Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Housing has been constructed for millennia, and while clearly our modern abodes are ever so slightly better than the elk tents we used to live in, the construction techniques behind housing today haven’t progressed all that much. What has progressed are prices — it’s more expensive than ever to build a modern unit, and that’s just for housing — head over to commercial real estate and the numbers don’t look much better.

For Martin Diz and his team, that’s a problem. Diz is not exactly a lifelong builder — in fact, he was building proverbial rockets as an aerospace engineering PhD researcher several years ago. As he was talking to his roommate back then, who was studying structural engineering, he realized that some of the techniques that his roommate’s field was trying to pioneer had already been discovered by the aerospace folks decades ago.

His roommate was trying to simulate an earthquake to model how the tremors would affect objects like a table inside a building. As Diz recalled, he said “Hey dude, did you know that in aerospace engineering, we did the same thing for the space station 50 years ago? … I learned this in grad school, you know, in our basic course because it’s a very old technique.”

Diz is legitimately a nice chap, and totally not the kind of aerospace engineer who goes around talking about how aerospace solved everything a century ago (okay, maybe just a tad of that). But the interaction and followup conversation got him thinking about what aerospace as a field had solved, and whether some of those techniques could be used in other domains.

Diz and his roommate kept talking over the years, and eventually, the two formed Tango Builder. Tango’s main premise is to bring more sophisticated engineering techniques to construction, improving performance and quality while lowering costs. It’s part of the current YC batch, and previously raised a small seed round, which included participation from Tracy Young, co-founder and CEO of PlanGrid.

The two, plus one employee, have already worked on a handful of projects, with some early promising results. Tango helped to design a hospital for COVID-19 patients in Ecuador that saw total savings of $1 million by lowering structural costs by a third. They consulted on the creation of a justice center in Mexico, and were able to reduce the required steel in the project by 40%. And they used their platform to optimize wall thickness in a masonry home to bring total cost down by 15%. All numbers are reported by the company and have not been independently verified.

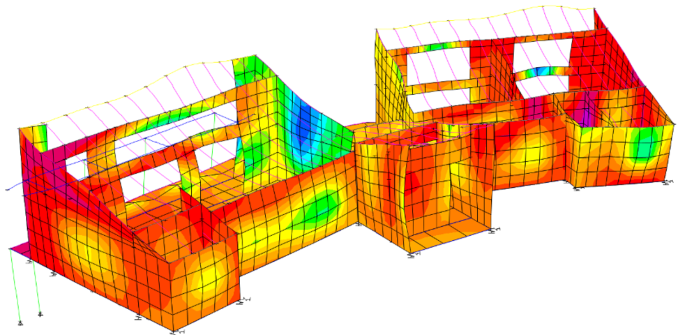

A look at Tango’s masonry home project. Photo from Tango Builder.

A look at Tango’s masonry home project. Photo from Tango Builder.

There is a heavy focus on structural integrity (as there should be in construction), but Tango particularly shines around seismic modeling. While earthquakes are perhaps most pronounced in places like California and Mexico, both of which suffered major tremors this past week, earthquakes are a lingering threat throughout the world, and buildings need to be designed to handle them even if they are rare.

Diz and his team want to give designers better tools to model what happens in different scenarios while understanding the trade-offs of various building materials and designs. “You’re building with steel stock, but it’s much more expensive now, so it’s up to the user or the owner to decide which of the paths he wants to take,” he said. Safety is always important, but how much steel do you place in a building that might see an earthquake once a century? That’s what Tango wants to help answer.

Beyond improving structural modeling, Tango’s big ambition is to find additional efficiencies in the construction process by helping everyone involved with construction work together through a better workflow. “Each person has benefits from the platform, the architect will get the approvals … faster, the engineer can focus on the creative side of things, the contractor” can bid earlier knowing what design is coming, Diz explained. Saving time in all these processes ultimately translates directly to a project’s bottom line.

It’s very early days of course, with just Diz, his co-founder Juan Aleman, and one employee “working extremely hard.” The hope though is that melding some aerospace engineering techniques with a much more robust and technical platform will help push construction to better quality while saving costs as well. After all, aerospace did all this a century ago.

Powered by WPeMatico

In a move that highlights how open the American IPO window may be at the moment, China-based Agora priced its public offering at $20 per share last night, ahead of its $16 to $18 proposed price range. (Update: As noted here, the company has a second HQ in California.)

At $20 per share, the 17.5 million shares sold in its debut raised $350 million, a huge haul for a company that reported around 10% of that figure in Q1 2020 revenue. Provided that your humble servant is doing his Class A to ADS share conversion calculations correctly, Agora is worth about $2 billion at its IPO price.

Agora raised well over $100 million while a private company, backed by GGV Capital, Coatue and others, according to Crunchbase data.

The Exchange is a daily look at startups and the private markets for Extra Crunch subscribers; use code EXCHANGE to get full access and take 25% off your subscription.

Agora is an API-powered company that allows customers to embed real-time video and voice abilities in their applications; appropriately, the company’s ticker symbol in America will be “API.”

With an annual run rate of $142.2 million, a $2 billion valuation gives Agora a run-rate multiple of around 14x. That’s rich, but not stratospheric. Perhaps Agora wasn’t able to command a higher multiple due to its sub-70% margins (68.8% in Q1)?

With an annual run rate of $142.2 million, a $2 billion valuation gives Agora a run-rate multiple of around 14x. That’s rich, but not stratospheric. Perhaps Agora wasn’t able to command a higher multiple due to its sub-70% margins (68.8% in Q1)?

Agora’s financials make its IPO pricing a neat puzzle, so let’s pull apart the good and the bad to better understand why the market was willing to pay more than the company anticipated.

After that short exercise, we’ll make note of the current IPO climate, inclusive of what we learn from Agora. (Spoiler for unicorns out there: Things look good.)

We can’t calculate Agora’s enterprise value with confidence until we get updated filings. But taking into account the company’s pre-IPO cash and liabilities, its implied enterprise value/run rate is something around 13x. (That figure will dip if the company’s shares don’t rise after its debut, as its cash position rises from its share sale; more on enterprise values here.)

Powered by WPeMatico

The direct-to-consumer health insurer Oscar has raised another $225 million in its latest, late-stage round of funding as its vision of tech-enabled healthcare services to drive down consumer costs becomes more and more of a reality.

In an effort to prevent a patient’s potential exposure to the novel coronavirus, COVID-19, most healthcare practices are seeing patients remotely via virtual consultations, and more patients are embracing digital health services voluntarily, which reduces costs for insurers and potentially provides better access to basic healthcare needs. Indeed, Oscar now has a $2 billion revenue base to point to and now a fresh pile of cash from which to draw.

“Transforming the health insurance experience requires the creation of personalized, affordable experiences at scale,” said Mario Schlosser, the co-founder and chief executive of Oscar.

Oscar’s insurance customers have the distinction of being among the most active users of telemedicine among all insurance providers in the U.S., according to the company. Around 30% of patients with insurance plans from the company have used telemedical services, versus only 10% of the country as a whole.

The new late-stage funding for Oscar includes new investors Baillie Gifford and Coatue, two late-stage investor that typically come in before a public offering. Other previous investors, including Alphabet, General Catalyst, Khosla Ventures, Lakestar and Thrive Capital, also participated in the round.

With the new funding, Oscar was able to shrug off the latest criticisms and controversies that swirled around the company and its relationship with White House official Jared Kushner as the president prepared its response to the COVID-19 epidemic.

As the Atlantic reported, engineers at Oscar spent days building a standalone website that would ask Americans to self report their symptoms and, if at risk, direct them to a COVID-19 test location. The project was scrapped within days of its creation, according to the same report.

The company now offers its services in 15 states and 29 U.S. cities, with more than 420,000 members in individual, Medicare Advantage and small group products, the company said.

As Oscar gets more ballast on its balance sheet, it may be readying itself for a public offering. The insurer wouldn’t be the first new startup to test public investor appetite for new listings. Lemonade, which provides personal and home insurance, has already filed to go public.

Oscar’s investors and executives may be watching closely to see how that listing performs. Despite its anemic target, the public market response could signal that more startups in the insurance space could make lemonade from frothy market conditions — even as employment numbers and the broader national economy continue to suffer from pandemic-induced economic shocks.

Powered by WPeMatico

Karat is a new startup promising to build better banking products for the creators who make a living on YouTube, Instagram, Twitch and other online platforms. Today it’s unveiling its first product — the Karat Black Card.

The startup, which was part of accelerator Y Combinator’s Winter 2020 batch, is also announcing that it has raised $4.6 million in seed funding from Twitch co-founder Kevin Lin, SignalFire, YC, CRV and Coatue.

Co-founder and co-CEO Eric Wei knows the creator world well, thanks to his time as product manager for Instagram Live. (His co-founder Will Kim was previously an investor with seed fund Lucky Capital.) Wei told me that although many creators have significant incomes, banks rarely understand their business or offer them good terms when they need capital.

“Traditional banks care a lot about FICO [credit scores],” he said. “A lot of YouTubers, when they’re blowing up, they don’t have time to think: Let me make sure my FICO is awesome as well.”

At the same time, he argued that creators have become suspicious of potentially scammy financial offers, to the point that if you were to attend a pre-COVID VidCon and tried to give out $3,000, “The good creators will not take it, even if you tell them there are no strings behind it.”

Karat co-founders Will Kim and Eric Wei

With the Karat Black Card, the startup is giving creators a credit card that they can use for their business-related expenses. When creators are approved, they receive a $250 bonus that can be applied to any future purchases of electronics or equipment. The card also comes with custom designs, 2% to 5% cash back on purchases and it even offers advances on sponsorship payments.

Underlying it, Wei said Karat has developed an underwriting model that works for creators. Instead of looking at credit scores, Karat focuses on the size of a creator’s following, their current revenue and whether or not they’re “business savvy.”

“It’s not just the number of followers you have, but what platforms,” Wei added. “I would rather have 100,000 subscribers on YouTube than 1 million on TikTok, because on TikTok, it’s all algorithmically driven.”

Karat has already provided the card to an initial group of creators, including TheRussianBadger, TierZoo and Nas Daily. Wei said the model is working so far, with no defaults.

For now, the card is aimed at professional, full-time creators who have at least 100,000 followers. Wei estimated that that’s a potential customer base of 1 million creators. Eventually, he wants to provide those creators with more than a black card.

“We’re building a vertical financial and biz ops experience,” he said. “People in earlier stages, we do want to get to them eventually, but only after we feel like we’ve developed enough of an underwriting model.”

Powered by WPeMatico

Earlier today, insurtech unicorn Lemonade filed an S-1/A, providing context into how the former startup may price its IPO and what the company may be worth when it begins to trade.

According to its new filing, Lemonade expects its IPO to price at $23 to $26 per share. As the company intends to sell 11 million shares in its debut, the rental and home insurance-focused unicorn would raise between $253 million and $286 million at those prices.

Counting an additional 1.65 million shares that it will make available to its underwriting banks, the company’s fundraise grows to $291 million to $328.9 million. Including shares offered to underwriters, Lemonade’s implied valuation given its IPO price range runs from $1.30 billion to $1.47 billion.

That’s the news. Now, is that expected valuation interval strong, and, if not, what might it portend for other insurtech startups? Let’s talk about it.

TechCrunch is speaking with the CEOs of Hippo (homeowner’s insurance) and Root (car insurance) later today, so we’ll get their notes in quick order regarding how Lemonade’s IPO is shaping up, and if they are surprised by its pricing targets.

But even without external commentary, the pricing range that Lemonade is at least initially targeting is not terribly impressive. That said, it’s stronger than I anticipated.

Powered by WPeMatico

As the IPO market heats up, one offering slipped beneath our radar. This morning, then, we’ll catch up on Accolade’s initial public offering and what its proposed pricing may tell us about the state of the IPO market.

The Exchange is a daily look at startups and the private markets for Extra Crunch subscribers; use code EXCHANGE to get full access and take 25% off your subscription.

Catching everyone back up, Accolade sells its service to employers who in turn offer it to their employees; the company’s tech provides a portal for individuals to “better understand, navigate and utilize the health care system and their workplace benefits,” Accolade states in its S-1 filings.

The firm goes on to point out that the U.S. health care system is complex, which puts “significant strain on consumers.” Correct. Its solution? To help “consumers make better, data-driven health care and benefits-related decisions” through its service by selling a “platform to support and influence consumer decision-making that is built on a foundation of mission-driven people and purpose-built technology.”

The firm goes on to point out that the U.S. health care system is complex, which puts “significant strain on consumers.” Correct. Its solution? To help “consumers make better, data-driven health care and benefits-related decisions” through its service by selling a “platform to support and influence consumer decision-making that is built on a foundation of mission-driven people and purpose-built technology.”

Yeah.

Regardless of that verbiage, Accolade’s business has proven sufficiently attractive to allow the firm to file to go public in late February, around when Procore filed. Both companies delayed their offerings, but Procore raised more private capital, a $150 million round that values it at around $5 billion. Accolade, to our knowledge, did not raise more funds. So, its IPO is back on and today we have its pricing interval.

Let’s unpack its pricing range, write some notes on its recent financial results and try to figure out how ambitious Accolade is being in terms of its expected valuation as it counts down to trading publicly.

According to Accolade’s June 24th S-1/A, the company expects a $19 to $21 per-share IPO price range. The company intends to sell 8.75 million shares in its debut, not counting a 1,312,500 share greenshoe option offered to its underwriters. Discounting the extra shares, Accolade would raise between $166.3 million to $183.8 million in its debut; inclusive of greenshoe shares, the total fundraise grows to a range of $191.2 million to $211.3 million.

Powered by WPeMatico

Homebuilding is not for the faint of heart, particularly those who want to build something custom. Selecting the right architect and designer, the myriad contractors, the complexity of building codes and siting, the regulatory approvals from local authorities. It’s a full-time job — and you don’t even have a roof built over your head.

Atmos wants to massively simplify homebuilding, and in the process, democratize customization to more and more homeowners.

The startup, which is in the current Y Combinator batch, wants to take both the big decisions and the sundries of construction and combine them onto one platform where selecting a design and moving forward is as simple as clicking through a Shopify shopping cart.

It’s a vision that has already piqued the attention of investors. The company disclosed that it has already raised $2 million, according to CEO and co-founder Nick Donahue, from Sam Altman, former YC president and now head of OpenAI, and Adam Nash, former president and CEO of Wealthfront, along with a bunch of other angels.

It’s also a vision that is a radical turn from where Atmos was before, which was centered in virtual reality.

Donahue comes from a line of homebuilders — his father built home subdivisions as a profession — but his interests initially turned toward the virtual. He dropped out of college after realizing process engineering wasn’t all that exciting (who can blame him?) and headed out to the Valley, where he built projects like “a Burning Man art installation and [an] open-source VR headset.” That headset attracted the attention of angels, who funded its development.

The concept at the heart of the headset was around what the team dubbed the “spatial web.” Donahue explained that the idea was that “the concept of the web would one day flow from the 2D into the 3D and that physical spaces would function more like websites.” The headset he was developing would act as a sort of “browser” to navigate these spaces.

Of course, the limitations around VR hit his company as much as the rest of the industry, including limits on computation performance to build these 3D environments and the lack of scaling in the sector so far.

The thinking around changing physical spaces though got Donahue pondering about what the future of the home would look like. “We think the next kind of wave of this is going to be an introduction to compute,” he said, arguing that “every home will have like a brain to it.” Homes will be digital, controllable and customizable, and that will revolutionize the definition of the home that has remained stagnant for generations.

The big vision for Atmos going forward then is to capture that trend, but for today at least, the company is focused on making housing customization easier.

To use the platform, a user inputs the location for a new home and a floor plan for the site, and Atmos will find builders that best match the plan and coordinate the rest of the tasks to get the home built. It’s targeting homes in the $400,000-$800,000 range, and its focus cities are Raleigh-Durham, Charlotte, Atlanta, Denver and Austin.

It’s very much early stages for the company — Donahue says that the company has its first few projects underway in the Raleigh-Durham area and is working to partner and scale up with larger homebuilders.

Image Credits: KentWeakley / Getty Images

Will it work? That’s the big question with anything that touches construction. Customization is great — everyone loves to have their own pad — but the traditional challenge for construction is that the only way to bring down the cost of housing is to make it as uniform as possible. That’s why you get “cookie-cutter” subdivisions and rows of identical apartment buildings. The sameness allows a builder to find scale. Work crews can move from one lot to the next in synchronicity saving labor costs and time while building materials can be bought in bulk to save costs.

With better technology and some controls, Atmos might be able to find synergies between its customers, particularly if it gets market penetration in individual cities. Yet, I find the longer-term vision ultimately more compelling for the company. Redefining the home may not have made much sense three months ago, but as more people work from home and connect with virtual worlds, how should our homes be redesigned to accommodate these activities? If Atmos can find an answer, it is sitting on a gold mine.

Atmos team pic (minus two). Image Credits: Atmos

In addition to Altman and Nash, Mark Goldberg, JLL Spark, Shrug Capital, Daniel Gross’ Pioneer, Venture Hacks, Yuri Sagalov, Brian Norgard and others participated in the company’s angel/seed round.

Powered by WPeMatico

When we announced the formation of The TechCrunch List last week, we had no idea what response we would get to our proposal for founders to recommend their “first-check” investors. While plenty of founders over the years have told us that they wanted such a database to rely on or to refer to other founders who are raising for the first time, there is always something nerve-wracking about launching a new product and waiting for feedback.

Well, the TechCrunch community came through, since in just a few days, we’ve already received more than 500 proposals from founders recommending VCs who wrote their first checks and who have been particularly helpful in fundraising and getting a round closed.

If you haven’t submitted a recommendation, please help us using the form linked here.

The short survey takes five minutes, and could save founders dozens of hours armed with the right intel. Our editorial team is carefully processing these submissions to ensure their veracity and accuracy, and the more data points we have, the better the List can be for founders.

We’ve gotten quite a few questions about this new initiative, so we wanted to answer some common queries.

First check into each round: We want to know who wrote the first check that helped catalyze a round at each stage of a startup. So it’s okay to submit a name for each round.

Only one recommendation per early-stage round: We are holding the line on only allowing one name per round though. We realize that party rounds are not uncommon at the angel and seed stages, but a list of 30 people who all “led” a round is precisely what we are trying to avoid with the List. So keep the recommendations to one name, please, or if you can’t, it’s best not to recommend anyone at all.

Deadline: There is no single deadline. We intend to publish a first draft of the list in the next two-three weeks, so earlier submissions are more likely to be processed in time for the draft list. Our goal with The TechCrunch List is to make it an up-to-date and living product, and so we intend to update it regularly with new information as we learn it. So it’s a rolling deadline.

Founders only: While we certainly appreciate VCs offering to humbly submit their own names for consideration, we really want to hear from the founders themselves who did the fundraise. Feel free to reach out to your founders to submit — many firms have already done so if our early data is any indication.

People not firms: We are obsessed about moving beyond firm brand names and instead identifying individual partners on recommendations, since ultimately, founders work with a person and not a brand.

Weighting: We’ve been asked how we are “weighting” the submissions. The simple answer is that we are (mostly) not weighting them. In addition to fact-checking and verifying each submission, our main consideration is a basic assessment of a startup’s quality — what was the size of the round, has it raised any follow-on financing and any other public displays of performance. The TechCrunch List isn’t assessing investor quality (there are plenty of other lists in our industry for that), but rather assessing the willingness of an investor to write a “first check.”

Keep submitting those names, and reach out to us if you have any questions.

Powered by WPeMatico

At a time when IT has to help employees set up and manage devices remotely, a service that simplifies those processes could certainly come in handy. Apple recognized that, and acquired Fleetsmith today, a startup that helps companies do precisely that with Apple devices.

While Apple didn’t publicize the acquisition, it has confirmed the deal with TechCrunch, while Fleetsmith announced the deal in a company blog post. Neither company was sharing the purchase price.

The startup has built technology that takes advantage of Apple’s Device Enrollment Program, allowing IT departments to bring devices online as soon as the employee takes it out of the box and powers it up.

At the time of its $30 million Series B funding last year, CEO Zack Blum explained the company’s core value proposition: “From a customer perspective, they can ship devices directly to their employees. The employee unwraps it, connects to Wi-Fi and the device is enrolled automatically in Fleetsmith,” Blum explained at that time.

Over time, the company has layered on other useful pieces beyond automating device registration, like updating devices automatically with OS and security updates, while letting IT see a dashboard of the status of all devices under management, all in a pretty slick interface.

While Apple will in all likelihood continue to work with Jamf, the leader in the Apple device management space, this acquisition gives the company a remote management option at a time when it’s essential with so many employees working from home.

Fleetsmith, which has raised more than $40 million from investors, like Menlo Ventures, Tiger Global Management, Upfront Ventures and Harrison Metal, will continue to sell the product through the company website, according to the blog post.

The founders put a happy face on the deal, as founders tend to do. “We’re thrilled to join Apple. Our shared values of putting the customer at the center of everything we do without sacrificing privacy and security, means we can truly meet our mission, delivering Fleetsmith to businesses and institutions of all sizes, around the world,” they wrote.

Powered by WPeMatico

A year after its initial release, Jumbo has two important pieces of news to announce. First, the company has released a major update of its app that protects your privacy on online services. Second, the company has raised an $8 million Series A funding round.

If you’re not familiar with Jumbo, the app wants to fix what’s broken with online privacy today. Complicated terms of services combined with customer-hostile default settings have made it really hard to understand what personal information is out there. Due to recent regulatory changes, it’s now possible to change privacy settings on many services.

While it is possible, it doesn’t mean it is easy. If you’ve tried to adjust your privacy settings on Facebook or LinkedIn, you know that it’s a convoluted process with a lot of sub-menus and non-descriptive text.

Similarly, social networks have been around for more than a decade. While you were comfortable sharing photos and public messages with a small group of friends 10 years ago, you don’t necessarily want to leave this content accessible to hundreds or even thousands of “friends” today.

The result is an iPhone and Android app that puts you in charge of your privacy. It’s essentially a dashboard that lets you control your privacy on the web. You first connect the app to various online services and you can then control those services from Jumbo. Jumbo doesn’t limit itself to what you can do with APIs, as it can mimic JavaScript calls on web pages that are unaccessible to the APIs.

For instance, if you connect your Facebook account, you can remove your profile from advertising lists, delete past searches, change the visibility of posts you’re tagged in and more. On Google, you can delete your history across multiple services — web searches, Chrome history, YouTube searches, Google Map activities, location history, etc.

More fundamentally, Jumbo challenges the fact that everything should remain online forever. Conversations you had six months ago might not be relevant today, so why can’t you delete those conversations?

Jumbo lets you delete and archive old tweets, Messenger conversations and old Facebook posts. The app can regularly scan your accounts and delete everything that is older than a certain threshold — it can be a month, a year or whatever you want.

While your friends will no longer be able to see that content, Jumbo archives everything in a tab called Vault.

With today’s update, everything has been refined. The main tab has been redesigned to inform you of what Jumbo has been doing over the past week. The company now uses background notifications to perform some tasks even if you’re not launching the app every day.

The data-breach monitoring has been improved. Jumbo now uses SpyCloud to tell you exactly what has been leaked in a data breach — your phone number, your email address, your password, your address, etc.

It’s also much easier to understand the settings you can change for each service thanks to simple toggles and recommendations that you can accept or ignore.

Image Credits: Jumbo

Jumbo’s basic features are free, but you’ll need to buy a subscription to access the most advanced features. Jumbo Plus lets you scan and archive your Instagram account, delete your Alexa voice recordings, manage your Reddit and Dropbox accounts and track more than one email address for data breaches.

Jumbo Pro lets you manage your LinkedIn account (and you know that LinkedIn’s privacy settings are a mess). You can also track more information as part of the data breach feature — your ID, your credit card number and your Social Security number. It also lets you activate a tracker blocker.

This new feature in the second version of Jumbo replaces default DNS settings on your phone. All DNS requests are routed through a Jumbo-managed networking profile on your phone. If you’re trying to access a tracker, the request is blocked; if you’re trying to access some legit content, the request goes through. It works in the browser and in native apps.

You can pay what you want for Jumbo Plus, from $3 per month to $8 per month. Similarly, you can pick what you want to pay for Jumbo Pro, between $9 per month and $15 per month.

You might think that you’re giving a ton of personal information to a small startup. Jumbo is well aware of that and tries to reassure its user base with radical design choices, transparency and a clear business model.

Jumbo doesn’t want to mine your data. Your archived data isn’t stored on Jumbo’s servers. It remains on your phone and optionally on your iCloud or Dropbox account as a backup.

Jumbo doesn’t even have user accounts. When you first open the app, the app assigns you a unique ID in order to send you push notifications, but that’s about it. The company has also hired companies for security audits.

“We don’t store email addresses so we don’t know why people subscribe,” Jumbo CEO Pierre Valade told me.

Jumbo has raised an $8 million funding round. It had previously raised a $3.5 million seed round. This time, Balderton Capital is leading the round. The firm had already invested in Valade’s previous startup, Sunrise.

A lot of business angels participated in the round as well, and Jumbo is listing them all on its website. This is all about being transparent again.

Interestingly, Jumbo isn’t betting on explosive growth and eyeballs. The company says it has enough funding until February 2022. By then, the startup hopes it can attract 100,000 subscribers to reach profitability.

Powered by WPeMatico