Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Kyklo, a startup that helps wholesale distributors of electrical and automation products launch e-commerce stores, is announcing that it has raised $8.5 million in seed funding.

The industry may sound a bit arcane, but it’s one that founders Remi Ducrocq (Kyklo’s CEO) and Fabien Legouic (CTO) know from having worked at Schneider Electric. Ducrocq said that the process of selling these products to manufacturers and electricians remains cumbersome, relying largely on PDF catalogs.

Shifting these businesses to digital is a much bigger challenge than creating your standard online store, both because of the number of products being sold and the needs for accurate listings.

“Even the small folks sell 100,000 SKUs [distinct products], up to 1 million SKUs,” Ducrocq told me. “If you choose the wrong product, your factory gets shut down. [It’s essential] to have accurate information present on the web store to have a transaction happen.”

Kyklo doesn’t automate the process completely, Ducrocq added, because “you can’t just create content or apply AI to something that is so unstructured.” Creating these stores remains a manual process for the Kylo team, but the company has built “technology to make that manual process as easy as possible.”

That includes standardized data structures and a variety of scripts to create these product listings more quickly. Ultimately, Ducrocq said Kyklo can get distributors up and running with an online store within 30 days, and sometimes as quickly as two weeks.

In total, Kyklo has created a catalog of more than 2.5 million products for more than 35 distributors. It’s also been endorsed by manufacturers like Schneider Electric, Wago, Festo US and Mitsubishi Electric Automation as their preferred e-commerce partner.

Ducrocq suggested that going digital with Kyklo helps these businesses both by allowing them to reach new customers with improved SEO and by giving them tools to expand their sales with existing customers. For example, IEC Supply says that its online sales increased 500% for the first six months after launching with Kyklo, while new customer interactions tripled.

“Market maturity accelerated because of the pandemic,” he added. “These B2B traditional businesses were reluctant to go towards digitization, with only visionaries embarking on the journey. But during the pandemic, salespeople haven’t been able to see their customers in person for six months, so many distributors are reassessing how they should effectively go to market.”

Kyklo has now raised a total of $10.2 million. The new funding was led by Felicis Ventures and IA Ventures, with participation from Jungle Ventures, partners at Wavemaker, Seedplus and strategic angel investors.

“With 80% of the $640 billion electrical, industrial and automation distribution industry still relying on PDF catalogs and phone and emails for its operations, distributors face a challenge in the market,” said Felicis Managing Director Sundeep Peechu in a statement. “KYKLO’s platform helps these companies keep pace with crucial industry needs and reassess how digital tools can transform their sales force.”

Powered by WPeMatico

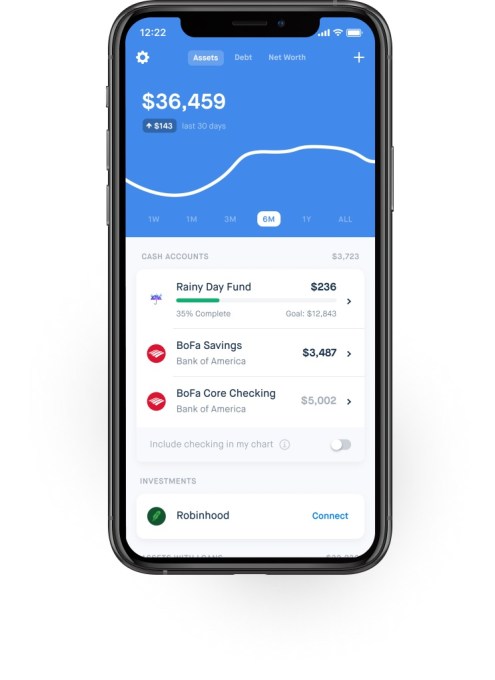

Truebill, a startup offering a variety of tools to help users take control of their finances, announced today that it has raised $17 million in Series C funding.

When I first wrote about the startup in 2016, it was focused on helping users track and cancel unwanted subscriptions. Since then, it’s expanded into other financial products, like reports on your personal expenses and the ability to negotiate lower bills.

This week, Chief Revenue Officer Yahya Mokhtarzada told me that with the pandemic leading to a dramatic reduction in ad costs, Truebill was able to make TV advertising a key channel for reaching new users.

And of course, the financial uncertainty has made the product more appealing too — particularly its smart savings tool, where users can automatically set aside money for their goals.

“People became aware of the need to have some cushion,” Mokhtarzada said. “You should start saving when things are going well, before you need it, but [saving during the pandemic] is better than not doing it at all. We’ve seen a big bump in smart savings adoption, which is at an all-time high.”

Image Credits: Truebill

The new round brings Truebill’s total funding to $40 million. It was led by Bessemer Venture Partners, with participation from Eldridge Capital, Cota Capital, Firebolt Ventures and Day One Ventures.

The startup says the round will allow it to develop new products and features, including net worth tracking, automated debt payments and shared accounts.

Mokhtarzada added that the company will be making big investments in data science to help follow its “north star” of financial health, where he said, “The data challenge is significant.”

Sure, it’s pretty straightforward to recognize whether someone’s doing well or poorly financially, but the real goal is to “recognize trends and shortfalls before they happen.”

For example, instead of simply alerting users when they’ve been charged an overdraft fee on their account, Mokhtarzada said, “What is helpful is to have predictive models analyze data to anticipate a cashflow shortage and have the right tools in place that prevent it.”

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

The full Equity crew was on hand to debate the current venture capital market, curious about how risk-on, or risk-off things really are today. Danny, Natasha and I framed the conversation around a number of news items from the week, including:

It was a busy week, despite the month. Expect more of the same next week.

Finally, don’t forget that our own Chris Gates is cutting Equity videos out of every episode that you can find over on YouTube. He does a great job and it’s great to be on video, as well as audio platforms.

Equity drops every Monday at 7:00 a.m. PDT and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Reports on November 9 that a COVID-19 vaccine looks incredibly effective moved the market. Software stocks sold off and long-suffering industries hammered by the pandemic saw their fortunes rise. It was odd to see airlines soaring and 2020 high-fliers like Zoom taking blows.

But amidst all that noise, another sector that has great import for startups was also taking lumps: edtech.

Looking at how a number of edtech companies traded in the aftermath of the vaccine news helps us understand how public investors view the companies and assess their long-term growth prospects.

Simply put, selling edtech on the vaccine news — as investors did — was a bet that growth in the sector would be constrained by a return to normalcy, something a solid vaccine could hasten. This is a related concept to what TechCrunch discussed regarding software’s own November 9 selloff — that investors were betting that future growth for those companies, boosted in 2020 by the pandemic shaking up how and where people worked, would be limited by a quick return to regular life.

The vaccine’s reported efficacy changed how investors see the future. But how much did it change investor expectations for the future of edtech? Let’s examine the public market results before asking our own edtech expert Natasha Mascarenhas on what she’s seeing in the numbers and hearing from investors.

There aren’t many public edtech companies, but TechCrunch surveyed those that we knew about. Here’s where three stood after the closing bell rang on Friday, November 3:

Powered by WPeMatico

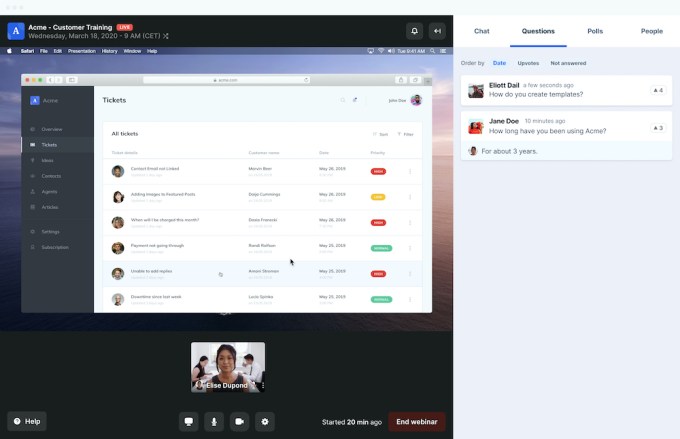

Video communication startup Livestorm announced today that it has raised $30 million in Series B funding.

Co-founder and CEO Gilles Bertaux told me that the company started out with a focus on webinars before launching a video meeting product as well (which we used for our interview).

“The way we think about it is, webinars and meetings are not use cases,” Bertaux said.

He argued that it’s more meaningful to talk about whether you’re having a team meeting or a training demo or whatever else, and then how many people you want to attend, with Livestorm supporting all of those use cases and meeting sizes through different templates: “We’re trying to remove the semantic distinction of meeting and webinar out of the equation.”

Among other things, Livestorm is distinguished from other video conferencing tools because it’s purely browser based, without requiring presenters or attendees to install any software. The company says it has grown revenue 8x since it raised its €4.6 million Series A last fall, with a customer base that now includes 3,500 customers such as Shopify, Honda and Sephora.

Image Credits: Livestorm

Of course, you’d expect a video communication product to do well in 2020. At the same time, Zoom has dominated the remote work conversation this year — in fact, Bertaux acknowledged that Zoom may have built “the best video meeting technology.”

But he also suggested that the landscape is changing: “The thing is, we’re entering a period where video is becoming a commodity.”

So the Livestorm team is less focused on the core video technology and more on the experience around the video, with in-meeting features like screen sharing and virtual background, as well as a broader suite of marketing tools that allow customers to continue delivering targeted messages to event attendees.

Bertaux compared Livestorm to HubSpot, which he said “didn’t reinvent landing pages,” but put the different pieces of the marketing stack together around those landing pages.

The Livestorm executive team. Image Credits: Livestorm

“In 2021, we want to have the biggest ecosystem of integrations on a video product,” he said.

The round was led by Aglaé Ventures and Bpifrance Digital Venture, with participation from Raise Ventures and IDInvest.

In a statement, Aglaé Ventures partner Cyril Guenoun similarly described Livestorm “the HubSpot for video communications,” adding, “Video and online events have become essential in 2020, and are here to stay. The Livestorm platform thrives in this environment, providing a seamless solution for meetings and events with all the connectors that marketing, sales, customer service and HR pros need to make video a tightly integrated part of their communications strategies.”

Bertaux said the new funding will allow Paris-headquartered Livestorm to continue expanding into North America — apparently, the U.S. already represents one-third of its customer base and is the company’s fastest-growing region.

Powered by WPeMatico

The Extra Crunch Live series rolls along with a big new installment next week as Jordan Crook and Alex Wilhelm will welcome Bessemer Venture Partners‘ Byron Deeter to the conversation.

Deeter is an obvious addition to the collection of investors, founders and tech luminaries that TechCrunch has interviewed so far in the Live series — for a taste, here’s a look at our discussion with Unusual Ventures’ John Vrionis and Sarah Leary, and our chat with Plaid co-founder Zach Perret.

Why talk to a Bessemer partner in the current moment? The firm is well-known for its investments into SaaS and cloud companies, a key startup cohort that has performed well. Recent days have shaken that narrative as Q4 races to the halfway mark, with public investors seeming to rotate into other equities, punishing software firms that had been the market’s favored bet for most of the year.

We’ll dig into what’s changing on the private side of that coin, looking to understand today’s software venture capital dynamics, and what Deeter sees happening in 2021.

But there’s more to Bessemer’s active portfolio than SaaS. The venture group has also dropped dollars into Discord, which is seeing both revenue and usage explode, and Betterment, which plays in the active fintech savings and investing space. There’s lots to get into.

If you are an Extra Crunch Live veteran — you rock star, you! — or a brand-new participant — make sure your Extra Crunch membership is live! — bring a question or two as we’ll try to work in a few from the audience as we go.

Chat with you next Tuesday afternoon! (Oh, and you can now pre-submit questions down below, which is a great improvement over the old system which only allowed for live submissions!)

Powered by WPeMatico

Earnings season is racing past us, with the big ride-hailing companies’ numbers in, all of the Big Five having wrapped their reporting and lots of SaaS numbers in the market. But amidst all the noise, The Exchange has kept an eye on two companies in particular: PayPal and Square.

We’re not really concerned with their overall revenue and profit metrics. Instead, we’ve been hunting around in their numbers for hints and notes about what is going on inside of fintech itself. Why? There are a host of hugely valuable fintech unicorns that have to go public in the future that also share some market space with one or both of our public charges.

What can we learn from looking at what PayPal and Square reported to their own investors?

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Lots, it turns out.

As TechCrunch reported when PayPal dropped its Q3 numbers, the public company had bullish results from its Venmo service, payment processing and consumer activity metrics. The numbers pointed to strong consumer adoption of fintech services during the pandemic, something that we presumed was not unique to PayPal itself, but was likely indicative of a generally warm environment for consumer fintech services.

Square continued the trend, posting a set of results that contains nearly all positive data for consumer fintech activity — with one critical caveat for Q4 that we’ll get to at the end.

Square continued the trend, posting a set of results that contains nearly all positive data for consumer fintech activity — with one critical caveat for Q4 that we’ll get to at the end.

Still, what the majors tell us about the fintech space indicates a warmth in activity that explains why Chime, Robinhood and others have had such fun in 2020, accreting tectonic capital to keep their growth hot.

Digging through Square’s earnings gives us a window into consumer payment activity, card usage, stock purchases and more. Let’s see what we can learn, and to which unicorns it might apply.

Let’s start by talking about the broader fintech market before niching down.

Powered by WPeMatico

Palo Alto Networks has been on a buying binge for the last couple of years, and today it added to its haul, announcing a deal to acquire Expanse for $800 million in cash and equity awards. The deal breaks down to $670 million in cash and stock and another $130 million in equity awards to Expanse employees.

Expanse provides a service to help companies understand and protect their attack surface, where they could be most vulnerable to attack. It works by giving the security team a view of how the company’s security profile could look to an attacker trying to gain access.

The plan is to fold Expanse into Palo Alto’s Cortex Suite, an AI-driven set of tools designed to detect and prevent attacks in an automated way. Expanse should provide Palo Alto with a highly valuable set of data to help feed the AI models.

“By integrating Expanse’s attack surface management capabilities into Cortex after closing, we will be able to offer the first solution that combines the outside view of an organization’s attack surface with an inside view to proactively address all security threats,” Palo Alto Networks chairman and CEO Nikesh Arora said in a statement.

Expanse sees the acquisition as a way to accelerate the company road map using the resources of a larger company like Palo Alto, a typical argument from companies being acquired. “Joining forces with Palo Alto Networks will let us achieve our most important business goals years ahead of schedule. During the course of conversations with Palo Alto Networks leadership, we shared optimism that the right combination of technology and people can solve many cybersecurity challenges that to date have seemed intractable,” the startup’s founders wrote in a blog post announcing the deal.

The two co-founders, Dr. Tim Junio and Dr. Matt Kraning, will be joining Palo Alto under the terms of the deal, which is expected to close in Palo Alto’s fiscal second quarter, assuming it passes regulatory muster.

Expanse was founded in 2012 and has raised $136 million, according to Crunchbase data. Its most recent raise was a $70 million Series C last year, which was led by TPG.

Today’s acquisition is Palo Alto’s third in 2020 and the 10th since 2018. Palo Alto stock was up 2.15% in early trading.

Powered by WPeMatico

Monday’s news that a COVID-19 vaccine candidate looks to be incredibly effective gave investors reasons to believe in a better future. Perhaps COVID-19 won’t be with us for years, investors appeared to think, but will instead become something that we can bend the curve on sooner than we thought.

A strong vaccine would be key toward moving back to life as it was. And for many companies battered by the pandemic, news that one was coming was more than a shot in the arm — it was stock market salvation. Airline shares soared. Cruise companies jumped. Even long-suffering Boeing shares took flight.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

But amidst the cheering, one sector of the stock market, a key comp for a host of startups, took hits. Yes, the high-flying SaaS and cloud stocks that have been such a key narrative in 2020 thanks to the pandemic and low interest rates, fell sharply while other sectors rallied off the vaccine tidings.

SaaS and cloud stocks are off more this morning, though their declines are shallower than Monday’s losses.

We asked yesterday what signal public investors were trying to send with their trades. But that’s just one angle of the picture. So, to better understand how private investors are viewing the same signals, I reached out to a few VCs who invest in SaaS and, in my experience, are worth listening to.

We asked yesterday what signal public investors were trying to send with their trades. But that’s just one angle of the picture. So, to better understand how private investors are viewing the same signals, I reached out to a few VCs who invest in SaaS and, in my experience, are worth listening to.

Below I’ve compiled notes from Bessemer’s Mary D’Onofrio, Work Life Ventures’ Brianne Kimmel, Day One Ventures’ Masha Drokova, Floodgate’s Iris Choi and Shasta’s Jacob Mullins on our question.

Are the bulls still bullish? Let’s find out.

D’Onofrio wrote that her firm was still digesting the vaccine news and that it was “too early to say decisively whether or not people will be back to a pre-COVID life in the next few quarters.” That’s fair. Some good vaccine news does not mean that I’ll be back to speed-running United Economy Plus across the country every two weeks come April.

That said, D’Onofrio doesn’t appear too worried about the early-week selloff, noting that SaaS and cloud stocks — as measured via her firm’s cloud index — are still far ahead of other, broader indices this year. Why does that matter? “Stocks are forward-looking,” she said, which tells her “that even with more visibility into returning to ‘normal,’ the market anticipates that cloud companies will still be able to capitalize on the [market expansion] and growth opportunities that COVID helped to propel.”

“The pie,” she concluded, “has expanded.” That’s bullish and fair, I reckon.

Powered by WPeMatico

Adobe just announced that it is acquiring marketing workflow management startup Workfront for $1.5 billion. Bloomberg first reported the sale earlier today.

Workfront was founded back in 2001, making it a bit long in the tooth for a private company that has raised $375 million, according to Crunchbase. (It’s worth noting that $280 million of that was secondary money raised last year.)

The acquisition gives Adobe more online marketing tooling to fit into its Experience Cloud. This one helps companies manage complex projects inside the marketing department (or elsewhere in the company, for that matter).

Suresh Vittal, VP of platform and product for Adobe Experience Cloud, said that the two companies often work together and encounter one another’s sales teams. As the pandemic has played out, it began to make more sense to bring in-house this kind of tooling that works well in a distributed environment, and over the last several months the deal came together.

“The new normal distributed marketing team, distributed experience delivery teams, people having to work remotely — we started to see new use cases emerge around the idea of work management, around the idea of content velocity, around the idea of providing compliance and governance capabilities so no asset escapes the organization, and it goes through this process of passing through creative and the marketing teams and getting out there and really representing your brand in the right way,” Vittal explained.

Workfront CEO Alex Shootman sees the deal as a way to accelerate the roadmap while working with a much larger company. “We are barely scratching the surface of marketing and we could grow tremendously, just by having that great kind of integrated relationship,” he said.

Holger Mueller, an analyst at Constellation Research, says the acquisition will help Adobe customers manage the complexities of marketing project management. “Scheduling and managing work had gotten orders of magnitude more complex for enterprises, and Adobe is accounting for that with the acquisition of Workfront, providing better tool support for the new future of work,” Mueller told TechCrunch.

Workfront’s 960 employees will become part of Adobe and become part of the Adobe Experience Cloud. Shootman will continue to run it and report to Anil Chakravarthy, executive vice president and general manager of the digital experience business at Adobe.

Workfront’s customers include Home Depot, T-Mobile and Deloitte, and the two companies share 1,000 common customers among Workfront’s 3,000 total customer base. In fact, it has APIs that connect to Adobe Creative Cloud and Experience Cloud, two parts of the company’s product family that marketers frequently access.

As Adobe battles Salesforce, SAP and Oracle in the marketing automation space, it’s been using its checkbook to acquire additional fire power in recent years. This acquisition comes after Adobe spent $1.6 billion for Magento and $4.75 billion for Marketo in 2018. That’s almost $8 billion for three companies in less than two years, even as it builds out parts of its Adobe Experience Cloud in-house. Combined, it shows just how serious the company is about making headway in this valuable area.

Customer experience has always been an essential element of online and in-person transactions, making sure the customer feels good about the interactions it has with a brand. It not only keeps them coming back, but it encourages them to act as ambassadors on behalf of a company, something that has incredible value.

Conversely, a bad experience can lead to the opposite impact, causing a prospective or even loyal customer to abandon a brand and speak badly about it to friends online and in person. Adobe hopes that by bringing another marketing tool into the fold, it can help its customers increase the likelihood of a positive online customer experience. This one should allow marketing personnel working at a company to move marketing projects through a workflow from idea to delivery.

The deal is expected to close in the first quarter of Adobe’s fiscal year. Per usual, it will be subject to typical regulatory scrutiny.

Powered by WPeMatico