Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Software valuations are bonkers, which means it’s a great time to go public. Asana, Monday.com, Wrike and every other gosh darn software company that is putting it off, pay attention. Heck, even service-y Palantir could excel in this market.

Let me explain.

Over the past few weeks, TechCrunch has tracked the filing, first pricing, rejiggered pricing range, and, today, the first day of trading for BigCommerce, a Texas-based e-commerce company. You can think of it as a comp with Shopify to a degree.

Image Credits: IMGFlip (opens in a new window)

In the wake of the Canadian phenom’s blockbuster earnings report, BigCommerce boosted its IPO range. Yesterday the company did itself one better, pricing $1 per share above that raised range, selling 9,019,565 shares at $24 per share, of which 6,850,000 came from BigCommerce itself.

Before some additions, there are now 65,843,546 shares of BigCommerce in the world, giving the company an IPO valuation of around $1.58 billion.

Given that the company’s Q2 expected revenue range is “between $35.5 million and $35.8 million,” the company sported a run-rate multiple of 11.1x to 11x, depending on where its final revenue tally comes in. That felt somewhat reasonable, if perhaps a smidgen light.

Then the company opened at $68 per share today, currently trading for $82 per share. Hello, 1999 and other insane times. BigCommerce is now worth, using some rough math, around $5.4 billion, giving it a run-rate multiple of around 38x, using the midpoint of its Q2 revenue range.

Powered by WPeMatico

Harness has made a name for itself creating tools like continuous delivery (CD) for software engineers to give them the kind of power that has been traditionally reserved for companies with large engineering teams like Google, Facebook and Netflix. Today, the company announced it has acquired Drone.io, an open-source continuous integration (CI) company, marking the company’s first steps into open source, as well as its first acquisition.

The companies did not share the purchase price.

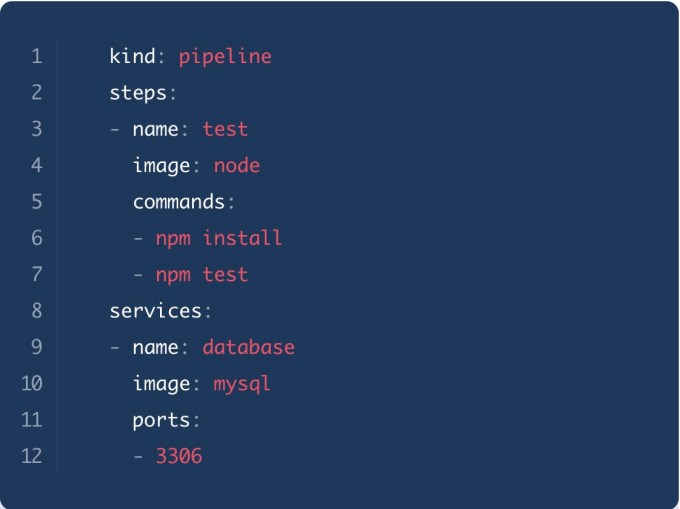

“Drone is a continuous integration software. It helps developers to continuously build, test and deploy their code. The project was started in 2012, and it was the first cloud-native, container-native continuous integration solution on the market, and we open sourced it,” company co-founder Brad Rydzewski told TechCrunch.

Drone delivers pipeline configuration information as code in a Docker container. Image: Drone.io

While Harness had previously lacked a CI tool to go with its continuous delivery tooling, founder and CEO Jyoti Bansal said this was less about filling in a hole than expanding the current platform.

“I would call it an expansion of our vision and where we were going. As you and I have talked in the past, the mission of Harness is to be a next-generation software delivery platform for everyone,” he said. He added that buying Drone had a lot of upside.”It’s all of those things — the size of the open-source community, the simplicity of the product — and it [made sense], for Harness and Drone to come together and bring this integrated CI/CD to the market.”

While this is Harness’ first foray into open source, Bansal says it’s just the starting point and they want to embrace open source as a company moving forward. “We are committed to getting more and more involved in open source and actually making even more parts of Harness, our original products, open source over time as well,” he said.

For Drone community members who might be concerned about the acquisition, Bansal said he was “100% committed” to continuing to support the open-source Drone product. In fact, Rydzewski said he wanted to team with Harness because he felt he could do so much more with them than he could have done continuing as a standalone company.

“Drone was a growing community, a growing project and a growing business. It really came down to I think the timing being right and wanting to partner with a company like Harness to build the future. Drone laid a lot of the groundwork, but it’s a matter of taking it to the next level,” he said.

Bansal says that Harness intends to also offer on the Harness platform a commercial version of Drone with some enterprise features, even while continuing to support the open source side of it.

Drone was founded in 2012. The only money it raised was $28,000 when it participated in the Alchemist Accelerator in 2013, according to Crunchbase data. The deal has closed and Rydzewski has joined the Harness team.

Powered by WPeMatico

Electric vehicles (EVs) are spreading throughout the world. While Tesla has drawn the most attention in the United States with its luxurious and cutting-edge cars, EVs are becoming a mainstay in markets far away from the environs of California.

Take India for instance. In the local mobility market, two- and three-wheel vehicles are starting to emerge as a popular option for a rapidly expanding middle class looking for more affordable options. EV versions are popular thanks to their reduced maintenance costs and higher reliability compared to gasoline alternatives.

Two-wheeled electric scooters are a fast-growing segment of India’s mobility market.

There’s just one problem, and it’s the same one faced by every country which has attempted to convert from gasoline to electric: how do you build out the charging station network to make these vehicles usable outside a small range from their garage?

It’s the classic chicken-and-egg problem. You need EVs in order to make money on charging stations, but you can’t afford to build charging stations until EVs are popular. Some startups have attempted to build out these networks themselves first. Perhaps the most famous example was Better Place, an Israeli startup that raised $800 million in venture capital before dying from negative cash flow back in 2013. Tesla has attempted to solve the problem by being both the chicken and egg by creating a network of Superchargers.

That’s what makes Statiq so interesting. The company, based in the New Delhi suburb of Gurugram, is bootstrapping an EV charging network using a multi-revenue model that it hopes will allow it to avoid the financial challenges that other charging networks have faced. It’s in the current Y Combinator batch and will be presenting at Demo Day later this month.

Akshit Bansal and Raghav Arora, the company’s co-founders, worked together previously as consultants and built a company for buying photos online, eventually reaching 50,000 monthly actives. They decided to make a pivot — a hard pivot really — into EVs and specifically charging equipment.

Statiq founders Raghav Arora and Akshit Bansal. Photos via Statiq

“We felt the need to do something about the climate because we were living in Delhi and Delhi is one of the most polluted cities in the world, and India is home to a lot of the polluted cities in the world. So we wanted to do something about it,” Bansal said. As they researched the causes of pollution, they learned that automobile exhaust represented a large part of the problem locally. They looked at alternatives, but EV charging stations remain basically non-existent across the country.

Thus, they founded Statiq in October 2019 and officially launched this past May. They have installed more than 150 charging stations in Delhi, Bangalore, and Mumbai and the surrounding environs.

Let’s get to the economics though, since that to me is the most fascinating part of their story. Statiq as I noted has a multi-revenue model. First, end users buy a subscription from Statiq to use the network, and then users pay a fee per charging session. That session fee is split between Statiq and the property owner, giving landlords who install the stations an incremental revenue boost.

A Statiq charging station. Photo via Statiq

When it comes to installation, Statiq has a couple of tricks up its sleeves. First, the company’s charging equipment — according to Bansal — costs roughly a third of the equivalent cost of U.S. equipment. That makes the base technology cheaper to acquire. From there, the company negotiates installations with landlords where the landlords will pay the fixed costs of installation in exchange for that continuing session charge fee.

On top of all that, the charging stations have advertising on them, offering another income stream particularly in high-visibility locations like shopping malls which are critical for a successful EV charging network.

In short, Statiq hasn’t had to outlay capital in order to put in place their charging equipment — and they were able to bootstrap before applying to YC earlier this year. Bansal said the company had dozens of charging stations and thousands of paid sessions on its platform before joining their YC batch, and “we are now growing 20% week-over-week.”

What’s next? It’s all about deliberate scaling. The EV market is turning on in India, and Statiq wants to be where those cars are. Bansal and his co-founder are hoping to ride the wave, continuing to build out critical infrastructure along the way. India’s government will likely continue to help: its approved billions of dollars in incentives for EVs and for charging stations, tipping the economics even further in the direction of a clean car future.

Powered by WPeMatico

You might have missed it, but amidst the current political-M&A-pandemic-election-disinformation news cycle we find ourselves in this week, SaaS and cloud companies reached new public market records.

Yesterday, the Bessemer-Nasdaq cloud index closed at 2,035.54, a new record finish for the basket of software companies. And, today, the index broached the 2,040 mark before ceding some ground.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

What matters for our purposes is that with a good chunk of the Q2 earnings cycle behind us, software companies are not only holding onto their gains from earlier in the year, they are managing to add to them, albeit modestly. Of course, valuation expansion during earnings season could still lead to gently falling multiples; as companies grow, if their shares gain value at a slower pace, their price/sales ratio can lose ground.

Regardless, for our purposes it’s notable that recent public market gains are not dissipating. Tech valuation boosts have helped major American indices regain ground lost early in the year, and Q2 earnings were a possible threat to prior progress. So far earnings-related dents are thin on the ground.

Regardless, for our purposes it’s notable that recent public market gains are not dissipating. Tech valuation boosts have helped major American indices regain ground lost early in the year, and Q2 earnings were a possible threat to prior progress. So far earnings-related dents are thin on the ground.

So, what’s going on? Why are SaaS and cloud stocks doing so well? Leaning on notes from two VCs — Jamin Ball from Redpoint and Mary D’Onofrio from Bessemer — we can unspool recent valuation highs.

Powered by WPeMatico

Qualified, a startup co-founded by former Salesforce executives Kraig Swensrud and Sean Whiteley, has raised $12 million in Series A funding.

Swensrud (Qualified’s CEO) said the startup is meant to solve a problem that he faced when he was CMO at Salesforce. Apparently he’d complain about being “blind,” because he knew so little about who was visiting the Salesforce website.

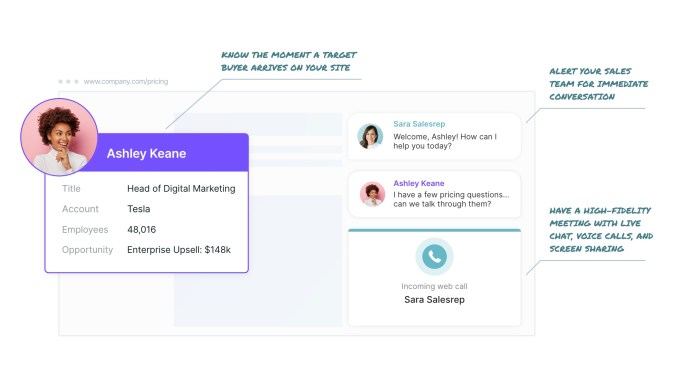

“There could be 10 or 100 or 100,000 people on my website right now, and I don’t know who they are, I don’t know what they’re interested in, my sales team has no idea that they’re even there,” he said.

Apparently, this is a big problem in business-to-business sales, where waiting five minutes after a lead leaves your website can result in a 10x decrease in the odds of making contact. But the solution currently adopted by many websites is just a chatbot that treats every visitor similarly.

Qualified, meanwhile, connects real-time website visitor information with a company’s Salesforce customer database. That means it can identify visitors from high-value accounts and route them to the correct salesperson while they’re still on the website, turning into a full-on sales meeting that can also include a phone call and screensharing.

Image Credits: Qualified

Of course, the amount of data Qualified has access to will differ from visitor to visitor. Some visitors may be purely incognito, while in other cases, the platform might simply know your city or where you work. In still others (say if you click on a link from marketing email), it can identify you individually.

That’s something I experienced myself, when I decided to take a look at the Qualified website this morning and was quickly greeted with a message that read, “ Welcome TechCrunch! We’re excited about our funding announcement…” It was a little creepy, but also much more effective than my visits to other marketing technology websites, where someone usually sends me a generic sales message.

Welcome TechCrunch! We’re excited about our funding announcement…” It was a little creepy, but also much more effective than my visits to other marketing technology websites, where someone usually sends me a generic sales message.

Swensrud acknowledged that using Qualified represents “a change to people’s selling processes,” as it requires sales to respond in real time to website visitors (as a last resort, Qualified can also use chatbots and schedule future calls), but he argued that it’s a necessary change.

“If you email them later, some percentage of those people, they ghost you, they get bored, they moved on to the competition,” he said. “This real-time approach, it forces organizations to think differently in terms of their process.”

And it’s an approach that seems to be working. Among Qualified’s customers, the company says ThoughtSpot increased conversations with its target accounts by 10x, Bitly grew its enterprise sales pipeline by 6x and Gamma drove over $2.5 million in new business pipeline.

The Series A brings Qualified’s total funding to $17 million. It was led by Norwest Venture Partners, with participation from existing investors including Redpoint Ventures and Salesforce Ventures. Norwest’s Scott Beechuk is joining Qualified’s board of directors.

“The conversational model is simply a better way to connect with new customers,” Beechuk said in a statement. “Buyers love the real-time engagement, sellers love the instant connections, and marketers have the confidence that every dollar spent on demand generation is maximized. The multi-billion-dollar market for Salesforce automation software is going to adopt this new model, and Qualified is perfectly positioned to capture that demand.”

Powered by WPeMatico

Radish is announcing that it has raised $63.2 million in new funding.

Breaking up book-length stories into smaller chapters that are released over days or weeks is an idea that was popularized in the 19th century, and startups have been trying to revive it for at least the past decade. Still, this round represents a major step up in funding, not just for Radish (which only raised around $5 million previously), but also compared to other startups in a relatively nascent market. (Digital fiction startup Wattpad is the notable exception.)

When I first wrote about Radish at the beginning of 2017, the startup was focused on user-generated content. Last year, however, the company launched the Radish Originals program, where Radish is able to produce more content using teams of writers lead by a “showrunner,” and where the startup owns the resulting intellectual property.

“Instead of becoming YouTube or Wattpad for serial fiction, we want to be more like Netflix and create our own originals,” founder and CEO Seungyoon Lee told me. “I got a lot of inspiration from platforms in Korea, China and Japan, where serial fiction is huge and established on mobile.”

One of the ideas Radish took from the Asian markets is rapidly updating its stories. For example, its most popular title, “Torn Between Alphas” (a romance story with werewolves) has released 10 seasons in less than a year, with each season consisting of more than 50 chapters — later seasons have more than 100 chapters — that are released multiple times a day.

“On Netflix, you can binge-watch three seasons of a show at once,” Lee said. “On Radish, you can binge-read a thousand episodes.”

While Radish borrowed the writing room model from TV — and hired Emmy-winning TV writers, particularly those with a background in soap operas — Lee said it’s also taken inspiration from gaming. For one thing, it relies on micro-payments to make money, with users buying coins that allow them to unlock later chapters of a story (chapters usually cost 20 or 30 cents, and more chapters get moved out from behind the paywall over time). In addition, the company can allow reader taste to determine the direction of stories by A/B testing different versions of the same chapter.

Lee pointed to the fall of 2019 as Radish’s “inflection point,” where the model really started to work. Now, the company says its most popular story has made more than $4 million and has received more than 50 million “reads.” Radish stories are mostly in the genres of romance, paranormal/sci-fi, LGBTQ, young adult, horror, mystery and thriller, and Lee said the audience is largely female and based in the United States.

By raising a big round led by SoftBank Ventures Asia (the early-stage investment arm of troubled SoftBank Group) and Kakao Pages (which publishes webtoons, web novels and more, and is part of Korean internet giant Kakao), Lee said he can take advantage of their expertise in the Asian market to grow Radish’s audience in the U.S. That will mean accelerating content production in the hopes of creating more hit titles, and also spending more on performance marketing.

“With its own fast-paced original content production, Radish is best positioned to become a leading player in the global online fiction market,” said SoftBank Ventures Asia CEO JP Lee in a statement. “Radish has proven that its serialized novel platform can change the way people consume online content, and we are excited to support the company’s continued disruption in the mobile fiction space. Leveraging our global SoftBank ecosystem, we hope to support and accelerate Radish’s expansion across different regions worldwide.”

Powered by WPeMatico

The TechCrunch Exchange newsletter just launched. Soon only a partial version will hit the site, so sign up to get the full download.

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter for your weekend enjoyment. It’s broadly based on the daily column that appears on Extra Crunch, but free. And it’s made just for you.

You can sign up for the newsletter here. With that out of the way, let’s talk money, upstart companies and the latest spicy IPO rumors.

If you are tired of reading about special purpose acquisition companies, or SPACs, we hear you. We’re sick of them as well. But they keep cropping up, this time in the form of a possible IPO alternative for Affirm, a fintech unicorn that has raised more than $1 billion to provide consumers with point-of-sale installment loans. (Rates from 0% to 30%, terms of up to 36 months.)

Affirm is effectively a lending company that plugs into e-commerce firms. Researching this entry I had an idea in the back of my head that Affirm had a super-neat credit system to rate users. But reading through its own FAQ and what NerdWallet has to say on the company, its methods seem somewhat pedestrian.

Regardless, distribution is key for the company, and Affirm recently linked up with Shopify. That should provide it another dose of growth. The very sort of thing that IPO investors want. The WSJ reported that Affirm could go public this year, perhaps via a SPAC, at a valuation of $5 to $10 billion.

I did my best to map out what those valuations implied, generally finding that Affirm needs to have hella loan volume to make the sort of money that a $10 billion figure implies. Of course, I was trying to make numerical sense. The stock market in 2020 is a bit more relaxed than that.

All this SPAC talk is still mostly bullshit, mind. We are seeing public debuts this year. And every single one of them that has been of note has been a traditional IPO, at least as far as I can recall. The running history of direct listings and SPAC debuts that matter is pretty slim.

Of course, Coinbase and Asana and DoorDash and Airbnb, among others, are in need of liquidity and could yet pull the trigger on a more exotic debut. Hell, Qualtrics could do something wild in its impending IPO but we doubt it will.

The biggest market news this week had little to do with startups. Instead, it came from the anti-startups, namely the largest American tech companies, which smashed their earnings reports. Alphabet actually shrank year-over-year, but it still beat expectations. Facebook and Amazon and Apple were juggernauts in the quarter.

The startups that aren’t are DOA. As Freestyle Capital’s Jenny Lefcourt told TechCrunch the other week, every investor wants into the next round of startups that have caught a COVID tailwind. And precisely zero investors want into the proximate funding event for startups that haven’t.

Moving along, don’t re-invest your retirement funds just yet, but bitcoin is back over $10,000 and is currently trading for $11,300 as I write to you. Given that the price of bitcoin is a workable barometer for consumer interest, trading volume and, perhaps, development work in the crypto space, the recent market movement is good news for crypto-fans.

Turning our heads to breaking news this Friday, news was brewing that the Trump administration was looking to force ByteDance, a Chine-based mega-startup, to sell the U.S. operations of TikTok, the super-popular social app.

There were 25 equity-only rounds of $50 million or more in the last week, 22 if you strip out private equity-led rounds and post-IPO investments. That’s a little over $2.6 billion in late-stage capital collected by Crunchbase in a single week. No matter what you might hear from startups stuck on the wrong side of the COVID-19 divide, money is still flowing and quickly.

Stack Overflow’s $85 million round was the tenth largest deal of the week. Damn.

Other rounds you may have missed: $33 million for San Mateo-based Helix, Argo AI is now worth $7.5 billion after its most recent fundraising, $11 million for Brazil-focused wealth manager Magnetis, $16 million for construction-tech company Buildots and $20 million for Instrumental, my favorite round of the week,

Investment into AI-focused startups suffered in Q2, but descended from all-time highs so the numbers were still pretty ok.

On the VC topic, TechCrunch’s own Danny Crichton (he’s on the podcast with me every week) has updated the TechCrunch list with another 116 VCs that are willing to write first checks. The project has been oceans of work, so please do check it out if you have the time, or are looking to fundraise.

And, to wrap up, as always, here’s a collection of data, news and other miscellania that is worth your time from this super insane week:

Moving toward the close, Redpoint VP Jamin Ball is writing a series on cloud/SaaS that I’m reading here and there. Take a peek.

And, speaking of VCs out there doing my job, Floodgate partner Iris Choi (an Equity regular) does frequent live streams that she calls Market Musings that I try to snag when I can. It’s always interesting to hear how people with more money than I do think about the market as they are ever-so-slightly more invested in its outcomes.

Excuse the pun, give yourself a hug for making it through the week, make sure to hit up the latest Equity episode and let’s all go for a run. — Alex

Powered by WPeMatico

As the Internet of Things proliferates, security cameras are getting smarter. Today, these devices have machine learning capability that helps the camera automatically identify what it’s looking at — for instance, an animal or a human intruder? Today, Cisco announced that it has acquired Swedish startup Modcam and is making it part of its Meraki smart camera portfolio with the goal of incorporating Modcam computer vision technology into its portfolio.

The companies did not reveal the purchase price, but Cisco tells us that the acquisition has closed.

In a blog post announcing the deal, Cisco Meraki’s Chris Stori says Modcam is going to up Meraki’s machine learning game, while giving it some key engineering talent, as well.

“In acquiring Modcam, Cisco is investing in a team of highly talented engineers who bring a wealth of expertise in machine learning, computer vision and cloud-managed cameras. Modcam has developed a solution that enables cameras to become even smarter,” he wrote.

What he means is that today, while Meraki has smart cameras that include motion detection and machine learning capabilities, this is limited to single camera operation. What Modcam brings is the added ability to gather information and apply machine learning across multiple cameras, greatly enhancing the camera’s capabilities.

“With Modcam’s technology, this micro-level information can be stitched together, enabling multiple cameras to provide a macro-level view of the real world,” Stori wrote. In practice, as an example, that could provide a more complete view of space availability for facilities management teams, an especially important scenario as businesses try to find safer ways to open during the pandemic. The other scenario Modcam was selling was giving a more complete picture of what was happening on the factory floor.

All of Modcams employees, which Cisco described only as “a small team,” have joined Cisco, and the Modcam technology will be folded into the Meraki product line, and will no longer be offered as a standalone product, a Cisco spokesperson told TechCrunch.

Modcam was founded in 2013 and has raised $7.6 million, according to Crunchbase data. Cisco acquired Meraki back in 2012 for $1.2 billion.

Powered by WPeMatico

Buildots, a Tel Aviv and London-based startup that is using computer vision to modernize the construction management industry, today announced that it has raised $16 million in total funding. This includes a $3 million seed round that was previously unreported and a $13 million Series A round, both led by TLV Partners. Other investors include Innogy Ventures, Tidhar Construction Group, Ziv Aviram (co-founder of Mobileye & OrCam), Magma Ventures head Zvika Limon, serial entrepreneurs Benny Schnaider and Avigdor Willenz, as well as Tidhar chairman Gil Geva.

The idea behind Buildots is pretty straightforward. The team is using hardhat-mounted 360-degree cameras to allow project managers at construction sites to get an overview of the state of a project and whether it remains on schedule. The company’s software creates a digital twin of the construction site, using the architectural plans and schedule as its basis, and then uses computer vision to compare what the plans say to the reality that its tools are seeing. With this, Buildots can immediately detect when there’s a power outlet missing in a room or whether there’s a sink that still needs to be installed in a kitchen, for example.

“Buildots have been able to solve a challenge that for many seemed unconquerable, delivering huge potential for changing the way we complete our projects,” said Tidhar’s Geva in a statement. “The combination of an ambitious vision, great team and strong execution abilities quickly led us from being a customer to joining as an investor to take part in their journey.”

The company was co-founded in 2018 by Roy Danon, Aviv Leibovici and Yakir Sundry. Like so many Israeli startups, the founders met during their time in the Israeli Defense Forces, where they graduated from the Talpiot unit.

“At some point, like many of our friends, we had the urge to do something together — to build a company, to start something from scratch,” said Danon, the company’s CEO. “For us, we like getting our hands dirty. We saw most of our friends going into the most standard industries like cloud and cyber and storage and things that obviously people like us feel more comfortable in, but for some reason we had like a bug that said, ‘we want to do something that is a bit harder, that has a bigger impact on the world.’ ”

So the team started looking into how it could bring technology to traditional industries like agriculture, finance and medicine, but then settled upon construction thanks to a chance meeting with a construction company. For the first six months, the team mostly did research in both Israel and London to understand where it could provide value.

Danon argues that the construction industry is essentially a manufacturing industry, but with very outdated control and process management systems that still often relies on Excel to track progress.

Construction sites obviously pose their own problems. There’s often no Wi-Fi, for example, so contractors generally still have to upload their videos manually to Buildots’ servers. They are also three dimensional, so the team had to develop systems to understand on what floor a video was taken, for example, and for large indoor spaces, GPS won’t work either.

The teams tells me that before the COVID-19 lockdowns, it was mostly focused on Israel and the U.K., but the pandemic actually accelerated its push into other geographies. It just started work on a large project in Poland and is scheduled to work on another one in Japan next month.

Because the construction industry is very project-driven, sales often start with getting one project manager on board. That project manager also usually owns the budget for the project, so they can often also sign the check, Danon noted. And once that works out, then the general contractor often wants to talk to the company about a larger enterprise deal.

As for the funding, the company’s Series A round came together just before the lockdowns started. The company managed to bring together an interesting mix of investors from both the construction and technology industries.

Now, the plan is to scale the company, which currently has 35 employees, and figure out even more ways to use the data the service collects and make it useful for its users. “We have a long journey to turn all the data we have into supporting all the workflows on a construction site,” said Danon. “There are so many more things to do and so many more roles to support.”

Powered by WPeMatico

The fortunes of startups that leverage artificial intelligence have soared dramatically in recent years.

These AI-powered startups have seen quarterly investment totals rise from a few hundred rounds and a few billion dollars each quarter to 1,245 rounds and $17.3 billion in the second and third quarters of 2019, according to data from CB Insights. The rise in dollars chasing AI startups has been huge, demonstrating strong venture capital interest in the cohort.

But in recent quarters, the trend has slowed as VC deals for AI-powered startups fell off.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

A new report from the business-data company looking at the second quarter of venture capital results for global AI startups shows historically strong but declining investing rates for the upstart firms. During a pandemic and widespread recession, this is not a complete surprise; other areas of VC investment have also fallen in recent quarters. This is The Exchange’s second look at quarterly data in the startup category, something partially spurred by our interest in the economics of the startups that make up the group.

The scale of decline is notable, however, as is the national breakdown of VC investment into AI. (The United States is doing better than you probably guessed, if you have only listened to politicians lately.)

The scale of decline is notable, however, as is the national breakdown of VC investment into AI. (The United States is doing better than you probably guessed, if you have only listened to politicians lately.)

Let’s unpack the latest results, determine how investing patterns have changed by stage and examine how different countries compare when it comes to deal and dollar volume for AI-powered startups.

In the second quarter of 2020, global investment into AI startups fell to 458 deals worth $7.2 billion. According to the CB Insights dataset, the deal volume is the lowest for 12 quarters, or since Q2 2017 when 387 investments into AI startups were worth $4.7 billion.

Powered by WPeMatico