Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

Yep, it’s another Equity Shot. We’re back. And then we’re going to be back on Friday. Because we can’t stop talking about the biggest news week in the world of startups and venture capital in some time.

Before we start, shout-out to the NBA for the growing, wildcat strike to protest racist police violence in America.

OK, back to our regularly scheduled programming. This time ’round Natasha and your humble servant were joined by Lucas Matney, a member of the TechCrunch reporting team and a first-timer on Equity. Where’s he been all this time? Covering all sorts of things, including VR startups for the publication. He was also a big part of our coverage of both days of YC’s Demo Days, making him a perfect fit for this episode.

Danny was given a break to sit at home, play board games and iron his favorite sweatshirt. He’s back Friday morning.

In case you’ve missed the words, here’s what we wrote this week on the subject:

Those entries should be pretty exhaustive, so dig into them when you can.

And make sure to read Natasha’s great piece on a super-hot startup from the batch, which comes up in the show. Peep that we are back on YouTube and we’ll be right back. Stay cool!

Equity drops every Monday at 7:00 a.m. PT and Friday at 6:00 a.m. PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

The Palantir S-1 finally dropped yesterday after TechCrunch spilled a bunch of its guts last Friday. You can read the filing here, if you are so inclined.

Today, however, instead of our usual overview, I have a different goal: We’re going to be a bit more specific.

It’s fun and easy to clown on Palantir’s ridiculous ownership structure, in which a few dudes have decided that, in perpetuity, they must remain co-Lords of the Ring. And, sure, the company is smaller in terms of revenue-scale than many expected (a bit more Hobbiton than Bree, really). And, yes, its net losses are somewhat staggering (post-Helm’s Deep Saruman?), reaching nearly 100% of revenue in 2018.

But things have gotten better in Palantir-land (Mordor?) in recent quarters, which we should note.

So, in light of the generally negative reviews of Palantir’s finances (similar to what is left of Moria?) that I’ve seen in the media and from investors both publicly and privately, here are the bullish bits about the impending direct listing.

In brief, falling net losses in absolute and percent-of-revenue terms paint the picture of a company that is past a high-burn period, allowing profitability to continue to improve; improving gross margins point to a company that is less service-focused and more software-driven over time; the company’s falling operating cash burn is encouraging, and new customer revenue appears sharply higher in 2020 than 2019.

Let’s examine each in order:

Powered by WPeMatico

We’ve all been in a video conference, especially this year, when the neighbor started mowing the lawn or kids were playing outside your window — and it can get pretty loud. Cisco, which owns the WebEx video conferencing service, wants to do something about that, and late yesterday it announced it was going to acquire BabbleLabs, a startup that can help filter out background noise.

BabbleLabs has a very particular set of skills. It uses artificial intelligence to enhance the speaking voice, while filtering out those unwanted background noises that seem to occur whenever you happen to be in a meeting.

Interestingly enough, Cisco also sees this as a kind of privacy play by removing background conversation. Jeetu Patel, senior vice president and general manager in the Cisco Security and Applications Business Unit, says that this should go a long way toward improving the meeting experience for Cisco users.

“Their technology is going to provide our customers with yet another important innovation — automatically removing unwanted noise — to continue enabling exceptional Webex meeting experiences,” Patel, who was at Box for many years before joining Cisco, recently said in a statement.

In a blog post, BabbleLabs CEO and co-founder Chris Rowen wrote that conversations about being acquired by Cisco began just recently, and the deal came together pretty quickly. “We quickly reached a common view that merging BabbleLabs into the Cisco Collaboration team could accelerate our common vision dramatically,” he wrote.

BabbleLabs, which launched three years ago and raised $18 million, according to Crunchbase, had an interesting, but highly technical idea. That can sometimes be difficult to translate into a viable commercial product, but makes a highly attractive acquisition target for a company like Cisco.

Brent Leary, founder and principal analyst at CRM Essentials, says this acquisition could be seen as part of a broader industry consolidation. “We’re seeing consolidation taking place as the big web conferencing players are snapping up smaller players to round out their platforms,” he said.

He added, “WebEx may not be getting the attention that Zoom is, but it still has a significant presence in the enterprise, and this acquisition will allow them to keep improving their offering.”

The deal is expected to close in the current quarter after regulatory approval. Upon closing, BabbleLabs employees will become part of Cisco’s Collaboration Group.

Powered by WPeMatico

When Snowflake filed its S-1 ahead of an upcoming IPO yesterday, it wasn’t exactly a shock. The company which raised $1.4 billion had been valued at $12.4 billion in its last private raise in February. CEO Frank Slootman, who had taken over from Bob Muglia in May last year, didn’t hide the fact that going public was the end game.

When we spoke to him in February at the time of his mega $479 million raise, he was candid about the fact he wanted to take his company to the next level, and predicted it could happen as soon as this summer. In spite of the pandemic and the economic fallout from it, the company decided now was the time to go — as did 4 other companies yesterday including J Frog, Sumo Logic, Unity and Asana.

If you haven’t been following this company as it went through its massive private fund raising process, investors see a company taking a way to store massive amounts of data and moving it to the cloud. This concept is known as a cloud data warehouse as it it stores immense amounts of data.

While the Big 3 cloud companies all offer something similar, Snowflake has the advantage of working on any cloud, and at a time where data portability is highly valued, enables customers to shift data between clouds.

We spoke to several industry experts to get their thoughts on what this filing means for Snowflake, which after taking a blizzard of cash, has to now take a great idea and shift it into the public markets.

Big market opportunities usually require big investments to build companies that last, that typically go public, and that’s why investors were willing to pile up the dollars to help Snowflake grow. Blake Murray, a research analyst at Canalys says the pandemic is actually working in the startup’s favor as more companies are shifting workloads to the cloud.

“We know that demand for cloud services is higher than ever during this pandemic, which is an obvious positive for Snowflake. Snowflake also services multi-cloud environments, which we see in increasing adoption. Considering the speed it is growing at and the demand for its services, an IPO should help Snowflake continue its momentum,” Murray told TechCrunch.

Leyla Seka, a partner at Operator Collective, who spent many years at Salesforce agrees that the pandemic is forcing many companies to move to the cloud faster than they might have previously. “COVID is a strange motivator for enterprise SaaS. It is speeding up adoption in a way I have never seen before,” she said.

It’s clear to Seka that we’ve moved quickly past the early cloud adopters, and it’s in the mainstream now where a company like Snowflake is primed to take advantage. “Keep in mind, I was at Salesforce for years telling businesses their data was safe in the cloud. So we certainly have crossed the chasm, so to speak and are now in a rapid adoption phase,” she said.

The fact is Snowflake is in an odd position when it comes to the big cloud infrastructure vendors. It both competes with them on a product level, and as a company that stores massive amounts of data, it is also an excellent customer for all of them. It’s kind of a strange position to be in says Canalys’ Murray.

“Snowflake both relies on the infrastructure of cloud giants — AWS, Microsoft and Google — and competes with them. It will be important to keep an eye on the competitive dynamic even although Snowflake is a large customer for the giants,” he explained.

Forrester analyst Noel Yuhanna agrees, but says the IPO should help Snowflake take on these companies as they expand their own cloud data warehouse offerings. He added that in spite of that competition, Snowflake is holding its own against the big companies. In fact, he says that it’s the number one cloud data warehouse clients inquire about, other than Amazon RedShift. As he points out, Snowflake has some key advantages over the cloud vendors’ solutions.

“Based on Forrester Wave research that compared over a dozen vendors, Snowflake has been positioned as a Leader. Enterprises like Snowflake’s ease of use, low cost, scalability and performance capabilities. Unlike many cloud data warehouses, Snowflake can run on multiple clouds such as Amazon, Google or Azure, giving enterprises choices to choose their preferred provider.”

In spite of the vast sums of money the company has raised in the private market, it had decided to go public to get one final chunk of capital. Patrick Moorhead, founder and principal analyst at Moor Insight & Strategy says that if the company is going to succeed in the broader market, it needs to expand beyond pure cloud data warehousing, in spite of the huge opportunity there.

“Snowflake needs the funding as it needs to expand its product footprint to encompass more than just data warehousing. It should be focused less on niches and more on the entire data lifecycle including data ingest, engineering, database and AI,” Moorhead said.

Forrester’s Yuhanna agrees that Snowflake needs to look at new markets and the IPO will give it the the money to do that. “The IPO will help Snowflake expand it’s innovation path, especially to support new and emerging business use cases, and possibly look at new market opportunities such as expanding to on-premises to deliver hybrid-cloud capabilities,” he said.

It would make sense for the company to expand beyond its core offerings as it heads into the public markets, but the cloud data warehouse market is quite lucrative on its own. It’s a space that has required a considerable amount of investment to build a company, but as it heads towards its IPO, Snowflake is should be well positioned to be a successful company for years to come.

Powered by WPeMatico

Today is the day for huge VC returns.

We talked a bit about Sequoia’s coming huge win with the IPO of game engine Unity this morning. Now, Sequoia might actually have the second largest return among companies filing to go public with the SEC today.

Snowflake filed its S-1 this afternoon, and it looks like Sutter Hill is going to make bank. The long-time VC firm, which invests heavily in the enterprise space and generally keeps a lower media profile, is the big winner across the board here, coming out with an aggregate 20.3% stake in the data management platform, which was last privately valued at $12.4 billion earlier this year. At its last valuation, Sutter Hill’s full stake is worth $2.5 billion. My colleagues Ron Miller and Alex Wilhelm looked a bit at the financials of the IPO filing.

Sutter Hill has been intimately connected to Snowflake’s early build-out and success, providing a $5 million Series A funding back in 2012, the year of the company’s founding, according to Crunchbase.

Now, there are some caveats on that number. Sutter Hill Ventures (aka “the fund”) owns roughly 55% of the firm’s total stake, with the balance owned by other entities owned by the firm’s management committee members. Michael Speiser, the firm’s partner who sits on Snowflake’s board, owns slightly more than 10% of Sutter Hill’s stake directly himself according to the SEC filing.

In addition to Sutter Hill, Sequoia also got a large slice of the data computing company: its growth fund is listed as having an 8.4% stake in the coming IPO. That makes for two Sequoia Growth IPOs today — a nice way to start the week this Monday afternoon.

Finally, Altimeter Capital, which did the Series C, owns 14.8%; ICONIQ owns 13.8%; and Redpoint, which did the Series B, owns 9.0%.

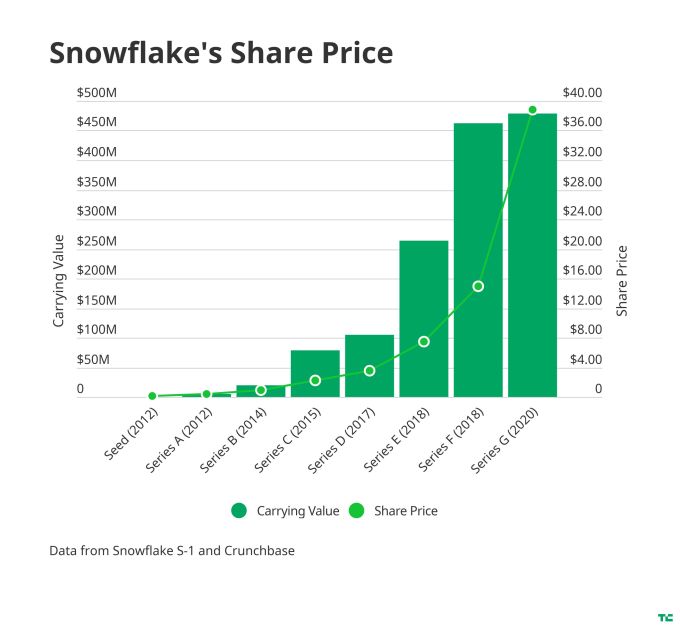

To see the breakdown in returns, let’s start by taking a look at the company’s share price and carrying values for each of its rounds of capital:

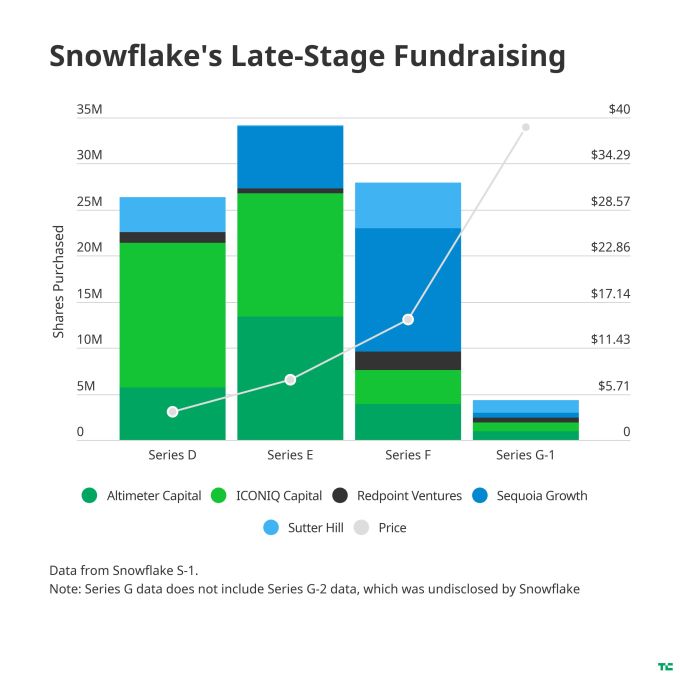

On top of that, what’s interesting is that Snowflake broke down the share purchases by firm for the last four rounds (D through G-1) the company fundraised:

That level of detail actually allows us to grossly compare the multiples on invested capital for these firms.

Sutter Hill, despite owning large sections of the company early on, continued to buy up shares all the way through the Series G, investing an additional $140 million in the later-stage rounds of the company. Adding in the entirety of its $5 million Series A round and a bit from the Series B assuming pro rata, the firm is looking on the order of a 16x return (assuming the IPO price is at least as good as the last round price).

Outside Sutter Hill, Redpoint has the best multiple return profile, given that it only invested $60 million in these later-stage rounds while still maintaining a 9.0% ownership stake. Both Sutter Hill and Redpoint purchased roughly 20% of their overall stakes in these later-stage rounds. Doing some roughly calculating, Redpoint is looking at a return of about 12-13x.

Sequoia’s multiple on investment is capped a bit given that it only invested in the most recent funding rounds. Its 8.4% stake was purchased for nearly $272 million, all of which came in these late-stage rounds. At Snowflake’s last round valuation of $12.4 billion, Sequoia’s stake is valued at $1.04 billion — a return of slightly less than 4x. That’s very good for mezzanine capital, but nothing like the multiple that Sutter Hill or Redpoint got for investing early.

Doing the same back-of-the-envelope math and Altimeter is looking at a better than 6x return, and ICONIQ got 7x. As before, if the stock zooms up, those returns will look all the better (and of course, if the stock crashes, well…)

One final note: The pattern for these last four funding rounds is unusual for venture capital: Snowflake appears to have “spread the love around,” having multiple firms build up stakes in the startup over several rounds rather than having one definitive lead.

Powered by WPeMatico

Snowflake filed to go public today joining a bushel of companies making their S-1 documents public today. TechCrunch has a longer digest of all the IPO filings coming soon, but we could not wait to get into the Snowflake numbers, given the huge anticipation that the company has generated in recent quarters.

Why? Because the cloud data warehouse company has been on a fundraising tear in recent years, including a $450 million Series F in late 2018 and a $479 million Series G in February of this year. The latter round valued the mega-unicorn at around $12.5 billion. More on this later.

Snowflake is, then, one of the world’s most valuable former startups that is still private. Its public debut will make a splash. But what did its $1.4 billion in capital raised (Crunchbase data) build? Let’s take a peek at the numbers.

Even glancing at the Snowflake S-1 makes it clear what investors are excited about when it comes to the big-data storage service: Its growth. In its fiscal year ending January 31, 2019, for example, Snowflake had revenue of $96.7 million. A year later that number was $264.7 million, or growth of around 150% at scale.

More recently, the company’s growth has remained impressive. In the six months ending July 31, 2019, Snowflake’s revenue was $104.0 million. A year later, those two quarters generated revenues of $242.0 million. That’s growth of 132.7% on a year-over-year basis. Impressive, and just the sort of top line expansion that private investors want to staple their wallet to.

So, lots of growth. But how high-quality is the revenue?

Let’s take a look at the company’s gross margins over different time periods. The data will help us better understand the company’s value, and its gross margin improvement, or impairment over time. Given Snowflake’s soaring valuation over time, we are expecting to see improvements as time passes:

Et voilà ! Just like we expected, improving gross margins over time. Recall that the higher (stronger) a company’s gross margins are, the more of its revenue it gets to keep to cover its operating costs. Which is, notably, where the Snowflake story goes from super-exciting to slightly harrowing.

Let’s talk losses.

In no way does Snowflake’s operations pay for themselves. Indeed, the company is super unprofitable on both an operating and net basis.

In its fiscal year ending January 31, 2019, Snowflake lost $178.0 million on a net basis. A year later the figure swelled to $348.5 million. In the six months ending July 31, 2019, the company’s net loss was $177.2 million. In the same two quarters of this year, it was slightly lower at $171.3 million.

And that’s why the company is probably trying to go public. Now that it can point to falling net losses as its revenues grow and its gross margins improve, you can chart a path to break-even. And Snowflake’s operations are burning less cash over time. The pace was north of $50 million a quarter in the two three-month periods ending July 31, 2019, for example.

And even more, if we look inside the last two quarters, the most recent period (three months ending July 31, 2019) is larger than the one preceding it in revenue terms ($133.1 million versus $108.8 million), and its net loss is smaller ($77.6 million versus $93.6 million). This lowered the company’s net margin from -86% to -58%. Still bad! But far less bad in short order, which could cut worries about Snowflake’s enormous history of unprofitability at scale.

Since Snowflake first appeared in 2012, its ability to take the idea of a data warehouse, a concept that has existed on prem for years, and move into a cloud context had great appeal — and it attracted great investment. Imagine taking virtually all your data and having it in a single place in the cloud.

The money train started slowly at first, with $900,000 in seed money in February 2012, followed quickly by a $5 million Series A later that year. Within a few years investors would be handing the company bundles of cash and the train would be the high-speed variety, first with former Microsoft executive Bob Muglia leading the way, and more recently with former ServiceNow CEO Frank Slootman in charge.

By 2017 there were rapid-fire rounds for big money: $105 million in 2017, $263 million in January 2018, $450 million in October 2018 and finally $479 million this past February. With each chunk of money came gaudier valuations, with the most recent weighing in at an eye-popping $12.4 billion. That was triple the company’s $3.9 billion valuation in that October 2018 investment.

In February, Slootman did not shy away from the IPO question. Unlike so many startup CEOs, he actually embraced the idea of finally taking his company public, whenever the time was right, and apparently that would be now, pandemic or not.

He actually almost called the timing in a conversation with TechCrunch at the time of the $479 million round:

I think the earliest that we could actually pull that trigger is probably early- to mid-summer time frame. But whether we do that or not is a totally different question because we’re not in a hurry, and we’re not getting pressure from investors.

All money talk aside, at its core, what Snowflake offers is this ability to store vast amounts of data in the cloud without fear of locking yourself in to any particular cloud vendor. While all three cloud players have their own offerings in this space, Snowflake has the advantage of being a neutral vendor — and that has had great appeal to customers, who are concerned about vendor lock-in.

As Slootman told TechCrunch in February:

One of the key distinguishing architectural aspects of Snowflake is that once you’re on our platform, it’s extremely easy to exchange data with other Snowflake users. That’s one of the key architectural underpinnings. So content strategy induces network effect which in turn causes more people, more data to land on the platform, and that serves our business model.

When it rains it pours. Unity filed. JFrog filed. We still need to talk X-Peng. Corsair has filed as well. And there are still a host of companies that have filed privately, like Airbnb and DoorDash, that could drop a new filing at any moment. What an August!

Powered by WPeMatico

Unity, the company founded in a Copenhagen apartment in 2004, is poised for an initial public offering with numbers that look pretty strong.

Even as its main competitor, Epic Games, is in the throes of a very public fight with Apple over the fees the computer giant charges developers who sell applications (including games) on its platform (which has seen Epic’s games get the boot from the App Store), Unity has plowed ahead, narrowing its losses and maintaining its hold on over half of the game development market.

For the first six months of 2020, the company lost $54.2 million on $351.3 million in revenue. The company narrowed its losses compared to 2019, when the company lost $163.2 million on $541.8 million in revenue, and 2018 when the company lost $131.6 million on $380.8 million in revenue. As of June 30, 2020 the company had total assets of $1.29 billion and $453.2 million in cash.

Increasing revenue and narrowing losses are things that investors like to see in companies that they’re potentially going to invest in, as they point to a path to profitability. Another sign of the company’s success is the number of customers that contribute more than $100,000 in annual revenue. In the first six month of the year, Unity had 716 such customers, pointing to the health of its platform.

The company will trade on the NYSE under the single-letter ticker “U”. The NYSE only has a few single letters left to offer, although Pandora gave up the letter P when it was bought by Liberty Media back in 2018.

Unlike Epic Games, Unity has long worked with the major platforms and gaming companies to get their engine in front of as many developers and gamers as possible. In fact, the company estimates that 53% of the top 1,000 mobile games on the Apple App Store and Google Play Store and over 50% of mobile, personal computer and console games were made with Unity.

Some of the top titles that the platform claims include Nintendo’s Mario Kart: Tour, Super Mario Run and Animal Crossing: Pocket Camp; Niantic’s Pokémon GO and Activision’s recent Call of Duty: Mobile are also Unity games.

The knock against Unity is that it’s not as powerful as Epic’s Unreal rendering engine, but that hasn’t stopped the company from making forays into industries beyond gaming — something that it will need to continue doing if it’s to be successful.

Unity already has a toehold in Hollywood, where it was used to recreate the jungle environment used in Disney’s “Lion King” remake (meanwhile, much of “The Mandalorian” was created using Epic’s Unreal engine).

Of course, Unity’s numbers also reveal that the size of its business is currently a bit smaller than its biggest rival. In 2019, Epic said it had earnings of $730 million on revenue of $4.2 billion, according to VentureBeat . And the North Carolina-based game developer is now worth $17.3 billion.

Still, the games market is likely big enough for both companies to thrive. “Historically there has been substantial industry convergence in the games developer tools business, but over the past decade the number of developers has increased so much, I believe the market can support two major players,” Piers Harding-Rolls, games analyst at Ampere Analysis, told the Financial Times.

Venture investors in the Unity platform have waited a long time for this moment, and they’re certainly confident in the company’s prospects.

The last investment round valued the company at $6 billion, with the secondary sale of $525 million worth of the company’s shares.

Powered by WPeMatico

Setting our dive into Palantir’s gross margins aside for another day, Sumo Logic filed to go public this morning. The Redwood City-based, former startup raised around $340 million while private, according to Crunchbase data.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Sumo Logic parses information collected from its customers’ enterprise apps and integrations to help them pinpoint operational and security issues and lets them dashboard additional elements as they wish. The company claims in its S-1 that its code is “continuous intelligence,” which it brands as “a new category of software.”

Our own Ron Miller summarized Sumo Logic as a “cloud data analytics and log analysis company” when it raised a $110 million Series G last May. At the time, it was valued at north of $1 billion, making it a unicorn.

Sumo Logic’s IPO has been in its plans for some time. We can see this in a 2017 TechCrunch headline noting that Sumo had then raised $75 million, and was “on path” to a public offering. So, how healthy is the company, and what have its investors bought with about a third of a billion dollars in capital? Let’s find out.

Up top: Sumo Logic operates on a fiscal calendar that ends January 31 of each calendar year. This is super standard for SaaS companies as it allows the firm to not wrap its year during the holiday period. This is good for sales teams and so forth.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest big news, chats about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here, and myself here, and don’t forget to check out last Friday’s episode.

What was on the docket this morning? All sorts of good stuff, though the Sumo Logic S-1 did drop just after we wrapped. Here’s today’s rundown:

Whew, with YC and Palantir this week and a chat with Twilio’s CEO it’s going to be an active few days. Ready?

Equity drops every Monday at 7:00 a.m. PT and Friday at 6:00 a.m. PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. You can subscribe to the newsletter here if you haven’t yet.

Ready? Let’s talk money, startups and spicy IPO rumors.

As I write to you on Friday afternoon, the Palantir S-1 has yet to drop, but TechCrunch did break some news regarding the impending filing and just how big the company actually is. Please forgive the block quote, but here’s our reporting:

In screenshots of a draft S-1 statement dated yesterday (August 20), Palantir is listed as generating revenues of roughly $742 million in 2019 (Palantir’s fiscal year is a calendar year). That revenue was up from $595 million in 2018, a gain of roughly 25%. […] Palantir lists a net loss of roughly $580 million for 2019, which is almost identical to its loss in 2018. The company listed a net loss percentage of 97% for 2018, improving to a loss of 78% for last year.

A few notes from this. First, those losses are flat icky. Palantir was founded in 2003 or 2004 depending on who you read, which means that it’s an old company. And it was running an effective -100% net margin in 2018? Yowza.

Second, what the flocking frack is that revenue number? Did you expect to see Palantir come in with revenues of less than $1 billion? If you did, well done. After a deluge of articles over the years discussing just how big Palantir had become, I was anticipating a bit more (more here for context). Here are two examples:

Notably, Palantir’s real revenue result, or one very close to it, made it into Business Insider this April. The reporting makes the company’s S-1 less of a climax and more of a denouement. But, hey, we’re still glad to have the filing.

The Exchange will have a full breakdown of Palantir’s numbers Monday morning, but I think what Palantir coverage over the years shows is that when companies decline to share specific revenue figures that are clear, just presume that what they do share is misleading. (ARR is fine, trailing revenue is fine, “contract” metrics are useless.)

The Exchange spent a lot of time digging into e-commerce venture capital results this week, including notes from some VCs about why e-commerce-focused startups aren’t raising as much as we might have guessed.

Overstock!

We got a chance to fire a question over to the CEO of Overstock.com on the matter, adding to what we learned from private investors on the same topic. So here’s the online retailer’s CEO Jonathan Johnson, answering our question on how many smaller vendors are signing up to sell on its platform during today’s e-comm boom:

We have had increased demand to sell on Overstock and we are adding new partners daily. To protect the customer experience, we have become more selective and have increased the requirements to become a selling partner on our site. Our customers’ experience is critical to our long-term success and if partners cannot perform to our operational standards, we do not allow them to sell on our site.

We care because Shopify and BigCommerce are stacking up new rev, and we were curious how widely the e-commerce step-change from major platforms extended. Seems like all of them are eating.

How today’s evolving economic landscape isn’t working out better for e-commerce-focused startups is still a surprise. Normally when the world changes rapidly, startups do well. This time it seems that Amazon and a few now-public unicorns are snagging most of the gains.

Airbnb!

Anyhoo, onto the Airbnb world; we have a few data points to share this week. According to Edison Trends data that was shared with us, here’s how Airbnb is doing lately:

This explains why the company is prepping to go public sooner rather than later: The second-half of Q2 was a ramp back to normal for the company, and July was pretty good by the looks of it. If Airbnb is worth what it once was is not clear, but the company is certainly doing better than we might have expected it to. (More on the comeback here.)

For more on the big unicorn IPOs, I wrote a digest on Friday that should help ground you. I can say that with some confidence, as I wrote it to ground myself!

Finally some loose ends and other notes like an after-dinner amuse-bouche:

And we’ll wrap with a tiny note from Greg Warnock, managing director at Mercato via email about the late-stage venture capital market. We asked for “notes on current valuation trends, in particular re: ARR/run rate multiples.” Here’s what we heard back:

I think valuations are correlated with economic activity and certainly something like COVID would qualify, but it’s very much a lagging indicator. It takes a while for entrepreneurs’ expectations to shift. Once they feel like the economy has moved in a permanent way, they begin to rethink. The first thing that they experience a little bit more urgency. They start from a belief that they can raise money any time they want, from anyone they want. Soon they realize there are fewer investors in market, that those opportunities appear less frequently, and each one should be managed more carefully. From there they go to thinking about terms. They might have to be flexible around some terms or some construct. Finally, they go to just fundamentally thinking about valuation in terms of multiples.

Going back to my first comment about economic factors being a lagging indicator, COVID related shocks haven’t moved through the system yet. It will take something more like a year for all the expectations to shift. My experience is that a shift in the economy from an investor standpoint creates a flight to quality. Companies with lackluster performance are first to feel lack of options in fundraising and exits. High performing businesses are the last ones to experience a change in valuation multiples. It disproportionately affects average businesses more quickly and more dramatically than high quality businesses which may feel no significant effects.

Hugs, fist bumps and good vibes,

Powered by WPeMatico