Intel Capital

Auto Added by WPeMatico

Auto Added by WPeMatico

Kaltura, a software company focused on providing video technology to other concerns, has filed to go public.

The Kaltura S-1 filing only partially surprised. TechCrunch previously covered the company as part of our ongoing $100 million ARR series focusing on private companies that have reached material scale. (TechCrunch has also covered its product life to a moderate degree.)

The company’s IPO documentation details a business that did more than merely accelerate its growth in 2020, and more specifically, during the COVID-19 era. Seeing a company that powers video tooling do well when much of the world has transitioned to remote work and education is not a bolt from the blue. What is notable, however, is that the company’s revenue growth has accelerated yearly since at least 2018 and its final quarter of 2020 placed the company at a new growth rate maximum.

Public investors, hungry for growth, may find such a progression compelling.

Kaltura also has an interesting profitability profile: As its GAAP net losses scaled in the last year, its adjusted profitability improved. Depending on your stance regarding adjusted metrics, Kaltura’s bottom line will either irk or delight you.

This afternoon, let’s rip into the company’s S-1 and yank out what we need to know. It is IPO season, with SPACs galore and other private companies taking more traditional routes to the public markets, including Coupang announcing a price range for its traditional debut today and Coinbase’s impending direct listing.

For now we’ll focus on Kaltura. Let’s get into it.

When TechCrunch last covered Kaltura’s financial results, we noted that the company founded in 2006 had raised just north of $166 million, crossed the $100 million ARR mark, and was, per its own reporting, “profitable on an EBITDA.” Kaltura also told TechCrunch that it had margins in the 60% range and was growing at around 25% year over year. That was just over a year ago.

Do those figures hold up? In the Q1 2020 period Kaltura recorded $25.9 million in revenue, software margins of around 78% and blended gross margins of 59.8%. And the company had grown 16.6% from the year-ago quarter. In Kaltura’s defense, the company’s growth accelerated to 24% in the year, so its self-reported numbers were mostly fair. Better than, I think, most numbers we get from private companies.

Powered by WPeMatico

When Wendell Brooks stepped down as managing partner and head of Intel Capital last August, Anthony Lin was named to replace him on an interim basis. At the time, it wasn’t clear if he would be given the role permanently, but today, six months later, the answer is known.

In a letter to the firm’s portfolio CEOs published on the company website, Lin mentioned, almost casually, that he had taken on the two roles on a permanent basis. “Personally, I want to share that I have been appointed to managing partner and head of Intel Capital. I have been a member of the investment committee for the past several years and am humbly awed by the talent of our entrepreneurs and our team,” he wrote.

Lin takes over in a time of turmoil for Intel as the company struggles to regain its place in the semiconductor business that it dominated for decades. Meanwhile, Intel itself has a new CEO with Pat Gelsinger returning in January from VMware to lead the organization.

As the corporate investment arm of Intel, it looks for companies that can help the parent company understand where to invest resources in the future. If that is its goal, perhaps it hasn’t done a great job, as Intel has lost some of its edge when it comes to innovation.

Lin, who was formerly head of mergers and acquisitions and international investing at the firm, can use the power of the firm’s investment dollars to try to help point the parent company in the right direction and help find new ways to build innovative solutions on the Intel platform.

Lin acknowledged how challenging 2020 was for everyone, and his company was no exception, but the firm invested in 75 startups, including 35 new deals and 40 deals involving companies in which it had previously invested. It has also made a commitment to invest in companies with more diverse founders. To that end, 30% of new venture-stage dollars went to startups led by diverse leaders, according to Lin.

What’s more, the company made a five-year commitment that 15% of all its deals would go to companies with Black founders. It made some progress toward that goal, but there is still a ways to go. “At the end of 2020, 9% of our new venture deals and 15% of our venture dollars committed were in companies led by Black founders. We know there is more progress to be made and we will continue to encourage, foster and invest in diverse and inclusive teams,” he wrote.

Lin faces a big challenge ahead as he takes over a role that had the same leader for the first 28 years in Arvind Sodhani. His predecessor, Brooks, was there for five years. Now it passes to Lin, and he needs to use the firm’s investment might to help Gelsinger advance the goals of the broader firm, while making sound investments.

Powered by WPeMatico

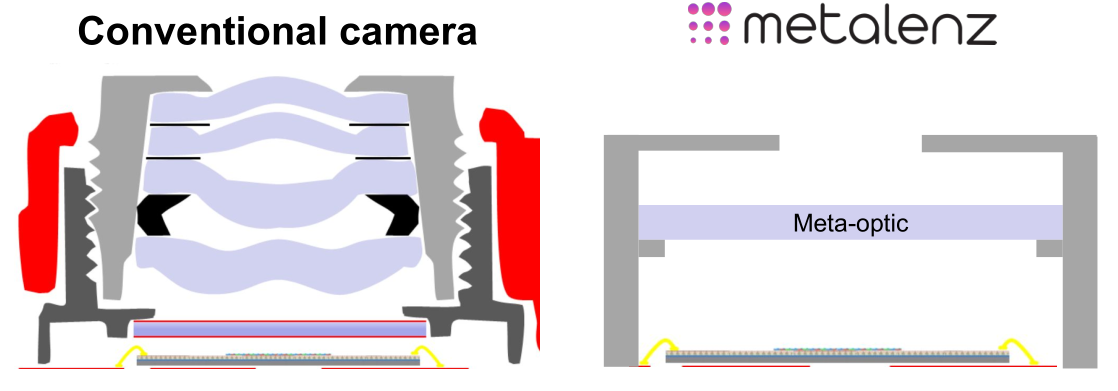

As impressive as the cameras in our smartphones are, they’re fundamentally limited by the physical necessities of lenses and sensors. Metalenz skips over that part with a camera made of a single “metasurface” that could save precious space and battery life in phones and other devices… and they’re about to ship it.

The concept is similar to, but not descended from, the “metamaterials” that gave rise to flat beam-forming radar and lidar of Lumotive and Echodyne. The idea is to take a complex 3D structure and accomplish what it does using a precisely engineered “2D” surface — not actually two-dimensional, of course, but usually a plane with features measured in microns.

In the case of a camera, the main components are of course a lens (these days it’s usually several stacked), which corrals the light, and an image sensor, which senses and measures that light. The problem faced by cameras now, particularly in smartphones, is that the lenses can’t be made much smaller without seriously affecting the clarity of the image. Likewise sensors are nearly at the limit of how much light they can work with. Consequently, most of the photography advancements of the last few years have been done on the computational side.

Using an engineered surface that does away with the need for complex optics and other camera systems has been a goal for years. Back in 2016 I wrote about a NASA project that took inspiration from moth eyes to create a 2D camera of sorts. It’s harder than it sounds, though — usable imagery has been generated in labs, but it’s not the kind of thing that you take to Apple or Samsung.

Metalenz aims to change that. The company’s tech is built on the work of Harvard’s Federico Capasso, who has been publishing on the science behind metasurfaces for years. He and Rob Devlin, who did his doctorate work in Capasso’s lab, co-founded the company to commercialize their efforts.

“Early demos were extremely inefficient,” said Devlin of the field’s first entrants. “You had light scattering all over the place, the materials and processes were non-standard, the designs weren’t able to handle the demands that a real world throws at you. Making one that works and publishing a paper on it is one thing, making 10 million and making sure they all do the same thing is another.”

Their breakthrough — if years of hard work and research can be called that — is the ability not just to make a metasurface camera that produces decent images, but to do it without exotic components or manufacturing processes.

“We’re really using all standard semiconductor processes and materials here, the exact same equipment — but with lenses instead of electronics,” said Devlin. “We can already make a million lenses a day with our foundry partners.”

The thing at the bottom is the chip where the image processor and logic would be, but the meta-optic could also integrate with that. The top is a pinhole. Image Credits: Metalenz

The first challenge is more or less contained in the fact that incoming light, without lenses to bend and direct it, hits the metasurface in a much more chaotic way. Devlin’s own PhD work was concerned with taming this chaos.

“Light on a macro [i.e. conventional scale, not close-focusing] lens is controlled on the macro scale, you’re relying on the curvature to bend the light. There’s only so much you can do with it,” he explained. “But here you have features a thousand times smaller than a human hair, which gives us very fine control over the light that hits the lens.”

Those features, as you can see in this extreme close-up of the metasurface, are precisely tuned cylinders, “almost like little nano-scale Coke cans,” Devlin suggested. Like other metamaterials, these structures, far smaller than a visible or near-infrared light ray’s wavelength, manipulate the radiation by means that take a few years of study to understand.

The result is a camera with extremely small proportions and vastly less complexity than the compact camera stacks found in consumer and industrial devices. To be clear, Metalenz isn’t looking to replace the main camera on your iPhone — for conventional photography purposes the conventional lens and sensor are still the way to go. But there are other applications that play to the chip-style lens’s strengths.

Something like the FaceID assembly, for instance, presents an opportunity. “That module is a very complex one for the cell phone world — it’s almost like a Rube Goldberg machine,” said Devlin. Likewise the miniature lidar sensor.

At this scale, the priorities are different, and by subtracting the lens from the equation the amount of light that reaches the sensor is significantly increased. That means it can potentially be smaller in every dimension while performing better and drawing less power.

Image (of a very small test board) from a traditional camera, left, and metasurface camera, right. Beyond the vignetting it’s not really easy to tell what’s different, which is kind of the point. Image Credits: Metalenz

Lest you think this is still a lab-bound “wouldn’t it be nice if” type device, Metalenz is well on its way to commercial availability. The $10 million Series A they just raised was led by 3M Ventures, Applied Ventures LLC, Intel Capital, M Ventures and TDK Ventures, along with Tsingyuan Ventures and Braemar Energy Ventures — a lot of suppliers in there.

Unlike many other hardware startups, Metalenz isn’t starting with a short run of boutique demo devices but going big out of the gate.

“Because we’re using traditional fabrication techniques, it allows us to scale really quickly. We’re not building factories or foundries, we don’t have to raise hundreds of mils; we can use what’s already there,” said Devlin. “But it means we have to look at applications that are high volume. We need the units to be in that tens of millions range for our foundry partners to see it making sense.”

Although Devlin declined to get specific, he did say that their first partner is “active in 3D sensing” and that a consumer device, though not a phone, would be shipping with Metalenz cameras in early 2022 — and later in 2022 will see a phone-based solution shipping as well.

In other words, while Metalenz is indeed a startup just coming out of stealth and raising its A round… it already has shipments planned on the order of tens of millions. The $10 million isn’t a bridge to commercial viability but short-term cash to hire and cover upfront costs associated with such a serious endeavor. It’s doubtful anyone on that list of investors harbors any serious doubts on ROI.

The 3D sensing thing is Metalenz’s first major application, but the company is already working on others. The potential to reduce complex lab equipment to handheld electronics that can be fielded easily is one, and improving the benchtop versions of tools with more light-gathering ability or quicker operation is another.

Though a device you use may in a few years have a Metalenz component in it, it’s likely you won’t know — the phone manufacturer will probably take all the credit for the improved performance or slimmer form factor. Nevertheless, it may show up in teardowns and bills of material, at which point you’ll know this particular university spin-out has made it to the big leagues.

Powered by WPeMatico

As 5G slowly moves from being a theoretical to an active part of the coverage map for the mobile industry — if not for consumers themselves — companies that are helping carriers make the migration less painful and less costly are seeing a boost of attention.

In the latest development, Cellwize, a startup that’s built a platform to automate and optimize data for carriers to run 5G networks within multi-vendor environments, has raised $32 million — funding that it will use to continue expanding its business into more geographies and investing in R&D to bring more capabilities to its flagship CHIME platform.

The funding is notable because of the list of strategic companies doing the investing, as well as because of the amount of traction that Cellwize has had to date.

The Series B round is being co-led Intel Capital and Qualcomm Ventures LLC, and Verizon Ventures (which is part of Verizon, which also owns TechCrunch by way of Verizon Media) and Samsung Next, with existing shareholders also participating. That list includes Deutsche Telekom and Sonae, a Portuguese conglomerate that owns multiple brands in retail, financial services, telecoms and more.

That backing underscores Cellwize’s growth. The company — which is based in Israel with operations also in Dallas and Singapore — says it currently provides services to some 40 carriers (including Verizon, Telefonica and more), covering 16 countries, 3 million cell sites, and 800 million subscribers.

Cellwize is not disclosing its valuation but it has raised $56.5 million from investors to date.

5G holds a lot of promise for carriers, their vendors, handset makers and others in the mobile ecosystem: the belief is that faster and more efficient speeds for wireless data will unlock a new wave of services and usage and revenues from services for consumers and business, covering not just people but IoT networks, too.

Notwithstanding the concerns some have had with health risks, despite much of that theory being debunked over the years, one of the technical issues with 5G has been implementing it.

Migrating can be costly and laborious, not least because carriers need to deploy more equipment at closer distances, and because they will likely be running hybrid systems in the Radio Access Network (RAN, which controls how devices interface with carriers’ networks); and they will be managing legacy networks (eg, 2G, 3G, 4G, LTE) alongside 5G, and working with multiple vendors within 5G itself.

Cellwize positions its CHIME platform — which works as an all-in-one tool that leverages AI and other tech in the cloud, and covers configuring new 5G networks, optimizing and monitoring data on them, and also providing APIs for third-party developers to integrate with it — as the bridge to letting carriers operate in the more open-shop approach that marks the move to 5G.

“While large companies have traditionally been more dominant in the RAN market, 5G is changing the landscape for how the entire mobile industry operates,” said Ofir Zemer, Cellwize’s CEO. “These traditional vendors usually offer solutions which plug into their own equipment, while not allowing third parties to connect, and this creates a closed and limited ecosystem. [But] the large operators also are not interested in being tied to one vendor: not technology-wise and not on the business side – as they identify this as an inhibitor to their own innovation.”

Cellwize provides an open platform that allows a carrier to plan, deploy and manage the RAN in that kind of multi-vendor ecosystem. “We have seen an extremely high demand for our solution and as 5G rollouts continue to increase globally, we expect the demand for our product will only continue to grow,” he added.

Previously, Zemer said that carriers would build their own products internally to manage data in the RAN, but these “struggle to support 5G.”

The competition element is not just lip service: the fact that both Intel and Qualcomm — competitors in key respects — are investing in this round underscores how Cellwize sees itself as a kind of Switzerland in mobile architecture. It also underscores that both view easy and deep integrations with its tech as something worth backing, given the priorities of each of their carrier customers.

“Over the last decade, Intel technologies have been instrumental in enabling the communications industry to transform networks with an agile and scalable infrastructure,” said David Flanagan, VP and senior MD at Intel Capital, in a statement. “With the challenges in managing the high complexity of radio access networks, we are encouraged by the opportunity in front of Cellwize to explore ways to utilize their AI-based automation capabilities as Intel brings the benefits of cloud architectures to service provider and private networks.”

“Qualcomm is at the forefront of 5G expansion, creating a robust ecosystem of technologies that will usher in the new era of connectivity,” added Merav Weinryb, Senior Director of Qualcomm Israel Ltd. and MD of Qualcomm Ventures Israel and Europe. “As a leader in RAN automation and orchestration, Cellwize plays an important role in 5G deployment. We are excited to support Cellwize through the Qualcomm Ventures’ 5G global ecosystem fund as they scale and expedite 5G adoption worldwide.”

And that is the key point. Right now there are precious few 5G deployments, and sometimes, when you read some the less shiny reports of 5G rollouts, you might be forgiven for feeling like it’s more marketing than reality at this point. But Zemer — who is not a co-founder (both of them have left the company) but has been with it since 2013, almost from the start — is sitting in on the meetings with carriers, and he believes that it won’t be long before all that tips.

“Within the next five years, approximately 75% of mobile connections will be powered by 5G, and 2.6 billion 5G mobile subscriptions will be serving 65% of the world’s population,” he said. “While 5G technology holds a tremendous amount of promise, the reality is that it is also hyper-complex, comprised of multiple technologies, architectures, bands, layers, and RAN/vRAN players. We are working with network operators around the world to help them overcome the challenges of rolling out and managing these next generation networks, by automating their entire RAN processes, allowing them to successfully deliver 5G to their customers.”

Powered by WPeMatico

No-code and low-code software have become increasingly popular ways for companies — especially those that don’t count technology as part of their DNA — to bring in more updated IT processes without the heavy lifting needed to build and integrate services from the ground up.

As a mark of that trend, today, a company that has taken this approach to speeding up customer experience is announcing some funding. EasySend, an Israeli startup which has built a no-code platform for insurance companies and other regulated businesses to build out forms and other interfaces to take in customer information and subsequently use AI systems to process it more efficiently, is announcing that it has raised $16 million.

The funding has actually come in two tranches, a $5 million seed round from Vertex Ventures and Menora Insurance that it never disclosed, and another $11 million round that closed more recently, led by Hanaco with participation from Intel Capital. The company is already generating revenue, and did so from the start, enough that it was actually bootstrapped for the first three years of its life.

Tal Daskal, EasySend’s CEO and co-founder, said that the funding being announced today will be used to help it expand into more verticals: up to now its primary target has been insurance companies, although organically it’s picked up customers from a number of other verticals, such as telecoms carriers, banks and more.

The plan will be now to hone in on specifically marketing to and building solutions for the financial services sector, as well as hiring and expanding in Asia, Europe and the US.

Longer term, he said, that another area EasySend might like to look at more in the future is robotic process automation (RPA). RPA, and companies that deal in it like UIPath, Automation Anywhere and Blue Prism, is today focused on the back office, and EasySend’s focus on the “front office” integrates with leaders in that area. But over time, it would make sense for EasySend to cover this in a more holistic way, he added.

Menora was a strategic backer: it’s one of the largest insurance providers in Israel, Daskal said, and it used EasySend to build out better ways for consumers to submit data for claims and apply for insurance.

Intel, he said, is also strategic although how is still being worked out: what’s notable to mention here is that Intel has been building out a huge autonomous driving business in Israel, anchored by MobileEye, and not only will insurance (and overall risk management) play a big part in how that business develops, but longer term you can see how there will be a need for a lot of seamless customer interactions (and form filling) between would-be car owners, operators, and passengers in order for services to operate more efficiently.

“Intel Capital chose to invest in EasySend because of its intelligent and impactful approach to accelerating digital transformation to improve customer experiences,” said Nick Washburn, senior managing director, Intel Capital, in a statement. “EasySend’s no-code platform utilizes AI to digitize thousands of forms quickly and easily, reducing development time from months to days, and transforming customer journeys that have been paper-based, inefficient and frustrating. In today’s world, this is more critical than ever before.”

The rise and persistence of Covid-19 globally has had a big, multi-faceted impact how we all do business, and two of those ways have fed directly into the growth of EasySend.

First, the move to remote working has given organizations a giant fillip to work on digital transformation, refreshing and replacing legacy systems with processes that work faster and rely on newer technologies.

Second, consumers have really reassessed their use of insurance services, specifically health and home policies, respectively to make sure they are better equipped in the event of a Covid-19-precipitated scare, and to make sure that they are adequately covered for how they now use their homes all hours of the day.

EasySend’s platform for building and running interfaces for customer experience fall directly into the kinds of apps and services that are being identified and updated, precisely at a time when its initial target customers, insurers, are seeing a surge in business. It’s that “perfect storm” of circumstances that the startup wouldn’t have wished on the world, but which has definitely helped it along.

While there are a lot of companies on the market today that help organizations automate and run their customer interaction processes, the Daskal said that EasySend’s focus on using AI to process information is what makes the startup more unique, as it can be used not just to run things, but to help improve how things work.

It’s not just about taking in character recognition and organizing data, it’s “understanding the business logic,” he said. “We have a lot of data and we can understand [for example] where customers left the process [when filling out forms]. We can give insights into how to increase the conversion rates.”

It’s that balance of providing tools to do business better today, as well as to focus on how to build more business for tomorrow, that has caught the eye of investors.

“Hanaco is firmly invested in building a digital future. By bridging the gap between manual processes and digitization, EasySend is making this not only possible, but also easy, affordable, and practical,” said Hanaco founding partner Alon Lifshitz, in a statement.

Powered by WPeMatico

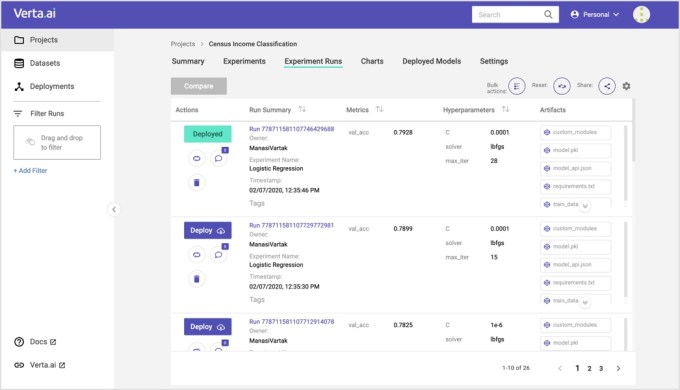

Manasi Vartak, founder and CEO of Verta, conceived of the idea of the open-source project ModelDB database as a way to track versions of machine models while she was still in grad school at MIT. After she graduated, she decided to expand on that vision to build a product that could not only track model versions, but provide a way to operationalize them — and Verta was born.

Today, that company emerged from stealth with a $10 million Series A led by Intel Capital with participation from General Catalyst, which also led the company’s $1.7 million seed round.

Beyond providing a place to track model versioning, which ModelDB gave users, Vartak wanted to build a platform for data scientists to deploy those models into production, which has been difficult to do for many companies. She also wanted to make sure that once in production, they were still accurately reflecting the current data and not working with yesterday’s playbook.

“Verta can track if models are still valid and send out alarms when model performance changes unexpectedly,” the company explained.

Image Credits: Verta

Vartak says having that open-source project helped sell the company to investors early on, and acts as a way to attract possible customers now. “So for our seed round, it was definitely different because I was raising as a solo founder, a first-time founder right out of school, and that’s where having the open-source project was a huge win,” she said.

Certainly Mark Rostick, VP and senior managing director at lead investor Intel Capital, recognized that Verta was trying to solve a fundamental problem around machine learning model production. “Verta is addressing one of the key challenges companies face when adopting AI — bridging the gap between data scientists and developers to accelerate the deployment of machine learning models,” Rostick said.

While Vartak wasn’t ready to talk about how many customers she has just yet at this early stage of the company, she did say there were companies using the platform and getting models into production much faster.

Today, the company has 9 employees, and even at this early stage, she is taking diversity very seriously. In fact, her current employee makeup includes four Indian, three Caucasian, one Latino and one Asian, for a highly diverse mix. Her goal is to continue on this path as she builds the company. She is looking at getting to 15 employees this year, then doubling that by next year.

One thing Vartak also wants to do is have a 50/50 gender split, something she was able to achieve while at MIT in her various projects, and she wants to carry on with her company. She is also working with a third party, Sweat Equity Ventures, to help with recruiting diverse candidates.

She says that she likes to work iteratively to build the platform, while experimenting with new features, even with her small team. Right now, that involves interoperability with different machine learning tools out there like Amazon SageMaker or Kubeflow, the open-source machine learning pipeline tool.

“We realized that we need to meet customers where they are at their level of maturity. So we focused a lot the last couple of quarters on building a system that was interoperable so you can pick and choose the components kind of like Lego blocks and have a system that works end to end seamlessly.”

Powered by WPeMatico

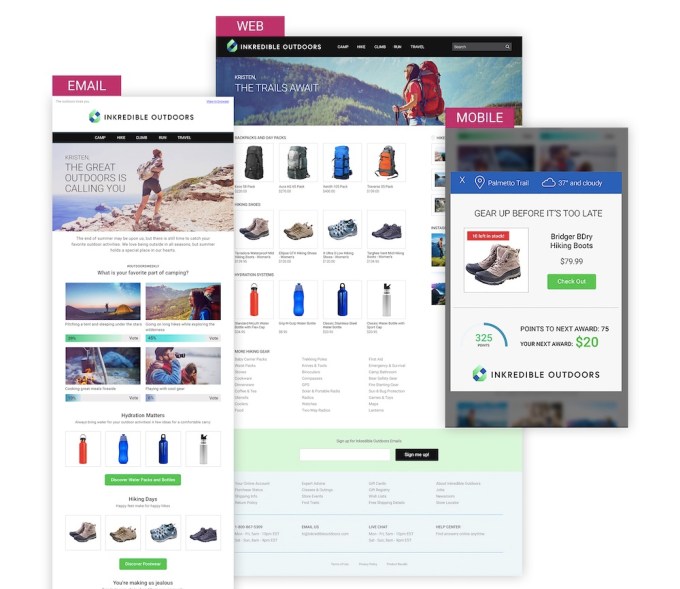

Movable Ink, a company that helps businesses deliver more personalized and relevant email marketing, is announcing that it has raised $30 million in Series C funding.

The company will be 10 years old in October, and founder and CEO Vivek Sharma told me that it’s always been “capital efficient” — even with the new round, Movable Ink has only raised a total of $39 million.

However, Sharma noted that with COVID-19, it felt like “a good idea to have some dry powder on our balance sheet … if things turned south.”

At the same time, he suggested that the pandemic’s impact has been more limited than he anticipated, and has been “really focused” on a few sectors like travel, hospitality and “old line retailers.”

“Those who are adopting to e-commerce really quickly have done well, financial services has done well, media has done well,” he said.

The company’s senior vice president of strategy Alison Lindland added that clients using Movable Ink were able to move much more quickly, with campaigns that would normally take months launching in just a few days.

“We really saw those huge, wholesale digital transformations in a time of duress,” Lindland said. “Obviously, large Fortune 500 companies were making difficult decisions, were putting vendors on hold, but email marketers are always the last people furloughed themselves, because of how critical email marketing is to their businesses. We were just as critical to their operations.”

Image Credits: Movable Ink

The company said it now works with more than 700 brands, and in the run up to the 2020 election, its customers include the Democratic National Committee.

The new funding comes from Contour Venture Partners, Intel Capital and Silver Lake Waterman. Sharma said the money will be spent on three broad categories: “Platforms, partners and people.”

On the platform side, that means continuing to develop Movable Ink’s technology and expanding into new channels. He estimated that around 95% of Movable Ink’s revenue comes from email marketing, but he sees a big opportunity to grow the web and mobile side of the business.

“We take any data the brand has available to it and activate and translate it into really engaging creative,” he said, arguing that this approach is applicable in “every other channel where there’s pixels in front of the consumer’s eyes.”

The company also plans to make major investments into AI. Sharma said it’s too early to share details about those plans, but he pointed to the recent hire of Ashutosh Malaviya as the company’s vice president of artificial intelligence.

As for partners, the company has launched the Movable Ink Exchange, a marketplace for integrations with data partners like Oracle Commerce Cloud, MessageGears Engage, Trustpilot and Yopto.

And Movable Ink plans to expand its team, both through hiring and potential acquisitions. To that end, it has hired Katy Huber as its senior vice president of people.

Sharma also said that in light of the recent conversations about racial justice and diversity, the company has been looking at its own hiring practices and putting more formal measures in place to track its progress.

“We use OKRs to track other areas of the business, so if we don’t incorporate [diversity] into our business objectives, we’re only paying lip service,” he said. “For us, it was really important to not just have a big spike of interest, and instead save some of that energy so that it’s sustained into the future.”

Powered by WPeMatico

When Wendell Brooks was promoted to president of Intel Capital, the investment arm of the chip giant, in 2015, he knew he had big shoes to fill. He was taking over from Arvind Sodhani, who had run the investment component for 28 years since its inception. Today, the company confirmed reports that Brooks has resigned that role.

“Wendell Brooks has resigned from Intel to pursue other opportunities. We thank Wendell for all his contributions and wish him the best for the future,” a company spokesperson told TechCrunch in a rather bland send off.

Anthony Lin, who has been leading mergers and acquisitions and international investing, will take over on an interim basis. Interestingly, when Brooks was promoted, he too was in charge of mergers and acquisitions. Whether Lin keeps that role remains to be seen.

When I spoke to Brooks in 2015 as he was about to take over from Sodhani, he certainly sounded ready for the task at hand. “I have huge shoes to fill in maintaining that track record,” he said at the time. “I view it as a huge opportunity to grow the focus of organization where we can provide strategic value to portfolio companies.”

In that same interview, Brooks described his investment philosophy, saying he preferred to lead, rather than come on as a secondary investor. “I tend to think the lead investor is able to influence the business thesis, the route to market, the direction, the technology of a startup more than a passive investor,” he said. He added that it also tends to get board seats that can provide additional influence.

Comparing his firm to traditional VC firms, he said they were as good or better in terms of the investing record, and as a strategic investor brought some other advantages as well. “Some of the traditional VCs are focused on a company-building value. We can provide strategic guidance and complement some of the company building over other VCs,” he said.

Over the life of the firm, it has invested $12.9 billion in more than 1,500 companies, with 692 of those exiting via IPO or acquisition. Just this year, under Brooks’ leadership, the company has invested $225 million so far, including 11 new investments and 26 investments in companies already in the portfolio.

Powered by WPeMatico

Overwolf, the in-game app-development toolkit and marketplace, has acquired Twitch’s CurseForge assets to provide a marketplace for modifications to complement its app development business.

Since its launch in 2009, developers have used Overwolf to build in-game applications for things like highlight clips, game-performance monitoring and metrics, and strategic analysis. Some of these developers have managed to earn anywhere between $100,000 and $1 million per year off revenue from app sales.

“CurseForge is the embodiment of how fostering a community of creators around games generates value for both players and game developers,” said Uri Marchand, Overwolf’s chief executive officer, in a statement. “As we move to onboard mods onto our platform, we’re positioning Overwolf as the industry standard for building in-game creations.”

It wouldn’t be a stretch to think of the company as the Roblox for applications for gamers, and now it’s moving deeper into the gaming world with the acquisition of CurseForge. As the company makes its pitch to current CurseForge users — hoping that the mod developers will stick with the marketplace, they’re offering to increase by 50% the revenue those developers will make.

Overwolf said it has around 30,000 developers who have built 90,000 mods and apps, on its platform already.

As a result of the acquisition, the CurseForge mod manager will move from being a Twitch client and become a standalone desktop app included in Overwolf’s suite of app offerings, and the acquisition won’t have any effect on existing tools and services.

“We’ve been deeply impressed by the level of passion and collaboration in the CurseForge modding community,” said Tim Aldridge, director of Engineering, Gaming Communities at Twitch. “CurseForge is an incredible asset for both creators and gamers. We are confident that the CurseForge community will thrive under Overwolf’s leadership, thanks to their commitment to empowering developers.”

The acquisition comes two years after Overwolf raised $16 million in a round of financing from Intel Capital, which had also partnered with the company on a $7 million fund to invest in app and mod developers for popular games.

“Overwolf’s position as a platform that serves millions of gamers, coupled with its partnership with top developers, means that Intel’s investment will convert into more value for PC gamers worldwide,” said John Bonini, VP and GM of VR, Esports and Gaming at Intel, in a statement at the time. “Intel has always prioritized gamers with high performance, industry-leading hardware. This round of investment in Overwolf advances Intel’s vision to deliver a holistic PC experience that will enhance the ways people interact with their favorite games on the software side as well.”

Other investors in the company include Liberty Technology Venture Capital, the investment arm of the media and telecommunications company, Liberty Media.

Powered by WPeMatico

Corporate venture capitalists (CVCs) are booming in the startup space as large companies look to take advantage of the fast-paced innovation and original thinking that entrepreneurs offer.

For startups, taking funding from CVCs can come with many benefits, including new opportunities for marketing, partnerships and sales channels. Still, no founder should consider a corporate investor “just another VC.” CVCs come with their own set of priorities, strategic objectives and rules.

When it comes to choosing a CVC with which to enter negotiations, the most important step is doing your own diligence beforehand. An entrepreneur’s goal is to find the perfect match to partner with and guide you as you grow your business. So before you start discussing terms, you’ll want to understand what’s driving the CVC’s interest in venture investing.

While traditional VCs are purely financially driven, CVCs can be in the venture game for a variety of reasons, including finding new technology that might generate marketplace demand for their products. An example is Amazon’s Alexa fund, which invested into emerging companies that drive use and adoption of Alexa. Alternatively, a CVC’s parent company may be looking to invest in tech that will help them operate their own products more efficiently, such as Comcast Ventures investing in DocuSign.

As a rule of thumb, the bigger CVC funds like GV and Comcast tend to be financially driven, meaning they’ll be approaching negotiations through a financial lens. As such, the negotiating process more closely resembles an institutional fund. You as a founder have to do the work to figure out what’s driving your CVC — is this a customer acquisition or distribution opportunity? Or are they seeking to find a source of knowledge transfer and/or bring new tech into their parent company?

“Before negotiating, always look at a CVC’s existing portfolio,” says Rick Prostko, managing director at Comcast Ventures. “Have they made a lot of investments, at what stage, and with whom? From this information you’ll see the strategic thinking of the CVC, and you can determine how best to position yourself when you begin negotiations.”

Powered by WPeMatico