Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

In a message posted to its internal communications channel earlier this week, the massive startup accelerator Y Combinator said it will change the terms of its own PPP (the YC pro rata investment program) and investing in companies raising seed and Series A rounds on a case-by-case basis.

The company began a policy of investing in every seed and Series A round for its portfolio companies back in 2015.

Since then, it has taken a 7% stake in every company that raised a priced seed and Series A round, investing in more than 300 Y Combinator companies over nearly 500 rounds.

Under its new policy, the accelerator is reducing its investment size from 7% to 4% and is only investing on a case-by-case basis going forward.

The reason for the change is that the number of companies in its portfolio has gotten too large for it to invest and some of the limited partners who back the accelerator’s operations are balking at making commitments to the pro rata investment program.

“We have significantly exceeded the funds we raised for pro ratas, and the investors who support YC do not have the appetite to fund the pro rata program at the same scale,” the accelerator wrote in a post seen by TechCrunch. “In addition, processing hundreds of follow-on rounds per year has created significant operational complexities for YC that we did not anticipate. Said simply, investing in every round for every YC company requires more capital than we want to raise and manage. We always tell startups to stay small and manage their budgets carefully. In this instance, we failed to follow our own advice.”

For entrepreneurs who take investments from the accelerator, the change is pretty significant. On the accelerator’s internal messaging board they worried about the potential optics of having the accelerator not make a follow-on commitment.

YC addressed those concerns by saying it would not make an investment decision until a company had already received an initial term sheet from a lead investor.

The changes will take effect on May 8, 2020, the investor said.

“In the future, we will no longer invest automatically in every priced seed and Series A/B round. Instead, we will exercise pro rata rights on a case-by-case basis, like other investors on your cap table,” the accelerator wrote. “We’ve heard your feedback that YC’s pro rata allocation is bigger than what some of you would prefer. So for those investments we do make, we will reduce the size of our pro rata and simplify its calculation to be a flat 4% participation right in each priced round. To calculate the size of YC’s pro rata investment in your round, simply multiply the amount of capital you are raising by 4%. If our ownership right before the round is less than 4%, we will cap our investment in the round at our then-current ownership. Our intention is not to have a super pro-rata right.”

Even with the reduced investment size, YC said it would only make investments in roughly one-third of its portfolio.

“The YC Continuity team will manage these investment decisions and will work very hard to inform you within a day or two of receiving your materials,” the accelerator wrote. “We will honor any pending pro rata investments for term sheets signed before May 8. But we wanted to communicate this message broadly so that founders can plan accordingly.”

Powered by WPeMatico

US carrier Verizon* has splashed out to buy veteran B2B videoconferencing platform, BlueJeans Network — shelling out less than $500 million on the acquisition, according to the Wall Street Journal which first reported the news.

A Verizon spokeswoman confirmed to TechCrunch that the price-tag is sub-$500M but did not provide a more exact figure. Videoconferencing platform Blue Jeans has raised ~$175M since being founded around a decade ago, per Crunchbase, with US investor NEA leading a Series E round back in 2015.

In a press release announcing the deal, Verizon said it has entered into a definitive agreement to acquire the enterprise-grade videoconferencing and event platform in order to expand its “immersive unified communications portfolio”.

“Customers will benefit from a BlueJeans enterprise-grade video experience on Verizon’s high-performance global networks. In addition, the platform will be deeply integrated into Verizon’s 5G product roadmap, providing secure and real-time engagement solutions for high growth areas such as telemedicine, distance learning and field service work,” it wrote.

“As the way we work continues to change, it is absolutely critical for businesses and public sector customers to have access to a comprehensive suite of offerings that are enterprise ready, secure, frictionless and that integrate with existing tools,” added Tami Erwin, CEO of Verizon Business, in a supporting statement. “Collaboration and communications have become top of the agenda for businesses of all sizes and in all sectors in recent months. We are excited to combine the power of BlueJeans’ video platform with Verizon Business’ connectivity networks, platforms and solutions to meet our customers’ needs.”

The acquisition comes at a time when videoconferencing is seeing a massive uptick in usage as white collar workers around the world log on to meetings from home during the coronavirus pandemic.

Although it’s BlueJeans’ rival, Zoom, that’s been the most high profile name linked to the viral videoconferencing boom in recent weeks. The latter recently revealed that daily meeting participants on its platform jumped from a modest 10M in December to 200M in March.

However such booming growth and consumer usage has brought increased scrutiny for Zoom — leading to a spate of warnings (and even some bans), related to security and privacy concerns. And earlier this month the company said it would freeze product dev to focus on the laundry list of issues that have surfaced as users have piled in and kicked its tires, taking a little of the shine off of surging growth.

On the sheer usage front BlueJeans is certainly small fish in comparison to Zoom — having remained b2b focused. A BlueJeans spokeswoman told us it has more than $100M ARR and over 15,000 customers at this point. (Some notable users include Facebook and Disney.)

But it’s paying users that are likely of most interest to Verizon, hence talk of telemedicine, distance learning and field service work — areas ripe for coronavirus-accelerated digitization. Carriers generally, meanwhile, haven’t been able to translate increased usage during the pandemic into a revenue growth story — as a result of a combination of fixed costs, debt and market disruption that’s been hitting their shares during the coronavirus crisis, per Reuters. Bolting on more b2b tools looks to be one way of growing network revenues.

“The combination of BlueJeans’ world class enterprise video collaboration platform and trusted brand with Verizon Business’ next generation edge computing innovation will deliver highly differentiated and compelling solutions to our joint customers,” said Quentin Gallivan, BlueJeans CEO, in a statement. “We are very excited about joining the Verizon team and we truly believe the future of business communications starts today!”

Verizon said today that said BlueJeans founders and “key management” will join the company as part of the acquisition, with BlueJeans employees set to become Verizon employees immediately following the close of the deal — which is expected in the second quarter, pending customary closing conditions.

BlueJeans co-founder Krish Ramakrishnan has a history of exits, selling a couple of his previous startups to networking giant Cisco — where he has also worked, in between spinning out his own companies.

*Disclosure: Verizon is also TechCrunch’s parent company

Powered by WPeMatico

Airwallex, a Melbourne-based cross-border financial startup that achieved “unicorn” status last year, announced today that it has raised a $160 million Series D. The round included ANZi Ventures, the investment arm of ANZ Bank, and Salesforce Ventures, along with returning investors DST Global, Tencent, Sequoia Capital China, Hillhouse Capital and Horizons Ventures.

Founded in 2015, the company’s financial services include foreign currency accounts that let businesses receive money from around the world. Airwallex’s system uses inter-bank exchanges to trade foreign currencies at a mid-market rate and targets companies that do business in several different countries. The new funding will be used on potential acquisitions; expansion in American, European and Middle Eastern markets; and the launch of new products, including payment acceptance tools.

Airwallex reached a valuation of more than $1 billion last year when it closed its Series C funding, and has now raised a total of $360 million. Since that round, it has launched new operations in Tokyo, Bangalore and Dubai, and introduced products including Airwallex Borderless Cards in partnership with Visa and integration with accounting platform Xero. The company also now offers an API that enables companies to issue their own virtual cards.

In a press statement, Salesforce Ventures’ head of Australia Rob Keith said, “Being able to transact and do business with customers all over the world is a key criteria for companies who are going through a digital transformation. We’re excited to partner with Airwallex at this critical time in its growth, expanding both its footprint globally and its product capabilities.”

Other startups that have also raised funding to help small to medium-sized businesses deal with the challenges of doing trade in different currencies include Brex, another unicorn, and Hong Kong-based Neat.

Powered by WPeMatico

Earlier today a grip of new data presented a sharply negative picture of the American economy. And this afternoon, news broke that a trio of well-known, heavily-backed unicorns were cutting staff.

With stocks down as well, we’ve received negative signals from the private market, the public market and the economy as a whole in the same day. Let’s take a minute to set the macro stage, and then go over the latest cuts from Carta (first reported by Bloomberg), Zume (Business Insider broke that particular story) and Opendoor (via The Information).

The backdrop for today’s cuts is a faltering American economy. A glance at recent news is sufficient. In the last few hours, home builder confidence recorded the “biggest drop in history,” while retail sales fell 8.7% in March, what CNBC noted was “the most ever in government data,” and CNN Business reported that American factories’ output fell 5.4% in March, “their steepest one-month slowdown since 1946.”

It’s perhaps no surprise, then, that we’ve seen unicorn layoffs all year. In January the news was Vision Fund-backed companies cutting burn to skate closer to profitability. Then, the first round of COVID-19-forced staff cuts landed at big companies; firms like Bird and TripActions slashed staff as their companies were rent by a slowdown in their core operations by the pandemic and its related economic and social changes.

Slimmer cuts at smaller companies have happened on a nearly chronic basis, something that TechCrunch has covered, as well.

Today, however, saw three cuts from three unicorns (private companies worth $1 billion or more) that have long been objects of TechCrunch’s attention. So, let’s talk about them briefly:

It’s getting hard to keep track of all the cuts. Heck, I helped break Modsy layoffs recently with TechCrunch’s Natasha Mascarenhas, and we were first to the BounceX cuts as well. It’s a rough, bad economy, and it’s harming growth-oriented companies that like startup unicorns.

More when we have it, probably sooner than we’d like to report.

Powered by WPeMatico

Mobile messaging startup Attentive continues to bring in new funding.

The startup raised a $40 million Series B last summer, followed by a $70 million Series C at the beginning of this year. Today it’s announcing that it’s extended the Series C by another $40 million, bringing the total round size to $110 million.

CEO Brian Long (who previously founded TapCommerce with his Attentive co-founder Andrew Jones and sold the company to Twitter) told me that the new funding closed just a week ago. He said the money comes from institutional investors who had wanted to participate in the Series C, but “for whatever reason, the timing didn’t work out.”

Then, as the startup wanted to invest in new areas — particularly in response to the COVID-19 pandemic — Long reached out again. Once they saw Attentive’s numbers for the first quarter of 2020, the firms were willing to invest.

Apparently, the number of new customer sign-ups is only increasing, with Attentive now working with more than 1,000 businesses. Companies like Coach, Urban Outfitters, CB2, PacSun, Lulus and Jack in the Box use the platform to manage their mobile messaging, with tools around adding text message subscribers, creating engaging messages and tracking the results of those campaigns.

And while we’re at the beginning of what’s likely to be a dramatic slowdown in advertising and marketing, Long suggested that even if businesses pull back on acquiring new customers, they’ll still need to maintain a relationship with existing ones.

“CRM is such a critical channel for companies … email and text are the last thing you would shut down,” he said.

Sequoia Capital Global Equities and Coatue are the new investors in the Series C. Sequoia’s venture fund already led (or co-led) the Series C and the Series B, but Long said he was interested in working with the firm’s crossover fund — and with Coatue — partly because they invest in public companies as well.

Not that he has immediate plans for Attentive to go public, but he said, “It just creates optionality,” so that there are fewer financial pressures regardless of the route the company takes.

Other investors in the Series C include IVP, Bain Capital Ventures, NextView Ventures, Eniac Ventures and High Alpha.

“Attentive’s rapid growth is an indicator of how consumers are eager to find a more direct, personalized and efficient channel to interact with businesses,” said Jeff Wang, managing partner at Sequoia Capital Global Equities, in a statement. “We’ve been impressed by how quickly Attentive’s business has scaled, its strong customer momentum, and the expertise of the team. We are thrilled to increase Sequoia’s partnership with Attentive through our Global Equities fund.”

As for how Attentive is responding to COVID-19, the startup plans to create funds to help customers navigate the economic fallout. There will be more details released in the coming weeks, but Long said the idea is to launch funds focused on the e-commerce/retail, food/beverage and educational sectors, providing free access to Attentive tools and services “to help those companies get recharged.”

Long added that he hopes to grow Attentive’s headcount from 260 employees to more than 400 by the end of this year.

Powered by WPeMatico

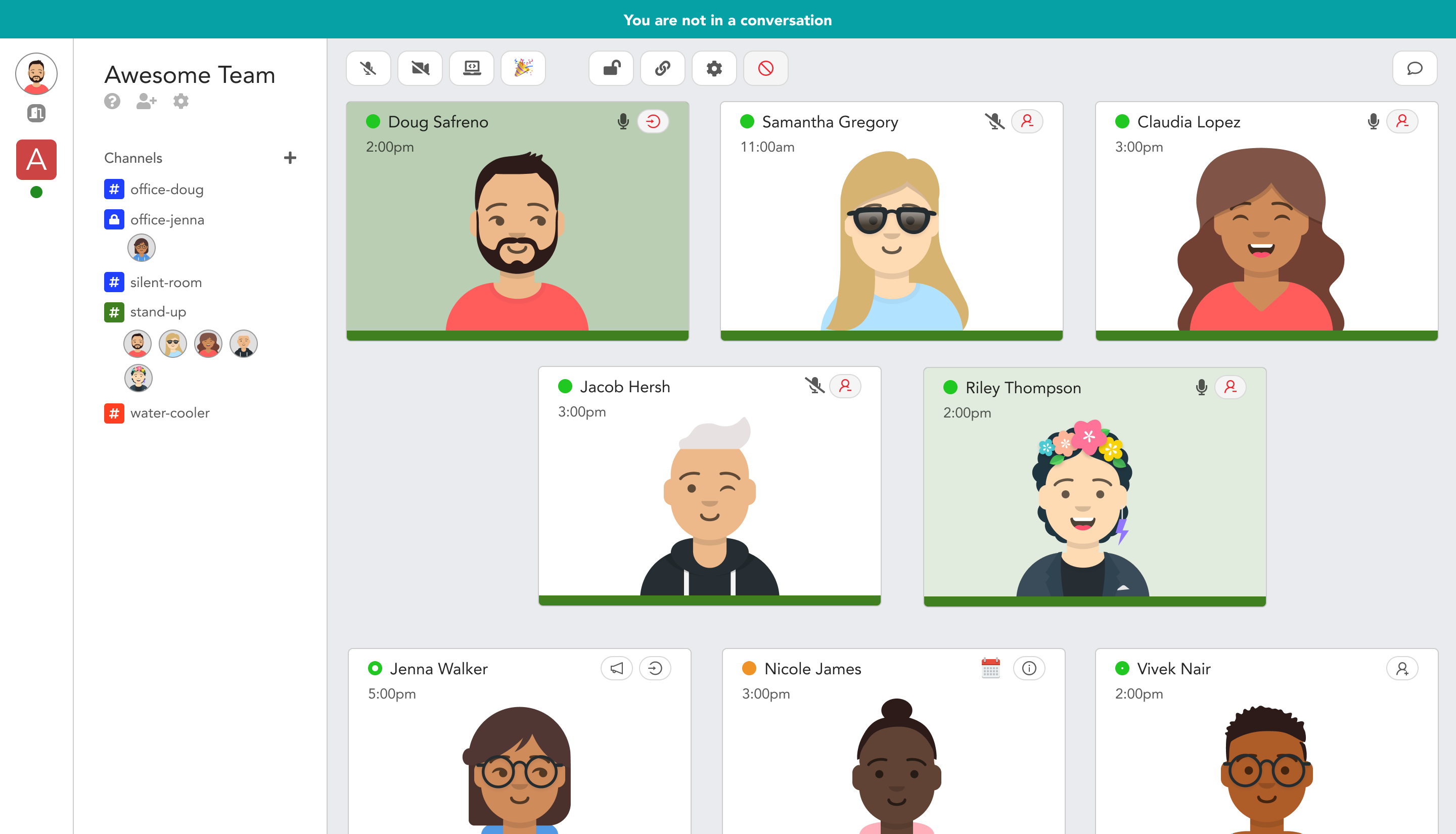

Could avatars that show what co-workers are up to save work-from-home teams from constant distraction and loneliness? That’s the idea behind Pragli, the Bitmoji for the enterprise. It’s a virtual office app that makes you actually feel like you’re in the same building.

Pragli uses avatars to signal whether co-workers are at their desk, away, in a meeting, in the zone while listening to Spotify, taking a break at a digital virtual water coooler or done for the day. From there, you’ll know whether to do a quick ad hoc audio call, cooperate via screenshare, schedule a deeper video meeting or a send a chat message they can respond to later. Essentially, it translates the real-word presence cues we use to coordinate collaboration into an online workplace for distributed teams.

“What Slack did for email, we want to do for video conferencing,” Pragli co-founder Doug Safreno tells me. “Traditional video conferencing is exclusive by design, whereas Pragli is inclusive. Just like in an office, you can see who is talking to who.” That means less time wasted planning meetings, interrupting colleagues who are in flow or waiting for critical responses. Pragli offers the focus that makes remote work productive with the togetherness that keeps everyone sane and in sync.

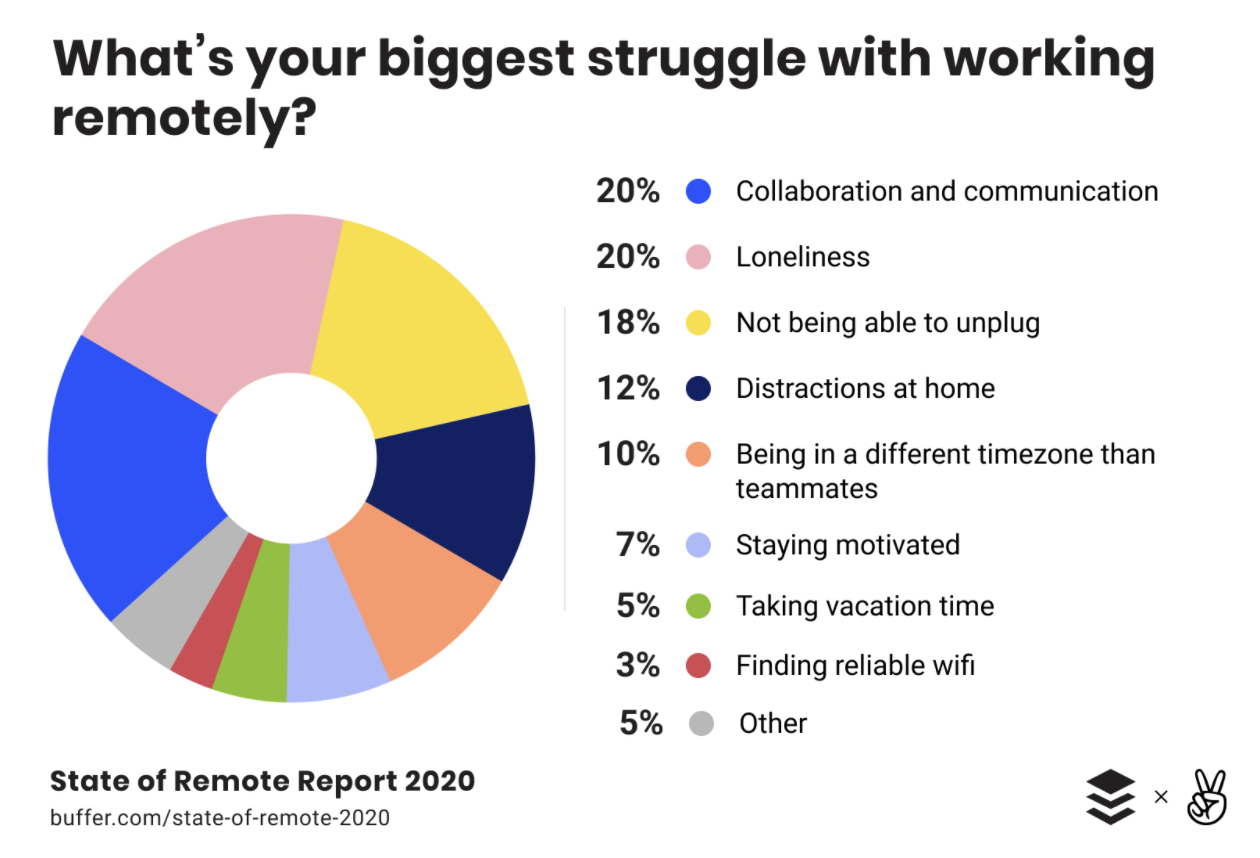

The idea is to solve the top three problems that Pragli’s extensive interviews and a Buffer/AngelList study discovered workers hate:

You never have to worry about whether you’re intruding on someone’s meeting, or if it’d be quicker to hash something out on a call instead of vague text. Avatars give remote workers a sense of identity, while the Pragli water cooler provides a temporary place to socialize rather than an endless Slack flood of GIFs. And because you clock in and out of the Pragli office just like a real one, co-workers understand when you’ll reply quickly versus when you’ll respond tomorrow unless there’s an emergency.

“In Pragli, you log into the office in the morning and there’s a clear sense of when I’m working and when I’m not working. Slack doesn’t give you a strong sense if they’re online or offline,” Safreno explains. “Everyone stays online and feels pressured to respond at any time of day.”

Pragli co-founder Doug Safreno

Safreno and his co-founder Vivek Nair know the feeling first-hand. After both graduating in computer science from Stanford, they built StacksWare to help enterprise software customers avoid overpaying by accurately measuring their usage. But when they sold StacksWare to Avi Networks, they spent two years working remotely for the acquirer. The friction and loneliness quickly crept in.

They’d message someone, not hear back for a while, then go back and forth trying to discuss the problem before eventually scheduling a call. Jumping into synchronous communicating would have been much more efficient. “The loneliness was more subtle, but it built up after the first few weeks,” Safreno recalls. “We simply didn’t socially bond while working remotely as well as in the office. Being lonely was de-motivating, and it negatively affected our productivity.”

The founders interviewed 100 remote engineers, and discovered that outside of scheduled meetings, they only had one audio or video call with co-workers per week. That convinced them to start Pragli a year ago to give work-from-home teams a visual, virtual facsimile of a real office. With no other full-time employees, the founders built and released a beta of Pragli last year. Usage grew 6X in March and is up 20X since January 1.

Today Pragli officially launches, and it’s free until June 1. Then it plans to become freemium, with the full experience reserved for companies that pay per user per month. Pragli is also announcing a small pre-seed round today led by K9 Ventures, inspired by the firm’s delight using the product itself.

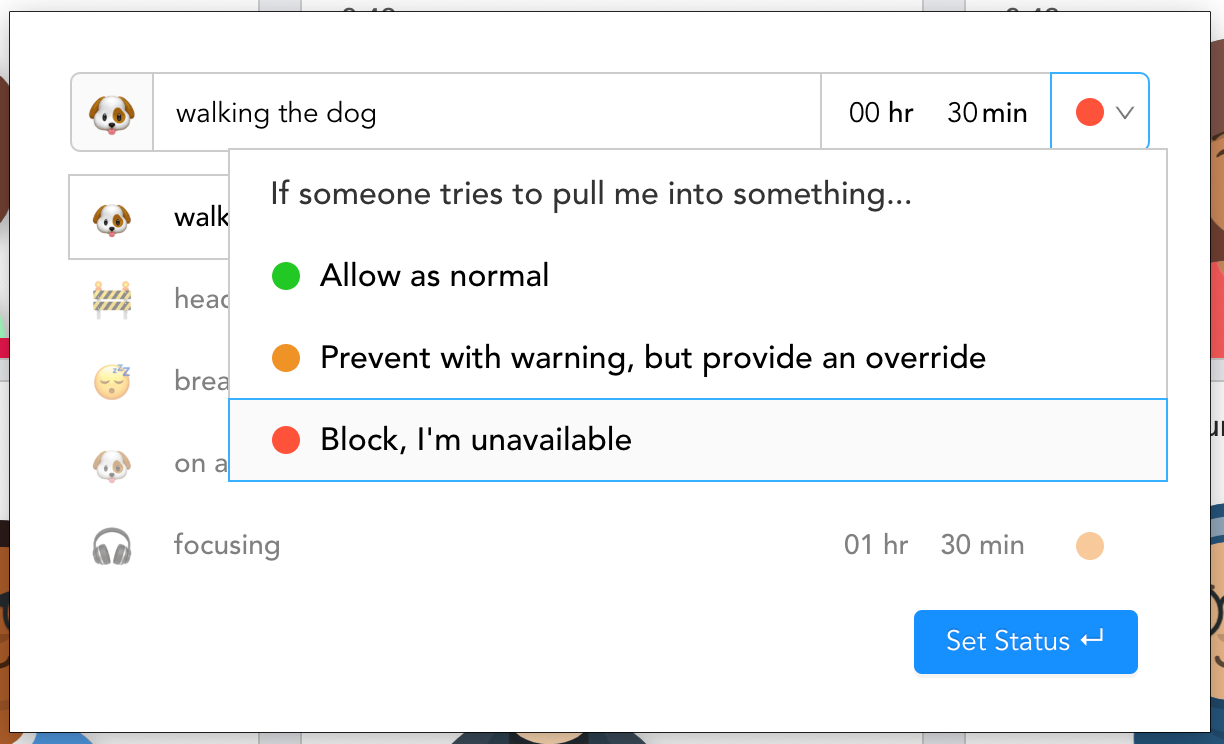

To get started with Pragi, teammates download the Pragli desktop app and sign in with Google, Microsoft or GitHub. Users then customize their avatar with a wide range of face, hair, skin and clothing options. It can use your mouse and keyboard interaction to show if you’re at your desk or not, or use your webcam to translate occasional snapshots of your facial expressions to your avatar. You can also connect your Spotify and calendar to show you’re listening to music (and might be concentrating), reveal or hide details of your meeting and decide whether people can ask to interrupt you or that you’re totally unavailable.

![]()

From there, you can by audio, video or text communicate with any of your available co-workers. Guests can join conversations via the web and mobile too, though the team is working on a full-fledged app for phones and tablets. Tap on someone and you can instantly talk to them, though their mic stays muted until they respond. Alternatively, you can jump into Slack-esque channels for discussing specific topics or holding recurring meetings. And if you need some down time, you can hang out in the water cooler or trivia game channel, or set a manual “away” message.

Pragli has put a remarkable amount of consideration into how the little office social cues about when to interrupt someone translate online, like if someone’s wearing headphones, in a deep convo already or if they’re chilling in the microkitchen. It’s leagues better than having no idea what someone’s doing on the other side of Slack or what’s going on in a Zoom call. It’s a true virtual office without the clunky VR headset.

“Nothing we’ve tried has delivered the natural, water-cooler-style conversations that we get from Pragli,” says Storj Labs VP of engineering JT Olio. “The ability to switch between ‘rooms’ with screen sharing, video and voice in one app is great. It has really helped us improve transparency across teams. Plus, the avatars are quite charming as well.”

With Microsoft’s lack of social experience, Zoom consumed with its scaling challenges and Slack doubling down on text as it prioritizes Zoom integration over its own visual communication features, there’s plenty of room for Pragli to flourish. Meanwhile, COVID-19 quarantines are turning the whole world toward remote work, and it’s likely to stick afterwards as companies de-emphasize office space and hire more abroad.

The biggest challenge will be making comprehensible enough to onboard whole teams such a broad product encompassing every communication medium and tons of new behaviors. “How do you build a product that doesn’t feel distracting like Slack but where people can still have the spontaneous conversations that are so important to companies innovating?,” Safreno asks. The Pragli founders are also debating how to encompass mobile without making people feel like the office stalks them after hours.

“Long-term, [Pragli] should be better than being in the office because you don’t actually have to walk around looking for [co-workers], and you get to decide how you’re presented,” Safreno concludes. “We won’t quit, because we want to work remotely for the rest of our lives.”

Powered by WPeMatico

Frank, a New York-based student-facing startup, has raised $5 million in what the company described as an “interim strategic round” that Chegg, a public edtech company, took part in. According to Frank founder and CEO Charlie Javice, previous investors Aleph and Marc Rowan took part in the round alongside new investor GingerBread Capital.

The education funding-focused startup last raised known capital in December of 2017, when it closed a $10 million Series A. Frank raised a seed round earlier that same year worth $5.5 million.

According to Javice, her firm closed its round in early March, before the recent market carnage. Bearing in mind that there is always lag between when a funding round is closed and when it is announced, the new Frank round is on the fresher side of things. Most rounds are a bit more like Shippo’s recent investment (closed in December, announced in April) than Podium’s recent deal, which it started raising in mid-February of this year.

Timing aside, what Frank is doing is interesting, so let’s talk about its business, how it approached 2019 and how it’s faring in today’s changed market.

To help keep student debt low, Frank is a bit akin to TurboTax for college money, as TechCrunch wrote when covering its Series A, helping students get through a thicket of forms and aid to collect as much aid as possible while avoiding borrowing.

American higher education is too expensive, and applying for financial help is irksome and byzantine. I can safely report that sans quoting an expert, as I had to go through it as a student and only finished paying my student loans last July.

Frank wants to help make college more affordable, with the company noting in a call with TechCrunch that there’s been a good number of companies working to help students service debt in a less expensive way after they’ve hired the money; it wants to help students avoid taking on so much red ink in the first place.

According to Javice, lots of students fail to finish signing up for federal aid programs, and some students wind up dropping out of programs before finishing them, leaving them saddled with debt but no degree. That’s a hell of a trap to wind up in, as student loans are the barnacles of the financial world — incredibly hard to get rid of.

According to Javice, Frank was a little early to rethinking its own growth/profit trade-off than the rest of the startup world, which woke up when WeWork filed to go public and was quickly booed off Wall Street. In mid-2019, Frank slowed growth to get closer to the margins it wanted. (Thinking out loud, this is probably how the startup managed to survive so long off its December 2017 Series A.)

Indeed, according to Frank’s CEO, it was in a comfortable cash position before this round, which she described as more a vote of confidence than a round of necessity.

Which brings us to today, and the new, COVID-19 world. In an email to TechCrunch, Javice said that “like everyone else,” her company is “adjusting to the new realities.” She added that college and university attendance “has typically been countercyclical” and that her company is “seeing a large demand for higher education and specifically financial aid.”

If the new economy winds up creating a little tailwind for Frank, it won’t be the only startup to accrue help; Slack and Zoom and other remote work-friendly companies have also seen their fortunes turn for the better in recent weeks. And now with $5 million more on hand, it can certainly meet new demand.

Update: An earlier version of this article listed Chegg as the round’s lead investor; it did receive a board seat in the transaction but Frank does not consider it a lead investor. The post has been amended.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

TechCrunch is taking a closer look at a few markets as the world changes. Following our dive into Boston late last week, we’re widening our scope and taking a peek at the state of Utah.

Utah’s startup scene has been in the news lately, with one of its better-known successes Podium raising $125 million, for example. The round valued Podium at around $1.5 billion, a healthy valuation for the company which recently reached $100 million ARR.

To get a handle on what’s going on in Utah, TechCrunch spoke with Qualtrics’ CEO and co-founder Ryan Smith about his home state. We’ve also snagged some recent news and venture data and taken a look at what the tech companies of Silicon Slopes are doing as a group. Let’s explore.

Powered by WPeMatico

Good morning friends, and welcome back to TechCrunch’s Equity Monday, a short-form audio hit to kickstart your week.

Before we jump into today’s show, don’t forget that the long-form Equity that started in the unicorn era and continue in today’s changed world still drops on Friday. We had a blast last week, so make sure to catch up.

That said, there was a lot to go over this morning, so let’s get into what we had to discuss:

And that’s the show for today. Stay safe, and we’ll be back Friday morning to cap off whatever this week winds up becoming.

Equity drops every Monday at 7:00 AM PT and Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Earlier this week TechCrunch caught up with Union Square Ventures‘ (USV) Albert Wenger. Wenger, a managing partner at the venture firm, is well-known in the New York startup scene. USV has invested in former startups like Twitter, Twilio, Etsy and Cloudflare.

TechCrunch is touching base with a number of investors during the COVID-19-driven economic slowdown. Everyone is already at home, in front of a computer, so why not get them on the phone? (Follow @TechCrunch for updates, we’re keeping the series alive over the next few weeks with more neat guests.)

We wanted to know what Wenger thought about the level of fear in his local market, and how much cash startups should hold during the COVID-19 era. On the latter point, Wenger noted that each company’s present situation is suitably diverse as to avoid any single rule, but implied that companies with healthy backers don’t have to hold as much cash, as they have access to more; the weaker a startup’s investing syndicate is, the more cash it should hold, as that might be all the money it has access to.

We also took time to talk about PPP loans, and what types of startups should apply for them, a subject that Wenger has written about. There’s a moral point in the discussion that’s worth understanding.

We also took a number of questions from folks tuned in on Zoom during the call and generally had a good time. We’ve preserved the audio, so take a listen. If you wanted to see the video of TechCrunch’s Jordan Crook and Alex Wilhelm talking to Wenger, every one of the three in a different state, you missed out. Come to our next public Zoom!

Powered by WPeMatico