Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Volopay, a Singapore-based startup building a “financial control center” for businesses, announced today it has raised $2.1 million in seed funding. The round was led by Tinder co-founder Justin Mateen, and included participation from Soma Capital, CP Ventures, Y Combinator, VentureSouq, the founders of Razorpay and other angel investors.

The funding will be used on hiring, product development, strategic partnerships and Volopay’s international expansion. It plans to launch operations in Australia later this month. The company currently has about 100 clients, including Smart Karma, Dathena, Medline, Sensorflow and Beam.

Launched in 2019 by Rajith Shaiji and Rajesh Raikwar, Volopay took part in Y Combinator’s accelerator program last year. It was created after chief executive officer Shaji, who worked for several fintech companies before launching Volopay, became frustrated by the process of reconciling business expenses, especially with accounting departments located in different countries. Shaiji and Raikwar also saw that many companies, especially startups and SMEs, struggled to track different kinds of spending, including subscriptions and vendor payments.

Most of Volopay’s clients are in the tech sector and have about 15 to 150 employees. Volopay’s platform integrates multicurrency corporate cards (issued by Visa Corporate), domestic and international bank transfers, automated payments and expense and accounting software, allowing companies to save money on foreign exchange fees and reconcile expenses more quickly.

In order to speed up its development, Volopay integrated Airwallex’s APIs. Its corporate cards offer up to 2% cash back on software subscriptions, hosting and international travel, which Volopay says are the three top expense categories for tech companies, and it in November 2020, it launched a credit facility for corporate cards to help give SMEs more liquidity during the COVID-19 pandemic.

Compared to traditional credit products, like credit cards and working capital loans, Shaji said Volopay’s credit facility, which is also issued by Visa Corporate, has a more competitive fixed-free pricing structure that depends on the level of credit used. This means companies know how much they owe in advance, which in turn helps them manage their cashflows more easily. The average credit line provided by Volopay is about $30,000.

Since TechCrunch last covered Volopay in July 2020, it has grown 70% month on month in terms of total funds flowing through its platform, Shaji said. It also launched two new features: A bill pay feature that allows clients to transfer money domestically and internationally with low foreign exchange rates and transaction fees, and the credit facility. The bill pay feature now contributes about 40% to Volopay’s total payment volume, while the credit product makes up 30% of its card spending.

Shaji told TechCrunch that Volopay decided to expand into Australia because because not only is it a much larger market than Singapore, but “SMEs in Australia are very comfortable using paid digital software to streamline internal operations and scale their businesses.” He added that there is currently no other provider in Australia that offers both expense management and credit to SMEs like Volopay.

Powered by WPeMatico

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. Click here if you want it in your inbox every Saturday morning.

Ready? Let’s talk money, startups and spicy IPO rumors.

It was yet another week of startups that became unicorns going public, only to see their valuation soar. Already marked up by their IPO pricing, seeing so many unicorns achieve such rich public-market valuations made us wonder who was mispricing whom.

It’s a matter of taste, a semantic argument, a tempest in a teacup. What matters more is that precisely no one knows what anything is worth, and that’s making a lot of people rich and/or mad.

This is not a new theme. I’ve touched on it for years, but what matters for us today is that there appear to be three distinct valuation bands for companies, and the gaps between them do not appear ready to shrink. You could even argue that they have widened.

Band 1 is the private capital cohort. These are the folks who valued Affirm at $19.93 per share in its September 2020 round and Roblox at $4 billion in February of 2020. Now Affirm is worth $116.58 per share, and Roblox is worth $29.5 billion. Whoops?

Band 2 is the long-term public investing cohort. These are folks critical in the IPO pricing context. They are willing to pay more for startups than the private capital crew. Affirm was not worth under $20 per share to this group, instead it was worth $49 per share just a few months later. Whoops?

Band 3 is the retail cohort, the /r/WallStreetBets, meme-stock, fintech Twitter rabble that are both incredibly fun to watch and also the sort of person you wouldn’t loan $500 to while in Las Vegas. They are willing to pay nearly infinite money for certain stocks — like Tesla — and often far more than the more conservative public money. Demand from the retail squad can greatly amplify the value of a newly listed company by making the supply/demand curve utterly wonky. This is how you get Poshmark more than doubling a strong IPO valuation on its first day.

Most investors do well in today’s world. Though Band 1 likes to blame Band 2 for not being willing to pay Band 3 prices, it always sounds like the private capital folks are merely complaining about sharing some of the winnings with another party.

Regardless, who really knows what anything is worth? I was recently chatting with an early-stage founder who has a history of investing — narrowing it down to 17,823 people, I know — about the price of software companies both private and public and why they may or may not make sense. He said that old valuation models at banks presumed that software companies’ growth would go to zero over time, and that profits would be rare among SaaS concerns. Both concepts were wrong, so prices went up.

But I have yet to have anyone explain to me why companies that would have been valued at 10x next year’s revenues can now get, at median, 18.1x. I have a working theory of what’s going on, but none of it points to sanity, or pricing that is grokkable through a lens that isn’t hype.

(You can hit reply to this email and tell me why I am dumb if you’d like. I will buy the person with the best valuation explanation coffee when the world works again.)

On the milestone front, it was a huge week for leaving the private markets and joining the Big Kid Club. Namely for Affirm and Poshmark, which priced well and started to trade. And for Bumble, which filed to go public. They are targeting a good IPO window.

But there was lots more going on, including a milestone that caught my eye. M1 Finance, a fintech startup that brings together lots of pieces of the fintech playbook into a single service, reached $3 billion in assets under management (AUM) this week. The company had reached $2 billion in AUM last September, after reaching $1 billion in February of 2020.

Why do we care? The company previously told TechCrunch that it works to generate revenues worth around 1% of AUM. If that percentage has held past its October, 2020 Series C, the company just added around $10 million in ARR in under half a year. That’s a pace of revenue creation that made me sit up and take notice. (Shoutout Josh for never shutting up about the Midwest.)

But I really bring up the M1 Finance milestone for a different reason. Namely that I am consistently surprised at how deep certain markets are. Neobanks that are still growing; the OKR software market’s surprising depth; the ability of M1 to accrete deposits in a market with so many incumbents and well-funded startups.

Perhaps this is why prices make no sense; if you can’t see the edge limits of TAM, can anything be overpriced?

Moving on, some quick notes on things from the week that mattered:

Aziz Gilani, a managing director at Mercury Fund and an advocate of Texas (observe his Twitter handle), wrote in late regarding our query for investor notes on the Visa-Plaid breakup. You can read the rest here.

But who are we to deprive you of useful notes. And Gilani is a nice person. So, here are his $0.02:

My big take-away on the Plaid/Visa deal falling apart is about how fast everything in 2021 is moving. Arguably the biggest advantage of SPACs over direct listings and IPOs is how fast those liquidity events can get done. In a world in which valuation[s] change week to week, the delays created by the DOJ can kill a deal – even if the DOJ would eventually lose in court.

I’m philosophically super negative about the government imposing their will, but I’m also personally excited about the current wave of insurgent startups not getting gobbled up by the FAANGs of the world. For the last several years too many startups fell victim to the “quick exit” mentality personified by Mint selling so fast to Intuit. With fast/cheap capital freely available, today’s crop of startups are going big.

Worth chewing on.

What a week. I have only a few things left for you, including some early-stage rounds that I could not get thanks to waves arms around generally but wanted to flag all the same.

Hugs,

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture-capital-focused podcast, where we unpack the numbers behind the headlines. We’re back on this lovely Saturday with a bonus episode!

Again!

There is enough going on that to avoid failing to bring you stuff that we think matters, we are back yet again for more. This time around we are not talking Roblox, we’re talking about ecommerce, and a number of rounds — big and small — that have been raised in the space. Honest question: do y’all plan to release news on the same week? Are trends a social construct?

From Natasha, Grace, Danny, and your humble servant, here’s your run-down:

And now we’re going back to bed.

Equity drops every Monday at 7:00 a.m. PST and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

The dating and networking service Bumble has filed to go public.

The company, launched by a former co-founder of the IAC-owned Tinder, plans to list on the Nasdaq stock exchange, using the ticker symbol “BMBL.” Bumble’s planned IPO was first reported in December.

Bumble CEO Whitney Wolfe Herd was on the founding team at Tinder before starting Bumble. She filed suit against Tinder for sexual harassment and discrimination, which was at least somewhat inspirational in her quest to build a dating app that put women in the driver’s seat.

In 2019, Wolfe Herd took the helm of MagicLab, renamed to Bumble Group, in a $3 billion deal with Blackstone, replacing Badoo founder and CEO Andrey Andreev following a harassment scandal at the firm.

The company is targeting the public markets at a particularly heady time for new offerings, with investors embracing venture-backed IPOs throughout late 2020 and the start of 2021. Previously privately held companies like Airbnb, Affirm and others have seen their fortunes soar on the back of prices that public investors are willing to pay, perhaps inducing more IPO filings than the market might have otherwise seen.

You can read its IPO filing here. TechCrunch will have its usual tear-down of the document later today, but we have pulled some top-line numbers for you to kick off your own research.

But before we do, the company’s board makeup, namely that it is over 70% women, is already drawing plaudits. Now, into its numbers.

Let’s consider Bumble from three perspectives: Usage, financial results and ownership.

On the usage front, Bumble is popular, as you would imagine a dating service would have to be to reach the scale required to go public. The company claims 42 million monthly active users (MAUs) as of Q3 2020 — many companies will try to get public on the strength of their third-quarter results from 2020, as it takes time to close Q4 and the full calendar year.

Those 42 million MAUs translated into 2.4 million total paying users through the first nine months of 2020; the percent, then, of paying users to MAUs is not 2.4 million divided by 42, but a smaller fraction.

Turning to the numbers, recall that Bumble sold a majority of itself a few years back. We bring that up as Bumble’s financial results are complicated thanks to its ownership structure.

After the IPO, Bumble Inc. will “be a holding company, and its sole material asset will be a controlling equity interest in Bumble Holdings,” per the S-1 filing. So, how is Bumble Holdings doing?

Medium? Doing the sums ourselves as the company’s S- 1 is fraught with accounting nuances, in the first nine months of 2019, Bumble managed the following:

And then, combining two columns to provide a similar set of results for the same period of 2020, Bumble recorded:

For those following along, we’re using the “Net (loss) earnings” line, for profitability, and not the “Net (loss) earnings attributable to owners / shareholders” as that would require even more explanation and we’re keeping it simple in this first look.

While Bumble saw modest growth in 2020 through Q3 and a sharp swing to losses on a GAAP basis, the company’s adjusted profitability grew over the same time period. The company’s adjusted EBITDA, a very non-GAAP metric, expanded from $80.0 million in the first three quarters of 2019 to $108.3 million in the same period of 2020.

While we are generally willing to allow quickly growing companies some leniency when it comes to adjusted metrics, the gap between Bumble’s GAAP losses and its EBITDA results is a stress-test of our compassion. Bumble also swung from free cash flow positivity during the first nine months of 2019 to the first quarters of 2020.

If you extrapolate Bumble’s Q1, Q2 and Q3 revenue to a full-year number, the company could manage $555.5 million in 2020 revenues. Even at a modest software-ish multiple, the company would be worth more than the $3 billion figure that we discussed before.

However, its sharp unprofitability in 2020 could damper its eventual valuation. More as we dig more deeply into the filing.

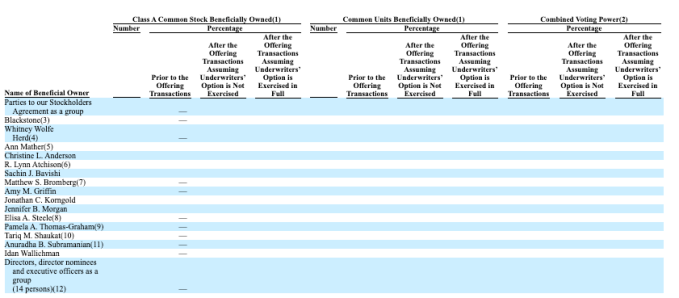

Finally, on the ownership question, the company’s filing is surprisingly denuded of data. Its principal shareholder section looks like this:

When we know more, we’ll share more. Until then, happy S-1 reading.

Powered by WPeMatico

Last year, a number of startups building OKR-focused software raised lots of venture capital, drawing TechCrunch’s attention.

Why is everyone making software that measures objectives and key results? we wondered with tongue in cheek. After all, how big could the OKR software market really be?

It’s a subniche of corporate planning tools! In a world where every company already pays for Google or Microsoft’s productivity suite, and some big software companies offer similar planning support, how substantial could demand prove for pure-play OKR startups?

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Pretty substantial, we’re finding out. After OKR-focused Gtmhub announced its $30 million Series B the other day, The Exchange reached out to a number of OKR-focused startups we’ve previously covered and asked about their 2020 growth.

Gtmhub had released new growth metrics along with its funding news, plus we had historical growth data from some other players in the space. So let’s peek at new and historical numbers from Gthmhub, Perdoo, WorkBoard, Ally.io, Koan and WeekDone.

Gtmhub had released new growth metrics along with its funding news, plus we had historical growth data from some other players in the space. So let’s peek at new and historical numbers from Gthmhub, Perdoo, WorkBoard, Ally.io, Koan and WeekDone.

A startup growing 400% in a year from a $50,000 ARR base is not impressive. It would be much more impressive to grow 200% from $1 million ARR, or 150% from $5 million.

So, percentage growth is only so good, as metrics go. But it’s also one that private companies are more likely to share than hard numbers, as the market has taught startups that sharing real data is akin to drowning themselves. Alas.

As we view the following, bear in mind that a simply higher percentage growth number does not indicate that a company added more net ARR than another; it could be growing faster from a smaller base. And some companies in the mix did not share ARR growth, but instead disclosed other bits of data. We got what we could.

Powered by WPeMatico

As expected, shares of Poshmark exploded this morning, blasting over 130% higher in afternoon trading from the company’s above-range IPO price of $42. The enormous and noisy debut of Poshmark comes a day after Affirm, another IPO, was treated similarly by the public markets.

Both explosive debuts were preceded by huge December debuts from C3.ai, Doordash and Airbnb. It seems today that any venture-backed company that can claim some sort of tech mantle is being treated to a strong IPO pricing run and a huge first-day result.

This is, of course, annoying to some people. Namely, certain elements of the venture capital community who would prefer to keep all outsized gains in their own pockets. But, no matter. You might be wondering what is going on. Let’s talk about it.

TechCrunch has covered the IPO window as closely as we can over the last few years. And the late-stage venture capital markets, along with the changing value of tech stocks and the huge boom in consumer (retail) investing.

Based on my participation in as much of that reporting as I could take part in here’s how you get a 130% first-day IPO pop in a company that has actually been around long enough for investors to math-out reasonable growth and profit expectations for the future:

Powered by WPeMatico

Medium is acquiring Paris-based startup Glose for an undisclosed amount. Glose has been building iOS, Android and web apps that let you buy, download and read books on your devices.

The company has turned reading into a multiplayer experience, as you can build a bookshelf, share notes with your followers and start conversations in the margins. Sure, there are social platforms that let you talk about books, such as Goodreads. But Glose’s differentiating point is that the social features are intrinsically linked with the reading features — those aren’t two separate platforms. There are also some gamification features that help you stay motivated as you read difficult books — you get streak rewards for instance.

In many ways, Glose’s one-tap highlighting and commenting features are reminiscent of Medium’s features on this front. You can highlight text in any reading app on your phone or tablet but you can’t do much with it.

More recently, Glose has launched a separate service called Glose Education. As the name suggests, that version is tailored for universities and high schools. Teachers can hand out assignments and you can read a book as a group.

More than 1 million people have used Glose and 25 universities have signed up to Glose Education, including Stanford and Columbia University.

But Glose isn’t just a software play. The company has also put together a comprehensive bookstore. The company has partnered with 20,000 publishers so that you can buy e-books directly from the app.

And if you are studying Virginia Wolf this semester, Glose also provides hundreds of thousands of public domain books for free. Glose also supports audio books.

This is by far the most interesting part, as Medium now plans to expand beyond articles and blogs. While Glose is sticking around for now, Medium also plans to integrate e-books and audio books to its service.

It’s a smart move, as many prolific bloggers are also book writers. Right now, they write a blog post on Medium and link to a third-party site if you want to buy their books. Having the ability to host everything written by an author is a better experience for both content creators and readers.

“We’re impressed not only by Glose’s reading products and technology, but also by their experience in partnering with book authors and publishers,” Medium CEO Ev Williams said in a statement. “Books are a means of exploring an idea, a way to go deeper. The vast majority of the world’s ideas are stored in books and journals, yet are hardly searchable nor shareable. With Glose, we want to improve that experience within Medium’s large network of engaged readers and writers. We look forward to working with the Glose team on partnering with publishers to help authors reach more readers.”

The Glose team will remain in Paris, which means that Medium is opening its first office outside of the U.S. Glose will continue to honor its partnerships with authors, publishers, schools and institutions.

Powered by WPeMatico

Tokyo-based SODA, which runs sneaker reselling platform SNKRDUNK, has raised a $22 million Series B led by SoftBank Ventures Asia. Investors also included basepartners, Colopl Next, THE GUILD and other strategic partners. Part of the funding will be used to expand into other Asian countries. Most of SNKRDUNK’s transactions are within Japan now, but it plans to become a cross-border marketplace.

Along with SODA’s $3 million Series A last year, this brings the startup’s total funding to $25 million.

While the COVID-19 pandemic was initially expected to put a damper on the sneaker resell market, C2C marketplaces have actually seen their business increase. For example, StockX, one of the biggest sneaker resell platforms in the world (which hit a valuation of $2.8 billion after its recent Series E), said May and June 2020 were its biggest months for sales ever.

SNKRDUNK’s sales also grew last year, and in December 2020, it recorded a 3,000% year-over-year increase in monthly gross merchandise value. Chief executive officer Yuta Uchiyama told TechCrunch this was because demand for sneakers remained high, while more people also started buying things online.

Launched in 2018, SNKRDUNK now has 2.5 million monthly users, which it says makes it the largest C2C sneaker marketplace in Japan. The Series B will allow it to speed up the pace of its international expansion, add more categories and expand its authentication facilities.

Like StockX and GOAT, SNKRDUNK’s user fees cover authentication holds before sneakers are sent to buyers. The company partners with FAKE BUSTERS, an authentication service based in Japan, to check sneakers before they are sent to buyers.

In addition to its marketplace, SNKRDUNK also runs a sneaker news site and an online community.

SODA plans to work with other companies in SoftBank Venture Asia’s portfolio that develop AI-based tech to help automate its operations, including logistics, payment, customer service and counterfeit inspection.

Powered by WPeMatico

Congratulations, you’re no longer selling your company for billions of dollars!

As strange as it sounds, that’s the leading perspective from venture capitalists concerning Plaid, now that its much-touted sale to Visa has fallen apart.

The $5.3 billion deal would have seen banking API startup Plaid join consumer payments and credit giant Visa. But the American government took a dim view of the deal, and according to Axios reporting, Plaid felt like it could be worth more money in time.

The TechCrunch team has collected views from venture capitalists, analysts and Anshu Sharma, CEO of another API-powered startup and a former VC to get a better view on the perspectives in the market concerning the blockbuster breakup.

From the venture capital side of things, most takes we received were bullish regarding Plaid’s chances now that it’s no longer being taken over by Visa. Amy Cheetham, for example, of Costanoa Ventures, said that the result is “good for the company, ultimately.” She added that Plaid may now see better “talent acquisition,” faster product decisions and a better eventual valuation.

“There is so much left for them to build in fintech infrastructure,” Cheetham said in an email, adding that she sees “Stripe-like scale potential” in Plaid. Stripe is reportedly raising capital at a valuation that could reach $100 billion.

Cheetham is not alone in her bullish perspective. Nico Berandi of Animo Ventures wrote to TechCrunch to say that he “still wishes” that his firm had been “around back then to have invested” in Plaid, adding a smiley face at the end of his missive.

Powered by WPeMatico

After launching in October, Tradeswell is announcing today that it has raised $15.5 million in Series A funding.

Co-founder and CEO Paul Palmieri previously led digital ad company Millennial Media (now owned by TechCrunch’s parent company Verizon Media), and he said the e-commerce market today is similar to the online ad market when he was leading Millennial — ready for more optimization and automation.

Tradeswell focuses on six components of e-commerce businesses — marketing, retail, inventory, logistics, forecasting, lifetime value and financials — with the key goal of allowing those businesses to improve their net margins, rather than simply driving more clicks or purchases. The platform can fully automate some processes, such as buying online ads.

To illustrate what it can accomplish, Tradeswell pointed to the work it did with a personal care brand on Amazon Prime Day, with total sales doubling versus the previous Prime Day and profits increasing 67%.

The startup has now raised a total of $18.8 million. The Series A was led by SignalFire, which also led Tradeswell’s seed round, while Construct Capital, Allen & Company and The Emerson Group also participated.

“With the explosion of ecommerce over the past year, Tradeswell is perfectly positioned to help brands manage the complexity of online sales across an ever-increasing number of platforms and marketplaces,” said SignalFire founder and CEO Chris Farmer in a statement. “Paul and his team bring together a unique blend of experience in data, marketing and logistics to address the challenges of today and a rapidly evolving market in the years ahead with a central command center to optimize profitable growth.”

Palmieri said the new funding will allow Tradeswell to continue investing in the product, which will also mean building more integrations so that more types of data become “more liquid,” which in turn means that the platform can “make much more real-time decisions.”

When Tradeswell launched publicly last fall, it already had 100 customers, and Palmieri told me that number has subsequently grown past 150. Nor does he expect the consumer shift in e-commerce to disappear once the pandemic ends.

“Some of it probably goes back to the way it was, some of it stays online,” he said. “I do think it’s important to point out there’s something in the middle — that something is this notion of high convenience, that is semi-brick-and-mortar with [elements of e-commerce], whether that’s mobile ordering or something like an Instacart.”

Naturally, he sees Tradeswell as the key platform to help businesses navigate that shift.

Powered by WPeMatico