Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

AI startup RealityEngines.AI changed its name to Abacus.AI in July. At the same time, it announced a $13 million Series A round. Today, only a few months later, it is not changing its name again, but it is announcing a $22 million Series B round, led by Coatue, with Decibel Ventures and Index Partners participating as well. With this, the company, which was co-founded by former AWS and Google exec Bindu Reddy, has now raised a total of $40.3 million.

In addition to the new funding, Abacus.AI is also launching a new product today, which it calls Abacus.AI Deconstructed. Originally, the idea behind RealityEngines/Abacus.AI was to provide its users with a platform that would simplify building AI models by using AI to automatically train and optimize them. That hasn’t changed, but as it turns out, a lot of (potential) customers had already invested into their own workflows for building and training deep learning models but were looking for help in putting them into production and managing them throughout their lifecycle.

“One of the big pain points [businesses] had was, ‘look, I have data scientists and I have my models that I’ve built in-house. My data scientists have built them on laptops, but I don’t know how to push them to production. I don’t know how to maintain and keep models in production.’ I think pretty much every startup now is thinking of that problem,” Reddy said.

Since Abacus.AI had already built those tools anyway, the company decided to now also break its service down into three parts that users can adapt without relying on the full platform. That means you can now bring your model to the service and have the company host and monitor the model for you, for example. The service will manage the model in production and, for example, monitor for model drift.

Another area Abacus.AI has long focused on is model explainability and de-biasing, so it’s making that available as a module as well, as well as its real-time machine learning feature store that helps organizations create, store and share their machine learning features and deploy them into production.

As for the funding, Reddy tells me the company didn’t really have to raise a new round at this point. After the company announced its first round earlier this year, there was quite a lot of interest from others to also invest. “So we decided that we may as well raise the next round because we were seeing adoption, we felt we were ready product-wise. But we didn’t have a large enough sales team. And raising a little early made sense to build up the sales team,” she said.

Reddy also stressed that unlike some of the company’s competitors, Abacus.AI is trying to build a full-stack self-service solution that can essentially compete with the offerings of the big cloud vendors. That — and the engineering talent to build it — doesn’t come cheap.

It’s no surprise then that Abacus.AI plans to use the new funding to increase its R&D team, but it will also increase its go-to-market team from two to ten in the coming months. While the company is betting on a self-service model — and is seeing good traction with small- and medium-sized companies — you still need a sales team to work with large enterprises.

Come January, the company also plans to launch support for more languages and more machine vision use cases.

“We are proud to be leading the Series B investment in Abacus.AI, because we think that Abacus.AI’s unique cloud service now makes state-of-the-art AI easily accessible for organizations of all sizes, including start-ups,” Yanda Erlich, a p artner at Coatue Ventures told me. “Abacus.AI’s end-to-end autonomous AI service powered by their Neural Architecture Search invention helps organizations with no ML expertise easily deploy deep learning systems in production.”

Powered by WPeMatico

French startup Yubo is the biggest social media app you’ve never heard of — unless you’re a teen. With a focus on young people under 25, the company has managed to attract 40 million users. A fraction of them hang out every day in live-streaming rooms, meet new people and spend money for more features.

That’s right, the company isn’t betting on ads. You can pay to unlock items or subscribe to the app. Yubo expects to generate $20 million in revenue this year — that’s twice as much revenue than it generated in 2019.

Yubo recently closed a Series C funding round of $47.5 million. Existing investors Idinvest Partners, Iris Capital, Alven and Sweet Capital are investing once again. Gaia Capital Partners is joining the round as a new investor. Jerry Murdock from Insight Partners isn’t investing in the company but he’s joining the company’s board.

So what is Yubo exactly? It’s a social media app that wants to reverse the current trend of social networks — you can’t follow other users, you can’t like content.

As we’ve seen many, many times in the past, once you introduce a following feature, the ability to like and algorithmic recommendations, your social network becomes a virtual stage. A tiny portion of your user base performs on that stage, the vast majority consumes content. Influencers emerge and monopolize your attention. We’ve seen that trend with Vine, Instagram, YouTube, Twitter, TikTok and even LinkedIn.

Yubo isn’t looking for performers. The company wants to help you meet other people, play games, hang out and create new friendships. In many ways, it feels like a way to hang out with teens that don’t attend your high school.

Image Credits: Yubo

When you open the app, you get a list of rooms that you can join. Users can live stream from their phone and chat with other users. You join rooms depending on what you’re looking for — local people, people talking about politics, people playing games, etc.

Once again, the idea isn’t to create giant room with a handful of performers and tens of thousands of viewers. There’s no tipping mechanism so it’s not like Twitch.

“In 95% of rooms, there are only streamers. Rooms have between 5 and 10 people on average,” co-founder and CEO Sacha Lazimi told me.

You can add people as friends and chat with them in the app. In addition to rooms, you can find new friends by swiping left and right on profile pages — an interaction borrowed from Tinder.

“We had 25 million registered users in December. Today, we have more than 40 million users,” Lazimi said. Most users are based in the U.S., the U.K., Canada, Australia and France.

And engagement has been going up as well. The number of hours spent in live rooms is up 400% year-over-year.

With in-app purchases and subscriptions, you get additional features. For instance, you can boost your live stream, promote your profile on the Swipe page or feature your profile at the top of the online section. It’s a way to get more people in your room, receive messages from more users and have more interactions in general.

“We think it’s the future of monetization for social platforms. If you focus on ads, you’re competing with Facebook, TikTok and Snap,” Lazimi said.

With such a young audience, moderation is extremely important. The company has been investing heavily on real-time moderation processes and it tries to enforce strict rules. When you sign up, Yubo checks your identity to put you in the right age group.

“We analyze all content both semantically and visually,” Lazimi said. The company is currently working on alert popups to tell users that they’re doing something inappropriate while it’s happening.

Yubo has in-house safety experts and also works with contractors — it can connect its users with local helplines as well. One-third of the company’s investments are focused on safety. It currently covers 36 languages.

With today’s funding round, Yubo will expand its team. There are currently 30 employees in Paris, London and Jacksonville, which is small when you think about the reach of the app. Yubo will open an office in New York.

On the product front, Yubo is working on recommendation algorithms. The company is also going to build a YouTube integration to consume YouTube content from a room directly. Yubo is also partnering with Snap to integrate Camera Kit. This way, Yubo will be able to build is own AR lenses for its users.

Powered by WPeMatico

In a period of social distancing, making new professional connections feels harder than ever. So Amsterdam-based Cooper is building a network that’s all about making and receiving introductions.

“Everything that happens in the network is based on the foundation of introductions,” CEO Robert Gaal told me. “You should never get an unwanted message, and there’s no such thing as a connection request, because it’s not necessary if you have an introduction.”

The startup is launching internationally today and announcing that it has raised $2 million in seed funding.

Gaal (who co-founded the company with CTO Emiel van Liere) described Cooper as “a private professional network that’s not about how many connections do I have, it’s about bringing the people that you already trust into a circle.”

That’s in contrast with existing professional networking sites, which are most useful as “directories” of online résumés, and usually emphasize the quantity of connections, rather than the quality. (I’ll admit that on LinkedIn, I’m connected to a bunch of people I barely know.)

So Cooper tries to take the opposite approach, limiting users’ connections to people they really know. To do this, it can pull data from a user’s online calendar, and it also provides them with a personal invite code that they can share with their professional contacts.

Image Credits: Cooper

Users then post requests or opportunities, which are viewable by their connections and by friends of friends, who can offer to make useful introductions via email or in Cooper itself.

In fact, Gaal said that during the initial beta test, multiple people have successfully used Cooper to find new jobs — sometimes after pandemic-related layoffs, which they’re comfortable sharing with their inner circle but don’t want to broadcast to the world at large.

“There’s more discovery, more trust and you can reinvent other things on top of that — what the résumé is, what mentorship is — if you get trust right first,” he said.

Of course, simply sharing a calendar invite with someone doesn’t really mean you trust them or know them well. Cooper could eventually start looking at other measures that indicate your “connectivity” with someone, like how often you email with them, Gaal said — but the first step is simply recreating the professional circle in which you feel comfortable saying, “Oh, you’re looking for a job? My friend is hiring.”

Yes, those kinds of conversations are already happening offline, but he noted that most of us can only remember “a handful of people” at once. Cooper is making that “marketplace” much more visible and easy to track.

The startup doesn’t sell ads or user data. Instead, Gaal hopes to make money by charging membership fees for features like customizing your profile or promoting your request more broadly.

The startup’s seed funding was led by Comcast Ventures, with participation from LocalGlobe and 468 Capital.

“At a time when the ability to connect is limited, Cooper is building a professional network fostering meaningful and substantive connections,” said Daniel Gulati, founding partner at Forecast Fund and former managing director at Comcast Ventures, in a statement. “We are excited to support the team on their journey ahead.”

Powered by WPeMatico

PingCAP, the open-source software developer best known for NewSQL database TiDB, has raised a $270 million Series D. TiDB handles hybrid transactional and analytical processing (HTAP), and is aimed at high-growth companies, including payment and e-commerce services, that need to handle increasingly large amounts of data.

The round’s lead investors were GGV Capital, Access Technology Ventures, Anatole Investment, Jeneration Capital and 5Y Capital (formerly known as Morningside Venture Capital). It also included participation from Coatue, Bertelsmann Asia Investment Fund, FutureX Capital, Kunlun Capital, Trustbridge Partners, and returning investors Matrix Partners China and Yunqi Partners.

The funding brings PingCAP’s total raised so far to $341.6 million. Its last round, a Series C of $50 million, was announced back in September 2018.

PingCAP says TiDB has been adopted by about 1,500 companies across the world. Some examples include Square; Japanese mobile payments company PayPay; e-commerce app Shopee; video-sharing platform Dailymotion; and ticketing platfrom BookMyShow. TiDB handles online transactional processing (OLTP) and online analytical processing (OLAP) in the same database, which PingCAP says results in faster real-time analytics than other distributed databases.

In June, PingCAP launched TiDB Cloud, which it describes as fully-managed “TiDB as a Service,” on Amazon Web Services and Google Cloud. The company plans to add more platforms, and part of the funding will be used to increase TiDB Cloud’s global user base.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

Today we have an Equity Shot for you about Airbnb’s S-1 filing, as it looks to go public before the year is out.

All that, and our trusty other host Danny Crichton was busy filing a post about the winners and losers of the Airbnb IPO. Ownership, you quiet, billionaire beast. There’s more coming from TechCrunch on the company’s IPO, and from the Equity crew on everything else we ferret out on Thursday. Stay tuned!

Equity drops every Monday at 7:00 a.m. PDT and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Airbnb filed to go public today, bringing the well-known unicorn one step closer to being a public company.

The financial results show a company on the rebound, but smaller than it was. Its more granular financial results also make clear how hard the pandemic was on the travel-reliant unicorn. Regarding Airbnb’s worth, investors will have to balance how they value recovery and recent profits over the company’s disrupted historical growth arc.

The home-sharing startup had a tumultuous year, with the COVID-19 pandemic harming its business in the first and second quarters of the year, and Airbnb later recovering on the strength of more local bookings.

Its filing comes mere days after fellow unicorns DoorDash and C3.ai themselves filed to go public in what could be a rush to the public markets by richly valued startups.

Airbnb’s S-1 filing was expected to come last week, but was delayed due to purported election concerns, a concept that TechCrunch staff did not find entirely convincing.

We’ve scraped together quite a lot about Airbnb’s recent financial performance, but its S-1 is the real treasure trove. What follows is a dive into the company’s high-level numbers. From there, TechCrunch will dig into the company’s financial nuances and ownership stakes.

What we want to know is how the pandemic impacted Airbnb’s business; its year-to-date results, and what we can suss out from its quarterly trends.

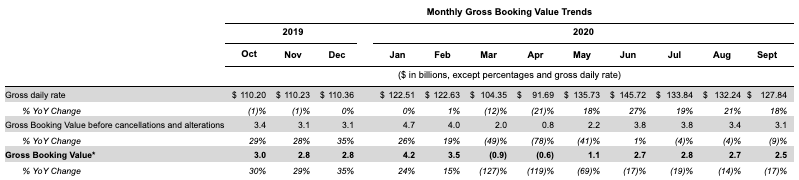

Up top in Airbnb’s S-1 is a chart that shows monthly bookings on its platform. The implication is somewhat simple; namely that Airbnb knows what we want to know and wanted to share. Here are those numbers:

Image Credits: Airbnb S-1

As expected, Airbnb took a huge hit in March. But by May things were back to year-over-year growth, where they stayed.

Now, the company has seen precious little bookings growth since June — indeed it has seen bookings fall in the months since. And, worse, the company’s gross bookings after removing cancellations are down on a year-over-year basis. (Update: We misread this table at first, and have updated our notes on it.)

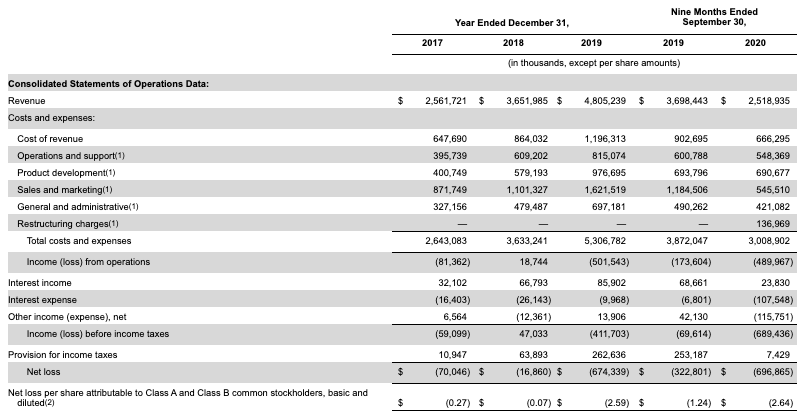

So, what does all of that look like in more traditional accounting figures? Here’s Airbnb’s reported income statement:

Image Credits: Airbnb S-1

As expected, Airbnb’s year has not been tremendous. Indeed, the company is on track to match its 2018 size, if we have our math correct.

What changed from the first three quarters of 2019 to the first three quarters of 2020? The biggest thing, apart from expected lower revenue costs — less revenue costs less — is the huge decline in sales and marketing spend at the company. Airbnb slashed S&M outlays from $1.18 billion in the first three quarters of 2019 to just $545.5 million in the same period of 2020.

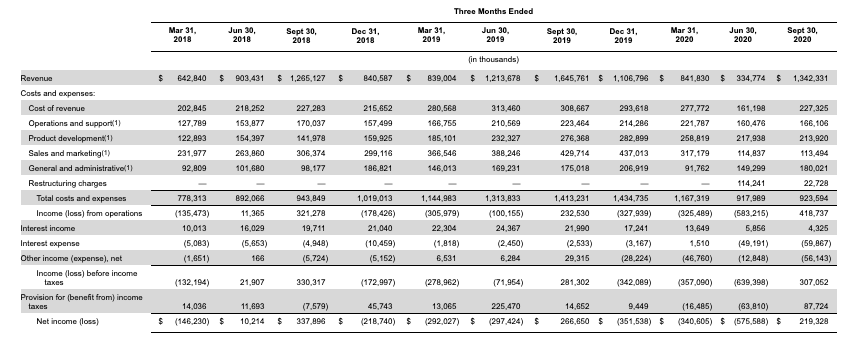

So, where will Airbnb wind up in 2020 once it’s all done? We’ll need to peek at its quarterly results for that. Here they are:

Image Credits: Airbnb S-1

Airbnb’s growth continues in year-over-year terms right until the March 31, 2020 quarter, when it was effectively flat compared to Q1 2019. Or, the company would have grown sans COVID-19. In the June 30, 2020 quarter we see the real damage, with Airbnb’s revenue falling from $1.2 billion in the year-ago quarter to just $334.8 million. That’s a shocking decline.

But, looking ahead to Q3 2020 we see a large return to form. Yes, Airbnb’s third quarter was smaller than its Q3 2019, with $1.34 billion in top line instead of $1.65 billion in 2019, but the company effectively quadrupled from its preceding quarter. If the company manages another Q3 worth of revenue in Q4, it would be larger than it was in 2018 by a few hundred million.

Critically, Airbnb managed to swing from a number of unprofitable quarters to a profit in Q3, akin to its 2019 Q3 when it was also in the black. Of course, Airbnb’s $219.3 million in GAAP net income during the third quarter pales compared to its losses tallied earlier in the year. The company will not break even in 2020.

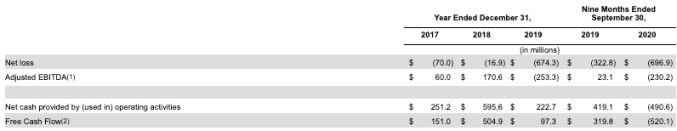

Airbnb also reported adjusted profit metrics. Its adjusted EBITDA results are based on the following definition:

Adjusted EBITDA is defined as net income or loss adjusted for (i) provision for income taxes; (ii) interest income, interest expense, and other income (expense), net; (iii) depreciation and amortization; (iv) stock-based compensation expense; (v) net changes to the reserves for lodging taxes for which we may be held jointly liable with hosts for collecting and remitting such taxes; and (vi) restructuring charges.

The decision to remove restructuring costs raised eyebrows, with Amy Cheetham, an investor at Costanoa Ventures, saying that “it feels like leaving out restructuring costs is a little aggressive?” We agree, as it gives the company too much flexibility to count the good in its results, like lower operating costs, while discounting what it took to get those results, like restructuring its business operations.

That’s having your cake and eating it as well and not counting the calories.

Still, who are we to withhold numbers from you? Here is the very adjusted EBITDA that Airbnb claims:

Image Credits: Airbnb S-1

The numbers are still not good even after ripping out so very any costs. Worse, perhaps is the company’s cash burn in the year. That deficit helps explain why Airbnb took on more capital when it did earlier this year.

It’s hard to put a firm grade on this S-1. It contains what we expected, but how investors weigh the company’s year-over-year revenue declines in Q3 2020 against its rapid comeback from Q2 2020 should help decide its eventual value. On the whole Airbnb has managed something incredibly impressive — bouncing back from so low a low.

But, now that it’s going public we can’t merely say “good job”; it wants to price itself well and trade strongly. So, all eyes on its first IPO range as that should tell us what investors just might be willing to pay for the famous company’s equity.

Powered by WPeMatico

Federal regulators have approved Mastercard’s acquisition of Salt Lake City-based startup Finicity, which provides open-banking APIs. The deal is expected to go for $825 million.

“We were notified that the Department of Justice completed its review of our planned acquisition of Finicity and has cleared it to move forward,” Mastercard wrote in a statement. “We are pleased to have reached this milestone.”

Finicity allows users to be able to decide how their financial information is shared and who can make money decisions on their behalf through open APIs. The buy will allow Mastercard to offer consumers and businesses more choice in these transactions, without requiring them to do heavy lifting themselves.

Finicity, according to Crunchbase, has raised nearly $80 million in known venture capital as a private company. When closed, it will be one of the largest fintech acquisitions at nearly $1 billion in 2020.

The DOJ approval comes just two weeks after the body filed an antitrust lawsuit challenging Visa’s proposed $5.3 billion buy of Plaid. Plaid, which empowers a large chunk of financial services through its data network, including Venmo and Acorns, is being accused of making Visa a monopoly in online debt services.

Plaid has denied these claims, saying that “Visa intends to defend the transaction vigorously.” The feds are also looking into Intuit’s $7 billion proposed buy of Credit Karma, which was first announced in February 2020.

The approval of the Mastercard-Finicity transaction could be a shot in the arm for fintech startup valuations. After both the Plaid and Credit Karma deals came under increasing regulatory scrutiny, it was an open questions whether big-dollar M&A was going to be an option for fintech unicorns.

If the path was closed due to regulatory concerns, fintech startups would have to either pursue earlier, smaller sales themselves, or wait for an eventual IPO. If that was the case, venture capitalists might shun putting as much capital to work in the sector. However, the Finicity approval makes it clear that not all fintech M&A worth $500 million or more is going to encounter oversight headaches. That should be welcome news for late-stage fintech valuations.

Powered by WPeMatico

This is The TechCrunch Exchange, a newsletter that goes out on Saturdays, based on the column of the same name. You can sign up for the email here.

DoorDash filed to go public on Friday, meaning we’ll have at least one more unicorn IPO before 2020 comes to a close. For a high-level look at its numbers, I wrote this, Danny covered who will profit from the deal, and I noodled on the impact of COVID-19 on its business.

I bring all that up because there is another COVID-19 impacted unicorn that we are expecting to see go public in very short order: Airbnb.

When Airbnb filed to go public in August, it seemed like a solid plan. The company was widely reported to be on an upswing from its COVID-doldrums, the public markets were hot for growth and tech shares, and the pandemic’s caseload in the United States was coming down from its summer highs. It looked great for Airbnb to wrap its Q3, drop its public S-1 with the new numbers, and laugh all the way to the bank after showing investors that even a global pandemic and travel industry depression couldn’t stop it.

And yet. The United States and world at large are now in the midst of the worst COVID-19 spike yet, and consumer spend is going down right before we get the company’s S-1. November feels less winsome for an Airbnb recovery than August or September did. Still, when Airbnb files — next week, the scuttlebutt indicates, so get ready — we’ll only have a look at its numbers through the third quarter.

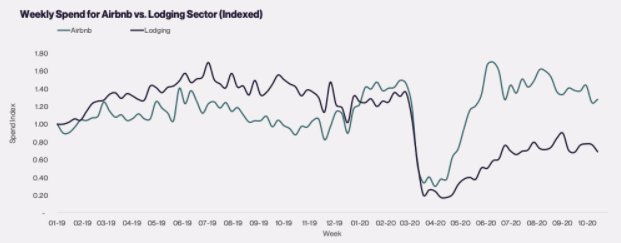

That’s effectively the same timeframe for a dataset that the folks at Cardify sent over and I dug through. Per the company, which tracks real-time consumer spend data, here’s a look at how well Airbnb recovered ahead of its larger industry after the initial recession in pandemic lodging spend:

Impressive, right? Sadly for Airbnb, the initial boom of demand through late June into July tapered as time continued.

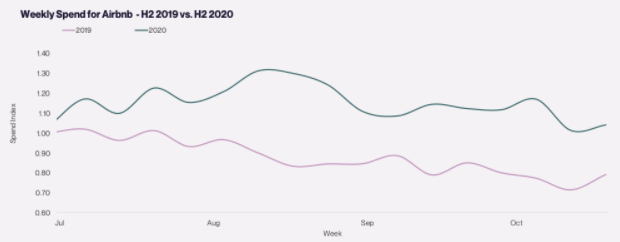

Zooming in somewhat, here’s Airbnb spend data from July 2020 through the end of October, the first month of Q4, compared to the same period of 2019:

Declines, then, but still an encouraging set of data for the company regardless. I would not have expected Airbnb spend — via third-party, admittedly — to be this strong.

The trend of folks renting a house for a month seems to have diminished somewhat, in case you are factoring that into your mental math concerning Airbnb revenues from the above charts. Cardify told TechCrunch that after peaking at around +70% in the March-April timeframe, “average booking sizes have now normalized and are approximately 30% higher on a YTD basis.”

There is weakness in October, the charts show, but that appears to be at least partially seasonal given the 2019 line, so I don’t want to over-ascribe rising COVID cases as the cause. The drooping line, however, was echoed in similar SimilarWeb data that was also shared with The Exchange. The dataset concerned accommodation booking volume around the world for a number of travel services, including Airbnb. Its data tracking the US market showed that a bookings recovery through September that made up some ground on March lows was undercut by October declines. Europe’s bookings’ recovery peaked in July and has been falling ever since. Asian volume is creeping higher, but down sharply from prior levels.

It was a mixed picture, but as Airbnb is doing better than its broader industry per Cardify, the aggregated data could be leading us to be more pessimistic than we otherwise need to be. We’ll see shortly what the real numbers are, but I couldn’t help but share what I was reading with you. On to the S-1!

Before DoorDash filed, we were going to talk about Brex today in this space after Airbnb. But, since we got extra busy, expect those notes early next week on The Exchange.

The week was super busy with earnings, so I’ve collected a few notes from calls with select companies after they reported. Apologies to everyone’s’ favorite reporting firm, but we’re space-limited.

Appian crushed earnings expectations. What drove the low-code application development services’ growth forward? According to CEO Matt Calkins, it wasn’t a single thing. Instead, the company’s performance was driven by a long ramp he said, though he did also state that the concept of low-code has reached the public consciousness in new, higher levels during the last few quarters.

Why? The year’s chaos pushed companies into new patterns faster than they had anticipated. Chalk this result up to the accelerating digital transformation being real, which is good news for startups. (For more on Appian and the low-code space, head here.)

Alteryx gave The Exchange an earnings first, providing both its newly former CEO Dean Stoecker and its new CEO Mark Anderson to chat results. The company crushed Q3 expectations, but its Q4 projections did not excite investors. What was up? Anderson argued that ARR growth, not forward GAAP revenue projections, is the most transparent and clear view of an expanding software company, to paraphrase his thinking. You can’t ignore revenue, he said, but given the nuances in how revenue is counted, pay attention to ARR.

Alteryx has a solid ARR target for 2021. We’ll see how investors view its Q4 results and if they align their thinking to that of the new CEO. Alteryx’s former CEO is bullish, saying that in time the market will realize that analytics is at the epicenter of digital transformation. And his company will be there with code to sell.

Moving along, earlier this week I asked a number of VCs about the software venture capital market in the wake of Monday’s sharp selloff and my question about what might happen to public and private software companies if other stocks suddenly became more attractive — strong vaccine news on Monday was later overwhelmed by surging cases as the week went along, but on Monday Zoom lost billions in value as investors fled.

One set of responses came in late, but I wanted to share them all the same as they were more bullish than I anticipated. In the view of Laela Sturdy, a general partner at Alphabet Capital G, “private software investors are unlikely to change their investing patterns much as a result of fluctuations in the public market,” adding later that “public market changes would have to be very extreme — as in 30 percent or more — in order to impact growth stage valuations.”

The connection between public valuations and trading patterns and private capital deployment exists, but how closely the two are linked depends on what’s happening at any given moment, and it appears that at the moment private investor excitement about software is durable.

Sturdy explained why that may be: “Long-term secular trends around cloud adoption, automation and AI, data, security, fintech infrastructure, and the ongoing rapid acceleration of digital transformation will help tech companies maintain their status as the darlings of growth investors in both the private and public markets.”

And finally, the rest of the stuff that I couldn’t get to this week. Here we go:

Closing with something fun, remember that look we did of the performance of various startups in Q3? That was fun. Anyhoo, no-code “online form builder” JotForm told The Exchange that its revenue is up 50% from its 2019 results, that its enterprise customer base is up 620%, and that it expects to reach “100,000 total paid users by end of year.” Neat!

Powered by WPeMatico

DoorDash filed to go public today, publishing numbers that showed rapid growth, enhanced profitability and an improving cash flow record which helped explain how the company had grown to a $16 billion valuation while private. The unicorn’s impending liquidity event will enrich a host of venture capital firms that bet on its eventual maturity.

Instead of posting this entry of The Exchange on Monday, we’ve put it out today for your Friday and weekend reading. Enjoy! — Alex and Walter.

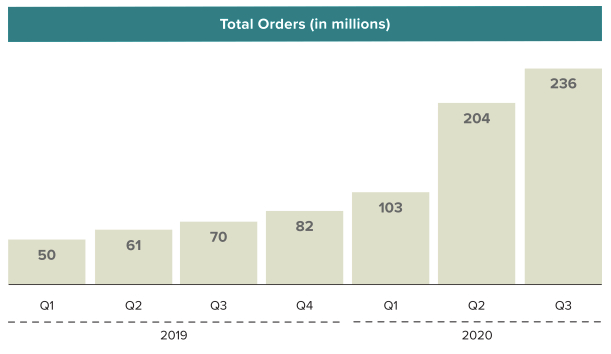

But notable in DoorDash’s impressive results is the impact of COVID-19, accelerating secular trends already in place, and boosting the unicorn’s growth. Before we get into pricing this IPO and guessing what the company might be worth, let’s strive to understand what portion of its 2020 business gains could stem from the pandemic — and might not persist into the future.

We’re not being pessimistic; we merely want to better understand the company. And DoorDash agrees with our general thrust, writing in its S-1 filing that “58% of all adults and 70% of millennials say that they are more likely to have restaurant food delivered than they were two years ago,” adding that it believes “the COVID-19 pandemic has further accelerated these trends.”

Even more, elsewhere in its filings DoorDash states plainly that COVD-19 led it to experience “a significant increase in revenue, Total Orders, and Marketplace [gross order volume] due to increased consumer demand for delivery, more merchants using our platform to facilitate both delivery and take-out, and improved efficiency of our local logistics platform.” The company then went on to warn investors that the “circumstances that have accelerated the growth of our business stemming from the effects of the COVID-19 pandemic may not continue in the future, and we expect the growth rates in revenue, Total Orders, and Marketplace [gross order volume] to decline in future periods.”

We’re not idly speculating.

Let’s observe how DoorDash’s growth accelerated from 2019 through 2020 and then peek at how the company’s economics improved during the same period, giving the company a shot at adjusted profitability for the full year, a nearly unheard of result in the on-demand market.

DoorDash generates revenue when a customer orders food via its service, splitting the total bill of food costs, taxes, fees and tips, distributing them to itself, the merchant creating the goods and the delivery person.

In an “illustrative” example that DoorDash notes its 2019 “approximate average per-order information,” the split works out as follows:

Given that the company is giving us old data and DoorDash’s performance has been stellar this year in terms of generating more gross profit, I wonder what has happened amidst 2020’s upheaval. But, the old numbers do for what we need, which is to understand the link between gross order volume (GOV) and DoorDash revenue. When the former goes up, the latter goes up.

So, as orders rise:

Powered by WPeMatico

Silicon Valley peer-to-peer car rental startup Getaround has secured a $25 million loan from Horizon Technology Finance Corporation. The financing announcement comes one month after Getaround raised $140 million from investors, including SoftBank Vision Fund, Menlo Ventures, Reid Hoffman and Mark Pincus’ Reinvent Capital.

Getaround’s raise signals that the company is looking for new ways to secure cash without further diluting executives or investors.

A Getaround spokesperson said “Horizon presented an opportunity that provides us with additional capital to accelerate our plans in the same way as our recent Series E fundraise.”

Dan Devorsetz, Horizon’s chief investment officer, told TechCrunch that venture debt has been a part of Getaround’s financing strategy for 2020.

“It diversifies funding sources and lowers their overall cost of capital, while also mitigating the dilution impact of incremental equity,” he said. While he wouldn’t clarify on where the debt capital was going, he said that the debt is allowing Getaround to accomplish both “working capital needs and long-term strategic growth initiatives.”

Getaround, like many travel-related startups, struggled in the beginning of the pandemic as governments issued stay-at-home orders in an effort to keep the disease caused by coronavirus from spreading. Bookings dropped 75% in March, forcing Getaround to lay off 100 employees. The company also applied and received approval for a Paycheck Protection Program loan to help retain workers. Getaround previously told TechCrunch that the program “helped reduce the otherwise severe impact on the health of our organization,” due to lockdowns and coronavirus restrictions.

Demand returned in May as travelers turned to cars instead of flights for short-distance trips. Getaround CEO Sam Zaid last told TechCrunch that worldwide revenue has more than doubled from pre-COVID baselines.

By July, Getaround said it had rehired all of its furloughed employees.

There have been scattered signs of a comeback throughout the mobility industry. This week, Uber had its highest close since IPO, and Lyft saw its ride revenues recover enough to give investors some calm.

The upshot: The green shoots have sprouted. But will another wave of COVID-19 nip those buds before they can establish roots?

Getaround’s decision to pursue debt financing so soon after raising a six-figure venture capital round could signal the company’s anticipation of another lockdown, and subsequent drop in bookings. Unlike other mobility companies, Getaround doesn’t own the cars, trucks and SUVs on its rental platform, a benefit that could help the company weather a short downturn.

Powered by WPeMatico