Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

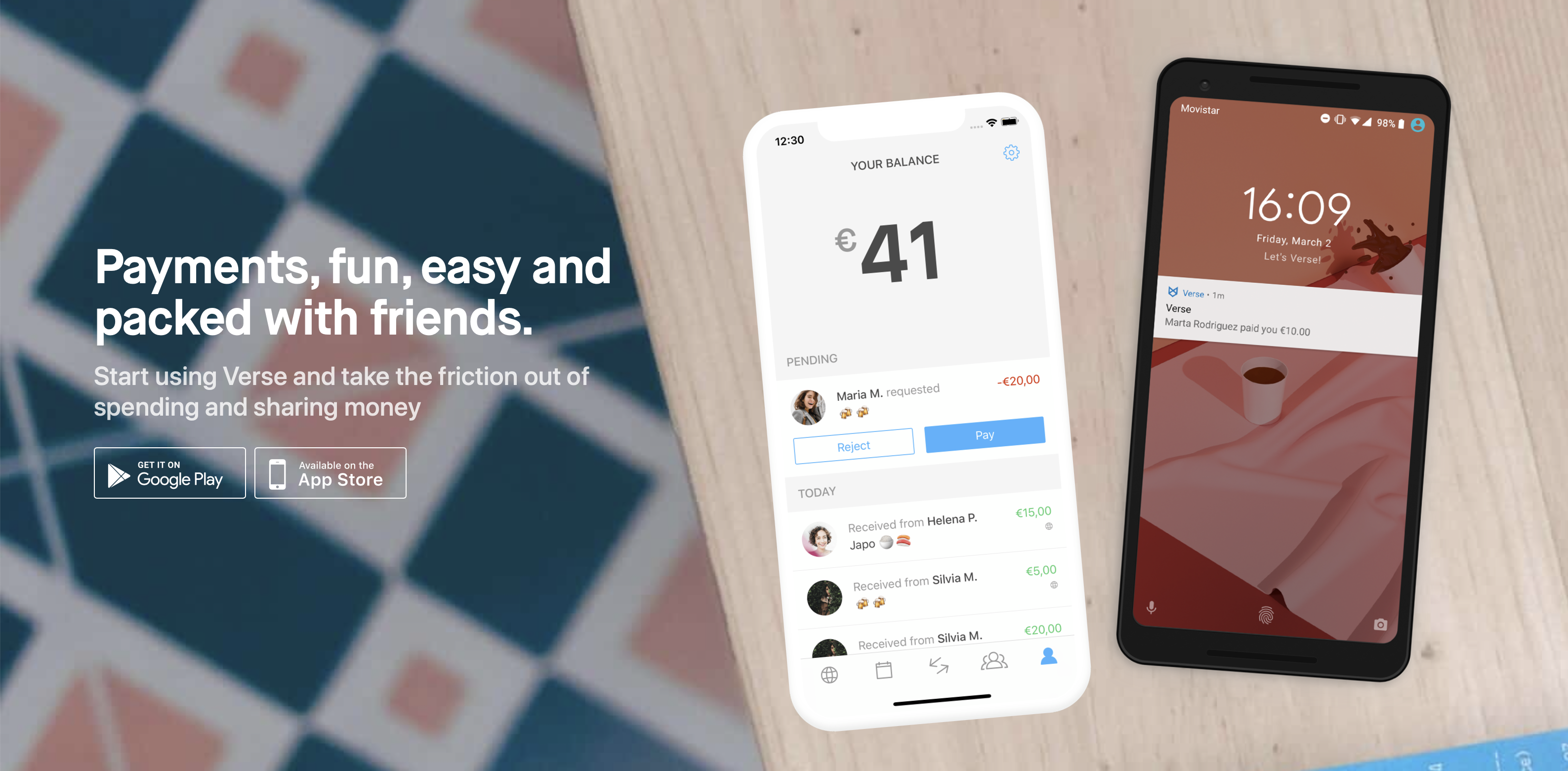

Square acquired Verse, a Spanish peer-to-peer payment app that works across Europe. Terms of the deal are undisclosed. According to Crunchbase, Verse had raised $37.6 million from Spark Capital, eVentures, Greycroft Partners and others.

Square has attracted a ton of users with Cash App, its peer-to-peer payment app that lets you easily send and receive money from your phone. But Cash App has only been available in the U.S. and the U.K.

Acquiring Verse seems like a good fit to expand Square’s presence in Europe. Verse’s team will join the Cash App division within Square.

There are many similarities between Cash App and Verse. Verse’s main feature is that it lets you send and receive money from a mobile app. Users don’t pay any fees and transfers occur in just a few seconds.

Verse users sign up with their phone numbers, which means that you can send money to other users as long as you have their phone numbers in your address book. If you don’t have enough money on your Verse account, the app can charge your debit card directly. And if you want to withdraw money from your Verse account, you can transfer your balance to your bank account.

You can also track group expenses from the app (like Splitwise), create money pots and organize events with a basic ticketing feature.

More recently, Verse launched a Visa debit card in Spain, which lets you spend money on your Verse account directly. You don’t pay any foreign exchange fees and you get two free ATM withdrawals per month. Verse uses Visa’s exchange rate.

While the startup hasn’t shared usage numbers for a while, according to App Annie, it is currently the No. 247 most downloaded app in the App Store in Spain across all categories. Peer-to-peer payment is a fragmented market. For instance, French startup Lydia has 3 million users in France.

“At this point, our main priority is enabling Verse to continue their successful growth in Europe. Verse will continue to operate as an independent business, working out of their offices with no immediate changes to their existing products, customers, or business operations,” Square wrote in the announcement.

The three most important words in this statement are “at this point.” Square doesn’t want to fix what isn’t broken. But I wouldn’t be surprised if Verse slowly evolves to become Cash App in Europe.

Image credits: Square

Powered by WPeMatico

Monzo, the U.K. challenger bank with more than 4 million customers, has confirmed it has closed £60 million in top-up funding.

Backing the round are existing investors Y Combinator, General Catalyst, Accel, Stripe, Goodwater, Orange, Thrive and Passion Capital, along with new investors Reference Capital and Vanderbilt University.

One of fintech’s worst-kept secrets, the down round sees the bank take a 40% hit in its paper pre-money valuation compared to its previous round, now priced at £1.24 billion.

That’s likely a reflection of the current funding climate amidst the coronavirus crisis, with Monzo having to raise a bridge round at quite possibly the worst time.

I also understand from sources that a number of Monzo’s later-stage investors played hardball, in a bid to force down the challenger bank’s ticket price, perhaps after investing at the height of the funding market pre-COVID-19. What is also interesting about the new round is that the share price is the same as the bank’s last equity crowdfund, meaning that the most recent armchair investors haven’t seen a paper loss.

Monzo is also disclosing that its business banking product has now reached 25,000 signups. Launched officially in March, the business bank account is aimed at sold traders and SMEs, with both free and premium paid-for versions available, offering various feature sets.

Meanwhile, it has been a turbulent time for Monzo, as it, along with many other fintech companies, tries to insulate itself from the coronavirus crisis and resulting economic downturn.

Planned layoffs in the U.K. were communicated internally earlier this month — up to 120, but now thought to be around 80. It followed earlier U.S. layoffs and the shuttering of its Las Vegas-based customer support office, and almost 300 U.K. staff being furloughed.

Like other banks and fintechs, the coronavirus crisis has resulted in Monzo seeing customer card spend reduce at home and (of course) abroad, meaning it is generating significantly less revenue from interchange fees. The bank has also postponed the launch of premium paid-for consumer accounts, one of only a handful of known planned revenue streams, alongside lending, of course, and the more recent business banking.

Separately, in May, Monzo co-founder Tom Blomfield announced internally that he was stepping down as CEO of the U.K. challenger bank to take up the newly created role of president. His replacement is current U.S. CEO TS Anil, who now also holds the title of “Monzo UK Bank CEO,” subject to regulatory approval.

Powered by WPeMatico

Startups need money. State and local governments need startups and the employment growth they offer. It should be obvious that the two groups can work together and make each other happy. Unfortunately, nothing could be further from the truth.

Each year, governments spend tens of billions of dollars on economic development incentives designed to attract employers and jobs to their communities. There are a huge number of challenges, however, for startups and individual contributors trying to apply for these programs.

First, economic development leaders typically focus on massive, flagship projects that are splashy and will drive the news cycle and bring good media attention to their elected official bosses. So, for example, you get a massive, $10 billion Foxconn plant in Wisconsin tied to hundreds of millions of incentives, only to see the project sputter into the ground.

Then there is the paperwork. As you’d expect with any government application process, it can be arduous to find the right incentive programs, apply for credits at the right time and max out the opportunities available.

That’s where MainStreet comes in.

Its CEO and founder Doug Ludlow’s third company. He previously founded Hipster, which sold to AOL, and The Happy Home Company, which sold to Google. After that transaction, Ludlow went on to become chief of staff for SMB ads at the tech giant, where he saw firsthand the challenges that startups and all small companies face in growing outside of major urban hubs like San Francisco.

When he and his co-founders Dan Lindquist and Daniel Griffin first started, they were focused on what Ludlow described as “a network of remote work hubs.” As they were experimenting last November they tried paying people to leave the Bay Area, offering them $10,000 if they moved to other cities. The offer caused a sensation, with outlets like CNN covering the news.

While the interest from customers was great, what ignited Ludlow and his co-founders’ passions was that “literally dozens of cities, states and counties reached out, letting us know that they had an incentive program.” As the team explored further, they realized there was a huge untapped opportunity to connect startups to these preexisting programs.

MainStreet was born, and it’s an idea that has also attracted the attention of investors. The company announced today that it raised a $2.3 million round from Gradient Ventures, Weekend Fund and others.

Startups apply for economic incentives through MainStreet’s platform, and then MainStreet takes a 20% cut of any successful application. Notably, that cut is only taken when the incentive is actually disbursed (there’s no upfront cost), and there is also no on-going subscription fee to use the platform. “If you identify the credit that you’re able to use six months from now, we will charge you six months from now, when you’re actually getting that credit. It seems to be a business model that is aligned well with founders,” Ludlow said.

Right now, he says that the average MainStreet client saves $51,000, and that MainStreet has crossed the $1 million ARR run rate threshold.

Right now, the company’s core clientele are startups applying for payroll credits and research and development credits, but Ludlow says that MainStreet is working to expand beyond its tech roots to all small businesses such as restaurants. The company also wants to expand the number of economic development programs that startups can apply for. Given the myriad of governments and programs, there are hundreds if not thousands of more programs to onboard onto the platform.

MainStreet’s team. Image Credits: MainStreet

While MainStreet is helping startups and small businesses, it also wants to help governments improve their operations around economic development. With MainStreet, “we can report back to cities and states showing exactly what their tax dollars or tax credits are being utilized for,” Ludlow said. “So the accountability is orders of magnitude greater than they had before. So already, there’s this better system for tracking the success of incentives.”

The big question for MainStreet this year is navigating the crisis around the COVID-19 pandemic. While more small businesses than ever need help navigating credits, state and local governments have suffered huge shortfalls in revenues as taxes have dried up and Washington continues to debate over what, if any aid, to offer. There’s no money for economic development, yet, economic development has never been more important than right now.

Ultimately, MainStreet is pushing the vanguard of economic development thinking forward away from massive checks designed to underwrite industrial factories to a more flexible and dynamic model of incentivizing knowledge workers to move to areas outside the major global cities. It’s an interesting bet, and one that, at the very least, will help many startups get the economic incentives they rightly have access to.

Outside of Gradient and Weekend Fund, Shrug Capital, SV Angel, Remote First Capital, Basement Fund, Basecamp Ventures, Backend Capital and a host of angels participated in the round.

Powered by WPeMatico

When 2020 began, the year seemed set to include another year of record-setting venture capital investment and, perhaps, some long-awaited IPOs. All that quickly faded when COVID-19 spread globally, shutting economies, undercutting swaths of the business world and rearranging the working life in countries around the globe.

Here at TechCrunch we’re navigating the changing landscape, talking to the founders and venture capitalists that make up the startup realm that we cover, hoping to decipher the new normal.

One way that we’ve done that this year is through a daily look at the private markets. This regular effort (you can read the full archive here) has been an attempt to understand the financial side of the startup world, and how the public markets exert gravity (or lift) on private companies, especially during tumultuous economic times.

The project kicked off with a look at companies that have reached the $100 million ARR mark (a series that is still ongoing), and has touched on all sorts of things since, including the growing popularity of venture debt, China’s VC slowdown, lots of coverage of VC-backed companies trying to go public and, recently, why API startups are so hot right now.

The project kicked off with a look at companies that have reached the $100 million ARR mark (a series that is still ongoing), and has touched on all sorts of things since, including the growing popularity of venture debt, China’s VC slowdown, lots of coverage of VC-backed companies trying to go public and, recently, why API startups are so hot right now.

Today I’m happy to announce that we’re giving the daily post a name and a lovely set of art. Previously called nothing at all, the series is now called “The Exchange.”

As a writer, this is an exciting moment. I’ve written a daily column focused on the markets since mid-2016 for various publications, but I’ve never had one that was as put together as The Exchange can now claim to be. A big thanks to Eric and Walter and Henry and Bryce and Holden and Natasha for their help and encouragement.

Looking ahead, we’re seeing more mega rounds than I would have anticipated, more market demand for tech IPOs than I think anyone anticipated, record highs for tech stocks until about 48 minutes ago and lots of new rounds worth digging into from a trends perspective. So, there’s a lot to do and I’m excited to talk about it all with you each and every weekday morning on The Exchange.

That’s it for now. The Exchange comes out Monday through Friday morning on TechCrunch for Extra Crunch subscribers. Use the code “EXCHANGE” for a discount if you’d like one.

A huge thanks to everyone who already reads this series, and a hug for everyone who’s signed up so that they can access it. Here’s to another hundred entries. And then one hundred more.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines. This is Equity Monday, our short-form week-starter in which we go over the weekend, look to the week ahead, talk about some neat funding rounds and dig into what is stuck on our minds.

So, by section then:

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Sinch said on Monday it has agreed to buy Indian firm ACL Mobile for £56 million (roughly $70 million) in what is the fourth acquisition deal the Swedish mobile voice and messaging firm has entered into at the height of a global pandemic.

The Swedish firm said acquiring ACL Mobile will enable it to leverage the Indian firm’s connections with local mobile operators in the world’s second largest internet market, as well as in Malaysia and UAE, to expand its end-to-end connectivity without working with a third-party firm.

Twenty-year-old ACL Mobile, which has headquarters in Delhi, Dubai and Kuala Lumpur, enables businesses to interact with their customers through SMS, email, WhatsApp and other channels. In a press statement, the Indian firm said it serves more than 500 enterprise customers, including Flipkart, OLX, MakeMyTrip, HDFC Bank and ICICI Bank.

“With ACL we gain critical scale in the world’s second-largest mobile market. We gain customers, expertise and technology and we further strengthen our global messaging product for discerning businesses with global needs,” said Sinch chief executive Oscar Werner.

The Indian firm, which employs 288 people, reported gross profits of $14.2 million on sales of about $65 million in the financial year that ended in March. During the same period, ACL Mobile claims it delivered 47 billion messages on behalf of its enterprise customers.

“Although the long-term growth outlook is favorable, lower commercial activity in India due to the COVID-19 pandemic means that the near-term growth outlook is less predictable,” Sinch said of ACL Mobile’s future outlook.

ACL Mobile is the fourth acquisition Sinch has unveiled since March this year. Last month the company said it was buying SAP’s Digital Interconnect for $250 million. In March, it announced deals to buy Wavy and Chatlayer.

Sinch, founded in 2008, employs more than 700 people in over 40 locations worldwide and is increasingly expanding to more markets. Last month it said acquiring SAP’s Digital Interconnect will help it expand in the U.S. market. The company says it is profitable.

“Together with Sinch we are scaling up to become one of the leading global players in our industry. I’m excited about this next chapter and the many new opportunities that we can pursue together,” said Sanjay K Goyal, founder and chief executive of ACL Mobile.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This time around we’re recording what we call an Equity Shot, a single-topic show that we pull together whenever there’s a news item of sufficient weight that it demands we break our regular cadence and record a little more.

So Danny and Tash and Alex got together to discuss the recent Vroom IPO and Lemonade filing to go public. These are topics that TechCrunch has covered quite a lot lately, so here’s a chronology to help you keep it all straight:

So you can catch up as you need to. What matters is that public investors have swooned over the Vroom IPO, pushing its pricing and, today, more than doubling its value as a public company. It’s a huge debut, and that bodes well for other gross-margin-light businesses — unicorns, even — that might want to go public.

The IPO window is pretty open, it appears. And best of all, we three disagreed quite a bit this week. It’s a fun show.

OK, that’s enough from us. We are back on Friday. Take care, and keep up the good fight.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Yesterday evening, Vroom, a digital used car retailer, priced its IPO at $22 per share, a figure that was a full $7 above the low end of its first proposed IPO price range. The venture-backed firm first proposed a $15 to $17 per-share IPO price range, which it later raised to $18 to $20 per share.

Pricing at $22 per share meant that there was strong demand for the company’s equity during its IPO process. Pricing strength doesn’t guarantee performance as a public company, but it does provide a proxy for investor interest.

TechCrunch has covered a few IPOs lately, noting along the way that some recent offerings have featured heavy financial backing and incredibly slim margins. Not profit margins, mind, those don’t exist for the firms we’re talking about — we’re discussing gross margins, the most basic element of corporate profitability.

Gross margins are part of why software companies are so valuable. Their incredibly strong gross margins make their revenues, and therefore their operations, attractive to investors; higher gross margins mean more money left over to cover expenses and redistribute to shareholders via dividends and buybacks. Lower gross margin businesses, in contrast, have less money once they are done paying for revenue costs, making it harder for those companies to cover operating costs, let alone give away leftover funds to their owners.

So it has been to our surprise that Kingsoft Cloud, Vroom, and, soon, Lemonade are seeing such strong responses. It’s perhaps even more surprising that these companies managed to raise as much private capital as they did in their youth, despite not sporting gross margins that track with what we expect from venture-backed, tech and tech-ish companies.

With markets at all-time highs — and thus comparable valuations contentedly stretched — it’s probably a great time to take low-margin, growth-y companies public. But that doesn’t mean the situation makes perfect financial sense.

Powered by WPeMatico

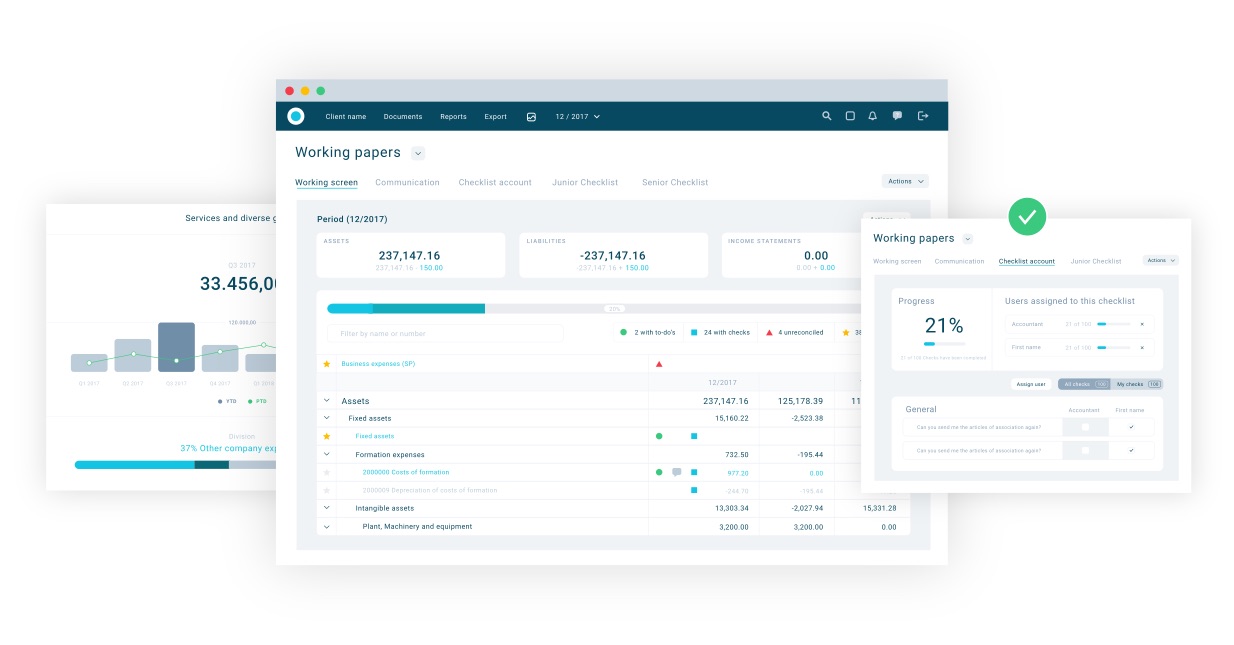

Meet Silverfin, a startup focused on accounting software. This isn’t about helping small startups handle accounting tasks themselves. Silverfin wants to build the cloud service for small and big accounting firms — Salesforce, but for accounting.

The startup just raised a Series B funding round led by Hg — Index Ventures led the previous Series A round. While terms of the deal are undisclosed, a source told me the round is worth approximately $30 million.

In order to improve productivity, Silverfin tries to automate the most time-consuming aspect of accounting — data collection. The company helps you connect with your clients’ accounting software directly to import their data, such as Xero, QuickBooks, Sage and SAP.

After that, Silverfin standardizes your data set and lets you add data manually so the platform can become the main data repository.

Once your data is in the system, you need to process it. Silverfin lets you configure automated workflows and templates so that anybody in the accounting firm can enrich data and check for compliance issues. Like Salesforce and other software-as-a-service products, multiple people can communicate on the service and look at all past edits and changes.

You can then visualize financial data, generate reports and statements. It opens up new possibilities for accounting firms. They can charge advisory services thanks to analytics tools and an alert system.

The startup was founded in Ghent, Belgium, but it has now expanded to London, Amsterdam and Copenhagen. Silverfin has attracted 650 customers, including big accounting firms in Europe and North America.

By targeting the most demanding customers first, Silverfin doesn’t need to replace Xero or QuickBooks altogether. It can integrate with those existing software solutions first. There’s an opportunity to go downmarket later and convince smaller companies that don’t necessarily have a big accounting team.

Powered by WPeMatico

Earlier this week, TechCrunch covered a grip of earnings reports showing that some companies helping other businesses move to modern software solutions are seeing accelerated growth. Inside the Software as a Service (SaaS) world, this is known as the digital transformation. Based on how many software companies are talking about it, the pace of change is only picking up.

But since we published that first entry, a number of SaaS companies that have posted financial results seemed to disappoint investors. Seeing some companies in the high-flying sector struggle made us sit back and think. What was going on?

Today we’re going to explore how the digital transformation’s acceleration seems real enough, but how it’s not landing equally. We’ll start by going over a short run of earnings results, talk to Yext CEO Howard Lerman about what his B2B SaaS company is seeing, and wrap with notes on what could be coming next from software shops.

We all hear about digital transformation, but it’s hard to define. Generally, it’s a broad area that includes digitization of manual processes, modern software development practices like continuous delivery and containerization and a general way of moving faster via technology — especially in the cloud.

Speaking last month on Extra Crunch Live, Box CEO Aaron Levie defined the term as he sees it. “The way that we think about digital transformation is that much of the world has a whole bunch of processes and ways of working — ways of communicating and ways of collaborating where if those business processes or that way we worked were able to be done in digital forms or in the cloud, you’d actually be more productive, more secure and you’d be able to serve your customers better. You’d be able to automate more business processes.” he said.

What we’re seeing now is that the pandemic has accelerated the rate of change much faster than many had anticipated. Efforts to slow the spread of COVID-19 and its related workplace disruptions have accelerated what would have been a normal timetable. But on its own, that doesn’t mean the market is seeing equal results across every company and industry that might be part of that trend.

Lots of SaaS companies reported earnings this week, but two sets of returns stuck out as we reviewed the results, those from Slack and Smartsheet.

Powered by WPeMatico