Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

While 2020 won’t be remembered fondly by many of us for much of anything, it was a blockbuster year for enterprise M&A with the top 10 deals totaling an astounding $165.2 billion.

This is the third straight year I’ve done this compilation. Last year the number was $40 billion. The year prior it was $87 billion. Those numbers pale in comparison to 2020’s result.

Last year’s biggest deal — Salesforce buying Tableau for $15.7 billion — would have only been good for fifth place on this year’s list. And last year’s fourth largest deal, where VMware bought Pivotal for $2.7 billion, wouldn’t have even made this year’s list at all.

The 2020 number was lifted by four chip company deals totaling $106 billion alone. Consider that the largest of these deals at $40 billion matched last year’s entire list. But let’s not forget the software company acquisitions, which accounted for the remainder, three of which were via private equity deals.

It’s worth noting that the $165.2 billion figure doesn’t include the Oracle-TikTok debacle, which remains for now in regulatory limbo and may never emerge from it. Nor does it include two purely fintech deals — Morgan Stanley acquiring E-Trade for $13 billion or Intuit snagging Credit Karma for $7.1 billion — but we did include the $5.3 billion Visa-Plaid deal because as it involved an enterprise-y API company we felt like it fit our criteria.

Keep in mind as you go through this year’s list that it appears to be an outlier year in terms of total deal flow. Most years have maybe one or two megadeals, which I would define as over $10 billion. There were six this year. And there were a host of unlisted deals worth between $1 billion and $3.2 billion, several of which would have made it to the list in quieter years.

Without further adieu, here is this year’s Top 10 deals in M&A organized from smallest to largest:

This deal happened just this week as we were writing the story, vaulting into 10th place past the $3.2 billion Twilio-Segment deal. Vista has been active as always and it has added Pluralsight, an online education platform for IT pros with plans to take it private again. At a time when more people are online, this deal seems like a wise move.

This was one of those under-the-radar private equity deals, but one with a bushel of money changing hands. Epicor, hardly a household name, is a mature ERP company dating back to the early 1970s. The company has been on a rocky financial road for much of the 21st century. This could be one of those deals where KKR sees a way to squeeze life from maintenance contracts. Otherwise this one is hard to figure.

In yet another private equity deal, Insight acquired Veeam, a cloud data backup and recovery startup based in Switzerland for $5 billion. This one was one of the earliest deals of 2020 and set the tone for the year. The firm had previously invested $500 million into Veeam and apparently liked what it saw and bought the company. Unlike the Epicor deal, Insight probably plans to invest in the company with an end goal of going public or flipping it for a profit at some point.

Powered by WPeMatico

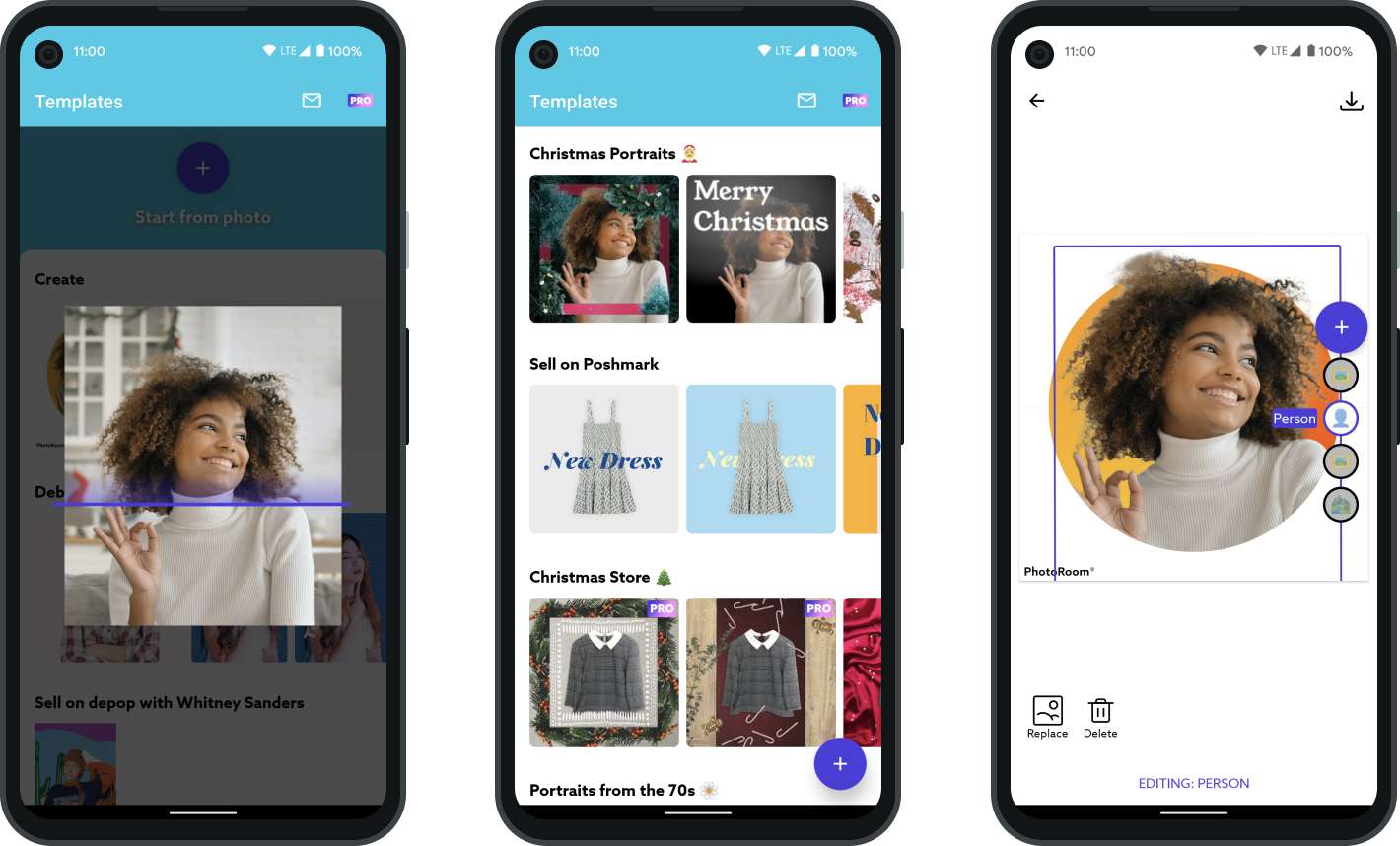

French startup PhotoRoom is launching its app on Android today. The company has been working on a utility photography app that lets you remove the background from a photo, swaps it for another background and tweaks your photo.

And it’s been working well on iOS already, as the company attended Y Combinator, doubled its annual recurring revenue to $2 million and raised a $1.2 million seed round.

In particular, influencers and people reselling clothes and fashion items have been relying on PhotoRoom . They use their phone as their main creativity platform. Like other professional photography apps, the startup relies on subscriptions to generate revenue ($9.49 per month or $46.99 per year).

PhotoRoom relies on machine learning to identify objects and separate them from the rest of the photo. This way, you can manipulate a specific part of your photo.

Image Credits: PhotoRoom

When the startup raised its seed round after Y Combinator, it chose to raise from Nicolas Wittenborn’s Adjacent fund, Liquid2 Ventures, as well as two groups:

With this funding round, the company plans to grow the team from three to eight persons and work on its deep learning algorithm. If you want to learn more about PhotoRoom, feel free to read my take on the product:

Powered by WPeMatico

French fintech startup Lydia has extended its Series B round. Accel is leading the extension with all major existing shareholders also participating. Lydia first raised $45 million in January 2020 — Tencent led that investment. The startup is now raising another $86 million, which means that Lydia has raised $131 million in total as part of its Series B round.

While Lydia wouldn’t discuss the valuation of the round, its co-founder and CEO gave me a hint. “The value of the company has really significantly increased between the two parts of the B round,” he told me.

Interestingly, Amit Jhawar is heading this investment for Accel . He joined Accel as a venture partner in July and he’s going to join Lydia’s board of directors.

Jhawar joined payments company Braintree in 2011 as COO and CFO. Shortly after, Braintree acquired peer-to-peer payment app Venmo. “When we acquired Venmo it was only 15 people. They had just released their mobile app in April of 2012,” Jhawar told me in a phone interview.

PayPal later acquired Braintree and Venmo — Jhawar stuck around until early 2020 to scale Venmo to the huge fintech consumer app that 52 million people use in the U.S. Jhawar believes that peer-to-peer payments represent the beginning of a long-term consumer relationship.

“You know that P2P is successful when they leave money in their account because they’re going to come back,” he said.

Back in 2014, when I first covered Lydia, I called it the Venmo for France — they had only raised €600,000 back then. It seems like Jhawar agrees with that take. Since then, Lydia has grown quite a lot and has expanded beyond peer-to-peer payments in various ways.

With Lydia, you can send money to another user in just a few seconds. You don’t have to enter an account number in your banking app — as long as you know their phone number, they’ll receive your payment.

If you have money in your account, you can choose to spend it directly using a Visa debit card. Lydia lets you generate a virtual card that works with Apple Pay and Google Pay — you can also order a plastic card.

Lydia also supports direct deposit as you get your own IBAN in the app. You can also create money pots and send a link to other users, view your bank accounts in Lydia, donate money to hospitals and charities, get a credit line, etc.

But there’s one killer feature that stands out over the rest. Bank accounts tend to be monolithic and don’t reflect how you use money. “If you look at banks today, they call the main account a checking account. It’s outdated by design,” CEO Cyril Chiche said.

Lydia has created flexible sub-accounts that you can use in many different ways. You can create a second sub-account and set some money aside for your bills. You can create a third one and share it with a few friends because you’re going on a vacation together.

You can move money from one account to another by swiping your finger across the account grid. As you can have multiple contributors and you can change the account associated with your debit card, it means that money flows more naturally. It feels like using a messaging app, not a financial app.

And it’s been working well in France. The company now has more than 4 million users. Transactions have doubled over the past year, which means that usage is accelerating.

“Lydia has the largest P2P network in Europe outside of PayPal and has the potential to grow all across Europe with a mobile-first, customer-focused solution. This will bring demand for incremental consumer financial products and high merchant interest to accept the payment,” Jhawar told me in an email.

And 2020 has been a busy year for Lydia. The company has just released a complete redesign to better position the app as a super app for financial services. All the interactions and all the main tabs have been changed.

Lydia also re-launched its premium offering with two new premium plans that offer you higher limits over the free plan and an insurance package for the most expensive offer. Those plans are more in line with what the app offers today and should contribute to the company’s bottom line. “The next step is bringing Lydia to profitability and it’s something that has always been important for us,” Chiche said in a recent interview.

Behind the scenes, Lydia has also upgraded many core features, such as migrating cards to a new infrastructure, adding alerts to account aggregation, supporting instant SEPA transfers to bank accounts, etc.

In 2021, the company plans to build on top of that new foundation with more financial products. “We’re going to try every single product — credit, savings, investment,” Chiche said.

The company is also slowly expanding to more countries. But it wants to offer a product that feels like a local product with a local card and a local IBAN to increase acceptance rates. Lydia is starting with Portugal.

Powered by WPeMatico

On Monday, Pluralsight, a Utah-based startup that sells software development courses to enterprises, announced that it has been acquired by Vista for $3.5 billion.

The deal, yet to close, is one of the largest enterprise buys of the year: Vista is getting an online training company that helps retrain techies with in-demand skills through online courses in the midst of a booming edtech market. Additionally, the sector is losing one of its few publicly traded companies just two years after it debuted on the stock market.

The Pluralsight acquisition is largely a positive signal that shows the strength of edtech’s capital options as the pandemic continues.

Investors and founders told Techcrunch that the Pluralsight acquisition is largely a positive signal that shows the strength of edtech’s capital options as the pandemic continues.

“What’s happening in edtech is that capital markets are liquidating,” said Deborah Quazzo, managing partner of GSV Advisors.

Quazzo, a seed investor in Pluralsight, said the ability to move fluidly between privately held and publicly held companies is a characteristic of tech sectors with deep capital markets, which is different from edtech’s “old days, where the options to exit were very narrow.”

Powered by WPeMatico

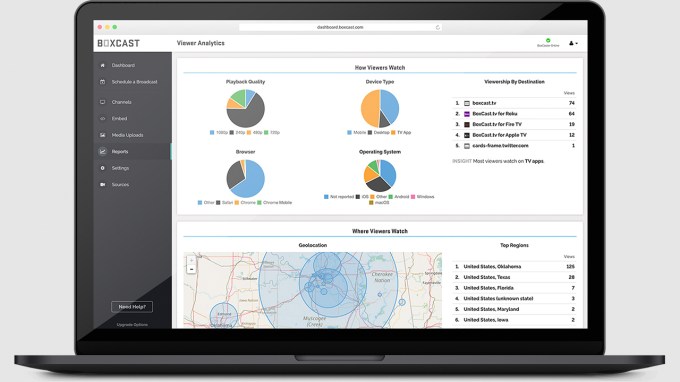

BoxCast, a Cleveland-based company aiming to make it easy to live stream any event, has raised $20 million in Series A funding.

Co-founder and CEO Gordon Daily said that when the company first launched in 2013, “streaming wasn’t something that everyone understood,” and you needed professional help to live stream anything. BoxCast is supposed to make that process accessible to anyone.

The company has created several different video encoder devices, but Daily said the “small box” is just a one piece of BoxCast platform, which is designed to cover all your live-streaming needs, with support for 1080p broadcasting; streaming to Facebook Live, YouTube and your own website; analytics and more — plus there are add-ons like automatic scoreboard displays and event ticketing.

Pricing starts at $99 per month for the “essential” streaming plan, plus $399 for a BoxCast encoder. (You can also just stream from an iOS device.)

And it’s no surprise that 2020 has been a “watershed moment” for the company, as Daily put it, with BoxCast now live streaming millions of events per year — everything from sports to religious services to virtual safaris offered by Sri Lanka’s tourism board.

BoxCast dashboard

“When you can’t even meet in-person … we knew that there was going to be higher usage,” he said. “What caught me off-guard was the volume increase — it’s new customers, it’s existing customers, at peak times there’s a 10x increase [from pre-pandemic usage].”

And while in-person events will hopefully become more common next year, Daily said live streams will still be a valuable tool to reach audiences who can’t attend, and to promote your business or organization with new kinds of programming.

COO Sam Brenner added that while BoxCast employed fewer than 40 people before the pandemic, the team has grown to 56, and will likely double within the next 12 months.

The Series A was led by Updata Partners, with participation from audio equipment manufacturer Shure.

“The live streaming video market has grown dramatically over the last decade, and COVID-19 has accelerated adoption in recent months. BoxCast offers a unique end-to-end platform that makes live streaming easy,” said Updata’s Carter Griffin in a statement. “We’re excited to partner with Gordon and his team, and look forward to contributing to their vision of making live events accessible to all.”

Powered by WPeMatico

Parsec, a startup that’s built streaming technology for both work and play, is announcing that it has raised $25 million in Series B funding.

This brings Parsec’s total funding to $33 million, according to Crunchbase. The round was led by Andreessen Horowitz, with the firm’s general partner Martin Casado joining the board. Previous investors Lerer Hippeau, Makers Fund, NextView Ventures and Notation Capital also participated.

CEO Benjy Boxer told me that since he and CTO Chris Dickson founded the company in 2016, the vision has always been “to make it easier for people to connect to their technology, software and content from anywhere, on any device.”

They started out by helping gamers access their gaming PCs from other devices (the Parsec app is currently available for Windows, Mac, Linux, Android, Raspberry Pi and the web).

“From the beginning, we thought that if we could build something that is great for gaming, it will be great for everything,” Boxer said.

But it was a natural transition to other use cases, since some of the people using Parsec to play games in their free time also turned out to work at TV production companies, video game companies or in other jobs where they need access to high-end workstations. That’s why the company launched Parsec for Teams this year, which offers the same low-latency remote experience, while also adding features like encryption, group permissions and collaboration on the same file.

Image Credits: Parsec

“The performance of Parsec is just way above everything else,” Boxer said. “People forget they’re using Parsec.”

Parsec works with major gaming clients like EA, Ubisoft, Blizzard Entertainment and Square Enix, and it’s also being used in industries like architecture, engineering and video broadcast/production/post-production.

And as you might imagine, the need for something like this has only increased during the pandemic. Boxer said customers have found that the platform is saving their employees more than an hour a day by eliminating the commute and giving them high-speed access to their workstations — rather than, say, having to wait an hour for a 100 gigabyte file to download.

And most of those clients anticipate that after the pandemic, their employees will continue for work from home for part of the time.

“So in that scenario, people are bringing their computers back to the office, and they can use Parsec to make sure it’s always accessible to them,” Boxer said.

On the consumer side, he said that where usage was previously heaviest during the weekends, during the pandemic “there’s no spike anymore on the weekends, people are playing all the time.”

Boxer added that the company will continue developing the core platform, leading to improvements for both gaming and enterprise users, while there’s a separate team focused on building administrative and collaborative features.

Powered by WPeMatico

Enterprise recruiting company iCIMS is announcing that it has acquired Altru.

ICIMS declined to comment on the terms of the deal, but a source with knowledge of the companies told us that the price is a combination of cash and stock, totaling around $60 million.

Founded in 2000, iCIMS offers a “talent cloud” used by more than 4,000 employers to attract, engage and hire new employees, and to help existing employees continue to develop their careers.

Former Marketo chief executive Steve Lucas became CEO in February, and he told me that the recruiting world is overdue for reinvention. After all, every company says they want to hire the most talented people around, so he wondered, “Well, okay, if you want that, why do you create such boring content? Why do you take a job that is exciting and should demand amazing human beings and create this super boring job description?”

Lucas sees video as a key piece of the solution, allowing companies to bring more “authenticity” to what can be a stuffy and bureaucratic process. Just over a month ago, iCIMS announced another acquisition in this area — Paris-based Easyrecrue.

Lucas said that while Easyrecrue has created tools to enrich video interviews, Altru can be most helpful earlier in the recruiting process, when companies are trying to stay connected with the most promising candidates and get them excited about a potential job.

Altru CEO Alykhan Rehmatullah (who founded the startup with CTO Vincent Polidoro — they’re both pictured above) told me that while the company started out with a focus on recording and sharing employee videos for recruitment, its asynchronous videos are becoming used more broadly across companies. He suggested that’s particularly true this year, while teams are working from home and everyone’s looking for ways to communicate that are more expressive than Slack and don’t require putting “another 30-minute Zoom call on your calendar.”

In fact, Lucas said that before talking to me, he’d actually been recording videos on Altru to explain the acquisition to his own team. He praised the platform’s ease of use, joking, “If I can use this thing, anybody can use it.”

Rehmatullah said the entire Altru team will be joining iCIMS, where he’ll become vice president of content strategy. The goal is to continue operating Altru as a standalone product while also finding new ways to integrate it into the iCIMS platform.

Altru previously raised a total of $1.3 million from Birchmere Ventures, Active Capital and Techstars.

Powered by WPeMatico

The hectic M&A cycle we have seen throughout 2020 continued this weekend when Vista Equity Partners announced it was acquiring Pluralsight for $3.5 billion.

That comes out to $20.26 per share. The company stock closed on Friday at $18.50 per share on a market cap of over $2.7 billion.

With Pluralsight, Vista gets an online training company that helps educate IT professionals, including developers, operations, data and security, with a suite of online courses. As the pandemic has taken hold, it has breathed new life into edtech, but even before that, there was a market for upskilling IT Pros online.

This trend certainly didn’t escape Monti Saroya, co-head of the Vista Flagship Fund and senior managing director at Vista. “We have seen firsthand that the demand for skilled software engineers continues to outstrip supply, and we expect this trend to persist as we move into a hybrid online-offline world across all industries and interactions, with business leaders recognizing that technological innovation is critical to business success,” he said in a statement.

As is typical for acquired companies, Pluralsight CEO Aaron Skonnard sees this as a way to grow the company more quickly. “The global Vista ecosystem of leading enterprise software companies provides significant resources and institutional knowledge that will open doors and help fuel our growth. We’re thrilled that we will be able to leverage Vista’s expertise to further strengthen our market leading position,” Skonnard said in a statement.

In a 2017 interview with TechCrunch’s Sarah Buhr, Skonnard described the company as an enterprise SaaS learning platform. It goes beyond simply offering the courses by giving professionals in a given category such as developer or IT operations the ability to measure their skills and abilities against other pros in that category. He saw this assessment capability as a big differentiator.

“Our platform is ultimately focused on closing the technology skills gap throughout the world,” Skonnard told Buhr.

Pluralsight, which was founded in 2004, raised more than $190 million before going public in 2018. The company has 1,700 employees and more than 17,000 customers. The acquisition is subject to standard regulatory oversight, but is expected to close in the first half of next year. Once that happens, the company will go private once again.

Powered by WPeMatico

French startup In&motion has raised a $12 million (€10 million) funding round led by Upfront Ventures, with 360 Capital also participating. The company has been working on wearable airbag systems for motorbikes.

Integrated in a vest, the airbag is completely autonomous and can detect crashes in 60 milliseconds. The company has worked on a device called the In&box that analyzes movements in real time. Thanks to different sensors, the device can determine when it’s time to activate the airbag.

In&motion has worked on different profiles for different types of activities. For instance, if you’re riding a motorcycle on a MotoGP track, chances are you’re going to move faster and change your trajectory quite often. You can choose between traditional motorcycle riding, track and off-road.

Professional racers are increasingly using airbag systems. In addition to MotoGP racers, participants in the 2021 Dakar Rallye will have to use airbags.

The go-to-market strategy is interesting as the startup isn’t selling its system directly to end users. In&motion has partnered with existing motorcycle brands so they can integrate the system in some vests. This way, In&motion doesn’t have to build out a network of resellers from scratch. So far, the company has sold tens of thousands of systems.

There’s also a subscription component, with unlimited warranty and the ability to replace the In&box device with a new model after three years.

With today’s funding round, the company wants to expand beyond its home country with a focus on Germany and the U.S. The company plans to double the size of its team.

Image Credits: In&motion

Powered by WPeMatico

Gorillas, a grocery delivery startup that operates its own hyper local fulfillment centers and has already been a hit in Berlin, has raised $44 million in Series A funding.

Probably one of European tech’s worst kept secrets this year, the round is led by hedge fund Coatue, with participation from other unnamed European investors. Coatue’s Daniel Senft and Bennett Siegel will join Gorillas‘ board.

Noteworthy, Accel and Index were reportedly in the running, but ultimately didn’t invest. Atlantic Food Labs previously backed Gorillas in a seed round thought to be around €1.2 million.

Founded by Kağan Sümer and Jörg Kattner in May this year and operating in Berlin and Cologne, Gorillas delivers groceries within an average of ten minutes. Unlike gig economy models, it employs riders directly and is emphasising its ability to get fresh groceries, along with other household items, to shoppers at very short notice and at “retail prices”. The idea is that the startup can address a large part of the groceries market that falls outside of a weekly bulk shop.

Some have dubbed the model that Gorillas is attempting to make work, “dark” convenience stores, in reference to the dark kitchens that run on top of Deliveroo and UberEats and operate as delivery only restaurants. In this instance, Gorillas and other European competitors, such as Dija (which we reported is closing its own large funding round) and Weezy, are building out local delivery only grocery/convenience stores. These startups are also often compared to goPuff in the U.S.

Gorillas CEO Kağan Sümer says that mass supermarkets, including their delivery models, are designed so that the consumer organises their grocery shopping around the needs of the supermarket and supply chain, rather than the supermarket being designed around the needs of the consumer.

This sees an emphasis on long shelf life products, where even fresh goods are treated for longer expiry dates, and a model that serves the weekly bulk shop well, but at the detriment of two other use-cases: “emergency” shopping, such as when you’re missing a key ingredient, or quickly replenishing your fridge based on what you fancy consuming right now.

“The biggest problem is that bulk purchases are super served. What I mean by that is this: all of the supermarket infrastructure is shaped around bulk purchases,” Sümer tells me, arguing that this leaves one third of the market underserved.

“You have penne but no Arrabiata; how do you get that sauce that you need now? [There is] no way.

“So we asked ourselves, what would happen if a company pops up and serves people with what they need when they need it? Our hypothesis was that people would appreciate it and shift their interaction with groceries to more on demand purchases”.

With a slogan that reads: “Faster than you,” and a delivery fee of just €1.80, one question mark over Gorillas (and others in the space) is if the unit economics can ever stack up, especially at scale and if the company really isn’t marking up prices significantly. “Through our procurement relationships, we have healthy margins which allow us to sell at retail prices,” says Sümer, pushing back. “Taking into account the solid basket sizes and procurement margins we are able to build a long-term sustainable business”.

He says the average delivery time is 10 minutes. “Through our network of centrally located fulfillment centers we are able to service customers in a small delivery radius. Ultimately we strive to deliver an efficient and fast service with full transparency on delivery times,” adds the Gorillas CEO.

Meanwhile, Gorillas says the new funding will be used for expansion across Germany and will accelerate its rollout across more of Europe — first stop, Amsterdam. Additionally, the company will use the capital to build out its team in Berlin. More ambitious, by the end of Q2 next year, Gorillas says it plans to be available in over 15 cities in Germany and across Europe, operating over 60 fulfillment centers.

Powered by WPeMatico