Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Bloomreach, an API company that helps eCommerce customers with search and web site creation, announced a $150 million investment today from Sixth Street Growth. Today’s funding values the company at $900 million.

At the same time, the company announced it has acquired Exponea, a startup that gives Bloomreach a marketing automation component it had been missing. The two companies did not reveal the acquisition price, but along with the pure functionality, the company gains 200 additional employees, which is significant, considering Bloomreach had 300 prior to the acquisition. It also gains 250 net new customers, giving it a total of 750.

“Historically, we have had two major pillars of the business — the search part of it and the content part,” Bloomreach CEO and co-Founder Raj De Datta told TechCrunch. The content management component lets customers build websites, while the search powers the search box, navigation and merchandising. He points out that all of it is powered by an underlying data analysis engine that matches data to people and people to products.

Exponea will give the company more of a complete platform of services, allowing marketers to target and personalize their marketing messages across multiple channels. De Datta says the two companies had similar missions and made a good fit. “We have a common vision and common sort of product direction. […] Both companies are data-driven optimization technologies[…] and both are entrepreneurial product-driven companies,” he said.

It also helped that they had been partnering together for six months prior to the sale, which has now closed. Exponea was founded in 2016 in Slovakia and has raised over $57 million, according to Pitchbook data. The plan is to leave Exponea as a stand-alone product, while finding ways to integrate it more smoothly with the other components in the Bloomreach platform. They expect the integration parts to happen over the next year.

While De Datta did not want to share specific revenue figures, he did say that the company had a record second half as business was pushed online due to the pandemic. Michael McGinn, partner at Sixth Street and co-head at investor Sixth Street Growth doesn’t see the demand for eCommerce abating, even post-COVID, and that will drive a need for more customized online shopping experiences.

“Technology serving more bespoke customer experiences is a rapidly expanding market and we are pleased to join Bloomreach in its leadership of the digital commerce experience and marketing sector,” McGinn said in a statement.

De Datta says the money was used in part to buy Exponea, but he also plans to invest more in engineering to continue building the product line. The ultimate goal is an IPO, but as you would expect, he wasn’t ready to commit to any timeline just yet.

“I wouldn’t say we have a timeline, but our goal is that the company over the course of 2021 should make investments towards that, so that it’s an option for us.”

Powered by WPeMatico

This morning, investor and SPAC raconteur Chamath Palihapitiya announced two new blank-check deals involving Latch and Sunlight Financial.

Latch, an enterprise SaaS company that makes keyless-entry systems, has raised $152 million in private capital, according to Crunchbase. Sunlight Financial, which offers point-of-sale financing for residential solar systems, has raised north of $700 million in venture capital, private equity and debt.

We’re going to chat about the two transactions.

There’s no escaping SPACs for a bit, so if you are tired of watching blind pools rip private companies into the public markets, you are not going to have a very good next few months. Why? There are nearly 300 SPACs in the market today looking for deals, and many will find one.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Think of SPACs are increasingly hungry sharks. As a shark get hungrier while the clock winds down on its deal-making window, it may get less choosy about what it eats (take public). There are enough SPACs on the hunt today that they would be noisy even if they were not time-constrained investment vehicles. But as their timers tick, expect their deal-making to get all the more creative.

This brings us back to Chamath’s two deals. Are they more like the Bakkt SPAC, which led us to raise a few questions? Or more akin to the Talkspace SPAC, which we found pretty reasonable? Let’s find out.

Let’s start with the Latch deal.

New York-based Latch sells “LatchOS,” a hardware and software system that works in buildings where access and amenities matter. Latch’s hardware works with doors, sensors and internet connectivity.

The company has raised a number of private rounds, including a $126 million deal in August of 2019 that valued the company at $454.3 million on a post-money basis, according to PitchBook data. The company raised another $30 million in October of 2020, though its final private valuation is not known.

As Chamath tweeted this morning, Latch is merging with TS Innovation Acquisitions Corp, or $TSIA. The SPAC is associated with Tishman Speyer, a commercial real estate investor. You can see the synergies, as Latch’s products fit into the commercial real estate space.

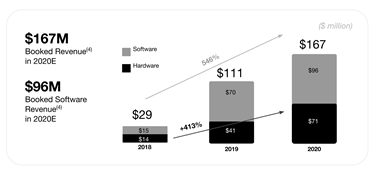

Up front, Latch is not a company that is only reporting future revenues. It has a history as an operating entity. Indeed, here’s its financial data per its investor presentation:

Image Credits: Latch

Doing some quick match, Latch grew booked revenues 50.5% from 2019 to 2020. Its booked software revenues grew 37.1%, while its booked hardware top line expanded over 70% during the same period.

That could be due to strong hardware installation fees, which could later result in software revenues; the company claims an average of a six-year software deal, so hardware revenues that are attached to new software incomes could low key declaim long-term SaaS revenues.

Update: Adding some clarity here, the above are “booked” revenues, which I’ve made more clear, not actual revenues. Its net revenues, better known as actual revenues, were $18 million, with $14 million of that coming from hardware. So, today, the company is certainly more hardware-heavy than I first thought. Damn non-S-1 filings!

While some were quick to note that the company is far from pure-SaaS — correct — I suspect that the model that could get some traction amongst investors is that this feels a bit like Peloton for real estate. How so? Peloton has large hardware incomes up front from new users, which convert to long-term subscription revenues. Latch may prove similar, albeit for a different customer base and market.

Per the deal’s reported terms, Latch will be worth $1.56 billion after the transaction. The combined entity will have $510 million in cash, including $190 million from a PIPE — a method of putting private money into a public entity — from “BlackRock, D1 Capital Partners, Durable Capital Partners LP, Fidelity Management & Research Company LLC, Chamath Palihapitiya, The Spruce House Partnership, Wellington Management, ArrowMark Partners, Avenir and Lux Capital.”

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and myself here — and make sure to check out last week’s main ep, which was super-packed and a real treat.

This morning the news was heavy, so here’s your rundown to get you into the show:

Hugs, and we are back Thursday, if not before. Stay safe!

Equity drops every Monday at 7:00 a.m. PST and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Wolt, the Helsinki-based online ordering and delivery company that initially focused on restaurants but has since expanded to other verticals, has raised $530 million in new funding. The round was led by Iconiq Growth, with participation from Tiger Global, DST, KKR, Prosus, EQT Growth and Coatue.

Previous backers 83North, Highland Europe, Goldman Sachs Growth Equity, EQT Ventures and Vintage Investment Partners also followed on. The new round takes the total amount of financing Wolt has raised to $856 million. Wolt declined to disclose the company’s latest valuation, although we know from the previous D round that the company is one of Europe’s so-called unicorns.

“We operate in an extremely competitive and well-funded industry, and this round allows us to have a long-term mindset when it comes to doubling down on our different markets,” says co-founder and CEO Miki Kuusi in a statement. “Despite the turbulence of 2020, we’ve remained focused on growth, tripling our revenue to a preliminary $330 million against a net loss of just $38 million. Compared to the $670 million in new capital that we’ve raised during this year, this puts us into a strong position for investing in our people, technology, and markets when thinking about the next few years ahead”.

Since launching with 10 restaurants in its home city in 2015, five years on Wolt has expanded to 23 countries and 120 cities, mostly in Europe but also including Japan and Israel. More recently, like others in the restaurant delivery space, Wolt has expanded beyond restaurants and takeout food into the grocery and retail sectors. This, says the company, sees it offer anything from cosmetics to pet food and pharmaceuticals on its platform.

“This was mostly a primary raise,” Kuusi tells me when I ask if the new round includes secondary funding (i.e. shareholders that exited to new investors). “We’re not looking to disclose the valuation at this time, but we’ve previously shared that the Series D round that we raised in early 2020 valued the company at above €1 billion,” he adds.

Kuusi says that the latest funding round is based on the belief that local services in the offline world will gradually be brought online by players “that can execute and maintain a great customer experience”. “We started with an exclusive focus on the restaurant, as it’s the biggest local service with an underlying high-frequency use case,” he says. “We quickly learnt that the magical product market fit for bringing the restaurant online was to offer a quick and predictable delivery experience from restaurants that didn’t use to be available for delivery. We do this by handling the complexity of the delivery on the restaurant’s behalf”.

However, this was especially difficult to do efficiently and sustainably in a small and difficult home market in the Nordics. To solve this, Wolt needed to build an “optimization-heavy logistics setup for last-mile delivery” that Kuusi says lets the service operate even in “very small cities with low income disparity, limited population density and high labor costs”.

“This means that we can operate efficiently even with relatively low order volumes, enabling us to grow and expand rapidly with much less financing than some of the other players in the market. We simply had no other choice than to do it this way as we came from such a difficult home market”.

On this foundation, Wolt is expanding into other ordering and local delivery verticals, aiming to be what Kuusi dubs as “the everything app” of goods and services. “Today, Wolt is much more than a restaurant delivery service; you can order groceries, electronics, flowers, clothes and many other things on our platform,” he explains. “We believe that the future of how people buy Nike shoes is a few taps on Wolt and some 30 minutes later you get any pair of shoes brought to your door. This is what we strive to make into a reality with our team at Wolt”. (I’m an Adidas guy myself, steadfastly European.)

Asked what he thinks about all the money being pumped into the dark convenience store model, Kuusi says Wolt is investing into its own dark store operation called Wolt Market. “It’s not surprising to also see a growing amount of financing going into this sector”, he admits. “We’re huge believers in a hybrid model where there will be both offline/online retailers as well as focused online retailers in the mix. Obviously the latter category is only getting started, and we should see a massive amount of growth for the coming years ahead”.

Powered by WPeMatico

Taboola is the latest company seeking to go public via special purpose acquisition company — more commonly known as a SPAC.

To achieve this, it will merge with ION Acquisition Corp., which went public in 2020 with the aim of funding an Israeli tech acquisition (Haaretz reported last month that Taboola was in talks with ION). The transaction is expected to close in the second quarter, and the combined company will trade on the New York Stock Exchange under the ticker symbol TBLA.

Founded in 2007, Taboola powers content recommendation widgets (and advertising on those widgets) across 9,000 websites for publishers including CNBC, NBC News, Business Insider, The Independent and El Mundo. It says it reaches 516 million daily active users while working with more than 13,000 advertisers.

The company had previously planned to merge with competitor Outbrain before the deal was canceled last fall, with sources pointing to the market impact of the COVID-19 pandemic, a “challenging culture fit” and regulatory issues to explain the deal’s end.

Taboola’s founder and CEO Adam Singolda (pictured above, left) told me that this didn’t lead directly to the SPAC deal. But he said, “I always wanted to go public,” which wasn’t possible while the merger was in the works. Once that deal was called off, and with 2020 turning out to be a strong year for Taboola — it’s projecting revenue of $1.2 billion, including $375 million ex-TAC revenue (revenue after paying publishers), with over $100 million in adjusted EBITDA — the time seemed right, and ION seemed like the right partner.

“We believe Taboola is an open web recommendation leader which is well positioned to challenge the walled gardens,” said ION CEO Gilad Shany in a statement. “We were looking to merge with a global technology leader with Israeli DNA and we found that in Taboola. The combination of long-term partnerships built by the company with thousands of open web digital properties, their direct access to advertisers, massive global reach and proven AI technology, allows Taboola to provide significant value to their partners while also achieving attractive unit economics as the company grows.”

The deal will value Taboola at $2.6 billion. Through this transaction, the company plans to raise a total of $545 million, including $285 million in PIPE financing secured from Fidelity Management & Research Company, Baron Capital Group, funds and accounts managed by Hedosophia, the Federated Hermes Kaufmann Funds and others.

Singolda said that the company plans to invest $100 million in R&D this year, and that he hopes to expand the technology into areas like e-commerce and TV advertising, with the goal of moving “beyond the browser.” More broadly, he said he wants Taboola to be “a strong public company that champions the open web.”

“The open web is a $64 billion advertising market [according to Taboola estimates], but there’s no Google for the open web,” he said.

Yes, Google itself spends plenty of time talking about similar ideas, but Singolda argued that while Google has consumer products like search and YouTube that compete with other publishers for time and attention, “Taboola is not in the consumer business … We serve our partners, and it’s in our identity to drive audience growth, engagement and revenue.”

Powered by WPeMatico

Sano Genetics, a startup with a broad mission to support personalised medicine research by increasing participation in clinical trials, has raised £2.5 million in seed funding.

The round is led by Episode1 Ventures, alongside Seedcamp, Cambridge Enterprise, January Ventures and several Europe and U.S.-based angel investors. It adds to £500,000 in pre-seed funding from 2018.

Sano Genetics says part of the new capital will be to fund free at-home DNA testing kits for 3,000 people affected by Long COVID. It will also further invest in the development of its tech platform and grow the team.

Founded in 2017 by Charlotte Guzzo, Patrick Short and William Jones after they met at Cambridge University while studying genomics as postgrads, Sano Genetics has built what it describes as a “private-by-design” tech platform to help patients take part in medical research and clinical trials. This includes at-home genetic testing capabilities, and is seeing the company support research into multiple sclerosis, ankylosing spondylitis, NAFLD and ulcerative colitis2, with a research programme for Parkinson’s disease on the agenda for later in 2021.

“For participants in medical research, the process is not user friendly,” says Sano Genetics CEO Patrick Short. “There is usually little to no benefit for participants beyond altruism, taking part is difficult and time-consuming and people are also concerned about the privacy of their sensitive genetic and medical information.

“[Therefore], for researchers in biotech, pharma and academia, it is very difficult to attract and retain research participants, which adds substantial costs and time to their research. In particular for research involving genetics and precision therapies, it is doubly challenging to find the ‘right’ patients because genetic testing is not routine in the healthcare system”.

To help solve this, Sano Genetics matches relevant participants to research via its platform. It then makes participation easier by enabling at-home genetic testing and by guiding participants through the process.

“The system is designed so users know exactly what will happen with their data, and we give them straightforward ways to control their data,” explains Short. “We keep our users engaged and involved in the research process by giving them updates on the research they have been a part of, and with free personalised content including genetic reports, and stories from other people like them on our blog”.

A typical end user is someone who has a chronic or rare disease and is using the platform to take part in research that helps them personally (e.g. access to a new therapy via a clinical trial) or to help others like them.

Meanwhile, Sano Genetics generates revenue by charging biotech and pharma companies fees to find the right patients for their studies. “The typical study for us consists of a set-up fee, a per-test fee for our at-home genetic testing and analysis, and a fee for each referral we make of an interested and eligible participant to their research study,” adds the Sano Genetics CEO.

Powered by WPeMatico

French startup Alma is raising a $59.4 million Series B funding round (€49 million). The company has been building a new payment option for expensive goods. You can choose to pay over three or four installments. This product sounds familiar if you’ve used Klarna in the past. But Klarna isn’t available in France.

Cathay Innovation, Idinvest, Bpifrance’s Large Venture fund, Seaya Ventures and Picus Capital are participating in today’s funding round. In addition to today’s equity round, Alma is raising a credit line of $25.5 million (€21 million) to finance merchant payments.

What makes Alma attractive to merchants is that the startup is handling 100% of the risk involved with a payment over multiple installments. When a customer buys a bike over four installments, they’ll get charged over several months. But the merchant gets paid on day one.

Since I first covered Alma, the startup has launched the ability to pay later. You enter your card information right now but you get charged 15 days or a month later. It can be particularly useful if you’re unsure about something you’re buying and if you think there’s a chance you’ll send it back.

And it’s an attractive option in France where debit cards are the norm — not credit cards. Alma also plans to offer longer plans, such as the ability to buy now and pay over 6, 10 or 12 installments.

Thanks to the new influx of cash, the startup plans to triple the size of its team and reach €1 billion in annual payment volume within two years. It’s also going to expand to other countries, but with a specific focus on helping French merchants reach European customers living in other European countries.

Powered by WPeMatico

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. Click here if you want it in your inbox every Saturday morning.

Ready? Let’s talk money, startups and spicy IPO rumors.

We’re shaking things up this weekend in the newsletter, focusing on a series of larger themes and news items instead of having a few discrete sections. Why? Because there was too much to fit into our usual format. If you were a fan of the original layout, we’ll be back to it next week.

Today we’re talking Coinbase’s growth, how Juked.gg tapped the equity crowdfunding market, a noodle or two on the a16z media game, Talkspace’s SPAC, VC and founder predictions for 2021, and where’s the right place to found a company.

Sound good? Let’s get into it!

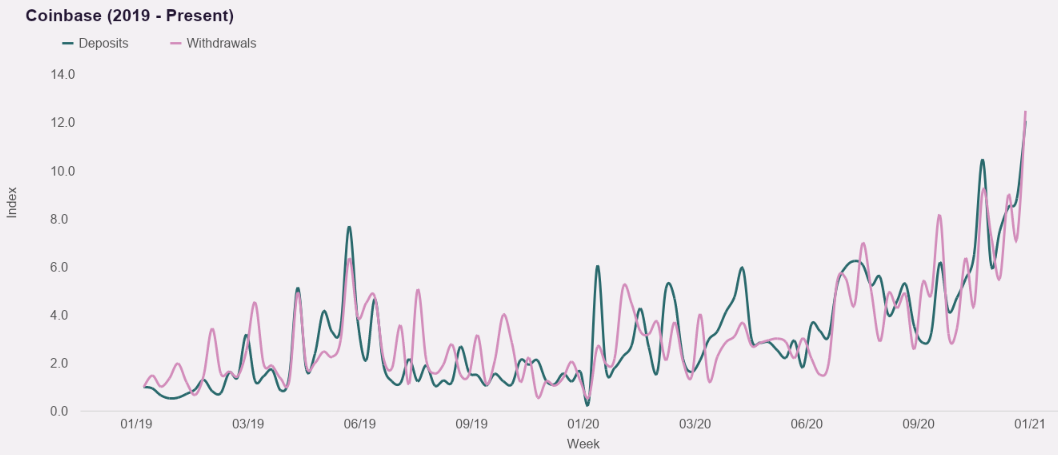

Thanks to Kazim Rizvi of Drop, parent company to Cardify which provides data on consumer spending, we have a look into how quickly deposits have scaled at American cryptocurrency platform Coinbase. As Coinbase has filed to go public, and we’re eagerly anticipating its eventual S-1 filing, we were stoked to get a directional look at how quickly consumer interest was growing for the assets it helps folks buy.

They are scaling rapidly. Using the first week of January 2019 as a baseline, by the last week of December 2020 deposits and withdrawals from Coinbase had grown by more than 12x apiece. That’s staggering growth, and while the data is somewhat volatile — and we’d treat it as directional instead of exact — on a week-to-week basis, it underscores how well companies like Coinbase may be performing as Bitcoin booms once again, bringing in more trading interest and consumer demand.

Via Cardify, Cardify data.

The Cardify data also indicates a multiplying of new customer acquisition at Coinbase over the same time period, and deposits scaling alongside the price of Bitcoin. As Bitcoin has topped the $30,000 mark recently, sharply higher than in recent quarters, the price gains may have helped Coinbase not only a solid Q4 2020, but perhaps put it on a path for a bonkers Q1 2021 as well.

If we were 10/10 excited about the Coinbase S-1 before this dataset, we’re now a heckin’ 12/10.

Esports is super cool and if you don’t agree, you are incorrect. But it doesn’t matter if you or I are right or not on the question, as the market has largely decided that competitive gaming is worth time, attention and investors’ money.

The proliferation of esports leagues and games and the like has led to a decidedly fragmented universe, however, lacking a central hub akin to what ESPN provides the world of traditional sports.

But not to worry, Juked.gg just raised capital to build a content hub for esports. This means that old folks like myself can still find out when tournaments are happening, and enjoy a dabble of League of Legends or Starcraft 2 pro play when we can, sans hunting around the internet for dates and times.

Juked.gg went through 500 Startups (more on its class here), catching our eye at the time as a neat nexus for esports-related content. Now flush with a little over $1 million that it raised on the Republic platform, it has big plans.

The Exchange spoke with Juked.gg’s co-founder and CEO Ben Goldhaber about his company’s performance to date. Per Goldhaber, Juked has scaled from 500 users when it launched in late 2019, to 50,000 in December of 2020. Ahead, Juked may invest more in journalism, more into social features, and more into user-generated content. We’ll have more on Juked as it gets its vision built, now powered by over a million dollars from 2,524 investors, each betting that the startup is building the right product to help unify a growing, if distributed, entertainment category.

To preserve our collective sanity, I’m not going to bang on at length here, but building out content at a VC firm is not new. Hell, how long ago did the First Round Review launch? What a16z appears to have in mind is different in scale, not substance. We chatted about it on Equity this week, in case you need more on the matter.

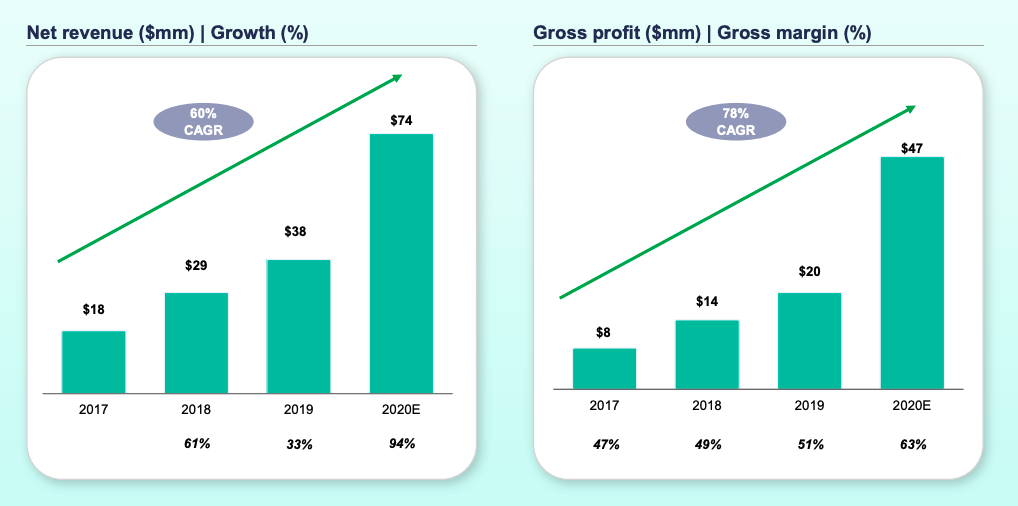

While it is enjoyable to mock SPACs, featuring as many do companies that are nascent to say the least, not all SPAC-led debuts are as silly as the rest. This is the case with the impending Talkspace deal, the deck for which you can read here.

What matters is this set of charts:

Look at that! Historical revenue growth! Improving gross margins! Rising gross profit!

You may argue that the company is not really worth an enterprise value of $1.4 billion that it will sport after its combination with Hudson Executive Investment Corp., but, hey, at least it’s a real business.

Seed VC NFX dropped a VC and founder survey the other day that I’ve been meaning to share with you. You can read the whole thing here, if you’d like.

I have two pull-outs for you this morning:

Initialized Capital put together some data on where founders think it is best to found a company. In 2020, nearly 42% of surveyed founders said the Bay Area. By 2021 that number had slipped to a little over 28%, with a plurality of 42% indicating that a distributed company is the best way to go.

I hear about this a lot from early-stage founders. They are often building what I call micro-multinationals, small companies that have a few employees in one country, and then a handful in others. Making that setup work is going to be a hotspot for HR software I reckon.

Regardless, the requirement of founding companies in the Bay Area is kaput. The advantages of founding there will linger much longer.

Coming up on The Exchange next week: The first entries of our new $50 million ARR series, featuring interviews with Assembly, SimpleNexus, Picsart, OwnBackup and others. And we have some $100 million ARR interviews in the can, as well.

Finally, to keep the The Powers That Be happy, The Exchange covered some neat stuff this week, including American VC results, fintech and unicorn venture capital, European and Asian venture capital results, how the IPO market is even more bonkers than you thought, and notes on what Qualtrics may be worth when it goes public.

Hugs, and let’s all get a nap in,

Powered by WPeMatico

Twenty years ago Drupal and Acquia founder Dries Buytaert was a college student at the University of Antwerp. He wanted to put his burgeoning programming skills to work by building a communications tool for his dorm. That simple idea evolved over time into the open-source Drupal web content management system, and eventually a commercial company called Acquia built on top of it.

Buytaert would later raise over $180 million and exit in 2019 when the company was acquired by Vista Equity Partners for $1 billion, but it took 18 years of hard work to reach that point.

When Drupal came along in the early 2000s, it wasn’t the only open-source option, but it was part of a major movement toward giving companies options by democratizing web content management.

Many startups are built on open source today, but back in the early 2000s, there were only a few trail blazers and none that had taken the path that Acquia took. Buytaert and his co-founders decided to reduce the complexity of configuring a Drupal installation by building a hosted cloud service.

That seems like a no-brainer now, but consider at the time in 2009, AWS was still a fledgling side project at Amazon, not the $45 billion behemoth it is today. In 2021, building a startup on top of an open-source project with a SaaS version is a proven and common strategy. Back then nobody else had done it. As it turned out, taking the path less traveled worked out well for Acquia.

Moving from dorm room to billion-dollar exit is the dream of every startup founder. Buytaert got there by being bold, working hard and thinking big. His story is compelling, but it also offers lessons for startup founders who also want to build something big.

In the days before everyone had internet access and a phone in their pockets, Buytaert simply wanted to build a way for him and his friends to communicate in a centralized way. “I wanted to build kind of an internal message board really to communicate with the other people in the dorm, and it was literally talking about things like ‘Hey, let’s grab a drink at 8:00,’” Buytaert told me.

He also wanted to hone his programming skills. “At the same time I wanted to learn about PHP and MySQL, which at the time were emerging technologies, and so I figured I would spend a few evenings putting together a basic message board using PHP and MySQL, so that I could learn about these technologies, and then actually have something that we could use.”

The resulting product served its purpose well, but when graduation beckoned, Buytaert realized if he unplugged his PC and moved on, the community he had built would die. At that point, he decided to move the site to the public internet and named it drop.org, which was actually an accident. Originally, he meant to register dorp.org because “dorp” is Dutch for “village or small community,” but he mistakenly inverted the letters during registration.

Buytaert continued adding features to drop.org like diaries (a precursor to blogging) and RSS feeds. Eventually, he came up with the idea of open-sourcing the software that ran the site, calling it Drupal.

About the same time Buytaert was developing the basis of what would become Drupal, web content management (WCM) was a fresh market. Early websites had been fairly simple and straightforward, but they were growing more complex in the late 90s and a bunch of startups were trying to solve the problem of managing them. Buytaert likely didn’t know it, but there was an industry waiting for an open-source tool like Drupal.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week we — Natasha and Danny and Alex and Grace — had more than a little to noodle over, but not so much that we blocked out a second episode. We try to stick to our current format, but, may do more shows in the future. Have a thought about that? equitypod@techcrunch.com is your friend and we are listening.

Now! We took a broad approach this week, so there is a little of something for everything down below. Enjoy!

Like we said, it’s a lot, but all of it worth getting into before the weekend. Hugs from the team, we are back early Monday.

Equity drops every Monday at 7:00 a.m. PST and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico