Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

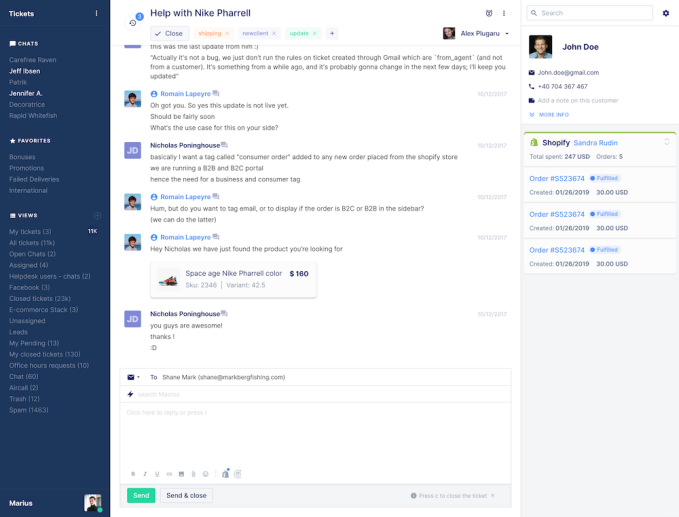

Gorgias announced today that it has raised $25 million in Series B funding, bringing the startup’s pre-money valuation to $300 million.

When the company raised its Series A just over a year ago, CEO Romain Lapeyre (who founded Gorgias with CTO Alex Plugaru) told me that it works with e-commerce businesses to automate responses to their most common customer service questions, while also providing tools that help the support team respond more quickly and even convince customers to buy additional products and services.

Gorgias says it now supports more than 4,500 stores, including Steve Madden, Timbuk2, Fjällräven, Marine Layer, Ellana, Electrolux and Sergio Tacchini. And revenue has grown 200% this year.

That may not be surprising, given the overall growth in e-commerce during the pandemic. As Lapeyre put it, merchants saw “a huge boost” in online orders, which resulted in a similar rise in customer service requests — so they’re increasingly turning to Gorgias for help.

Initially, Lapeyre said merchants are just eager to respond to their customers more quickly and to make their support team more efficient. But over time, they become more interested in using customer support “as way to drive sales.” In fact, he recalled talking to one business that used to compensate its support team based on response time and now offers them a sales commission.

Image Credits: Gorgias

He said he expects these trends to continue after the pandemic ends: “We just jumped five years into the future.”

Gorgias has now raised a total of $40 million. The new round was led by Sapphire Ventures, with participation from SaaStr, Alven, Amplify Partners, CRV and Greycroft.

Lapeyere said the money will allow Gorgias to continue hiring (it went from a team of 30 people to more 100 people this year), particularly on the engineering side, where it can develop even more automation for the platform.

“As consumers increasingly shop online, the Gorgias platform powers a new breed of customer support for high-growth e-commerce brands,” said Sapphire Ventures Managing Director Rajeev Dham in a statement. “Co-founder and CEO Romain Lapeyre and team have built an incredible product that provides e-commerce merchants with a single app to manage all of their customer communications — ultimately delivering a far better customer experience.”

Powered by WPeMatico

Demand for contactless payments and e-commerce has grown in South Korea during the COVID-19 pandemic. This is good news for payment service operators, but the market is very fragmented, so adding payment options is a time-consuming process for many merchants. CHAI wants to fix this with an API that enables companies to accept over 20 payment systems. The Seoul-based startup announced today it has raised a $60 million Series B.

The round was led by Hanhwa Investment & Securities, with participation from SoftBank Ventures Asia (the early-stage venture capital arm of SoftBank Group), SK Networks, Aarden Partners and other strategic partners. It brings CHAI’s total funding to $75 million, including a $15 million Series A in February.

Last month, the Bank of Korea, South Korea’s central bank, released a report showing that ()contactless payments increased 17% year-over-year since the start of COVID-19.

CHAI serves e-commerce companies with an API called I’mport, that allows them to accept payments from over twenty options, including debit and credit cards through local payment gateways, digital wallets, wire transfers, carrier billings and PayPal. It is now used by 2,200 merchants, including Nike Korea and Philip Morris Korea.

CHAI chief executive officer Daniel Shin told TechCrunch that businesses would usually have to integrate each kind of online payment type separately, so I’mport saves its clients a lot of time.

The company also offers its own digital wallet and debit card called the CHAI Card, which launched in June 2019 and now has 2.5 million users, a small number compared South Korea’s leading digital wallets, which include Samsung Pay, Naver Pay, Kakao Pay and Toss.

“CHAI is a late comer to Korea’s digital payments market, but we saw a unique opportunity to offer value,” said Shin. The CHAI Card offers merchants a lower transaction fee than other cards and users typically check its app about 20 times to see new cashback offers and other rewards based on how often they pay with their cards or digital wallet.

“We’ve digitized the plastic card experience, and this is the first step towards creating a robust online rewards platform,” Shin added.

In press statement, Hanhwa Investment & Securities director SeungYoung Oh director said, “I’mport has reduced what once took e-commerce businesses weeks to complete into a simple copy-and-paste task, radically reducing costs. It is a first-of-its-kind business model in Korea, and I have no doubt that CHAI will continue to grow this service into an essential infrastructure of the global fintech landscape.”

Powered by WPeMatico

The Federal Trade Commission has sued to block Procter & Gamble’s acquisition of Billie, a NY-based startup that sells razors and body wash.

In the notice, the FTC alleged that the merger would “eliminate innovative nascent competitors for wet shave razors” to the loss of consumers.

Billie was founded in 2017 with the goal of fighting the “pink tax” on goods marketed to women, including razors and body wash. It went up against companies like P&G and Edgewell Personal Care by offering high-quality and cheap razors. The company announced its intent to be acquired by P&G after raising just $35 million in venture capital in June.

“As its sales grew, Billie was likely to expand into brick-and-mortar stores, posing a serious threat to P&G. If P&G can snuff out Billie’s rapid competitive growth, consumers will likely face higher prices,” Ian Conner, director of the FTC’s Bureau of Competition said in a statement.

P&G has been on a buying spree as of late. Along with the Billie news, Procter & Gamble acquired Walker & Company, which created Bevel, a grooming line for men of color, and Form, a hair-care line for women of color. In February 2019, P&G announced plans to acquire This is L, a feminine-care brand that sells tampons, pads and wipes.

If the FTC wins, this is another blow for direct-to-consumer brands on the base of competition dynamics. In May 2019, Edgewell Personal Care announced it intended to buy Harry’s, another direct-to-consumer shaving brand. In February 2020, the FTC filed a lawsuit to block the deal from happening, similarly citing how the deal would limit competition and innovation in the razor market.

Unlike Harry’s, Billie was bought before it broke into brick-and-mortar retail stores. If the deal doesn’t close, Billie lost precious time it could have used to expand into new locations and markets — and P&G will lose some of its competitive advantage in the women’s shaving world.

Harry’s and Billie’s blocks could negatively trickle down to hurt direct-to-consumer products looking at health and wellness more broadly.

Note that exit market isn’t as dull for all companies in the consumer packaged goods (CPG) world. We’ve seen deals close like Blue Bunny’s buy of Halo Top, Mars’ acquisition of Kind Bars and, of course, Unilever’s $1 billion acquisition of Dollar Shave Club.

Andrea Hernández, a founder and consultant on food and beverage CPG, says that DTC companies often need to partner with mega-businesses to get the distribution scale they need, focusing more on omni-channel presence versus a single seller point.

“It’s very limited for these companies to scale at the same level and grow without incurring debt or needing constant injections of [money],” she said. “Or [you can go] the preferred route which is having BigDaddyCorp come whisk you away. You get a success story and the resources to continue your journey.”

That said, the coronavirus has even impacted food CPG companies by forcing them to slash SKUs (or stock keeping units) and prioritize essential goods. Whereas before, CPG companies might stock a variety of goods for a variety of customer needs, they’re now prioritizing a smaller slice of the pie to manage uncertainty among consumer behavior. Long-term, this means that CPGs might be buying fewer of the Billies and Harry’s of the world and just focusing on what’s working now.

Regardless of how this plays out, today’s news shows that the FTC is paying more attention than ever to consumer and tech.

Powered by WPeMatico

Thumbtack, a marketplace where you can hire local professionals for home improvement and other services, is announcing that it has acquired Setter.

Founded in 2016, Setter provides its customers with video home checkups conducted by experts, then offers personalized plans for how to address any issues. In a blog post, Thumbtack CEO Marco Zappacosta said that by acquiring the startup, his company will be able to offer those same consultations, which in turn could lead to recommendations for different Thumbtack services.

“This is an enormous step for Thumbtack,” Zappacosta wrote. “We won’t just be the platform homeowners turn to when a pipe breaks. We’ll be the only app any homeowner needs for the care and maintenance of their home. For our pros, this means there will be more projects than ever on our platform.”

In response to emailed questions, Zappacosta told me that Thumbtack will “likely” offer both free and paid home consultations: “Our goal is to get this in the hands of as many people as possible and to give homeowners peace of mind when it comes to home maintenance.”

He also said the entire Setter team will be joining Thumbtack, giving the company a presence in Toronto.

“Homeownership is hard,” said Setter co-founder and President David Steckel in a statement. “Together with Thumbtack, we can now give our homeowners both a game plan and a way to tackle their to dos all on one platform.”

The financial terms of the acquisition were not disclosed. According to Crunchbase, Setter raised a total of $12 million from investors including Sequoia Capital and NFX.

Thumbtack laid off 250 employees at the end of March, after the company saw big declines in its major markets. Since then, however, Zappacosta said there’s been “a renewed focus on the home and an acceleration of digital adoption.”

“In this new era of hyperfocus on the home, we are seeing permanent changes in consumer behavior,” he added. “People are investing in their most important asset, their home.”

Powered by WPeMatico

Funding-round stories are TechCrunch’s bread and butter.

For early-stage companies, the fact that an investor has put thousands, millions (or billions) into an idea that will likely fail, and might never make money, is big news. That’s a story that we can tell every day.

From time to time, a debate pops up about the role of funding-round stories: Are financings the right metric to focus on? Should the trend be scratched and reinvented? After all, raising money is not indicative of making money. Let’s be real: news needs news to be published. There needs to be a tension, or a surprise, but most of all, a reason for the reader to keep reading.

It’s a healthy conversation, and one the Equity crew decided to discuss last Friday:

It’s easy to mock funding-round coverage: There are far more rounds than hands to write them, so the coverage is inherently partial; they are a poor milestone to use as a benchmark for growth; and coverage of the startup in question nearly always has an overly positive tilt, given that the piece in question centers around something that is a win for the company.

Yet, I still think they are worth writing and try to get to a few each week.

There are good reasons for doing so that run counter to the obvious complaints. Sure, there are more rounds than we could ever cover, but in theory we’re filtering as best we can for the most interesting, the furthest outlying and the trend-elucidating rounds that we can use as a light to better illuminate how the broader startup and technology worlds are changing.

I think TechCrunch does a reasonable job of picking the right companies to cover and we spend a good amount of time aggregating discrete funding events into trends. It’s super-hard work, as covering a single round is time-consuming and ultimately not incredibly well-read.

And yes, funding rounds are not really milestones to celebrate. The startup isn’t suddenly destined to win. Capital just means that the venture class has increased its wager on the startup generating more wealth for themselves and their backers, whom are largely already rich.

But trying to lever any information from private companies is an exercise in sadistic dentistry, and startups tend to open up the most around funding rounds. So, if you want to chat with a CEO on the record for half an hour, the next time their startup raises is probably your best chance.

And there is signal in a venture round. Someone felt strongly enough about the company’s prospects to inject it with more capital, making a funding event a reasonable signal that something is going on at the company.

Then there’s the issue of positive bias. All publications have a bias. TechCrunch has many biases, the most important and salutary of which is that we think that startups are cool. We do! Quickly-growing, private companies are inherently interesting and I came back to this publication in part so that I could keep writing about them. I am never bored.

So, yes, funding-round coverage tends to be a bit more on the positive side of balanced than I would like, but I balance that by becoming increasingly orthodox as a startup scales. When a young company raises its first few million, the chat with the CEO is her telling me about her small team, first customers and fitful progress.

By the time she raises a $50 million Series C, we’re talking gross margin expansion, YoY ARR growth and diversity metrics. Before she takes her unicorn public, I’m asking pressing questions about GAAP results, the public markets and what sort of external offers are coming in for the whole concern.

Being slightly optimistic about startups when they’re young is, then, tempered by increasing scrutiny as the company grows. That seems like a fair balance for the company and our readers.

So I won’t stop covering funding rounds. Even if I didn’t have this job I probably still would for my personal blog. I always learn something from high-growth companies; they have a window into the market that is dynamic and far from ossified. And early-stage founders tend to not be overly media-trained, so they are still interesting.

And sometimes something you write winds up changing the direction of a startup. That’s always a very weird and disconcerting feeling. But as this impact is nearly always good for the company in question, you’ve only accidentally made the lives of others a bit better for a short while. It’s not so harsh a sentence.

Covering startups is one of the hardest news beats out there (trust me, I’m unbiased — I cover startups for a living).

If you cover the Senate, you report regularly on 100 individuals, their staffs and interactions. If you cover banking, you watch a handful of banks since no one gives a flying rat’s tushy about the industry’s middle market. There’s generally a limited scope in political and general business reporting where you know the key players and the key newsmakers.

In startups, you cover … everything. There are a couple of hot sectors that everyone is talking about … and then there is every other sector that might be the next hot sector, but no one has ever heard of it. It’s probably not important. But it might just be. That startup you talked to this week sounds boring. Four years later, it sells for $20 billion. The startup world is constantly changing, and unless you blow up your whole worldview on a regular basis, you’ll never keep up.

Powered by WPeMatico

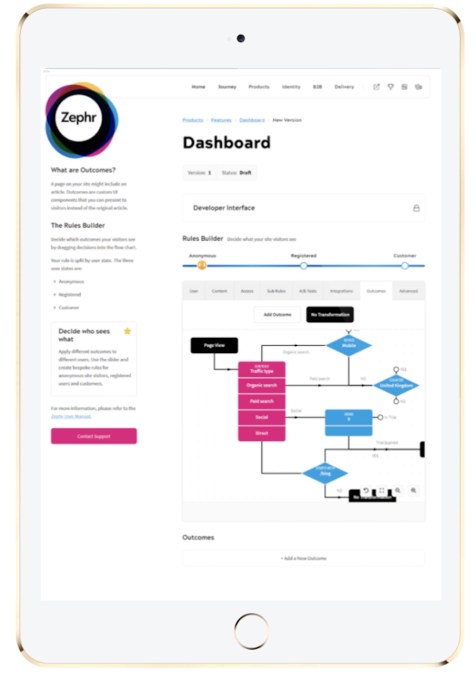

Zephr has raised $8 million in a new funding round led by Bertelsmann Digital Media Investments (owned by media giant Bertelsmann).

The London-headquarted startup’s customers already include publishers like McClatchy, News Corp Australia, Dennis Publishing and PEI Media. CEO James Henderson told me via email that rather than creating “a monolithic product that tries to do a bit of everything,” Zephr is “focused entirely on the experience and journey for the prospect or customer,” driving an average 150% increase in conversion rates and 25% increase in subscription revenue within the first six months.

Henderson added, “By offering the right product, package or message at the right time to the right person, Zephr improves conversion rates, drastically decreases churn and drives new, stable revenue.”

To do this, Zephr largely relies on the publisher’s first-party data about its readers — Henderson said that this data is “by far the most important and powerful type of data that Zephr both uses and generates.” But it also takes advantage of contextual data, such as “time of day, to location, device or consumption patterns.”

He also noted that Zephr is a no-code tool, allowing non-technical members of the marketing, revenue and product teams to use a drag-and-drop editor to create different customer journeys.

Image Credits: Zephr

Asked how the pandemic has affected the startup’s business, Henderson said there were both “positive and negative indicators,” with newsrooms seeing record readership but in some cases also freezing spending.

“As firms prepare for a ‘post-pandemic’ world, we are beginning to see our markets seize the opportunity of all these new potential subscribers and invest in subscription models — and in Zephr.” he said. “In publishing and news media, the old model of dominant advertising revenue is on the way out and we are well-placed to capitalize on that interest.”

The new funding also includes financing from Silicon Valley Bank UK Branch and brings Zephr’s total funding to $11 million. Previous investors include Knight Capital and Nauta Capital.

According to the company’s funding announcement, this money will go toward further product development (with a focus on increased personalization), as well as expansion across the United States, Europe and Asia.

“The recent weakness in the advertising market increased pressure for media companies to diversify revenue streams and aim to introduce or optimize subscription models,” said BDMI Managing Director Urs Cete in a statement. “We recognise Zephr’s excellent technology that empowers publishers to galvanise the online subscription opportunity and create customer journeys that are truly unique.”

Powered by WPeMatico

Latin America’s startup scene has attracted troves of venture investment, lifting highly-valued companies such as Rappi and NuBank into behemoth businesses. Now that the spotlight has arrived, those same startups need more talent than ever before to meet demand.

That’s where one seed-stage Buenos Aires startup wants to help. Henry has created an online computer science school that trains software developers from low-income backgrounds to understand technical skills and get employed. The company was founded by brother-sister duo Luz and Martin Borchardt, as well as Manuel Barna Ferrés, Antonio Tralice and Leonardo Maglia.

The Henry team.

The company claims that there’s an estimated 1 million software engineering job openings in Latin America, but fewer than 100,000 professionals that have training suitable for those roles.

“Higher education is only for 13% of the population in Latin America,” says Martin Borchardt, CEO and co-founder of Henry . “It’s very exclusive, very expensive, and has very low impact skills. So we’re giving these people an opportunity.”

With 90% of graduates coming from no formal higher education background, Henry seeks to help bring more back-end junior developers and full-stack developers into startups. Henry offers a five-month course that goes from Monday to Friday, 9 a.m. to 6 p.m., which focuses on software developer skills. Beyond technical training, Henry gives participants job coaching, resume workshops and up-skilling opportunities post-graduation.

To make the school more affordable, Henry looks to take on the same strategy used by Lambda School, a YC-graduate that has raised over $122 million in known funding: income-share agreements. The set-up would allow for boot camp participants to join the program at zero upfront costs, and then only pay once they get hired at a job.

Lambda School’s ISA terms ask students to pay 17% of their monthly salary for 24 months once they earn $4,167 monthly. The students pay a maximum of $30,000. Henry takes a much smaller slice of the pie, partly because salaries are lower in Latin American than in the United States. Henry asks students to pay 15% of their monthly salary for 24 months once students earn $500 a month.

If a Henry student doesn’t get employed in a job that allows them to make $500 a month within five years after the program completes, they are off the hook for paying back the boot camp.

Henry is also focused on helping more women get into the field of software development. Internally, Henry’s remote team is 20% women, 64% men. The current students reflect the same breakdown.

One issue with coding boot camps is that while it might help a student go from unemployed to employed, the lack of credential and degree might limit career mobility past that first job. For that reason, Henry has created a database of alumni resources, including up-skilling and reskilling opportunities in the latest skill, which will be free of charge for graduates.

Henry needs to execute on job placement to be successful in its field. Currently, more than 80% of students in Henry’s first cohort have found jobs, but it’s too soon in the startups’ trajectory to get a stronger metric on that front. About four Henry graduates have been employed by the startup.

The need for more talent in emerging countries has not gone unnoticed. Microverse, also funded by Y Combinator, is similarly using income-sharing agreements to bring education to the masses in developing countries, including spaces in Latin America. Henry thinks the competitor is approaching the dynamic too broadly.

“They’re focusing on all emerging markets and don’t teach to Spanish speakers,” Borchardt said. Henry, alternatively, focuses on Spanish speakers, over 60% of its market in Latin America.

What if Lambda School, the source of Henry’s inspiration, was to break into Latin America? The founder added that the richly funded company has tried, and failed, to expand into international geographies, including China and Europe, due to fragmentation.

Currently, Henry has graduated 200 students and is working with 600 students across Colombia, Chile, Uruguay and Argentina. It plans to expand into Mexico and to bring on Portuguese instruction.

Now, VCs are giving Henry some cash to do so. After going through Y Combinator’s Summer batch, Henry announced today that it has raised $1.5 million in seed funding in a round led by Accion Venture Lab, Emles Venture Partners and Noveus VC. There were also a number of edtech angel investors from Latin American that participated in the round.

“I love the human interaction within instructors and our staff and students,” Borchardt said. “That is something very powerful of Henry compared to a MOOC. The biggest challenge is how do you scale maintaining those assets that bring you that?”

Powered by WPeMatico

Esports One, a startup bringing the fantasy approach to esports, is announcing that it has raised an additional $4 million in funding.

When I first wrote about Esports One in April, co-founder and COO Sharon Winter described it as the first “all-in-one fantasy platform” in the esports world, allowing you to research players, create fantasy teams and watch games, with an initial focus on the North American and European divisions of League of Legends.

According to the Esports One team, creating this platform required building out a set of data and analytics products, as well as using computer vision technology that can track game activity (and update player stats) without relying on a publisher’s API.

The startup says its user base has been growing by more than 25% month-over-month. It may also have benefited from the pause in professional sports earlier this year, while CEO and co-founder Matt Gunnin told me recently that he also sees fantasy as a way to make video games accessible to a broader audience — he recalled one Esports One user who introduced his sister to League of Legends using the fantasy platform.

“I use the example of growing up and sitting there with my dad, watching a baseball game, he’s telling me everything that’s happening,” Gunnin said. “Now it’s the opposite — parents are sitting and watching their kids.”

Many parents, he suggested, are “never going to pick up a mouse and keyboard and play League of Legends,” but they might play the fantasy version: “That’s an entry point … if we can make it easily accessible to individuals both that are hardcore gamers playing video games and watching League of Legends their entire life, as well as someone who has no idea what’s going on.”

The new funding was led led by XSeed Capital, Eniac Ventures, and Chestnut Street Ventures, bringing Esports One to a total of $7.3 million raised. The company also recently signed a partnership deal with lifestyle company ESL Gaming.

Gunnin said the money will allow the company to grow its Bytes virtual currency, which players use to enter contests and buy customizations — starting next year, players will be able to spend real money to purchase Bytes. In addition, it’s working on native iOS and Android apps (Esports One is currently accessible via desktop and mobile web).

Gunnin and his team also plan to develop fantasy competitions for Rainbow Six: Siege, Rocket League, Valorant and Fortnite.

“As a fairly new player in the esports world, we’ve seen immense determination and grit from Matt, Sharon, and the whole Esports One team to grow into a household name,” said XSeed’s Damon Cronkey in a statement. “I’m excited to be partnering with a company that will deliver new perspectives and features to an evolving industry. We’re eager to see how Esports One grows in 2021.”

Powered by WPeMatico

ANYbotics, the creators of ANYmal, a four-legged autonomous robot platform intended for a variety of industrial uses, has raised a $20 million Swiss Franc (~$22.3 million) round A to continue developing and scaling the business. With similar robots just beginning to break into the mainstream, the market seems ready to take off.

The company spun out of ETH Zurich in 2016, at which point the robot was already well into development. ANYmal is superficially similar to Spot, the familiar quadrupedal robot from Boston Dynamics, but the comparison mustn’t be taken too far. A four-legged robot is a natural form for navigating and interacting with environments built for humans.

ANYbotics is on the third generation of the robot, which has progressively integrated computing units and sensors of increasing sophistication.

“Our current ANYmal C model features three built-in high-end Intel i7 computers that power the robot and customer-applications such as automated inspection tasks,” explained co-founder and CEO Péter Fankhauser in an email to TechCrunch. “The availability of smaller and more performant sensors, propelled by AR/VR and autonomous driving applications, has enabled us to equip the latest ANYmal model with 360-degree situational awareness and long-range scanning capabilities. Where commercially available components are not satisfactory, we invest in our proprietary technologies, which have resulted in core components such as custom motors, docking stations, and inspection payload units.”

The most obvious application for robots like ANYmal is inspection of facilities that would normally involve a human. If a robot can traverse the same paths, climb stairs, open doors and so on, it can do so more frequently and regularly than its human counterparts, who tire and take breaks. It also can monitor and relay its surroundings in detail, using lidar and RGB cameras, among other tools. Humans can then perform the more difficult (and human) work of integrating that information and making decisions based on it. An ANYmal at a factory, power plant, or data center could save costs and shoe leather.

Of course, that’s no use if the bot is fragile; fortunately, that’s not the case.

“In terms of mobility, we have focused on what matters most to our industrial customers: Operational reliability and robustness to harsh environmental conditions,” Fankhauser said. “For example, we design and test ANYmal for day and night usage in indoor and outdoor locations, including offshore platforms with salty air and large temperature ranges. It’s less about agility in these environments but more about reliably and safely performing the tasks multiple times a day over many months without human intervention.”

Swisscom Ventures leads the round, and partner Alexander Schläpfer said that good roots (ETHZ is of course highly respected) and good results from early commercial partnerships more than justified their investment.

“Over 10 years ago, some of our co-founders developed their first walking robots during their studies at ETH Zurich,” said Fankhauser. “Today, the industries are ready to adopt this technology, and we are deploying our robots to our early customers.”

Powered by WPeMatico

Ultimate.ai, a virtual customer service agent builder, has closed a $20 million Series A round of funding, led by Omers Ventures with participation from Felicis Ventures and existing investors HV Capital, and Maki.vc — bringing its total raised to date to more than $25 million.

The European startup’s flagship claim for the data-ingesting bot-builder platform is it’s capable of automating up to 80% of customer support interactions.

The focus, as tends to be the case for all these customer service conversational AI plays, is freeing (human) support agents from dealing with dull, repetitive stuff — so they can apply their (less limited) skills to more complex, consultative or emotionally demanding customer queries.

When we last spoke to the Helsinki- and Berlin-based startup, back in 2018 for a $1.3 million seed round, it described itself as a “language-agnostic” conversational AI — having started out with the hard (linguistic) challenge of Finnish — claiming that gave it an edge in a competitive space with customers in non-English speaking markets. (Though it did also tackle English too.)

Two years on the startup’s marketing focus is broader; today it talks about its customer service automation platform as an “AI-first” ‘no code’ tool — sating it wants to empower b2c users to get the most out of AI by helping them design virtual agents that can usefully handle complex customer interactions.

ultimate.ai will hand-hold you through the process of building a super savvy customer service robot, is the pitch.

Co-founder and CEO Reetu Kainulainen claims it’s always been “no code and intuitive” — though there’s now a handy reference label to align what it’s doing with a wider b2b trend. (‘No code’ or ‘low code’ referring to a digital tool-building movement that aims to widen access to powerful technologies like AI without the need for the user to possess deep technical know-how in order to make useful use of them.)

“Everything we build is to guide users to creating the best virtual agents. The whole user journey — discovery, design, expansion — is all within ultimate.ai,” Kainulainen tells TechCrunch.

“In the past two years, we have been laser focused on building a very deep customer service automation platform — one that goes beyond simple FAQ answers in chat — and enables brands to design complex, personalized workflows that can be deployed across all digital support channels.

“We believe that customer service automation will be its own category in the future and so we are working hard to define what that means today.”

As an example, Kainulainen points to “one click” integration with “any major CRM” (including Salesforce and Zendesk) — which lets customers quickly import existing customer support logs so ultimate.ai’s platform can analyze the data to help them build a useful bot.

“Immediately, you are shown a breakdown of your most common customer service cases and the impact automation can have for your business,” he goes on, saying the platform shows templates and “best practices” to help the customer design their automation workflows — “tailored for your cases and industry”.

Once a virtual agent is live users can run A/B tests via the platform to check and optimize performance — and, here too, the promise is further hand-holding, with Kainulainen saying it will “proactively suggests new cases and data to improve your virtual agent”.

“Where we are very strong is in large-scale customer support organizations, who are looking for a holistic, advanced automation platform that can be managed and implemented by non-technical users,” he says.

“The bigger picture is that each of our competitors views the opportunity more narrowly than ultimate.ai does: Our best competitors are either focused on chatbots only, or otherwise limited to the ecosystem of their mother company. Our vision has always been the big picture: Of automation becoming one of the primary means of providing customer service.”

Having multilingual smarts remains an advantage, with ultimate.ai’s virtual agents able to handle interactions in over 20 languages at this point.

“Our market — the customer service automation market — has a lot of players,” Kainulainen goes on, name-checking the likes of Ada Support and Einstein Bots (Salesforce’s own solution) as key competitors.

“This is because it is new and, until recently, solutions were so early that there were virtually no barriers to entry. But the market has changed a lot in the last four years. There are now only a handful of players globally that are worth paying attention to and we are one of them.”

The 2016-founded startup is hitting the nail on the head for a growing number of customers — with close to 100 signed up to its platform at this point, including the likes of Deezer, Telia, Footasylum, and Finnair. Per Kainulainen, it works best for “b2c brands with large (and often repetitive) customer service volumes”.

“This is where automation can provide a huge impact from day one and really free up people to take on more creative and challenging work. We have a broad customer base of close to 100 great brands… and do particularly well in industries like retail/ecommerce, telecommunications and travel,” he adds.

It’s enjoyed a major growth spurt this year, as businesses of all stripes were forced to ramp up their attention to online customer interactions as the coronavirus pandemic became an engine for digital activity.

Customer retention has also risen in priority for many businesses, as a highly contagious virus and public health safety measures put in place to reduce its spread, flipped markets into recession — which Kainulainen points to as another growth driver.

Overall, he says it’s tripled ARR over the last 12 months (albeit, it was the same growth story last year too). Plus it’s tripled headcount to deal with the COVID-19 effect.

Now ultimate.ai is gearing up for fresh growth — saying it’s expecting major developments next year.

“COVID-19 has… prompted one of the most accelerated periods of change in the customer service industry,” says Kainulainen, predicting 2021 will bring “immense innovation” in the space — and that “booming” automation technologies will take “center stage”.

Of course it’s a convenient narrative for a customer service chatbot maker to tell.

But COVID-19 is clearly accelerating digital transformation of consumer focused businesses — a movement that, logically, pumps demand for smarter tools to handle online customer support. So those positioned to harness new momentum for customer service automation — by being able to offer an accessible, scalable and effective product (as ultimate.ai claims it does) — are sitting pretty in the middle of a pandemic.

“We believe that the best product will win this market,” adds Kainulainen. “We have a big vision for what we want ultimate.ai to be. Market maturity for our technology has accelerated massively in 2020, achieving in one year what could have probably taken five. We will capitalize on that by building more, faster.”

The Series A funding will go on sales and marketing, with a planned market push in North America and a desire to go deeper throughout Europe, as well as being ploughed into further product development.

And while — clearly — not every potential b2c customer will be able to ‘automagic’ away 80% of their customer support pings, Kainulainen argues ultimate.ai can still offer a compelling sales pitch to businesses with more “consultative” customer support needs, where automation will only be able to play a far more limited role.

“There’s often a strong correlation between how consultative a customer service organization needs to be and how highly trained and experienced their team is. In other words, it is often the case that organizations with ‘lower bound’ automation potential also only need 10% automation to still drive a huge ROI,” he suggests.

“For example, one of our customers is a large national pharmacy group, where customer service agents are qualified pharmacists who provide prescription medical advice. Here, the goal isn’t to achieve a very high automation rate but rather to automate basic, repetitive processes to free up the pharmacists for more challenging tasks that better use their capabilities.

“For this customer, in addition to the automation of simple requests (which alone provides a huge value) our real-time answer recommendations help pharmacists respond faster and easier.”

Commenting on the Series A in a statement, Omers Ventures managing partner, Jambu Palaniappan, dubbed the startup’s growth “truly spectacular”, as well as lauding its “world-class team” and founders “with a strong vision and unrivalled knowledge of AI”.

“There are numerous chatbot companies out there but ultimate.ai represents something much bigger because at its core is an automation company with massive potential,” he added. “We look forward to working with Sarah, Reetu, Jaakko, and Markus as they expand internationally and advance their deep product capabilities even further.”

“The customer service industry is undergoing an automation revolution. In ultimate.ai, we saw a vision that’s bold enough to lead the way,” added Aydin Senkut, founder and managing partner of Felicis Ventures, in another supporting statement. “We believe that, just in the same way that category leaders have defined marketing and sales automation, ultimate.ai will do the same for customer service.”

Jambu Palaniappan, managing partner at Omers Ventures, will join the ultimate.ai board. Aydin Senkut, founder and managing partner of Felicis Ventures, will join as an investor, alongside former head of Airbnb for Business Mark McCabe, and former EVP global sales of payment giant Adyen, Thijn Lamers.

Powered by WPeMatico