Ingrid Lunden

Auto Added by WPeMatico

Auto Added by WPeMatico

Let’s rewind a decade. It’s 2009. Vancouver, Canada.

Stewart Butterfield, known already for his part in building Flickr, a photo-sharing service acquired by Yahoo in 2005, decided to try his hand — again — at building a game. Flickr had been a failed attempt at a game called Game Neverending followed by a big pivot. This time, Butterfield would make it work.

To make his dreams a reality, he joined forces with Flickr’s original chief software architect Cal Henderson, as well as former Flickr employees Eric Costello and Serguei Mourachov, who like himself, had served some time at Yahoo after the acquisition. Together, they would build Tiny Speck, the company behind an artful, non-combat massively multiplayer online game.

Years later, Butterfield would pull off a pivot more massive than his last. Slack, born from the ashes of his fantastical game, would lead a shift toward online productivity tools that fundamentally change the way people work.

In mid-2009, former TechCrunch reporter-turned-venture-capitalist M.G. Siegler wrote one of the first stories on Butterfield’s mysterious startup plans.

“So what is Tiny Speck all about?” Siegler wrote. “That is still not entirely clear. The word on the street has been that it’s some kind of new social gaming endeavor, but all they’ll say on the site is ‘we are working on something huge and fun and we need help.’”

Maybe I make a terrible boss, but at least I know it. Work with me: http://tinyspeck.com/jobs/cptl/

— Stewart Butterfield (@stewart) July 10, 2009

Siegler would go on to invest in Slack as a general partner at GV, the venture capital arm of Alphabet .

“Clearly this is a creative project,” Siegler added. “It almost sounds like they’re making an animated movie. As awesome as that would be, with people like Henderson on board, you can bet there’s impressive engineering going on to turn this all into a game of some sort (if that is in fact what this is all about).”

After months of speculation, Tiny Speck unveiled its project: Glitch, an online game set inside the brains of 11 giants. It would be free with in-game purchases available and eventually, a paid subscription for power users.

Powered by WPeMatico

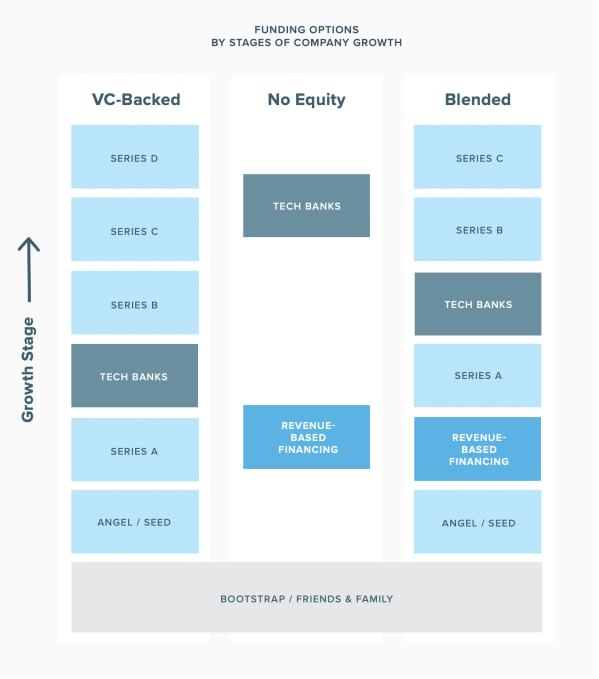

Revenue-based financing is on the rise, at least according to Lighter Capital, a firm that doles out entrepreneur-friendly debt capital.

What exactly is RBF you ask? It’s a relatively new form of funding for tech companies that are posting monthly recurring revenue. Here’s how Lighter Capital, which completed 500 RBF deals in 2018, explains it: “It’s an alternative funding model that mixes some aspects of debt and equity. Most RBF is technically structured as a loan. However, RBF investors’ returns are tied directly to the startup’s performance, which is more like equity.”

Source: Lighter Capital

What’s the appeal? As I said, RBFs are essentially dressed up debt rounds. Founders who opt for RBFs as opposed to venture capital deals hold on to all their equity and they don’t get stuck on the VC hamster wheel, the process in which you are forced to continually accept VC while losing more and more equity as a means of pleasing your investors.

RBFs, however, are better than traditional debt rounds because the investors are more incentivized to help the companies they invest in because they are receiving a certain portion of that business’s monthly revenues, typically 1% to 9%. Eventually, as is explained thoroughly in Lighter Capital’s newest RBF report, monthly payments come to an end, usually 1.3 to 2.5X the amount of the original financing, a multiple referred to as the “cap.” Three to five years down the line, any unpaid amount of said cap is due back to the investor. When all is said in done, ideally, the startup has grown with the support of the capital and hasn’t lost any equity.

At this point, they could opt to raise additional revenue-based capital, they could turn to venture capital or they could tap a tech bank to help them get to the next step. The idea is RBF is easier on the founder and it allows them optionality, something that is often lost when companies turn to VCs.

IPO corner, rapid-fire edition

Slack’s direct listing will be on June 20th. Get excited.

China’s Luckin Coffee raised $650 million in upsized U.S. IPO

Crowdstrike, a cybersecurity unicorn, dropped its S-1.

Freelance marketplace Fiverr has filed to go public on the NYSE.

Plus, I had a long and comprehensive conversation with Zoom CEO Eric Yuan this week about the company’s closely watched IPO. You can read the full transcript here.

Silicon Valley entrepreneur Hosain Rahman, the man behind Jawbone, has managed to raise $65.4 million for his new company, according to an SEC filing. The paperwork, coincidentally or otherwise, was processed while most of the world’s attention was focused on Uber’s IPO. Jawbone, if you remember, produced wireless speakers and Bluetooth earpieces, and went kaput in 2017 after burning up $1 billion in venture funding over the course of 10 years. Ouch.

On the heels of enterprise startup UiPath raising at a $7 billion valuation, the startup’s biggest investor is announcing a new fund to double down on making more investments in Europe. VC firm Accel has closed a $575 million fund — money that it plans to use to back startups in Europe and Israel, investing primarily at the Series A stage in a range of between $5 million and $15 million, reports TechCrunch’s Ingrid Lunden. Plus, take a closer look at Contrary Capital. Part accelerator, part VC fund, Contrary writes small checks to student entrepreneurs and recent college dropouts.

Our paying subscribers are in for a treat this week. Our in-house venture capital expert Danny Crichton wrote down some thoughts on Uber and Lyft’s investment bankers. Here’s a snippet: “Startup CEOs heading to the public markets have a love/hate relationship with their investment bankers. On one hand, they are helpful in introducing a company to a wide range of asset managers who will hopefully hold their company’s stock for the long term, reducing price volatility and by extension, employee churn. On the other hand, they are flagrantly expensive, costing millions of dollars in underwriting fees and related expenses…”

Read the full story here and sign up for Extra Crunch here.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I chat about the notable venture rounds of the week, CrowdStrike’s IPO and more of this week’s headlines.

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico

Greetings from Seattle, the land of Amazon, Microsoft, two of the world’s richest men and some startups.

I’m always surprised the Seattle startup ecosystem hasn’t grown to compete with the likes of Silicon Valley — or at least Boston and New York City — since the dot-com boom. Today, it’s the strongest it’s been due to the successes of companies like the newly minted unicorn Outreach, trucking business Convoy and, of course, the dog walking startup Rover. But the city still lags behind, failing to adopt the culture of entrepreneurship that defines San Francisco.

I spent a lot of time wondering why it hasn’t reached its full potential. Is it because Microsoft and Amazon pay their employees so well they don’t have the same urge to build something from the ground up? Is it a lack of access to capital? Is the city not attracting top talent? If you have thoughts, send them my way.

“We think part of the issue is a lack of capital and a lack of help,” Rover and Pioneer Square Labs co-founder Greg Gottesman told TechCrunch earlier this year. “If we can provide a little bit of both of those things, we can really put Seattle where it deserves to be, should be and will be.”

Despite its shortcomings, there is still some action in the city I want to highlight this week. A same-day delivery business, Dolly, is on the rise. The startup told me on Thursday it had raised a $7.5 million round from Unlock Venture Partners, Maveron and Jeff Wilke, the chief executive officer of Amazon Worldwide Consumer. Maveron, if you remember, is the VC fund co-founded by Starbucks founder Howard Schultz.

In other Seattle news, Madrona Venture Group, a well-regarded fund, raised an additional $100 million this week. Typically, Madrona focuses on companies based in the Pacific Northwest, but this fund will deploy capital throughout the entire U.S. Hmmm, that’s not necessarily a good sign for Seattle founders, but great progress for the ecosystem nonetheless.

If you’re interested in learning more about Seattle tech, I’ve covered it a bit because it’s my hometown! Start with this story, which dives deep into a Seattle accelerator that’s working hard to encourage entrepreneurship in the city. Alright, on to other news.

Want more TechCrunch newsletters? Sign up here.

WeWork: The co-working giant now known as The We Company submitted confidential IPO documents to the SEC, the company confirmed in a press release Monday. Is this the next massive startup win or a house of cards waiting to be toppled by the glare of the public markets? TechCrunch’s Danny Crichton investigates.

Slack: The business is in its final steps toward a much-anticipated direct listing, with one source telling TechCrunch the listing will be complete within 45 days. The WSJ reported this week that Slack will make an online presentation to potential shareholders on May 13. This week, we dug deep into Slack’s S-1 and decided to evaluate just how well the tech press, us included, did in covering the company. For the most part, the tech press did decently well, except for one curious, $162 million gap.

Uber: Finally! That ride-hailing company is going public next week. That latest news? Uber co-founder Travis Kalanick won’t be ringing the opening bell. Uber would not be where it is today without Kalanick, but him being there would surely be a reminder of Uber’s rocky past.

Beyond Meat: Shares of the company surged up 135 percent in their market opener last week, valuing the company as high as $3.52 billion. Volatility was so high on the company’s stock that the Nasdaq had to pause trading of “BYND” shares.

Ofo has run into its fair share of issues, laying off hundreds of workers, shutting down its international division and more. Now, you can buy a piece of the startup’s history.

Now you can buy a piece of startup history… Ofo bikes for ~$60 https://t.co/LLJbDOXm0C

— Jon Russell (@jonrussell) April 29, 2019

In other micro-mobility news, Lyft’s head of scooter & bikes Liam O’Connor, who was hired to help transportation company Lyft build its bike and scooter operations, has left after seven months with the newly-public company. TechCrunch’s Ingrid Lunden has the scoop. Plus, Bird, the electric scooter unicorn doing its best to overcome regulatory barriers, has made its way back to San Francisco. Bird is using its business license in San Francisco to introduce monthly personal rentals in the city. The program enables people to rent a scooter for $24.99 a month with no cap on the number of rides. We’ll how that goes.

For some reason, people are giving Magic Leap more money. The company has secured another $280 million in a deal with Japan’s largest mobile operator, Docomo. Do you know what that means? The developer fo AR/VR headsets has raised a total of $2.6 billion. We’re just as confused as you.

Brand new venture capital funds:

Unshackled Ventures raised $20 million.

Exclusive: @UnshackledVC has a new $20M pre-seed fund to invest only in immigrants. Why? Because immigrants are “inherently more entrepreneurial:” https://t.co/ZLiZ1UczJV

— Kate Clark (@KateClarkTweets) May 2, 2019

Jungle Ventures closed on $175 million.

And Toyota AI Ventures launched a $100 million fund.

I have the inside story on Menlo Ventures early Uber stake and TechCrunch’s Connie Loizos goes deep with early Uber backer Bradley Tusk.

This week, we offer TechCrunch Extra Crunch subscribers exclusive tips on building extraordinary teams. Plus, the final piece in TechCrunch’s Greg Kumparak’s series on Niantic, the fast-growing developer of Pokemon Go. If you recall, we’ve captured much of Niantic’s ongoing story in the first three parts of our EC-1, from its beginnings as an “entrepreneurial lab” within Google, to its spin-out as an independent company and the launch of Pokémon GO, to its ongoing focus on becoming a platform for others to build augmented reality products upon.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and TechCrunch’s Danny Crichton chat about updates at the Vision Fund, Cheddar’s big exit and more of this week’s headlines.

Powered by WPeMatico

The Wall Street Journal published a thought-provoking story this week, highlighting limited partners’ concerns with the SoftBank Vision Fund’s investment strategy. The fund’s “decision-making process is chaotic,” it’s over-paying for equity in top tech startups and it’s encouraging inflated valuations, sources told the WSJ.

The report emerged during a particularly busy time for the Vision Fund, which this week led two notable VC deals in Clutter and Flexport, as well as participated in DoorDash’s $400 million round; more on all those below. So given all this SoftBank news, let us remind you that given its $45 billion commitment, Saudi Arabia’s Public Investment Fund (PIF) is the Vision Fund’s largest investor. Saudi Arabia is responsible for the planned killing of dissident journalist Jamal Khashoggi.

Here’s what I’m wondering this week: Do CEOs of companies like Flexport and Clutter have a responsibility to address the source of their capital? Should they be more transparent to their customers about whose money they are spending to achieve rapid scale? Send me your thoughts. And thanks to those who wrote me last week re: At what point is a Y Combinator cohort too big? The general consensus was this: the size of the cohort is irrelevant, all that matters is the quality. We’ll have more to say on quality soon enough, as YC demo days begin on March 18.

Anyways…

Surprise! Sort of. Not really. Pinterest has joined a growing list of tech unicorns planning to go public in 2019. The visual search engine filed confidentially to go public on Thursday. Reports indicate the business will float at a $12 billion valuation by June. Pinterest’s key backers — which will make lots of money when it goes public — include Bessemer Venture Partners, Andreessen Horowitz, FirstMark Capital, Fidelity and SV Angel.

Ride-hailing company Lyft plans to go public on the Nasdaq in March, likely beating rival Uber to the milestone. Lyft’s S-1 will be made public as soon as next week; its roadshow will begin the week of March 18. The nuts and bolts: JPMorgan Chase has been hired to lead the offering; Lyft was last valued at more than $15 billion, while competitor Uber is valued north of $100 billion.

Despite scrutiny for subsidizing its drivers’ wages with customer tips, venture capitalists plowed another $400 million into food delivery platform DoorDash at a whopping $7.1 billion valuation, up considerably from a previous valuation of $3.75 billion. The round, led by Temasek and Dragoneer Investment Group, with participation from previous investors SoftBank Vision Fund, DST Global, Coatue Management, GIC, Sequoia Capital and Y Combinator, will help DoorDash compete with Uber Eats. The company is currently seeing 325 percent growth, year-over-year.

Here are some more details on those big Vision Fund Deals: Clutter, an LA-based on-demand storage startup, closed a $200 million SoftBank-led round this week at a valuation between $400 million and $500 million, according to TechCrunch’s Ingrid Lunden’s reporting. Meanwhile, Flexport, a five-year-old, San Francisco-based full-service air and ocean freight forwarder, raised $1 billion in fresh funding led by the SoftBank Vision Fund at a $3.2 billion valuation. Earlier backers of the company, including Founders Fund, DST Global, Cherubic Ventures, Susa Ventures and SF Express all participated in the round.

Here’s your weekly reminder to send me tips, suggestions and more to kate.clark@techcrunch.com or @KateClarkTweets.

Menlo Ventures has a new $500 million late-stage fund. Dubbed its “inflection” fund, it will be investing between $20 million and $40 million in companies that are seeing at least $5 million in annual recurring revenue, growth of 100 percent year-over-year, early signs of retention and are operating in areas like cloud infrastructure, fintech, marketplaces, mobility and SaaS. Plus, Allianz X, the venture capital arm attached to German insurance giant Allianz, has increased the size of its fund to $1.1 billion and London’s Entrepreneur First brought in $115 million for what is one of the largest “pre-seed” funds ever raised.

Flipkart co-founder invests $92M in Ola

Redis Labs raises a $60M Series E round

Chinese startup Panda Selected nabs $50M from Tiger Global

Image recognition startup ViSenze raises $20M Series C

Circle raises $20M Series B to help even more parents limit screen time

Showfields announces $9M seed funding for a flexible approach to brick-and-mortar retail

Podcasting startup WaitWhat raises $4.3M

Zoba raises $3M to help mobility companies predict demand

Indian delivery men working with the food delivery apps Uber Eats and Swiggy wait to pick up an order outside a restaurant in Mumbai. ( INDRANIL MUKHERJEE/AFP/Getty Images)

According to Indian media reports, Uber is in the final stages of selling its Indian food delivery business to local player Swiggy, a food delivery service that recently raised $1 billion in venture capital funding. Uber Eats plans to sell its Indian food delivery unit in exchange for a 10 percent share of Swiggy’s business. Swiggy was most recently said to be valued at $3.3 billion following that billion-dollar round, which was led by Naspers and included new backers Tencent and Uber investor Coatue.

Lalamove, a Hong Kong-based on-demand logistics startup, is the latest venture-backed business to enter the unicorn club with the close of a $300 million Series D round this week. The latest round is split into two, with Hillhouse Capital leading the “D1” tranche and Sequoia China heading up the “D2” portion. New backers Eastern Bell Venture Capital and PV Capital and returning investors ShunWei Capital, Xiang He Capital and MindWorks Ventures also participated.

Longtime investor Keith Rabois is joining Founders Fund as a general partner. Here’s more from TechCrunch’s Connie Loizos: “The move is wholly unsurprising in ways, though the timing seems to suggest that another big fund from Founders Fund is around the corner, as the firm is also bringing aboard a new principal at the same time — Delian Asparouhov — and firms tend to bulk up as they’re meeting with investors. It’s also kind of time, as these things go. Founders Fund closed its last flagship fund with $1.3 billion in 2016.”

If you enjoy this newsletter, be sure to check out TechCrunch’s venture capital-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I discuss Pinterest’s IPO, DoorDash’s big round and SoftBank’s upset LPs.

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico

We’re three weeks into January. We’ve recovered from our CES hangover and, hopefully, from the CES flu. We’ve started writing the correct year, 2019, not 2018.

Venture capitalists have gone full steam ahead with fundraising efforts, several startups have closed multi-hundred million dollar rounds, a virtual influencer raised equity funding and yet, all anyone wants to talk about is Slack’s new logo… As part of its public listing prep, Slack announced some changes to its branding this week, including a vaguely different looking logo. Considering the flack the $7 billion startup received instantaneously and accusations that the negative space in the logo resembled a swastika — Slack would’ve been better off leaving its original logo alone; alas…

On to more important matters.

Rubrik more than doubled its valuation

The data management startup raised a $261 million Series E funding at a $3.3 billion valuation, an increase from the $1.3 billion valuation it garnered with a previous round. In true unicorn form, Rubrik’s CEO told TechCrunch’s Ingrid Lunden it’s intentionally unprofitable: “Our goal is to build a long-term, iconic company, and so we want to become profitable but not at the cost of growth,” he said. “We are leading this market transformation while it continues to grow.”

Deal of the week: Knock gets $400M to take on Opendoor

Will 2019 be a banner year for real estate tech investment? As $4.65 billion was funneled into the space in 2018 across more than 350 deals and with high-flying startups attracting investors (Compass, Opendoor, Knock), the excitement is poised to continue. This week, Knock brought in $400 million at an undisclosed valuation to accelerate its national expansion. “We are trying to make it as easy to trade in your house as it is to trade in your car,” Knock CEO Sean Black told me.

While we’re on the subject of VCs’ favorite industries, TechCrunch cybersecurity reporter Zack Whittaker highlights some new data on venture investment in the industry. Strategic Cyber Ventures says more than $5.3 billion was funneled into companies focused on protecting networks, systems and data across the world, despite fewer deals done during the year. We can thank Tanium, CrowdStrike and Anchorfree’s massive deals for a good chunk of that activity.

Send me tips, suggestions and more to kate.clark@techcrunch.com or @KateClarkTweets.

I would be remiss not to highlight a slew of venture firms that made public their intent to raise new funds this week. Peter Thiel’s Valar Ventures filed to raise $350 million across two new funds and Redpoint Ventures set a $400 million target for two new China-focused funds. Meanwhile, Resolute Ventures closed on $75 million for its fourth early-stage fund, BlueRun Ventures nabbed $130 million for its sixth effort, Maverick Ventures announced a $382 million evergreen fund, First Round Capital introduced a new pre-seed fund that will target recent graduates, Techstars decided to double down on its corporate connections with the launch of a new venture studio and, last but not least, Lance Armstrong wrote his very first check as a VC out of his new fund, Next Ventures.

More money goes toward scooters

In case you were concerned there wasn’t enough VC investment in electric scooter startups, worry no more! Flash, a Berlin-based micro-mobility company, emerged from stealth this week with a whopping €55 million in Series A funding. Flash is already operating in Switzerland and Portugal, with plans to launch into France, Italy and Spain in 2019. Bird and Lime are in the process of raising $700 million between them, too, indicating the scooter funding extravaganza of 2018 will extend into 2019 — oh boy!

TechCrunch’s Josh Constine introduced readers to Squad this week, a screensharing app for social phone addicts.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase editor-in-chief Alex Wilhelm and I marveled at the dollars going into scooter startups, discussed Slack’s upcoming direct listing and debated how the government shutdown might impact the IPO market.

Powered by WPeMatico