Intel Capital

Auto Added by WPeMatico

Auto Added by WPeMatico

It seems that we are in the middle of a mini acquisition spree for Kubernetes startups, specifically those that can help with Kubernetes security. In the latest development, Venafi, a vendor of certificate and key management for machine-to-machine connections, is acquiring Jetstack, a U.K. startup that helps enterprises migrate and work within Kubernetes and cloud-based ecosystems, which has also been behind the development of cert-manager, a popular, open-source native Kubernetes certificate management controller.

Financial terms of the deal, which is expected to close in June of this year, have not been disclosed, but Jetstack has been working with Venafi to integrate its services and had a strategic investment from Venafi’s Machine Identity Protection Development Fund.

Venafi is part of the so-called “Silicon Slopes” cluster of startups in Utah. It has raised about $190 million from investors that include TCV, Silver Lake and Intel Capital and was last valued at $600 million. That was in 2018, when it raised $100 million, so now it’s likely Venafi is worth more, especially considering its customers include the top five U.S. health insurers, the top five U.S. airlines, the top four credit card issuers, three out of the top four accounting and consulting firms, four of the top five U.S., U.K., Australian and South African banks and four of the top five U.S. retailers.

For the time being, the two organizations will continue to operate separately, and cert-manager — which has hundreds of contributors and millions of downloads — will continue on as before, with a public release of version 1 expected in the June-July time frame.

The deal underscores not just how Kubernetes -based containers have quickly gained momentum and critical mass in the enterprise IT landscape, in particular around digital transformation, but specifically the need to provide better security services around that at speed and at scale. The deal comes just one day after VMware announced that it was acquiring Octarine, another Kubernetes security startup, to fold into Carbon Black (an acquisition it made last year).

“Nowadays, business success depends on how quickly you can respond to the market,” said Matt Barker, CEO and co-founder of Jetstack . “This reality led us to re-think how software is built and Kubernetes has given us the ideal platform to work from. However, putting speed before security is risky. By joining Venafi, Jetstack will give our customers a chance to build fast while acting securely.”

To be clear, Venafi had been offering Kubernetes integrations prior to this — and Venafi and Jetstack have worked together for two years. But acquiring Jetstack will give it direct, in-house expertise to speed up development and deployment of better tools to meet the challenges of a rapidly expanding landscape of machines and applications, all of which require unique certificates to connect securely.

“In the race to virtualize everything, businesses need faster application innovation and better security; both are mandatory,” said Jeff Hudson, CEO of Venafi, in a statement. “Most people see these requirements as opposing forces, but we don’t. We see a massive opportunity for innovation. This acquisition brings together two leaders who are already working together to accelerate the development process while simultaneously securing applications against attack, and there’s a lot more to do. Our mutual customers are urgently asking for more help to solve this problem because they know that speed wins, as long as you don’t crash.”

The crux of the issue is the sheer volume of machines that are being used in computing environments, thanks to the growth of Kubernetes clusters, cloud instances, microservices and more, with each machine requiring a unique identity to connect, communicate and execute securely, Venafi notes, with disruptions or misfires in the system leaving holes for security breaches.

Jetstack’s approach to information security came by way of its expertise in Kubernetes, developing cert-mananger specifically so that its developer customers could easily create and maintain certificates for their networks.

“At Jetstack we help customers realize the benefits of Kubernetes and cloud native infrastructure, and we see transformative results to businesses firsthand,” said Matt Bates, CTO and co-founder of Jetstack, in a statement. “We developed cert-manager to make it easy for developers to scale Kubernetes with consistent, secure, and declared-as-code machine identity protection. The project has been a huge hit with the community and has been adopted far beyond our expectations. Our team is thrilled to join Venafi so we can accelerate our plans to bring machine identity protection to the cloud native stack, grow the community and contribute to a wider range of projects across the ecosystem.” Both Bates and Barker will report to Venafi’s Hudson and join the bigger company’s executive team.

Powered by WPeMatico

When it comes to corporate venture capital, semiconductor giant Intel has shaped up to be one of the most prolific and prescient investors in the tech world, with investments in 1,582 companies worldwide, and a tally of some 692 portfolio companies going public or otherwise exiting in the wake of Intel’s backing.

Today, the company announced its latest tranche of deals: $132 million invested in 11 startups. The deals speak to some of the company’s most strategic priorities currently and in the future, covering artificial intelligence, autonomous computing and chip design.

Many corporate VCs have been clear in drawing a separation between their activities and that of their parents, and the same has held for Intel. But at the same time, the company has made a number of key moves that point to how it uses its VC muscle to expand its strategic relationships and also ultimately expand through M&A. Just earlier this month, it acquired Moovit, an Intel Capital portfolio company, for $900 million (a deal that was knocked down to $840 million when accounting for its previous investment).

“Intel Capital identifies and invests in disruptive startups that are working to improve the way we work and live. Each of our recent investments is pushing the boundaries in areas such as AI, data analytics, autonomous systems and semiconductor innovation. Intel Capital is excited to work with these companies as we jointly navigate the current world challenges and as we together drive sustainable, long-term growth,” said Wendell Brooks, Intel senior vice president and president of Intel Capital, in a statement.

The tranche of deals come at a critical time in the worlds of startups and venture investing. Many are worried that the slowdown in the economy, precipitated by the COVID-19 pandemic, will mean a subsequent slowdown in tech finance. Intel says that it plans to invest between $300 million and $500 million in total this year, so this would go some way to refuting that idea, along with some of the other monster deals and big funds that we’ve written out in the last couple of months.

The list announced today doesn’t include specific investment numbers, but in some cases the startups have also announced the fundings themselves and given more detail on round sizes. These still, however, do not reveal Intel’s specific financial stakes.

Here’s the full list:

Powered by WPeMatico

Anodot, a startup that helps customers monitor business operations against a set of KPIs, announced a $35 million Series C investment today.

Intel Capital led this round with a lot of help. New investors SoftBank Ventures Asia, Samsung NEXT and La Maison also participated along with existing investors Disruptive Technologies L.P., Aleph Venture Capital and Redline Capital. Today’s investment brings the total raised to $62.5 million, according to the company.

Anodot lets you take any kind of data, whatever your company finds important, and it tracks it automatically and reports on changes that would have an impact on the business, according to David Drai, CEO and co-founder.

“We take any kind of normalized data into our platform and learn all the behavior of the data against normal behavior. When I say normal behavior, it means any time-based data in what is called a time series. And we understand all the trends of that data, and we do this autonomously without any configuration, except defining what is interesting for you,” Drai explained.

That means that the platform will let you know, for example, of any drop in your business, any drop in your conversions, any spike in your costs — and so forth. What you track depends on your vertical and what’s important to your business.

He compares it to applications performance monitoring, but instead of monitoring the company’s technology systems, it’s monitoring the systems that run the business. Just as you don’t want to miss signals that your servers could be going down, neither do you want to let factors that could cost your business money go unnoticed.

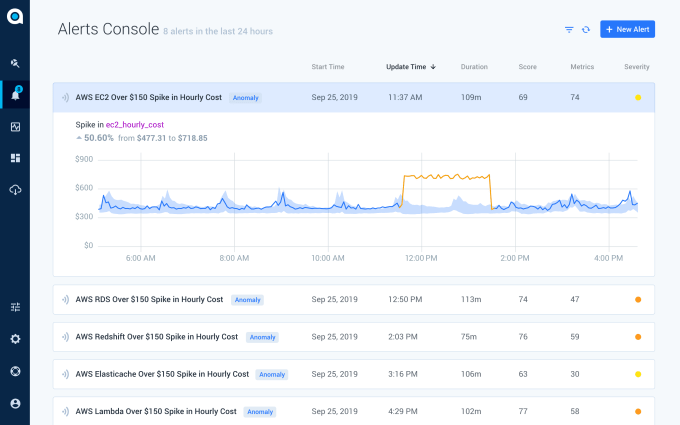

This dashboard lets you monitor unusual changes in cloud costs. Image Credit: Anodot

The way it works is you connect to the systems that matter, and Anodot can review those systems, learn what constitutes a level of normal behavior, then identify when anomalies occur. It does this by mapping against your KPIs, and this can involve thousands or even tens of thousands of KPIs based on an individual company.

As Drai points out, an eCommerce company with 1000 products in 50 countries, will have 50,000 KPIs, one for each product in each country, and you can track these in Anodot.

He says that under the current economic conditions, he is taking a two-pronged approach to building his business involving both offense and defense. On defense, he will take a cautious approach to hiring, but he sees his product helping companies understand and control costs, so he will continue to sell the product as a cost-saving device at a time when that is of increasing importance to businesses everywhere.

The company was founded in 2014. It currently has 70 employees and 100 paying customers including Atlassian, T Mobile, Lyft and Pandora.

Powered by WPeMatico

Model9, an Israeli startup launched by mainframe vets, has come up with a way to transfer data between mainframe computers and the cloud, and today the company announced a $9 million Series A.

Intel Capital led the round with help from existing investors, including StageOne, North First Ventures and Glenrock Israel. The company reports it has now raised almost $13 million.

You may not realize it, but the largest companies in the world, like big banks, insurance companies, airlines and retailers, still use mainframes. These companies require the massive transaction processing capabilities of these stalwart machines, but find it’s difficult to get the valuable data out for more modern analytics capabilities. This is the hard problem that Model9 is attempting to solve.

Gil Peleg, CEO and co-founder at Model9, says that his company’s technology is focused on helping mainframe users get their data to the cloud or other on-prem storage. “Mainframe data is locked behind proprietary storage that is inaccessible to anything that’s happening in the evolving, fast-moving technology world in the cloud. And this is where we come in with patented technology that enables mainframes to read and write data directly to the cloud or any non-mainframe distributed storage system,” Peleg explained.

This has several important use cases. For starters, it can act as a disaster recovery system, eliminating the need to maintain expensive tape backups. It also can move this data to the cloud where customers can apply modern analytics to data that was previously inaccessible.

The company’s solution works with AWS, Google Cloud Platform, Microsoft Azure and IBM’s cloud solution. It also works with other on-prem storage solutions like EMC, Nutanix, NetApp and Hitatchi. He says the idea is to give customers true hybrid cloud options, whether a private cloud or a public cloud provider.

“Ideally our customers will deploy a hybrid cloud topology and benefit from both worlds. The mainframe keeps doing what it should do as a reliable, secure, trusted [machine], and the cloud can manage the scale and the rapidly growing amount of data and provide the new modern technologies for disaster recovery, data management and analytics,” he said.

The company was founded in 2016 and took a couple of years to develop the solution. Today, the company is working with a number of large organizations using mainframes. Peleg says he wants to use the money to expand the sales and marketing operation to grow the market for this solution.

Powered by WPeMatico

Open source has become a critical building block of modern software, and today a new startup is coming out of stealth to capitalise on one of the newer frontiers in open source: using it to build and manage distributed application environments, an approach being used increasingly to handle large computing projects, such as those involving artificial intelligence or scientific or other complex calculations.

Anyscale, a startup founded by the same team that built the Project Ray open-source distributed programming framework out of UC Berkeley — Robert Nishihara, Philipp Moritz and Ion Stoica, and Berkeley professor Michael I. Jordan — has raised $20.6 million in a Series A round of funding led by Andreessen Horowitz, with participation also from NEA, Intel Capital, Ant Financial, Amplify Partners, 11.2 Capital and The House Fund.

The company plans to use the money to build out its first commercial products — details of which are still being kept under wraps but will more generally include the ability to easily scale out a computing project from one laptop to a cluster of machines; and a group of libraries and applications to manage projects. These are expected to launch next year.

“Right now we are focused on making Ray a standard for building applications,” said Stoica in an interview. “The company will build tools and a runtime platform for Ray. So, if you want to run a Ray application securely and with high performance then you will use our product.”

The funding is partly strategic: Intel is one of the big companies that has been using Ray for its own computing projects, alongside Amazon, Microsoft and Ant Financial.

“Intel IT has been leveraging Ray to scale Python workloads with minimal code modifications,” said Moty Fania, principal engineer and chief technology officer for Intel IT’s Enterprise and Platform Group, in a statement. “With the implementation into Intel’s manufacturing and testing processes, we have found that Ray helps increase the speed and scale of our hyperparameter selection techniques and auto modeling processes used for creating personalized chip tests. For us, this has resulted in reduced costs, additional capacity and improved quality.”

With an impressive user list like this for the free-to-use Ray, you might ask yourself, what is the purpose of Anyscale? As Stoica and Nishihara explained, the idea will be to create simpler and easier ways to implement Ray, to make it usable whether you’re one of the Amazons of the world, or a more modest, and possibly less tech-centric operation.

“We see that this will be valuable mostly for companies who do not have engineering experts,” Stoica said.

The problem that Anyscale is solving is a central one to the future of large-scale, involved computing projects: there are an increasing array of problems that are being tackled with computing solutions, but as the complexity of the work involved increases, there is a limit to how much work a single machine (even a big one) can handle. (Indeed, Anyscale cites IDC figures estimating that the amount of data created and copied annually will reach 175 zettabytes by 2025.)

While one day there may be quantum-computing machines that can run efficiently and at scale to address these kinds of tasks, today this isn’t a realistic option, and so distributed computing has emerged as a solution.

Ray was devised as a standard to use to implement distributed computing environments, but on its own it’s too technical for the uninitiated to use.

“Imagine you’re a biologist,” added Nishihara. “You can write a simple program and run it at a large scale, but to do that successfully you need not only to be a biology expert but a computing expert. That’s just way too high a barrier.”

The people behind Anyscale (and Ray) have a long and very credible list of other work behind them that speaks to the opportunities that are being spotted here. Stoica, for example, was also the co-founder of Databricks, Conviva and one of the original developers of Apache Spark.

“I worked on Databricks with Ion and that’s how it started,” Andreessen Horowitz co-founder Ben Horowitz said in an interview. He added that the firm has been a regular investor into projects coming out of UC Berkeley. Ray, and more specifically Anyscale, is notable for its relevance to today’s computing needs.

“With Ray it was a very attractive project because of the open-source metrics but also because of the issue it addresses,” he said.

“We’ve been grappling with Moore’s Law being over, but more interestingly, it’s inadequate for things like artificial intelligence applications,” where increasing computing power is needed that outstrips what any single machine can do. “You have to be able to deal with distributed computing, but the problem for everyone but Google is that distributed computing is hard, so we have been looking for a solution.”

Powered by WPeMatico

The ubiquity of APIs and cloud solutions have opened up a world of interesting ways for businesses to create a service without having to build every part of it themselves. But they have unleashed something else, too: an increased risk of breaches resulting from data being moved and used in multiple places and in multiple ways. Now, a startup that has built a way to help safeguard against that threat — using homomorphic encryption — is announcing funding, a sign of market demand and the opportunity it presents for cybersecurity.

Duality, which builds solutions based on homomorphic encryption — a technique that encrypts an organization’s data in a way that lets it stay encrypted even as the company collaborates with third parties that also process the data — is today announcing that it has raised $16 million in funding.

The Series A round is being led by Intel Capital, with participation from Hearst Ventures and Team8.

Team8 is the heavyweight Israeli cybersecurity incubator that counts Intel as a strategic partner and itself has an impressive list of backers, including Microsoft, Walmart, Eric Schmidt and Accenture.

Intel is a financial and strategic backer here: last year the two worked on a project to expose the security challenges of AI workloads, which utilised homomorphic encryption on Intel platforms in order to minimise data exposure. Intel’s are used in a wide range of use cases that include cloud services and massive hardware companies; you could see where the two might work together more in the future.

Other companies that Duality works with are in the financial markets, healthcare and insurance, although it says it cannot disclose who because of NDAs. One customer it did name was the CDA, the Cyber Defense Alliance, in the U.K., a cross-bank security alliance.

Another may well be Hearst, the other investor named in this round.

“As a leading global, diversified media, information and services company with more than 360 businesses across industries, we are acutely aware of the increasing importance of data and data collaboration in companies across many market segments,” said Kenneth Bronfin, senior managing director of Hearst Ventures, in a statement. “Sensitive data is constantly being generated by both individuals and businesses; there needs to be technology available that protects such data while allowing us to extract insights. We are excited by Duality’s mission and its ability to deliver complex technology to real-world use cases and applications.”

There are a handful of cybersecurity startups and larger companies emerging that are building solutions on the principle of homomorphic encryption.

They include Enveil, CryptoNext Security and IBM. Duality, however, has an interesting pedigree when it comes to the field: one of its co-founders, Shafi Goldwasser, won a Turing Award for her groundbreaking work in cryptographic algorithms that form the basis of homomorphic encryption.

As with a lot of high-level math, that work is largely theoretical, and so the work that Duality — led by its other co-founders Alon Kaufman, Rina Shainski, Vinod Vaikuntanathan and Kurt Rohloff, all of whom also have long lists of cybersecurity and data science credentials — has done has involved making the algorithms into something that is commercially viable and usable by most businesses.

That being said, there is still a lot of time and computing energy needed to process encrypted data, and so the idea with Duality is that it’s used on a company’s most sensitive information. With some of the funding going toward R&D, it will be interesting to see whether algorithms can improve enough to extend that kind of encryption in a practical way to wider data sets.

“There is no free lunch here,” said Kaufman, the CEO, in an interview this week. “Homomorphic encryption is the Holy Grail of security and privacy since it removes huge challenges. But there are overheads. When we deploy it with a customer, we don’t say, ‘from now on encrypt everything and assume nothing is open.’ That’s because it’s a storage and computational overhead. That is why we focus on sensitive data sets.” He added that one of Duality’s unique qualities is that its overhead is dramatically improved compared to others that are also building solutions on this principle, but all the same, “you apply it only when you need to.”

“The ability to secure data during analysis is a critical component in the future computation stack, specifically in the context of AI. Intel Capital has been following the space closely, and we are excited to see secure computing and homomorphic encryption becoming practical and broadly applicable,” said Anthony Lin, vice president and senior managing director of Intel Capital, in a statement. “We believe privacy-preservation in AI and ML represents a huge market need, and we’re investing in Duality because of its unique founding team and world-leading expertise in both advanced cryptography and data science.”

Powered by WPeMatico

Away from the limelight of the press and the frenzy of fundraising, a tech startup in India has achieved a feat that few of its peers have managed: going public.

IndiaMART, the country’s largest online platform for selling products directly to businesses, raised nearly $70 million in a rare tech IPO for India this week.

The milestone for the 23-year-old firm is so uncommon for India’s otherwise burgeoning startup ecosystem that, beyond being over-subscribed 36 times, pent up demand for IndiaMART’s stock saw its share price pop 40% on its first day of trading on National Stock Exchange on Thursday — a momentum that it sustained on Friday.

The stock ended Friday at Rs 1326 ($19.3), compared to its issue price of Rs 973 ($14.2).

IndiaMART is the first business-to-business e-commerce firm to go public in India. Its IPO also marks the first listing for a firm following the May reelection of Narendra Modi as the nation’s Prime Minister and the months-long drought that led to it.

Accounting firm EY said it expects more companies from India to follow suit and file for IPO in the coming months.

“Now that national elections are over and favorable results secured, IPO activity is expected to gain momentum in H2 2019 (second half of the year). Companies that had filed their offer documents with the Indian stock markets regulator during H2 2018 and Q1 2019 may finally come to market in the months ahead,” it said in a statement (PDF).

The fireworks of the IPO are just as impressive as IndiaMART’s journey.

The startup was founded in 1996 and for the first 13 years, it focused on exports to customers abroad, but it has since modernized its business following the wave of the internet.

“The thesis was, in 1996, there were no computers or internet in India. The information about India’s market to the West was very limited,” Dinesh Agarwal, co-founder and CEO of IndiaMART, told TechCrunch in an interview.

Until 2008, IndiaMART was fully bootstrapped and profitable with $10 million in revenue, Agarwal said. But things started to dramatically change in that year.

“The Indian rupee became very strong against the dollar, which dwindled the exports business. This is also when the stock market was collapsing in the West, which further hurt the exports demand,” he explained.

Dinesh Agarwal, founder and CEO of IndiaMart.com, poses for a profile shot on July 29, 2015 in Noida, India.

By this time, millions of people in India were on the internet and, with tens of millions of people owning a feature phone, the conditions of the market had begun to shift towards digital.

“This is when we decided to pursue a completely different path. We started to focus on the domestic market,” Agarwal said.

Over the last 10 years, IndiaMART has become the largest e-commerce platform for businesses with about 60% market share, according to research firm KPMG. It handles 97,000 product categories — ranging from machine parts, medical equipment and textile products to cranes — and has amassed 83 million buyers and 5.5 million suppliers from thousands of towns and cities of India.

According to the most recent data published by the Indian government, there are about 50 to 60 million small and medium-sized businesses in India, but only around 10 million of them have any presence on the web. Some 97% of the top 50 companies listed on National Stock Exchange use IndiaMART’s services, Agarwal said.

That’s not to say that the transition to the current day was a straightforward process for the company. IndiaMART tried to capitalize on its early mover advantage with a stream of new services which ultimately didn’t reap the desired rewards.

In 2002, it launched a travel portal for businesses. A year later, it launched a business verification service. It also unveiled a payments platform called ABCPayments. None of these services worked and the firm quickly moved on.

Part of IndiaMART’s success story is its firm leadership and how cautiously it has raised and spent its money, Rajesh Sawhney, a serial angel investor who sits on IndiaMART’s board, told TechCrunch in an interview.

IndiaMART, which employs about 4,000 people, is operationally profitable as of the financial year that ended in March this year. It clocked some $82 million in revenue in the year. It has raised about $32 million to date from Intel Capital, Amadeus Capital Partners and Quona Capital. (Notably, Agarwal said that he rejected offers from VCs for a very long time.)

The firm makes most of its revenue from subscriptions it sells to sellers. A subscription gives a seller a range of benefits including getting featured on storefronts.

4/4. So many Indian small businesses have so much to thank @DineshAgarwal for. And after the iconic IPO, so many Indian entreprenuers will have so much to thank him for – forever unlocking the Indian public markets to current & future generation of Indian internet companies

— Kunal Bahl (@1kunalbahl) July 4, 2019

There are only a handful of internet companies in India that have gone public in the last decade. Online travel service MakeMyTrip went public in 2010. Software firm Intellect Design Arena and e-commerce store Koovs listed in 2014, then travel portal Yatra and e-commerce firm Infibeam followed two years later.

India has consistently attracted billions of dollars in funding in recent years and produced many unicorns. Those include Flipkart, which was acquired by Walmart last year for $16 billion, Paytm, which has raised more than $2 billion to date, Swiggy, which has bagged $1.5 billion to date, Zomato, which has raised $750 million, and relatively new entrant Byju’s — but few of them are nearing profitability and most likely do not see an IPO in their immediate future.

In that context, IndiaMART may set a benchmark for others to follow.

“The fact that we have a homegrown digital commerce business, serving both the urban and smaller cities, and having struggled and been around for so long building a very difficult business and finally going public in the local exchange is a phenomenal story,” Ganesh Rengaswamy, a partner at Quona Capital, told TechCrunch in an interview. “It keeps the story of India tech, to the Western world, going.”

Congratulations @DineshAgarwal for an iconic IPO! @IndiaMART has set an example and hope for all Indian Internet companies looking to go public. Cheers! https://t.co/yJumFjfitS

— Vani Kola (@VaniKola) July 4, 2019

Generally, it is agreed that there are too few IPOs in India and the industry can benefit from momentum and encouragement of high profile and successful public listings.

“There is a firm consensus that in India, markets will prefer only the IPOs of companies that are profitable. And investors in India might not value those companies. Both of these issues are being addressed by IndiaMART,” said Sawhney.

“We need 30 to 40 more IPOs. This will also mean that the stock market here has matured and understands the tech stocks and how it is different from other consumer stocks they usually handle. More tech companies going public would also pave the way for many to explore stock exchanges outside of India.

“Indian market is ready for more tech stocks. We just need to get more companies to go out there,” Sawhney added, although he did predict that it will take a few years before the vast majority of leading startups are ready for the public market.

The Indian government, for its part, this week announced a number of incentives to uplift the “entrepreneurial spirit” in the nation.

Finance minister Nirmala Sitharaman said the government would ease foreign direct investment rules for certain sectors — including e-commerce, food delivery, grocery — and improve the digital payments ecosystem. Sitharaman, who is the first woman to hold this position in India, said the government would also launch a TV program to help startups connect with venture capitalists.

IndiaMART has managed to build a sticky business that compels more than 55% of its customers to come back to the platform and make another transaction within 90 days, Agarwal — its CEO — said. With some 3,500 of its 4,000 employees classified as sales executives, the company is aggressive in its pursuit of new customers. Moving forward, that will remain one of its biggest focuses, according to Agarwal.

“Most of our time still goes into educating MSMEs on how to use the internet. That was a challenge 20 years ago and it remains a challenge today,” he told TechCrunch.

In recent years, IndiaMART has begun to expand its suite of offerings to its business customers in a bid to increase the value they get from its platform and thus increase their reliance on its service.

IndiaMART has built a customer relationship management (CRM) tool so that customers need not rely on spreadsheets or other third-party services.

“We will continue to explore more SaaS offerings and look into solving problems in accounting, invoice management and other areas,” said Agarwal.

The firm also recently started to offer payment facilitation between buyers and sellers through a PayPal -like escrow system.

“This will bridge the trust gap between the entities and improve an MSME’s ability to accept all kinds of payment options including the new age offerings.”

There’s an elephant in the room, however.

A bigger challenge that looms for IndiaMART is the growing interest of Amazon and Walmart in the business-to-business space. Several startups including Udaan — which has raised north of $280 million from DST Global and Lightspeed Venture Partners — have risen up in recent years and are increasingly expanding their operations. Agarwal did not seem much worried, however, telling TechCrunch that he believes that his prime competition is more focused on B2C and serving niche audiences. Besides he has $100 million in the bank himself.

Indeed, as Quona Capital’s Rengaswamy astutely noted, competition is not new for IndiaMART — the company has survived and thrived more than two decades of it.

“Alibaba came and gave up,” he noted.

An important — and unanswered question — that follows the successful IPO is how IndiaMART’s stock will fare over the coming months. A glance to the U.S. — where hyped companies like Uber, Lyft and others have seen prices taper off — shows clearly that early demand and sustained stock performance are not one and the same.

Nobody knows at this point, and the added complexity at play is that the concept of a tech IPO is so uncommon in India that there is no definitive answer to it… yet. But IndiaMART’s biggest achievement may be that it sets the pathway that many others will follow.

Powered by WPeMatico

Pixeom, a startup that offers a software-defined edge computing platform to enterprises, today announced that it has raised a $15 million funding round from Intel Capital, National Grid Partners and previous investor Samsung Catalyst Fund. The company plans to use the new funding to expand its go-to-market capacity and invest in product development.

If the Pixeom name sounds familiar, that may be because you remember it as a Raspberry Pi-based personal cloud platform. Indeed, that’s the service the company first launched back in 2014. It quickly pivoted to an enterprise model, though. As Pixeom CEO Sam Nagar told me, that pivot came about after a conversation the company had with Samsung about adopting its product for that company’s needs. In addition, it was also hard to find venture funding. The original Pixeom device allowed users to set up their own personal cloud storage and other applications at home. While there is surely a market for these devices, especially among privacy-conscious tech enthusiasts, it’s not massive, especially as users became more comfortable with storing their data in the cloud. “One of the major drivers [for the pivot] was that it was actually very difficult to get VC funding in an industry where the market trends were all skewing towards the cloud,” Nagar told me.

At the time of its launch, Pixeom also based its technology on OpenStack, the massive open-source project that helps enterprises manage their own data centers, which isn’t exactly known as a service that can easily be run on a single machine, let alone a low-powered one. Today, Pixeom uses containers to ship and manage its software on the edge.

What sets Pixeom apart from other edge computing platforms is that it can run on commodity hardware. There’s no need to buy a specific hardware configuration to run the software, unlike Microsoft’s Azure Stack or similar services. That makes it significantly more affordable to get started and allows potential customers to reuse some of their existing hardware investments.

What sets Pixeom apart from other edge computing platforms is that it can run on commodity hardware. There’s no need to buy a specific hardware configuration to run the software, unlike Microsoft’s Azure Stack or similar services. That makes it significantly more affordable to get started and allows potential customers to reuse some of their existing hardware investments.

Pixeom brands this capability as “software-defined edge computing” and there is clearly a market for this kind of service. While the company hasn’t made a lot of waves in the press, more than a dozen Fortune 500 companies now use its services. With that, the company now has revenues in the double-digit millions and its software manages more than a million devices worldwide.

As is so often the case in the enterprise software world, these clients don’t want to be named, but Nagar tells me they include one of the world’s largest fast food chains, for example, which uses the Pixeom platform in its stores.

On the software side, Pixeom is relatively cloud agnostic. One nifty feature of the platform is that it is API-compatible with Google Cloud Platform, AWS and Azure and offers an extensive subset of those platforms’ core storage and compute services, including a set of machine learning tools. Pixeom’s implementation may be different, but for an app, the edge endpoint on a Pixeom machine reacts the same way as its equivalent endpoint on AWS, for example.

Until now, Pixeom mostly financed its expansion — and the salary of its more than 90 employees — from its revenue. It only took a small funding round when it first launched the original device (together with a Kickstarter campaign). Technically, this new funding round is part of this, so depending on how you want to look at this, we’re either talking about a very large seed round or a Series A round.

Powered by WPeMatico

Robotics process automation (RPA) is as hot as any enterprise technology at the moment, as companies look for ways to marry their legacy systems with a more modern flavor of automation. Catalytic, a startup from the Midwest, is putting its own flavor on RPA, aiming at more unstructured data. Today it was rewarded with a $30 million Series B investment.

The investment was led by Intel Capital, with participation from Redline Capital and existing investors NEA, Boldstart and Hyde Park Angel. Today’s round brings the total raised to almost $42 million, according to the company.

RPA helps automate highly mundane processes. Sean Chou, Catalytic co-founder and CEO, says there are a couple of ways his company’s solution diverts from his competition, which includes companies like Blue Prism, Automation Anywhere and UIPath.

For starters, Chou says, his company’s solution concentrates on unstructured data, like pulling information from documents or emails using a variety of techniques, depending on requirements. It could be old-fashioned scanning and OCR or more modern natural language process (NLP) to “read” the document, depending on requirements.

It is designed like all RPA tools to take humans out of the loop when it comes to the most mundane business processes, but, as Chou says, his company wants human employees in the loop whenever needed, whether that’s exception processing or tasks that are simply too challenging to program at the moment.

The company launched in 2015 using money Chou had earned from the sale of his previous company, Fieldglass, which he had sold the previous year to SAP for more than $1 billion dollars. Fieldglass helped with outsourcing, and as Chou developed that company, he saw a growing problem around automating certain tedious business processes, especially when they touched legacy systems inside an organization. He raised $3.1 million in seed money from Boldstart Ventures in NYC in 2016 and began building out the product in earnest.

Today, Catalytic has a dozen customers, including Bosch, the German manufacturing conglomerate. It employs 60 people in its Chicago headquarters. While its investors come from the coasts, Catalytic is building a company in the heart of the Midwest, a part of the country that has often been left out of the startup economy.

With $30 million, Catalytic can begin expanding the number of employees, including helping service its large customers, building out it partner network with other software companies and systems integrators and bringing in more engineering talent to continue building out the product.

The product is offered on a subscription basis as a cloud service.

Powered by WPeMatico

Early last year, LinkedIn co-founder and prolific venture capital investor Reid Hoffman called Chris Urmson “the Henry Ford of autonomous vehicles (AV).” The vote of confidence and big check from Hoffman, coupled with a team of deeply knowledgable AV entrepreneurs, has catapulted his company, Aurora Innovation, squarely into “unicorn” territory.

Aurora, the developer of a full-stack self-driving software system for automobile manufacturers, is raising at least $500 million in equity funding at more than a $2 billion valuation in a round expected to be led by new investor Sequoia Capital, according to a Recode report. A $500 million financing would bring Aurora’s total raised to date to $596 million and would provide a 4x increase to its most recent valuation.

The company, founded in 2016, raised a $90 million Series A last February from Hoffman’s Greylock Partners and Index Ventures . Hoffman and Index general partner Mike Volpi joined Aurora’s board as part of the deal. Greylock and Index are Aurora’s only existing investors, per PitchBook data. The young business has a lean cap table often characteristic of startup’s led by experienced entrepreneurs able to secure financing deals briskly from top VCs.

Aurora’s C-suite is chock-full of veteran AV workers. Urmson, for his part, formerly headed up the self-driving vehicles program at Google, now known as Waymo. Chief technology officer Drew Bagnell was head of perception and autonomy at Uber and Sterling Anderson, Aurora’s chief product officer, directed the autopilot program at Tesla from 2015 to 2016.

“Between these three co-founders, they have been thinking and working collectively in robotics, automation automotive products for over 40 years,” Hoffman wrote in a blog post announcing Aurora’s Series A funding.

In addition to the high-caliber of the founding team, Aurora’s collaborative approach to building self-driving cars has attracted investors, too. The company has partnered with a number of automotive retailers to integrate its technology into their vehicles and make self-driving cars a “practical reality.” Currently, Aurora counts Volkswagen, Hyundai and Chinese manufacturer Byton as partners.

2018 was a banner year for VC investment in U.S. autonomous vehicle startups. In total, investors poured $1.6 billion across 58 deals, nearly doubling 2017’s high of $893 million. Around the world, AV startups secured $3.41 billion, on par with the $3.48 billion invested in 2017, per PitchBook.

Though we are just days into 2019, LiDAR technology developer AEye has completed a previously announced $40 million Series B. The Pleasanton, Calif.-headquartered company raised the funds from Taiwania Capital, Kleiner Perkins, Intel Capital, Airbus Ventures and Tychee Partners. And last week, Sydney-based Baraja, another LiDAR startup, brought in a $32 million Series A from Sequoia China, Main Sequence Ventures’ CSIRO Innovation Fund and Blackbird Ventures.

Powered by WPeMatico