Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Back in early July, TechCrunch covered the Envision Accelerator. The program was put together by a group of students and recent graduates, often with some early venture capital experience, to help give some young startups a boost, and to shake up industry diversity metrics at the same time.

Now on the other side of their first batch’s official program and into its investor week, Envision shared a number of statistics regarding that first cohort, and talked about plans for its second.

What I appreciate about the Envision group is that by simply going out and making their own accelerator, they have shown that it is possible to attract a diverse group of startups to a program. How diverse? Let’s find out.

According to data provided to TechCrunch by Annabel Strauss and Eliana Berger from the Envision team (more on them here, if you’re curious), 17 companies made it into the first group. Of those 17 companies and their founding teams, around one-third of founders were black, around one in five were Latinx and more than 75% had a female founder.

Those are impressive metrics, frankly, especially when we consider what other groups have managed in recent sessions. Envision’s founders also skew young, not a surprise, given that the effort was effectively students making a program for their fellow students, with a three-to-one bias in favor of undergrads versus graduate students.

We’ll list the participating companies with links to their sites below, as per usual with this sort of accelerator roundup.

But, before we do, a few notes on how the first batch went down. When we last talked about Envision, they were still fundraising to pull together more capital to give to their selected companies. The idea was to provide $10,000 in equity-free capital, along with an eight-week program of lectures, networking and hands-on help from the Envision collective and a group of advisors.

According to Strauss and Berger, Envision was able to raise all the money that it needed to provide funding to its selected companies, though not every team picked up the full $10,000, with the duo noting that the amount varied based somewhat on need.

It will not be clear for a bit if the companies that went through Envision’s maiden class manage to raise more capital, scale, and become success. But for the Envision team itself, round one went well enough that a second effort is just around the corner.

And when it comes to that second push — or class, really — Envision remains in a hurry. After putting together its initial cohort while building its own organization on the fly, the group is going to kick off its second batch in October, giving it slim breathing room between cohorts.

There’s a reason for the haste, however. First, Envision wants to add two weeks to its programming, bringing the accelerator to a total of 10 weeks to include more training, and to fit that into the current semester, October was the kickoff month. Strauss and Berger noted that some students are taking leave during the first semester of this academic year.

More on Envision itself when we hear more on how the first batch did in attracting investor interest.

Here are the companies from batch one:

- Adora: Adora is a personalized, digital campus visit platform that makes compelling visits accessible to everyone.

- Devie: Devie is a parent coaching app that guides parents through challenges in a personal, accessible and actionable way.

- Forage: Forage is a mobile application that provides real-time pricing at grocery stores so families can save money.

- Holdette: At Holdette, we make professional work wear with real pockets for women entering the workforce for the first time.

- Justice Text: Justice Text makes video evidence management software to produce fair outcomes in the criminal justice system.

- Klara: Klara is a data science platform transforming the way consumers discover skincare and haircare products.

- Mindstand: Mindstand helps leaders identify implicit bias, employee engagement and culture fit within their internal communications.

- MODE: MODE helps people discover and purchase clothes through a personalized, social shopping experience.

- Mylabox: Mylabox is a cross-border e-commerce marketplace enabling SMBs in LatAm to access high-quality overseas products.

- Nibble: Nibble is a platform solving food waste by helping restaurants sell excess meals and ingredients at a discount.

- Pareto: Pareto is building a library of quick-to-launch workflows that startups can deploy for operations as they scale.

- Schefs: Schefs is a platform for college students to facilitate and participate in themed conversations over a virtual meal.

- UrConvey: UrConvey is a safe app that makes it easy to ride share with people you know by harnessing your network.

- Vngle: Vngle is a decentralized grassroots news network bringing “various angles” of local reality coverage to news deserts.

- Wellnest: Wellnest is a joyful journaling app that increases mindfulness by prioritizing user experience, voice and insights.

- Winkshare: Winkshare is a secure messaging app designed for the modern relationship. Your relationship, your business.

- Yup: Yup rewards valuable opinions across the web. Rate anything, earn rewards for accuracy, and gain status.

Powered by WPeMatico

Gong announced a $200 million Series D investment just last month, and loaded with fresh cash, the company wasted no time taking advantage. Today, it announced it was buying early-stage Isreali sales technology startup Vayo. The companies did not share terms of the deal, but Gong CEO Amit Bendov said the deal closed a couple of weeks ago.

The two companies match up quite well from a tech standpoint. While Gong searches unstructured data like emails and phone call transcripts and finds nuggets of data, Vayo looks at structured data, which is essentially the output of the Gong search process. What’s more, it handles large amounts of data at scale.

“Vayo helps find customer interactions at a large scale to identify trends like customers likely to churn or usage is going up, or your deals are starting to slow down — and they do this for structured data at scale,” Bendov told TechCrunch.

He said this ability to identify trends was really what attracted him to the company, even though it was still at an early stage of development. “It’s a perfect fit for Gong. We take unstructured data — emails, audio calls video calls — and extract insights. Customers, especially with a large organization, don’t want to see individual interactions but high order insights […] and they’ve developed [a solution] to identify trends on large data volumes for customer interactions,” he said.

Vayo was founded in 2018 and raised $1.7 million in seed capital, according to Crunchbase. Joining forces with Gong gives them an opportunity to develop the technology inside a company that’s growing quickly and is extremely well capitalized, having raised more than $300 million in the last 18 months.

Avshi Avital, CEO at Vayo, who has joined Gong with his four fellow employees, gave a familiar argument for selling the company. “With Gong we found the perfect partner to realize this mission faster and maximize the impact of the technology we built given the scale of their customer base and growth potential,” he said.

The plan is to fold the Vayo tech into the Gong platform, a process that will take three to six months, according to Bendov.

Powered by WPeMatico

Bambuser is a name you may not have heard in a while, but the Stockholm-headquartered company is announcing today that it has raised $45 million in new funding this year, with $34.5 million of that amount raised during the pandemic.

Bambuser’s history goes back more than a decade (the first TechCrunch coverage appeared in 2008). CEO Maryam Ghahremani told me that the founders’ idea — using smartphones to stream live video journalism — made them “very, very much ahead of their time.”

However, being ahead of your time isn’t always a good thing, and Ghahremani that the company has also struggled with having “too little capital” (although it publicly listed on Nasdaq First North in 2017) and also with turning its technology into a great product and a scalable business model.

So Ghahremani was brought on to change all that two years ago. She told me she soon saw an opportunity in the growth of live video shopping, particularly in China, with potential clients starting to ask whether Bambuser had any products for this. It didn’t at the time, but it quickly shifted focus and launched its first live video shopping products last fall.

“We didn’t plan for the pandemic to hit the world,” Ghahremani said. “We started this because we believe that this is going to be the future of retail.”

At the same time, she suggested that the pandemic — and the resulting shutdowns and struggles of brick-and-mortar retail — have accelerated the transition, giving Bambuser’s business a big boost. The company’s offering has been used by brands including H&M, Motivi, Moda Operandi, Frame, LUISAVIAROMA and Showfields, and it says that in Q2, net sales were up 669% year-over-year.

Bambuser CEO Maryam Ghahremani (Image Credits: Bambuser)

While e-commerce and social media platforms are expanding their support in this area, Ghahremani said brands are turning to Bambuser because they want to offer a live shopping experience while still owning the brand experience, the customer data and the transaction itself.

She also emphasized that Bambuser is focused on being a business-to-business product, rather than a consumer shopping platform.

“We are trying to create not another Instagram or Facebook or marketplace, because we believe other [companies] are already doing that,” she said. “We’re not even interested in going into that battle. What we’re trying to do, what we need to do is help the larger brands.”

Participants in the new funding include Consensus Asset Management, Handelsbanken, Harmony Partners, Lancelot Asset Management, Tenth Avenue Holdings and TIN Fonder .

Among other things, Ghahremani said she’d hoped to create a physical presence in the United States earlier this year, but those plans were delayed by the pandemic. Still, she’s now planning to open a New York office this quarter. And in the meantime, the U.S. has already become the company’s largest market.

Powered by WPeMatico

With Dorian, co-founder and CEO Julia Palatovska said she’s hoping to empower fiction writers and other storytellers to create their own games.

The startup is announcing that it has raised $3.25 million in seed funding led by March Capital Partners, with participation from VGames, Konvoy Ventures, London Venture Partners, Michael Chow (co-creator of the Twitch series “Artificial”), Andover Ventures and talent management company Night Media.

In addition, John Howell, the former vice president of partnerships at Twitch, has joined the board as an independent director.

Palatskova previously worked in gaming as the head of business development at G5 Entertainment, and she said she’d also become entranced by narrative games and interactive fiction. And while there are existing interactive fiction platforms, she saw “an opportunity that I felt was missing,” particularly in the fact that those platforms are “entirely single player, with no opportunity to play and collaborate with other people.”

So she gave me a quick tour of the Dorian platform, showing me how, without coding, a writer can essentially design characters and backgrounds by choosing from a variety of visual assets (and they’ll eventually be able to upload assets of their own), while using a flowchart-style interface to allow the writer to connect different scenes in the story and create player choices. And as Palatskova noted, you can also collaborate on a story in real-time with other writers.

“In terms of writer productivity, I would say there is almost no difference between creating interactive fiction on our engine and just writing fiction,” she said.

Image Credits: Dorian

From what I could see, the resulting games look similar to what you’d find on platforms like Pocket Gems’ Episode, where there aren’t a lot of technical bells and whistles, so the story, dialogue and character choices move to the forefront.

When I brought up the open-source game creation software Twine, Palatskova said Twine is “just a tool.”

“We want to be more like Roblox, both the tools and the distribution,” she said.

In other words, writers use Dorian to create interactive stories, but they also publish those stories using the Dorian app. (The writer still owns the resulting intellectual property.) Palatskova noted that Dorian also provides detailed analytics on how readers are responding, which is helpful not just for creating stories, but also for monetizing via premium story choices.

In fact, Dorian says that in early tests involving around 50,000 players, writers were able to improve monetization by 70% after only one or two iterations. And Palatskova noted that with Dorian’s games — unlike an interactive film such as “Black Mirror: Bandersnatch” —”It’s fast and easy to test multiple branches.”

Dorian is currently invite-only, but the plan is to launch more broadly later this year. Palatskova is recruiting writers with and without gaming experience, but she also expects plenty of successful contributions to come from complete novices. She wants Dorian to be “a completely open platform, like Roblox or Twitch for writers.”

“Dorian’s success in creating an interactive platform that values storytelling while prioritizing monetization for its writers is a game-changer,” said March Capital’s Gregory Milken in a statement. “Julia and her team are creating a community that is primed to capture the attention of today’s influential but underrepresented audiences of diverse content creators.”

Update: An earlier version of this post incorrectly stated that Dorian had raised $3.15 million.

Powered by WPeMatico

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. (You can sign up for the newsletter here!)

Ready? Let’s talk money, startups and spicy IPO rumors.

During Monday’s IPO wave I was surprised to see Asana join the mix.

After news had broken in June that the company had raised hundreds of millions in convertible debt, I hadn’t guessed that the productivity unicorn wouldn’t give us an S-1 in the very next quarter. I was contentedly wrong. But the reason why Asana’s IPO is notable isn’t really much to do with the company itself, though do take the time to dig into its results and history.

What matters about Asana’s debut is that it appears set to test out a model that, until very recently, could have become the new, preferred way of going public amongst tech companies.

Here’s what I mean: Instead of filing to go public, and raising money in a traditional IPO, or simply listing directly, Asana executed two, large, convertible debt offerings pre-debut, thus allowing it to direct list with lots of cash without having raised endless equity capital while private.

The method looked like a super-cool way to get around the IPO pricing issue that we’ve seen, and also provide a ramp to direct listing for companies that didn’t get showered with billions while private. (That Asana co-founder Dustin Moskovitz’s trust led the debt deal is simply icing on this particular Pop-Tart).

This brief column was going to be all about how we may see unicorns follow the Asana route in time, provided that its debt-powered direct listing goes well. But then the NYSE got permission from the SEC to allow companies to raise capital when they direct-list.

In short, some companies that direct-list in the future will be able to sell a bloc of shares at a market-set value that would have previously set their “open” price. So instead of flogging the stock and setting a price and selling shares to rich folks and then finding out what public investors would really pay, all that IPO faff is gone and bold companies can simply offer shares at whatever price the market will bear.

All that is great and cool, but as companies will be able to direct-list and raise capital, the NYSE’s nice news means that Asana is blazing a neat trail, but perhaps not one that will be as popular as we had expected.

The NASDAQ is working to get in on the action. As Danny said yesterday on the show, this new NYSE method is going to crush traditional IPOs, provided that we’re understanding it during this, its nascent period.

Look, this week was bananas, and my brain is scrambled toast. You, like myself, are probably a bit confused about how it is only finally Saturday and not the middle of next week. But worry not, I have a quick roundup of the big stuff from our world. And, notes from calls with the COO of Okta and the CEO of Splunk, from after their respective earnings report:

Over to our chats, starting with Okta COO and co-founder Frederic Kerrest:

And then there was new McLaren F-1 sponsor Splunk, data folks who are in the midst of a transition to SaaS that is seeing the firm double-down on building ARR and letting go of legacy incomes:

And finally for Market Notes, my work BFF and IRL friend Ron Miller wrote about Box’s earnings this week, and how the changing world is bolstering the company. It’s worth a read. (Most public software companies are doing well, mind.)

We’re already over length, so I’ll have to keep our bits-and-bobs section brief. Thus, only the brightest of baubles for you, my friend:

And with that, we are out of room. Hugs, fist bumps and good vibes,

Powered by WPeMatico

The global legal services industry was worth $849 billion in 2017 and is expected to become a trillion-dollar industry by the end of next year. Little wonder that Steno, an LA-based startup, wants a piece.

Like most legal services outfits, what it offers are ways for law practices to run more smoothly, including in a world where fewer people are meeting in conference rooms and courthouses and operating instead from disparate locations.

Steno first launched with an offering that centers on court reporting. It lines up court reporters, as well as pays them, removing both potential headaches from lawyers’ to-do lists.

More recently, the startup has added offerings like a remote deposition videoconferencing platform that it insists is not only secure but can manage exhibit handling and other details in ways meant to meet specific legal needs.

It also, very notably, has a lending product that enables lawyers to take depositions without paying until a case is resolved, which can take a year or two. The idea is to free attorneys’ financial resources — including so they can take on other clients — until there’s a payout. Of course, the product is also a potentially lucrative one for Steno, as are most lending products.

We talked earlier this week with the company, which just closed on a $3.5 million seed round led by First Round Capital (it has now raised $5 million altogether).

Unsurprisingly, one of its founders is a lawyer named Dylan Ruga who works as a trial attorney at an LA-based law group and knows first-hand the biggest pain points for his peers.

More surprising is his co-founder, Gregory Hong, who previously co-founded the restaurant reservation platform Reserve, which was acquired by Resy, which was acquired by American Express. How did Hong make the leap from one industry to a seemingly very different one?

Hong says he might not have gravitated to the idea if not for Ruga, who was Resy’s trademark attorney and who happened to send Hong the pitch behind Steno to get Hong’s advice. He looked it over as a favor, then he asked to get involved. “I just thought, ‘This is a unique and interesting opportunity,’ and said, ‘Dylan, let me run this.’ ”

Today the 19-month-old startup has 20 full-time employees and another 10 part-time staffers. One major accelerant to the business has been the pandemic, suggests Hong. Turns out tech-enabled legal support services become even more attractive when lawyers and everyone else in the ecosystem is socially distancing.

Hong suggests that Steno’s idea to marry its services with financing is gaining adherents, too, including amid law groups like JML Law and Simon Law Group, both of which focus largely on personal injury cases.

Indeed, Steno charges — and provides financing — on a per-transaction basis right now, even while its revenue is “somewhat recurring,” in that its customers constantly have court cases.

Still, a subscription product is being considered, says Hong. So are other uses for its videoconferencing platform. In the meantime, says Hong, Steno’s tech is “built very well” for legal services, and that’s where it plans to remain focused.

Powered by WPeMatico

KitchenMate is a Toronto-based startup promising businesses a fresh approach to feeding their employees.

The startup has raised $3.5 million in seed funding led by Eniac Ventures and Golden Ventures, with participation from FJ Labs and Techstars. It’s also expanding into the United States.

Founder and CEO Yang Yu said KitchenMate was founded with the goal of providing “healthy meals at an affordable cost.” The solution he and his team developed combines refrigerated, tamper-proof “smart meal-pods” containing fresh, prepared meals that are then heated in a “smart cooker.”

You might think a pandemic is the wrong time for this idea, since so many companies are still working from home. And Yu acknowledged that some of KitchenMate’s most likely customers (such as tech companies) don’t need the product right now.

At the same time, he said there are many “old-school companies” in industries like manufacturing, distribution and essential services that can’t operate that way — and in those sectors, business is “booming.”

“[Before the pandemic,] it was a nice-to-have for a lot of companies that care about employees and want to offer them a healthy meal,” he said. “It’s become a must-have for a lot of companies now that everything is closed.”

In other words, Yu said that with many restaurants and other businesses shuttered by the pandemic, KitchenMate has emerged for some employers as “the only option.” He also said it’s being used by hospitals as an efficient way to prepare healthy meals for patients.

Without a KitchenMate Smart Cooker at home, I can’t vouch for the quality of the food, but Yu showed me how he prepared a meal in the KitchenMate office: He opened the refrigerator, removed a Smart Meal-Pod and scanned it with his phone, then loaded the Meal-Pod into the cooker. A few minutes later, a tasty-looking lunch of rice, curry, vegetables and tofu was ready for him.

KitchenMate offers the equipment for sale or rent to employers. The meals are then purchased by employees via smartphone app at an average cost of $9, usually with employees paying $7 and employers subsidizing the rest.

KitchenMate delivers new Meal-Pods once or twice a week, and teams can influence what gets delivered by voting on the dishes that they want. The startup also offers an option where staff members can prepare the meals for employees, rather than having everyone raid the refrigerator and making meals for themselves.

Yu suggested that as offices reopen, people will want to avoid crowded cafeterias, and they’ll choose KitchenMate’s bulk deliveries over having lots of individual deliveries going in and out of buildings and elevators.

Yu acknowledged that there is a risk of a “backlog” in the kitchen if everyone wants their lunch at the same time, but he said KitchenMate tries to alleviate this issue by allowing people to pre-order their meals in the app.

“We create more flexibility around people eating for a lot of companies who either can’t afford catering or, post-COVID, it’s just not possible anymore to have shared meals,” he said.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

This is the fourth episode of the week, pushing our production calendar to the test. Happily, we’ve managed to hold it together amidst the news deluge that the last few days have brought. It was a good week for our scheduling change, with the main episode of the show coming to you on Thursday afternoon versus Friday morning.

Change is good.

But unchanging this time around was our hosting lineup, with Natasha Mascarenhas and Danny Crichton and myself yammering with Chris Gates on the mix. Here’s what we got into:

And with that, we’re all going to bed. We’re tired. No more news, thanks!

Equity drops every Monday at 7:00 a.m. PT and Friday at 6:00 a.m. PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Meet Fondeadora, a fintech startup based in Mexico City that wants to build a full-stack neobank. The company just raised a $14 million Series A round led by Gradient Ventures, Google’s AI-focused venture fund. Founded in 2018, the company already manages 150,000 accounts and is adding $20 million in deposits every month.

Mexico represents a massive opportunity for a challenger bank as many people still rely on cash for most of their transactions. Given that all countries are progressively switching to card and digital payments, it seems like the right time to launch Fondeadora .

Y Combinator, Scott Belsky, Sound Ventures, Fintech Collective and Ignia are also participating in the funding round.

“We launched the first crowdfunding platform in Mexico about 10 years ago,” co-founder and co-CEO Norman Müller told me. “About 50% of card transactions failed in the system.”

That platform was also called Fondeadora. After a deal with Kickstarter, Müller and Fondeadora co-founder René Serrano went back to the drawing board and thought about the problems they had while operating the crowdfunding platform. It became Fondeadora as we know it today, a challenger bank that wants to improve the banking experience in Mexico.

The team traveled across Mexico to find a bank charter that they could use. “We acquired the charter, it was owned by a group of tomato farmers in Mexico. Twenty years ago, the government gave about 10 charters to create financial inclusion,” Müller told me.

The company launched its banking service after that. You can open an account without visiting a branch. You then receive a Mastercard debit card. You can choose to receive notifications after each purchase, lock and unlock your card, send instant transfers to other users and more. There are no monthly subscription fee and no foreign transaction fee.

Up next, Fondeadora wants to democratize savings accounts. “Cash has a great UX and UI. You can touch it, you can store it in your drawer. But as a medium to generate income, it’s terrible,” Müller told me.

In the coming months, you’ll earn interest on your deposits in your Fondeadora account. “We’re investing in government bonds, it’s a very secure type of instruments. In Mexico, you can get 5% or 6% interest rate,” Müller said. The startup could allocate a small portion of deposits to medium-risk investments as well.

Image credits: Fondeadora

Powered by WPeMatico

Narrative has raised $8.5 million in Series A funding and is launching a new product designed to further simplify the process of buying and selling data.

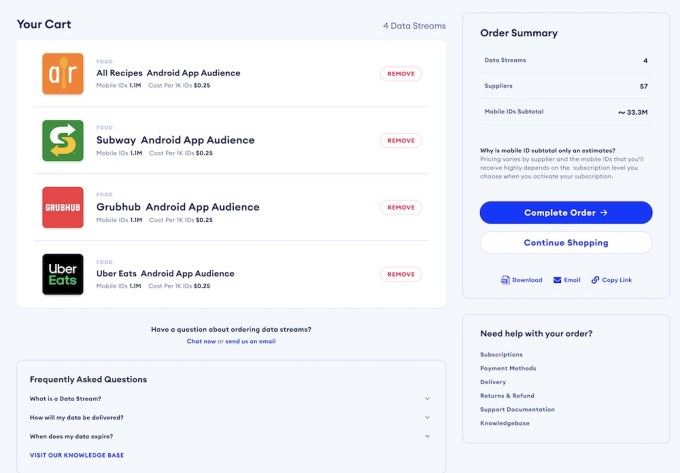

I’ve already written about the company’s existing marketplace and software for managing data transactions. With the new Data Streams Marketplace, the process should be simpler than ever — not much different than buying products on Amazon.

“Essentially, the idea was to take the best parts of the e-commerce and search models and apply that to a non-consumer offering to find, discover and ultimately buy data,” founder and CEO Nick Jordan (pictured above on the left) told me. “The premise is make it as easy to buy data as it is to buy stuff online.”

For example, Jordan showed me how a marketer could browse and search for different types of data in the marketplace. Once they find something they want to purchase (say, the mobile IDs of people who have the Uber Driver app installed on their phones, or the Zoom app) at a price they’re willing to pay (usually via subscription), they can just add the data set to their shopping cart, enter their credit card information, accept the terms of service and check out.

In Jordan’s view, this approach has become more attractive in recent months, because with all the uncertainty, companies need more data, and they need it quickly. For example, he suggested that a large company spending tens of millions of dollars on advertising “needs a way to find and buy the data almost programmatically and have the whole thing take five minutes instead of five months — those are the orders of magnitude we’re talking about here.”

Image Credits: Narrative

This data is generally sold by third-party sellers who are vetted by Narrative before they join the platform. Jordan also said the marketplace allows buyers to learn more about who they’re buying data from and even to establish a direct relationship — something that could be important for understanding things like regulatory compliance and data quality.

Although Narrative works to “deeply understand [sellers’] data collection methodologies,” Jordan warned, “There’s not necessarily a silver bullet for things being safe from a regulatory perspective.”

Similarly, he said that Narrative isn’t going to be grading the quality of the data sold on the platform. He argued, “Data quality is in the eye of the beholder. Someone’s signal is someone else’s noise.”

The goal with both of these issues is to provide transparency and allow buyers to do more research when necessary. Jordan also said Narrative is building out a marketplace of third-party applications — and that could include applications that score the quality of a data set.

“In the long run, I can imagine a number of use cases that’s almost infinite,” he said.

Narrative had previously raised $5.3 million in funding, according to Crunchbase. The Series A was led by G20 Ventures, with additional funding from existing investors Glasswing Ventures, MathCapital, Revel Partners, Tuhaye Venture Partners and XSeed Capital.

Jordan said the new round will allow the company to hire in areas like product, engineering, sales and marketing. He also noted that Narrative has long prioritized hiring team members from across North America, and recently it’s been placing a bigger focus on outreach and hiring from underrepresented groups.

“It’s easier said than done,” he acknowledged. “Any company that’s doing it well has to make it a priority and not just something they hope happens.”

Powered by WPeMatico