Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

On the heels of new filings from both Sumo Logic and JFrog, Snowflake, a venture-backed unicorn looking to go public on the strength of its data-focused cloud service, set an initial price range for its IPO.

The $75 to $85 per-share IPO price target values the firm at between $20.9 billion and $23.7 billion, huge sums for the private company. Its IPO could raise more than $2.7 billion for the startup.

Snowflake was last valued at around $12.5 billion when it raised a Series G worth $479 million earlier this year.

Built into those valuation projections are two private placements of stock in Snowflake, $250 million apiece from both Salesforce, the well-known CRM player, and Berkshire Hathaway, better known for its investment returns in the 80s and 90s, Cherry Coke and Charlie Munger’s humor.

Jokes aside, the inclusion of Salesforce in the IPO is notable, but not a shock, but Berkshire taking part in the public market debut of Snowflake, a company with historic losses that are nigh-tyrannical, is.

Here’s the S-1/A text on the setup:

Immediately subsequent to the closing of this offering, and subject to certain conditions of closing as described in the section titled “Concurrent Private Placements,” each of Salesforce Ventures LLC and Berkshire Hathaway Inc. will purchase $250 million of our Class A common stock from us in a private placement at a price per share equal to the initial public offering price. Based on an assumed initial public offering price of $80.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, each of Salesforce Ventures LLC and Berkshire Hathaway Inc. would purchase 3,125,000 shares of our Class A common stock. […]

In addition, Berkshire Hathaway Inc. has agreed to purchase 4,042,043 shares of our Class A common stock from one of our stockholders in a secondary transaction at a price per share equal to the initial public offering price that will close immediately subsequent to the closing of this offering.

That second paragraph makes it clear that Berkshire is actually looking to snooker even more shares into its corner, for a total purchase price that might scale to more than $500 million.

What is so attractive about Snowflake? TechCrunch wrote a bit about that when the company filed, but the short gist is that it has epic growth, improving gross margins and dramatically curtailed losses. The package adds up to one valuable IPO, and something durable enough to tempt Buffett.

Regardless, what could be the most highly valued IPO of the year — Airbnb depending — here in America just got a lot more exciting.

Powered by WPeMatico

Despite the public markets posting a few days of losses, the IPO wave continues to crest as a number of well-known technology companies line up to float their equity on American exchanges. Most recently we saw e-commerce giant Wish file (albeit privately) and news that dating service Bumble could look to go public next year.

Those bits of news came on the heels of Airbnb filing, again privately, and the public release of IPO filings from Unity, Asana, Snowflake and, key for our work today, Sumo Logic and JFrog.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

There are too many venture capital firms associated with the above companies to name here, but the mid-to-late-2020 IPO cohort is a fulcrum upon which a number of venture funds rest, their return profile waiting to see which way the scales tip.

Which made new IPO filings from Sumo Logic and JFrog this morning all the more exciting. The documents provide a bit of homework for us to handle, namely calculating the company’s valuation ranges. But when we do have those figures in place, we’ll be able to see what sort of revenue multiples each company may be able to earn during their public offerings and what sort of delta the former startups can build against their final, private valuations.

Which made new IPO filings from Sumo Logic and JFrog this morning all the more exciting. The documents provide a bit of homework for us to handle, namely calculating the company’s valuation ranges. But when we do have those figures in place, we’ll be able to see what sort of revenue multiples each company may be able to earn during their public offerings and what sort of delta the former startups can build against their final, private valuations.

If you are just catching up to these IPOs, we have notes on Sumo Logic and JFrog’s earlier SEC filings ready for you. Let’s go!

We’ll proceed in alphabetical order, kicking off with JFrog .

You can read JFrog’s new IPO filing here, which has all the notes you could want on its new price and past performance. Today, however, in honor of saving time, I’ll walk you through the key numbers quickly:

Powered by WPeMatico

Progress, a Boston-area developer tool company, boosted its offerings in a big way today when it announced it was acquiring software automation platform Chef for $220 million.

Chef, which went 100% open source last year, had annual recurring revenue (ARR) of $70 million from the commercial side of the house. Needless to say, Progress CEO Yogesh Gupta was happy to bring the company into the fold and gain not only that revenue, but a set of highly skilled employees, a strong developer community and an impressive customer list.

Gupta said that Chef fits with his company’s acquisition philosophy. “This acquisition perfectly aligns with our growth strategy and meets the requirements that we’ve previously laid out: a strong recurring revenue model, technology that complements our business, a loyal customer base and the ability to leverage our operating model and infrastructure to run the business more efficiently,” he said in a statement.

Chef CEO Barry Crist offered a typical argument for an acquired company; that Progress offered a better path to future growth, while sending a message to the open-source community and customers that Progress would be a good steward of the startup’s vision.

“For Chef, this acquisition is our next chapter, and Progress will help enhance our growth potential, support our Open Source vision, and provide broader opportunities for our customers, partners, employees and community,” Crist said in a statement.

Chef’s customer list is certainly impressive, and includes tech industry stalwarts like Facebook, IBM and SAP, as well as non-tech companies like Nordstrom, Alaska Airlines and Capital One.

The company was founded in 2008 and had raised $105 million, according to Crunchbase data. It hadn’t raised any funds since 2015, when it raised a $40 million Series E led by DFJ Growth. Other investors along the way included Battery Ventures, Ignition Partners and Scale Venture Partners.

The transaction is expected to close next month, pending normal regulatory approvals.

Powered by WPeMatico

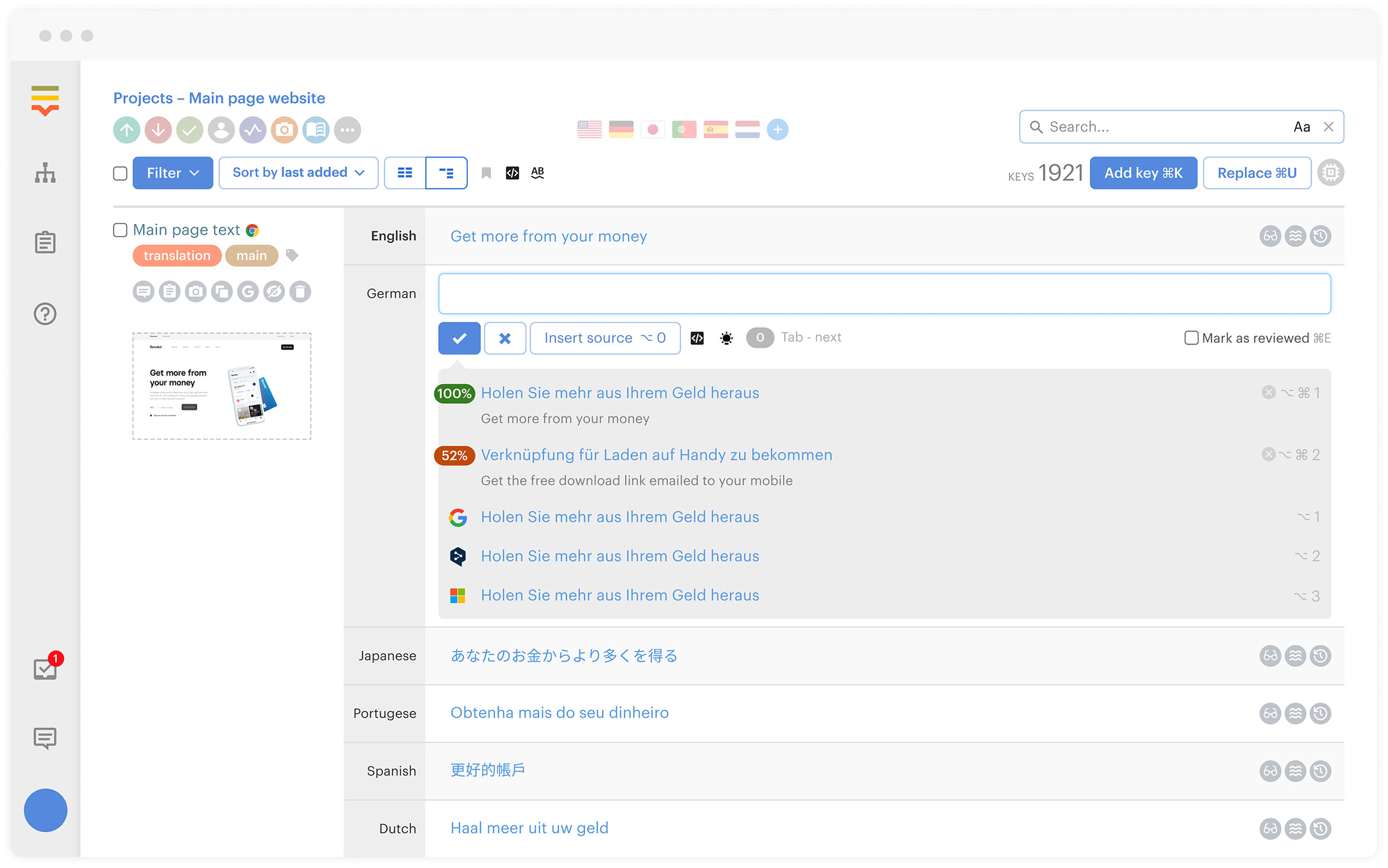

Meet Lokalise, a Latvian startup that focuses on translation and localization of apps, websites, games and more. The company provides a software-as-a-service product that helps you improve your workflow and processes when you need to update text in different languages in your product.

The company just raised a $6 million funding round led by Mike Chalfen, with capital300, Andrey Khusid, Nicolas Dessaigne, Des Traynor, Matt Robinson and others also participating.

When it’s time to ship an update, many companies waste time at the last minute as they still need to translate new buttons and new text in other languages. It’s often a manual process that involves sending and incorporating files with long lists of text strings in different languages.

“As a matter of fact, the most popular tools used in localisation processes are still Excel and Google Sheets. Next come internally-built scripts and tools,” co-founder and CEO Nick Ustinov told me.

Lokalise is all about speeding up that process. You can either manually upload your language files or integrate directly with GitHub or GitLab so that it automatically fetches changes.

You can then browse each sentence in different languages from the service. Your team of translators can edit text in the Lokalise interface. As a web-based service, everybody remains on the same page.

Image Credits: Lokalise

Some productivity features let you collaborate with other team members. You can comment and mention other people. You can assign tasks and trigger events based on completed tasks. For instance, Lokalise can notify a reviewer when a translation is done.

When everything is completed, you can use Lokalise to dynamically deliver language files to your mobile apps using SDKs and an API, or you can simply upload to an object storage bucket so that your app can fetch the latest language file from a server.

If you’re a small company and don’t have a team of translators, Lokalise lets you use Google Translate or a marketplace of professional translators. It works with Gengo or Lokalise’s own marketplace. There are some built-in spelling and grammar features to help you spot the most obvious errors.

“Most customers work with internal or external individual translators or language service providers (LSPs) directly,” Ustinov said. “The SaaS product generates 90% of our revenue — the revenue breakdown between the SaaS product and the marketplace of translation services is 90%/10%.”

The startup now has 1,500 customers, such as Revolut, Yelp, Virgin Mobile and Notion. It currently generates $4 million in annual recurring revenue.

Overall, Lokalise solves a very specific need. It is probably overkill for many companies. But if you ship often and you have customers all around the world, it could speed up the process a little bit.

Image Credits: Lokalise

Powered by WPeMatico

Based in Bangkok, Freshket simplifies the process of getting fresh produce from farms to tables. Launched in 2017, the startup has now raised a $3 million Series A, led by Openspace Ventures.

Other participants included Thai private equity firm ECG-Research; Innospace; and Pamitra Wineka and Ivan Sustiawan, the co-founders of Indonesian agriculture technology startup TaniHub. French-Singaporean food conglomerate Denis Asia Pacific and Thai family office Seedersclub, who made previous investments in Freshket, also returned for the Series A.

Freshket’s technology includes an e-commerce marketplace that connects farmers and food processors to businesses, like restaurants, and consumers in Thailand. The startup was co-founded by chief executive Ponglada Paniangwet and chief marketing officer Tuangploi Chiwalaksanangkoon, who each worked in marketing before launching Freshket three years ago.

Paniangwet told TechCrunch she wanted to enter agritech because her family has worked in the agriculture business for 25 years. “I grew up learning a lot about what worked and didn’t work in the industry,” Paniangwet said. “Overall, the industry is tedious, messy and highly manual.”

Freshket’s goal is to become “an enabler for the entire food supply chain,” she added.

Before Freshket, Paniangwet started a processing center, which sources, cuts and trims fresh produce at wholesale fresh markets before delivering them to restaurants and other customers. She realized technology could be used to simplify the supply chain, increasing farmers’ incomes and the quality of produce received by customers.

There is also ample market opportunity. According to an April 2019 Euromonitor International report, the food service market in Thailand is worth over $7.7 billion in annual purchases, made by more than 200,000 restaurants (link in Thai).

Chiwalaksanangkoon, who was already good friends with Paniangwet, left her position at one of Thailand’s largest banks to co-found Freshket. The company’s platform pull together Thailand’s fragmented produce supply chain by bringing together processing centers and suppliers, and connecting them directly with farmers, who usually rely on middlemen. Freshket also provides its users with data to help them predict supply and demand for their crops.

The expenses of operating a delivery business, especially for perishable goods, can be very high. To stay cost-efficient, Freshket itself doesn’t stock fresh produce. Instead, Freshket tells its network, including farmers, how much product they will need to provide on a daily basis, so they can plan their supply chains.

Paniangwet also said the B2B food delivery business has high average order values, fortifying its unit economics. Freshket’s order, warehouse and logistics management systems are all linked together and “because of that, we are able to control the flow of goods, limit additional and labor costs and keep our overall cost base manageable,” she said.

Freshket’s main rivals in the B2B space are traditional supply chain businesses; in the consumer space, it is up against include grocery delivery startups. It competes with delivery apps by offering lower retail prices, since Freshket is already tapped into a streamlined supply chain. For B2B customers, Freshket’s selling points include more precise delivery, a wider variety of products and produce gradings.

Freshket’s new funding will be used to upgrade its supply management technology. In the future, Paniangwet said the company plans to add more services, like financing, demand forecasting and price matching.

Freshket is among several startups in Southeast Asia markets focused on streamlining the food supply chain in different countries. Others include TaniHub and Eden Farm in Indonesia, Agribuddy in Cambodia and Singapore-based Glife.

This is the third agritech investment Openspace Ventures, which focuses on early-stage companies in Southeast Asia, has made (the other are TaniHub and Singaporean grocery platform RedMart).

In a press statement about the investment, Openspace Ventures founding partner Hian Goh said, “As Openspace Ventures’ second investment in Thailand this year, Freshket reflects our growing conviction in the potential of the Thai market for high quality and innovative startups.”

Powered by WPeMatico

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading.

Ready? Let’s talk money, startups and spicy IPO rumors.

Throughout all the chaos of 2020’s economic upheaval in the startup world, I’ve worked to pay more attention to low-code and no-code services. The short gist of chats I’ve had with investors and founders and public company execs in the past few weeks is that market awareness of no-code/low-code terminology is starting to spread more broadly.

Why? Again, summarizing aggressively, it seems that the gap between what different business units need (marketing, say) and what in-house or external engineering teams are capable of providing is widening. This means there is more total pain in the market, hunting for a solution, often with a tooling budget in hand.

Enter no-code and low-code startups, and even big-company services alike that can help non-developers do more without having to beg for engineering inputs.

I spoke with Arun Mathew this week. He’s a partner at Accel, a venture firm that has invested in all sorts of companies that you’ve heard of — including Webflow, which raised a $72 million Series A last August that Mathew led for his firm. (More on the round here, and notes from TechCrunch on Webflow’s early days here, and here, if you are curious.)

More interesting than that single round is how Accel wound up building a thesis around no-code startups. According to Mathew, Accel had made large investments into companies like Qualtrics, for example, when they were already pretty big and had found product-market fit. That same general approach led to the Webflow deal last year.

At the time, Webflow “wasn’t really defining what they were doing as n- code, they just said ‘we have a very simple drag and drop UI, to build websites, and soon full web applications, very simply,’ ” he told TechCrunch. But, according to Mathew, what Webflow was doing “lined up really well” with the “rising movement of no-code.”

From there, Accel “made a couple [more no-code] investments in Europe where [it has] an early-stage team and a growth team,” along with a few more in India. In the investor’s view, some of the investing activity was “thesis driven because we think [no-code is] a really interesting theme,” but some of the deals “happened opportunistically” where Accel had found “really talented founders in the space that we thought was interesting, executing on a vision that we found appealing.”

In the “span of a year, year-and-a-half,” Accel totted up “seven or eight companies in this no-code space,” which over the last five or six quarters became “a real thesis” for the firm, Mathew said. Accel now has “a global team” of around a dozen people “spending a lot of our time in and around no-code” he added.

Apologies for the length there, but what Mathew said makes me feel a bit less behind. After dipping a toe into learning more about no-code services and tooling (and, yes, low-code as well) it felt somewhat like I was playing catch-up. But as I covered that Webflow round and have since started paying more attention to no-code as well, perhaps you and I are right on time.

(We also recently ran an investor survey on the no-code topic, so hit it up if you want more VC scribbles on the topic.)

For Market Notes this week, we have four things. First, riffs from chats with two public company execs about the software market, some public market stuff and then some neat Airbnb spend data by which I am confounded:

Public company execs are pretty guarded in how they talk because they have to be. But what Putman and Lerman seemed to intimate is that economic damage — provided you are selling to business, and not individuals — seems more contained on a per-sector basis than I would have anticipated. And that there are some good things ahead, at least in a handful of hot sectors.

Opening our aperture a bit, some SaaS companies struggled this week to meet investor expectations, even as more companies added themselves to the IPO queue. It’s going to be very busy for a few quarters. (Speaking of which, you can find the good and bad from the new Sumo IPO filing here.)

The economy is still garbage for many, but at least for companies it’s improving. And on that note, some data regarding Airbnb. According to the folks over at Edison Trends, things are going better for the home-booking site than I would have guessed. Per the group:

Wild, right? Perhaps that’s why Airbnb has filed to go public.

We’re a tiny bit short on space, so I’ll keep our V&S dose short this week to respect your time. Here’s what I couldn’t not share:

And with that, we are out of room. Hugs, fist bumps and good vibes, and thank you so much for reading this little newsletter on the weekends. It’s a treat to write, and I hope you like it.

Hit me up with notes at alex.wilhelm@techcrunch.com. (I don’t know if you reply to this email if I will get the response. But try it so that we can find out?)

Powered by WPeMatico

A few days ago I wrote down a few notes making a bullish case for Palantir, searching to find good news amidst the company’s huge historical deficits.

Heading into the next phase of Palantir’s march to the public markets, I was very curious to see how the company would hone its S-1 filing to give itself the best possible shot during its impending debut.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

And we finally did get a new S-1/A filing, a document that our own Danny Crichton quickly parsed and covered. What he found was a set of amendments that seem to increase the chance that three Palantir insiders will control more than 50% of the company’s voting power forever, possibly making it a controlled company, which would loose the firm from select regulatory requirements.

Danny dryly noted that “given the diminished voting power of employee and investor shares, it is possible that these voting provisions will negatively impact the final price of those shares.” That’s being polite.

Danny dryly noted that “given the diminished voting power of employee and investor shares, it is possible that these voting provisions will negatively impact the final price of those shares.” That’s being polite.

Mulling this over this morning, I kept thinking about Snap, which sold stock in its IPO that gave new shareholders no votes at all, and Facebook, which is controlled by Mark Zuckerberg as his personal fiefdom. The two are not alone in this matter. There are a number of other public tech companies that provide certain groups of pre-IPO shareholders more votes than others on a per-share basis, though perhaps to a smaller degree than what Facebook has managed.

It feels like many startups (and former startups) have decided over time that having material shareholder input is a bad idea. That, in effect, they must run companies as not merely monarchies, but unquestioned ones, to boot.

I am not entirely convinced that this is the best way to create long-term shareholder wealth.

If you are on the other side of this particular fence, I understand. After all, Facebook is a global juggernaut and Snap has finally managed to eke out stock-market gains to bring its value back around to where it was when it went public. (A three-year journey.)

But those arguments are only so good. You could easily argue that the two companies could have done much more with less self-sabotage (Facebook) and a bit more spend discipline (Snap).

Powered by WPeMatico

Episerver is announcing that it has reached an agreement to acquire Optimizely for an undisclosed sum.

Optimizely was founded in 2009 by Dan Siroker and Pete Koomen. It became synonymous with A/B testing, subsequently building a broader suite of tools for marketers to experiment with and personalize their websites and apps, with more than 1,000 customers, including Gap, StubHub, IBM and The Wall Street Journal.

The company had raised more than $200 million in funding from Goldman Sachs, Index Ventures, Andreessen Horowitz, GV and others. Earlier this year, it laid off 15% of its staff, citing the impact of COVID-19.

Episerver, meanwhile, was founded in Stockholm back in 1994 and offers tools for marketers to manage their digital content. Accel-KKR sold the company to Insight Partners for $1.1 billion in 2018. (Today’s announcement describes Insight as a “strategic advisor and sponsor” in the acquisition.)

In a statement, Episerver CEO Alex Atzberger said this is “the most significant transformation in our company’s history – one that will set a new industry standard for digital experience platforms.” It sounds like the idea is to extend Episerver’s capabilities around content and commerce with Optimizely’s experimentation tools.

“The breakthrough combination of Episerver and Optimizely will transform digital experience creation and optimization, enabling digital teams to replace guesswork with evidence-based outcomes,” Atzberger said. “This, along with our shared mission to empower growing companies to compete digitally, makes me thrilled to welcome the Optimizely team to Episerver, as we prove there are no extraordinary experiences without experimentation.”

A company spokesperson said the deal is for a mix of cash and stock. The acquisition is expected to close in the fourth quarter of this year, with the companies remaining fully staffed and independent until then.

“Winning in today’s digital world requires delivering the best and most personalized digital experiences,” said Jay Larson, who replaced Siroker as Optimizely CEO in 2017, in a statement. “Episerver and Optimizely have a shared vision to optimize every customer touchpoint through the use of experimentation. Together, we will enable our customers to do more testing, in more places, with greater ease than ever before.”

Powered by WPeMatico

Process automation startup Hypatos has raised a €10 million (~$11.8 million) seed round of funding from investors including Blackfin Tech, Grazia Equity, UVC Partners and Plug & Play Ventures.

The Germany and Poland-based company was spun out of AI for accounting startup Smacc at the back end of 2018 to apply deep learning tech to power a wider range of back-office automation, with a focus on industries with heavy financial document processing needs, such as the financial and insurance sectors.

Hypatos is applying language processing AI and computer vision tech to speed up financial document processing for business use cases such as invoices, travel and expense management, loan application validation and insurance claims handling via — touting a training data set of more than 10 million annotated data entities.

It says the new seed funding will go on R&D to expand its portfolio of AI models so it can automate business processing for more types of documents, as well as for fueling growth in Europe, North American and Asia. Its customer base at this point includes Fortune 500 companies, major accounting firms and more than 300 software companies.

While there are plenty of business process automation plays, Hypatos says its use of deep learning tech supports an “in-depth understanding” of document content — which in turn allows it to offer customers a “soup to nuts” automation menu that covers document classification, information capturing, content validation and data enrichment.

It dubs its approach “cognitive process automation” (CPA) versus more basic applications of business process automation with software robots (RPA), which it argues aren’t so contextually savvy — thereby claiming an edge.

As well as document processing solutions, it has developed machine learning modules for enhancing customers’ existing systems (e.g. ECM, ERP, CRM, RPA); and offers APIs for software providers to draw on its machine learning tech for their own applications.

“All offerings include machine learning pipeline software for continuous model training in the cloud or in on-premise deployments,” it notes in a press release.

“We have deep knowledge of how financial documents are processed and millions of data entities in our training data,” says chief commercial officer Cem Dilmegani, discussing where Hypatos fits in the business process automation landscape. “We get compared to RPA companies like UiPath, enterprise content management (ECM) companies like Kofax Readsoft as well as generalist ML document automation companies like Hyperscience. However, we are quite different.

“We focus on end-to-end automation, we don’t only help companies capture data, we help them process it using our deep domain understanding, enabling higher rates of automation. For example, to automate incoming invoice processing (A/P automation) we apply our document understanding AI to capture all data, classify the document, identify the specific goods and services, validate for internal/external compliance and assign financial accounts, cost centers, cost categories etc. to automate all processing tasks.

“Finally, we offer this technology as components easily accessible via APIs. This allows RPA or ECM users to leverage our technology and increase their level of automation.”

Hypatos claims it’s seeing uplift as a result of the coronavirus pandemic — noting it’s providing a service to more than a dozen Fortune 500 companies to help with in-shoring efforts, which it says are accelerating as a result of COVID-19 putting pressure on the traditional business process outsourcing model as offshore workforce productivity in lower wage regions is affected by coronavirus lockdowns.

“We believe that we are in a pivotal moment of machine learning adoption in large organizations,” adds Andreas Unseld, partner at UVC Partners, in a supporting statement. “Hypatos’ technology provides ample opportunity to transform many core business processes. We’re impressed by the Hypatos machine learning technology and see the team in a perfect position to take a leading role in the machine learning revolution to come.”

Powered by WPeMatico

As Slack ramps up its investment in Asia, Toss Lab, the South Korea-based creator of enterprise collaboration platform JANDI, is preparing to become a more formidable rival. The startup announced today that it has raised a $13 million Series B led by SoftBank Ventures Asia, the early-stage venture arm of SoftBank Group. Participating investors also included SV Investment, Atinum Investment, Must Asset Management, Shinhan Capital, SparkLabs and T Investment.

Founded in 2014, Toss Lab said the round means it is the first Korean company in the collaboration space to raise over $20 million to date. The company says JANDI is the top collaboration platform in Japan and Taiwan. It serves companies ranging from small to mid-sized businesses to large enterprises with thousands of employees. Its clients include LG CNS (the Korean conglomerate’s IT services subsidiary), Korean tire manufacturer Nexen Tire and Lexus. Toss Labs says its revenue has grown more than 100% over the past three years.

Matthew Kim, chief executive of Toss Lab, told TechCrunch that the Series B will be used for global expansion and to increase the company’s headcount by 20% to 25%.

JANDI has seen a 80% increase in the number of users acquired during the COVID-19 pandemic across its Asian markets. To serve remote workers, JANDI added integration with Zoom, enhanced its security and developed an advanced admin dashboard.

The platform currently supports English, Chinese, Japanese, Korean and Vietnamese, and plans to grow its operations in Japan, Taiwan, Malaysia, Vietnam and the Middle East.

Last October, Slack said it was planning to increase its investment in Asia, including new data regions in Japan and Australia.

But Kim said JANDI’s biggest rival isn’t Slack. Instead, it is competing against popular messaging apps, like Line, Kakao, WhatsApp, Zalo and Facebook Messenger, which Kim said the majority of workers in Asia still rely on for workplace communication. While Slack is used by some startups and tech companies in Asia, Chatwork and Base.vn are the top collaboration platforms in Japan and Vietnam, respectively, while JANDI is the leader in South Korea and Taiwan.

One of JANDI’s advantages is that “we are currently integrating with the legacy systems that are unique in each region and we have the local onboarding support team for enterprise,” said Kim. He added that Japan and Taiwan have the most growth potential in the near-term, followed by the United Arab Emirates, Malaysia and Indonesia.

Like other collaboration platforms, JANDI offers messaging and group chats. But it also features collaboration tools that the company says is geared toward work culture in its Asian markets. These include organization charts to help people find colleagues by department; a “board view” for company announcements and reports; video calls that can support up to 300 participants at a time; read receipts; and a secure file manager for storing confidential team documents.

As part of the funding, Toss Labs also added four new board directors: Ticket Monster founder Daniel Shin and former Kakao chief strategy officer Joon-yeol Kang, the founders of Bass Investment; SoftBank Ventures Asia CEO JP Lee; and SBI Investment Korea CEO Joon-hyo Lee. Sendbird CEO John S. Kim and Bespin Global founder HanJoo Lee are joining as advisors to Toss Labs.

Powered by WPeMatico