Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Liberis, the U.K.-based fintech that provides finance for small businesses as an alternative to a traditional bank loan or extended overdraft, has replenished its own coffers with £70 million in funding. The round is a mixture of debt and venture debt, although the company is declining to disclose the percentage split, so we can likely chalk this up as mostly debt to fund the loans Liberis issues.

Providing the financing are previous backers British Business Investments, Paragon Bank and BCI Europe, along with new partner Silicon Valley Bank (SVB). It brings the total funding raised by Liberis to £200 million, including more than £50 million in equity funding. “The new funds will be used to fuel company growth, launch new products and markets, and provide additional customer financing solutions,” says the fintech.

To date, 2007-founded Liberis has provided over £500 million in financing to 16,000 SMEs across Europe, the U.S. and the U.K. (the product is available in five new countries: U.S., Finland, Sweden, Czech Republic and Slovakia). However, lending has really picked up lately, with £250 million lent in the past two years alone.

Liberis provides SMEs with funding from £1,000 to £300,000 based on projected credit and debit card sales. However, the clever part is that the loan is paid back via a pre-agreed percentage of the business’ digital transactions. In other words, bar any minimum monthly payment agreed, the repayment schedule is directly tied to the size and pace of a business’ card transactions.

Noteworthy, the go-to-market strategy has shifted toward B2B2B — or “embedded finance” — with Liberis now predominantly partnering with marketplaces, software providers and acquirers, such as Worldpay from FIS and Global Payments. These partners integrate with Liberis to offer personalised pre-approved revenue-based financing to their end customers.

“Liberis’ core business is to enable partners to offer embedded business finance to their customers,” Rob Straathof, CEO of Liberis, tells TechCrunch. “Back in 2015, we launched one of the world’s first embedded business finance partnerships with Worldpay from FIS, and have significantly expanded our partnerships across the globe over the past years, including Global Payments, Opayo (Sagepay), EPOS Now and Worldpay U.S.”

Straathof says that by integrating Liberis’ business finance platform into a partner’s existing ecosystem and customer experience, the fintech is able to provide “instant value” for its partners and the SMEs they support.

“Through our single API integration, we receive privileged data from our partners which enables Liberis to offer hyper-personalised and pre-approved finance to SMEs,” he explains. “By making finance more personalised, intuitive and accessible for SMEs, we in turn empower our partners to unlock greater customer value by improving engagement, satisfaction and loyalty which lowers churn. Ultimately, everyone wins”.

Comments Folake Shasanya, SVB’s head of EMEA warehouse financing: “We are pleased to become a new funding partner to Liberis and have been impressed with their ability to embed financing solutions across technology platforms, payments providers and more. At SVB, supporting innovation is in our DNA and we are delighted to provide this global growth opportunity to Liberis through our warehouse and venture debt products”.

Article updated to clarify the round is a mixture of debt and venture debt, without any pure equity funding.

Powered by WPeMatico

Here in the final few working days of 2020, a surprising number of new unicorns have come to light. The mad scramble that investors are seeing in seed-stage startups appears to be reflected across the later stages as well.

That deal-making is still alive is not a surprise, but the cadence at which the market is crowning new unicorns is slightly startling, given the time of year. I’ve given up expecting a slowdown in venture capital, but I did anticipate some deceleration in huge rounds and resulting unicorn valuations this close to Christmas.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

This morning after contrasting a PitchBook-derived $500 million, post-money valuation for Bolt’s Series C that its CEO had said was roughly doubled in its Series C1, TechCrunch discovered that the online checkout software company likely landed a new valuation right around the unicorn mark. Bolt’s PR team declined to share a new valuation or grade our math, saying that its framing was “fine.”

One new unicorn — or near-unicorn, perhaps — was not enough for the day. The Information broke news this afternoon that Ironclad, which sells contract management software, put together a round worth “at least $100 million,” valuing the company at “more than $950 million.” Akin to Bolt, this unicorn-or-just-under valuation is also a doubling or better from its last private round.

In fact, two new unicorns were insufficient: a third company also made the mark today, namely Qualia, which trumpeted the valuation achievement in a release. Qualia builds real estate software.

Three unicorns in one day is busy. To see three come to light on December 21st is a little bonkers.

And they are hardly the only startups we’ve seen sprout horns and race about on four legs in recent days. There’s Boom, Zenoti and BigID also in the last week or so. That’s at least six new unicorns since roughly the mid-point of December. Wild!

Let’s talk about the rounds and see what we can learn from them.

Starting with Bolt, there are a few lessons for us to take away. First: not every company that secures a unicorn (or a near-unicorn valuation) wants to make noise about it. We’ve known this, but the company’s currently coy attitude underscores the point. Second from Bolt is that inside investors are more than willing to crown unicorns in their own portfolio.

According to CEO Ryan Breslow, after his company raised its Series C, the round’s lead investor offered the company another term sheet. But WestCap was not its only lead. General Atlantic came in as well, giving the $75 million investment two leads. Bolt had already decided to call its new round a Series C1 before General Atlantic entered the deal, the addition of which brought $15 million to what was previously a $60 million investment.

Bolt’s round fits neatly into a number of trends that we’ve been watching: inside rounds being bullish not bearish in 2020, the fastest-growing companies raising two rounds this year and the incredible focus by venture investors into startups that were not merely surviving COVID-19, but benefiting from how it shook up the market.

Turning to Ironclad, around $100 million at around a $950 million valuation is about as basic as a unicorn round can get. And because it has been more than a year since its last round, you might think that there is not that much to learn in its case.

Powered by WPeMatico

Bolt, a startup that offers online checkout technology to retailers, announced this morning that it has added $75 million to its Series C round, bringing the financing to a total of $125 million.

WestCap and General Atlantic led the new tranche, which Bolt CEO Ryan Breslow told TechCrunch was raised at around twice its Series C valuation. PitchBook pegs the company’s Series C at a post-money valuation of $500 million, implying that the Series C1 values Bolt at around $1 billion.

The company is calling the latest check its “Series C1.” Why not just call it a Series D? According to Breslow, Bolt’s future Series D will be much larger.

While Bolt’s creatively demarcated Series C1 is interesting, the capital event is in line with how the checkout space is growing in aggregate right now. There’s a lot of money being put to work on solving a particular e-commerce pain point.

Fast, a competing online checkout software provider, raised $20 million in March. And this June, Checkout.com, which is based in England but has a global stable of offices, raised $150 million at a $5.5 billion valuation.

Bolt, meanwhile, announced the first $50 million of its Series C in July. The company’s C1 event, therefore, represents not only the fourth major investment into checkout tech this year, but it also fits into a now-regular trend of fast-growing startups raising two checks in 2020 — companies like Welcome, Skyflow, AgentSync and Bestow also completed the feat this year.

But enough talking about its market. Let’s dig into what Bolt is building and why it just took on another truckload of cash.

Bolt offers four connected services: checkout, payments, user accounts and fraud protection.

The company’s core offering is its checkout product, which it claims is both faster than comparable industry averages and has higher conversion rates. The startup’s payments and fraud services fits into its checkout universe by ensuring that transactions are real and that payments can be accepted. Finally, Bolt’s user accounts (shoppers are prompted to save their credentials when they first execute a purchase with the startup’s tech) boost the chance that someone who has checked out online using its tech will do so again in the future, helping Bolt to sell its service and ensure customers benefit from it.

The more shoppers that Bolt can attract, the more accounts it will have in the market feeding more data into its anti-fraud tool and checkout personalization technology.

And Bolt is reaching more online buyers, with the company claiming a roughly 10x gain of the number of people who have made accounts with its service this year. According to Breslow, the number was around 450,000 last December. It’s around 4.5 million now, he said, and Bolt expects the figure to reach 30 million next year.

Given the huge scale of its expected account creation, TechCrunch asked Breslow about his confidence interval in the number. He said 90%, thanks to Authentic Brands Group (ABG) linking up with Bolt, a deal that his company announced last month. Breslow said that ABG has 50 million shoppers; perhaps the 30 million figure is possible.

(Distribution for checkout tech is like oxygen, so competing companies in the space love to chat about their availability gains. Here’s Fast talking about being supported by WooCommerce from last week, for example. Fast declined to share processing growth metrics with TechCrunch after that announcement.)

Bolt’s historical shopper growth has paid dividends for its total transaction volume. The company told TechCrunch that it processed around $1 billion in transactions this year, up around 3.5x from its 2019 gross merchandise volume (GMV). That approximate pace of growth implies a roughly $286 million GMV result for Bolt last year; how far the company can scale that figure in 2021 will be our chief measuring stick for how well its ABG deal performs.

Breslow told TechCrunch that Bolt expects to 3x its GMV in 2021, which we read as implying a roughly $3 billion number.

But don’t just take that figure, apply a payment processing percentage and walk away with a revenue guess for Bolt. The company does make money from payments, but also from charging for its other services — like fraud protection — on a SaaS basis. So Bolt is a hybrid payments-and-software company, an increasingly popular model, though one that certain categories of software are slow to pick up on.

Underpinning Bolt’s plans to treble GMV and greatly expand its shopper network is its new capital. The $75 million cache of new dollars is going into handling market demand, moving upmarket and engineering, the company said. In short there’s a lot of in-market demand for better checkout tech — hence all the venture activity — and larger customers need more customizations and sales support. Bolt is going to spend on that.

Given that Bolt just reloaded, it would not be a surprise to see Fast or Checkout.com raise more capital in Q1 or Q2 of 2021. More when that happens.

Powered by WPeMatico

IBM has been busy since it announced plans to spin out its legacy infrastructure management business in October, placing an all-in bet on the hybrid cloud. Today, it built on that bet by acquiring Helsinki-based multi-cloud consulting firm Nordcloud. The companies did not share the purchase price.

Nordcloud fits neatly into this strategy with 500 consultants certified in AWS, Azure and Google Cloud Platform, giving the company a trained staff of experts to help as they move away from an IBM -centric solution to choosing to work with the customer however they wish to implement their cloud strategy.

This hybrid approach harkens back to the $34 billion Red Hat acquisition in 2018, which is really the lynchpin for this approach, as CEO Arvind Krishna told CNBC’s Jon Fortt in an interview last month. Krishna is in the midst of trying to completely transform his organization, and acquisitions like this are meant to speed up that process:

The Red Hat acquisition gave us the technology base on which to build a hybrid cloud technology platform based on open-source, and based on giving choice to our clients as they embark on this journey. With the success of that acquisition now giving us the fuel, we can then take the next step, and the larger step, of taking the managed infrastructure services out. So the rest of the company can be absolutely focused on hybrid cloud and artificial intelligence.

John Granger, senior vice president for cloud application innovation and COO for IBM Global Business Services, says that IBM’s customers are increasingly looking for help managing resources across multiple vendors, as well as on premises.

“IBM’s acquisition of Nordcloud adds the kind of deep expertise that will drive our clients’ digital transformations as well as support the further adoption of IBM’s hybrid cloud platform. Nordcloud’s cloud-native tools, methodologies and talent send a strong signal that IBM is committed to deliver our clients’ successful journey to cloud,” Granger said in a statement.

After the deal closes, which is expected in the first quarter next year subject to typical regulatory approvals, Nordcloud will become an IBM company and operate to help continue this strategy.

It’s worth noting that this deal comes on the heels several other small recent deals, including acquiring Expertus last week and Truqua and Instana last month. These three companies provide expertise in digital payments, SAP consulting and hybrid cloud applications performance monitoring, respectively.

Nordcloud, which is based in Helsinki with offices in Amsterdam, was founded in 2011 and has raised more than $26 million, according to PitchBook data.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and myself here — and don’t forget to check out our latest main episode, which spent a good bit of time talking about OnlyFans.

The weekend was busy, as always, so there was a lot to chew over this morning. Here’s a partial list:

Closing, here’s the Owen Thomas piece that I mentioned at the very end of the show.

Equity drops every Monday at 7:00 a.m. PST and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

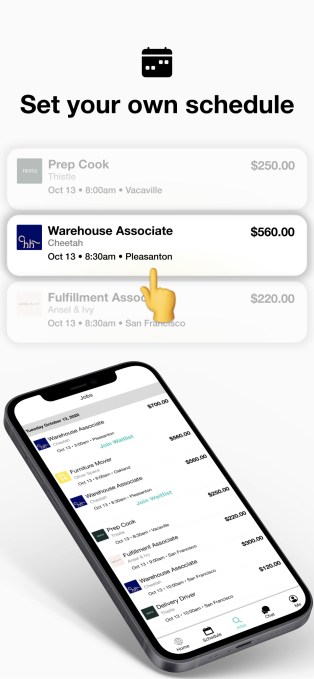

While there’s been plenty of recent debate around the gig economy, Jarah Euston argued that it’s time to rethink a bigger part of the workforce — hourly workers.

Euston, who was previously an executive at mobile advertising startup Flurry and a co-founder at data operations startup Nexla, told me that although 80 million Americans are paid on an hourly basis, the current system doesn’t work particular well for either employers or workers.

On the employer side, there are usually high rates of turnover and absenteeism, while workers have to deal with unpredictable schedules and often struggle to get assigned all the hours they want. So Euston has launched WorkWhile to create a better system, and she’s also raised $3.5 million in seed funding.

WorkWhile, she explained, is a marketplace that matches hourly workers with open shifts — employers identify the shifts that they want filled, while workers say which hours they want to work. That means employers can grow or shrink their workforce as needed, while the workers only work when they want.

“By pooling the labor force … we can provide the flexibility that both sides want,” Euston said.

Image Credits: WorkWhile

WorkWhile screens workers with one-on-one interviews, background checks and tests based on cognitive science, with the goal of identifying applicants who are qualified and reliable.

Employers pay WorkWhile a service fee, while the platform is free for users. And because the startup aims to build a long-term relationship with its workforce, Euston said it will also invest by providing additional benefits, starting with sick leave credits earned when you work and next-day payments to your debit cards.

“It’s hard to find a job that works with you and doesn’t give you a take it or leave it schedule,” said Michael Zavala, one of the workers on the platform, in a statement. “WorkWhile was exactly what I was looking for with the ability to create your own schedule for full time.”

The startup is launching in the San Francisco Bay Area, Los Angeles, Orange County and Dallas-Forth Worth.

Given the broader economic and employment trends during the pandemic, there should plenty of people looking for more work, while Euston said she’s seen a “feast or famine” situation on the employer side — yes, some companies have had to freeze or cut staff, but others have grown rapidly, including WorkWhile customers including restaurant supplier Cheetah, meal delivery service Thistle and horticultural e-commerce company Ansel & Ivy.

The funding, meanwhile, was led by Khosla Ventures, with participation from Stitch Fix founder and CEO Katrina Lake, Jennifer Fonstad, F7, Siqi Chen, Philipp Brenner, Zouhair Belkoura and Nicholas Pilkington.

“The majority of hourly workers are honest and reliable but some have difficult personal circumstances they need help with,” Vinod Khosla said in a statement. “Companies treat these employees as high turnover and expendable but, if given respect and appropriate support, they can become longer-term, model employees. WorkWhile wants to help solve this problem.”

Powered by WPeMatico

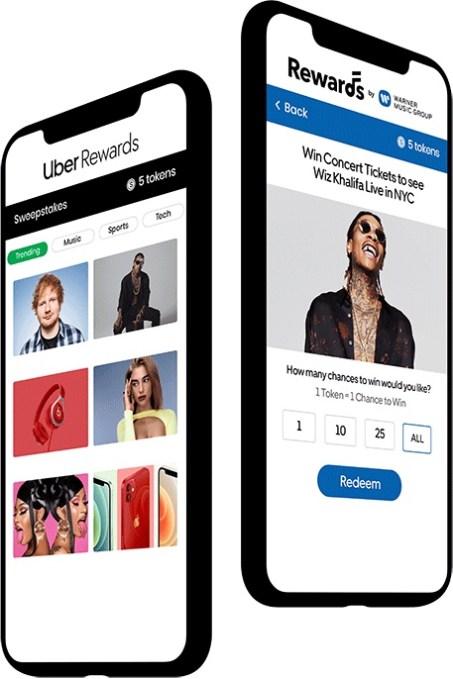

Tap Network is providing a new approach to loyalty rewards programs that it describes as “rewards as a service.”

You may recognize the Tap Network name, as well as its co-founder and CEO Lin Dai, from Hooch, a startup that offered a drink-a-day subscription service before shifting focus to a broader rewards program. Dai told me he “learned a lot from the Hooch experience” but ultimately “decided that Tap is a much bigger opportunity, we’re really looking at rewards in general.”

So Tap Network is a new startup, one that recently raised $4 million in funding from investors including Revelis Capital, Nima Capital, the Forbes family office, Warner Music Group, Access Industries, Bill Tai, Bob Hurst, Edward Devlin and others.

Dai said that normal rewards programs are only accessible to the top 10% or 20% of a company’s customers. So in his view, businesses have an opportunity to “super serve the average customers who 40 years ago might not have been considered important customers, but who today could be building a loyalty behavior pattern.”

Image Credits: Tap Network

He added that making rewards programs accessible to more customers has an added benefit for many businesses, because “whether it’s a major bank or major travel company, they are starting to accrue billions of dollars that are locked up in these wallets.” Those points might never be redeemed, but they’re still considered liabilities from an accounting perspective.

Tap Network aims to solve this problem by allowing customers to spend those points through a broader network of rewards, which can usually be redeemed at a lower point level. It’s offered as a white-label addition to an existing rewards program, with each program choosing the rewards that might be the best fit for their customers.

For example, Uber recently worked with Tap Network to expand its Uber Rewards program, offering new Tap Network-powered rewards like free Apple Music or HBO Max, as well as the option to donate to causes like World Central Kitchen. And the minimum number of points needed to claim a reward fell from 500 points to 100 points.

Other companies using Tap Network include Warner Music Group (which, as previously mentioned, is also an investor) and privacy-focused browser company Brave.

Dai said that in the future, Tap could even allow consumers to combine rewards points from different programs: “If I want to redeem something, I might be able to take a little bit of my Uber points, a little bit of my Warner points, a little bit of points from another program,” and combine them.

Powered by WPeMatico

V7 Labs, the makers of a computer vision platform that helps AI teams “automate” and future-proof their training data workflows as advances in AI continue, has picked up $3 million in funding. Leading the seed round is Amadeus Capital Partners, with participation from Partech, Nathan Benaich’s Air Street Capital and Miele Venture.

Founded in 2018 by Singularity University alumnus Alberto Rizzoli and former R&D lead at RSI, Simon Edwardsson (the same team behind “seeing” app Aipoly), the V7 Labs platform promises to accelerate the creation of high-quality training data by 10-100x. It does this by giving users the ability to build automated image and video data pipelines, organize and version complex data sets, and train and deploy “state-of-the-art” vision AI models.

“For companies to build computer vision solutions that deliver business value, they must continuously collect, label and retrain their models,” explains V7 Labs’ Rizzoli. “When we built Aipoly in 2015, we needed to build and maintain our own tools, whilst keeping up with the rapid state of the art of AI, because no third-party SaaS products were available”.

Fast-forward to today and Rizzoli says that many of the best computer vision companies are now turning to SaaS platforms like V7 to solve this problem. “There’s a lot to think of when building an AI startup, and ‘how can we efficiently store and query 100 different video data sets’ is something you only think of when you’re mid-flight in trying to deliver your service.

“V7 codifies industry best-practices for organizing data, labelling and launching computer vision models for real-world problems”.

Image Credits: V7 Labs

The browser and cloud-based platform claims the ability to quickly upload and render large image/video data sets “without lag,” and enable labelling to be automated (to varying degrees) without the need for prior training data. V7 has also been designed to make it possible to keep track of a very large number of labels per image/video, supporting thousands of annotations per image and millions of images per data set. Crucially, Rizzoli tells me it is possible to train, deploy and run computer vision models within the platform “in a few clicks without having to worry about DevOps”.

“Customers will soon be able to audit those models — and their corresponding training sets — to debug, test data quality, discover failure cases and eliminate any unwanted bias,” he adds, noting that these are all huge unsolved pain-points in the AI industry.

To that end, V7 Labs’ existing 100 or so customers include Tractable, GE Healthcare and Merck. It is growing fastest within medical imaging, in part because it offers support for DICOM annotation and HIPAA compliance, both must-haves in healthcare.

However, measured by the quantity of data processed on the platform, Rizzoli tells me that routine “expert inspections” are the most popular tasks. “These include dozens of companies using AI to look for damage or anomalies in cars, oil rigs, power lines, pipelines or roads,” he says.

Powered by WPeMatico

The coronavirus pandemic has underscored, and often exacerbated, the mental health crisis that exists across the world. Even the spread of remote work is part of the problem: As everyone stays at home, the lack of interaction and watercooler chat has left employees without in-person interaction.

The need for a solution has helped tech-powered mental health solutions raise funding to meet increased demand. In the latest development, it emerged that Lyra Health, a platform that focuses on providing workforces with mental health care, has filed paperwork to raise a $175 million Series E at a $2.25 billion valuation.

The paperwork was uncovered by Prime Unicorn Index. While it is not clear whether the company has closed the round, filings in Delaware usually appear after part or all of the funding has been secured. Prime Unicorn Index notes that the terms surrounding this Series E round include a “pari passu liquidation preference with all other preferred, and conventional convertible, meaning they will not participate with common stock if there are remaining proceeds.” It also noted that Lyra Health’s most recent price per share is $27.47, an up round from the Series D, which priced shares at $14.21.

We are reaching out to the company and investors for a response to the filing. One investor noted that the round has not closed yet.

Past backers of the company include Adams Street Partners, Tenaya Capital, Meritech Capital Partners, IVP and Greylock.

We seem to be in a period of rapid growth rounds getting raised in quick succession for the most promising startups. As with Discord — which confirmed a $100 million round just six months after raising $100 million — Lyra Health also recently raised funding — specifically a $110 million Series D that catapulted it above a $1 billion valuation.

That effectively means the startup doubled its valuation in a handful of months, suggesting rapid growth or key validation. As reported by Forbes, Lyra Health was set to bring in around $100 million in revenue by the end of the year at the time of its prior fundraise.

There have been a number of categories of technology that have seen a bump of usage and interest during this coronavirus pandemic, and sadly — or perhaps usefully, depending on how you look at it — mental health and wellness startups, aimed at helping our well-being in this trying time, have been one of them. Just last week, the meditation app Calm raised $75 million at a $2 billion valuation.

Burlingame, California-based Lyra Health wants to live in offices everywhere. The company helps employers give their employees a suite of safe and confidential tools to support their mental health needs. This is a tricky space to play in, considering that mental health can still feel taboo in workplaces and employees might feel uncomfortable turning to their employers for support. Still, in a world where in-office perks are no longer available, mental health might be a key investment to help startup retention.

Once an employee joins Lyra, the company creates a set of recommendations for the now-patient based on a survey. Lyra Health then can connect patients to its network of thousands of therapists for appointments, consultations and check-ins. The flywheel continues.

During the pandemic, Lyra Health has brought on 80,000 new users, to a total of 1.5 million users last reported.

Tech-enabled mental health care has found tailwinds as the coronavirus pandemic leads to a surge of telehealth, as in-person doctor’s appointments could leave patients at risk. Indeed, Lyra Health started Lyra Blended Care, which pairs video therapy with online lessons and exercises rooted in cognitive behavioral therapy.

Powered by WPeMatico

UiPath, the robotic process automation startup that has been growing like gangbusters, filed confidential paperwork with the SEC today ahead of a potential IPO.

“UiPath, Inc. today announced that it has submitted a draft registration statement on a confidential basis to the U.S. Securities and Exchange Commission (the “SEC”) for a proposed public offering of its Class A common stock. The number of shares of Class A common stock to be sold and the price range for the proposed offering have not yet been determined. UiPath intends to commence the public offering following completion of the SEC review process, subject to market and other conditions,” the company said in a statement.

The company has raised more than $1.2 billion from investors like Accel, CapitalG, Sequoia and others. Its biggest raise was $568 million led by Coatue on an impressive $7 billion valuation in April 2019. It raised another $225 million led by Alkeon Capital last July when its valuation soared to $10.2 billion.

At the time of the July raise, CEO and co-founder Daniel Dines did not shy away from the idea of an IPO, telling me:

We’re evaluating the market conditions and I wouldn’t say this to be vague, but we haven’t chosen a day that says on this day we’re going public. We’re really in the mindset that says we should be prepared when the market is ready, and I wouldn’t be surprised if that’s in the next 12-18 months.

This definitely falls within that window. RPA helps companies take highly repetitive manual tasks and automate them. So for example, it could pull a number from an invoice, fill in a number in a spreadsheet and send an email to accounts payable, all without a human touching it.

It is a technology that has great appeal right now because it enables companies to take advantage of automation without ripping and replacing their legacy systems. While the company has raised a ton of money, and seen its valuation take off, it will be interesting to see if it will get the same positive reception as companies like Airbnb, C3.ai and Snowflake.

Powered by WPeMatico