Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Yin Wu has co-founded several companies since graduating from Stanford in 2011, including a computer vision company called Double Labs that sold to Microsoft, where she stayed on for a couple of years as a software engineer. In fact, it was only after that sale she she says she “actually understood all of the nuances with a company’s cap table.”

Her newest company, Pulley, a 14-month-old, Mountain View, Ca.-based maker of cap table management software aims to solve that same problem and has so far raised $10 million toward that end led by the payments company Stripe, with participation from Caffeinated Capital, General Catalyst, 8VC and numerous angel investors.

Wu is going up against some pretty powerful competition. Carta was reportedly raising $200 million in fresh funding at a $3 billion valuation as of the spring (a round the company never official confirmed or announced). Last year, it raised $300 million. Morgan Stanley has meanwhile been beefing up its stock plan administration business, acquiring Solium Capital early last year and more recently purchasing Barclay’s stock plan business.

Of course, startups often manage to find a way to take down incumbents and a distraction for Carta, at least, in the form of a very public gender discrimination lawsuit by a former VP of marketing, could be the kind of opening that Pulley needs. We emailed with Yu yesterday to ask if that might be the case. She didn’t answer directly, but she did mention “values,” as well as sharing some more details about what she sees as different about the two products.

TC: Why start this company? Has Carta’s press of late created an opening for a new upstart in the space?

YW: I left Microsoft in 2018 and started Pulley a year later. We skipped the seed and raised the A because of overwhelming demand from investors. Many wanted a better product for their portfolio companies. Many founders are increasingly thinking about choosing with companies, like Pulley, that better align with their values.

TC: How many people are working for Pulley and are any folks you pulled out of Carta?

YW: We’re a team of seven and have four people on the team who are former Y Combinator founders. We attract founders to the team because they’ve experienced firsthand the difficulties of managing a cap table and want to build a better tool for other founders. We have not pulled anyone out of Carta yet.

TC: Carta has raised a lot of funding and it has long tentacles. What can Pulley offer startups that Carta cannot?

YW: We offer startups a better product compared to our competitors. We make every interaction on Pulley easier and faster. 409A valuations take five days instead of weeks, and onboarding is the same day rather than months. By analogy, this is similar to the difference between Stripe and Braintree when Stripe initially launched. There were many different payment processes when Stripe launched. They were able to capture a large portion of the market by building a better product that resonated with developers.

One of the features that stands out on Pulley is our modeling feature [which helps founders model dilution in future rounds and helps employees understand the value of their equity as the company grows]. Founders switch from our competitors to Pulley to use our modeling tool [and it works] with pre-money SAFEs, post-money SAFEs and factors in pro-ratas and discounts. To my knowledge, Pulley’s modeling tool is the most comprehensive product on the market.

TC: How does your pricing compare with Carta’s?

YW: Pulley is free for early-stage companies regardless of how much they raise. We’re price competitive with Carta on our paid plans. Part of the reason we started Pulley is because we had frustrations with other cap table management tools. When using other services, we had to regularly ping our accountants or lawyers to make edits, run reports or get data. Each time we involved the lawyers, it was an expensive legal fee. So there is easily a $2,000 hidden fee when using tools that aren’t self-serve for setting up and updating your cap table.

TC: Is there a business-to-business opportunity here, where maybe attorneys or accountants or wealth managers private label this service? Or are these industry professionals viewed as competitors?

YW: We think there are opportunities to white label the service for accountants and law firms. However, this is currently not our focus.

TC: How adaptable is the software? Can it deal with a complicated scenario, a corner case?

YW: We started Pulley one year ago and we’re launching today because we have invested in building an architecture that can support complex cap table scenarios as companies scale. There are two things that you have to get right with cap table systems, First, never lose the data and second, always make sure the numbers are correct. We haven’t lost data for any customer and we have a comprehensive system of tests that verifies the cap table numbers on Pulley remain accurate.

TC: At what stage does it make sense for a startup to work with Pulley, and do you have the tools to hang onto them and keep them from switching over to a competitor later?

YW: We work with companies past the Series A, like Fast and Clubhouse. Companies are not looking to change their cap table provider if Pulley has the tool to grow with them. We already have the features of our competitors, including electronic share issuance, ACH transfers for options, modeling tools for multiple rounds and more. We think we can win more startups because Pulley is also easier to use and faster to onboard.

TC: Regarding your paid plans, how much is Pulley charging and for what? How many tiers of service are there?

YW; Pulley is free for early-stage startups with less than 25 stakeholders. We charge $10 per stakeholder per month when companies scale beyond that. A stakeholder is any employee or investor on the cap table. Most companies upgrade to our premium plan after a seed round when they need a 409A valuation.

Cap table management is an area where companies don’t want a free product. Pulley takes our customers’ data privacy and security very seriously. We charge a flat fee for companies so they rest assured that their data will never be sold or used without their permission.

TC: What’s Pulley’s relationship to venture firms?

YW: We’re currently focused on founders rather than investors. We work with accelerators like Y Combinator to help their portfolio companies manage their cap table, but don’t have a formal relationship with any VC firms.

Powered by WPeMatico

“More than 50% of our founders still are in their current jobs,” said John Vrionis, co-founder of seed-stage fund Unusual Ventures.

The fund, which closed a $400 million investment vehicle in November 2019, has noticed that more and more startup employees are thinking about entrepreneurship as the pandemic has shown how much room there is for new innovation. To gain a competitive advantage, Unusual is investing small checks into founders before they’re full-time.

Unusual, which cuts an average of eight checks per year into seed-stage companies, isn’t doling out millions to every employee who decides to leave Stripe. The firm is conservative with its spending and takes a more focused approach, often embedding a member from the firm into a portfolio company. It’s not meant to scale to dozens of portfolio companies a year, but instead requires a methodical approach.

One with a healthy pipeline of companies to choose from.

In an Extra Crunch Live chat, Vrionis and Sarah Leary, co-founder of Nextdoor and the firm’s newest partner, said lightweight investing matters in the early days of a company.

“There were a lot of teams that needed capital to start the journey, but frankly, it would have been over burdensome if they took on $2 or $3 million,” Leary said. “[New founders] want to be in a place where they have enough money to get going but not too much money that they get locked into a ladder in terms of expectations that they’re not ready to take advantage of.” The checks that Unusual cuts in pre-seed often range between $100,000 to half a million dollars.

Leary chalks up the boom to the disruption in consumer behavior, which opens up the opportunity for new companies to win.

Powered by WPeMatico

Last night Datto priced its IPO at $27 per share, the top end of its range that TechCrunch covered last week. The data and security-focused software company had targeted a $24 to $27 per-share IPO price range, meaning that its final per-share value was at the top of its estimates.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

The Datto IPO won’t draw lots of attention; its business is somewhat dull, as selling software to managed service providers rarely excites. But, the public offering matters for a different reason: It gives us a fresh lens into today’s IPO market.

That lens is the perspective of slower, more profitable growth. What is that worth?

The value of quickly growing and unprofitable software and cloud companies is well known. Snowflake made a splash earlier this year on the back of huge growth and enormous losses. Investors ate its shares up, pushing its valuation to towering heights. This year we’ve even seen rapid growth and profits valued by public investors in the form of JFrog’s IPO.

The value of quickly growing and unprofitable software and cloud companies is well known. Snowflake made a splash earlier this year on the back of huge growth and enormous losses. Investors ate its shares up, pushing its valuation to towering heights. This year we’ve even seen rapid growth and profits valued by public investors in the form of JFrog’s IPO.

But slower growth, software margins and profitability? Datto’s financial picture feels somewhat unique among the IPOs that TechCrunch has covered this year.

It’s a similar bet to the one that Egnyte is making; the enterprise software company crested $100 million ARR last year and announced that it grew by around 22% in the first half of 2020. And, it is profitable on an EBITDA basis. Therefore, the Datto IPO could provide a clue as to whether companies like Egnyte and the rest of the late-stage startup crop should be content to grow more slowly, but with the benefit of actually making money.

Here are the deal’s nuts and bolts:

Powered by WPeMatico

Synthetaic is a startup working to create data — specifically images — that can be used to train artificial intelligence.

Founder and CEO Corey Jaskolski’s experience includes work with both National Geographic (where he was recently named Explorer of the Year) and a 3D media startup. In fact, he told me that his time with National Geographic made him aware of the need for more data sets in conservation.

Sound like an odd match? Well, Jaskolski said that he was working on a project that could automatically identify poachers and endangered animals from camera footage, and one of the major obstacles was the fact that there simply aren’t enough existing images of either poachers (who don’t generally appreciate being photographed) or certain endangered animals in the wild to train AI to detect them.

He added that other companies are trying to create synthetic AI training data through 3D worldbuilding (in other words, “building a replica of the world that you want to have an AI learn in”), but in many cases, this approach is prohibitively expensive.

In contrast, the Synthetaic (pronounced “synthetic”) approach combines the work of 3D artists and modelers with technology based on generative adversarial networks, making it far more affordable and scalable, according to Jaskolski.

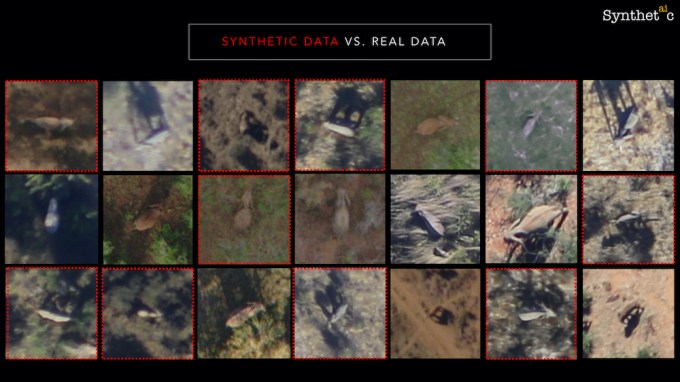

Image Credits: Synthetaic

To illustrate the “interplay” between the two halves of Synthetaic’s model, he returned to the example of identifying poachers — the startup’s 3D team could create photorealistic models of an AK-47 (and other weapons), then use adversarial networks to generate hundreds of thousands of images or more showing that model against different backgrounds.

The startup also validates its results after an AI has been trained on Synthetaic’s synthesized images, by testing that AI on real data.

For Synthetaic’s initial projects, Jaskolski said he wanted to partner with organizations doing work that makes the world a better place, including Save the Elephants (which is using the technology to track animal populations) and the University of Michigan (which is developing an AI that can identify different types of brain tumors).

Jaskolski added that Synthetaic customers don’t need any AI expertise of their own, because the company provides an “end-to-end” solution.

The startup announced today that it has raised $3.5 million in seed funding led by Lupa Systems, with participation from Betaworks Ventures and TitletownTech (a partnership between Microsoft and the Green Bay Packers). The startup, which has now raised a total of $4.5 million, is also part of Lupa and Betaworks’ Betalab program of startups doing work that could help “fix the internet.”

Powered by WPeMatico

This morning Root Insurance, a neoinsurance provider that has attracted ample private capital for its auto-insurance business, is targeting a valuation of as much as $6.34 billion in its pending IPO.

The former startup follows insurtech leader Lemonade to the public markets during a year in which IPOs have been well-received by investors focused more on growth than profitability. In the wake of Lemonade’s strong public offering and rich revenue multiples, it was not impossible to see another, similar startup test the same waters.

Root’s $6.34 billion valuation upper limit at its current price range matches expectations for its bulk. The company is targeting $22 to $25 per share in its debut.

The startup will raise over $500 million from the shares it is selling in its regular offering. Concurrent placements worth $500 million from Dragoneer and Silver Lake raise that figure to north of $1 billion and could help boost general demand for shares in the company. Snowflake’s epic IPO came with similar private placements from well-known investors in what became the transaction of the year.

Will we see Root boost its target? And what does Root’s IPO price range mean for insurtech startups? Let’s dig into the numbers.

We’ve dug into Root’s business a few times now, both before and after it formally filed its IPO documents. This morning we will merge both sets of work, snag a fresh revenue multiple from Lemonade, apply it to Root’s own numbers, observe any valuation deficit and ask ourselves what’s next for the debuting company.

Will we see Root’s IPO price rise? Here’s how to think about the question:

Powered by WPeMatico

SK Hynix, one of the world’s largest chip makers, announced today it will pay $9 billion for Intel’s flash memory business. Intel said it will use proceeds from the deal to focus on artificial intelligence, 5G and edge computing.

“For Intel, this transaction will allow us to to further prioritize our investments in differentiated technology where we can play a bigger role in the success of our customers and deliver attractive returns to our stockholders,” said Intel chief executive officer Bob Swan in the announcement.

The Wall Street Journal first reported earlier this week that the two companies were nearing an agreement, which will turn SK Hynix into one of the world’s largest NAND memory makers, second only to Samsung Electronics.

The deal with SK Hynix is the latest one Intel has made so it can double down on developing technology for 5G network infrastructure. Last year, Intel sold the majority of its modem business to Apple for about $1 billion, with Swan saying that the time that the deal would allow Intel to “[put] our full effort into 5G where it most closely aligns with the needs of our global customer base.”

Once the deal is approved and closes, Seoul-based SK Hynix will take over Intel’s NAND SSD and NAND component and wafer businesses, and its NAND foundry in Dalian, China. Intel will hold onto its Optane business, which makes SSD memory modules. The companies said regulatory approval is expected by late 2021, and a final closing of all assets, including Intel’s NAND-related intellectual property, will take place in March 2025.

Until the final closing takes places, Intel will continue to manufacture NAND wafers at the Dalian foundry and retain all IP related to the manufacturing and design of its NAND flash wafers.

As the Wall Street Journal noted, the Dalian facility is Intel’s only major foundry in China, which means selling it to SK Hynix will dramatically reduce its presence there as the United States government puts trade restrictions on Chinese technology.

In the announcement, Intel said it plans to use proceeds from the sale to “advance its long-term growth priorities, including artificial intelligence, 5G networking and the intelligent, autonomous edge.”

During the six-month period ending on June 27, 2020, NAND business represented about $2.8 billion of revenue for its Non-volatile Memory Solutions Group (NSG), and contributed about $600 million to the division’s operating income. According to the Wall Street Journal, this made up the majority of Intel’s total memory sales during that period, which was about $3 billion.

SK Hynix CEO Seok-Hee Lee said the deal will allow the South Korean company to “optimize our business structure, expanding our innovative portfolio in the NAND flash market segment, which will be comparable with what we achieved in DRAM.”

Powered by WPeMatico

Today Juniper Networks announced it was acquiring smart wide area networking startup 128 Technology for $450 million.

This marks the second AI-fueled networking company Juniper has acquired in the last year and a half after purchasing Mist Systems in March 2019 for $405 million. With 128 Technology, the company gets more AI SD-WAN technology. SD-WAN is short for software-defined wide area networks, which means networks that cover a wide geographical area such as satellite offices, rather than a network in a defined space.

Today, instead of having simply software-defined networking, the newer systems use artificial intelligence to help automate session and policy details as needed, rather than dealing with static policies, which might not fit every situation perfectly.

Writing in a company blog post announcing the deal, executive vice president and chief product officer Manoj Leelanivas sees 128 Technology adding great flexibility to the portfolio as it tries to transition from legacy networking approaches to modern ones driven by AI, especially in conjunction with the Mist purchase.

“Combining 128 Technology’s groundbreaking software with Juniper SD-WAN, WAN Assurance and Marvis Virtual Network Assistant (driven by Mist AI) gives customers the clearest and quickest path to full AI-driven WAN operations — from initial configuration to ongoing AIOps, including customizable service levels (down to the individual user), simple policy enforcement, proactive anomaly detection, fault isolation with recommended corrective actions, self-driving network operations and AI-driven support,” Leelanivas wrote in the blog post.

128 Technologies was founded in 2014 and raised over $96 million, according to Crunchbase data. Its most recent round was a $30 million Series D investment in September 2019 led by G20 Ventures and The Perkins Fund.

In addition to the $450 million, Juniper has asked 128 Technology to issue retention stock bonuses to encourage the startup’s employees to stay on during the transition to the new owners. Juniper has promised to honor this stock under the terms of the deal. The deal is expected to close in Juniper’s fiscal fourth quarter, subject to normal regulatory review.

Powered by WPeMatico

This is The TechCrunch Exchange, a newsletter that goes out on Saturdays, based on the column of the same name. You can sign up for the email here.

It was an active week in the technology world broadly, with big news from Facebook and Twitter and Apple. But past the headline-grabbing noise, there was a steady drumbeat of bullish news for unicorns, or private companies worth $1 billion or more.

The Exchange spent a good chunk of the week looking into different stories from unicorns, or companies that will soon fit the bill, and it’s surprising to see how much positive financial news there was on tap even past what we got to write about.

Databricks, for example, disclosed a grip of financial data to TechCrunch ahead of regular publication, including the fact that it grew its annual run rate (not ARR) to $350 million by the end of Q3 2020, up from $200 million in Q2 2019. It’s essentially IPO ready, but is not hurrying to the public markets.

Sticking to our theme, Calm wants more money for a huge new valuation, perhaps as high as $2.2 billion which is not a surprise. That’s more good unicorn news. As was the report that “India’s Razorpay [became a] unicorn after its new $100 million funding round” that came out this week.

Razorpay is only one of a number of Indian startups that have become unicorns during COVID-19. (And here’s another digest out this week concerning a half-dozen startups that became unicorns “amidst the pandemic.”)

There was enough good unicorn news lately that we’ve lost track of it all. Things like Seismic raising $92 million, pushing its valuation up to $1.6 billion from a few weeks ago. How did that get lost in the mix?

All this matters because while the IPO market has captured much attention in the last quarter or so, the unicorn world has not sat still. Indeed, it feels that unicorn VC activity is the highest we’ve seen since 2019.

And, as we’ll see in just a moment, the grist for the unicorn mill is getting refilled as we speak. So, expect more of the same until something material breaks our current investing and exit pattern.

What do unicorns eat? Cash. And many, many VCs raised cash in the last seven days.

A partial list follows. It could be that investors are looking to lock in new funds before the election and whatever chaos may ensue. So, in no particular order, here’s who is newly flush:

All that capital needs to go to work, which means lots more rounds for many, many startups. The Exchange also caught up with a somewhat new firm this week: Race Capital. Helmed by Alfred Chuang, formerly or BEA who is an angel investor now in charge of his own fund, the firm has $50 million to invest.

Sticking to private investments into startups for the moment, quite a lot happened this week that we need to know more about. Like API-powered Argyle raising $20 million from Bain Capital Ventures for what FinLedger calls “unlocking and democratizing access to employment records.” TechCrunch is currently tracking the progress of API-led startups.

On the fintech side of things, M1 Finance raised $45 million for its consumer fintech platform in a Series C, while another roboadvisor, Wealthsimple, raised $87 million, becoming a unicorn at the same time. And while we’re in the fintech bucket, Stripe dropped $200 million this week for Nigerian startup Paystack. We need to pay more attention to the African startup scene. On the smaller end of fintech, Alpaca raised $10 million more to help other companies become Robinhood.

A few other notes before we change tack. Kahoot raised $215 million due to a boom in remote education, another trend that is inescapable in 2020 as part of the larger edtech boom (our own Natasha Mascarenhas has more).

Turning from the private market to the public, we have to touch on SPACs for just a moment. The Exchange got on the phone this week with Toby Russell from Shift, which is now a public company, trading after it merged with a SPAC, namely Insurance Acquisition Corp. Early trading is only going so well, but the CEO outlined for us precisely why he pursued a SPAC, which was actually interesting:

So now Shift is public and newly capitalized. Let’s see what happens to its shares as it gets into the groove of reporting quarterly. (Obviously, if it flounders, it’s a bad mark for SPACs, but, conversely, successful trading could lead to a bit more momentum to SPAC-mageddon.)

A few more things and we’re done. Unicorn exits had a good week. First, Datto’s IPO continues to move forward. It set an initial price this week, which could value it above $4 billion. Also this week, Roblox announced that it has filed to go public, albeit privately. It’s worth billions as well. And finally, DoubleVerify is looking to go public for as much as $5 billion early next year.

Not all liquidity comes via the public markets, as we saw this week’s Twilio purchase of Segment, a deal that The Exchange dug into to find out if it was well-priced or not.

We’re running long naturally, so here are just a few quick things to add to your weekend mental tea-and-coffee reading!

Next week we are digging more deeply into Q3 venture capital data, a foretaste of which you can find here, regarding female founders, a topic that we returned to Friday in more depth.

Powered by WPeMatico

The Equity crew this week chewed through a trio of media stories, each dealing with private companies and their successes. The Wall Street Journal recently reported that Axios was growing rapidly and near profitability. The paper also broke news that Morning Brew might exit to Business Insider for a hefty $75 million potential payout. Meanwhile, we covered the news that The Juggernaut raised $2 million for its paywalled publication focused on South Asian news.

The conversation, as a result, was a fairly indulgent and nerdy affair. It’s always fun to celebrate other journalists finding success in different ways, and this week felt like a moment for the media news landscape. Because the topic is so near to our hearts, for better or worse, we’re fitting our broader thoughts into this post about the future of media.

Our own Natasha Mascarenhas writes about how inequity in media and who gets to succeed, Danny Crichton has some pretty strong feelings about digital advertising and Alex Wilhelm writes about how the varied methods of recent media success are themselves heartening.

So this weekend let’s pause for a minute to ruminate on the upstart media world, a place where too often private capital and media economics have had a falling out.

This week, it was announced that advertising might not be a bad idea after all. Axios is reportedly expected to become profitable this year, and Morning Brew, a free newsletter about business insights, could get acquired for between $50 million to $75 million by Business Insider. Both of these media companies make money off of newsletters. And if you end the story there, it’s clear that news isn’t simply a fundamental aspect of our democracy — it makes money, too.

But, the story shouldn’t end there.

Powered by WPeMatico

Lawmatics, a San Diego startup that’s building marketing and CRM software for lawyers, is announcing that it has raised $2.5 million in seed funding.

CEO Matt Spiegel used to practice law himself, and he told me that even though tech companies have a wide range of marketing tools to choose from, “lawyers have not been able to adopt them,” because they need a product that’s tailored to their specific needs.

That’s why Spiegel founded Lawmatics with CTO Roey Chasman. He said that a law firm’s relationship with its clients can be divided into three phases — intake (when a client is deciding whether to hire a firm); the active legal case; and after the case has been resolved. Apparently most legal software is designed to handle phase two, while Lawmatics focuses on phases one and three.

The platform includes a CRM system to manage the initial client intake process, as well as tools that can automate a lot of what Spiegel called the “blocking and tackling” of marketing, like sending birthday messages to former clients — which might sound like a minor task, but Spiegel said it’s crucial for law firms to “nurture” those relationships, because most of their business comes from referrals.

Lawmatics’ early adopters, Spiegel added, have consisted of the firms in areas where “if you need a lawyer, you go to Google and start searching ‘personal injury,’ ‘bankruptcy,’ ‘estate planning,’ all these consumer-driven law firms.” And the pandemic led to accelerated the startup’s growth, because “lawyers are at home now, their business is virtual and they need more tools.”

Spiegel’s had success selling technology to lawyers in the past, with his practice management software startup MyCase acquired by AppFolio in 2012 (AppFolio recently sold MyCase to a variety of funds for $193 million). He said that the strategies for growing both companies are “almost identical” — the products are different, but “it’s really the same segment, running the same playbook, only with additional go-to-market strategies.”

The funding was led by Eniac Ventures and Forefront Venture Partners, with participation from Revel Ventures and Bridge Venture Partners.

“In my 10 years investing I have witnessed few teams more passionate, determined, and capable of revolutionizing an industry,” said Eniac’s Tim Young in a statement. “They have not only created the best software product the legal market has seen, they have created a movement.”

Powered by WPeMatico