Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

VPNs, or virtual private networks, are a mainstay of corporate network security (and also consumers trying to stream Netflix while pretending to be from other countries). VPNs create an encrypted channel between your device (a laptop or a smartphone) and a company’s servers. All of your internet traffic gets routed through the company’s IT infrastructure, and it’s almost as if you are physically located inside your company’s offices.

Despite its ubiquity though, there are significant flaws with a VPN’s architecture. Corporate networks and VPNs were designed assuming that most workers would be physically located in an office most of the time, and the exceptional device would use a VPN. As the pandemic has made abundantly clear, fewer and fewer people work in a physical office with a desktop computer attached to ethernet. That means the vast majority of devices are now outside the corporate perimeter.

Worse, VPNs can have massive performance problems. By routing all traffic through one destination, VPNs not only add latency to your internet experience, they also transmit all of your non-work traffic through your corporate servers as well. From a security perspective, VPNs also assume that once a device joins, it’s reasonably safe and secure. VPNs don’t actively check network requests to make sure that every device is only accessing the resources that it should.

Twingate is fighting directly to defeat VPNs in the workplace with an entirely new architecture that assumes zero trust, works as a mesh and can segregate work and non-work internet traffic to protect both companies and employees. In short, it may dramatically improve the way hundreds of millions of people work globally.

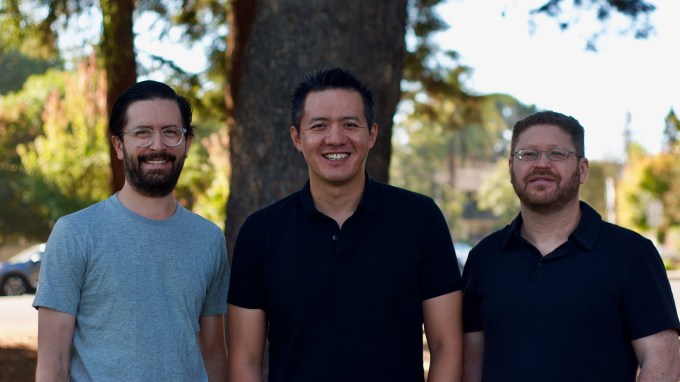

It’s a bold vision from an ambitious trio of founders. CEO Tony Huie spent five years at Dropbox, heading up international and new market expansion in his final role at the file-sharing juggernaut. He’s most recently been a partner at venture capital firm SignalFire . Chief Product Office Alex Marshall was a product manager at Dropbox before leading product at lab management program Quartzy. Finally, CTO Lior Rozner was most recently at Rakuten, and before that Microsoft.

Twingate founders Alex Marshall, Tony Huie and Lior Rozner. Photo via Twingate.

The startup was founded in 2019, and is announcing today the public launch of its product, as well as its Series A funding of $17 million from WndrCo, 8VC, SignalFire and Green Bay Ventures. Dropbox’s two founders, Drew Houston and Arash Ferdowsi, also invested.

The idea for Twingate came from Huie’s experience at Dropbox, where he watched its adoption in the enterprise and saw firsthand how collaboration was changing with the rise of the cloud. “While I was there, I was still just fascinated by this notion of the changing nature of work and how organizations are going to get effectively re-architected for this new reality,” Huie said. He iterated on a variety of projects at SignalFire, eventually settling on improving corporate networks.

So what does Twingate ultimately do? For corporate IT professionals, it allows them to connect an employee’s device into the corporate network much more flexibly than a VPN. For instance, individual services or applications on a device could be set up to securely connect with different servers or data centers. So your Slack application can connect directly to Slack, your JIRA site can connect directly to JIRA’s servers, all without the typical round-trip to a central hub that a VPN requires.

That flexibility offers two main benefits. First, internet performance should be faster, since traffic is going directly where it needs to rather than bouncing through several relays between an end-user device and the server. Twingate also says that it offers “congestion” technology that can adapt its routing to changing internet conditions to actively increase performance.

More importantly, Twingate allows corporate IT staff to carefully calibrate security policies at the network layer to ensure that individual network requests make sense in context. For instance, if you are a salesperson in the field and suddenly start trying to access your company’s code server, Twingate can identify that request as highly unusual and outright block it.

“It takes this notion of edge computing and distributed computing [and] we’ve basically taken those concepts and we’ve built that into the software we run on our users’ devices,” Huie explained.

All of that customization and flexibility should be a huge win for IT staff, who get more granular controls to increase performance and safety, while also making the experience better for employees, particularly in a remote world where people in, say, Montana might be very far from an East Coast VPN server.

Twingate is designed to be easy to onboard new customers according to Huie, although that is almost certainly dependent on the diversity of end users within the corporate network and the number of services to which each user has access. Twingate integrates with popular single sign-on providers.

“Our fundamental thesis is that you have to balance usability, both for end users and admins, with bulletproof technology and security,” Huie said. With $17 million in the bank and a newly debuted product, the future is bright (and not for VPNs).

Powered by WPeMatico

Rockset, a cloud-native analytics company, announced a $40 million Series B investment today led by Sequoia with help from Greylock, the same two firms that financed its Series A. The startup has now raised a total of $61.5 million, according to the company.

As co-founder and CEO Venkat Venkataramani told me at the time of the Series A in 2018, there is a lot of manual work involved in getting data ready to use and it acts as a roadblock to getting to real insight. He hoped to change that with Rockset.

“We’re building out our service with innovative architecture and unique capabilities that allows full-featured fast SQL directly on raw data. And we’re offering this as a service. So developers and data scientists can go from useful data in any shape, any form to useful applications in a matter of minutes. And it would take months today,” he told me in 2018.

In fact, “Rockset automatically builds a converged index on any data — including structured, semi-structured, geographical and time series data — for high-performance search and analytics at scale,” the company explained.

It seems to be resonating with investors and customers alike as the company raised a healthy B round and business is booming. Rockset supplied a few metrics to illustrate this. For starters, revenue grew 290% in the last quarter. While they didn’t provide any foundational numbers for that percentage growth, it is obviously substantial.

In addition, the startup reports adding hundreds of new users, again not nailing down any specific numbers, and queries on the platform are up 313%. Without specifics, it’s hard to know what that means, but that seems like healthy growth for an early stage startup, especially in this economy.

Mike Vernal, a partner at Sequoia, sees a company helping to get data to work faster than other solutions, which require a lot of handling first. “Rockset, with its innovative new approach to indexing data, has quickly emerged as a true leader for real-time analytics in the cloud. I’m thrilled to partner with the company through its next phase of growth,” Vernal said in a statement.

The company was founded in 2016 by the creators of RocksDB. The startup had previously raised a $3 million seed round when they launched the company and the $18.5 million A round in 2018.

Powered by WPeMatico

Lightyear, a New York City startup that wants to make it easier for large companies to procure networking infrastructure like internet and SD-WAN, announced a $3.7 million seed round today.

Amplo led the round with help from Susa Ventures, Ludlow Ventures, Mark Cuban, David Adelman and Operator Partners. While it was at it, the company announced that it was emerging from stealth and offering its solution in public beta.

Company CEO and co-founder Dennis Thankachan says that while so much technology buying has moved online, networking technology procurement still involves phone calls for price quotes that could sometimes take weeks to get. Thankachan says that when he was working at a hedge fund specializing in telecommunications he witnessed this first hand and saw an opportunity for a startup to fill the void.

“Our objective is to make the process of buying telecom infrastructure, kind of like buying socks on Amazon, providing a real consumer-like experience to the enterprise and empowering buyers with data because information asymmetry and a lack of transparent data on what things should cost, where providers are available, and even what’s existing already in your network is really at the core of the problem for why this is frustrating for enterprise buyers,” Thankachan explained.

The company offers the ability to simply select a service and find providers in your area with costs and contract terms if it’s a simple purchase, but he recognizes that not all enterprise purchases will be that simple and the startup is working to digitize the corporate buying process into the Lightyear platform.

To provide the data that he spoke of, the company has already formed relationships with over 400 networking providers worldwide. The pricing model is in flux, but could involve a monthly subscription or a percentage of the sale. That is something they are working out, but they are using the latter during beta testing to keep the product free for now.

The company already has 10 employees and flush with the new investment, it plans to double that in the next year. Thankachan says as he builds the company, particularly as a person of color himself, he takes diversity and inclusion extremely seriously and sees it as part of the company’s core values.

“Trying to enable people from non-traditional backgrounds to succeed will be really important to us, and I think providing economic opportunity to people that traditionally would not have been afforded several aspects of economic opportunity is the biggest ways to fix the opportunity gap in this country,” he said.

The company, which launched a year ago has basically grown up during the pandemic. That means he has yet to meet any of his customers or investors in person, but he says he has learned to adapt to that approach. While he is based in NYC, his investors are are in the Bay Area and so that remote approach will remain in place for the time being.

As he makes his way from seed to a Series A, he says that it’s up to him to stay focused and execute with the goal of showing product-market fit across a variety of company types. He believes if the startup can do this, it will have the data to take to investors when it’s time to take the next step.

Powered by WPeMatico

Earlier this year, the founders of event analytics platform Hubilo pivoted to become a virtual events platform to survive the impact of COVID-19. Today, the startup announced it has raised a $4.5 million seed round, led by Lightspeed, and says it expects to exceed $10 million bookings run rate and host more than one million attendees over the next few months.

The round also included angel investors Freshworks CEO Girish Mathrubootham; former LinkedIn India CEO Nishant Rao; Slideshare co-founder Jonathan Boutelle; and Helpshift CEO Abinash Tripathy.

Hubilo’s clients have included the United Nations, Roche, Fortune, GITEX, IPI Singapore, Tech In Asia, Infocomm Asia and Clarion Events. The startup is headquartered in San Francisco, but about 12% of its sales are currently from Southeast Asia, and it plans to further scale in the region. It will also focus on markets in the United States, Europe, the Middle East and Africa.

Vaibhav Jain, Hubilo’s founder and CEO, told TechCrunch that many of its customers before the pandemic were enterprises and governments that used its platform to help organize large events. Those were also the first to stop hosting in-person events.

In February, “we knew that most, if not all, physical events were getting postponed or cancelled globally. To counter the drop in demand for offline events, we agreed to extend the contracts by six more months at no cost,” Jain said. “However, this was not enough to retain our clients and most of them either cancelled the contracts or put the contract on hold indefinitely.”

As a result, Hubilo’s revenue dropped to zero in February. With about 30 employees and reserves for only three months, Jain said the company had to choose between shutting down or finding an alternative model. Hubilo’s team created an MVP (minimum viable product) virtual event platform in less than a month and started by convincing a client to use it for free. That first virtual event was hosted in March and “since then, we’ve never looked back,” said Jain.

This means Hubilo is now competing with other virtual event platforms, like Cvent and Hopin (which was used to host TechCrunch Disrupt). Jain said his company differentiates by giving organizers more chances to rebrand their virtual spaces; focusing on sponsorship opportunities that include contests, event feeds and virtual lounges to increase attendee engagement; and providing data analytic features that include integration with Salesforce, Marketo and HubSpot.

With so many events going virtual that “Zoom fatigue” and “webinar fatigue” have now become catchphrases, event organizers have to not only convince people to buy tickets, but also keep them engaged during an event.

Hubilo “gamifies” the experience of attending a virtual event with features like its Leaderboard. This enables organizers to assign points for things like watching a session, visiting a virtual booth or messaging someone. Then they can give prizes to the attendees with the most points. Jain said the Leaderboard is Hubilo’s most used feature.

Powered by WPeMatico

Internships are an opportunity for students to experiment with new career paths and land a full-time offer ahead of graduation. For companies, the weeks-long programs help recruit and train job-ready hires.

While the stakes are high, the coronavirus-spurred office closures and market volatility made a number of tech companies slim down or cancel their internship programs. Similar to remote schooling, the startups that kept their programs had a huge hurdle to face: How do you teach and train students across the world about your company?

That’s where Symba, a Techstars alum, comes in. The 12-person startup created a white-label software tool to help companies, including Robinhood and Genentech, create an online space to communicate and collaborate with their now-distributed interns.

“Every year, organizations are reinventing the wheel and starting their internship program from scratch,” Ahva Sadeghi, CEO of Symba, said. “It’s like, you’re spending so much money, this is a core part of your recruitment, but you’re not invested in an infrastructure to make sure it’s sustainable.”

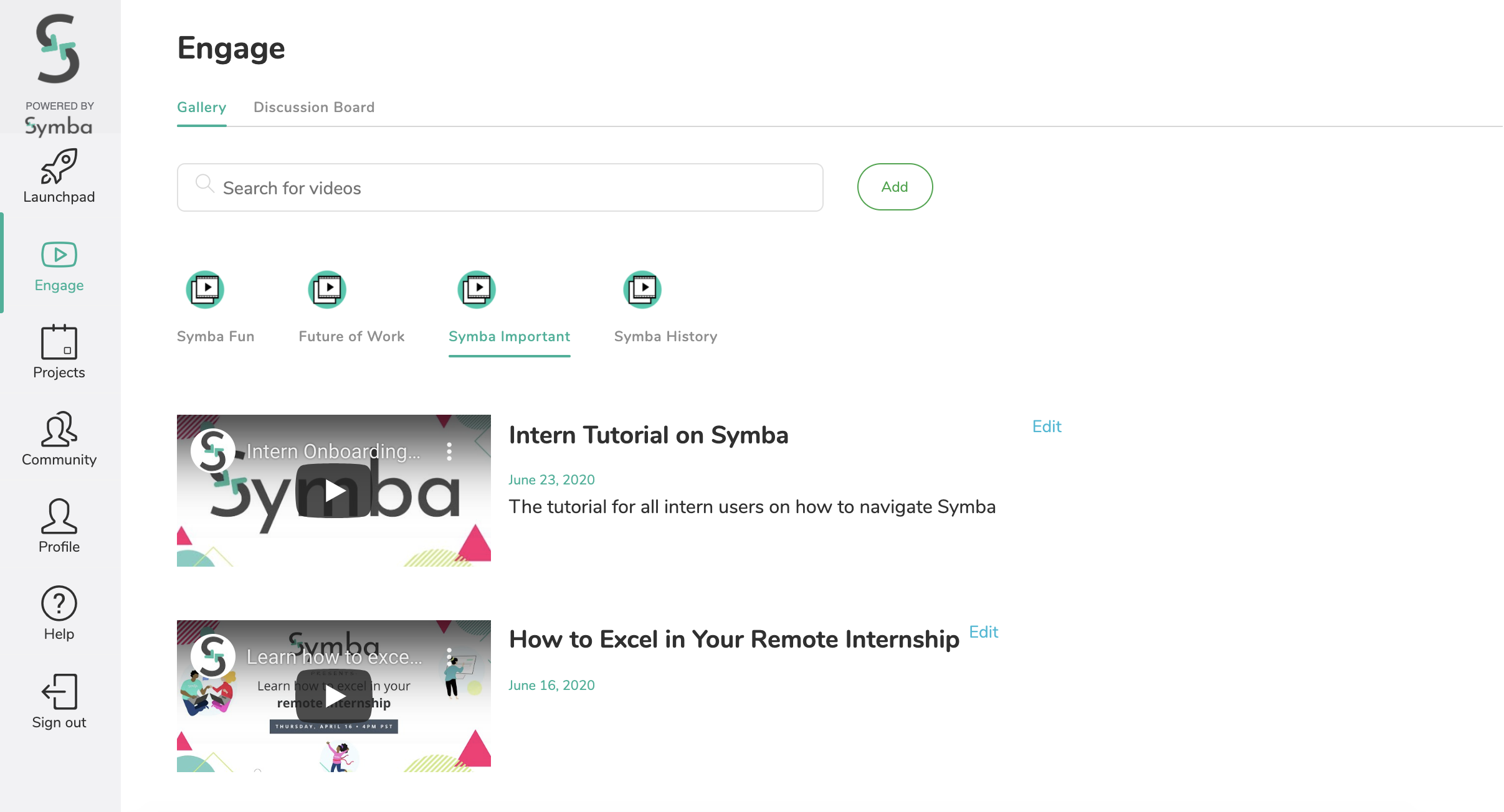

Symba sells a plug-and-play workspace for both interns and managers. Interns sign into Symba through a branded landing page and are brought into a workspace. They can then toggle between feedback, community, profiles and projects. There’s also an entire area for onboarding tutorials and company history.

Interns are brought to a workspace upon login. Image via Symba.

Sadeghi is joined by co-founder and CTO Nikita Gupta, who built the entire site from scratch.

Symba was built with a big focus on creating channels for feedback between interns and managers. There is a tab dedicated solely to feedback, where managers can consistently rank their direct reports on a five-star rating scale across various skills. Interns are also able to request feedback.

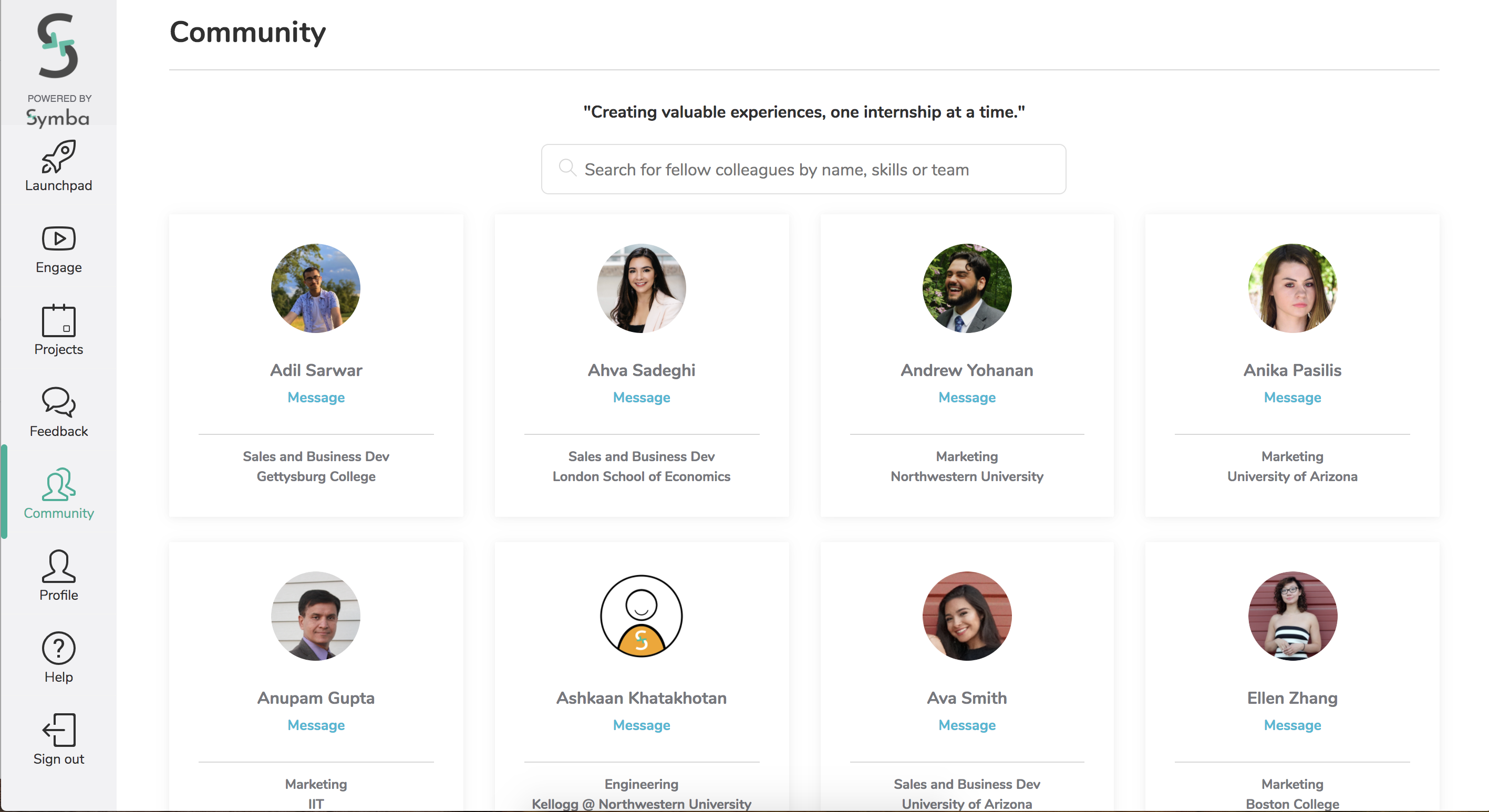

Each user is invited to create a profile so other interns can reach out and learn about their cohort. While Symba wants to be where interns live during their internship, there’s no direct messaging mechanisms within the web-based platform. Instead, Symba has embedded a Slack integration for users who want to talk directly.

The community board allows interns to meet other interns and chat. Image via Symba.

Managers, on the other hand, are able to log in, assign tasks and check on progress for their direct reports. Feedback is also tracked during the entirety of the internship, to help see who has made progress and deserves a potential return offer.

Because interns come in for only eight to 12 weeks, she says the traditional internship onboarding process — which includes bringing them all onto a company’s full-time tech stack — could create chaos for the organization. Symba wants to be a low-lift alternative.

Sadeghi says that customers have been attracted to the alumni features in their platform, which allow managers to engage interns after the program is complete. The applicant-tracking system works to keep potential hires in the fold of the company.

So far, Symba is optimistic that the tool is working. Users log into the product an average of six to nine times per day, and there have been more than 15,000 intern-projects created on Symba.

The company declined to disclose revenue, citing the stage of its business, but said that it charges companies $30 to $50 per user per month for the product. The average size of a Symba cohort is 80, but they have had customers who bring more than 2,000 interns onto the product. It only works with companies who pay their interns.

A hurdle of Symba will be the seasonality of its revenue. Because most internships are in the summer, Symba will likely find most growth opportunities during that three-month period.

Symba’s early growth is directly related to the pandemic, as the fear of the virus closed offices, and, in turn, shuttered internship programs. Symba’s success will hinge on if the team can convince companies that an online workspace for interns is a necessary product even when offices reopen.

Beyond translating into a post-pandemic world, Symba wants to be a solution for clients such as bootcamps, accelerators or fellowships. If it’s able to land year-round clients, it will be able to balance the seasonality of its current revenue of summer internships.

The success so far is promising: Early momentum has helped Symba raise $750,000 from a number of investors, including 1517 Fund, January Ventures and Hustle Fund.

Powered by WPeMatico

TechCrunch recently covered Databricks’ financial performance in 2020, contrasting its recent performance to some historical 2019 data that the company shared.

The data-and-analysis-focused unicorn grew its annual run rate 75% to $350 million, compared to its year-ago quarter, meaning that the firm is growing well at scale. TechCrunch described it as “an obvious IPO candidate” at the time, a little under two weeks ago.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Since that point, Bloomberg reported that Databricks is indeed charging ahead with an IPO, a transaction that could come as soon as the first half of 2021, writing that it “has held talks with banks but has yet to hire underwriters” for its flotation.

That is enough news for us to have fun with. So, this morning let’s collate all that we know about the company’s financial performance, mix in some current market valuation metrics, and do some light projecting of Databricks’ growth. Our question? What might the company be worth at the end of Q1 or Q2 next year.

That is enough news for us to have fun with. So, this morning let’s collate all that we know about the company’s financial performance, mix in some current market valuation metrics, and do some light projecting of Databricks’ growth. Our question? What might the company be worth at the end of Q1 or Q2 next year.

Of course, there are some worrying signs on the horizon that the stock market is about to shift lower, but, hey, there’s no need to be a pessimist this early on a Monday morning. Let’s get into the math.

Starting with some history, Databricks was worth $6.2 billion after its September, 2019 Series F round of capital. The company raised $400 million in the transaction, its largest round to-date by $150 million. That capital should get the company to an H1 2020 IPO, provided that its spending didn’t go all old-school Dropbox.

Powered by WPeMatico

The long-anticipated IPO of Alibaba-affiliated Chinese fintech giant Ant Group could raise tens of billions of dollars in a dual-listing on both the Shanghai and Hong Kong exchanges.

Shares for the company formerly known as Ant Financial are expected to price at around HK$80, or roughly 68 to 69 Chinese Yuan. The company is selling around 134 million shares in the Hong Kong portion of its debut, worth around $17.25 billion American dollars at HK$80 apiece.

Given that the share sale is expected to raise a similar amount of money from its Shanghai listing, the company’s IPO could raise as much as $34.5 billion. That tally would make the debut the largest in history, besting the recent Aramco IPO that raised around $29.4 billion.

Alibaba owns a 33% stake in Ant Group. At its currently expected share price, Ant Group would be worth as much as $310 billion, according to The New York Times, or $313 billion per CNBC.

Ant Group’s huge IPO fits its own epic scale. As TechCrunch reported in July, Ant had around 1.3 billion annual active users in March of this year, a number that could have risen in recent quarters. Ant’s Alipay competes with Tencent’s WeChat Pay in the huge and lucrative Chinese market.

The Ant Group IPO could be viewed as a moment in which the United States stock markets showed weakness. When Alibaba went public back in 2014, it did so via the New York Stock Exchange. The Chinese tech giant later dual-listed on the Hong Kong exchange. To see Ant Group dual-list on the Hong Kong and Shanghai indices without a float in New York shows what is possible outside of the United States when it comes to capital financing.

Fintech startups have broadly seen their fortunes rise during 2020 as the global pandemic changed consumer behavior and moved more commerce and payments into the digital realm. And IPOs have generally performed strongly as well, meaning that Ant Group could find a few tailwinds for its equity when it begins to trade.

Ant has not been content to stick to its knitting, keeping itself busy by investing in other startups. The company took a small stake in installment-payment service Klarna earlier this year, for example.

At a valuation of more than $310 billion, Ant Group would be worth about as much as JPMorgan Chase, the most valuable American bank today. It would also best U.S.-based digital payments leader PayPal, which is currently valued at $236 billion, as well as Square, which is valued at $77 billion.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest big news, chats about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and myself here — and don’t forget to check out last Friday’s episode that includes some high-quality Quibi jokes, if I recall correctly.

Shout-out to Lewis Hamilton and that G2 series. OK, chat Thursday!

Equity drops every Monday at 7:00 a.m. PT and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Simple, link-centric user profiles might not sound like a particularly ambitious idea, but it’s been more than big enough for Linktree.

The Melbourne startup says that 8 million users — whether they’re celebrities like Selena Gomez and Dua Lipa or brands like HBO and Red Bull — have created profiles on the platform, with those profiles receiving more than 1 billion visitors in September.

Plus, there are more than 28,000 new users signing up every month.

“This category didn’t exist when we started,” CEO Alex Zaccaria told me. “We created this category.”

Zaccaria said that he and his co-founders Anthony Zaccaria and Nick Humphreys created Linktree to solve a problem they were facing at their digital marketing agency Bolster. Instagram doesn’t allow users to include links in posts — all you get is a single link in your profile, prompting the constant “link in bio” reminder when someone wants to promote something.

Meanwhile, most of Bolster’s clients come from music and entertainment, where a single link can’t support what Zaccaria said is a “quite fragmented” business model. After all, an artist might want to point fans to their latest streaming album, upcoming concert dates, an online store for merchandise and more. A website could do the job in theory, but they can be clunky or slow on mobile, with users probably giving up before they finally reach the desired page.

Linktree founders Anthony Zaccaria, Alex Zaccaria and Nick Humphreys. Image via Linktree.

So instead of constantly swapping out links in Instagram and other social media profiles, a Linktree user includes one evergreen link to their Linktree profile, which they can update as necessary. Selena Gomez, for example, links to her latest songs and videos, but also her Rare Beauty cosmetics brand, her official store and articles about her nonprofit work.

Zaccaria said that after launching the product in 2016, the team quickly discovered that “a lot more people had the same problem,” leading them to fully separate Linktree and Bolster two years ago. Since then, the company hasn’t raised any outside funding — until now, with a $10.7 million Series A led by Insight Partners and AirTree Ventures. (Update: Strategic investors in the round include Twenty Minute VC’s Harry Stebbings, Patreon CTO Sam Yam and Culture Amp CTO Doug English.)

“We had the option to just continue to grow sustainably, but we wanted to pour some fuel on the fire,” Zaccaria said.

In fact, Linktree has already grown from 10 to 50 employees this year. And while the company started out by solving a problem for Instagram users, Zaccaria described it as evolving into a much broader platform that can “unify your entire digital ecosystem” and “democratize digital presence.” He said that while some customers continue to maintain “a giant, brand-immersive website,” for others, Linktree is completely replacing the idea of a standalone website.

Zaccaria added that Instagram only represents a small amount of Linktree’s current traffic, while nearly 25% of that traffic now comes from direct visitors.

Image Credits: Linktree

Black Lives Matter has also been a big part of Linktree’s recent growth, with activists and other users who want to support the movement using their profiles to point visitors to websites where they can donate, learn more and get involved. In fact, Linktree even introduced a Black Lives Matter banner over the summer that anyone could add to their profile.

Linktree is free to use, but you have to pay $6 a month for Pro features like video links, link thumbnails and social media icons.

Zaccaria said that the new funding will allow the startup to add more “functionality and analytics.” He’s particularly eager to grow the data science and analytics team, though he emphasized that Linktree does not collect personally identifiable information or monetize visitor data in any way — he just wants to provide more data to Linktree users.

In a statement, Insight Managing Director Jeff Lieberman said:

As the internet becomes increasingly fragmented, brands, publishers, and influencers need a solution to streamline their content sharing and connect their social media followers to their entire online ecosystem, ultimately increasing brand awareness and revenue. Linktree has successfully created this new “microsite” category enabling companies to monetize the next generation of the internet economy via a single interactive hub. The impressive traction and growing number of customers Linktree has gained over the last few months demonstrates its proven market fit, and we could not be more excited to work with the Linktree team as they transition to the ScaleUp phase of growth.

Powered by WPeMatico

This is The TechCrunch Exchange, a newsletter that goes out on Saturdays, based on the column of the same name. You can sign up for the email here.

Back in August during Y Combinator’s two-day demo extravaganza, TechCrunch noted a number of startups from India that stood out from the batch. Names like Bikayi (e-commerce tools), Decentro (consumer banking APIs), Farmako Healthcare (digital health records) and MedPiper Technologies (helping hire health professionals) joined our list of favorites from the batch.

Seeing so many India-focused startups in the mix wasn’t a fluke. Data shows that India’s venture capital scene has grown sharply in recent years. 2019 was the country’s biggest ever in terms of venture dollars invested, with Bain counting $10 billion during the year.

In 2020, the third quarter brought the country’s venture capital scene back to form. After a somewhat average start to the year, Indian startups saw their venture capital investment fall to just $1.5 billion in Q2, the lowest quarterly tally since 2016. But data via KPMG and PitchBook make it plain that Q3 was a rebound, with $3.6 billion invested into Indian startups during the three-month period.

That figure was not a historical record, mind; the Q3 total looks to be only the fourth-biggest VC quarter in India’s startup history since at least 2013 and, perhaps, ever. But it was a good bounce-back during a crippling pandemic all the same. The country’s VC deal count also rebounded a bit in the third quarter, with some of that money landing in big chunks, including a $500 million investment into Byju’s this September.

Smaller startups are also seeing strong results. Bikayi is one such startup. TechCrunch caught up with the company via email, digging into its post-Demo Day results. Its monthly recurring revenue (MRR) grew 60% in August from its July results, it said. And in late August the company told TechCrunch that it was on track to reach $1 million annual recurring revenue (ARR) by the end of the year.

Bikayi said more recently that it recorded 100% growth in the number of merchants it supports, and 100% revenue growth in September. So the WhatsApp-focused Shopify-for-India is racing ahead. October results, Bikayi CEO Sonakshi Nathani added, are looking “promising” as well.

To get a better handle on the Indian startup market more broadly, The Exchange got ahold of Accel investors Arun Mathew (based in the United States), and Prayank Swaroop (based in India), for a bit of digging.

Historically, falling bandwidth and smartphone costs along with improved Internet reliability helped lay the foundation for the recent Indian startup wave, according to Swaroop. Mathew added that some high-profile successes like Flipkart made startups a more attractive option, with the ecommerce company’s success helping to “change the tenor” of the conversation around founding tech firms in recent years.

It also helps, Swaroop added, that seasoned folks from existing Indian tech companies are branching out and starting companies of their own, recycling knowledge into new, smaller companies. This is a key method by which Silicon Valley has managed to create an outsized number of hits over time; a concentration of operators who have built big startups are key grist in the unicorn mill. And there’s more money being raised to help power new Indian tech companies.

All told, 2019 was a huge year for the Indian startup market in venture capital terms, and 2020’s recovery is underway. Let’s see what gets built.

The Exchange spent a lot of this week digging into venture capital data and trends, something that we love to do. If you need to catch up, here’s our look at the U.S. venture capital scene in Q3, and here are our notes on the more global picture. And we touched on India above. What more could there be?

Well, some data on healthcare-focused companies is just what we need. Per a new report from CB Insights, there are 41 healthcare-focused unicorns today. More importantly, startups focused on health-related matters (telemedicine, mental health, AI, etc.) just had a record quarter. Even for a pandemic, $21.8 billion went into the space across 1,539 global rounds in the third quarter. That’s far more activity than I would have guessed.

And with that, we’re cutting Market Notes short this week for some important TechCrunch news:

Hey y’all. It’s Megan Rose Dickey busting into Alex’s newsletter for a couple of quick news items. First, I officially launched my newsletter, Human Capital! It covers labor and diversity and inclusion in tech. Also, I relaunched the Mixtape podcast with my colleague Henry Pickavet. You can check out our first episode of Season 3 about California’s gig worker ballot measure Prop 22 here.

Megan is amazing and you should check out her pod and newsletter.

As always, there was more good stuff to share here than I can possibly fit, so let’s get right into the data, takes, links and other delicacies.

Wrapping, a survey from Salesforce shows that enterprise cloud CEOs are reporting better-than-anticipated revenue growth and lower-than-anticipated churn, when compared to their March estimates. That is probably why earnings haven’t been a disaster and so many unicorns were able to go public in Q3.

That and valuations in the public sphere are higher than what private investors are dishing up, inverting the market’s last few years.

See you Monday,

Powered by WPeMatico