and other Mediterranean nations have been fighting fires for weeks to bring a number of massive blazes under control.

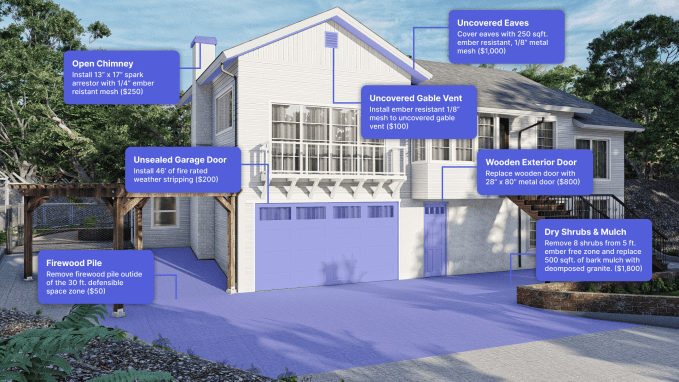

With the climate increasingly warming, millions of homes just in the United States alone are sitting in zones at high risk for wildfires. Insurance companies and governments are putting acute pressure on homeowners to invest more in defending their homes in what is typically dubbed “hardening,” or ensuring that if fires do arrive, a home has the best chance to survive and not spread the disaster further.

SF-based Firemaps has a bold vision for rapidly scaling up and solving the problem of home hardening by making a complicated and time-consuming process as simple as possible.

The company, which was founded just a few months ago (in March), sends out a crew with a drone to survey a homeowner’s house and property if it is in a high-risk fire zone. Within 20 minutes, the team will have generated a high-resolution 3D model of the property down to the centimeter. From there, hardening options are identified and bids are sent out to trade contractors to perform the work on the company’s marketplace.

Once the drone scans a house, Firemaps can create a full CAD model of the structure and the nearby property. Image Credits: Firemaps.

While early, it’s already gotten traction. In addition to hundreds of homeowners who have signed up on its website and a few dozen that have been scanned, Andrew Chen of a16z has led a $5.5 million seed round into the business (the Form D places the round sometime around April). Uber CEO Dara Khosrowshahi and Addition’s Lee Fixel also participated.

Firemaps is led by Jahan Khanna, who co-founded it along with his brother, who has a long-time background in civil engineering, and Rob Moran. Khanna was co-founder and CTO of early ridesharing startup Sidecar, where Moran joined as one of the company’s first employees. The trio spent cycles exploring how to work on climate problems, while staying focused on helping people in the here and now. “We have crossed certain thresholds [with the climate] and we need to get this problem under control,” Khanna said. “We are one part of the solution.”

Over the past few years Khanna and his brother explored opening a solar farm or a solar-powered home in California. “What was wild, whenever we talked to someone, is they said you cannot build anything in California since it will burn down,” Khanna said. “What is kind of the endgame of this?” As they explored fire hardening, they realized that millions of homeowners needed faster and cheaper options, and they needed them sooner rather than later.

While there are dozens of options to harden a home to fire, some popular options include constructing an ember-free zone within a few feet of a home, often by placing gravel made of granite on the ground, as well as ensuring that attic vents, gutters and siding are fireproof and can withstand high temperatures. These options can vary widely in cost, although some local and state governments have created reimbursement programs to allow homeowners to recoup at least some of the expenses of these improvements.

A Firemaps house in 3D model form with typical hardening options and associated prices. Image Credits: Firemaps.

The company’s business model is simple: vetted contractors pay Firemaps to be listed as an option on its platform. Khanna believes that because its drone offers a comprehensive model of a home, contractors will be able to bid for contracts without doing their own site visits. “These contractors are getting these shovel-ready projects, and their acquisition costs are basically zero,” Khanna said.

Long-term, “our operating hypothesis is that building a platform and building these models of homes is inherently valuable,” Khanna said. Right now, the company is launched in California, and the goal for the next year is to “get this model repeatable and scalable and that means doing hundreds of homes per week,” he said.

Powered by WPeMatico

Creating single-family homes for the homeless using 3D printing robotics. Developing construction systems to create infrastructure and habitats on the moon, and eventually Mars, with NASA. Delivering what is believed to be the largest 3D-printed structure in North America — a barracks for Texas Military Department.

These are just some of the things that Austin, Texas-based construction tech startup ICON has been working on.

And today, the company is adding a massive $207 million Series B raise to its list of accomplishments.

I’ve been covering ICON since its $9 million seed round in October of 2018, so seeing the company reach this milestone less than three years later is kind of cool.

Norwest Venture Partners led the startup’s Series B round, which also included participation from 8VC, Bjarke Ingels Group (BIG), BOND, Citi Crosstimbers, Ensemble, Fifth Wall, LENx, Moderne Ventures and Oakhouse Partners. The financing brings ICON’s total equity raised to $266 million. The company declined to reveal its valuation.

ICON was founded in late 2017 and launched during SXSW in March 2018 with the first permitted 3D-printed home in the U.S. That 350-square-foot house took about 48 hours (at 25% speed) to print. ICON purposely chose concrete as a material because, as co-founder and CEO Jason Ballard put it, “It’s one of the most resilient materials on Earth.”

Since then, the startup says it has delivered more than two dozen 3D-printed homes and structures across the U.S. and Mexico. More than half of those homes have been for the homeless or those in chronic poverty. For example, in 2020, ICON delivered 3D-printed homes in Mexico with nonprofit partner New Story. It also completed a series of homes serving the chronically homeless in Austin, Texas, with nonprofit Mobile Loaves & Fishes.

The startup broke into the mainstream housing market in early 2021 with what it said were the first 3D-printed homes for sale in the U.S. for developer 3Strands in Austin, Texas. Two of the four homes are under contract. The remaining two homes will hit the market on August 31.

And recently, ICON revealed its “next generation” Vulcan construction system and debuted its new Exploration Series of homes. The first home in the series, “House Zero,” was optimized and designed specifically for 3D printing.

For some context, ICON says its proprietary Vulcan technology produces “resilient, energy-efficient” homes faster than conventional construction methods and with less waste and more design freedom. The company’s new Vulcan construction system, according to Ballard, can 3D print homes and structures up to 3,000 square feet, is 1.5x larger and 2x faster than its previous Vulcan 3D printers.

From the company’s early days, Ballard has maintained ICON is motivated by the global housing crisis and lack of solutions to address it. Using 3D printers, robotics and advanced materials, he believes, is one way to tackle the lack of affordable housing, a problem that is only getting worse across the country and in Austin.

ICON’s list of future plans include the delivery of social, disaster relief and more mainstream housing, Ballard said, in addition to developing construction systems to create infrastructure and habitats on the moon, and eventually Mars, with NASA.

ICON also has two ongoing projects with NASA. Recently, Mars Dune Alpha was just announced by NASA, ICON and BIG – and ICON so far has finished printing the wall system and is onto the roof now. Also, NASA is recruiting for crewed missions to begin nextfFall to live in the first simulated Martian habitat 3D printed by ICON.

When asked, Ballard said the most significant thing that has happened since the company’s $35 million Series A last August has been the “the radical increase in demand for 3D-printed homes and structures.”

“That single metric represents a lot for us,” Ballard told TechCrunch. “People have to want these houses.”

To tackle the housing shortage, the world needs to increase supply, decrease cost, increase speed, increase resiliency, increase sustainability… all without compromising quality and beauty, he added.

“Perhaps there are a few approaches that can do some of those things, but only construction scale 3D printing holds the potential to do all of those things,” he said.

ICON has seen impressive financial growth, with 400% revenue growth nearly every year since inception, according to Ballard. It’s also tripled its team in the past, year and now has more than 100 employees. It expects to double in size within the next year.

Image Credits: Co-founders with next-gen Vulcan Construction System / ICON

The series B funds will go toward more construction of 3D-printed homes, “rapid scaling and R&D,” further space-based tech advancements and creating “a lasting societal impact on housing issues,” Ballard said.

“We have already stood up early-stage manufacturing and are in the process of upgrading and accelerating those efforts in order to meet demand for more 3D-printed houses even as we close the round,” Ballard said. “In the next five years, we believe we will be delivering thousands of homes per year and on our way to tens of thousands of homes per year.”

Norwest Venture Partners Managing Partner Jeff Crowe, who is joining ICON’s board as part of the financing, said his firm believes that ICON’s 3D printing construction technology will “massively impact the housing shortage in the U.S. and around the globe.”

It is “enormously difficult” to bring together the advanced robotics, materials science and software to develop a robust 3D printing construction technology in the first place, Crowe said.

“It is still harder to develop the technology in a way that can produce hundreds and thousands of beautiful, affordable, comfortable, energy efficient homes in varying geographies with reliability and predictability — not just one or two demonstration units in a controlled setting,” he wrote via e-mail. “ICON has done all that, and…has all the elements to be a breakout, generational success.”

Powered by WPeMatico

Y Combinator-backed Kapacity.io is on a mission to accelerate the decarbonization of buildings by using AI-generated efficiency savings to encourage electrification of commercial real estate — wooing buildings away from reliance on fossil fuels to power their heating and cooling needs.

It does this by providing incentives to building owners/occupiers to shift to clean energy usage through a machine learning-powered software automation layer.

The startup’s cloud software integrates with buildings’ HVAC systems and electricity meters — drawing on local energy consumption data to calculate and deploy real-time adjustments to heating/cooling systems which not only yield energy and (CO2) emissions savings but generate actual revenue for building owners/tenants — paying them to reduce consumption such as at times of peak energy demand on the grid.

“We are controlling electricity consumption in buildings, focusing on heating and cooling devices — using AI machine learning to optimize and find the best ways to consume electricity,” explains CEO and co-founder Jaakko Rauhala, a former consultant in energy technology. “The actual method is known as ‘demand response’. Basically that is a way for electricity consumers to get paid for adjusting their energy consumption, based on a utility company’s demand.

“For example if there is a lot of wind power production and suddenly the wind drops or the weather changes and the utility company is running power grids they need to balance that reduction — and the way to do that is either you can fire up natural gas turbines or you can reduce power consumption… Our product estimates how much can we reduce electricity consumption at any given minute. We are [targeting] heating and cooling devices because they consume a lot of electricity.”

“The way we see this is this is a way we can help our customers electrify their building stocks faster because it makes their investments more lucrative and in addition we can then help them use more renewable electricity because we can shift the use from fossil fuels to other areas. And in that we hope to help push for a more greener power grid,” he adds.

Kapcity’s approach is applicable in deregulated energy markets where third parties are able to play a role offering energy saving services and fluctuations in energy demand are managed by an auction process involving the trading of surplus energy — typically overseen by a transmission system operator — to ensure energy producers have the right power balance to meet customer needs.

Demand for energy can fluctuate regardless of the type of energy production feeding the grid but renewable energy sources tend to increase the volatility of energy markets as production can be less predictable versus legacy energy generation (like nuclear or burning fossil fuels) — wind power, for example, depends on when and how strongly the wind is blowing (which both varies and isn’t perfectly predictable). So as economies around the world dial up efforts to tackle climate change and hit critical carbon emissions reduction targets there’s growing pressure to shift away from fossil fuel-based power generation toward cleaner, renewable alternatives. And the real estate sector specifically remains a major generator of CO2, so is squarely in the frame for “greening”.

Simultaneously, decarbonization and the green shift looks likely to drive demand for smart solutions to help energy grids manage increasing complexity and volatility in the energy supply mix.

“Basically more wind power — and solar, to some extent — correlates with demand for balancing power grids and this is why there is a lot of talk usually about electricity storage when it comes to renewables,” says Rauhala. “Demand response, in the way that we do it, is an alternative for electricity storage units. Basically we’re saying that we already have a lot of electricity consuming devices — and we will have more and more with electrification. We need to adjust their consumption before we invest billions of dollars into other systems.”

“We will need a lot of electricity storage units — but we try to push the overall system efficiency to the maximum by utilising what we already have in the grid,” he adds.

There are of course limits to how much “adjustment” (read: switching off) can be done to a heating or cooling system by even the cleverest AI without building occupants becoming uncomfortable.

But Kapacity’s premise is that small adjustments — say turning off the boilers/coolers for five, 15 or 30 minutes — can go essentially unnoticed by building occupants if done right, allowing the startup to tout a range of efficiency services for its customers; such as a peak-shaving offering, which automatically reduces energy usage to avoid peaks in consumption and generate significant energy cost savings.

“Our goal — which is a very ambitious goal — is that the customers and occupants in the buildings wouldn’t notice the adjustments. And that they would fall into the normal range of temperature fluctuations in a building,” says Rauhala.

Kapacity’s algorithms are designed to understand how to make dynamic adjustments to buildings’ heating/cooling without compromising “thermal comfort”, as Rauhala puts it — noting that co-founder (and COO) Sonja Salo, has both a PhD in demand response and researched thermal comfort during a stint as a visiting researcher at UC Berkley — making the area a specialist focus for the engineer-led founding team.

At the same time, the carrots it’s dangling at the commercial real estate to sign up for a little algorithmic HVAC tweaking look substantial: Kapacity says its system has been able to achieve a 25% reduction in electricity costs and a 10% reduction in CO2-emissions in early pilots. Although early tests have been limited to its home market for now.

Its other co-founder, Rami El Geneidy, researched smart algorithms for demand response involving heat pumps for his PhD dissertation — and heat pumps are another key focus for the team’s tech, per Rauhala.

Heat pumps are a low-carbon technology that’s fairly commonly used in the Nordics for heating buildings, but whose use is starting to spread as countries around the world look for greener alternatives to heat buildings.

In the U.K., for example, the government announced a plan last year to install hundreds of thousands of heat pumps per year by 2028 as it seeks to move the country away from widespread use of gas boilers to heat homes. And Rauhala names the U.K. as one of the startup’s early target markets — along with the European Union and the U.S., where they also envisage plenty of demand for their services.

While the initial focus is the commercial real estate sector, he says they are also interested in residential buildings — noting that from a “tech core point of view we can do any type of building”.

“We have been focusing on larger buildings — multifamily buildings, larger office buildings, certain types of industrial or commercial buildings so we don’t do single-family detached homes at the moment,” he goes on, adding: “We have been looking at that and it’s an interesting avenue but our current pilots are in larger buildings.”

The Finnish startup was only founded last year — taking in a pre-seed round of funding from Nordic Makers prior to getting backing from YC — where it will be presenting at the accelerator’s demo day next week. (But Rauhala won’t comment on any additional fund raising plans at this stage.)

He says it’s spun up five pilot projects over the last seven months involving commercial landlords, utilities, real estate developers and engineering companies (all in Finland for now), although — again — full customer details are not yet being disclosed. But Rauhala tells us they expect to move to their first full commercial deals with pilot customers this year.

“The reason why our customers are interested in using our products is that this is a way to make electrification cheaper because they are being paid for adjusting their consumption and that makes their operating cost lower and it makes investments more lucrative if — for example — you need to switch from natural gas boilers to heat pumps so that you can decarbonize your building,” he also tells us. “If you connect the new heat pump running on electricity — if you connect that to our service we can reduce the operating cost and that will make it more lucrative for everybody to electrify their buildings and run their systems.

“We can also then make their electricity consumed more sustainable because we are shifting consumption away from hours with most CO2 emissions on the grid. So we try to avoid the hours when there’s a lot of fossil fuel-based production in the grid and try to divert that into times when we have more renewable electricity.

“So basically the big question we are asking is how do we increase the use of renewables and the way to achieve that is asking when should we consume? Well we should consume electricity when we have more renewable in the grid. And that is the emission reduction method that we are applying here.”

In terms of limitations, Kapacity’s software-focused approach can’t work in every type of building — requiring that real estate customers have some ability to gather energy consumption (and potentially temperature) data from their buildings remotely, such as via IoT devices.

“The typical data that we need is basic information on the heating system — is it running at 100% or 50% or what’s the situation? That gets us pretty far,” says Rauhala. “Then we would like to know indoor temperatures. But that is not mandatory in the sense that we can still do some basic adjustments without that.”

It also of course can’t offer much in the way of savings to buildings that are running 100% on natural gas (or oil) — i.e. with electricity only used for lighting (turning lights off when people are inside buildings obviously wouldn’t fly); there must be some kind of air conditioning, cooling or heat pump systems already installed (or the use of electric hot water boilers).

“An old building that runs on oil or natural gas — that’s a target for decarbonization,” he continues. “That’s a target where you could consider installing heat pumps and that is where we could help some of our customers or potential customers to say OK we need to estimate how much would it cost to install a heat pump system here and that’s where our product can come in and we can say you can reduce the operating cost with demand response. So maybe we should do something together here.”

Rauhala also confirms that Kapacity’s approach does not require invasive levels of building occupant surveillance, telling TechCrunch: “We don’t collect information that is under GDPR [General Data Protection Regulation], I’ll put it that way. We don’t take personal data for this demand response.”

So any guestimates its algorithms are making about building occupants’ tolerance for temperature changes are, therefore, not going to be based on specific individuals — but may, presumably, factor in aggregated information related to specific industry/commercial profiles.

The Helsinki-based startup is not the only one looking at applying AI to drive energy cost and emissions savings in the commercial buildings sector — another we spoke to recently is Düsseldorf-based Dabbel, for example. And plenty more are likely to take an interest in the space as governments start to pump more money into accelerating decarbonization.

Asked about competitive differentiation, Rauhala points to a focus on real-time adjustments and heat pump technologies.

“One of our key things is we’re developing a system so that we can do close to real-time control — very, very short-term control. That is a valuable service to the power grid so we can then quickly adjust,” he says. “And the other one is we are focusing on heat pump technologies to get started — heat pumps here in the Nordics are a very common and extremely good way to decarbonize and understanding how we can combine these to demand response with new heat pumps that is where we see a lot of advantages to our approach.”

“Heat pumps are a bit more technically complex than your basic natural gas boiler so there are certain things that have to be taken it account and that is where we have been focusing our efforts,” he goes on, adding: “We see heat pumps as an excellent way to decarbonize the global building stock and we want to be there and help make that happen.”

Per capita, the Nordics has the most heat pump installations, according to Rauhala — including a lot of ground source heat pump installations which can replace fossil fuel consumption entirely.

“You can run your building with a ground source heat pump system entirely — you don’t need any supporting systems for it. And that is the area where we here in Europe are more far ahead than in the U.S.,” he says on that.

“The U.K. government is pushing for a lot of heat pump installations and there are incentives in place for people to replace their existing natural gas systems or whatever they have. So that is very interesting from our point of view. The U.K. also has a lot of wind power coming online and there have been days when the U.K. has been running 100% with renewable electricity which is great. So that actually is a really good thing for us. But then in the longer term in the U.S. — Seattle, for example, has banned the use of fossil fuels in new buildings so I’m very confident that the market in the U.S. will open up more and quickly. There’s a lot of opportunities in that space as well.

“And of course from a cooling perspective air conditioning in general in the U.S. is very widespread — especially in commercial buildings so that is already an existing opportunity for us.”

“My estimate on how valuable electricity use for heating and cooling is it’s tens of billions of dollars annually in the U.S. and EU,” he adds. “There’s a lot of electricity being used already for this and we expect the market to grow significantly.”

On the business model front, the startup’s cloud software looks set to follow a SaaS model but the plan is also to take a commission of the savings and/or generated income from customers. “We also have the option to provide the service with a fixed fee, which might be easier for some customers, but we expect the majority to be under a commission,” adds Rauhala.

Looking ahead, were the sought-for global shift away from fossil fuels to be wildly successful — and all commercial buildings’ gas/oil boilers got replaced with 100% renewable power systems in short order — there would still be a role for Kapacity’s control software to play, generating energy cost savings for its customers, even though our (current) parallel pressing need to shrink carbon emissions would evaporate in this theoretical future.

“We’d be very happy,” says Rauhala. “The way we see emission reductions with demand response now is it’s based on the fact that we do still have fossil fuels power system — so if we were to have a 100% renewable power system then the electricity does nothing to reduce emissions from the electricity consumption because it’s all renewable. So, ironically, in the future we see this as a way to push for a renewable energy system and makes that transition happen even faster. But if we have a 100% renewable system then there’s nothing [in terms of CO2 emissions] we can reduce but that is a great goal to achieve.”

Powered by WPeMatico

Less than three months after announcing a $300 million Series E, Brazilian proptech QuintoAndar has raised an additional $120 million.

New investors Greenoaks Capital and China’s Tencent co-led the round, which included participation from some existing backers as well. São Paulo-based QuintoAndar is now valued at $5.1 billion, up from $4 billion at the time of its last raise in late May. With the extension, the startup has now raised more than $700 million since its 2013 inception. Ribbit Capital led the first tranche of its Series E.

QuintoAndar describes itself as an “end-to-end solution for long-term rentals” that, among other things, connects potential tenants to landlords and vice versa. Last year, it also expanded into connecting home buyers to sellers. Its long-term plan is to evolve into a one-stop real estate shop that also offers mortgage, title insurance and escrow services.

To that end, earlier this month, the startup acquired Atta Franchising, a 7-year-old São Paulo-based independent real estate mortgage broker. Specifically, acquiring Atta is designed to speed up its ability to offer mortgage services to its users. QuintoAndar also plans to explore the possibility of offering a product to perform standalone transactions outside of its marketplace in partnership with other brokers, according to CEO and co-founder Gabriel Braga.

This year, QuintoAndar expanded operations into 14 new cities in Brazil. Eventually, QuintoAndar plans to enter the Mexican market as its first expansion outside of its home country, but it has not yet set a date for that step. Today, the company has more than 120,000 rentals under management and about 10,000 new rentals per month. Its rental platform is live in 40 cities across Brazil, while its home-buying marketplace is live in four (São Paulo, Rio de Janeiro, Belo Horizonte and Porto Alegre) and seeing more than 10,000 sales in annualized terms.

QuintoAndar, he said, is open to acquiring more companies that it believes can either help it accelerate in a particular way or add something it had not yet thought about.

“We’re receptive to the idea but our core strategy is to focus on organic growth and our own innovation and accelerate that,” Braga said.

The Series E was oversubscribed with investors who got in and “some who could not join,” according to Braga.

Greenoaks and Tencent, he said, couldn’t participate because of “timing issues.”

“We kept talking and they came back to us after the round, and wanted to be involved so we found a way to have them on board,” Braga said. “We did not need the money. But we have been constantly overachieving on the forecast that we shared with our investors. And that’s part of the reason why we had this extension.”

Greenoaks’ long-term time horizon was appealing because the firm’s investment was designed to be “perpetual capital with no predefined time frame,” Braga said.

“We’re doing our best to build an enduring company that will be around for many, many years, so it’s good to have investors who share that vision and are technically aligned,” he added.

Greenoaks partner Neil Shah said his firm believes that what QuintoAndar is building will “fundamentally reshape real estate transactions, enhancing transparency, expanding options for Brazilians seeking housing, dramatically simplifying the experience for landlords and driving increased investment into real estate across the country.” He also believes there is big potential for the company to take its offering to other parts of Latin America.

“We look forward to being partners for decades to come,” he added.

Tencent’s experience in China is something QuintoAndar also finds valuable.

“We believe we can learn a lot from them and other Chinese companies doing interesting stuff there,” Braga said.

QuintoAndar isn’t the only Brazilian proptech firm raising big money: In March, São Paulo digital real estate platform Loft announced it had closed on $425 million in Series D funding led by New York-based D1 Capital Partners. Then, about one month later, it revealed a $100 million extension that valued the company at $2.9 billion.

Powered by WPeMatico

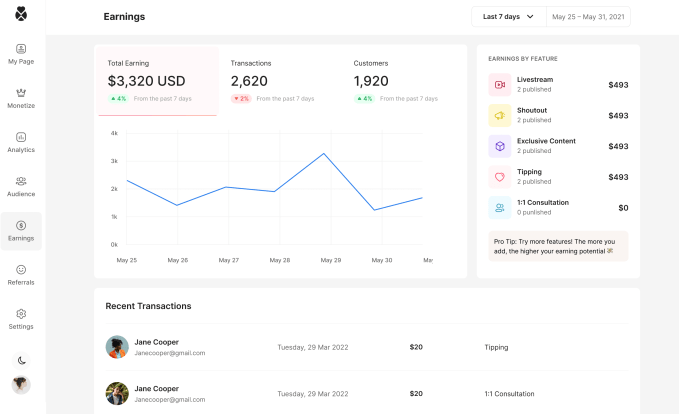

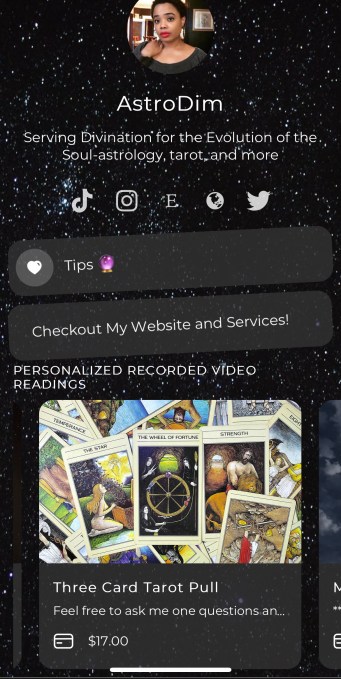

The link-in-bio business is heating up as more mobile website builders compete for a coveted slice of real estate on a creator’s TikTok, Instagram or Twitter. Linktree leads the space, securing a recent $45 million Series B raise to build out e-commerce features, but Beacons boasts competitive creator monetization tools with just a $6 million seed round in May. Now, Snipfeed enters the ring with its own $5.5 million seed round, including investments from CRV, Abstract Ventures, Crossbeam (Ali Hamed), id8, Michael Ovitz (founder of CAA), Michael Bosstick, Diaspora Ventures and others.

Linktree has been around since 2016 and has more funding than its up-and-coming competitors. But for creators seeking to monetize their following, these newer platforms may be more attractive to some creators, since they already have built-in tools to help them monetize their followings. Linktree currently supports tipping on the platform for users subscribed to its $6 Linktree Pro platform, but Snipfeed offers a wider range of monetization options; some creators are making more than $20,000 per month on the platform, according to CEO and co-founder Rédouane Ramdani.

Snipfeed started as a content discovery platform with 44,000 weekly active users — but when Snipfeed added a creator monetization tool to its platform, it became its most popular feature. So, in February 2020, with little to no funding left, the company completely pivoted to its current link-in-bio business. Since then, Snipfeed has amassed 50,000 registered users, with the user base growing 500% in the last six months (Linktree, for comparison, has more than 12 million users).

Based in Paris and Los Angeles, Snipfeed’s 15-person staff is particularly interested in the “long tail” of creators, which it says encompasses more than 46 million people.

“Content creator doesn’t necessarily mean you’re going to be the next Addison Rae or a TikTok star,” explained Ramdani. “It means that you might be a doctor or lawyer, and on top of that, you’re going to have a TikTok where you explain how to file your taxes and that kind of stuff. They have this expertise, and they’re wondering, ‘How can I turn that into a side-hustle?’ ”

Image Credits: Snipfeed

In addition to a standard tipping tool, Snipfeed allows users to sell digital goods, like on-demand video, e-books, access to livestreams and one-on-one consultations. But Snipfeed’s biggest differentiator is its Cameo-like system for selling personalized content. For example, TikToker maylikethemonthh uses Snipfeed to sell asynchronous, video-recorded tarot readings. While asking a single, personalized astrology question costs $5, a more in-depth reading can cost up to $20 or $40.

Snipfeed is free to set up, but if you make sales, the company takes 15% — this percentage is inclusive of any transaction fees. Through Snipfeed’s referral program, creators can make 5% of sales from anyone they onboard to the platform (this comes out of Snipfeed’s commission).

“We decided to go with this model because we really want to have a relationship where we help the creators really make money. We only make money if they make money,” Ramdani said.

If a creator or celebrity were to sell personalized videos on Cameo, they’d lose 25% to the platform. Meanwhile, Beacons takes 9% of sales from its free version, and 5% from its $10 per month version, which offers more customization, integrations and analytics.

Image Credits: Snipfeed

Still, depending on the type of creator, the features that each link-in-bio startup offers might matter more than the cost. Beacons allows users to share a shopping-enabled TikTok feed, which could be a huge money-maker for creators that often share product recommendations with affiliate links, which give them a commission from sales. Ramdani said that astrologers have been particularly successful on Snipfeed, since fans can book a variety of asynchronous services at a wide range of prices. But these features could benefit any creator who can profit from answering followers’ specific questions — a chef could offer recipe ideas based on what’s in a fan’s fridge, or a life coach could make a personalized video if a follower requests advice.

With its $5.5 million in seed funding, Snipfeed plans to build out its e-commerce tools so that creators can sell physical products on their link-in-bio (Beacons and Linktree are also working on this with their recent funding rounds — but Beacons’ and Snipfeed’s seed rounds are small compared to Linktree’s Series B). The company also wants to develop educational content to show its users how to best monetize their platform — if Snipfeed can help its creators make money, then it’ll make more money too.

Powered by WPeMatico

We’ve all been there. (Or at least I have.)

You’re getting ready to vacate a property you’ve rented, only to be told by the landlord that you won’t be getting your security deposit back.

This happened to me the first time I ever rented a place in the late 90s. I was shocked, but more than anything, I was angry at the injustice because I knew that what the landlord claimed was not true. It was her word against mine and my roommate’s. Still, we took her to small claims court, not so much over the $800 she was trying to keep but more to prove her wrong. In the end, we won.

But it was a lot of work, and a lot of time spent. If only there was some kind of technology available to have helped us make our case.

Well, today there is. RentCheck, a startup that is out to help solve the “he said, she said” challenge in these situations with an automated property inspection platform, has recently raised $2.6 million in seed money.

Lydia Winkler and Marco Nelson started the company in mid-2019 after Winkler experienced a similar situation to mine and ended up suing her landlord in small claims court. She was working on getting her JD/MBA at Tulane University at the time.

“It was an injustice for me not to pursue it,” she told TechCrunch. “I took meticulous photos of the move-out condition of my apartment. The process took 18 months. But not everyone has the time or knowledge to fight in court.”

She then met Nelson, who had bought several properties that he ended up renting out. He had issues with security deposits too, but the opposite ones. He had to settle disputes over deposits, and found himself documenting properties’ condition at the time of move-out.

“I met Lydia and we realized we were passionate about the same problem,” Nelson recalled.

And so New Orleans-based RentCheck was born.

Image Credits: RentCheck; Co-founders Marco Nelson and Lydia Winkler

There are an estimated 48 million rental units in the U.S., with an average deposit of $1,000.

“A good chunk of that is being fought after on aggregate,” Winkler said. “And so many need that money to put down a deposit on another unit.”

To address the problem, RentCheck built a web app for property managers that they believe also benefits tenants. The company’s digital platform works by providing a way for property managers to facilitate and conduct remote, guided property inspections. For obvious reasons, the company saw increased demand upon the onset of the COVID-19 pandemic, considering that the platform was automated and contactless. It saw 1,000% — mostly organic — growth in terms of the number of properties on the platform.

“What we do is, using a guided inspection process, prompt users and guide them room by room, telling them exactly what to take photos of so that floors, ceilings, windows and walls are all accounted for,” Winkler said.

Everything is done within the app so that users can’t upload photos that were previously on their camera roll “to ensure the integrity of the inspection” and that everything is time stamped. Once the inspection is complete, whoever does it signs off on it that they completed it accurately and honestly. Then the property manager can also sign off on it so both parties can agree on the move-out condition.

The company operates as a SaaS business, and charges property management companies a subscription fee based on the number of properties that they have on the RentCheck platform. They can then conduct “as many inspections as they want,” Nelson says, “whether the residents are doing them, their internal teams are doing them, or a third-party vendor, or a hybrid of the three.”

Image Credits: RentCheck/Bryce Ell Photography

The startup has attracted some large-name investors since its inception, first catching the attention of James “Jim” Coulter, the founder of TPG Capital, when the company won New Orleans Entrepreneurship Week. Coulter subsequently became one of the company’s first investors in its $1 million pre-seed round.

The company’s seed round included participation from Cox Enterprises, for its operations in the multifamily housing space, and angels such as Jim Payne, who previously sold MoPub to Twitter, and MAX to AppLovin; Ken Goldman, the former CFO of Yahoo, and who currently runs Hillspire, Eric and Wendy Schmidt’s family office; Mark Zaleski and John Kuolt of BCG Digital Ventures, and Brian Long, the founder of Attentive, who previously sold TapCommerce to Twitter. It also included institutional investors such as Irongrey, Context Ventures and Techstars.

“What we love about RentCheck is that it’s using very clever technology to automate and solve arguably the industry’s biggest problem in terms of money and time for both property managers and tenants,” said Kuolt, former managing director at BCG Digital Ventures and an early RentCheck investor. “The deposit deduction issue needs a technology-based solution, and almost everyone, at some time, has felt like they’ve been screwed over on their deposit by a landlord. When you see and use RentCheck’s solution, it makes you think: ‘Why didn’t I think of this?’ ”

Powered by WPeMatico

One year after raising $16 million, construction technology company Buildots is back to claim another $30 million, this time in Series B funding.

Lightspeed Venture Partners led the round, with participation from previous investors TLV Partners, Future Energy Ventures, Tidhar Construction Group and Maor Investments. This gives the company $46 million in total funding, Roy Danon, co-founder and CEO of Buildots, told TechCrunch.

The three-year-old company, with headquarters in Tel Aviv and London, is leveraging artificial intelligence computer vision technology to address construction inefficiencies. Danon said though construction accounts for 13% of the world’s GDP and employs hundreds of millions of people, construction productivity continues to lag, only growing 1% in the past two decades.

Danon spent six months on construction sites talking to workers to understand what was happening and learned that control was one of the areas where efficiency was breaking down. While construction processes would seem similar to manufacturing processes, building to the design or specs didn’t happen often due to different rules and reliance on numerous entities to get their jobs done first, he said.

Buildots’ technology is addressing this gap using AI algorithms to automatically validate images captured by hardhat-mounted 360-degree cameras, detecting immediately any gaps between the original design, scheduling and what is actually happening on the construction site. Project managers can then make better decisions to speed up construction.

“It even finds events where contractors are installing out of place and streamline payments so that information is transparent and clear,” Danon said. “Buildots also creates a collaborative environment and trust by having a single source telling everyone what is going on. There is no more blaming or cutting corners because the system validates that and also makes construction a healthier industry to work in.”

Buildots went after new funding once it was able to show product market fit and was expanding into other countries. The platform is being utilized on major building projects in countries like the U.S., U.K., Germany, Switzerland, Scandinavia and China. To meet demand, Buildots will use the new funding to continue that expansion; double the size of its global team with a focus on sales, marketing and R&D; and grow on the business side. Danon’s aim is “to get to the point where we are the standard for every construction site.” The company is also looking at areas outside construction where its technology would be applicable.

Tal Morgenstern, partner at Lightspeed Venture Partners, said he keeps an eye on graduates of the Israel Defense Forces, where the three Buildots founders came from. However, in the case of this company, Lightspeed actually passed on both the seed and Series A.

Morgenstern admits the decision was a mistake, but at the time, he thought the technology Buildots was trying to build “first, impossible and second, I knew construction was difficult to sell into.” He felt that Buildots, with such a premium product, would have a challenge selling to a low-margin industry that was late to adopt technology in general.

By the time the Series B came round, he said Buildots had solved both of those issues, proving that it works, but also that customers were adopting the technology without much sales and marketing. In addition, other solutions in construction tech were still relying on lasers or people to manually input or tap photos.

“Buildots is seamlessly capturing images and providing a level of insights that is so high, and that is why the company is able to command the price structure they have and are receiving interesting commercial results,” Morgenstern said.

Walking around today’s construction site, Danon said the adoption of technology is enabling Buildots to move quickly to build processes for the industry.

As such, the company saw more than 50% growth quarter over quarter over the past year in three of the countries in which it operates. It is now working with four of the top 10 construction companies in Europe and around the world.

“We did a good job selling remotely, but now we need local offices,” Danon added. “We are also sitting on piles of data from construction sites. We learn from one project to another and want to look for the challenges where data will help make a financial impact. It’s a natural next step for the company.”

Powered by WPeMatico

Commercial real estate has been slow to embrace technology; though it has an addressable financing market of more than $40 billion, putting together a deal is still mostly manual, paper-heavy and complicated.

New York-based Lev is taking on this problem by automating workflows online and gathering hundreds of millions of data points into machine learning software to ensure financing accuracy. To do this, the commercial real estate financing transaction platform raised $30 million to give it a $130 million valuation just two years into its inception.

The latest financing comes four months after the company raised $10 million in seed funding led by NFX. Greenspring led the latest round, with participation from First American Title. Existing investors NFX, Canaan Partners, JLL Spark, Animo Ventures and Ludlow Ventures also joined in to give Lev total investments of more than $34 million, according to Crunchbase data.

Lev founder and CEO Yaakov Zar previously co-founded Boston-based Dispatch, which built tools for home services businesses. It was when he and his wife went through the homebuying process — and their mortgage fell through — that Zar decided to look at real estate financing.

He channeled his frustration into becoming a licensed mortgage loan originator. After relocating to New York, Zar was helping a friend at a nonprofit organization refinance their building and got a firsthand look at what he said was a fragmented commercial real estate mortgage industry.

Companies like Blend are addressing the problem of real estate lending, Zar told TechCrunch, but very few are focusing on commercial real estate, where lending is sensitive to interest rates and total amortization. In addition, property owners have a burden of refinancing every five to 10 years.

“Legacy businesses like JLL, which is an investor, Cushman Wakefield and CBRE work on lending, but they are much more ‘relationship focused’ than tech focused,” Zar said. “We think that it is a necessary part because the deals are so large and complex that you need a relationship for them, but transactions less than $1 billion are pretty straightforward. On experience and product, no one is close to us.”

Initially, Zar and his team wanted to build the “Rocket Mortgage of commercial real estate lending,” but found that to be difficult because real estate brokers are putting together their own pitch books for lenders. Instead, Lev is building a technology platform of more than 5,000 lenders with information on what projects they like to finance. It then analyzes a customer’s portfolio and connects them in minutes with the right lender, taking 1% of the loan amount for each transaction as payment. Lev is also working to be able to close deals online.

Zar wasn’t looking for funding when he was approached by investors, but said he was introduced to some people who liked the company’s growth and trajectory and decided to accept the funding offer.

He intends to use the new funding on product development, with the aim of giving a term sheet in seconds and closing a loan in seven days. Right now it can take a week or two to get the term sheet and 45 to 90 days to close a loan.

The company has about 40 employees currently in its New York headquarters, Miami R&D center, Los Angeles outpost and remotely. Continued investments will be made to expand the team.

Lev grew 10 times in volume in the past year, closing approximately $100 million of loans in 2020. Zar expects to close over $1 billion in 2021.

“Customers come back to us repeatedly, and there are a ton of referrals,” Zar said. “We want to be the platform on which capital market transactions are processed. You need an advantage to network and find great deals. I don’t want to mess with that, but when you find it, bring it to us, we will close it and provide the asset management with the best option to close online and manage the deal from a single platform.”

Meanwhile, Pete Flint, general partner at NFX, told TechCrunch that he got to know the Lev team over the last 18 months, checking in on the company during various stages of the global pandemic, and was impressed at how the company navigated it.

As co-founder of Trulia, he saw firsthand the problems in the real estate industry over search and discovery, but as that problem was being solved, the focus shifted to financing. NFX is also an investor in Tomo and Ribbon, which both focus on residential financing.

Wanting to see what opportunities were on the commercial real estate side, Flint heard Lev’s name come up more and more among brokers and industry insiders.

“As we got to know the Lev team, we recognized that they were the best team out there to solve this problem,” Flint said. “We are also among an amazing group of people complementing the round. The folks that are deep industry insiders will put a helpful lens on strategy and business development opportunities.”

Powered by WPeMatico