Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Arculus, the Ingolstadt, Germany-based startup that has developed a “modular production platform” to bring assembly lines into the 21st century, has raised €16 million in Series A investment.

Leading the round is European venture firm Atomico, with participation from Visionaries Club and previous investor La Famiglia. Arculus says it will use the injection of capital to “strengthen product development, broaden customer base and prepare for a global rollout”.

As part of the investment, Atomico partner Siraj Khaliq is joining the Arculus board. (Khaliq seems to be on a bit of a run at the moment after quietly leading the firm’s investment in quantum computing company PsiQuantum last month.)

Founded in 2016, Arculus already works with some of the leading manufacturing companies across a range of industries. They include Siemens in robotics, heating, ventilation and air conditioning, Viessmann in logistics, and Audi in automotive.

Its self-described mission is to transform the “one-dimensional” assembly line of the 20th century into a more flexible modular production process that is capable of manufacturing today’s most complex products in a much more efficient way.

Instead of a single line with a conveyor belt, a factory powered by Arculus’ hardware and software is made up of modules in which individual tasks are performed and the company’s robots — dubbed “arculees” — move objects between these modules automatically based on which stations are free at that moment. Underlying this system is the assembly priority chart, a tree of interdependencies that connects all the processes needed to complete individual products.

That’s in contrast to more traditional linear manufacturing, which, claims Arculus, hasn’t been able to keep up as demand for customisation increases and “innovation cycles speed up”.

Explains Fabian Rusitschka, co-founder and CEO of Arculus: “Manufacturers can hardly predict what their customers will demand in the future, but they need to invest in production systems designed for specific outputs that will last for years. With Modular Production we can now ensure optimal productivity for our customers, whatever the volume or mix. This technological shift in manufacturing, from linear to bespoke, has been long overdue but for manufacturers looking ahead at the coming decades of shifting consumer buying behaviours it is mission critical to survival”.

To that end, Arculus is making some bold claims, namely that the company’s technology increases worker productivity by 30% and reduces space consumption by 20%. It also reckons it can save its customers up to €155 million per plant every year “at full implementation”.

Siraj Khaliq, Partner at Atomico, says the manufacturing sector “is huge and the inefficiencies are well known”.

“We estimate that the auto industry alone could save nearly $100bn, were all manufacturers to adopt Arculus’s modular production technology,” he tells TechCrunch. “And beyond auto, their technology applies to any linear/assembly line manufacturing process – in time perhaps a tenfold greater market still. We’ve already seen the Covid-19 crisis hugely boost interest in the wave of startups democratizing automation, as companies try to build resilience into their supply chains. If you’re an exec thinking through this kind of thing right now, the way we see it, using Arculus’s technology is just common sense”.

Asked why it is only now that assembly lines can be reinvented, the Atomico VC says a number of building blocks weren’t in place until now. They include cheap, versatile sensors, reliable connectivity, “sufficiently powerful compute resources”, machine vision, and “learning-driven” control systems.

“And even if the tech could have been deployed, the motivation doesn’t come until you buckle under the pressure of increasing product customisation,” he says. “High-speed linear production lines are pretty efficient if you’re only producing one thing, ideally in one colour. But as this has become less and less the case, the industry reacted by incrementally improving, such as adding sub-assemblies that feed into the main line. You can only go so far with that… to be really efficient you’ve got to start fresh and be modular from the ground up. That’s hard”.

Meanwhile, Arculus also counts a number of German entrepreneurs as previous backers. They include Hakan Koc (founder of Auto 1), Johannes Reck (founder of GetYourGuide), Valentin Stalf (founder of N26), as well as the founders of Flixbus.

Powered by WPeMatico

When Verizon (which owns this publication) announced it was buying video conferencing company BlueJeans for around $500 million last month, you probably thought it was going take awhile to bake, but the companies announced today that they has closed the deal.

While it’s crystal clear that video conferencing is a hot item during the pandemic, all sides maintained that this deal was about much more than the short-term requirements of COVID-19. In fact, Verizon saw an enterprise-grade video conferencing platform that would fit nicely into its 5G strategy around things like tele-medicine and online learning.

They believe these needs will far outlast the current situation, and BlueJeans puts them in good shape to carry out a longer-term video strategy, especially on the burgeoning 5G platform. As BlueJean’s CEO Quentin Gallivan and co-founders, Krish Ramakrishnan and Alagu Periyannan reiterated in a blog post today announcing the deal has been finalized, they saw a lot of potential for growth inside the Verizon Business family that would have been difficult to achieve as a stand-alone company.

“Today, organizations are relying on connectivity and digital communications now more than ever. As Verizon announced, adding BlueJeans’ trusted, enterprise-grade video conferencing and event platform to the company’s Advanced Communications portfolio is critical to keep businesses, from small organizations to some of the world’s largest multinational brands, operating at the highest level,” the trio wrote.

As Alan Pelz-Sharpe, founder and principal analyst at Deep Analysis told TechCrunch at the time of the acquisition announcement, Verizon got a good deal here.

Verizon is getting one of the only true enterprise-grade online conferencing systems in the market at a pretty low price,” he told TechCrunch. “On one level, all these systems do pretty much the same thing, but BlueJeans has always prided itself on superior sound and audio quality. It is also a system that scales well and can handle large numbers of participants as well, if not better, than its nearest competitors.

BlueJean brings with it 15,000 enterprise customers. It raised $175 million since its founding in 2009.

Powered by WPeMatico

A famous investor published notes today concerning its startup investments, detailing where they excelled and where they struggled. To understand why we care about this particular investor’s results, a little context helps.

The investor in question is Japanese telecom giant and startup benefactor SoftBank, which reported its fiscal year results this morning. SoftBank’s investments are famous because of its $100 billion Vision Fund effort, which saw it put capital to work in a host of private companies around the world in an aggressive manner.

The information it shared this morning included a slide deck detailing the conglomerate’s view of the future of unicorn health, and notes on the conclusion of the SoftBank Vision Fund’s investment into net-new companies.

SoftBank’s earnings have made headlines around the financial and technology press, especially regarding the performance of its investments into Uber, an American ride-hailing company, and WeWork, an American coworking startup. The former’s post-IPO performance has led to a lackluster outcome for SoftBank, while the implosion of WeWork after its failed IPO has continued; SoftBank’s results noted a new, lower value for WeWork.

The rest of the information painted a picture of mixed outcomes, with SoftBank recording wins in enterprise-focused deals and “Health Tech” investments. Other invested sectors saw less salubrious results, including the three we’ll focus on today: consumer-focused deals, transit-related investments and real estate-related outlays.

Let’s explore what SoftBank had to say about each. Then we’ll see what we can infer about the broader startup market itself.

SoftBank’s Vision Fund made big bets into Uber and WeWork, two companies that fit into the sectors we are exploring. To provide investors with clarity of its outcomes outside of those two outsized and troubled bets, the company broke out sector performances less their outcomes.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Today we’re digging into SoftBank’s latest earnings slides. Not only do they contain a wealth of updates and other useful information, but some of them are gosh-darn-freaking hilarious. We all deserve a bit of levity after the last few months.

The visual elements we quote below come from SoftBank’s reporting of its own results from its fiscal year ending March 31, 2020. Much of the deck is made up of financial reporting tables and other bits of stuff you don’t want to read. We’ve cut all that out and left the fun parts.

Before we dive in, please note that we are largely giggling at some slide design choices and only somewhat at the results themselves. We are certainly not making fun of people who’ve been impacted by layoffs and other such things that these slides’ results encompass.

But we are going to have some fun with how SoftBank describes how it views the world, because how can we not? Let’s begin.

TechCrunch has a number of folks parsing SoftBank’s deck this morning, looking to do serious work. That’s not our goal. Sure, this post will tell you things like the fact that there are 88 companies in the Vision Fund portfolio, and that when it comes to unrealized gains and losses, the portfolio has seen $13.4 billion in gains and $14.2 billion in losses. $4.9 billion of gains have been realized, mind you, while just $200 million of losses have had the same honor.

And this post will tell you that the “net blended [internal rate of return] for SoftBank Vision Fund investors is -1%.”

Hell, you probably also want to know that Uber was detailed as Vision Fund’s worst-performing public company, generating a $1.46 billion loss for the group. In contrast, Guardant Health is good for a $1.67 billion gain, while 2019 IPO Slack has been good for $605 million in profits. Those were the two best companies in the Vision Fund’s public portfolio.

But what you really want is the good stuff. So, shared by slide number, here you go:

Powered by WPeMatico

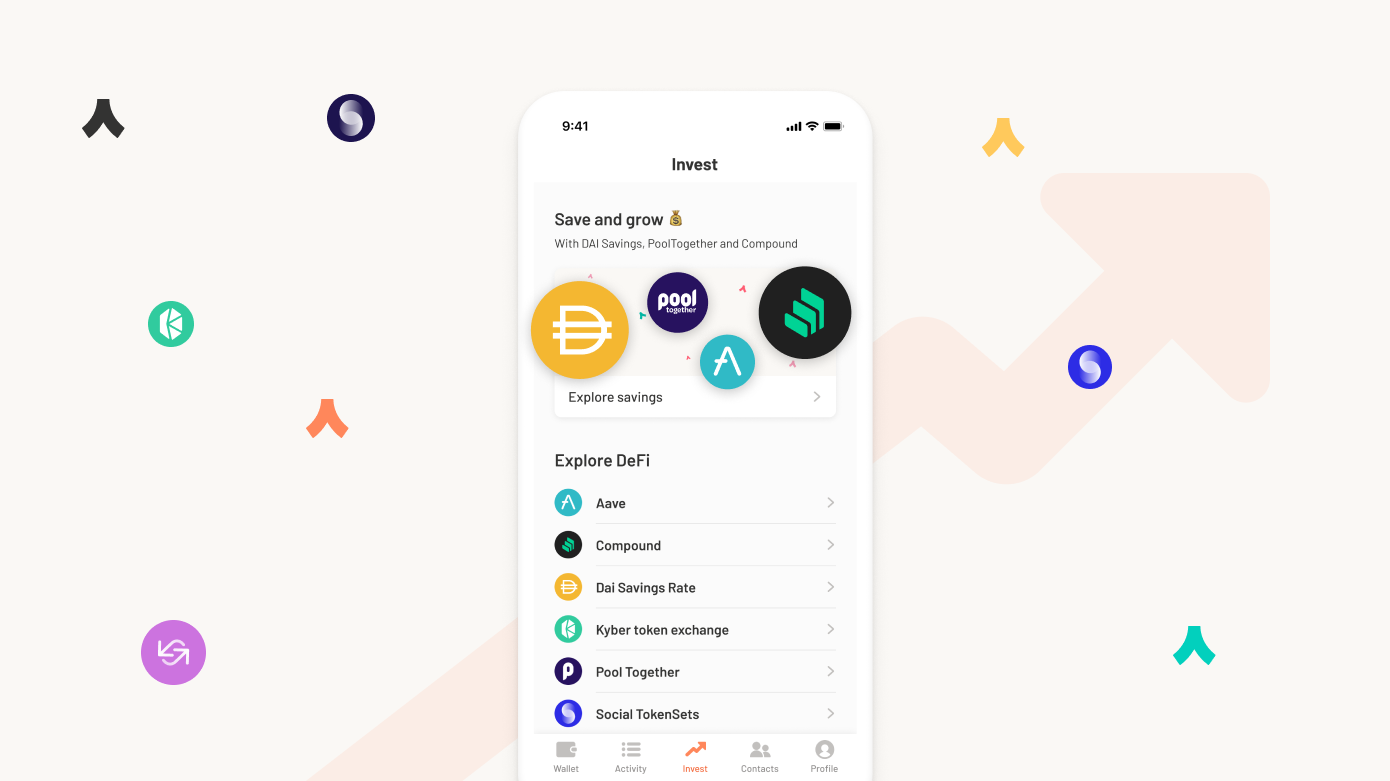

Argent is launching the first public version of its Ethereum wallet for iOS and Android. The company has been available as a limited beta for a few months with a few thousand users. But it has already raised a seed and a Series A round with notable investors, such as Paradigm, Index Ventures, Creandum and Firstminute Capital. Overall, the company has raised $16 million.

I managed to get an invitation to the beta a few months ago and have been playing around with it. It’s a well-designed Ethereum wallet with some innovative security features. It also integrates really well with DeFi projects.

Many people leave their crypto assets on a cryptocurrency exchange, such as Coinbase or Binance. But it’s a centralized model — you don’t own the keys, which means that an exchange could get hacked and you’d lose all your crypto assets. Similarly, if there’s a vulnerability in the exchange API or login system, somebody could transfer all your crypto assets to their own wallets.

At heart, Argent is a non-custodial Ethereum wallet, like Coinbase Wallet or Trust Wallet. You’re in control of the keys. Argent can’t initiate a transaction without your authorization for instance.

But that level of control brings a lot of complexities. Hardware wallets, such as Ledger wallets, ask you to write down a seed phrase so that you can recover your wallet if you lose your device. It requires some discipline and it’s hard to understand if you’re not familiar with the concept of seed phrases.

Even Coinbase Wallet tells you to back up your seed phrase when you first create a wallet. “We see them as advanced tools for developers,” Argent co-founder and CEO Itamar Lesuisse told me.

That’s why a new generation of wallets tries to hide the complexity from the end user, such as ZenGo and Argent. Creating a wallet on Argent is one of the best experiences in the cryptocurrency space. Your wallet is secured by something called ‘guardians’.

A guardian can be someone you know and trust, a hardware wallet (or another phone) or a MetaMask account. Argent also provides a guardian service, which requires you to confirm your identity with a text message and an email. If you lose your phone and you want to recover your wallet on another phone, you need to speak to your guardians and get a majority of confirmations. If they can all confirm that, yes, indeed, your phone doesn’t work anymore and you want to recover your crypto assets, the recovery process starts.

Let’s take an example. Here’s your list of guardians:

In total, there are five different factors involved, you including. If you lose your phone, you can recover your wallet by downloading Argent on another phone (factor #1), asking Argent’s guardian service to send you a text and an email to confirm your identity (factor #2) and confirming your identity with the Ledger Nano S (factor #3).

You have reached a majority and the recovery process starts. You’ll get your funds in 36 hours so that you have enough time to cancel it it’s a hijacking attempt.

But you could also have downloaded the Argent app on another phone (factor #1) and pinged your two friends (factor #2 and #3) directly. If they can confirm the same sequence of characters (emojis in that case), the recovery process would start as well.

“I’m interested in social recovery, multi-key schemes,” Ethereum creator Vitalik Buterin said in a TechCrunch interview in July 2018. It’s not a new concept as social media apps already use social recovery systems. On WeChat, if you lose your password, WeChat asks you to select people in your contact list within a big list of names.

In Argent’s case, social recovery adds an element of virality as well. The experience gets better as more people around you start using Argent.

In addition to wallet recovery, Argent uses guardians to put some limits. Just like you have some limits on your bank account, you can set a daily transaction limit to prevent attackers from grabbing all your crypto assets. You can ask your guardians to waive transactions above your daily limits.

Similarly, you can ask your guardians to lock your account for 5 days in case your phone gets stolen.

Argent is focused on the Ethereum blockchain and plans to support everything that Ethereum offers. Of course, you can send and receive ETH. And the startup wants to hide the complexity on this front as well as it covers transaction fees (gas) for you and gives you usernames. This way, you don’t have to set the transaction fees to make sure that it’ll go through.

The startup plans to integrate DeFi projects directly in the app. DeFi stands for decentralized finance. As the name suggests, DeFi aims to bridge the gap between decentralized blockchains and financial services. It looks like traditional financial services, but everything is coded in smart contracts.

There are dozens of DeFi projects. Some of them let you lend and borrow money — you can earn interest by locking some crypto assets in a lending pool for instance. Some of them let you exchange crypto assets in a decentralized way, with other users directly.

Argent lets you access TokenSets, Compound, Maker DSR, Aave, Uniswap V2 Liquidity, Kyber and Pool Together. And the company already has plans to roll out more DeFi features soon.

Overall, Argent is a polished app that manages to find the right balance between security and simplicity. Many cryptocurrency startups want to build the ‘Revolut of crypto’. And it feels like Argent has a real shot at doing just that with such a promising start.

Powered by WPeMatico

French startup Angell has signed a wide-ranging partnership with SEB, the French industrial company behind All-Clad, Krups, Moulinex, Rowenta, Tefal and others. As part of the deal, SEB will manufacture Angell’s electric bikes in a factory in Is-sur-Tille near Dijon, France.

SEB’s investment arm, SEB Alliance, is also investing in Angell . The terms of the deal are undisclosed, but Angell says it plans to raise between $7.6 and $21.7 million (between €7 and €20 million) with a group of investors that include SEB.

“We originally planned to manufacture 1,500 bikes in 2020,” Angell founder Marc Simoncini told me. “We realized that we were selling more bikes than expected. We now expect to sell 10,000 bikes.”

Angell has accepted 2,000 pre-orders over the past six months — 75% in France and 25% from the rest of the world. But pre-orders accelerated drastically with the lockdown in France. During the month of May, Angell expects to sell three times more bikes than during an average month.

Originally, Angell planned to build its own factory and assemble bikes itself. SEB is allocating 25 employees on the production line and production should start at the end of May. It should definitely make things move faster and reduce potential delays.

Angell unveiled its smart electric bike in November 2019. It has a 2.4-inch touch screen, an aluminum frame, integrated lights and a removable battery.

Like other connected bikes from Cowboy and VanMoof, it pairs with your phone using Bluetooth. This way, the Angell bike has an integrated lock and alarm system. There are also an integrated GPS chip and cellular modem to track it if it ever gets stolen.

But Angell is going one step further with the integrated display. You can select the level of assistance and display information on the screen, such as speed, calories, battery level and distance. It can also display turn-by-turn directions. Your handlebar also vibrates to indicate when you’re supposed to turn left or right.

The company is also announcing a second model this week, the Angell/S. It is a smaller, lighter version of the bike with a step-through frame. Both models feature the same battery, same motor and same electronics. They also both cost €2,690 ($2,900).

Angell now expects to deliver the first batch of bikes in July. By the end of the summer, new customers should be able to order a bike and get delivered within 10 days. Eventually, the company will also roll out a full line of accessories, such as fenders, baskets and mirrors.

Powered by WPeMatico

Earlier today, DigitalOcean announced that it raised $50 million more from prior investors Access Industries and Andreessen Horowitz. The capital comes after the SMB and developer-focused cloud infrastructure company raised nine-figures worth of debt back in February.

DigitalOcean is a large private company that generated revenue at a run rate of around $250 million towards the end of 2019. The company announced today that it has reached $300 million in annual recurring revenue, or ARR. (We recently added the company to our ARR club here.) That’s growth of around 20% in less than half a year, though we don’t know precisely when the company reached the $250 million mark, making it hard to calculate its true growth pace.

Critically, DigitalOcean is walking toward profitability while expanding.

DigitalOcean’s CEO Yancey Spruill told TechCrunch earlier this year that his firm would reach free cash flow positivity in the next few years, a timeline that appears to have moved up (more on that shortly). Provided that the cloud company can keep its growth pace up over the same time period, it could be well positioned for an IPO.

The new $50 million values the company at $1.15 billion, meaning it was worth $1.1 billion pre-money. DigitalOcean is not being valued like a SaaS startup today in revenue multiple terms, then, though its new valuation is still nearly double its old Series B valuation (a company spokesperson confirmed the numbers on that page).

TechCrunch wanted to know why the company raised equity capital so quickly after it had added debt to its books. The capital was surely welcome given the world’s economic condition, but the timing was worth digging into.

DigitalOcean was not “seeking additional funding,” according to Spruill, but after “reviewing our business performance and outlook with our investors at Access and a16z, they were interested in investing for our next phase of growth.” The company accepted, Spruill said.

Presumably, Digital Ocean’s quick revenue growth from a $250 million run rate to $300 million ARR played a part in the investment decision. For DigitalOcean, receiving a new, higher valuation and a monetary top-off from well-known investors may even provide a brand boost (see this article, especially in light of recent coverage the firm has attracted).

Regarding its plans for the new capital, Spruill told TechCrunch that DigitalOcean can now “better support the increase in demand we’ve seen from entrepreneurs and SMBs around the world as more businesses are transitioning to the cloud, particularly as a result of COVID.” Mark DigitalOcean down as one of the world’s companies that is seeing an uptick from the pandemic; most aren’t, but the firms that are appear to be using the moment to put more capital onto their balance sheets.

TechCrunch also wanted to know if the new capital opened new ground for the firm, or if its priorities for the new capital were similar to its preceding goals. The CEO told TechCrunch that his firm’s focus is the same, namely expanding its business.

“We remain committed to reaching $1 billion in revenue, achieving free cash flow profitability in the second half of this year and, ultimately, position DigitalOcean to be a public company,” Spruill said in an email.

That’s clear enough.

By that measure we can expect to see a DigitalOcean S-1 in the first half of 2021, if markets recover. So a16z and Access Industries (longtime investors in the company) could see a quick return for their most recent checks if current plans hold up.

The company’s release made note of “accelerating growth,” which TechCrunch wanted to know more about. How quickly is the company growing? Spruill didn’t share numbers to confirm or deny our rough math based on his firm’s public revenue milestones, but did tell TechCrunch that the company is “actively working on a number of initiatives to accelerate our revenue growth rate,” adding that these are internally dubbed “Grow Faster” initiatives.

Finally, TechCrunch was curious about the impact that COVID-19 is having on DigitalOcean. The company told us that it has “seen a modest increase in churn as a result of COVID-19,” but nothing too bad, saying that the change was “not significant” when “compared with recent trends immediately prior to the pandemic.”

On the positive side of the ledger, DigitalOcean said that its “sign up of new customers has been accelerating” and that it is seeing “increased business from some existing customers.” Adding that up for the SaaS kids: A little bit more churn, good new logo addition, and some upsell tailwinds. Overall that adds up to growth.

More when we have it, but now we’re at least set up to understand what the company does next.

Powered by WPeMatico

With the global economy still sorting itself out in the face of the pandemic, we’re hearing about fewer new venture capital funds these days. However, today is an exception, as Cathay Innovation has raised a $550 million second fund, which is about double the size of its first fund and, according to its leader Denis Barrier, is larger than the firm’s “original target.”

Cathay Innovation’s initial fund had some winners. The firm, which is part of the same org but distinct from private-equity outfit Cathay Capital, invested in Pinduoduo. The Chinese e-commerce giant raised money from Cathay Innovation when it was an early-stage startup. It’s worth around $70 billion today. Cathay Innovation’s first fund also led Chime’s Series B; that company is now worth nearly $6 billion.

We got on the horn with Barrier to learn a bit more about what’s changed for his firm and what its plans are for the new capital.

With its new fund, Barrier told TechCrunch that his firm’s model — target stage, target ownership percentage, etc. — isn’t changing. So if the model isn’t changing, why raise more money? What will it do with the surplus cash?

According to Barrier, two things. First, more money will allow the fund to follow winners a bit more over time. According to the VC, fund one might have put more capital into Pinduoduo and Chime if it had had the capacity to do so. Some venture firms use one-off special purpose vehicles (SPVs) for this sort of work. The other option is to raise a larger fund. And second, Barrier wants to do more deals in Southeast Asia.

This geographic expansion fits into Cathay Innovation’s model. The firm has offices around the world, and tries to share information from one geo to another. The goal is to learn from one and apply that knowledge elsewhere in order to spot impending trends in, say, America, after watching, say, China. The hope is that this sort of information sharing allows it to make earlier, better bets.

Indeed, this concept is something that Barrier has stressed to TechCrunch before. In our most recent chat he noted two examples of the concept in action. The first being that his firm saw the rise of neobanks (challenger banks) in Europe before they really got off the ground in the United States. Hence the Chime deal. And the Cathay Innovation executive noted that because his firm has an office in China, it had a 45-day advance on the rest of the world regarding COVID-19, giving it the chance to tell its portfolio companies what was coming.

It’s an interesting model that worked in its first fund; the real proof of the firm’s ability to see around corners will come with its second fund’s results. Given that this new capital vehicle is about twice as large as its first it has lots more returns to generate. It will need more breakout deals, and will need to ensure that it pours capital into them.

On that point, there is one more potential difference between the first and second funds. Barrier told TechCrunch that his team can now lead larger rounds if it wants. This could, again, help the firm get larger cuts of companies it believes will deliver outsize returns.

And for all the founders out there, Cathay Innovation says its investing pace is about the same as before, so if you are looking for capital, here’s a new fund that’s hunting for deals.

Powered by WPeMatico

It seems that we are in the middle of a mini acquisition spree for Kubernetes startups, specifically those that can help with Kubernetes security. In the latest development, Venafi, a vendor of certificate and key management for machine-to-machine connections, is acquiring Jetstack, a U.K. startup that helps enterprises migrate and work within Kubernetes and cloud-based ecosystems, which has also been behind the development of cert-manager, a popular, open-source native Kubernetes certificate management controller.

Financial terms of the deal, which is expected to close in June of this year, have not been disclosed, but Jetstack has been working with Venafi to integrate its services and had a strategic investment from Venafi’s Machine Identity Protection Development Fund.

Venafi is part of the so-called “Silicon Slopes” cluster of startups in Utah. It has raised about $190 million from investors that include TCV, Silver Lake and Intel Capital and was last valued at $600 million. That was in 2018, when it raised $100 million, so now it’s likely Venafi is worth more, especially considering its customers include the top five U.S. health insurers, the top five U.S. airlines, the top four credit card issuers, three out of the top four accounting and consulting firms, four of the top five U.S., U.K., Australian and South African banks and four of the top five U.S. retailers.

For the time being, the two organizations will continue to operate separately, and cert-manager — which has hundreds of contributors and millions of downloads — will continue on as before, with a public release of version 1 expected in the June-July time frame.

The deal underscores not just how Kubernetes -based containers have quickly gained momentum and critical mass in the enterprise IT landscape, in particular around digital transformation, but specifically the need to provide better security services around that at speed and at scale. The deal comes just one day after VMware announced that it was acquiring Octarine, another Kubernetes security startup, to fold into Carbon Black (an acquisition it made last year).

“Nowadays, business success depends on how quickly you can respond to the market,” said Matt Barker, CEO and co-founder of Jetstack . “This reality led us to re-think how software is built and Kubernetes has given us the ideal platform to work from. However, putting speed before security is risky. By joining Venafi, Jetstack will give our customers a chance to build fast while acting securely.”

To be clear, Venafi had been offering Kubernetes integrations prior to this — and Venafi and Jetstack have worked together for two years. But acquiring Jetstack will give it direct, in-house expertise to speed up development and deployment of better tools to meet the challenges of a rapidly expanding landscape of machines and applications, all of which require unique certificates to connect securely.

“In the race to virtualize everything, businesses need faster application innovation and better security; both are mandatory,” said Jeff Hudson, CEO of Venafi, in a statement. “Most people see these requirements as opposing forces, but we don’t. We see a massive opportunity for innovation. This acquisition brings together two leaders who are already working together to accelerate the development process while simultaneously securing applications against attack, and there’s a lot more to do. Our mutual customers are urgently asking for more help to solve this problem because they know that speed wins, as long as you don’t crash.”

The crux of the issue is the sheer volume of machines that are being used in computing environments, thanks to the growth of Kubernetes clusters, cloud instances, microservices and more, with each machine requiring a unique identity to connect, communicate and execute securely, Venafi notes, with disruptions or misfires in the system leaving holes for security breaches.

Jetstack’s approach to information security came by way of its expertise in Kubernetes, developing cert-mananger specifically so that its developer customers could easily create and maintain certificates for their networks.

“At Jetstack we help customers realize the benefits of Kubernetes and cloud native infrastructure, and we see transformative results to businesses firsthand,” said Matt Bates, CTO and co-founder of Jetstack, in a statement. “We developed cert-manager to make it easy for developers to scale Kubernetes with consistent, secure, and declared-as-code machine identity protection. The project has been a huge hit with the community and has been adopted far beyond our expectations. Our team is thrilled to join Venafi so we can accelerate our plans to bring machine identity protection to the cloud native stack, grow the community and contribute to a wider range of projects across the ecosystem.” Both Bates and Barker will report to Venafi’s Hudson and join the bigger company’s executive team.

Powered by WPeMatico

Last December, when CRM startup Kustomer was announcing its latest round of funding — a $60 million round led by Coatue — its co-founder and CEO Brad Birnbaum said it would use some of the money to build more RPA-style automations into its platform to expand KustomerIQ, its AI-based product that helps understand and respond to customer enquiries to take some of the more repetitive load off of agents. Today, Kustomer is announcing some M&A that will help in that strategy: it is acquiring Reply.ai, a startup originally founded in Madrid that has built a code-free platform for companies to create customised chatbots to handle customer service enquires that use machine learning to, over time, become better at responding to those inbound contacts.

Kustomer, which has raised more than $170 million and is now valued at $710 million (per PitchBook), said it is not disclosing the financial terms of the deal.

Reply .ai — whose customers include Coca-Cola, Starbucks, Samsung, and a number of retailers and major ad and marketing agencies working on behalf of clients — had by comparison raised a modest $4 million in funding (with the last round back in 2018). Its list of investors included strategic backers like Aflac and Westfield (the shopping mall giant), as well as Seedcamp, Madrid’s JME Ventures, and Y Combinator, where Reply.ai was a part of its Startup School cohort in 2017.

Birnbaum said that the conversation for acquiring Reply.ai started before the global health pandemic — the two already worked together, as part of Reply.ai’s integrations with a number of CRM platforms. But active discussions, due diligence, and the closing of the deal were all done over Zoom. “We were fortunate that we got to meet before corona, but for the most part we did this remotely,” he said.

Reply.ai was founded back in 2016 — the year when chatbots suddenly became all the rage — and it managed to make it through that and then the subsequent trough of disillusionment, when a lot of the early novelty wore off after they were discovered to be not quite as effective as many had hoped or assumed they would be. One of the reasons for Reply.ai’s survival was that it had proven to be a builder of effective applications in one of the only segments of the market to become a willing customer and user of chatbots: customer service.

While a large part of the CRM industry — estimated to be worth some $40 billion in 2019 — is still based around human interactions, there has been a growing push to leverage advances in AI, cloud services, and use of the internet as a point of interaction to bring more automation into the process, both to help those who are agents deal with more tricky issues, and to help bring overall costs down for those who rely on customer support as part of their service proposition.

That trend, if anything, is only getting a boost right now. In some cases, agents are unable to work because of social distancing rules in cases where customer queries cannot be handled by remote workers. In others, companies are seeing a lot of financial pressure and are looking to reduce expenses. But at the same time, with more people at home and unable to make physical queries at stores, the whole medium of customer support is seeing new levels of usage.

Kustomer has been taking on the bigger names in CRM, including Salesforce (where Birnbaum and his cofounder Jeremy Suriel previously worked), Zendesk and Oracle, by providing a platform that makes it easier for human agents to handle inbound “omnichannel” customer requests — another big trend, leveraging the rise of multiple messaging and communications platforms as potential routes to both speaking to customers and seeing them complain for all the world to see. So moving deeper into chatbots and other AI-powered tools is a natural progression.

Birnbaum said that one of its key interests with Reply.ai was its focus on “deflection” — the term for using non-human tools and services to help resolve inbound requests before needing to call in a human agent. Reply.ai’s tools have been shown to help deflect 40% of initial inbound queries, he noted.

“Some companies have been dealing with a significant increase in inbound volume, and it’s been hard to scale their teams of agents, especially when they are remote,” he said. “So those companies are looking for ways to respond more rapidly. So anything they can do to help with that deflection and let their agents be more productive to drive higher levels of satisfaction, anything that can enable self-service, is what this is about.”

Other tools in the Reply toolkit, in addition to its chatbot-building platform and deflection capabilities, include agent-assistant tools for suggesting relevant answers, as well as suggestions for tagging (for analytics) and re-routing.

“We are excited for Reply to join Kustomer and share its mission to make customer service more efficient, effective and personalized,” said Omar Pera, one of Reply.ai’s founders, in a statement. “As a long-time partner of Kustomer, we are able to seamlessly integrate our deflection and chatbots technologies into Kustomer’s platform and help brands more cost-effectively increase efficiency. We look forward to working with Brad and the entire team.”

Powered by WPeMatico