Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Metromile, the pay-per-mile auto insurer that earlier this year laid off a third of its staff due to economic uncertainties caused by COVID-19, is taking the SPAC path to the public markets.

The company, which was founded in 2011 and is led by CEO Dan Preston, said it has reached a merger agreement with special purpose acquisition company INSU Acquisition Corp. II, with an equity valuation of $1.3 billion.

Metromile said it was able to raise $160 million in private investment in public equity, or PIPE, in an investment round led by Chamath Palihapitiya’s firm Social Capital. Existing investors Hudson Structured Capital Management and Mark Cuban, as well as new backers Miller Value and Clearbridge participated. Metromile will have about $294 million of cash at closing.

The company plans to use those proceeds to reduce existing debt and accelerate growth, specifically to hire employees to support its consumer insurance and enterprise businesses, and grow beyond its eight-state geographic footprint to a goal of 21 states by the end of next year and nationwide coverage by the end of 2022.

Metromile is credited for disrupting some of the inefficiencies of the auto insurance business model, notably how consumers are charged. Instead of a standard flat fee, Metromile charges customers based on their mileage, which it is able to measure via a device plugged into the vehicle. Some two-thirds of U.S. drivers are considered low-mileage, according to Metromile. By charging per mile, Metromile says its customers save 47% on average compared to their previous insurer.

The company developed a mobile app, which besides allowing users to file claims, offers other features such as alerting the driver of possible parking violations due to street sweeping activity. Now, with three billion miles of driver data, the company is able to make predictive models that help lower customer costs and improve their overall experience.

The company also built out an enterprise division in 2019 that offers a cloud-based software as a service to large legacy insurers. Metromile licenses components of its platform, including claims automation and fraud detection tools.

The COVID-19 pandemic created initial headwinds for Metromile, which had been one of the fastest-growing startups in the Bay Area. Metromile ended up laying off about 100 people as it aimed to pare back its workforce. The company said at the time that its business was affected by pandemic-related stay-at-home orders, which caused its customers to drive less. The pandemic also prompted U.S. drivers to shop around for insurance and look for deals that supported their shift to lower mileage.

Investor Cuban said in the company’s SPAC announcement sees an upside for the business.

“During these times of financial hardship, unemployment and work from home, Metromile provides an important insurance alternative,” Cuban said. “The option to pay for insurance by the mile is a game changer and why I’m incredibly excited about Metromile’s future!”

Social Capital’s Palihapitiya is equally bullish on the company, tweeting Tuesday “Buffett had Geico. I pick @Metromile.”

Metromile has hired back staff and returned employees that it placed on furlough this spring. Today, the company has more than 230 employees and doesn’t expect any reductions in the workforce in the future. Instead, the company told TechCrunch it plans to hire additional staff on the expectation that both its consumer and enterprise businesses will grow “considerably” in the next few years.

The transaction is expected to close in the first quarter of 2021. The combined company will be named Metromile Inc., and is expected to remain listed on NASDAQ under the new ticker symbol “MLE.”

Powered by WPeMatico

Dija, a new U.K.-based startup founded by senior former Deliveroo employees, is closing in on $20 million in funding, TechCrunch has learned.

According to multiple sources, the round, which has yet to close, is being led by Blossom Capital, the early-stage venture capital firm founded by ex-Index and LocalGlobe VC Ophelia Brown. It’s not clear who else is in the running, although I understand it was highly contested and the startup had offers from several top-tier funds. Blossom Capital and Dija declined to comment.

Playing in the convenience store and delivery space, yet to launch Dija is founded by Alberto Menolascina and Yusuf Saban, who both spent a number of years at Deliveroo in senior positions.

Menolascina was previously director of Corporate Strategy and Development at the takeout delivery behemoth and held several positions before that. He also co-founded Everli (formerly Supermercato24), the Instacart-styled grocery delivery company in Italy, and also worked at Just Eat.

Saban is the former chief of staff to CEO at Deliveroo and also worked at investment bank Morgan Stanley.

In other words, both are seasoned operators in food logistics, from startups to scale-ups. Both Menolascina and Saban were also instrumental in Deliveroo’s Series D, E and F funding rounds.

Meanwhile, few details are public about Dija, except that it will offer convenience and fresh food delivery using a “dark” convenience store mode, seeing it build out hyper local fulfilment centers in urban high population areas for super quick delivery. It’s likely akin to Accel and SoftBank-backed goPuff in the U.S. or perhaps startup Weezy in the U.K.

That said, the model is yet to be proven everywhere it’s been tried and will likely be a capital intensive race in which Dija is off to a good start. And, of course, with everybody making the shift to online groceries while in a pandemic, as ever, timing is everything.

Powered by WPeMatico

Time flies.

It was nearly a year ago that The Exchange started keeping tabs on startups that managed to reach $100 million in annual recurring revenue, or ARR. Our goal was to determine which unicorns were more than paper horses so we could keep tabs on upcoming IPO targets.

We found that Bill.com, Asana, WalkMe and Druva were impressively large and growing nicely. Since then two of the four companies from that post have gone public.

GitLab, Egnyte, Braze and O’Reilly Media joined the club before 2019 was even closed, with two of those companies taking part in the recent Disrupt conference, talking about how they managed their historical growth.

In early 2020 we added Sisense, Siteminder, Monday.com and Lemonade to the club, wrote about ExtraHop’s path to $100 million ARR, Cloudinary’s epic growth sans external capital, Siteminder’s own records and BounceX reaching $100 million ARR while it rebranded to Wunderkind.

In early 2020 we added Sisense, Siteminder, Monday.com and Lemonade to the club, wrote about ExtraHop’s path to $100 million ARR, Cloudinary’s epic growth sans external capital, Siteminder’s own records and BounceX reaching $100 million ARR while it rebranded to Wunderkind.

As the year rolled along, MetroMile, Tricentis, Kaltura and Diligent joined the club. As did Recorded Future, ON24 and ActiveCampaign. There were even more names: Movable Ink, Noom, Riskified, Seismic, ThoughtSpot, along with Snow Software, A Cloud Guru, Zeta Global and Upgrade.

Today we have three more names to add to the group: UserTesting, Udemy’s business arm and Expensify. But, more than merely adding those companies to the mix — more after the jump — I wanted to shake up our radar a bit as we head into 2021.

Yes, The Exchange will keep tabs on startups and other private companies that reach $100 million in ARR, or annual run rate, as the case may be. But next year we also want to find the startups around $50 million ARR that are growing like hell. We want to go a year or two earlier in growth histories to better watch how startups scale into nine-figure revenues, instead of hearing about it after the fact.

So, if you are a startup that is expanding aggressively and will reach the $50 million revenue mark inside the next quarter or two, please say hello. I suspect a good cut of the global unicorn market could fit this bill, and therefore might provide a window into which highly valued startups are growing into their valuations.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

It’s going to be fun. Now, let’s quickly chat about the latest members of the $100 million ARR club.

You’ve heard of each of our $100 million ARR companies this morning, so there’s less need for prelude and introduction. Here’s the group:

Expensify is an expense-tracking company well-known around the technology world, so it’s no real surprise that it has reached the $100 million ARR threshold, a feat it announced yesterday.

But the company did us one better than merely dropping a single data point and racing back into the shadows. Instead, Expensify also disclosed that it has “maintained profitability for years [and] recorded its highest monthly revenue ever in October.”

Powered by WPeMatico

Supply chains used to be one of those magical elements of capitalism that seemed to be designed by Apple: they just worked. Minus the occasional salmonella outbreak in your vegetable aisle, we could go about our daily consumer lives never really questioning how our fast-fashion clothes, tech gadgets and medical supplies actually got to our shelves or homes.

Of course, a lot has changed over the past few years. Anti-globalization sentiment has grown as a political force, driving governments like the United States and the United Kingdom to renegotiate free trade agreements and attempt to onshore manufacturing while disrupting the trade status quo. Meanwhile, the COVID-19 pandemic placed huge stress on supply chains — with some entirely breaking in the process.

In short, supply chain managers suddenly went from one of those key functions that no one wants to think about, to one of those key functions that everyone thinks about all the time.

While these specialists have access to huge platforms from companies like Oracle and SAP, they need additional intelligence to understand where these supply chains could potentially break. Are there links in the supply chain that might be more brittle than at first glance? Are there factories in the supply chain that are on alert lists for child labor or environmental violations? What if government trade policy shifts — are we at risk of watching products sit in a cargo container at a port?

New York-headquartered Altana wants to be that intelligence layer for supply chain management, bringing data and machine learning to bear against the complexity of modern capitalism. Today, the company announced that it has raised $7 million in seed financing led by Anne Glover of London-based Amadeus Capital Partners.

The three founders of the startup, CEO Evan Smith, CTO Peter Swartz and COO Raphael Tehranian, all worked together on Panjiva, a global supply chain platform that was founded in 2006, funded by Battery Ventures a decade ago, and sold to S&P Global in early 2018. Panjiva’s goal was to build a “graph” of supply chains that would offer intelligence to managers.

That direct experience informs Altana’s vision, which in many ways is the same as Panjiva’s but perhaps revamped using newer technology and data science. Again, Altana wants to build a supply chain knowledge graph, provide intelligence to managers and create better resilience.

The difference has to do with data. “What we continually found when we were in the data sales business was that you are kind of stuck in that place in the value chain,” Smith said. “Your customers won’t let you touch their data, because they don’t trust you with it, and other proprietary data companies don’t let you work on and manage and transform their data.”

Instead of trying to be the central repository for all data, Altana is “operating downstream” from all of these data sources, allowing companies to build their own supply chain graphs using their own data and whatever other data sources to which they have access.

The company sells into procurement offices, which are typically managed in the CFO’s office. Today, the majority of customers for Altana are government clients such as border control, where “the task is to pick the needles out of the haystack as the ship arrives and you’ve got to pick the illicit shipments from the safe ones and actually facilitate the lawful trade,” Smith said.

The company’s executive chairman is Alan Bersin, who is a former commissioner of the U.S. Customs and Border Protection agency currently working as a policy consultant for Covington & Burling, which has been one of the premier law firms on trade issues like CFIUS during the Trump administration.

Altana allows one-off investigations and simulations, but its major product goal is to offer real-time alerts that give supply chain managers substantive visibility into changes that affect their business. For instance, rather than waiting for an annual labor or environmental audit to find issues, Altana hopes to provide predictive capabilities that allow companies to solve problems much faster than before.

In addition to Amadeus, Schematic Ventures, AlleyCorp and the Working Capital – The Supply Chain Investment Fund also participated.

Powered by WPeMatico

Consumer drones have over the years struggled with an image of being no more than expensive and delicate toys. But applications in industrial, military and enterprise scenarios have shown that there is indeed a market for unmanned aerial vehicles, and today, a startup that makes drones for some of those latter purposes is announcing a large round of funding and a partnership that provides a picture of how the drone industry will look in years to come.

Percepto, which makes drones — both the hardware and software — to monitor and analyze industrial sites and other physical work areas largely unattended by people, has raised $45 million in a Series B round of funding.

Alongside this, it is now working with Boston Dynamics and has integrated its Spot robots with Percepto’s Sparrow drones, with the aim being better infrastructure assessments, and potentially more as Spot’s agility improves.

The funding is being led by a strategic backer, Koch Disruptive Technologies, the investment arm of industrial giant Koch Industries (which has interests in energy, minerals, chemicals and related areas), with participation also from new investors State of Mind Ventures, Atento Capital, Summit Peak Investments and Delek-US. Previous investors U.S. Venture Partners, Spider Capital and Arkin Holdings also participated. (It appears that Boston Dynamics and SoftBank are not part of this investment.)

Israel-based Percepto has now raised $72.5 million since it was founded in 2014, and it’s not disclosing its valuation, but CEO and founder Dor Abuhasira described as “a very good round.”

“It gives us the ability to create a category leader,” Abuhasira said in an interview. It has customers in around 10 countries, with the list including ENEL, Florida Power and Light and Verizon.

While some drone makers have focused on building hardware, and others are working specifically on the analytics, computer vision and other critical technology that needs to be in place on the software side for drones to work correctly and safely, Percepto has taken what I referred to, and Abuhasira confirmed, as the “Apple approach”: vertical integration as far as Percepto can take it on its own.

That has included hiring teams with specializations in AI, computer vision, navigation and analytics as well as those strong in industrial hardware — all strong areas in the Israel tech landscape, by virtue of it being so closely tied with its military investments. (Note: Percepto does not make its own chips: these are currently acquired from Nvidia, he confirmed to me.)

“The Apple approach is the only one that works in drones,” he said. “That’s because it is all still too complicated. For those offering an Android-style approach, there are cracks in the complete flow.”

It presents the product as a “drone-in-a-box”, which means in part that those buying it have little work to do to set it up to work, but also refers to how it works: its drones leave the box to make a flight to collect data, and then return to the box to recharge and transfer more information, alongside the data that is picked up in real time.

The drones themselves operate on an on-demand basis: they fly in part for regular monitoring, to detect changes that could point to issues; and they can also be launched to collect data as a result of engineers requesting information. The product is marketed by Percepto as “AIM”, short for autonomous site inspection and monitoring.

News broke last week that Amazon has been reorganising its Prime Air efforts — one sign of how some more consumer-facing business applications — despite many developments — may still have some turbulence ahead before they are commercially viable. Businesses like Percepto’s stand in contrast to that, with their focus specifically on flying over, and collecting data, in areas where there are precisely no people present.

It has dovetailed with a bigger focus from industries on the efficiencies (and cost savings) you can get with automation, which in turn has become the centerpiece of how industry is investing in the buzz phrase of the moment, “digital transformation.”

“We believe Percepto AIM addresses a multi-billion-dollar issue for numerous industries and will change the way manufacturing sites are managed in the IoT, Industry 4.0 era,” said Chase Koch, president of Koch Disruptive Technologies, in a statement. “Percepto’s track record in autonomous technology and data analytics is impressive, and we believe it is uniquely positioned to deliver the remote operations center of the future. We look forward to partnering with the Percepto team to make this happen.”

The partnership with Boston Dynamics is notable for a couple of reasons: it speaks to how various robotics hardware will work together in tandem in an automated, unmanned world, and it speaks to how Boston Dynamics is pulling up its socks.

On the latter front, the company has been making waves in the world of robotics for years, specifically with its agile and strong dog-like (with names like “Spot” and “Big Dog”) robots that can cover rugged terrain and handle tussles without falling apart.

That led it into the arms of Google, which acquired it as part of its own secretive moonshot efforts, in 2013. That never panned out into a business, and probably gave Google more complicated optics at a time when it was already being seen as too powerful. Then, SoftBank stepped in to pick it up, along with other robotics assets, in 2017. That hasn’t really gone anywhere either, it seems, and just this month it was reported that Boston Dynamics was reportedly facing yet another suitor, Hyundai.

All of this is to say that partnerships with third parties that are going places (quite literally) become strong signs of how Boston Dynamics’ extensive R&D investments might finally pay off with enterprising dividends.

Indeed, while Percepto has focused on its own vertical integration, longer term and more generally there is an argument to be made for more interoperability and collaboration between the various companies building “connected” and smart hardware for industrial, physical applications.

It means that specific industries can focus on the special equipment and expertise they require, while at the same time complementing that with hardware and software that are recognised as best-in-class. Abuhasira said that he expects the Boston Dynamics partnership to be the first of many.

That makes this first one an interesting template. The partnership will see Spot carrying Percepto’s payloads for high-resolution imaging and thermal vision “to detect issues including hot spots on machines or electrical conductors, water and steam leaks around plants and equipment with degraded performance, with the data relayed via AIM.” It will also mean a more thorough picture, beyond what you get from the air. And, potentially, you might imagine a time in the future when the data that the combined devices source results even in Spot (or perhaps a third piece of autonomous hardware) carrying out repairs or other assistance.

“Combining Percepto’s Sparrow drone with Spot creates a unique solution for remote inspection,” said Michael Perry, VP of Business Development at Boston Dynamics, in a statement. “This partnership demonstrates the value of harnessing robotic collaborations and the insurmountable benefits to worker safety and cost savings that robotics can bring to industries that involve hazardous or remote work.”

Powered by WPeMatico

Cashfree, an Indian startup that offers a wide-range of payments services to businesses, has raised $35.3 million in a new financing round as the profitable firm looks to broaden its offering.

The Bangalore-based startup’s Series B was led by London-headquartered private equity firm Apis Partners (which invested through its Growth Fund II), with participation from existing investors Y Combinator and Smilegate Investments. The new round brings the startup’s to-date raise to $42 million.

Cashfree kickstarted its journey in 2015 as a solution for restaurants in Bangalore that needed an efficient way for their delivery personnel to collect cash from customers.

Akash Sinha and Reeju Datta, the founders of Cashfree, did not have any prior experience with payments. When their merchants asked if they could build a service to accept payments online, the founders quickly realized that Cashfree could serve a wider purpose.

In the early days, Cashfree also struggled to court investors, many of whom did not think a payments processing firm could grow big — and do so fast enough. But the startup’s fate changed after Y Combinator accepted its application, even though the founders had missed the deadline and couldn’t arrive to join the batch on time. Y Combinator later financed Cashfree’s seed round.

Fast-forward five years, Cashfree today offers more than a dozen products and services and helps over 55,000 businesses disburse salary to employees, accept payments online, set up recurring payments and settle marketplace commissions.

Some of its customers include financial services startup Cred, online grocer BigBasket, food delivery platform Zomato, insurers HDFC Ergo and Acko and travel ticketing service provider Ixigo. The startup works with several banks and also offers integrations with platforms such as Shopify, PayPal and Amazon Pay.

Based on its offerings, Cashfree today competes with scores of startups, but it has an edge — if not many. Cashfree has been profitable for the past three years, Sinha, who serves as the startup’s chief executive, told TechCrunch in an interview.

“Cashfree has maintained a leadership position in this space and is now going through a period of rapid growth fuelled by the development of unique and innovative products that serve the needs of its customers,” Udayan Goyal, co-founder and a managing partner at Apis, said in a statement.

The startup processed over $12 billion in payments volumes in the financial year that ended in March. Sinha said part of the fresh fund will be deployed in R&D so that Cashfree can scale its technology stack and build more services, including those that can digitize more offline payments for its clients.

Cashfree is also working on building cross-border payments solutions to explore opportunities in emerging markets, he said.

“We still see payments as an evolving industry with its own challenges and we would be investing in next-gen payments as well as banking tech to make payments processing easier and more reliable. With the solid foundation of in-house technologies, tech-driven processes and in-depth industry knowledge, we are confident of growing Cashfree to be the leader in the payments space in India and internationally,” he said.

Powered by WPeMatico

A spate of startups focused on mental health recently made enough noise as a group that they caught the eye of the Equity podcast crew. Sadly, the segment we’d planned to discuss this topic was swept away by a blizzard of IPO filings that piled up like fresh snow.

But in preparation, I reached out to CB Insights for new data on the mental health startup space that they were kind enough to supply. So this morning we’re going to dig into it.

Regular readers of The Exchange will recall that we last dug into overall wellness venture capital investment in August, noting that it was mental health startups inside the vertical that were seeing the most impressive results.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

I wanted to know what had happened even more recently.

After all, Spring Health recently raised $76 million for its service that helps companies offer their workers mental health benefits, Mantra Health disclosed that it has raised $3.2 million to help with college-age mental health issues and Joon Care announced $3.5 million in new capital to “grow its remote therapy service for teens and young adults,” per GeekWire.

Sticking to theme, Headway just raised $32 million to build a platform that “helps people search for and engage therapists who accept insurance for payments,” according to our own reporting, and online therapy provider Talkspace is pursuing a sale — it looks like an active time in the mental health startup realm.

So, let’s shovel into the latest data and see if the signals that we are seeing really do reflect more total investment into mental health startups, or if we’re overindexing off a few news items.

So, let’s shovel into the latest data and see if the signals that we are seeing really do reflect more total investment into mental health startups, or if we’re overindexing off a few news items.

To prepare the ground, let’s talk about the general state of healthcare investing in the venture capital world. Per CB Insights’ Q3 healthcare VC report, venture capital deal volume and venture capital dollar volume reached new record highs in the sector during Q3 2020.

The quarter’s 1,539 rounds and $21.8 billion in invested capital were each comfortably ahead of prior records set in Q2 2018 for round volume (1,431) and Q2 2020 for dollar volume ($18.4 billion) for healthcare startups.

Powered by WPeMatico

Superpeer, a startup that helps experts share and monetize their knowledge online, is announcing that it has raised $8 million in additional funding.

As I wrote in March, the Superpeer platform allows experts to promote, schedule and charge for one-on-one video calls with anyone who might want to ask for their advice.

In addition to announcing funding, the startup is also moving beyond one-on-one sessions by launching paid channels, where experts can charge a subscription fee for access to larger group sessions with video and chat. Co-founder and CEO Devrim Yasar suggested that channels allow Superpeer experts to be more accessible, reaching a larger audience by hosting sessions that cost less money to watch.

“It can be hard to say, ‘Hi, I’m Anthony Ha, if you want to talk to me, my hourly rate is $500,’ ” Yasar said. (To be clear: I would never say that.) “But if you have a channel where anyone can subscribe for $1 or $5, that makes you feel better that you are accessible.”

Plus, you can still offer (and charge more for) one-on-one meetings, say for subscribers who still have “burning questions” after a channel session.

In the midst of the pandemic, we’re seeing a widespread embrace of online mentoring and content as a new source of revenue. Last week, for example, Squarespace launched a new paywall feature called Member Areas, and I’ve also written about another video mentoring platform called Prox.

Yasar acknowledged that things are getting pretty competitive, but he said that Superpeer is trying to build the most attractive brand for public intellectuals and thought leaders — he described the vision (half-jokingly, half-proudly) as “OnlyFans for brains.”

“If you are an intellectual, if you have an audience, if you are a TED speaker with 30 million views on your video, you’ve never had a platform to really monetize that audience,” Yasar said. “All you could do is maybe write a book and sell that, you could be a guest at someone else’s event [but not much else]. Those people don’t want to go to YouTube or Instagram, that’s not the brand that they associate themselves with.”

Beyond branding, Yasar said that Superpeer has also worked hard on the technology side to create a lightweight video experience in the browser.

The new round comes from Acrew Capital, Audacious Ventures, Homebrew, Moxxie Ventures, Brianne Kimmel, Scott Belsky and OnDeck, and it brings Superpeer’s total funding to $10 million.

Yasar said the startup will be expanding its growth, partnership and revenue teams. It also will be offering financial support for experts through a brand ambassador program, though the company is still working out the details.

And if you’d like to see the platform in action, I’ll also be talking to Yasar and his investors at Eniac Ventures tomorrow in a free session at noon Eastern.

Powered by WPeMatico

AvePoint, a company that gives enterprises using Microsoft Office 365, SharePoint and Teams a control layer on top of these tools, announced today that it would be going public via a SPAC merger with Apex Technology Acquisition Corporation in a deal that values AvePoint at around $2 billion.

The acquisition brings together some powerful technology executives, with Apex run by former Oracle CFO Jeff Epstein and former Goldman Sachs head of technology investment banking Brad Koenig, who will now be working closely with AvePoint’s CEO Tianyi Jiang. Apex filed for a $305 million SPAC in September 2019.

Under the terms of the transaction, Apex’s balance of $352 million plus a $140 million additional private investment will be handed over to AvePoint. Once transaction fees and other considerations are paid for, AvePoint is expected to have $252 million on its balance sheet. Existing AvePoint shareholders will own approximately 72% of the combined entity, with the balance held by the Apex SPAC and the private investment owners.

Jiang sees this as a way to keep growing the company. “Going public now gives us the ability to meet this demand and scale up faster across product innovation, channel marketing, international markets and customer success initiatives,” he said in a statement.

AvePoint was founded in 2001 as a company to help ease the complexity of SharePoint installations, which at the time were all on-premise. Today, it has adapted to the shift to the cloud as a SaaS tool and primarily acts as a policy layer enabling companies to make sure employees are using these tools in a compliant way.

The company raised $200 million in January this year led by Sixth Street Partners (formerly TPG Sixth Street Partners), with additional participation from prior investor Goldman Sachs, meaning that Koenig was probably familiar with the company based on his previous role.

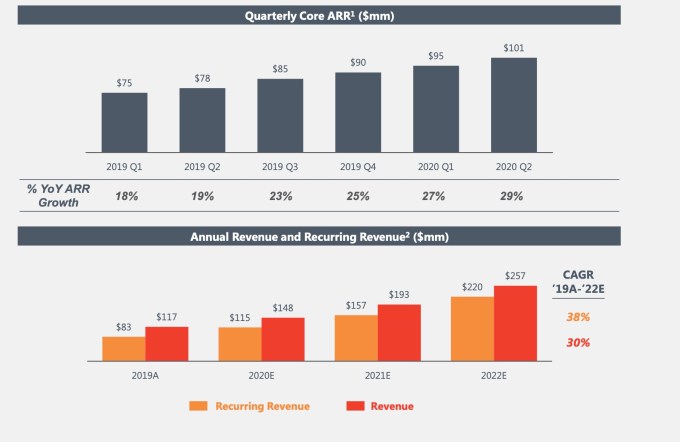

The company has raised a total of $294 million in capital before today’s announcement. It expects to generate almost $150 million in revenue by the end of this year, with ARR growing at over 30%. It’s worth noting that the company’s ARR and revenue has been growing steadily since Q12019. The company is projecting significant growth for the next two years with revenue estimates of $257 million and ARR of $220 million by the end of 2022.

Image Credits: AvePoint

The deal is expected to close in the first quarter of next year. Upon close the company will continue to be known as AvePoint and be publicly traded on Nasdaq under the new ticker symbol AVPT.

Powered by WPeMatico

This is The TechCrunch Exchange, a newsletter that goes out on Saturdays, based on the column of the same name. You can sign up for the email here.

I had a neat look into the world of mental health startup fundraising planned for this week, but after being slow-motion carpet-bombed by S-1s, that is now shoved off to Monday and we have to pause and talk about COVID-19.

The pandemic has been the most animating force for startups and venture capital in 2020, discounting the slow movement of global business into the digital realm. But COVID did more than that, as we all know. It crashed some companies as assuredly as it gave others a boost. For every Peloton there is probably a Toast, in other words.

Such is the case with this week’s crop of unicorn IPO candidates, though they are unsurprisingly weighted far more toward the COVID-accelerated cohort of startups instead of the group of startups that the pandemic cut off at the knees.

More simply, COVID-19 gave most of our recent IPOs a polite shove in the back, helping them jog a bit faster toward the public-offering finish line. Let’s talk about it.

Roblox, the gaming company that targets kids, has been a beneficiary during the COVID-19 pandemic, as folks stayed home and, it appears, gave their kids money to buy in-game currency so that their parents could have some peace. Great business, even if Roblox warned that growth could slow sharply next year, when compared to its epic 2020 gains.

But Roblox is hardly the only company taking advantage of COVID-19’s impacts on the market to get public while their numbers are stellar. We saw DoorDash file last week, crowing from atop a mountain of revenue growth that came in part from you and I trying to stay home since March. As it turns out you order more delivery when you can’t leave your house.

Affirm got a COVID-19 boost as well, with not only e-commerce spend growing — Affirm provides point-of-sale loans to consumers during online shopping — but also because Peloton took off, and lots of folks chose to finance their new exercise bike with the payment service. Call it a double-boost.

The IPO is well-timed. Wish falls into the same bucket, though it did hit some supply-chain and delivery issues due to the pandemic, so you could argue it either way.

Regardless, as we have seen from global numbers, COVID-19 is very much not done wreaking havoc on our health, happiness, and ability to go about normal life. So the trends that this week’s S-1s have shown us still have some room to run.

Which is irksome for Airbnb, a unicorn that was supposed to have debuted already via a direct listing, but instead had to hit pause, borrow money, lay off staff, and now jog to the startup finish line with less revenue in this Q3 than the last. In time, Airbnb will get back to full-speed, but among our new IPO candidates it’s the only company net-harmed by COVID-19. That makes it special.

There are other trends to keep tabs on, regarding the pandemic. Not every software company that you might expect to be thriving at the moment actually is; Workday shares are off 8% today as I write to you, because the company said that COVID-19 is harming its ability to land new customers. Here’s its CFO Robynne Sisco from its earnings call

Keep in mind, however, that while we have seen some recent stability in the underlying environment, headwinds due to COVID remains particularly to net new bookings. And given our subscription model, these headwinds that have impacted us all year will be more fully evident in next year’s subscription revenue weighing on our growth in the near-term.

Yeesh. So don’t look at recent IPOs and think that all things are good for all companies, or even all software companies. (To be clear, the pandemic is a human crisis, but my job is to talk about its business impacts so here we are. Hugs, and please stay as safe as you can.)

There was so much news this week that we have to be annoyingly summary.

I caught up with Brex CEO Henrique Dubugras the other day, giving The Exchange a chance to parse what happened to the company during the early COVID days when the company decided to cut staff. The short answer from the CEO is that the company went from growing 10% to 15% each month, to seeing negative growth — not a sin, Airbnb saw negative gross bookings for a few months earlier this year — and as the company had hired for a big year, it had to make cuts. Dubugras talked about how hard of a choice that was to make.

Brex’s business rebounded faster than the company expected, however, driven in part by strong new business formation — some data here — and companies rapidly moving into the digital realm and moving to finance systems like Brex’s.

Looking forward, Dubugras wants to expand the pool of companies that Brex can underwrite, which makes sense as that would open up its market size quite a lot. And the company is as remote as companies are now, with its CEO opening up during our chat about the pros and cons of the move. Happily for the business fintech unicorn, Dubugras said that some of the negatives of companies working more remotely haven’t been as tough as expected.

Next up: Growth metric. Verbit, a startup that uses AI to transcribe and caption videos, raised a $60 million Series C this week led by Sapphire Ventures. I couldn’t get to the round, but the company did note in its release that it has seen 400% year-over-year revenue growth, and that its “revenue run-rate [has] grown five-fold since 2019.” Nice.

Jai Das led the round for Verbit, and, in a quirk of good timing, I’m hosting an Extra Crunch Live with him in a few weeks. (Extra Crunch sub required for that, head here if you need one. The discount code ‘EQUITY’ should still be working if it helps.)

Telos, a Virginia-based cybersecurity and identity company went public this week. It fell under our radar because there is more news than we have hands to type it up. Such is the rapid-fire news cycle of late 2020. But, to catch us both up, Telos priced midrange but with an upsized offering, valuing it around $1 billion, according to MarketWatch.

After going public, Telos shares have performed well. Cybersecurity is having one hell of a year.

Turning back to our favorite topic in the world, SaaS, ProfitWell’s Patrick Campbell dropped a grip of data on the impact of COVID-19 on the B2B SaaS market. Mostly it’s positive. There was a hit early on, but then growth seems to have accelerated. Just keep in mind the Workday example from earlier; not everyone is in software growth paradise as 2020 comes to a close.

And, finally, after Affirm released its S-1 filing, competing service Klarna decided it was a good time to drop some performance data of its own. First of all, Klarna — thanks. We like data. Second of all, just go public. Klarna said that it grew from 10 million customers in the United States to 11 million in three weeks, and that the second statistic was up 106% compared to its year-ago tally.

Affirm, you are now required by honor to update your S-1 with even more data as an arch-nerd clapback. Sorry, I don’t make the rules.

Alright, that’s enough of all that. Chat to you soon, and I hope that you are safe and well and good.

Powered by WPeMatico