Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

5G has been on a tear the last few years as wireless operators and smartphone manufacturers have made a marketing push touting higher bandwidth and lower latency for users. Yet, for all the attention that 5G gets from consumers, some of the most important new applications for the next-generation wireless technology are actually on the enterprise side. The canonical example is self-driving cars, which will presumably rely on a combination of edge computing, low latency and high bandwidth in order to work.

Yet, there are far more applications that are perhaps even more interesting and more readily deployable today than AVs. On farms, connectivity can help with managing equipment, monitoring livestock and analyzing water usage to optimize plant growth. Logistics companies need to monitor global supply chains, tracking shipping containers as they wend their way around the world from port to port.

There’s just one problem: 5G wireless is hard to implement in rural areas where base stations are unprofitable to deploy and therefore few and far between. On the oceans of course, there are no wireless base stations at all.

DC-based Omnispace wants to offer ubiquitous 5G-compliant connectivity for enterprise users using a hybrid of wireless ground technology and satellites. The idea is that by integrating these two different modes — terrestrial and space — into one cohesive package, end users like agriculture and logistics companies wouldn’t have to transition their IoT connectivity between different types of technologies in order to secure the promise of 5G.

Today, the company announced a $60 million equity investment led by Joshua Pack of Fortress Investment Group, who serves as the burgeoning firm’s head of credit investing and also co-leads one of the firm’s SPACs, Fortress Value Acquisition. Existing investors Columbia Capital, Greenspring Associates, TDF Ventures and Telcom Ventures also participated in the round.

Omnispace started in 2012 as a holding company for wireless spectrum assets, particularly around the 2Ghz “S band” spectrum, which were purchased from the remnants of ICO Global, a satellite-based provider that had previously gone into bankruptcy. CEO Ram Viswanathan, who joined Omnispace in early 2016, said that the company started looking at how to use a technology layer to integrate its various assets together, eventually identifying an opportunity around global 5G connectivity with specific applications in IoT.

“The 5G rollout is going to be gated by the scope and rollout of mobile operators,” Viswanathan said. “Neither all of the landmass or customers are going to be covered” using traditional ground-based wireless technology. “Satellite’s main utility is really extending the reach of the network into more remote and rural areas.”

Viswanathan has spent decades in the satellite and wireless market, most recently as the co-founder of Devas Multimedia, an India-focused connectivity startup that has been embroiled in a long-running legal spat with the government there over the cancelation of the firm’s satellite launch, with U.S. courts recently ordering a government-affiliated commercialization business to pay Devas $1.2 billion in compensation.

While there is perhaps an easy comparable with SpaceX’s Starlink project, Omnispace is not focused on the consumer broadband market, but rather enterprise and IoT use cases. Furthermore, Omnispace is a hybrid network using a mix of different technologies, whereas Starlink is focused only on space deployment.

Omnispace is using its new capital from Fortress to flesh out its services and finish up pilot trials with some mobile operators and prepare the network for commercial usage starting in 2023, with the network ready in 2022. Viswanathan said that “our aim is to provide the service globally” with “a footprint that covers everywhere.”

Omnispace has contracted with Thales Alenia, part of the French space and defense conglomerate Thales Group, to execute on its space strategy. On the terrestrial side, it is tying together its spectrum assets and piloting with several mobile operators to bring out a cohesive solution, with early strength in Asia-Pacific and Latin America.

Powered by WPeMatico

Soon all tech news will be fintech news, all fintech news will be trading platform news and all trading platform news will concern the business mechanics of such services.

So, after looking into Robinhood’s fourth-quarter payment for order flow (PFOF) revenues this morning, we’re back with a related story. This time, however, we’re talking about Public.

Public, like Robinhood, is a zero-cost trading service. Its founders have worked to build a community-first platform, including offering ways to let groups chat about their investments.

And like Robinhood, Public has seen its growth skyrocket in recent days. Company representatives told TechCrunch today it was seeing “steady ~30%” month-over-month growth until Thursday, when “new user signups went up 20x.”

Both share strong backing from investors: Robinhood raised billions in new capital this week to ensure it has enough cash to meet clearinghouse deposit requirements. It managed to do so in part because its Q4 2020 numbers show that its PFOF business is ticking along nicely.

Public, flush with a recent $65 million Series C, took a different tack this morning and announced it would “stop participating in the practice of Payment for Order Flow.”

To which we say … all right.

On one level, this is neat. Public is not going to sell its order flow to market makers for fees. That’s good for users, but how will it make up the lost revenue? Tips, which will prove an interesting experiment in monetization.

TechCrunch asked the company if it believes tips will compensate for PFOF revenue, to which founders Leif Abraham and Jannick Malling replied via email that they were “optimistic that the difference will be offset by the optional tipping feature.”

However, dropping payment for order flow is only so brave a move from Public. After all, Public was not making Robinhood-level amounts of fetti from its PFOF business. Indeed, as we wrote when Public raised its Series C:

Before chatting with Public, I dug into its trading partner Apex’s filings to learn about its payment for order flow results from its recent filings. The resulting sums are somewhat modest for Apex’s collected clients. This means that Public’s revenue metrics, a portion of the aggregate sums, are even more unassuming.

Powered by WPeMatico

Another hour, another billion-dollar round. That’s how February is kicking off. This time it’s Databricks, which just raised $1 billion Series G at a whopping $28 billion post-money valuation.

Databricks is a data-and-AI focused company that interacts with corporate information stored in the public cloud.

News of the new round began leaking last week. Franklin Templeton led the round, which also included new investors Fidelity and Whale Rock. Databricks also raised part of the capital from major cloud vendors including AWS, Alphabet via its CapitalG vehicle, and Salesforce Ventures. Microsoft is a previous investor, and it took part in the round as well.

But we’re not done! Other prior investors including a16z, T. Rowe Price, Tiger Global, BlackRock and Coatue were also involved along with Alkeon Capital Management.

Consider that Databricks just raised a bushel of capital from a mix of cloud companies it works with, public investors it wants as shareholders when it goes public and some private money that is enjoying a stiff markup from their last check into the company.

The company has made its mark with a series of four open-source products with a core data lake product call Delta Lake leading the way. You may recall that another hot data lake company, Snowflake, raised almost a half a billion dollars on a $12.4 billion valuation a year ago before going public last September with a valuation twice that. Databricks has already exceeded that public valuation with this round — as a private company.

When we spoke to Databricks CEO Ali Ghodsi at the time of his company’s $400 million round in 2019, one which valued the company at $6.2 billion at the time, he said his company was the fastest-growing enterprise cloud software companies ever, and that’s saying something.

The company makes money by offering each of those open-source products as a software service and it’s doing exceedingly well at it, so much so that investors were tripping over each other to be part of this deal. In fact, Ghodsi said in a conversation with TechCrunch today that his company had targeted a much more modest $200 million raise, but that figure grew as more parties wanted to invest funds into the company. Even with that, Databricks had to turn capital away, he added, after deciding to cap the round at $1 billion.

The extra $800 million that the company raised will be used for M&A opportunities with an eye on talent, spend on establishing a Lakehouse concept, international expansion, while also expanding its engineering team, the CEO said.

Ghodsi also made clear that he does not intend to let the percentage of revenue that the company spends on R&D to drop, as is common at modern software companies — as many SaaS companies grow, they expend more of their revenue on sales and marketing efforts over product spend, something that Databricks wants to avoid by continuing to invest in engineering talent.

Why? Because Ghodsi says that the pace of innovation in AI is so rapid that IP becomes outdated in just a few years. That means that companies that want to lead in this space will have to stay on the bleeding edge of their market or fall back swiftly.

The Databricks model appears to be working well, with the company closing 2020 at $425 million in annual recurring revenue, or ARR. That figure, up 75% from the year-ago period, is also up from a $350 million run rate at the end of its Q3 2020. (For more on Databricks’ business, product and growth, head here.)

Notably Ghodsi told TechCrunch that this deal only started to come together in December. It’s February 1st today, which means that it took on this bushel of new funding remarkably quickly.

Finally, at $425 million in ARR, is the CEO worried about having a valuation sitting at roughly a 65x multiple? Ghodsi said that he is not. He said that he told his company during an all-hands earlier today that the AI market is a long journey, one that he hopes to be on for decades, and the stock market will go up and down. His point, as far as I could read into it, was that so long as Databricks keeps growing as it has, its valuation will take care of itself (and that seems to be the case so far with this company).

What’s certainly true is that Databricks is now as rich as it has ever been, as large as it has ever been, and in a market that is maturing. Let’s see what it can do with all this money.

Powered by WPeMatico

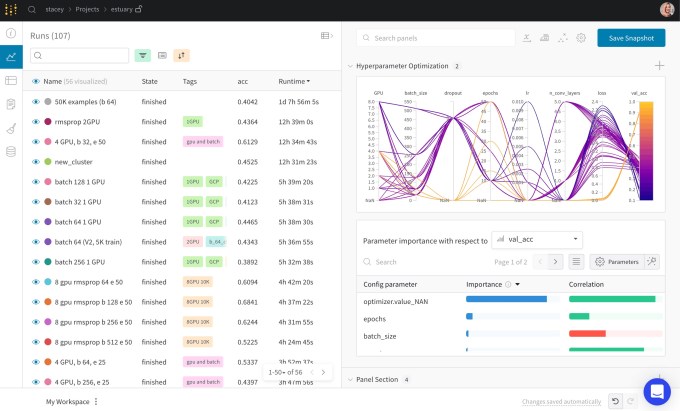

Weights & Biases, a startup building tools for machine learning practitioners, is announcing that it has raised $45 million in Series B funding.

The company was founded by Lukas Biewald, Chris Van Pelt and Shawn Lewis — Biewald and Van Pelt previously founded CrowdFlower/Figure Eight (acquired by Appen). Weights & Biases says it now has more than 70,000 users at more than 200 enterprises.

Biewald (whom I’ve known since college) argued that while machine learning practitioners are often compared to software developers, “they’re more like scientists in some ways than engineers.” It’s a process that involves numerous experiments, and Weights & Biases’ core product allows practitioners to track those experiments, while the company also offers tools around data set versioning, model evaluation and pipeline management.

“If you have a model that’s controlling a self-driving car and the car crashes, you really want to know what happened,” Biewald said. “If you built that model years ago and you’ve run all these experiments since then, it can be hard to systematically trace through what happened” unless you’re using experiment tracking.

He described the startup as “an early leader” in this market, and as competing tools emerge, he said it’s also differentiated because it is “completely focused on the ML practitioner” rather than top-down enterprise sales. Similarly, he said that as machine learning has been adopted more widely, Weights & Biases is occasionally confronted by a “high-class problem.”

Image Credits: Weights & Biases

“We’re not interested in selling to companies that are doing machine learning for machine learning’s sake,” Biewald said. “With some companies, there’s a mandate from the CEO to sprinkle some machine learning in the company. That’s just really depressing to me, to not have any impact. But I would actually say the vast majority of companies that we talk to really do something useful.”

For example, he said agriculture giant John Deere is using the startup’s platform to continually improve the way it uses robotics to spray fertilizer, rather than pesticides, to kill weeds and pests. And there are pharmaceutical companies using the platform for how they model how different molecules will behave.

Weights & Biases previously raised $20 million in funding. The new round was led by Insight Partners, with participation from Coatue, Trinity Ventures and Bloomberg Beta. Insight’s George Mathew is joining the board of directors.

“I’ve never seen a MLOps category leader with such a high NPS and deep customer focus as Weights and Biases,” Mathew said in a statement. “It’s an honor to make my first investment at Insight to serve an ML practitioner user-base that grew 60x these last two years.”

The startup says it will use the funding to continue hiring in engineering, growth, sales and customer success.

Powered by WPeMatico

Boston-based security operations company Rapid7 has been making moves into the cloud recently, and this morning it announced that it has acquired Kubernetes security startup Alcide for $50 million.

As the world shifts to cloud native using Kubernetes to manage containerized workloads, it’s tricky ensuring that the containers are configured correctly to keep them safe. What’s more, Kubernetes is designed to automate the management of containers, taking humans out of the loop and making it even more imperative that the security protocols are applied in an automated fashion as well.

Brian Johnson, SVP of Cloud Security at Rapid7 says that this requires a specialized kind of security product and that’s why his company is buying Alcide. “Companies operating in the cloud need to be able to identify and respond to risk in real time, and looking at cloud infrastructure or containers independently simply doesn’t provide enough context to truly understand where you are vulnerable,” he explained.

“With the addition of Alcide, we can help organizations obtain comprehensive, unified visibility across their entire cloud infrastructure and cloud-native applications so that they can continue to rapidly innovate while still remaining secure,” he added.

Today’s purchase builds on the company’s acquisition of DivvyCloud last April for $145 million. That’s almost $200 million for the two companies that allow Rapid7 to help protect cloud workloads in a fairly broad way.

It’s also part of an industry trend with a number of Kubernetes security startups coming off the board in the last year as bigger companies look to enhance their container security chops by buying talent and technology. This includes VMware nabbing Octarine last May, Cisco getting PortShift in October and Red Hat buying StackRox last month.

Alcide was founded in 2016 in Tel Aviv, part of the active Israeli security startup scene. It raised about $12 million along the way, according to Crunchbase data.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Natasha and Danny and Alex and Grace hopped online for our weekly show, sans Gamestop news (which you can find here) to talk about all the other busy news happening in startup world right now.

Here’s a taste of what we got into:

As always, it was a ton to get through because there is just so much going on. More Monday morning, until then stay cool!

Equity drops every Monday at 7:00 a.m. PST and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts

Powered by WPeMatico

Amidst all of the the sturm und drang of l’affaire GameStop, Qualtrics went public today.

After pricing its stock above its raised IPO range, the company received a warm welcome from public investors. After starting its trading life worth $41.85, Qualtrics closed the day worth $45.50, up some 51.67%.

Qualtrics did everything that it said it was going to.

The software company’s debut comes after a lengthy path to the public markets; Qualtrics sold to SAP on the eve of its first run at a public listing back in 2018. Now, SAP has completed spinning the company out, though the software giant remains the Utah unicorn’s largest shareholder.

That Qualtrics’ IPO might perform well was presaged in its pricing run, having prices far above its initial valuation estimates; there was evidence of strong demand even before its shares started to trade.

But did Qualtrics misprice, given its strong first-day performance? TechCrunch spoke with Qualtrics CEO Zig Serafin, and its founder and current executive chairman Ryan Smith about its public offering, hoping to learn a bit about what is next for the company.

Having spoken to myriad folks on IPO days, I’ve learned the best way to kick off is to ask about emotions. Most CEOs and other execs are tied up in what they can (and cannot) say. And they are well-trained by communications experts regarding what to repeat and emphasize. You can sometimes loosen them up a little, however, by asking them how they feel.

In response to that question, Serafin described a feeling of gratitude and Smith brought up the long game. Qualtrics, he said, had been told that it couldn’t bootstrap, that it couldn’t build in Utah, that SAP had overpaid, that SAP had messed up and so forth.

Powered by WPeMatico

Workday started the work day with some big news today. It’s acquiring employee feedback platform Peakon for $700 million in cash.

One thing we have learned during the pandemic is that organizations need to find new ways to build stronger connections with their employees, and that’s precisely what Peakon provides. “Bringing Peakon into the Workday family will be very compelling to our customers — especially following an extraordinary past year that has magnified the importance of having a constant pulse on employee sentiment in order to keep people engaged and productive,” Workday co-founder and co-CEO Aneel Bhusri, said in a statement.

Without the ability to have face-to-face meetings with employees, managers have struggled throughout 2020 to understand how COVID, working from home and all the trials and tribulations of the last year have affected the workforce.

But this ability to check the pulse of employees goes beyond this crisis period. Managers of large organizations know that the bigger and more spread out your firm becomes, the more challenging it is to understand what’s happening across the company. The company uses weekly surveys to ask specific questions about the organization. For them it’s all about getting good data, and so far customers have used the platform to ask over 153 million questions since inception six years ago.

Peakon CEO and co-founder Phil Chambers sees Workday as a logical partner. “Workday excels at helping enable customers to leverage their data. Together, we’ll be able to help drive greater productivity, talent development and employee retention for our customers — and unify how employees interact with their organizations,” he said in a Workday blog post announcing the deal.

Peakon was founded in Copenhagen in 2014 and has raised $68 million along the way, according to Crunchbase data. Its most recent round was a $35 million Series B in March 2019. The deal is expected to close by the end of this quarter subject to typical regulatory review.

Powered by WPeMatico

Rumors have been flying this week that SAP was going to buy Berlin business process automation startup Signavio, and sure enough the company made it official today. The companies did not reveal the purchase price, but Bloomberg reported earlier this week that the deal could be worth $1.2 billion.

With Signavio SAP gets a cloud-native business process management tool. SAP CFO Luka Mucic sees a world where understanding and automating businesses processes has become a key part of a company’s digital transformation efforts.

“I cannot overstress the importance for companies to be able to design, benchmark, improve and transform business processes across the enterprise to support new capabilities and business models,” he said in a statement.

While traditional enterprise BPA tools have existed for years, having a cloud-native tool gives SAP a much more modern approach to attacking this problem, and being able to automate business processes via the cloud has become more important during the pandemic when many employees are working entirely from home.

SAP also sees Signavio as a key missing piece in the company’s business process intelligence unit. “The combination of business process intelligence from SAP and Signavio creates a leading end-to-end business process transformation suite to help our customers achieve the requirements needed to gain a competitive edge,” he said.

SAP has been making moves into process automation of late. In fact at SAP TechEd in December, the company announced SAP Intelligent Robotic Process Automation, its foray into the RPA space. This should fit in nicely alongside it.

Dr. Gero Decker, Savigno co-founder and CEO, sees SAP resources helping push the company beyond what it could have done on its own. “Considering the positioning of SAP, its geographical coverage and financial muscle, SAP is the biggest and best platform to bring process intelligence to every organization,” he said in a statement.

The increased resources and reach argument is one that just about every acquired company CEO makes, but being pulled into a company the size of SAP can be a double-edged sword. Yes, it has vast resources, but it also can be hard for an acquired company to find its place in such a large pond. How well they fit in and make that transition from startup to big company cog, will go a long way in determining the success of this transaction in the long run.

Signavio launched in 2009 in Berlin and has raised almost $230 million, according to Crunchbase data. Investors include Apax Digital and Summit Partners. The most recent investment was a July 2019 Series C for $177 million, which came in at a $400 million valuation.

Customers include Comcast, Bosch, Liberty Mutual and yes SAP. Perhaps it will be getting a discount now.

Powered by WPeMatico

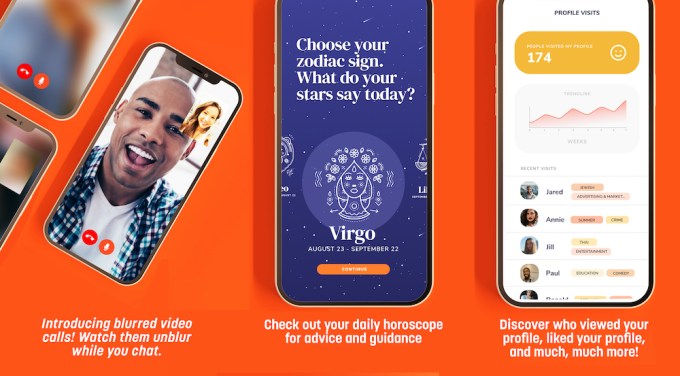

S’More, a dating app that’s focused on helping users find more meaningful relationships, announced today that it has raised $2.1 million in seed funding.

S’More (short for “something more”) ensures that users can’t focus on physical appearance, because photos are initally blurred — they gradually un-blur as you interact with someone. The startup has introduced new features like video chat (also blurred initially), and it launched a redesigned app of the beginning of this month — CEO Adam Cohen-Aslatei said it’s a “completely rebuilt product” with new features like real-time conversation prompts and the ability to pay to promote your profile.

Cohen-Aslatei also said that S’More’s focus on “anti-superficial relationships” is attracting a real audience, with 160,000 downloads in its first year and “thousands” of paying users, including a 50% increase in subscriptions after launching the new app in January.

Looking at how dating will evolve after the pandemic, Cohen-Aslatei suggested, “I don’t think we’re going back to the way things were.” He pointed to a recent survey of S’More users in which 80% of respondents said they hadn’t gone on a single live, in-person date in 2020.

“Do you want to meet for casual encounter on Tinder, or do you have to want to have a conversation get to know a real person on S’More?” he said. Assuming that many people will choose the latter, the next question is: “How do you make discovery fun? There’s got to be multimedia, video, audio, games, all of those features are part of our product roadmap … S’More will feel like Hinge meets Nextdoor.” (Apparently, there’s “a huge cohort” of users on Nextdoor who are single and looking for relationships.)

Image Credits: S’More

The new funding comes from a long list of investors: Benson Oak Ventures, Mark Pincus’ Workplay Ventures, Gaingels VC, Loud Capital/Pride Fund

SideCar Angels, AppLovin Chairman Rafael Vivas, Joshua Black of Apollo Management, Plus Grade CEO Ken Harris, Harvard geneticist George Church, former Meet Group CEO John Abbott, former IMAX CEO Brad Weschler, Aaron and Sharon Stern, Justen Stepka/Enterprise Fund, Boston Harbor Angels, Grit Daily CEO Jordan French, Kind.Fund founder Marty Isaac, Craig Mullett and Dating Group.

Cohen-Asletai told me the funding has already allowed him to hire what he’s calling a “founding team,” including chief architect Long Nguyen, head of operations Sneha Ramanchandran, head of product and design Regina Guinto and senior developer David Lichy.

S’More is also announcing that it has signed a production deal with producers Elvia Van Es Oliva and Jack Tarantino, who have worked on shows like “90 Day Fiancé.” Cohen-Asletai said the startup will work with them to create “anti-superficial” dating content for digital platforms and TV networks.

This deal builds on the success of S’More Live, the startup’s celebrity dating show on Instagram Live, which has aired 60 episodes so far.

“We’re using that show to build our brand, to gain awareness and then … we’re actually able to leverage all of the viewers and retarget them with content from S’More, which has made our cost to acquire a user [very affordable],” Cohen-Asletai said.

Powered by WPeMatico