Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Stripe makes a big acquisition, Google rolls out search improvements and Snapchat adds a TikTok-y feature. This is your Daily Crunch for October 15, 2020.

The big story: Stripe acquires Nigeria’s Paystack

Stripe has made its biggest acquisition to date. It announced today that it bought Paystack, a Lagos-headquartered startup that makes it easy to integrate payment services — we’ve referred to it in the past as “the Stripe of Africa.”

Sources tell us that the acquisition price was more than $200 million.

In an interview with TechCrunch, Stripe CEO Patrick Collison said that expanding into Africa presents the company with “an enormous opportunity,” adding that Stripe is planning for “a longer time horizon” than most other companies: “We are thinking of what the world will look like in 2040-2050.”

The tech giants

Google launches a slew of Search updates — These new AI-focused improvements include the ability to better answer questions with very specific answers, as well as a new algorithm to better handle the typos in your queries.

Snapchat launches its TikTok rival, Sounds on Snapchat — Snapchat made good on its promise to release a new feature that would allow users to set their Snaps to music.

Mario Kart Live: Home Circuit review — Bryce Durbin offers an illustrated look at a new edition of Mario Kart that incorporates a real remote-controlled car.

Startups, funding and venture capital

River, the latest venture from Wander founder Jeremy Fisher, launches with $10.4M in funding — River is meant to rethink the way we consume content across the internet.

Small business payments and marketing startup Fivestars raises $52.5M — It’s a difficult time for small businesses, and Fivestars CEO Victor Ho said that many of the big digital platforms aren’t helping.

Bipedal robot developer Agility announces $20M raise — Agility’s Digit is a package delivery robot capable of navigating stairs and other terrain.

Advice and analysis from Extra Crunch

News that Calm seeks more funding at a higher valuation is not transcendental thinking — We rewind the clock and review data from 2018, 2019 and 2020 about the meditation app.

Brighteye Ventures’ Alex Latsis talks European edtech funding in 2020 — European edtech firm Brighteye Ventures recently announced the $54 million first close of its second fund.

Tesla’s decision to scrap its PR department could create a PR nightmare — The move effectively makes founder Elon Musk the company’s lone voice.

(Reminder: Extra Crunch is our subscription membership program, which aims to democratize information about startups. You can sign up here.)

Everything else

New Oxford machine learning-based COVID-19 test can provide results in under 5 minutes — The test also offers advantages when it comes to detecting actual virus particles, instead of antibodies or other signs of the presence of the virus.

When was the last time you worked out your soul? — Another discussion of wellness startup funding, this time via the latest episode of the Equity podcast.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Powered by WPeMatico

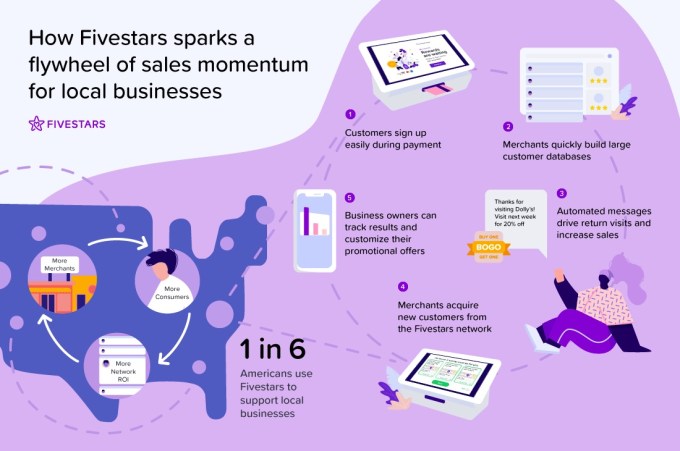

It’s a difficult time for small businesses — to put it mildly. And Fivestars CEO Victor Ho said that many of the big digital platforms aren’t really helping.

Ho argued that those platforms (whether they offer delivery services, user reviews or marketing tools) all have the same underlying model: “They seek to take over a small business’ customer base and then charge them a tax to start reaching those customers.”

Superficially, a company like Fivestars, which has created software to support small business payments and marketing, might not sound that different.

But Ho said that the startup actually takes the “opposite” approach, because Fivestars isn’t trying to build up a big “walled garden” of its own customers that businesses pay to access. Instead, businesses pay for the software, which they use to build a database of their own customers; they don’t have to pay to reach those customers.

“The incentives are more aligned,” he said.

Image Credits: Fivestars

The Fivestars platform includes its own payment product, integration with other point-of-sale systems, marketing automation that delivers personalized messages to customers and a broader network of 60 million shoppers, allowing for cross-promotion across different Fivestars businesses.

The startup is announcing today that it has raised $52.5 million in new funding, combining a Series D equity round as well as debt and bringing its total funding to $145.5 million. The round was led by Salt Partners, with participation from Lightspeed Venture Partners, DCM Ventures, Menlo Ventures and HarbourVest Partners.

Ho said Fivestars actually closed the round before the COVID-19 pandemic, but the team decided to hold off on the announcement because it seemed like a bad idea to “flaunt” the company’s bank account when so many of its customers were suffering.

The company has seen “record usage” during the pandemic, with 1 million new shoppers joining the network every month. At the same time, Ho acknowledged that the pandemic has caused Fivestars to shift its strategy. Originally, the goal for the funding was “just to keep growing our portfolio of merchants across our existing products,” but he said, “What changed pretty dramatically through this period for us was emphasizing the payments piece and the network” and focusing on “what small businesses need more than ever.”

Ho also noted that during the pandemic, the company has provided customers with more than $1 million worth of credits and also made more of its products free to use.

“It’s very clear that small businesses are incredibly resilient,” he added. “Particularly when it comes to the category of experiences — you’re not going to take your wife on a date to Pizza Hut; when you go to Paris, you’re not going to go to generic chains.”

In the funding announcement, Natasha Teague of Fort Lauderdale health food store Tropibowls described the Fivestars platform as “a huge help.”

“The value of being able to communicate with our customers and share updates in real-time has been immeasurable,” Teague said in a statement. “The power of Fivestars’ expansive network and payment tech has made our reopening process seamless and a lifesaver as we navigate new needs as a result of the pandemic.”

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

The whole crew was back today, with Natasha and Danny and I gathered to parse over what was really a blast of news. Lots of startups are raising. Lots of VCs are raising. And some unicorns are shooting to go public. It’s a lot to get through, but we’re here to catch you up.

Here’s what we got into:

And with that, we’re off until Monday morning. Chat soon, and stay safe.

Equity drops every Monday at 7:00 a.m. PDT and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

A video call group photo of NeuraLegion’s team working remotely around the world

Application security platform NeuraLegion announced today it has raised a $4.7 million seed round led by DNX Ventures, an enterprise-focused investment firm. The funding included participation from Fusion Fund, J-Ventures and Incubate Fund. The startup also announced the launch of a new self-serve, community version that allows developers to sign up on their own for the platform and start performing scans within a few minutes.

Based in Tel Aviv, Israel, NeuraLegion also has offices in San Francisco, London and Mostar, Bosnia. It currently offers NexDAST for dynamic application security testing, and NexPLOIT to integrate application security into SDLC (software development life cycle). It was launched last year by a founding team that includes chief executive Shoham Cohen, chief technology officer Bar Hofesh, chief scientist Art Linkov and president and chief commercial officer Gadi Bashvitz.

When asked who NeuraLegion views as its closest competitors, Bashvitz said Invicti Security and WhiteHat Security. Both are known primarily for their static application security testing (SAST) solutions, which Bashvitz said complements DAST products like NeuraLegion’s.

“These are complementary solutions and in fact we have some information partnerships with some of these companies,” he said.

Where NeuraLegion differentiates from other application security solutions, however, is that it was created specifically for developers, quality assurance and DevOps workers, so even though it can also be used by security professionals, it allows scans to be run much earlier in the development process than usual while lowering costs.

Bashvitz added that NeuraLegion is now used by thousands of developers through their organizations, but it is releasing its self-serve, community product to make its solutions more accessible to developers, who can sign up on their own, run their first scans and get results within 15 minutes.

In a statement about the funding, DNX Ventures managing partner Hiro Rio Maeda said, “The DAST market has been long stalled without any innovative approaches. NeuraLegion’s next-generation platform introduces a new way of conducting robust testing in today’s modern CI/CD environment.”

Powered by WPeMatico

There are more than 2 billion websites in existence in the world today, millions of apps and a growing range of digital screens where people and businesses present constantly changing arrays of information to each other. But all that opportunity also has a flip side: How can you say what you want, just how you want to say it, without technical hurdle after hurdle getting in your way?

A startup called Sanity has built a platform to help businesses (and their people) do that more easily with a SaaS platform that lets developers create code and systems to manage content. Now, after picking up some 25,000 customers, from “traditional” publishers like Conde Nast and National Geographic through to hundreds of others like Sonos, Brex, Figma, Cloudflare, Mux, Remarkable, Kleiner Perkins, Tablet Magazine, MIT, Universal Health Services, Eurostar and Nike, it is announcing funding of $9.3 million to fuel its growth.

The funding, a Series A, is being led by Threshold Ventures (the VC formerly known as Draper Fisher Jurvetson, rebranded in 2019 after none of the namesakes remained at the firm), with an interesting cast of others also participating.

They include Ev Williams (who knows a thing or two about “content” as the co-founder of Blogger, Twitter and most recently Medium); Adam Gross, ex-CEO of Heroku; Guillermo Rauch, inventor of NextJS and CEO and co-founder of Vercel; Stephanie Friedman (ex-Xamarin and Microsoft); and Monochrome Capital, the new firm launched by Ben Metcalfe (the co-founder of WP Engine, among many other roles).

Heavybit and Alliance Venture, which led its seed round of $2.4 million last year, also participated. Other existing investors include Mathias Biilman and Chris Bach, co-founders of Netlify; Jon Dahl, CEO and co-founder of Mux; and Edvard Engesæth, co-founder of NURX.

Sanity bills itself as a “content platform”, and the open-ended idea of what that could possibly mean is essentially the essence of what the company is about.

Led by co-founder and CEO Magnus Hillestad, it has crafted a set of tools that can help developers structure how and where content gets created, input and eventually presented to people, with its target audience being any organization or person that might be putting together a digital experience whose content is regularly updated and is not static.

Hillestad said that thinking of content as a separate and dynamic element in digital experiences represents a “paradigm shift” in terms of how the web and other content experiences are developing. The idea, he said, is for an organization “not to be held back by features but to have the code to make the components they want.” He described it as a progression along the same trajectories of “what Twilio did by coming in with APIs for communications, and Figma did with its concept of collaboration.”

While e-commerce has typically been a major customer of such “headless” platforms — they will use services like these to help design and manage the front end, with another service like Shopify to manage the commerce at the back end — it’s actually a basic framework that has been applied to a pretty wide range of use cases at Sanity.

They do include e-commerce experiences, but also companies building interactive tools for customers to look at, mix and match various light fixtures from a lighting consultancy; more standard publishing services; and for helping tailor materials for emergency medical training services.

These days, the medium, as they say, is the message, and in that regard “publishing” has taken on a new meaning in the digital age. Whereas in the past it only referred to materials prepared for print, such as books, magazines and newspapers, these days it can be any kind of content prepared for the web or any other endpoint where it will not only be “read” but potentially manipulated in some way, and likely also changed by the producers as well. The very un-static nature of that content makes it fun and interesting, but also a pain to manage.

Sanity has a notable origin that speaks to how it has always given a wide berth and prime positioning to the sanctity of content. It was built originally by an agency in Oslo, Norway, as part of a remit to rethink and recast how to present works for a new website for OMA, the architecture firm co-founded by the iconic Dutch designer Rem Koolhaas.

The information matrix and content management system concept that they put together was strong enough to use the agency to build more sites using the CMS, and eventually the firm spun Sanity out as its own independent firm, founded by Even Westvang, Hillestad, Oyvind Rostad and Simen Svale Skogsrud.

Part of the team, including Hillestad, relocated to the Bay Area to build the startup and integrate it deeper with the bigger tech ecosystem in the region and build out the concept under a SaaS model, while others remained in Oslo.

In its move to the U.S., Sanity has over the past few years been tapping into a growing market for services to enable those who rely on the web to do business do it in a more creative and dynamic way.

“A decade ago, I co-founded WP Engine with the goal of bringing the power of WordPress to the enterprise and small business buyer,” said Metcalfe in a statement. “Not only are we moving away from monolithic codebases to API-driven services, but the way we think about content is changing; as we create once and expect it to appear across web, apps and even IoT devices. Sanity has reimagined the headless CMS, bringing content closer to the developer where it can exist as the defacto content system of record across an entire organization. With CMS so close to my roots, I couldn’t be more delighted that Sanity is the inaugural investment for Monochrome Capital.”

It is not the only company in this wider area getting a lot of attention. Last week, Shogun — which focuses only on e-commerce and front-end design, raised $35 million. Others include Commercetools, Commerce Layer, Strapi, Contentful and ContentStack. Sanity stands out partly by keeping its focus wider than e-commerce and by not using the words “content” or “commerce” in its name.

“We’re seeing a tidal wave of companies transform and digitize every aspect of their business, but the tools they use limit their progress,” said Josh Stein, partner, Threshold Ventures, in a statement. “Sanity’s content platform liberates content and content owners by enabling a truly collaborative and customizable experience, while treating content as data to maximize content velocity across all customer touchpoints and surfaces. We’re excited to back the Sanity team and their impressive developer-focused content management platform.”

Stein and Jesse Robbins, a partner at Heavybit, are both joining Sanity’s board of directors with this round.

Powered by WPeMatico

Just months after it announced a $33 million Series B, Chicago-based M1 Finance today disclosed a $45 Series C.

The new financing event was led by Left Lane Capital, the same investor that led M1’s Series B. Bear in mind that so-called inside rounds are now a bullish sign in 2020, as opposed to in prior VC eras when they were viewed more cooly. Other M1 investors include Jump Capital, Clocktower Technology Ventures and Chicago Ventures, though only the first two appear to have taken part in this round.

Per M1, the Series C comes just 120 days after it raised a Series B. A good question is why M1 has raised more capital, and why Left Lane Capital wanted to lead two rounds for the consumer-focused fintech provider. Going back to our prior coverage, we can figure it out.

In February, we reported that M1 Finance had reached the $1 billion assets under management mark, or AUM.

The startup combines three different traditional fintech services into one (roboadvising, neobanking and lending), allowing it to price the package aggressively. The model appears to be working. When M1 raised its Series B a few months later in June, it had reached the $1.45 billion AUM, or about 45% growth in just over a quarter. That’s very good.

Today, the company announced that it has surpassed the $2 billion AUM mark, up more than 38% in the last four months.

M1 posted slower AUM growth in percentage terms and greater growth in raw AUM over a similar time frame heading into its Series C. But regardless of that nuance, the company’s AUM grew quickly.

That fact helps explain its new round. If you were Left Lane Capital, had just led a round into the company, and then watched it keep growing rapidly, you’d want to double-down quickly. Not only to buy more of the company, but also to get the round done before another investor could show up and buy its own piece of M1, diluting you and nabbing your ascendant position as the startup’s most recent lead investor.

So Left Lane led the Series C, hoping that M1 keeps growing like the proverbial garden irritant.

Something fun about M1 is that it shared a revenue target as a percent of AUM earlier in the year, namely that it aims to generate around 1% of its AUM in revenue each year. The company’s CEO Brian Barnes re-confirmed the number for TechCrunch this week.

So, with more than $2 billion in AUM, we can see that M1’s revenues are probably on a run rate of more than $20 million today, and could crest a $25 million run rate by the end of the year, provided that growth continues as it has for the startup.

How is M1 adding so much capital to its platform? Barnes told TechCrunch that M1 has tripled its userbase since the start of the year, and that its current users are bringing more funds in from other financial platforms. The combination is making M1 larger, and quickly.

To wrap, our notes above about Left Lane probably wanting to lead the Series C to keep some other firm from doing it — pre-emption is a regular thing in today’s hot VC market — weren’t mere idle speculation. Barnes told TechCrunch in response to a question about its Series C that his company was “fortunate to have significant investor demand for our Series C, partly due to hitting milestones as quickly” as it has. That sounds like the possibility of competing lead investors to us, at least from our present remove.

The M1 round continues the savings and investing boom we’ve tracked this year. And the round is a win for the Midwest at the same time. More when M1 reaches $3 billion in AUM. Start your countdown.

Powered by WPeMatico

The Exchange regularly covers companies as they approach and crest the $100 million revenue mark. Our goal in tracking startups growing at scale is to scout future IPO candidates and better understand the late-stage financing market.

Today we’re digging into a company that is a little bit bigger than that. Namely Databricks, a data analytics company that was most recently valued at around $6.2 billion in its October, 2019 Series F when it raised $400 million.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

The former startup reached a run rate of around $350 million at the end of Q3 2020, up from $200 million in revenue in Q3 2019, putting it on a rapid growth pace for a former startup of its size.

To better dig into the company’s performance, I got on the phone with its CEO, Ali Ghodsi, hoping to better understand how Databricks has managed to grow as much as it has in recent years. Ghodsi took over as CEO in 2016 after serving as the company’s VP of engineering. He’s also a co-founder.

To better dig into the company’s performance, I got on the phone with its CEO, Ali Ghodsi, hoping to better understand how Databricks has managed to grow as much as it has in recent years. Ghodsi took over as CEO in 2016 after serving as the company’s VP of engineering. He’s also a co-founder.

Databricks is an obvious IPO candidate, but it’s also a company with broad private-market options, given its revenue expansion and attractive economics. Today, let’s talk about Databricks’ growth history, how it changed its sales process and what’s ahead for the unicorn more than six times over.

What does Databricks actually do? Normally I’d be content to wave my hands at data analytics and call it a day. Chatting with Ghodsi, however, clarified the matter, so let me help.

Let’s say that a company has a lot of data on its machinery and wants to know when different pieces are going to fail. Or, perhaps a company wants to find patterns in some economic data. How do they find that information?

Ghodsi reckons you need three things: First, data engineering, or getting customer data “massaged into the right forms so that you can actually start using it.” Second, data science, which Ghodsi describes as “the machine learning algorithms, the predictive algorithms that you need to have.” And third, on top, companies “more and more” also want data warehousing and some “basic analytics,” he added.

Powered by WPeMatico

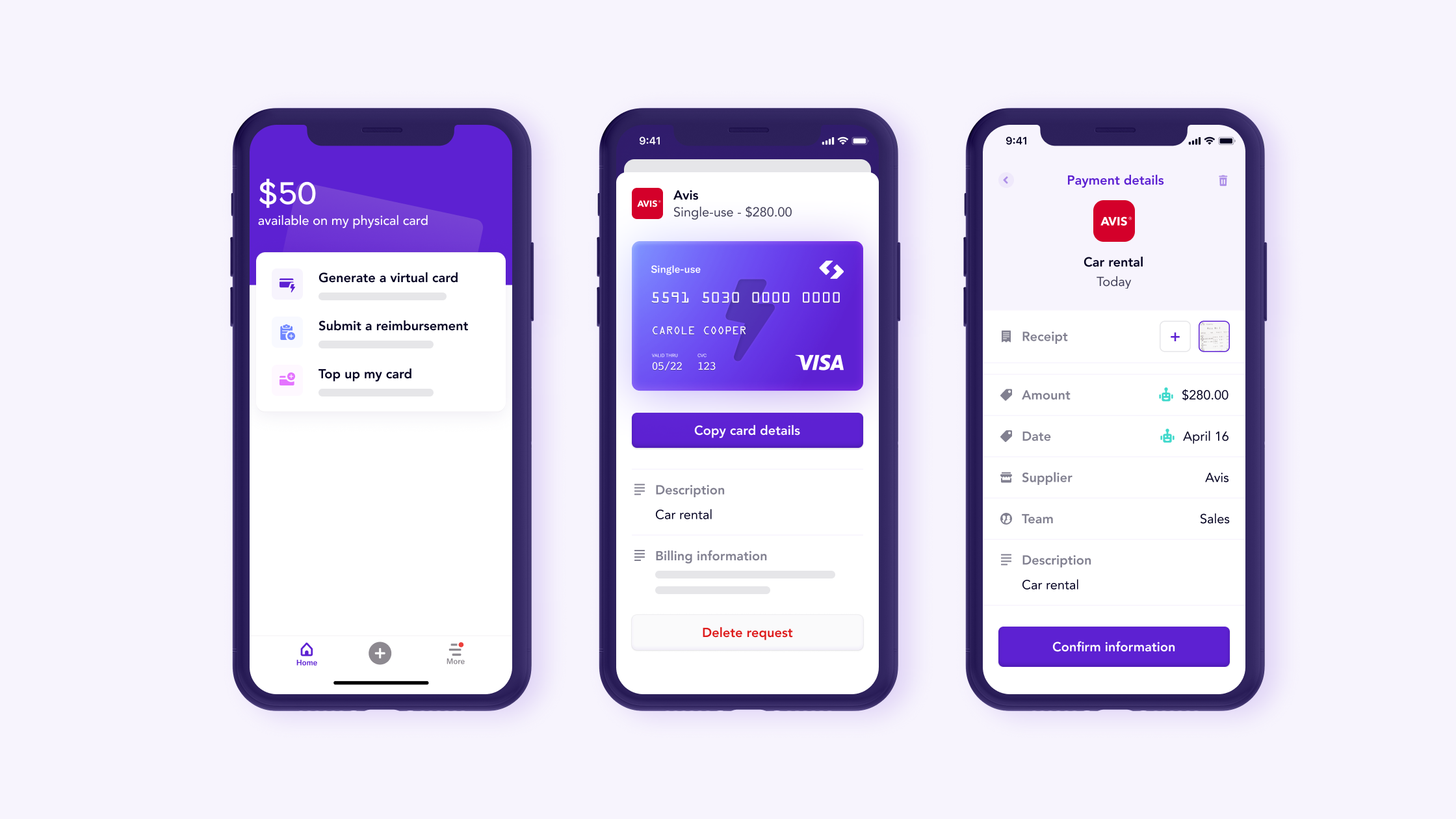

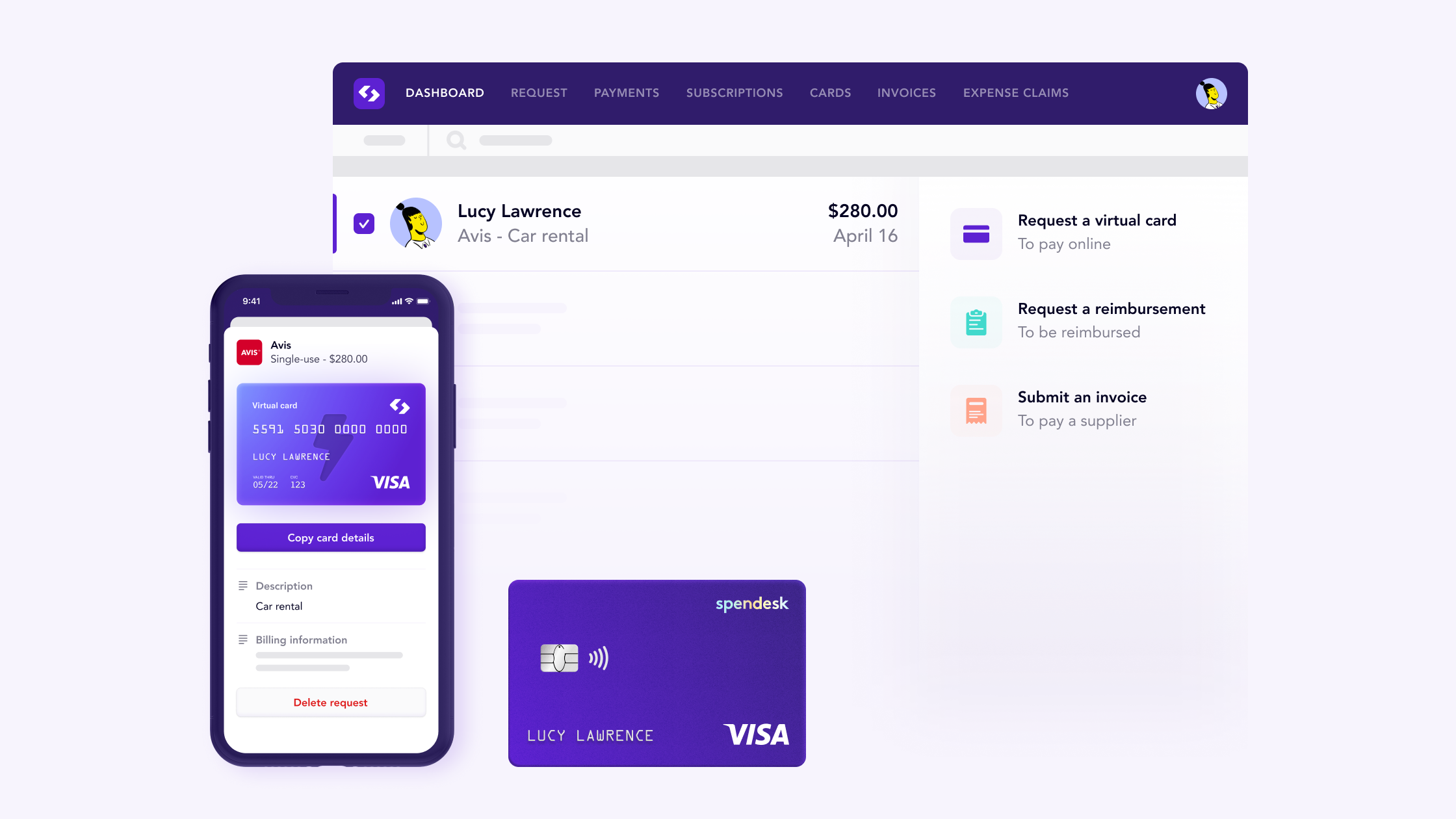

French startup Spendesk has added $18 million to its Series B round. The company already raised $38.4 million as part of its Series B last year, which means that it raised $56.4 million as part of this round. Eight Roads Ventures is investing in today’s extension round.

Spendesk, as the name suggests, focuses on all things related to spend management. The company issues virtual and physical cards for employees, lets you set up an approval workflow and manages expense reimbursements. It can also centralize all your invoices and receipts on the platform.

By centralizing everything on the same platform, it lets you control your spending in real-time and save time on accounting tasks. Reconciliation is easier if you combine transactions and receipts on Spendesk. Clients can also export data to Xero, Datev, Netsuite or Sage.

Image Credits: Spendesk

For big expenses, you can send a request to your manager. If they approve your request, you receive a single-use virtual card for that expense.

Similarly, if your company gives you a physical debit card, you get a pre-defined budget. Your manager can top up your card for big expenses, block ATM withdrawals, block weekend transactions and more. Employees can check their payments from the mobile app, see their card balance and add receipts.

Spendesk is a software-as-a-service product with a monthly subscription fee. While transactions have probably slowed down due to the economic crisis, the company says that its subscription revenue has doubled year-over-year. In just a year, the company grew from 100 to 200 people.

It remains focused on small and medium companies across Europe. There are 40,000 people using Spendesk through their companies. Clients include Algolia, Curve, Doctolib, Raisin and Wefox. The company has hired Joseph Smith as Chief Revenue Officer, pictured left above with the company’s CEO Rodolphe Ardant (pictured right).

Image Credits: Spendesk

Powered by WPeMatico

Today’s the day! This afternoon at 2 p.m. EDT/11 a.m. PDT, Yext CEO Howard Lerman will join TechCrunch for a live chat.

The conversation is part of our continuing Extra Crunch Live series, now in its second season. What are we up to in the second installment of the conversations? The same as before, bringing the most interesting founders and investors ’round for a chat that you can contribute to by bringing your own questions. (Make sure you’re signed up so you can jump right in.)

As we wrote last week, Lerman is not just another public company CEO: His company, Yext, has some old-fashioned history with TechCrunch, having pitched at one of our events back in 2009. It went well, with Yext quickly raising money afterward.

We’ll spend a little bit of time in the past talking about Yext’s history as a startup. I want to know at what stage did Howard begin to consciously prep Yext for an IPO — the company went public in 2017 — and how long until he felt the company was ready? Given that we just came off one of the most active quarters in recent history for technology companies going public, it’s a good time to dig into the matter.

We’ll also get Howard’s take on the public markets in 2020 and whether he was happy with Yext’s IPO timing.

For the early-stage founders in the crowd, we have stuff prepped for you as well. Yext has moved from a business best-known for building a system that helps companies keep their diverse online listings up to date with their most pertinent information, to a search-first company that is leading its customer acquisition cycles with its “Answers” product.

How did the company manage to build the latter while eating off the former, and how has the company balanced its continued development since? What can startups learn from the choices that Yext has made?

And, TechCrunch recently reviewed Howard’s social media posts regarding Black Lives Matter: “As CEO, I will see to it that our company continues to be advocates for equality and justice.” So, how does he view the role of politics inside of tech companies, and what advice does he have for founders who are looking to build a lasting culture?

It’s going to be a great chat. Make sure you’ve signed up for Extra Crunch and I’ll see you in a few hours.

Bring your best questions. Howard is a good chat, so he’ll have something to say if you ask something great. Details after the jump.

Below are links to add the event to your calendar and to save the Zoom link. We’ll share the YouTube link shortly before the discussion:

Powered by WPeMatico

The Twilio-Segment acquisition was the biggest story of the weekend, and in our current IPO lull, it is the most discussed deal of the moment.

So it hasn’t been a surprise to see folks working to figure out if the $3.2 billion price tag Twilio expects to pay for Segment is cheap, reasonable or expensive.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

We had the same question.

The all-stock transaction is another big deal from Twilio, which previously scooped up SendGrid. Some expected Twilio to be picked up by a larger company after it went public, I’ve been told. Instead, Twilio has become the acquiring entity, boosting its size and adding to its total addressable market (TAM) through deal-making.

But a smart company can still overpay while executing a generally intelligent strategy. So, does the Segment deal look cheap, or expensive? While we don’t have all the data we’d like, a few useful VCs dropped hints about the size of Segment in my DMs.

But a smart company can still overpay while executing a generally intelligent strategy. So, does the Segment deal look cheap, or expensive? While we don’t have all the data we’d like, a few useful VCs dropped hints about the size of Segment in my DMs.

Our hunt begins with Twilio’s own release on the matter. From there, we’ll bring in some historical data from the deal that Twilio compares the Segment transaction to, compare the resulting multiples to today’s market norms and close with a discussion of the acquiring company’s rising share price. The synthesis of all the elements will give us an answer. And we’ll have some fun at the same time.

A quick refresher on the deal: Twilio will spend $3.2 billion in shares of itself to purchase Segment. Per the company, the transaction is worth about 6% of the combined entity.

Powered by WPeMatico