Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Swiss keyboard startup Typewise has bagged a $1 million seed round to build out a typo-busting, ‘privacy-safe’ next word prediction engine designed to run entirely offline. No cloud connectivity, no data mining risk is the basic idea.

They also intend the tech to work on text inputs made on any device, be it a smartphone or desktop, a wearable, VR — or something weirder that Elon Musk might want to plug into your brain in future.

For now they’ve got a smartphone keyboard app that’s had around 250,000 downloads — with some 65,000 active users at this point.

The seed funding breaks down into $700K from more than a dozen local business angels; and $340K via the Swiss government through a mechanism (called “Innosuisse projects“), akin to a research grant, which is paying for the startup to employ machine learning experts at Zurich’s ETH research university to build out the core AI.

The team soft launched a smartphone keyboard app late last year, which includes some additional tweaks (such as an optional honeycomb layout they tout as more efficient; and the ability to edit next word predictions so the keyboard quickly groks your slang) to get users to start feeding in data to build out their AI.

Their main focus is on developing an offline next word prediction engine which could be licensed for use anywhere users are texting, not just on a mobile device.

“The goal is to develop a world-leading text prediction engine that runs completely on-device,” says co-founder David Eberle. “The smartphone keyboard really is a first use case. It’s great to test and develop our algorithms in a real-life setting with tens of thousands of users. The larger play is to bring word/sentence completion to any application that involves text entry, on mobiles or desktop (or in future also wearables/VR/Brain-Computer Interfaces).

“Currently it’s pretty much only Google working on this (see Gmail’s auto completion feature). Applications such as Microsoft Teams, Slack, Telegram, or even SAP, Oracle, Salesforce would want such productivity increase – and at that level privacy/data security matters a lot. Ultimately we envision that every “human-machine interface” is, at least on the text-input level, powered by Typewise.”

You’d be forgiven for thinking all this sounds a bit retro, given the earlier boom in smartphone AI keyboards — such as SwiftKey (now owned by Microsoft).

The founders have also pushed specific elements of their current keyboard app — such as the distinctive honeycomb layout — before, going down a crowdfunding route back in 2015, when they were calling the concept Wrio. But they reckon it’s now time to go all in — hence relaunching the business as Typewise and shooting to build a licensing business for offline next word prediction.

“We’ll use the funds to develop advanced text predictions… first launching it in the keyboard app and then bringing it to the desktop to start building partnerships with relevant software vendors,” says Eberle, noting they’re working on various enhancements to the keyboard app and also plan to spend on marketing to try to hit 1M active users next year.

“We have more ‘innovative stuff’ [incoming] on the UX side as well, e.g. interacting with auto correction (so the user can easily intervene when it does something wrong — in many countries users just turn it off on all keyboards because it gets annoying), gamifying the general typing experience (big opportunity for kids/teenagers, also making them more aware of what and how they type), etc.”

The competitive landscape around smartphone keyboard tech, largely dominated by tech giants, has left room for indie plays, is the thinking. Nor is Typewise the only startup thinking that way (Fleksy has similar ambitions, for one). However gaining traction vs such giants — and over long established typing methods — is the tricky bit.

Android maker Google has ploughed resource into its Gboard AI keyboard — larding it with features. While, on iOS, Apple’s interface for switching to a third party keyboard is infamously frustrating and finicky; the opposite of a seamless experience. Plus the native keyboard offers next word prediction baked in — and Apple has plenty of privacy credit. So why would a user bother switching is the problem there.

Competing for smartphone users’ fingers as an indie certainly isn’t easy. Alternative keyboard layouts and input mechanism are always a very tough sell as they disrupt people’s muscle memory and hit mobile users hard in their comfort and productivity zone. Unless the user is patient and/or stubborn enough to stick with a frustratingly different experience they’ll soon ditch for the keyboard devil they know. (‘Qwerty’ is an ancient typewriter layout turned typing habit we English speakers just can’t kick.)

Given all that, Typewise’s retooled focus on offline next word prediction to do white label b2b licensing makes more sense — assuming they can pull off the core tech.

And, again, they’re competing at a data disadvantage on that front vs more established tech giant keyboard players, even as they argue that’s also a market opportunity.

“Google and Microsoft (thanks to the acquisition of SwiftKey) have a solid technology in place and have started to offer text predictions outside of the keyboard; many of their competitors, however, will want to embed a proprietary (difficult to build) or independent technology, especially if their value proposition is focused on privacy/confidentiality,” Eberle argues.

“Would Telegram want to use Google’s text predictions? Would SAP want that their clients’ data goes through Microsoft’s prediction algorithms? That’s where we see our right to win: world-class text predictions that run on-device (privacy) and are made in Switzerland (independent environment, no security back doors, etc).”

Early impressions of Typewise’s next word prediction smarts (gleaned by via checking out its iOS app) are pretty low key (ha!). But it’s v1 of the AI — and Eberle talks bullishly of having “world class” developers working on it.

“The collaboration with ETH just started a few weeks ago and thus there are no significant improvements yet visible in the live app,” he tells TechCrunch. “As the collaboration runs until the end of 2021 (with the opportunity of extension) the vast majority of innovation is still to come.”

He also tells us Typewise is working with ETH’s Prof. Thomas Hofmann (chair of the Data Analytic Lab, formerly at Google), as well as having has two PhDs in NLP/ML and one MSc in ML contributing to the effort.

“We get exclusive rights to the [ETH] technology; they don’t hold equity but they get paid by the Swiss government on our behalf,” Eberle also notes.

Typewise says its smartphone app supports more than 35 languages. But its next word prediction AI can only handle English, German, French, Italian and Spanish at this point. The startup says more are being added.

Powered by WPeMatico

Back in 2016, Mobalytics wowed the judges at Disrupt SF with its data-based coach for the exploding competitive gaming world, winning the Startup Battlefield. The company is building on the success of the past few years with a new funding round and a compelling new collaboration with Tobii that uses eye-tracking to provide powerful insights into gamers’ skills.

Mobalytics began with the idea that, by leveraging the in-game data of a competitive esport like League of Legends (LoL), they could provide objective feedback to players along the lines of how fast or effective they are in different situations. Quantifying things like survivability or teamplay provides an analogue to similar measures in physical sports.

“On an athlete you have all these measurements, like pulse oximeters, ECGs, the 40-yard dash,” said Amine Issa, co-founder and “Warchief of Science.” Not so much with PC games. Their challenge at that time was to take the LoL API provided by Riot and transform it into actionable feedback, which the company’s success in the years since suggests they managed to do.

But Issa had always wanted to use another, more direct and objective measurement of a gamer’s mental processes: eye tracking. And last year they began an internal project to evaluate doing just that, in partnership with eye-tracking hardware maker Tobii.

“If you know where someone is looking, it’s the closest thing to knowing what they’re thinking,” Issa said. “When you combine that with the larger picture you can put together something to help them along. So we spent six months conducting research, taking players of different levels and roles and studying their eye tracking data to find some metrics we could organize the platform around.”

Not surprisingly, there are characteristics of the highly skilled (and practiced) that set them apart, and the team was able to collect them into a set of characteristics that any player can relate to.

Well, the gif compression isn’t so hot, but you get the idea — the purple square indicates attention. Image Credits: Mobalytics

“We had to think about how to build a product that people want to use. One thing we learned after TechCrunch is that even a simple score from 0-100 doesn’t work for everyone. You need to provide the context for that. So with something like eye tracking, you’re getting 30 data points per second — how do you break that down in a way that players understand it?”

Talking to professional gamers and coaches during the study helped them form the main categories that Mobalytics now tracks with the aid of a Tobii device, like information processing, map awareness and tunnel vision.

“It’s important to be able to tell a narrative to people. Say you get ganked a lot,” said Issa, referring to the unfortunate occurrence of being picked off by enemy players while alone. “Why are you getting ganked? If your vision score is high but map awareness is low, that’s one thing. Did you know all the information and go in arrogantly, or were you not aware? League is a very complicated game, so players want to know, in this specific fight, what did I do wrong, and what should I have done instead?”

That second question is a tougher one (though perhaps AI MOBA players may have something to say about it), but the metrics are powerful in and of themselves. “Pros are fascinated by this technology,” Issa said. “There’s a lot of ‘I had no idea’ moments. Coaches have said, these are my fastest players but it’s cool to see that as a quantifiable variable.”

Tobii’s head of gaming, Martin Lindgren, echoed this feeling: “Pro teams aren’t interested in being told what to do. They want the data so they can draw their own conclusions.”

Tobii now has a gaming-focused eye-tracker and integrates with a number of AAA games, like Rise of the Tomb Raider, where it can be used in place of fiddly aiming using the analog sticks. As someone who’s bad at specifically that part of games, this is attractive to me, and Lindgren said opportunities like that are only increasing as gaming companies embrace both accessibility and try to stand out in a crowded market.

The companies have worked together to improve the eye-tracking coaching, for instance lowering the number of games a user must play before the system can accurately track their in-game actions; Lindgren said the collaboration with Mobalytics is ongoing — “definitely a long-term partnership” — in fact Tobii’s relationship with the founders predates their startup.

The ultimate goal of Mobalytics is to have a gaming assistant that adapts itself to your playing and preferences, making intelligent suggestions to improve your skills. That’s a ways off, but the company is getting the hang of it. Its first product, the LoL assistant, took a year to build, Issa said. A more recent one, for Legends of Runeterra, took three months. Teamfight Tactics took three weeks.

Admittedly it was more difficult to design one for Valorant, which, being a first-person shooter, is wildly different from the other games — but now that it’s done, a lot of that work could be applied to an assistant for Counter-Strike or Overwatch.

Expansion to other games and genres is the reason for raising an $11 million Series A, led by Almaz Capital and Cabra VC, with HP Tech Ventures, General Catalyst, GGV Capital, RRE Ventures, Axiomatic and T1 Esports participating.

“It was a very different experience from the post-TechCrunch one, where you’re in the spotlight and everyone’s throwing money your way,” said Issa. “But we’ve built a successful product on LoL, expanded to four games, today we have more than seven million monthly active users… Our plan is to double down on what’s worked for us and create the ultimate gaming companion.”

Powered by WPeMatico

SaaS is hot in 2020. Tooling that helps facilitate remote work is hot in 2020. And we all know that anything related to video chatting in particular is on fire this year. In the midst of all three trends is Kudo, which just raised $6 million in a round led by Felicis.

But Kudo’s video chatting and conferencing tool with built-in support for translators and multiple audio streams wasn’t initially constructed for the COVID-19 era. It got started back in 2016, so let’s talk about how it got to where it is today before we talk about how much the pandemic and ensuing remote-work boom accelerated its growth by what the company described in a release as 3,500%.

TechCrunch spoke to Fardad Zabetian, Kudo’s founder and CEO, earlier this week to learn about how his company got started. According to the executive, he started working on Kudo back in 2016 after feeling the need to add language support to what he calls decentralized meetings.

After getting a proof of concept (could interactive audio and video be compiled for remote participants with less than 500 milliseconds of latency?) in place, the company itself launched in 2017, and after more work its product was put into the market in September, 2018.

During that time, Kudo put together angel and friends-and-family money that Zabetian described as less than $1 million, meaning that the startup got a lot done without spending a lot. (In my experience, talking to founders over the last decade or so, that’s a good sign.)

All that work paid off this year when COVID-19 shook up the world, forcing companies to cancel business travel and instead lean on video conferencing solutions. Given the international nature of modern business — globalization is a fact, regardless of what nationalists want — the change in the world’s meeting landscape scooted demand toward Kudo.

Here’s how it works: Kudo provides a self-serve SaaS video conferencing solution, allowing any company to spin up meetings as they need. It also has a translator pool, and can supply humans to fill out a meeting’s needs if a customer wants. Or, customers can bring their own translators.

So, Kudo is SaaS with an optional services component, though given the lower margins inherent to services over software, I’d hazard that we should think of its services revenue as a helper to its SaaS incomes. There’s no need to fret about their impact on Kudo’s blended gross margins, in other words.

According to Zabetian, about three-quarters of its customers bring their own translators, while about a fourth hire them through Kudo’s cadre.

As noted, Kudo got into the market back in 2018, which means it was already selling its software in the pre-pandemic days. Lead investor Niki Pezeshki told TechCrunch that Kudo has “stepped up in a big way for its customers during the pandemic,” but that while COVID “has certainly accelerated Kudo’s growth, we think they are enabling a longer-term shift in the market by showing customers that it is possible to effectively run multilingual conferences and meetings without the hassle of international travel and all the planning that goes into it.”

Kudo was already right about where the world was going, then, even if the pandemic provided a boost.

That tailwind is evident in its round size, notably. Kudo’s CEO said that he set out to raise $2 million, not $6 million; the $4 million delta is indicative of a company that has become a competitive asset for the venture class to fight over.

And Kudo’s growth has brought with it notable financial benefits, including several months of cash flow positivity — something nearly unheard of amongst startups of its age and size. But the company will spend from its $6 million and push that line-item negative, it said. Kudo has 30 open positions today that it expects to fill in the next few quarters, including building out its sales and marketing functions, which to date it has not invested in (another good sign among startups is how long they can grow attractively without needing to spend heavily on sales and marketing). That won’t come cheap, in the short-term.

So that’s Kudo and its round. What we want to know next is its H1 2020 year-over-year revenue growth. Do write in if you know that number.

Powered by WPeMatico

Now that I’ve offered an overview to help you think through where concentrated stock sits in your overall plan, let’s take a closer look at why selling can be challenging for some.

In the following section, I reveal the facts of the concentrated stock “get rich” myths that reside in the minds of many first-time concentrated stock owners, and I show why it is prudent to consider greater diversification.

Keep reading to learn more about the benefits of diversification, discover how much company stock is likely too much to hold, and the options you have when it comes to diversifying strategically.

There are several hard facts to keep in mind in contemplating maintaining a concentrated position:

The odds of any new IPO being among the top 4% is just slightly better than hitting your lucky number on the roulette wheel. But is your investment portfolio success and the odds of achieving your long-term financial goals something you want to spin the wheel on?

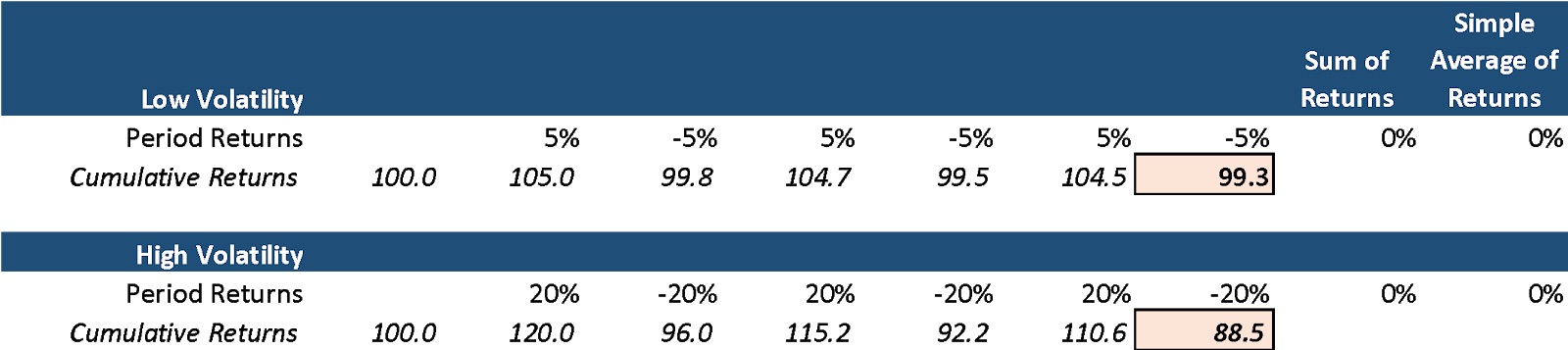

Excess volatility can harm returns. Note the example below that shows the comparison between a low-volatility diversified portfolio versus a high-volatility concentrated portfolio. Despite the same simple average return, the low-volatility portfolio below materially outperforms the high-volatility portfolio.

Image Credits: Peyton Carr

Beyond the math, unexpected spikes in volatility can cause significant price declines. Volatility increases the chances that an investor reacts emotionally and makes a poor investment decision. I’ll cover the behavioral finance aspect of this later. Lowering your portfolio volatility can be as simple as increasing your portfolio diversification.

The Russell 3000, an index representing the 3,000 largest U.S.-based publicly traded companies, has lower volatility when compared against 95%+ of all single stocks. So, how much return do you give up for having lower volatility?

According to Northern Trust Research, the 5.96% annualized average return of the Russell 3000 is 0.73% more than the 5.23% return of the median stock. Additionally, owning the Russell 3000, rather than a single stock, eliminates the likelihood of catastrophic loss scenarios — more than 20% of shares averaged a loss of more than 10% per year over a 20-year time frame.

If this establishes that the avoidance of overly concentrated portfolios is important, how much stock is too much? And at what price should you sell?

We consider any stock position or exposure greater than 10% of a portfolio to be a concentrated position. There is no hard number, but the appropriate level of concentration is dependent on several factors, such as your liquidity needs, overall portfolio value, the appetite for risk and the longer-term financial plan. However, above 10% and the returns and volatility of that single position can begin to dominate the portfolio, exposing you to high degrees of portfolio volatility.

The company “stock” in your portfolio often is only a fraction of your overall financial exposure to your company. Think about your other sources of possible exposure such as restricted stock, RSUs, options, employee stock purchase programs, 401k, other equity compensation plans, as well as your current and future salary stream tied to the company’s success. In most cases, the prudent path to achieving your financial goals involves a well-diversified portfolio.

Facts aside, maintaining a concentrated position in your company stock is far more tempting than taking a more measured approach. Token examples like Zuckerberg and Bezos tend to outshine the dull rationale of reality, and it’s hard to argue against the possibility of becoming fabulously wealthy by betting on yourself. In other words, your emotions can get the best of you.

But your goals — not your emotions — should be driving your investment strategy and decisions regarding your stock. Your investment portfolio and the company stock(s) within it should be used as tools to achieve those goals.

So first, we’ll take a deep dive into the behavioral psychology that influences our decision-making.

Despite all the evidence, sometimes that little voice remains.

“I want to hold the stock.”

Why is it so hard to shake? This is a natural human tendency. I get it. We have a strong impetus to rationalize our biases and not believe we are vulnerable to being influenced by them.

Becoming attached to your company is common, since after all, that stock has made you, or has the potential of making you wealthy. More often than not, selling and diversifying is the tough, but more rational decision.

Numerous studies have furnished insights into the correlation between investing and psychology. Many unrecognized psychological barriers and behavioral biases can influence you to hold concentrated stock even when the data shows that you should not.

Understanding these biases can be helpful when deciding what to do with your stock. These behavioral biases are hard to spot and even harder to overcome. However, awareness is the first step. Here are a few more common behavioral biases, see if any apply to you:

Familiarity bias: Familiarity is likely why so many founders are willing to hold concentrated positions in their own company’s stock. It is easy to confuse the familiarity with your own company with the safety in the stock. In the stock market, familiarity and safety are not always related. A great (safe) company sometimes can have a dangerously overvalued stock price, and terrible companies sometimes have terrifically undervalued stock prices. It’s not just about the quality of the company but the relationship between the quality of a company and its stock price that dictates whether a stock is likely to perform well in the future.

Another way this manifests is when a founder has less experience with stock market investing and has only owned their company stock. They may think the market has more risk than their company when in actuality, it is usually safer than holding just their individual position.

Overconfidence: Every investor is exhibiting overconfidence when they hold an overly concentrated position in an individual stock. Founders are likely to believe in their company; after all, it already achieved enough success to IPO. This confidence can be misplaced in the stock. Founders often are reluctant to sell their stock if it has been going up since they believe it will continue to go up. If the stock has sold off, the opposite is true, and they are convinced it will recover. Often, it is challenging for founders to be objective when they are so close to the company. They commonly believe that they have unique information and know the “true” value of the stock.

Anchoring: Some investors will anchor their beliefs to something they experienced in the past. If the price of the concentrated stock is down, investors may anchor their belief that the stock is worth its recent previous higher value and be unwilling to sell. This previous value of the stock is not an indicator of its real value. The real value is the current price where buyers and sellers exchange the stock while incorporating all presently available information.

Endowment effect: Many investors tend to place a higher value on an asset they currently own than if they did not own it at all. It makes it harder to sell. An excellent way to check for the endowment effect is to ask yourself: “If I did not own these shares, would I purchase them today at this price?” If you are not willing to purchase the shares at this price today, it likely means you are only holding onto the shares because of the endowment effect.

A fun spin on this is to look into the IKEA effect study, which demonstrates that people assign more value to something that they made than it is potentially worth.

When framed this way, investors can make more intentional decisions on whether to continue holding concentrated stock or selling. At times, these biases are hard to spot, which is why having a second person, a co-pilot, or an advisor, is helpful.

Congratulations to those of you with a concentrated stock position in your company; it is hard-earned and likely represents a material wealth. Understand, there is no “right” answer when it comes to managing concentrated stock. Each situation is unique, so it is essential to speak with a professional about options specific to your situation.

It starts with having a financial plan, complete with specific investment goals that you want to achieve. Once you have a clear picture of what you want to accomplish, you can look at the facts in a new light and gain a deeper appreciation for the dangers of holding a concentrated position in company stock versus the benefits of diversification, considering all of the implications and opportunities involved in rational decision-making and investment behavior.

Most individuals understand they can simply and directly sell their equity, but there are a variety of other strategies. Some of these opportunities may be far better at minimizing taxes or better at achieving the desired risk or return profile. Some might wonder what the best timing is to sell. I will cover these topics in the final article of the series.

Powered by WPeMatico

Think back to the last time you onboarded at a new job. Was it a mishmash of documents and calendar invites and calls and, generally speaking, a mess?

Probably. That’s likely because onboarding is a process that often depends on disparate, unconnected HR tools. Sora, a startup that today announced $5.3 million in collected fundraising, wants to shake up the HR software world with a low-code service that helps companies connect their tooling and automate their HR processes. The startup might be able to make things like onboarding better for employees and companies alike.

Startups looking to bring low, and no-code tooling to non-engineering teams have become a trend in recent quarters. TechCrunch recently covered a $2.2 million round for no-code text analysis and machine-learning shop MonkeyLearn, for example. There have been hundreds of millions of dollars raised by low, and no-code tools in 2020 alone.

By building tools to assist non-engineers do more, faster without developer help — be it analysis, or visual programming — some technology upstarts are helping non-technical teams do what only technical teams were able to in previous years.

Sora fits into the trend because its service allows non-developers to create workflows, to use a term that the startup’s co-founder and CEO Laura Del Beccaro employed when she walked TechCrunch through her company’s product.

The Sora workflows can be built from templates, and employ triggers to fire off various processes (sending emails, pulling in data from other apps and services, that sort of thing), allowing non-engineers to create visual logic flows. The Sora system is “like a no-code workflow builder,” Del Beccaro said in an interview, allowing users to “add tasks where you have to tell someone to do something, and automate the follow-up. That’s actually one of our biggest pain point relievers. A lot of HR teams right now are manually tracking people down: Did you set up this laptop yet? Did you set up this new hire launch for these three people?”

Sora CEO Laura Del Beccaro, via the company.

The Sora workflow system is slick in practice, allowing, for example, customization around a single employee. Del Beccaro explained that her startup’s software can do things like ask a manager who a new hire’s work-buddy might be, and then send that person an email later saying that the hire has arrived.

According to Del Beccaro, Sora, wants to help “democratize your [HR] processes.” Today’s HR denizens are too dependent on data analysts for “people analytics reporting” she said, adding that once a company has all its HR “data in one place, which again, is our core offering, you can set up all these automations that you want by yourself, you don’t have to go to IT or engineering.”

And because Sora can handle swapping out different providers as needed, Sora should help HR teams at growing companies lower the “risk of changing systems,” helping them “stay flexible no matter what [their] processes look like.”

It’s a neat tool.

Sora has raised $5.3 million in capital to date, a funding total that includes a pre-seed round from September, 2018. First Round and Elad Gil led its most recent round, which makes up a majority of its capital raised thus far.

With 11 employees today, Sora has around “25 people on [its] cap table,” the CEO said, telling TechCrunch that it was “pretty important to [her] to have a relatively diverse set of investors.” Del Beccaro provided this publication with a full list, which we’ve included below.

Sticking to the subject of money, after Mixpanel served as an early customer, Sora opened to more customers earlier this year. The CEO said that its customers are on one or two-year contracts, and charges per-employee, per-month, which seems reasonable. With its new cash, Sora has around 2.5 years of runway she said.

First Round’s Bill Trenchard liked Sora’s approach to building its service, saying in an email that the company was “never interested in scaling for the sake of scaling,” highlighting its work in concert with “a development partner to make sure what they were working on was actually solving real HR pain points before they took it to the market” as evidence of its “thoughtful and intentional” product approach.

Today, thanks to that method, in his view “what’s compelling about Sora is their sales momentum this year after launching,” the investor said. The next question for Sora, then, is how fast it can grow now that it has more capital in the bank than it has likely ever had before.

For fun, here’s the full investor list that Del Beccaro provided, which I’m including as it’s rare to get a full cap table:

- Sarah Adams (Plaid)

- Shan Aggarwal (Coinbase, Greycroft)

- Scott Belsky (Adobe)

- Mathilde Collin (Front)

- Cooley Investment Fund

- David Del Beccaro & Arleen Armstrong (Music Choice/Legal)

- Viviana Faga (Emergence Capital)

- Avichal Garg (Electric Capital)

- Elad Gil

- Kent Goldman (Upside VC)

- Jonah Greenberger (Bright)

- Daniel Gross (Pioneer, YC)

- Charles Hudson (Precursor Ventures)

- Todd Jackson (First Round Capital)

- Oliver Jay (Asana)

- Nimi Katragadda (BoxGroup)

- Nicky Khurana (Facebook)

- Brianne Kimmel (Work Life Ventures)

- David King (Curious Endeavors)

- Fritz Lanman (ClassPass)

- Lisa & Mat Lori (Perfect Provenance/New Mountain Capital)

- Shrav Mehta (SecureFrame)

- Sean Mendy (Concrete Rose)

- Jana Messerschmidt (#ANGELS, Lightspeed)

- Katie Stanton (Katie Stanton, #ANGELS, Moxxie Ventures)

- Erik Torenberg (Village Global)

- Bill Trenchard (First Round Capital)

- Jeannette zu Fürstenberg (La Famiglia VC)

Powered by WPeMatico

Consolidation continues apace in the world of e-commerce, and today it was the turn of the classified ads market. Today, eBay announced it had reached a deal to sell off its Classifieds business unit to Adevinta, a Norway-based classified ads publisher majority owned by Norwegian publisher Schibsted. The deal is valued at $9.2 billion, which includes eBay getting $2.5 billion in cash and 540 million Adevinta shares. The deal makes eBay a 44% owner of Adevinta, with a 33.3% voting stake.

Adevinta’s interest in eBay was reported earlier in the week, but with the deal coming at a much lower valuation, of $8 billion.

More generally, it caps off months of speculation about the future for the classifieds business, which has come out of long-term pressure spurred by activist investors for eBay to rationalise what had once been a sprawling e-commerce business empire (advocating for a reverse Amazon, I guess you could say). That included not just its marketplace, but classified ads, payment services (PayPal, which got spun out as a separate company) and ticketing (Viagogo acquired its Stubhub business in a $4 billion deal last year, although that is now facing some regulatory scrutiny).

Now, all three of those business units are no longer a part of eBay.

Adevinta is in 15 countries and prior to this deal had 35 digital products and websites. Ebay meanwhile owns 12 brands in 13 countries around the world, but the business has been hard hit by the coronavirus crisis. In the last quarter, eBay said that Classifieds brought in revenues of just $248 million, down 3% on an as-reported basis and remaining flat on a FX-Neutral basis. For some context, eBay’s Marketplace unit brought in revenues of $1.9 billion in the same period.

The overlap will mean a classified ad footprint of 20 countries, and the companies believe that some $150 million – $185 million in synergies will be reached through the combination.

“We are pleased we reached an agreement with Adevinta that brings together two great companies,” said Jamie Iannone, CEO of eBay, in a statement. “eBay believes strongly in the power of community and connections between people, which has been essential to our Classifieds businesses globally. This sale creates short-term and long-term value for shareholders and customers, while allowing us to participate in the future potential of the Classifieds business.”

With little needed but text and a search facility to create a very basic list of offers, classifieds were one of the first early “hits” of the internet, disrupting newspapers and one of their traditionally most consistent revenue streams (not so anymore, of course). Classifieds was an obvious area for eBay to move into in the early days: it complemented its marketplace, which back then had a strong emphasis on used goods and selling items on auction rather than buying outright, and for selling by using imagery and dynamic sales pitches (something that was not second nature to many, who were migrating from newspaper ads based only on a small amount of text).

But over the years, the tech behind what constitutes a “classified ad” has changed, and so have expectations from buyers and sellers.

And those in the classified ads market now compete with a wide plethora of alternatives, for example, which leverage social and geographical networks to connect people to things or services they might like to buy or rent. They include the likes of Facebook’s Marketplace but also handy mobile app-based listings services, and more. Some of these completely undercut the business model of the original classifieds disruptors.

That has meant that those who have established themselves in the space have played on consolidation to grow and improve their economies of scale.

“With the acquisition of eBay Classifieds Group, Adevinta becomes the largest online classifieds company globally, with a unique portfolio of leading marketplace brands. We believe the combination of the two companies, with their complementary businesses, creates one of the most exciting and compelling equity stories in the online classifieds sector,” said Rolv Erik Ryssdal, CEO of Adevinta, in a statement.

“We have been impressed with eBay Classifieds Group’s achievements in recent years, leading across markets with nationally recognized brands including Mobile.de, Gumtree, Marktplaats, dba, Bilbasen, Kijiji, 2dehands, 2ememain, Vivanuncios, Automobile.it, Motors.co.uk, Autotrader (Australia), Carsguide (Australia), and eBay Kleinanzeigen, and innovating consistently across its product portfolio and advertising technology platform.”

For now, there are no announcements of layoffs or other moves, with eBay’s classifieds executive team coming over with the deal.

“This deal is a testament to the growth and potential of the eBay Classifieds business,” said Alessandro Coppo, SVP and GM, eBay Classifieds Group. “We are excited for our local classifieds brands to join Adevinta and shape a global leader in an industry full of potential.”

The deal is expected to be completed in the first quarter of 2021, subject to regulatory and shareholder approvals.

As part of Schibsted, will acquire eBay Classifieds’ Danish business once the deal closes.

“Schibsted’s Board of Directors and management strongly supports the agreement between Adevinta and eBay, as we are confident that it will further strengthen the value creation potential for Schibsted and the rest of Adevinta’s shareholders. Schibsted intends to continue to contribute to the value creation for all Adevinta shareholders as a significant long-term anchor shareholder,” said Kristin Skogen Lund, CEO of Schibsted in a statement.

Powered by WPeMatico

Today Jamf, a software company that helps other firms manage their Apple devices, raised its IPO price range.

The company had previously targeted a $17 to $19 per-share range. A new SEC filing from the firm today details a far higher $21 to $23 per-share IPO price interval.

Jamf still intends to sell up to 18.4 million shares in its debut, including 13.5 million in primary stock, 2.5 million shares from existing shareholders and an underwriter option worth 2.4 million shares. The whole whack at $21 to $23 per share would tally between $386.4 million and $423.2 million, though not all those funds would flow to the company.

At the low and high-end of its new IPO range, Jamf is worth between $2.44 billion and $2.68 billion, steep upgrades from its prior valuation range of $1.98 billion to $2.21 billion.

Jamf follows in the footsteps of recent IPOs like nCino, Vroom and others in seeing demand for its public offering allow its pricing to track higher the closer it gets to its public offering. Such demand from public-market investors indicates there is ample demand for debut shares in mid-2020, a fact that could spur other companies to the exit market.

Coinbase, Airbnb and DoorDash are three such companies that are expected to debut in the next year’s time, give or take a quarter or two.

In anticipation of the Jamf debut that should come this week, let’s chat about the company’s recent performance.

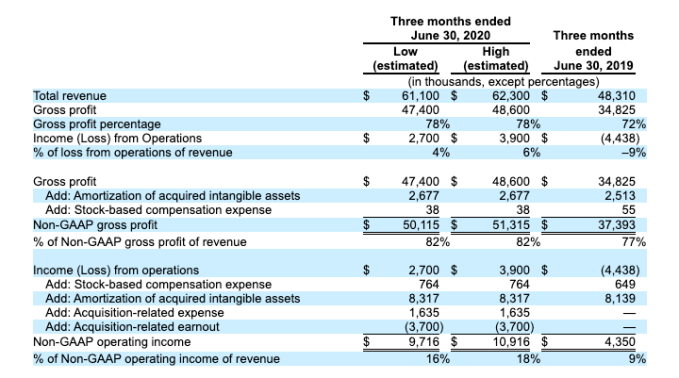

Observe the following table from the most-recent Jamf S-1/A:

From even a quick glance we can learn much from this data. We can see that Jamf is growing, has improving gross margins and has managed to swing from an operating loss to operating profit in Q2 2020, compared to Q2 2019. And, for you fans out there of adjusted metrics, that Jamf managed to generate more non-GAAP operating income in its most recent period than the year-ago quarter.

In more precise terms:

Profits! Growth! Software! Improving margins! It’s not a huge surprise that Jamf managed to bolster its IPO price range.

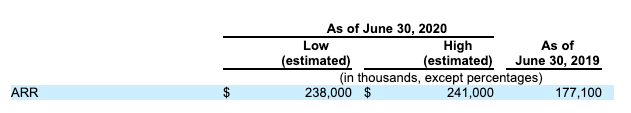

Finally, for the SaaS-heads out there, the following:

This data lets us have a little fun. Recall that we have seen possible valuations for Jamf at IPO that started at $1.98 billion to $2.21 billion, and now include $2.44 billion and $2.68 billion? With our two ARR ranges for the end of Q2, we can now come up with eight ARR multiples for Jamf, from the low-end of its initial IPO price estimate, to the top-end of its new range.

Here they are:

From that perspective, the pricing changes feel a bit more modest, even if they work out to a huge spread on a valuation basis.

Regardless, this is the current state of the Jamf IPO. Rackspace also filed a new S-1/A today, but we can’t find anything useful in it. A bit like the Jamf S-1/A from Friday. Perhaps we’ll get a new Rackspace document soon with pricing notes.

And, of course, like the rest of the world we await the Palantir S-1 with bated breath. Consider that our white whale.

Powered by WPeMatico

Welcome to The Exchange, an upcoming weekly newsletter featuring TechCrunch and Extra Crunch reporting on startups, money and markets. You can sign up for it here to receive it regularly when it launches on July 25th, and catch up on prior editions of the column and newsletter here.

It’s Saturday, July 18, and this is The Exchange. Today we’re wrapping our look at second-quarter VC, capping off the recent IPOs of some venture-backed startups, and digging into the hottest VCs while peeking at a new startup trend.

As July rubs along we’re getting deeper into the third quarter of 2020, meaning it’s time to close the books on Q2. To that end The Exchange combed through all the second-quarter VC data that we could this week.

But, despite working to grasp the health of the global venture scene, the United States’ own venture capital totals, and diving more deeply into AI/ML startups and how women-founded startups fundraised in Q2, there’s still more data to sift.

Keeping brief as we are a bit charted-out, New York City-based venture capital group Work-Bench released a grip of numbers detailing the city’s enterprise-focused startups’ Q2 VC results. Given that Work-Bench invests in enterprise tech, the data’s focus was not a surprise.

The numbers, per the firm, look like this:

The data is not surprising. B2B startups are raking in a larger share of venture capital rounds as time goes along, so to see NYC’s own enterprise-focused startups doing well is not shocking. (And if you add in the recent $225 million UIPath round, the Big Apple’s enterprise startups are even closer to their 2019 venture dollar benchmark, though the UIPath deal came in Q3.)

One last bit of data and we are done. Fenwick & West, a law firm that works with startups, released a report this week concerning Silicon Valley’s own May VC results. Two data points in particular from the digest stood out. Chew on these (emphasis TechCrunch):

The percentage of up-rounds declined modestly from 71% in April to 67% in May, but continued [to be] noticeably lower than the 83% up-rounds on average in 2019. […] The average share price increase of May financings weakened noticeably, declining from 63% in April to 43% in May. The results for both April and May were significantly below the 2019 average increase of 93%.

The Q2 data mix then shakes out to be better than I would have expected with plenty of highlights. But if you look, it isn’t hard to find weaker points, either. We are, after all, in the midst of a pandemic.

nCino and GoHealth went public this week. TechCrunch got on the blower afterwards with nCino CEO Pierre Naudé and GoHealth CEO Clint Jones. By now you’ve seen the pricing pieces and notes on their companies’ early performance, so let’s instead talk about why they chose to pursue traditional IPOs.

Our goal was to understand why CEOs are going public through initial public offerings when some players in the venture space have soured on traditional IPOs. Here’s what we gleaned from the leaders of the week’s new offerings:

nCino: Naudé didn’t want to dig into nCino’s IPO process, but did note that he read TechCrunch’s coverage of his company’s IPO march. The CEO said that his firm was going to have an all-hands this Friday, and then get back to work. Naudé also said that becoming a public company could help the nCino brand by helping others understand the company’s financial stability. The company’s larger-than-expected IPO haul (one point for the old-fashion public offering, we suppose) could provide it with more options, we learned, including possibly upping its sales and marketing spend.

GoHealth: Jones told TechCrunch that GoHealth’s IPO was oversubscribed, implying good pre-IPO demand. When it came to pricing, GoHealth worked through a number of scenarios according to the CEO, who didn’t have anything negative to share about how his company finally set its IPO valuation. He did bring up the importance of collecting long-term investors.

The method by which a company goes public is only a piece of the public-markets saga that companies spin. Once public, either through a direct listing or SPAC-led reverse-IPO, all companies become lashed to the quarterly reporting cycle. Even more common than complaints about the IPO process among Silicon Valley is the refrain that public investors are too short-term-focused to let really innovative companies do well once they stop being private.

Is that true? TechCrunch spoke with Medallia CEO Leslie Stretch this week to get notes on the current level of patience that public investors have for growing tech companies; are public markets as impatient as some claim?

According to Stretch, there can be enough space in the public markets for tech shops to maneuver. At least that was his take a year after Medallia’s own 2019 IPO (transcript edited by TechCrunch for clarity; additions denoted by brackets):

[Our] partnership with public investors has been phenomenal. They really test you, you know? They really test your proposition, [and] they test your operational resilience in a way that just makes you better. And they give you feedback. Our philosophy is feedback always makes you better.

What people want to do is they want to crest the really big growth rate [that] is unassailable, it can’t be challenged. And then you come out in public, and it’s a no brainer. And some companies managed to do that. But of the [thousands of Series] A rounds that took place in early 2000s, you know, only 75 companies made it public. Right? We’re one of them.

I’m not fearful. I don’t think people should be fearful of [going public]. They should partner with public investors. The stock price, and the quarter-to-quarter, will be what it will be. Don’t worry about that. It’s what are you building for the long term, and make sure you have enough cash, of course, to meet your ambitions. [But] also a bit of fiscal discipline actually makes your products better, because you think how about how you invest, and harder about your priorities. That’s my view on [the] public piece.

Who wants to bet that unicorns keep putting off their IPOs anyways?

Let’s wrap with some fun stuff, kicking off with the TechCrunch List, a dataset that set out to figure out which VCs were the most likely to cut first checks. I’ve already used it to help put together an investor survey (stay tuned). It’s in front of the Extra Crunch paywall, so give it a whirl.

If you are part of Extra Crunch, Danny also pulled out an even more exclusive list that we built off the back of thousands of founder comments.

And I have two trends for you to think on. First, a wave of startups are trying to make our new, video-chatting based world a better place to be. It will be super interesting to see how much space is left in the market by the incumbent players currently battling for market leadership.

Second, some startups are raising extension rounds not only because they need defensive capital, but because they’ve caught a tailwind in the COVID era and want to go even faster. So, from a somewhat safe move, some extension rounds these days are more weapons than shields.

And that’s all we have. Say hi on Twitter if there’s something you want The Exchange to explore. Chat soon!

Powered by WPeMatico

The venture capital world is constantly changing, and its evolution can sometimes flip pieces of conventional wisdom on their heads. For example, a recent flurry of extension rounds from Silicon Valley’s hottest startups like Stripe and Robinhood seem to signal that the investment type has suddenly become cool.

Extensions evolving from unloved to hot is not the first time that a type of VC deal has gained, or lost luster. In past times, for example, raising consecutive rounds from the same lead investor was often perceived as a negative signal; why couldn’t the startup find a new, different lead investor? Today, in contrast, venture capitalists are using inside rounds to double-down on winning startups, a way of helping ensure returns for their own backers.

The recent phenomenon of extensions becoming vogue is a tale of the times, in which the best startups get to play offense, and startups that can’t show accelerating growth are left behind. Let’s explore what has changed.

TechCrunch first wrote about the new extension-round trend after seeing what felt like a wave of the deals crop up. Some were large, like MariaDB’s huge $25 million add-on to its Series C, or Robinhood’s biblical $320 million addition to its Series F.

But most were smaller events like Sayari adding $2.5 million to its Series B, or CALA adding $3 million to its seed round. Even more recently, Eterneva raised another $3 million on top of its seed round, and also out this week was a million pounds more for Edinburgh-based Machine Labs’ seed round.

One reason for the growth of extension rounds in 2020 has been runway — making sure that a startup has enough. Upstarts often raise on an 18-month cadence. But because of COVID-19 and its constituent economic disruptions, many have reduced costs in a bid to bolster how long they have until their cash stores reach zero.

Powered by WPeMatico

As Zoom and Microsoft and Google hammer it out for video-chat hegemony, startups are developing apps and services that either add on or compete with the major players.

There hasn’t been enough activity — yet — to call it a boom, but there’s enough going on to warrant our attention. Call it a boomlet, if you will, of startups looking to ride the wave of demand that video-conferencing has seen during the COVID-19 pandemic.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or receive it for free in your inbox. Sign up for The Exchange newsletter, which drops Saturdays starting July 25.

The big players are not sitting still. Zoom has spent lots of 2020 on platform security after a surge in popularity exposed some frayed ends. Google has been working to make Meet, its own video-chat service, better and easier to find. And Microsoft has been hammering Teams’s abilities into stronger form as it uses the same product to fend off both Slack and Zoom, which is a tall order.

Other giants are getting into the mix. Reliance Jio, the Indian telecom subsidiary of megacorp Reliance, recently launched JioMeet, which has turned heads for looking rather similar to Zoom. It also quickly raced to millions of downloads. (That Google just put billions into JioMeet’s parent is an odd twist in the video-chatting wars; Google has effectively helped fund a competitor in the country, it appears.)

Other giants are getting into the mix. Reliance Jio, the Indian telecom subsidiary of megacorp Reliance, recently launched JioMeet, which has turned heads for looking rather similar to Zoom. It also quickly raced to millions of downloads. (That Google just put billions into JioMeet’s parent is an odd twist in the video-chatting wars; Google has effectively helped fund a competitor in the country, it appears.)

TechCrunch’s parent company, Verizon, recently bought BlueJeans, giving the American telecom company its own video chatting service. (It’s also eyeing the Indian market.)

But that’s only part of the action. More recently we’ve seen interesting rounds for video-chat software startups Macro and Mmhmm. And we’ve seen money go into companies like Daily.co, which want to let any company bake video-chatting capabilities into their service. And Y Combinator-backed Sidekick has been in the press lately, after building a hardware solution in mind for today’s remote workers who need video comms.

An upstart boomlet, then, amid a war of the majors. But should we have expected anything less from the huge wave of demand that COVID-19 kicked off? Zoom was growing quickly before the pandemic. Now the public company and a host of rivals, big and small, all want a larger slice of an expanding pie.

The two most interesting recent venture rounds for video-conferencing startups are those belonging to Mmhmm and Macro.

Powered by WPeMatico