Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

ZoomInfo went public yesterday. After pricing its IPO $1 ahead of its proposed range at $21 per share, the company closed its first day’s trading worth $34.00, up 61.9%, according to Yahoo Finance. Then the company gained another 5.2% in after-hours trading.

Whether you feel that this SaaS player was worth the revenue multiple its original, $8 billion valuation dictated — let alone that same multiple times 1.6x — the message from the offering was clear: the IPO window is open.

This is not news to a few companies looking to take advantage of today’s strong equity prices.

Used-car marketplace Vroom is looking to get its shares public before its Q2 numbers come out, despite a history of slim gross profit generation. The company hopes to go public for as much as $1.9 billion, a modest uptick from its final private valuations.

We’ll get another dose of data when Vroom does price — how much investors are willing to pay for slim-margin revenue will tell us a bit more than what we learned from ZoomInfo, which has far superior gross margins. Investors have already signaled that they are content to value high-margin software-ish revenues richly. Vroom is more of a question, but if it does price strongly we’ll know public investors are looking for any piece of growth they can find.

This brings us to the latest news: Amwell has confidentially filed to go public. Formerly known as American Well, CNBC reports that the venture-backed telehealth company has dramatically expanded its customer base:

Telemedicine has seen an uptick in recent months, as people in need of health services turned to phone calls and video chats so they could avoid exposure to COVID-19. The company told CNBC last month that it’s seen a 1,000% increase in visits due to coronavirus, and closer to 3,000% to 4,000% in some places.

Powered by WPeMatico

When Spotinst rebranded to Spot in March, it seemed big changes were afoot for the startup, which originally helped companies find and manage cheap infrastructure known as spot instances (hence its original name). We had no idea how big at the time. Today, NetApp announced plans to acquire the startup.

The companies did not share the price, but Israeli publication CTECH pegged the deal at $450 million. NetApp would not confirm that price.

It may seem like a strange pairing, a storage company and a startup that helps companies find bargain infrastructure and monitor cloud costs, but NetApp sees the acquisition as a way for its customers to bridge storage and infrastructure requirements.

“The combination of NetApp’s leading shared storage platform for block, file and object and Spot’s compute platform will deliver a leading solution for the continuous optimization of cost for all workloads, both cloud native and legacy,” Anthony Lye, senior vice president and general manager for public cloud services at NetApp said in a statement.

Holger Mueller, an analyst with Constellation Research says the deal makes sense on that level, but it depends on how well NetApp incorporates the Spot technology into its stack. “At the end of the day to run next generation applications successfully in the cloud you need to be efficient on compute and storage usage. NetApp is doing great on the latter but needed way to monitor and automate compute consultation. This is what Spot brings to the table, so the combination makes sense, but as in all acquisitions execution is key now,” Mueller told TechCrunch.

Spot helps companies do a couple of things. First of all it manages spot and reserved instances for customers in the cloud. Spot instances in particular, are extremely cheap because they represent unused capacity at the cloud provider. The catch is that the vendor can take the resources back when they need them, and Spot helps safely move workloads around these requirements.

Reserved instances are cloud infrastructure you buy in advance for a discounted price. The cloud vendor gives a break on pricing, knowing that it can count on the customer to use a certain amount of infrastructure resources.

At the time it rebranded, the company also had gotten into monitoring cloud spending and usage across clouds. Amiram Shachar, co-founder and CEO at Spot, told TechCrunch in March, “With this new product we’re providing a more holistic platform that lets customers see all of their cloud spending in one place — all of their usage, all of their costs, what they are spending and doing across multiple clouds — and then what they can actually do [to deploy resources more efficiently],” he said at the time.

Shachar writing in a blog post today announcing the deal indicated the company will continue to support its products as part of the NetApp family, and as startup CEOs typically say at a time like this, move much faster as part of a large organization.

“Spot will continue to offer and fully support our products, both now and as part of NetApp when the transaction closes. In fact, joining forces with NetApp will bring additional resources to Spot that you’ll see in our ability to deliver our roadmap and new innovation even faster and more broadly,” he wrote in the post.

NetApp has been quite acquisitive this year. It acquired Talon Storage in early March and CloudJumper at the end of April. This represents the twentieth acquisition overall for the company, according to Crunchbase data.

Spot was founded in 2015 in Tel Aviv. It has raised over $52 million, according to Crunchbase data. The deal is expected to close later this year, assuming it passes typical regulatory hurdles.

Powered by WPeMatico

In 2015, Atlassian was preparing to go public, but it was not your typical company in so many ways. For starters, it was founded in Australia, it had two co-founder co-CEOs, and it offered collaboration tools centered on software development.

That meant that the company leaders really needed to work hard to help investors understand the true value proposition that it had to offer, and it made the roadshow deck production process even more critical than perhaps it normally would have been.

A major factor in its favor was that Atlassian didn’t just suddenly decide to go public. Founded in 2002, it waited until 2010 to accept outside investment. After 10 straight years of free cash flow, when it took its second tranche of investment in 2014, it selected T. Rowe Price, perhaps to prepare for working with institutional investors before it went public the next year.

We sat down with company president Jay Simons to discuss what it was like, and how his team produced the document that would help define them for investors and analysts.

Powered by WPeMatico

When this editor first met Jeremy Conrad, it was in 2014, at the 8,000-square-foot former fish factory that was home to Lemnos, a hardware-focused venture firm that Conrad had co-founded three years earlier.

Conrad — who as a mechanical engineering undergrad at MIT worked on self-driving cars, drones and satellites — was still excited about investing in hardware startups, having just closed a small new fund even while hardware was very unfashionable (and remains challenging). One investment his team made around that time was in Airware, a company that made subscription-based software for drones and attracted meaningful buzz and $118 million in venture funding before shutting down in 2018.

By then, Conrad had already moved on — though not from his love of hardware. He instead decided in late 2017 that a nascent team that was camping out at Lemnos was onto a big idea relating to the future of construction. Conrad didn’t have a background in real estate or, at the time, a burning passion for the industry. But the “more I learned about it — not dissimilar to when I started Lemnos — it felt like there was a gap in the market, an opportunity that people were missing,” says Conrad from his home in San Francisco, where he has hunkered down throughout the COVID-19 crisis.

Enter Quartz, Conrad’s now 1.5-year-old, 14-person company, which quietly announced $7.75 million in Series A funding earlier this month, led by Baseline Ventures, with Felicis Ventures, Lemnos and Bloomberg Beta also participating.

What it’s selling to real estate developers, project managers and construction supervisors is really two things, which is safety and information.

Here’s how it works: Using off-the-shelf hardware components that are reassembled in San Francisco and hardened (meaning secured to reduce vulnerabilities), the company incorporates its machine-learning software into this camera-based platform, then mounts the system onto cranes at construction sites. From there, the system streams 4K live feeds of what’s happening on the ground, while also making sense of the action.

Say dozens of concrete-pouring trucks are expected on a construction site. The cameras, with their persistent view, can convey through a dashboard system whether and when the trucks have arrived and how many, says Conrad. It can determine how many people on are on a job site, and whether other deliveries have been made, even if not with a high degree of specificity.

“We can’t say [to project managers] that 1,000 screws were delivered, but we can let them know whether the boxes they were expecting were delivered and where they were left,” he explains.

It’s an especially appealing proposition in the age of coronavirus, as the technology can help convey information that’s happening at a site that’s been shut down, or even how closely employees are gathered.

Conrad says the technology also saves on time by providing information to those who might not otherwise be able to access it. Think of the developer on the 50th floor of the skyscraper that he or she is building, or even the crane operator who is perhaps moving a two-ton object and has to rely on someone on the ground to deliver directions but can enjoy far more visibility with the aid of a multi-camera set-up.

Quartz, which today operates in California but is embarking on a nationwide rollout, was largely inspired by what Conrad was seeing in the world of self-driving. From sensors to self-perception systems, he knew the technologies would be even easier to deploy at construction sites, and he believed it could make them safer, too. Indeed, like cars, construction sites are highly dangerous. According to the Occupational Safety and Health Administration, of the worker fatalities in private industry in 2018, more than 20% were in construction.

Conrad also saw an opportunity to take on established companies like Trimble, a 42-year-old, publicly traded, Sunnyvale, Calif.-based company that sells a portfolio of tools to the construction industry and charges top dollar for them. Quartz is meanwhile charging $2,000 per month per crane for its series of cameras, their installation, a live stream and “lookback” data, though this may well rise as its adds features.

It’s a big enough opportunity that, perhaps unsurprisingly, Quartz is not alone in chasing it. Last summer, for example, Versatile, an Israeli-based startup with offices in San Francisco and New York City, raised $5.5 million in seed funding from Germany’s Robert Bosch Venture Capital and several other investors for a very similar platform, though it uses sensors mounted under the hook of a crane to provide information about what’s happening below. Construction Dive, a media property that’s dedicated to the industry, highlights many other, similar and competitive startups in the space, too.

Still, Quartz has Conrad, who isn’t just any founding CEO. Not only does he have that background in engineering, but having launched a venture firm and spent years as an investor may also serve him well. He thinks a lot about the payback period on its hardware, for example.

Unlike a lot of founders, he even says he loves the fundraising process. “I get the highest-quality feedback from some of the smartest people I know, which really helps focus your vision,” says Conrad, who says that Quartz, which operates in California today, is now embarking on a nationwide rollout.

“When you talk with great VCs, they ask great questions. For me, it’s the best free consulting you can get.”

Powered by WPeMatico

When Cisco bought AppDynamics in 2017 for $3.7 billion just before the IPO, the company sent a clear signal it wanted to move beyond its pure network hardware roots into the software monitoring side of the equation. Yesterday afternoon the company announced it intends to buy another monitoring company, this time snagging internet monitoring solution ThousandEyes.

Cisco would not comment on the price when asked by TechCrunch, but published reports from CNBC and others pegged the deal at around $1 billion. If that’s accurate, it means the company has paid around $4.7 billion for a pair of monitoring solutions companies.

Cisco’s Todd Nightingale, writing in a blog post announcing the deal said that the kind of data that ThousandEyes provides around internet user experience is more important than ever as internet connections have come under tremendous pressure with huge numbers of employees working from home.

ThousandEyes keeps watch on those connections and should fit in well with other Cisco monitoring technologies. “With thousands of agents deployed throughout the internet, ThousandEyes’ platform has an unprecedented understanding of the internet and grows more intelligent with every deployment, Nightingale wrote.

He added, “Cisco will incorporate ThousandEyes’ capabilities in our AppDynamics application intelligence portfolio to enhance visibility across the enterprise, internet and the cloud.”

As for ThousandEyes, co-founder and CEO Mohit Lad told a typical acquisition story. It was about growing faster inside the big corporation than it could on its own. “We decided to become part of Cisco because we saw the potential to do much more, much faster, and truly create a legacy for ThousandEyes,” Lad wrote.

It’s interesting to note that yesterday’s move, and the company’s larger acquisition strategy over the last decade is part of a broader move to software and services as a complement to its core networking hardware business.

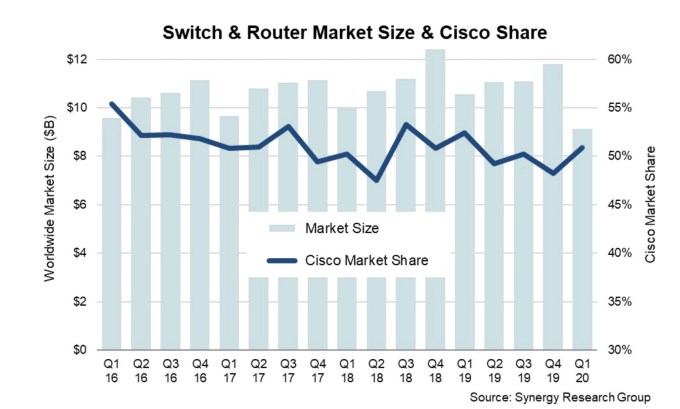

Just yesterday, Synergy Research released its network switch and router revenue report and it wasn’t great. As companies have hunkered down during the pandemic, they have been buying much less network hardware, dropping the Q1 numbers to seven year low. That translated into a $1 billion less in overall revenue in this category, according to Synergy.

While Cisco owns the vast majority of the market, it obviously wants to keep moving into software services as a hedge against this shifting market. This deal simply builds on that approach.

ThousandEyes was founded in 2010 and raised over $110 million on a post valuation of $670 million as of February 2019, according to Pitchbook Data.

Powered by WPeMatico

What does a global mindset look like in a world where most of us no longer travel? And what does it mean to be local when everyone is connected?

Those are the first questions we had in mind when we read GGV Capital’s Twitter bio, which asserts that the investing shop with offices in five cities is a “global venture capital firm that invests in local founders.”

Certainly, some of its investments are far from home, including Khatabook (based in Bangalore), Keep (Beijing), Coder, (Austin) and Slice (New York City). And those are just GGV deals from the last few months.

But what constitutes a local investment in a world where, until recently, no deal was more than a plane ride or two away? Hans Tung and Jeff Richards, managing partners at GGV Capital, are swinging by Extra Crunch Live next week, and we’re going to dive into the above to figure it out.

Of course, we’ll also ask critical, founder-focused questions about their current investing pace, check sizes and how they are adapting to the COVID-19 era. But after that, there’s a lot of work to do.

We’ll call on Tung to share some of what he’s learned from his time investing in China’s tech landscape, with a specific focus on what he sees in the future that might prove encouraging. The other GGV partner joining, Richards, also has international experience working in Asia and Latin America, so the conversation should be interesting.

In February, the firm published a mom-and-pop shop investment thesis. GGV Capital wants to invest in startups that help small retailers digitize operations and work with better supply chains. It is also interested in startups that want to establish logistic and online payment infrastructure. (Surely Shopify can’t be this entire market, right?)

The thesis hinges on consumer shopping habits and retailers open for business, so we’ll see how Tung and Richards are changing their appetite, or further shaping it.

Details are below for Extra Crunch subscribers; if you need a pass, get a cheap trial here.

Chat with you all in a week!

Powered by WPeMatico

Vast monoculture farms outstripped the ability of bee populations to pollinate them naturally long ago, but the techniques that have arisen to fill that gap are neither precise nor modern. Israeli startup BeeHero aims to change that by treating hives both as living things and IoT devices, tracking health and pollination progress practically in real time. It just raised a $4 million seed round that should help expand its operations into U.S. agriculture.

Honeybees are used around the world to pollinate crops, and there has been growing demand for beekeepers who can provide lots of hives on short notice and move them wherever they need to be. But the process has been hamstrung by the threat of colony collapse, an increasingly common end to hives, often as the result of mite infestation.

Hives must be deployed and checked manually and regularly, entailing a great deal of labor by the beekeepers — it’s not something just anyone can do. They can only cover so much land over a given period, meaning a hive may go weeks between inspections — during which time it could have succumbed to colony collapse, perhaps dooming the acres it was intended to pollinate to a poor yield. It’s costly, time-consuming, and decidedly last-century.

So what’s the solution? As in so many other industries, it’s the so-called Internet of Things. But the way CEO and founder Omer Davidi explains it, it makes a lot of sense.

“This is a math game, a probabilistic game,” he said. “We’ve modeled the problem, and the main factors that affect it are, one, how do you get more efficient bees into the field, and two, what is the most efficient way to deploy them?”

Normally this would be determined ahead of time and monitored with the aforementioned manual checks. But off-the-shelf sensors can provide a window into the behavior and condition of a hive, monitoring both health and efficiency. You might say it puts the API in apiculture.

Normally this would be determined ahead of time and monitored with the aforementioned manual checks. But off-the-shelf sensors can provide a window into the behavior and condition of a hive, monitoring both health and efficiency. You might say it puts the API in apiculture.

“We collect temperature, humidity, sound, there’s an accelerometer. For pollination, we use pollen traps and computer vision to check the amount of pollen brought to the colony,” he said. “We combine this with microclimate stuff and other info, and the behaviors and patterns we see inside the hives correlate with other things. The stress level of the queen, for instance. We’ve tested this on thousands of hives; it’s almost like the bees are telling us, ‘we have a queen problem.’ ”

All this information goes straight to an online dashboard where trends can be assessed, dangerous conditions identified early and plans made for things like replacing or shifting less or more efficient hives.

The company claims that its readings are within a few percentage points of ground truth measurements made by beekeepers, but of course it can be done instantly and from home, saving everyone a lot of time, hassle and cost.

The results of better hive deployment and monitoring can be quite remarkable, though Davidi was quick to add that his company is building on a growing foundation of work in this increasingly important domain.

“We didn’t invent this process, it’s been researched for years by people much smarter than us. But we’ve seen increases in yield of 30-35% in soybeans, 70-100% in apples and cashews in South America,” he said. It may boggle the mind that such immense improvements can come from just better bee management, but the case studies they’ve run have borne it out. Even “self-pollinating” (i.e. by the wind or other measures) crops that don’t need pollinators show serious improvements.

The platform is more than a growth aid and labor saver. Colony collapse is killing honeybees at enormous rates, but if it can be detected early, it can be mitigated and the hive potentially saved. That’s hard to do when time from infection to collapse is a matter of days and you’re inspecting biweekly. BeeHero’s metrics can give early warning of mite infestations, giving beekeepers a head start on keeping their hives alive.

“We’ve seen cases where you can lower mortality by 20-25%,” said Davidi. “It’s good for the farmer to improve pollination, and it’s good for the beekeeper to lose less hives.”

“We’ve seen cases where you can lower mortality by 20-25%,” said Davidi. “It’s good for the farmer to improve pollination, and it’s good for the beekeeper to lose less hives.”

That’s part of the company’s aim to provide value up and down the chain, not just a tool for beekeepers to check the temperatures of their hives. “Helping the bees is good, but it doesn’t solve the whole problem. You want to help whole operations,” Davidi said. The aim is “to provide insights rather than raw data: whether the queen is in danger, if the quality of the pollination is different.”

Other startups have similar ideas, but Davidi noted that they’re generally working on a smaller scale, some focused on hobbyists who want to monitor honey production, or small businesses looking to monitor a few dozen hives versus his company’s nearly 20,000. BeeHero aims for scale both with robust but off-the-shelf hardware to keep costs low, and by focusing on an increasingly tech-savvy agriculture sector here in the States.

“The reason we’re focused on the U.S. is the adoption of precision agriculture is very high in this market, and I must say it’s a huge market,” Davidi said. “Eighty percent of the world’s almonds are grown in California, so you have a small area where you can have a big impact.”

The $4 million seed round’s investors include Rabo Food and Agri Innovation Fund, UpWest, iAngels, Plug and Play, and J-Ventures.

BeeHero is still very much also working on R&D, exploring other crops, improved metrics and partnerships with universities to use the hive data in academic studies. Expect to hear more as the market grows and the need for smart bee management starts sounding a little less weird and a lot more like a necessity for modern agriculture.

Powered by WPeMatico

London-based Greyparrot, which uses computer vision AI to scale efficient processing of recycling, has bagged £1.825 million (~$2.2M) in seed funding, topping up the $1.2M in pre-seed funding it had raised previously. The latest round is led by early stage European industrial tech investor Speedinvest, with participation from UK-based early stage b2b investor, Force Over Mass.

The 2019 founded startup — and TechCrunch Disrupt SF battlefield alum — has trained a series of machine learning models to recognize different types of waste, such as glass, paper, cardboard, newspapers, cans and different types of plastics, in order to make sorting recycling more efficient, applying digitization and automation to the waste management industry.

Greyparrot points out that some 60% of the 2BN tonnes of solid waste produced globally each year ends up in open dumps and landfill, causing major environmental impact. While global recycling rates are just 14% — a consequence of inefficient recycling systems, rising labour costs, and strict quality requirements imposed on recycled material. Hence the major opportunity the team has lit on for applying waste recognition software to boost recycling efficiency, reduce impurities and support scalability.

By embedding their hardware agnostic software into industrial recycling processes Greyparrot says it can offer real-time analysis on all waste flows, thereby increasing efficiency while enabling a facility to provide quality guarantee to buyers, mitigating against risk.

Currently less than 1% of waste is monitored and audited, per the startup, given the expensive involved in doing those tasks manually. So this is an application of AI that’s not so much taking over a human job as doing something humans essentially don’t bother with, to the detriment of the environment and its resources.

Greyparrot’s first product is an Automated Waste Monitoring System which is currently deployed on moving conveyor belts in sorting facilities to measure large waste flows — automating the identification of different types of waste, as well as providing composition information and analytics to help facilities increase recycling rates.

It partnered with ACI, the largest recycling system integrator in South Korea, to work on early product-market fit. It says the new funding will be used to further develop its product and scale across global markets. It’s also collaborating with suppliers of next-gen systems such as smart bins and sorting robots to integrate its software.

“One of the key problems we are solving is the lack of data,” said Mikela Druckman, co-founder & CEO of Greyparrot in a statement. “We see increasing demand from consumers, brands, governments and waste managers for better insights to transition to a more circular economy. There is an urgent opportunity to optimise waste management with further digitisation and automation using deep learning.”

“Waste is not only a massive market — it builds up to a global crisis. With an increase in both world population and per capita consumption, waste management is critical to sustaining our way of living. Greyparrot’s solution has proven to bring down recycling costs and help plants recover more waste. Ultimately it unlocks the value of waste and creates a measurable impact for the environment,” added Marie-Hélène Ametsreiter, lead partner at Speedinvest Industry, in another statement.

Greyparrot is sitting pretty in another aspect — aligning with several strategic areas of focus for the European Union, which has made digitization of legacy industries, industrial data sharing, investment in AI, plus a green transition to a circular economy core planks of its policy plan for the next five+ years. Just yesterday the Commission announced a €750BN pan-EU support proposal to feed such transitions as part of a wider coronavirus recovery plan for the trading bloc.

Powered by WPeMatico

Otrium has raised a $26 million Series B funding round (€24 million), with Eight Roads Ventures leading the round. Existing investors Index Ventures and Hans Veldhuizen also participated. Otrium works with clothing brands to help them sell items when they reach the end-of-season status.

Due to fast fashion, you have to regularly clear some space in your stores and recover inventory from third-party stores to release new items. But end-of-season sales aren’t enough. Brands end up with a lot of inventory on their hand. And those items often get destroyed.

Otrium wants to add another sales channel for those specific items — and it’s an online one, which should help when it comes to shelf space. Lockdowns around the world have also generated more excess inventory for the spring-summer 2020 collections.

Fashion brands don’t want to sell outdated items on their own site because scarcity creates value. First, customers should check regularly with their favorite fashion brand to see what they’re selling right now. Second, fashion brands don’t want you to see that you could wait a few months to get an item for cheap.

That’s why Otrium has created a marketplace and tries to be as friendly as possible with fashion brands. If you decide to sell end-of-season collections on Otrium, you can manage your own outlet, get in-depth analytics and enable a dynamic pricing engine to maximize revenue on those outdated items.

Two hundred brands have decided to partner with Otrium, such as Joseph, Reiss, G-Star, Asics, Puma, Vans, Pepe Jeans, Alexachung and Scotch & Soda. There are one million registered customers on Otrium.

The e-commerce website is currently live in the Netherlands, France and Germany. It just launched its site in the U.K. as well. With today’s funding round, you can expect more international expansions in the future.

Powered by WPeMatico

Singapore-based fintech startup GoBear has raised $17 million from returning investors Walvis Participaties, a Dutch venture capital firm, and Aegon N.V., a life insurance and asset management provider. The funding brings GoBear’s total funding so far to $97 million, and will be used to expand its consumer financial services platform, which is available in seven Asian markets: Hong Kong, Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam.

Founder and CEO Adrian Chng told TechCrunch that GoBear will focus on what it calls its “three growth pillars”: an online financial supermarket that evolved from the company’s financial products aggregator/comparison service; an online insurance brokerage; and its digital lending business, which it recently expanded by acquiring consumer lending platform AsiaKredit.

The company has also added three new executives over the past few months: chief information technology officer Valeriy Gasratov; chief strategy officer Jinnee Lim as Chief Strategy Officer; and Mike Singh from AsiaKredit as its new chief lending officer.

GoBear originally launched in 2015 as a metasearch engine, before transitioning into financial services. The company now works with over 100 financial partners, including banks and insurance providers, and says its platform has been used by over 55 million people to search for more than 2,000 personal financial products.

The startup serves consumers who don’t have credit cards or other access to traditional credit building tools. Similar to other fintech companies that focus on underbanked populations, GoBear aggregates and analyzes alternative sources of data to judge lending risk, including patterns in consumer behavior. For example, Chng said if a loan application is filled out in less than a minute, it is more likely to be fraudulent, and applications made between 8:30PM and midnight are less risky than ones made between 2AM to 5AM.

Data points from smartphones is also used to assess creditworthiness in markets like the Philippines, where the credit card penetration rate is less than 10%, but more than 40% of the population uses a smartphone.

Despite the COVID-19 pandemic, Chng said GoBear has been gross margin positive since the end of 2019. Interest in travel insurance has declined, but the company has continued to see demand for other insurance products and lending. Its online insurance brokerage has grown its average order by 52% over the last three months, and the company has seen 50% year-over-year growth from its loan products.

There are other fintech companies in Asia that overlap with some of the services that GoBear offers, like comparison platform MoneySmart, CompareAsiaGroup and Grab Financial Group. In terms of competition, Chng told TechCrunch that not only is the market opportunity in Asia huge (he said there are 400 million underbanked people across GoBear’s seven markets), but the company also differentiates with its three core services, which are all interconnected and draw on the same data sources to score credit.

Chng anticipates that the pandemic will spur more financial institutions to begin digitizing their products and looking for partners like GoBear to help them manage risk. In turn, that will make more financial institutions open to using non-traditional data to score credit, enabling underbanked markets to have increased access to financial products.

“The momentum is here. I think now is the time for tech and data to transform financial services,” he said. “As a platform, we are really looking for partners to come with us for the next phase of growth and investment. I feel positive even with COVID-19, because I think that we will have more acceleration, and the opportunity to change people’s lives and benefit them and investors by solving tough problems will only increase.”

Powered by WPeMatico