Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Lightrun, a Tel Aviv-based startup that makes it easier for developers to debug their production code, today announced that it has raised a $4 million seed round led by Glilot Capital Partners, with participation from a number of engineering executives from several Fortune 500 firms.

The company was co-founded by Ilan Peleg (who, in a previous life, was a competitive 800m runner) and Leonid Blouvshtein, with Peleg taking the CEO role and Blouvshtein the CTO position.

The overall idea behind Lightrun is that it’s too hard for developers to debug their production code. “In today’s world, whenever a developer issues a new software version and deploys it into production, the only way to understand the application’s behavior is based on log lines or metrics which were defined during the development stage,” Peleg explained. “The thing is, that is simply not enough. We’ve all encountered cases of missing a very specific log line when trying to troubleshoot production issues, then having to release a new hotfix version in order to add this specific logline, or — alternatively — reproduce the bug locally to better understand the application’s behavior.”

With Lightrun, as the co-founders showed me in a demo, developers can easily add new logs and metrics to their code from their IDE and then receive real-time data from their real production or development environments. For that to work, they need to have the Lightrun agent installed, but the overhead here is generally low because the agent sits idle until it is needed. In the IDE, the experience isn’t all that different from setting a traditional breakpoint in a debugger — only that there is no break. Lightrun can also use existing logging tools like Datadog to pipe its logging data to them.

While the service’s agent is agnostic about the environment it runs in, the company currently only supports JVM languages. Blouvshtein noted that building JVM language support was likely harder than building support for other languages and the company plans to launch support for more languages in the future.

“We make a point of investing in technologies that transform big industries,” said Kobi Samboursky, founder and managing partner at Glilot Capital Partners . “Lightrun is spearheading Continuous Debugging and Continuous Observability, picking up where CI/CD ends, turning observability into a real-time process instead of the iterative process it is today. We’re confident that this will become DevOps and development best practices, enabling I&O leaders to react faster to production issues.”

For now, there is still a bit of an onboarding process to get started with Lightrun, though that’s generally a very short process, the team tells me. Over time, the company plans to make this a self-service process. At that point, Lightrun will likely also become more interesting to smaller teams and individual developers, though the company is mostly focused on enterprise users and, despite only really launching out of stealth today and offering limited language support, the company already has a number of paying customers, including major enterprises.

“Our strategy is based on two approaches: bottom-up and top-down. Bottom-up, we’re targeting developers, they are the end-users and we want to ensure they get a quality product they can trust to help them. We put a lot of effort into reaching out through the developer channels and communities, as well as enabling usage and getting feedback. […] Top-down approach, we are approaching R&D management like VP of R&D, R&D directors in bigger companies and then we show them how Lightrun saves company development resources and improves customer satisfaction.”

Unsurprisingly, the company, which currently has about a dozen employees, plans to use the new funding to add support for more languages and improve its service with new features, including support for tracing.

Powered by WPeMatico

The fintech revolution is just getting started.

At least that’s the impression we got after a conversation with Plaid co-founder Zach Perret. He appeared on Extra Crunch Live last week to talk about his company’s announced exit to Visa and the larger fintech landscape.

Perret and Plaid announced a deal to sell the company to Visa earlier this year for $5.3 billion, a transaction that highlighted the company’s central position in the fintech world. Plaid provides APIs that link consumer bank accounts to apps and other financial services, making it the connective tissue of the fintech boom.

It’s probably no surprise, then, that Perret is bullish: “You’ve heard it a million times, but the quote of software eating the world [is true], and my corollary to that is [that] every company is a fintech company. And certainly every financial services company should be a fintech company.”

He said there’s lots of room left for fintech and finservices companies to create new products, which is not a bad view of the future if you want to be cheered up. Perret also noted that there are widespread opportunities for fintech companies to help underbanked people in the U.S. and abroad, which indicates a massive, untapped total addressable market.

To make sure you can take your own notes, we’ve included the full session below and excerpted a few passages from the transcript. (You can sign up for Extra Crunch here if you need access.)

First up, here’s the full call:

Powered by WPeMatico

While we await a fresh IPO filing from heavily backed insurtech startup Lemonade, let’s talk a little more about its public offering.

Since our first dig into its S-1 filing, TechCrunch has spoken to a number of investors and operators in Lemonade’s space to find out if our initial read was off — were we being too generous or too kind to Lemonade after reading its somewhat complex financial results?

The Exchange is a daily look at startups and the private markets for Extra Crunch subscribers; use code EXCHANGE to get full access and take 25% off your subscription.

The short answer is not really, though there are some positive notes and themes worth highlighting. This morning, let’s ask three questions about Lemonade’s IPO filing that will help us understand what’s ahead for the SoftBank-backed unicorn.

Three questions

Three questions1. How quickly can Lemonade accelerate its rental insurance graduation rate?

On the theme of things that bode well for Lemonade is its ability to “graduate” customers from low-cost rental insurance to more lucrative products.

In its S-1 filing, Lemonade noted this fact early on. After stating that a “an entry-level $60 a year [rental] policy [corresponds] to $10,000 of possessions,” the company said that as its customers age, they tend to buy more insurance and sometimes swap rental plans for homeowner policies. Moving from the former to the latter is graduating in the company’s parlance.

If many customers moved from rental insurance to homeowner insurance while keeping Lemonade as their provider, the company could do very well, as illustrated by this section of its SEC filing:

Powered by WPeMatico

With more companies moving workers home, making sure your systems are up and running has become more important than ever. ServiceNow, which includes in its product catalog an IT Help Desk component, recognizes that help desks have been bombarded during the pandemic. To help stop configuration problems before they start, the company today acquired Sweagle, a configuration management startup based in Belgium.

The companies did not share the purchase price.

ServiceNow gets a couple of boosts in the deal. First of all, it gets the startup’s configuration management products, which it can incorporate into its own catalog, but it also gains the machine learning and DevOps knowledge of the company’s employees. (The company would not share the exact number of employees, but PitchBook pegs it at 15.)

RJ Jainendra, ServiceNow’s vice president and general manager of DevOps and IT Business Management, sees a company that has pioneered the IT configuration management automation space, and brings with it capabilities that can boost ServiceNow’s offerings. “With capabilities for configuration data management from Sweagle, we will empower DevOps teams to deliver application and infrastructure changes more rapidly while reducing risk,” Jainendra said in a statement.

ServiceNow claims that there can be as many as 50,000 different configuration elements in a single enterprise application. Sweagle has designed a configuration data management platform with machine learning underpinnings to help customers simplify and automate that complexity. Configuration errors can cause shutdowns, security issues and other serious problems for companies.

Sweagle was founded in 2017 and raised $4.05 million on a post-valuation of $11.88 million, according to PitchBook data.

The company is part of a growing pattern of early-stage startups being sucked up by larger companies during the pandemic, including VMware acquiring Ocatarine and Atlassian buying Halp in May and NetApp snagging Spot earlier this month.

This is the third acquisition for ServiceNow this year, all involving AI underpinnings. In January it bought Loom Systems and Passsage AI. The deal is expected to close in Q3 this year, according to ServiceNow.

Powered by WPeMatico

It all started with an email from a customer: “Do you know why Bain Capital Ventures is reaching out to me about Clockwise?”

That email would mark the beginning of a journey toward closing $18 million in new funding that will dramatically accelerate my company, Clockwise . It would require getting to know a partner in lockdown, long nights assembling a pitch deck and many bleary-eyed Zoom calls with some of the best VCs in the world.

Here’s how Ajay Agarwal from Bain Capital Ventures and I established trust online, how I made high-stakes decisions in extreme economic uncertainty and how we were able to turn the pandemic’s constraints into opportunities.

Let’s start at the beginning.

Clockwise was founded in late fall of 2016. We realized that, as personal as time is, our schedules inside modern work environments are intertwined by a network of calendar events and attendees. People schedule meetings without considering the preferences of colleagues by simply hunting for any available “white space” (read: time to do real work). The net effect is that our most valuable resource, time, is easy to take and almost impossible to protect.

More than two years later, in June of 2019, we launched Clockwise to the public. After years of experimentation and refinement, we delivered to the world an intelligent calendar assistant that frees up your time so you can focus on what matters. Workers soon confirmed our hunch that they’re hungry for a tool that gives them more productive hours in their day. Our rapid user growth carried throughout 2019.

By January of 2020, we were on fire. Since January 1, our user base has grown by more than 90%, expanding at a clip of well over 5% week-over-week. As people sought remote tools during shelter-in-place, our rate of growth accelerated even further.

Our growth, incredible team, top-tier existing investors (Accel and Greylock) and strong cash position meant we didn’t need to raise additional capital until the fall of 2020. While COVID-19 certainly sent shock waves through the community, I was in regular communication with a few highly engaged investors who still seemed eager to invest in the future of productivity. I felt cautiously confident more capital could wait.

But, you know, best-laid plans.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Your humble Equity team is pretty tired but in good spirits, as there was a lot to talk about this week. But, first, three things to start us off:

All that said, here’s what we talked about on the show:

And that’s that. Have a lovely weekend and catch up on some sleep.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Mapillary, the Swedish startup that wants to take on Google and others in mapping the world via a crowdsourced database of street-level imagery, has been acquired by Facebook, according to the company’s blog. Terms of the deal aren’t being disclosed.

The Mapillary team and project will become part of Facebook’s broader open mapping efforts. Mapillary also says its “commitment to OpenStreetMap stays.” Writes Mapillary co-founder and CEO Jan Erik:

From day one of Mapillary, we have been committed to building a global street-level imagery platform that allows everyone to get the imagery and data they need to make better maps. With tens of thousands of contributors to our platform and with maps being improved with Mapillary data every single day, we’re now taking the next big step on that journey.

As Erik notes, Facebook is known to be “building tools and technology to improve maps through a combination of machine learning, satellite imagery and partnerships with mapping communities.” Mapping has immediate use-cases for the social networking behemoth, such as Facebook Marketplaces and its local business offerings, while another application is augmented reality.

This saw it recently acquire another European startup, Scape, news that TechCrunch broke in February. Founded in 2017, Scape Technologies was developing a “Visual Positioning Service” based on computer vision, which lets developers build apps that require location accuracy far beyond the capabilities of GPS alone. The technology initially targeted augmented reality apps, but also had the potential to be used to power applications in mobility, logistics and robotics. More broadly, Scape wanted to enable any machine equipped with a camera to understand its surroundings.

Mapillary is also the latest “open” project to join and now be funded by Facebook. Last December, it quietly acquired U.K.-based Atlas ML, the custodian of “Papers With Code,” the free and open resource for machine learning papers and code.

Returning to Mapillary, the startup is keen to stress that it will continue being a “global platform for imagery, map data, and improving all maps.” “You will still be able to upload imagery and use the map data from all the images on the platform,” says Erik. It is also changing the license to permit commercial use:

Historically, all of the imagery available on our platform has been open and free for anyone to use for non-commercial purposes. Moving forward, that will continue to be true, except that starting today, it will also be free to use for commercial users as well. By continuing to make all images uploaded to Mapillary open, public, and available to everyone, we hope to enable new use cases, and grow the breadth of coverage and usage to benefit mapping for everyone. While we previously needed to focus on commercialisation to build and run the platform, joining Facebook moves Mapillary closer to the vision we’ve had from day one of offering a free service to anyone.

Powered by WPeMatico

Over the past two decades, the venture capital industry has exploded beyond anyone’s wildest imaginations.

What began as a sleepy industry in Boston and Menlo Park has now expanded to dozens of cities the world over. The National Venture Capital Association estimates that VCs deployed more than $130 billion in 2018 and 2019, and thousands of new investors have joined the ranks in recent years to find the next great startups.

All that activity, though, poses a dilemma for founders: Who actively writes checks? Who is a leader in a specific market or vertical? Who has the conviction to underwrite pathbreaking investments? Who, ultimately, do you want to have by your side for the next decade as your startup grows?

There are lists that rank VCs by their exit returns. There are lists that rank young VCs by their potential. There are lists of VCs who claim investment interest in various sectors. There are lists that try to ferret out deal volume, impact and other quantitative metrics. There are internal lists at accelerators that share collective wisdom between founders.

Who actively writes checks? Who is a leader in a specific market or vertical? Who has the conviction to underwrite pathbreaking investments? Who, ultimately, do you want to have by your side for the next decade as your startup grows?

All those lists and rankings have an important function to serve, but for all the compilations of investors out there, we couldn’t find a single one that publicly answered a simple yet vital question: Who are the VC investors who are leaders in specific verticals who should be a founder’s first stop during a fundraise?

Today’s venture industry is made up of thousands of investors with varying specialties, and far too many passive investors that are willing to participate in rounds but don’t actively participate in deals unless other investors have committed. Many don’t actively push to get deals done or don’t actively lead the charge to build a syndicate of investors.

With all that in mind, we’re excited to launch a new initiative that we hope will help answer those questions and help founders find that first check — The TechCrunch List.

Over the next few weeks, we’re going to be collecting data around which individual investors are actually willing to write the proverbial “first check” into a startup’s fundraising round and help catalyze deals for founders — whether it be seed, Series A or otherwise (i.e. out of your Series A investors, the first person who was willing to write the check and get the ball rolling with other investors). Once we’ve collected, cleaned and analyzed the data, we’ll publish lists of the most recommended “first check” investors across different verticals, investment stages and geographies, so founders can see which investors are potentially the best fit for their company.

Founders are used to being specialized; after all, they have to live and breathe their startups every single day. So it can be jarring to start talking to generalist investors who know little about a category and ask shallow questions only to render a judgment with irrelevant advice. One of the greatest impetuses for us to put together The TechCrunch List is that like founders, we also struggle to cut through the noise around the interests of individual VCs.

We’d argue that’s close to impossible. There is more spend on technology than ever before in history. Verticals are getting more competitive — market maps that used to have 10 to 50 companies have expanded to hundreds. The only way to compete today is to specialize, and that has never been more true for VCs.

In all, The TechCrunch List will publish the most recommended “first check” writers across 22 different categories, ranging from D2C & e-commerce brands to space, and everything in between. Through some data analysis around total investments in each space, we believe our 22 categories should cover the entirety or majority of the venture activity today.

To make this project a success and create a useful resource for founders, we need your help. We want to hear from company builders and we want to hear from them directly.

To make this project a success and create a useful resource for founders, we need your help. We want to hear from company builders and we want to hear from them directly. We will be collecting endorsements submitted by founders through the form linked here.

Through the form, founders will be asked to submit their name, their startup, the stage of company, the name of the one “first check” investor they want to endorse and a couple of minor logistical items. We are asking founders here for their on-the-record endorsement. We ask that you limit your recommendations to one (1) person per fundraise round.

While many investors may have helped you in your journey, we are specifically interested in the person who most helped you get a round underway and closed. The one who catalyzed your round. The one who guided you through the fundraise process. The one investor you would ultimately recommend to other founders who are trying to find their VC champion.

Our main goal is to help founders, dreamers and company builders find investors who will invest in them today, and with your help, we think we can. The TechCrunch List is not meant to identify every possible investor under the sun who might make an investment within a space, nor just the big household-name VCs whose reputations can sometimes seem more linked to their follower counts on Twitter as opposed to their bold term sheets.

Our hope is that this can be a go-to resource for founders looking to fundraise going forward, and with that in mind, we are very determined to improve the glaring representation gaps in the venture industry. It’s no secret that the world of VC still looks like a country-club membership roster, dominated by white men with strong opinions and loud voices. Looking at the data, it’s clear that there are groups that are particularly underrepresented, with only a small portion of the industry made up of Black, Latinx and female investors, for example.

We want to amplify these voices and we want to hear particularly from founders of color, female founders and other underrepresented groups. We also want to make sure our recommended investor lists are sufficiently representative and highlight underrepresented investors who might not have had equal opportunities in the past.

We want to help builders wade through the BS politics and fundraising annoyances that founders complain to us about on a daily basis, and help them identify qualified leads that are actually active, engaged and specialized and are the best fit to help founders raise money and grow now.

Thank you for your support. We’re excited to build The TechCrunch List with you — and for you.

Powered by WPeMatico

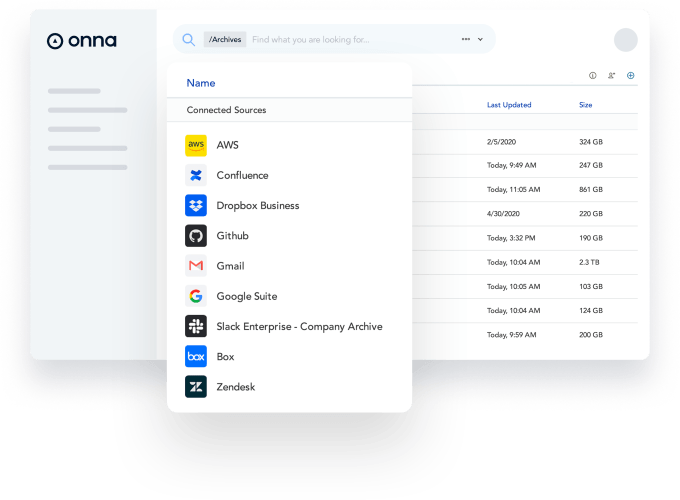

Onna, the “knowledge integration platform” (KIP) that counts Dropbox and Slack as backers, has raised $27 million in Series B funding.

Leading the round is Atomico, with participation from Glynn Capital. Previous investors Dawn Capital, Nauta Capital and Slack Fund also followed on.

Founded in 2015, Barcelona and New York-based Onna integrates with a plethora of workplace apps, including Slack, Dropbox, G Suite, Microsoft 365 and Salesforce, to help unlock the proprietary knowledge stored in a company’s various cloud and on-premise software. Typical applications for a KIP include compliance, governance, archiving and “eDiscovery.”

From communication apps to cloud storage to HR platforms, the idea is to unify all of this data and make it searchable but in a way that is secure and protects existing permissions and privacy. In fact, another way to think of Onna is like Apple’s Spotlight functionality but for the enterprise. However, pitched as a platform not just a feature, Onna also offers an API of its own so that various use cases can be built on top of this “single source of truth.”

“Onna’s knowledge integration platform is a centralised, searchable and secure hub that connects company data wherever it resides and makes it easier and faster to make informed decisions,” Onna founder and CEO Salim Elkhou tells TechCrunch. “It is a productivity tool built for the way businesses work today… something that didn’t exist before, creating a new industry standard which benefits all companies within the ecosystem.”

“Onna’s knowledge integration platform is a centralised, searchable and secure hub that connects company data wherever it resides and makes it easier and faster to make informed decisions,” Onna founder and CEO Salim Elkhou tells TechCrunch. “It is a productivity tool built for the way businesses work today… something that didn’t exist before, creating a new industry standard which benefits all companies within the ecosystem.”

Citing a report by single sign-in provider Okta, Elkhou notes that companies today use an average of 88 different apps across their workforce, a 21% increase from three years ago.

“The reason apps have become so popular is that they’re very effective for tackling specific challenges, or even a broad range of tasks. But the problem large organisations were coming up against is that their knowledge was spread across a wide range of apps that weren’t necessarily designed to work together.”

For example, a legal counsel could be looking to find contracts company-wide to assess a company’s exposure. The problem is that contracts may be saved in Salesforce, sent by email, shared over Slack or even saved on desktops. “Your company may have acquired another company, which has its own ways of saving information, so now the simple task of finding contracts can be a heavy lifting exercise, involving everyone’s time. With Onna, being the connective tissue across these applications, this search would take a split second,” claims Elkhou.

But the potential power of a KIP goes well beyond search alone. Elkhou says a more ambitious use case is unifying knowledge across apps and using Onna as infrastructure. “We believe that the next generation of workplace apps will be built on top of a knowledge integration platform like Onna,” he explains. “Due to our plug and play integrations with most enterprise apps and our open API, you can now build your own bespoke workflows on top of your company’s knowledge. More importantly, we handle all the heavy lifting on the back end when it comes to processing the right contextual information across multiple systems securely, which means you can get on with creatively building a more efficient workplace.”

“In Onna, we saw a product in a new and complementary category, providing a solution not at the data level but at the ‘knowledge level,’ ” adds Atomico’s Ben Blume, who has also joined the Onna board. “Onna’s core solution integrates with any tools in an organisation where knowledge resides, [and] ingests, indexes and classifies the knowledge inside, enabling it to power applications in many areas.”

Blume also points to the belief that some of the cloud tools vendors themselves have in Onna, with both Slack and Dropbox “investing, using and promoting” Onna’s solution. “As they look to grow their own penetration in organisations with a wider range of needs and demands, we saw partnering with Onna as a recognition of its best in class nature to their customers,” he says.

Meanwhile, I understand the new round of funding was done remotely due to lockdown, even though Atomico and Onna had already met and stayed in touch after the VC firm ended up not participating in the startup’s Series A.

Recalls Elkhou: “We had met with our investors in person over a year ago, and have had many video calls since and prior to the pandemic. However, soon after the lockdowns took effect, the need for remote collaboration tools skyrocketed which only accelerated the critical role Onna has in helping people within organisations access and share knowledge that was spread across an ever growing number of apps. If anything, it brought new urgency to the problem we were solving, because workplace serendipity no longer existed. You couldn’t answer questions over a coffee or by the water cooler, but these new remote workers still needed to access knowledge and share it securely.”

Powered by WPeMatico

Adtech startup Admix is announcing that it has raised $7 million in Series A funding.

The London-based company was founded by CEO Samuel Huber (previously owner of an indie gaming studio) and COO Joe Bachle-Morris (who previously worked in the ad agency world). The company is working to bring ads to games, esports, virtual reality and augmented reality.

In-game advertising is already a huge market, but Admix says it’s differentiated by focusing on building a product that supports game advertising at scale, where advertisers can bid programmatically through traditional ad-buying platforms, rather than relying on an ad agency model.

For developers, Admix offers an SDK for the Unity and Unreal game engines, allowing them to drag and drop into their games ad formats like billboards, posters and 3D spaces. The startup says it’s working with more than 200 developers and is running campaigns from more than 500 advertisers each month, with past advertisers including National Geographic, Uber and State Farm.

“The concept of putting ads in games is obviously not new, but the scalability of our solution is what is revolutionary, delivering instant and consistent revenue to game makers, or streaming platforms,” Huber said in a statement. “This coupled with the fact that 1.5B people play games globally every day, means that gaming is becoming a truly mainstream advertising channel.”

Admix previously raised $2.1 million, according to Crunchbase. The Series A was led by U.K.-based Force Over Mass, with the participation from Speedinvest, Sure Valley Ventures and Nigel Morris (a former Dentsu Aegis executive), as well as other angel investors.

Powered by WPeMatico