Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Natasha and Danny and Alex and Grace were all here to chat through the week’s biggest tech happenings. The good news is that we managed to fit it all into a single episode this week. The bad news is that that means the show is pretty long. Sorry about that!

So, what took us so much time to get through? All of this:

And somehow we still have another entire day before the week is up! So much for 2021 calming down after 2020’s storms.

Equity drops every Monday at 7:00 a.m. PST and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

The recent Databricks funding round, a $1 billion investment at a $28 billion valuation, was one of the year’s most notable private investments so far.

For Databricks signaled its IPO readiness by disclosing to TechCrunch last year that it had scaled its revenue run rate from $200 million to $350 million in a year, so the new capital looked like the capstone on its private fundraising before an eventual public debut.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

But I did have a few questions, starting with the price of the round.

At a $28 billion valuation and ARR of $425 million, Databricks is valued at around 66x top line. That’s steep, if not the highest number we can dredge up on the public markets. Of course, for Databricks shareholders, seeing the value of their stock rise so quickly is hardly a bad thing. They are hardly going to complain about having more paper wealth.

But what about the investor perspective? Does the price really make sense? The Exchange caught up with Battery Ventures’ Dharmesh Thakker earlier this week to discuss a number of things, one of which was Databricks’ round and pricing. Thakker is named in the Databricks Series D funding announcement, which brought Battery into the company.

What was surprising about our conversation was not that Thakker was bullish on Databricks — a company that he and his firm have backed since its $140 million, 2017 round when the company was worth just under $1 billion. What surprised me was that he thinks its new $28 billion valuation might be a little low.

What was surprising about our conversation was not that Thakker was bullish on Databricks — a company that he and his firm have backed since its $140 million, 2017 round when the company was worth just under $1 billion. What surprised me was that he thinks its new $28 billion valuation might be a little low.

Intriguing, yeah? So this morning for both of us, I’ve pulled out quotes from our chat to help explain how Thakker views the market for Databricks, unicorns at scale more broadly through the lens of risk-adjusted investing, and the scale of the market some unicorns are playing in.

At the close, we’ll remind ourselves what Databricks CEO Ali Ghodsi told TechCrunch when we asked him the same question. Let’s go!

Here’s how the valuation part of my chat with the Battery Ventures’ investor went down:

The Exchange: I want to talk about Databricks, because I spoke to [CEO] Ali [Ghodsi] yesterday about this round, and hot damn, it’s a lot of money at a valuation that is roughly 64x ARR, give or take. I don’t understand the price, and I know it’s a boring thing to talk about. [It’s a] great company, I get their market, I’ve talked to them a bunch, I know their revenue numbers. [But] I don’t understand the price, and I was hoping you could tell me why I’m being too conservative.

Dharmesh Thakker: I, for what it’s worth, think [the price] fair. If anything, I think it is on the lower end — he could have done better, frankly. But I think it comes down to three major things, right?

One is the addressable market. Just think about the addressable market of data. If there’s a trillion dollars spent in software or technology, I think you and I would be both hard pressed to say, almost all of that [isn’t] influenced by some data-oriented decisioning. Whether it’s digital transformation, whether it’s analytics, data is everywhere. So the TAM is massive … I think you and I both agree on that, whether it is $20 billion or $80 billion — it’s massive.

Powered by WPeMatico

Meet moka.care, a French startup that has built several services that should help you improve your psychological well-being. The company sells its solution to employers directly. They can then offer access to moka.care to their employees.

The startup raised a $3 million (€2.5 million) funding round from Singular, the VC firm founded by former Alven partners Jeremy Uzan and Raffi Kamber. A long list of business angels are also participating in today’s round, such as Nicolas Dessaigne (Algolia), Ning Li (Made.com, Typology), Florian Douetteau (Dataiku), Céline Lazorthes (Leetchi, MangoPay), Pierre Dubuc (OpenClassrooms), Marc-Antoine de Longevialle (LeCab), Adrien Ledoux (JobTeaser), Roxanne Varza (Station F), Thibault Lamarque (CASTALIE) and Côme Fouques (Indy).

Moka.care believes that companies aren’t doing enough when it comes to mental health. Many companies give you a phone number and tell you that you can call that number to get mental support. But few employees actually call those helplines.

That’s why the startup is taking a completely different approach. The most important principle is that people are looking for different things. And you don’t necessarily know what you’re looking for when you’re feeling down. When you first contact moka.care, the company spends roughly half an hour talking with you to understand what you’re looking for.

There are three main options after that. Moka.care could send you some recommendations for a practitioner — it can be a psychologist, a certified coach or a licensed therapist. Moka.care also organizes group sessions around a specific topic. It could be focused on remote work, work-life balance, self-confidence, etc. Finally, moka.care also provides content on some of those topics. You can access that content and learn more about yourself.

With this granular approach, the company hopes it can tackle mental health conditions before it’s too late — you don’t want to recommend a therapist when an employee is already suffering from excessive stress, fatigue or burnout.

Employees don’t pay for the first sessions as it’s part of moka.care’s plans. This way, the barrier to entry should be much lower for employees. Of course, if you want to book further appointments, you’ll have to pay at some point.

For employers, moka.care tries to lower the barrier to entry as well. Clients agree on a per-employee-per-month subscription plan based on some usage rate. If your employees end up using moka.care more than that, you don’t pay more. If your employees don’t use the service at all and you’re overpaying, the startup pays you back.

There are 30 companies currently using moka.care — it represents thousands of employees that could potentially create an account and access the service. The startup currently works with around 50 practitioners.

Powered by WPeMatico

Flux, the London fintech that has built a technology platform for banks and merchants to power itemised digital receipts and more, has seen its lengthy pilot with Barclays bear fruit.

Announced formally today — but actually quietly rolled out a few months ago — Flux-powered digital receipts are now available as an opt-in for all U.K. Barclays debit card holders within the bank’s main mobile banking app. Previously, the functionality was only available within the Barclays Launchpad app, which is available for customers that want to try out experimental or upcoming features.

Early last year, Barclays announced that it has invested in Flux, taking a minority stake, so the strengthening of its partnership isn’t too much of a surprise. Flux also went through the Techstars-powered Barclays accelerator in its very early days. However, not all corporate accelerators lead to great outcomes as corporates are notoriously risk-adverse. This one certainly wasn’t rushed but it’s meaningful regardless, giving Flux a major shot in the arm in reaching mainstream banking customers beyond the existing challenger bank partnerships it has forged.

“Customers who pay using their Barclays debit card for future in store purchases at H&M, shoe retailer schuh and food outlets, which include Just Eat and Papa Johns, will see their receipts sent automatically to their app after making a purchase. They can then easily and securely view their receipts whenever they need by tapping on the transaction,” says Barclays. Crucially, although opt-in, Barclays customers will receive a prompt to set up digital receipts when they purchase items from retailers currently on-boarded to Flux.

Founded in 2016 by former early employees at Revolut, Flux bridges the gap between the itemised receipt data captured by a merchant’s point-of-sale (POS) system and what little information typically shows up on your bank statement or mobile banking app. Off the back of this, it can also power loyalty schemes and card-linked offers, as well as give merchants much deeper POS analytics via aggregated and anonymised data on consumer behaviour, such as which products are selling best in unique baskets.

On the banking side, along with Barclays, Flux has partnered with challenger banks Starling and Monzo. Once banking customers link their account to the service, Flux delivers digital receipts (and where available rewards and loyalty) for transactions at Flux retailer partners.

Longer term, Flux wants to become a standard for the interchange of item level digital receipt data — and the proprietary platform that powers that standard — but has always faced a chicken-and-egg problem: It needs bank integrations to sign up merchants and it needs merchant integrations to sign up banks. Barclays going live properly is another significant turn in the upstart’s flywheel.

Powered by WPeMatico

Latitude, a startup building games with “infinite storylines” generated by artificial intelligence, is announcing that it has raised $3.3 million in seed funding.

The idea of an AI-generated story might make you think of hilariously nonsensical experiments like “Sunspring,” but Latitude’s first title, AI Dungeon, is an impressively open-ended (and coherent) text adventure game where you can choose from a wide variety of genres and characters.

Unlike a classic text adventure like Zork — where players quickly become familiar with “you can’t do that”-style messages when they type something the designers hadn’t planned for — AI Dungeon can respond to any command. For example, when my brave knight was charging into battle, I typed “get depressed” and he quickly sat on a rock with his head between his hands.

“How does the AI know what’s a good story?” said co-founder and CEO Nick Walton. “Because it’s read a lot of good stories and knows the patterns involved in that.”

AI Dungeon actually started out as one of Walton’s hackathon projects. While the initial version didn’t win any prizes, he kept at it, assisted by improvements in OpenAI’s language generator, of which the most recent version is GPT-3.

AI Dungeon, Image Credits: Latitude

“The very first version of AI Dungeon I built was coherent on a sentence level, but on a paragraph level it made no sense,” Walton said. “Once you get to GPT-2, it makes a lot more sense. Once you get to GPT-3, it’s a lot more coherent on a story level. And so I think to a degree, these issues with coherency, the story not making sense, get solved as the AI gets better.”

Latitude says AI Dungeon is attracting 1.5 million monthly active users. The startup plans to create more AI-powered games, and eventually to release a platform allowing other game designers to do the same.

Walton noted that without AI, video games are always constrained by the imagination of its creators. Even when you get to games like The Elder Scrolls II: Daggerfall or No Man’s Sky, with randomly generated towns or planets, he argued that they’re really offering “the same spin on a similar concept.”

For example, he said that in Daggerfall, “When you go to all these towns, they’re all basically the same. That’s the problem with procedural generation: You’re not coming up with unique things.” AI, on the other hand, can come up with “something completely unique that’s so, so different every time.”

Latitude CEO Nick Walton. image Credits: Latitude

From a business perspective, he said that this could lower the cost of developing AAA games from more than $100 million to less than $100,000 — though Latitude has a ways to go before it reaches that level, since it hasn’t even released a game with graphics yet. Walton also said this could lead to new levels of immersion and interactivity.

“With this technology, you could have a world with tens of thousands of characters with their own hopes and wants and dreams,” he said. “You can have worlds that are dynamic, that are alive, rather than something like World of Warcraft, where you’ve got 10 million people who are doing the same quest.”

The startup’s funding was led by NFX, with participation from Album VC and Griffin Gaming Partners.

“Latitude is revolutionizing how games are made, creating a whole new genre of entertainment gaming fueled by AI,” said James Currier of NFX in a statement. “The best AI minds and engineers are gathering there to produce games that the world has never seen before. Latitude is already by far the leading AI games company.“

Powered by WPeMatico

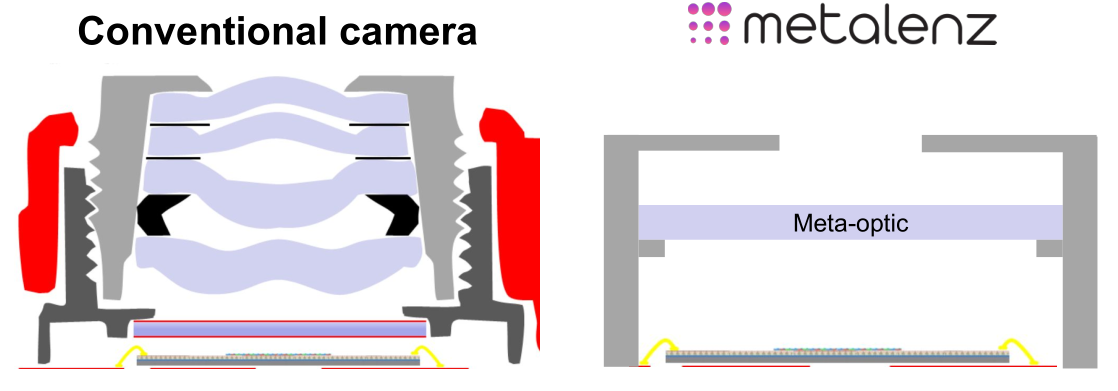

As impressive as the cameras in our smartphones are, they’re fundamentally limited by the physical necessities of lenses and sensors. Metalenz skips over that part with a camera made of a single “metasurface” that could save precious space and battery life in phones and other devices… and they’re about to ship it.

The concept is similar to, but not descended from, the “metamaterials” that gave rise to flat beam-forming radar and lidar of Lumotive and Echodyne. The idea is to take a complex 3D structure and accomplish what it does using a precisely engineered “2D” surface — not actually two-dimensional, of course, but usually a plane with features measured in microns.

In the case of a camera, the main components are of course a lens (these days it’s usually several stacked), which corrals the light, and an image sensor, which senses and measures that light. The problem faced by cameras now, particularly in smartphones, is that the lenses can’t be made much smaller without seriously affecting the clarity of the image. Likewise sensors are nearly at the limit of how much light they can work with. Consequently, most of the photography advancements of the last few years have been done on the computational side.

Using an engineered surface that does away with the need for complex optics and other camera systems has been a goal for years. Back in 2016 I wrote about a NASA project that took inspiration from moth eyes to create a 2D camera of sorts. It’s harder than it sounds, though — usable imagery has been generated in labs, but it’s not the kind of thing that you take to Apple or Samsung.

Metalenz aims to change that. The company’s tech is built on the work of Harvard’s Federico Capasso, who has been publishing on the science behind metasurfaces for years. He and Rob Devlin, who did his doctorate work in Capasso’s lab, co-founded the company to commercialize their efforts.

“Early demos were extremely inefficient,” said Devlin of the field’s first entrants. “You had light scattering all over the place, the materials and processes were non-standard, the designs weren’t able to handle the demands that a real world throws at you. Making one that works and publishing a paper on it is one thing, making 10 million and making sure they all do the same thing is another.”

Their breakthrough — if years of hard work and research can be called that — is the ability not just to make a metasurface camera that produces decent images, but to do it without exotic components or manufacturing processes.

“We’re really using all standard semiconductor processes and materials here, the exact same equipment — but with lenses instead of electronics,” said Devlin. “We can already make a million lenses a day with our foundry partners.”

The thing at the bottom is the chip where the image processor and logic would be, but the meta-optic could also integrate with that. The top is a pinhole. Image Credits: Metalenz

The first challenge is more or less contained in the fact that incoming light, without lenses to bend and direct it, hits the metasurface in a much more chaotic way. Devlin’s own PhD work was concerned with taming this chaos.

“Light on a macro [i.e. conventional scale, not close-focusing] lens is controlled on the macro scale, you’re relying on the curvature to bend the light. There’s only so much you can do with it,” he explained. “But here you have features a thousand times smaller than a human hair, which gives us very fine control over the light that hits the lens.”

Those features, as you can see in this extreme close-up of the metasurface, are precisely tuned cylinders, “almost like little nano-scale Coke cans,” Devlin suggested. Like other metamaterials, these structures, far smaller than a visible or near-infrared light ray’s wavelength, manipulate the radiation by means that take a few years of study to understand.

The result is a camera with extremely small proportions and vastly less complexity than the compact camera stacks found in consumer and industrial devices. To be clear, Metalenz isn’t looking to replace the main camera on your iPhone — for conventional photography purposes the conventional lens and sensor are still the way to go. But there are other applications that play to the chip-style lens’s strengths.

Something like the FaceID assembly, for instance, presents an opportunity. “That module is a very complex one for the cell phone world — it’s almost like a Rube Goldberg machine,” said Devlin. Likewise the miniature lidar sensor.

At this scale, the priorities are different, and by subtracting the lens from the equation the amount of light that reaches the sensor is significantly increased. That means it can potentially be smaller in every dimension while performing better and drawing less power.

Image (of a very small test board) from a traditional camera, left, and metasurface camera, right. Beyond the vignetting it’s not really easy to tell what’s different, which is kind of the point. Image Credits: Metalenz

Lest you think this is still a lab-bound “wouldn’t it be nice if” type device, Metalenz is well on its way to commercial availability. The $10 million Series A they just raised was led by 3M Ventures, Applied Ventures LLC, Intel Capital, M Ventures and TDK Ventures, along with Tsingyuan Ventures and Braemar Energy Ventures — a lot of suppliers in there.

Unlike many other hardware startups, Metalenz isn’t starting with a short run of boutique demo devices but going big out of the gate.

“Because we’re using traditional fabrication techniques, it allows us to scale really quickly. We’re not building factories or foundries, we don’t have to raise hundreds of mils; we can use what’s already there,” said Devlin. “But it means we have to look at applications that are high volume. We need the units to be in that tens of millions range for our foundry partners to see it making sense.”

Although Devlin declined to get specific, he did say that their first partner is “active in 3D sensing” and that a consumer device, though not a phone, would be shipping with Metalenz cameras in early 2022 — and later in 2022 will see a phone-based solution shipping as well.

In other words, while Metalenz is indeed a startup just coming out of stealth and raising its A round… it already has shipments planned on the order of tens of millions. The $10 million isn’t a bridge to commercial viability but short-term cash to hire and cover upfront costs associated with such a serious endeavor. It’s doubtful anyone on that list of investors harbors any serious doubts on ROI.

The 3D sensing thing is Metalenz’s first major application, but the company is already working on others. The potential to reduce complex lab equipment to handheld electronics that can be fielded easily is one, and improving the benchtop versions of tools with more light-gathering ability or quicker operation is another.

Though a device you use may in a few years have a Metalenz component in it, it’s likely you won’t know — the phone manufacturer will probably take all the credit for the improved performance or slimmer form factor. Nevertheless, it may show up in teardowns and bills of material, at which point you’ll know this particular university spin-out has made it to the big leagues.

Powered by WPeMatico

Marketing software company HubSpot is acquiring The Hustle, the business and tech media startup behind the popular newsletter of the same name.

Axios broke the news of the deal and reported that it values the startup at around $27 million. HubSpot declined to comment on the deal price, and while tweeting about the acquisition, The Hustle CEO Sam Parr wrote, “Early in my career I was transparent with money. But I didn’t like the result of sharing that stuff. So we’re not disclosing the price and HubSpot has agreed. I’m taking it to the grave!”

In its press release about the acquisition, HubSpot noted that customers are finding its products through content like its YouTube videos and HubSpot Academy.

“By acquiring The Hustle, we’ll be able to better meet the needs of these scaling companies by delivering educational, business and tech trend content in their preferred formats,” said HubSpot’s senior vice president of marketing Kieran Flanagan in a statement. “Sam and his team have a proven ability to create content that entrepreneurs, startups and scaling companies are deeply passionate about, and I’m excited to bring them on board to take that work to the next level.”

HubSpot says The Hustle’s flagship newsletter has 1.5 million subscribers. It also has a subscription offering called Trends and a podcast called My First Million.

“The goal is to build the largest business content network in the world,” Parr tweeted. “Soon, we’ll expand to a variety of mediums on a bunch of different topics and will have really innovative products coming out. We’re also going to hire the best content creators in the world.”

Powered by WPeMatico

Box announced this morning that it has agreed to acquire e-signature startup SignRequest for $55 million. The acquisition gives the company a native signature component it has been lacking and opens up new workflows for the company.

Box CEO Aaron Levie says the company has seen increased demand from customers to digitize more of their workflows, and this acquisition is about giving them a signature component right inside Box that will be known as Box Sign moving forward. “With Box Sign, customers can have a seamless e-signature experience right where their content already lives,” Levie told me.

While Box has partnerships with other e-signature vendors, this gives it one to call its own, one that will be built into Box starting this summer. As we have learned during this pandemic, the more work we can do remotely, the safer it is. Even after the pandemic ends and we get back to more face-to-face interactions, being able to do things fully in the cloud and removing paper from the workflow will speed up everything.

“The massive push to remote work effectively instantly highlighted for every enterprise where their digital workflows were breaking down. And e-signature was a major part of that — too many industries still rely on paper-based processes,” he said.

Levie says that the signature component has been a key missing piece from the platform. “As for our platform, when you look at Snowflake, they’re the data cloud. Salesforce is the sales cloud. Adobe is the marketing cloud. We want to build the content cloud. Imagine one platform that can power the entire lifecycle of content. E-signature has been a major missing link for critical workflows,” he said.

He believes this will open up the platform for a number of scenarios, that while possible before, could not flow as easily between Box components. “Having SignRequest gets us more natively into mission-critical workflows like customer contracts, vendor onboarding, healthcare onboarding and supply chain collaboration,” Levie explained.

It’s worth noting that Dropbox acquired HelloSign for $230 million two years ago to provide it with a similar kind of functionality and workflow capability, but analyst Alan Pelz-Sharpe from Deep Analysis, a firm that follows the content management market, says this wasn’t really in reaction to that.

“I think what is interesting here is that Box is going to integrate SignRequest and bundle it as part of the standard service. That’s what really caught my eye as the challenge with e-sig is that it’s typically a separate product and so gets limited use. They bought it partly in response to Dropbox, but it was a hole that needed fixing regardless so would have done so anyway,” Pelz-Sharpe explained.

As for SignRequest, the company was founded in the Netherlands in 2014. Neither PitchBook nor Crunchbase has a record of it raising funds. The plan is for the company’s employees to join Box and help build the signature component that will become Box Sign. According to a message to customers on the company website, existing customers will have the opportunity over the next year to move to Box Sign, and get all of the other components of the Box platform.

Levie says the basic Box Sign function will be built into the platform at no additional charge, but there will be more advanced features coming that they could charge for. The deal is expected to close soon with the SignRequest team remaining in The Netherlands.

Powered by WPeMatico

BukuWarung, an Indonesian startup focused on digitizing the country’s 60 million small businesses, announced today it has raised new funding from Rocketship.vc and an Indonesian retail conglomerate.

The amount was undisclosed, but sources say it brings BukuWarung’s total funding so far to $20 million. The company’s last round, announced in September 2020, was between $10 million to $15 million. Launched in 2019, BukuWarung was founded by Chinmay Chauhan and Abhinay Peddisetty and took part in Y Combinator last year.

Rocketship.vc is also an investor in Indian startup Khatabook, which reached a valuation between $275 million to $300 million in its last funding round. Like Khatabook, BukuWarung helps small businesses, like neigborhood stores called warung, that previously relied on paper ledgers transition to digital bookkeeping and online payments. BukuWarung recently launched Tokoko, a Shopify-like tool that lets merchants create online stores through an app, and says Tokoko has been used by 500,000 merchants so far.

Chuahan, BukuWarung’s president, said it has started making revenue through its payments solution. In total, BukuWarung now claims more than 3.5 million registered merchants in 750 Indonesian towns and cities, and says it is recording over $15 billion worth of transactions across its platform and processing over $500 million in terms of volume.

SMEs contribute about 60% to Indonesia’s gross domestic product and employ 97% of its domestic workforce, but many have difficulty accessing financial services that can help them grow. By digitizing their financial records, companies like BukuWarung can make it easier for them to access lines of credit, working capital loans and other services. Other companies serving SMEs in Indonesia, Southeast Asia’s largest economy, include BukuKas and CrediBook.

BukuWarung will use its new funding to grow its tech and product teams in Indonesia, India and Singapore. It plans to launch more monetization products, including credit, and grow its payments solution this year.

Powered by WPeMatico

Landed, a startup aiming to improve the hiring process for hourly employers and job applicants, is officially launching its mobile app today. It’s also announcing that it has raised $1.4 million in seed funding.

Founder and CEO Vivian Wang said that the app works by asking applicants to fill out a profile with information like work experience and shift availability, as well as recording videos that answer basic common interview questions. It then uses artificial intelligence to analyze those responses across 50 traits such as communication skills and body language, then matches them up with job listings from employers.

Landed has been in beta testing since March of last year — yes, right as COVID-19 was hitting the United States. Wang acknowledged that this was bad news for some of the startup’s potential customers, but she said businesses like grocery stores and fast food restaurants needed the product more than ever.

“That’s why we continuously grew through 2020,” she said.

After all, Landed allowed those businesses to continue hiring without having to conduct large group interviews in person. Even beyond health concerns, she said managers struggle with rapid turnover in these positions (something Wang saw herself during her time on the corporate team at Gap, Inc.) and with a hiring process that’s usually “only a small part of their job.” So Landed saves time and automates a large part of the product.

Landed CEO Vivian Wang. Image Credits: Landed

Meanwhile, Wang said job applicants benefit because they can find jobs more easily and quickly, often within a week of creating a profile. She also argued that Landed can improve on existing diversity and inclusion efforts by allowing managers to see a broader pool of candidates, and because its AI matching isn’t subject to the same unconscious biases that employers might have.

Of course, bias can also be inadvertently built into AI, but when I raised this issue, Wang pointed to Landed’s partnerships with local nonprofits to bring in underrepresented candidates, and she added, “AI can be scary when there are no human checks in place. We partner directly with our employers to ensure the matches that we’re sending them are the right matches, and there are calibration periods.”

Landed is free for job applicants, while it charges a monthly fee to employers, with customers already including Wendy’s, Chick-fil-A and Grocery Outlet franchisees. In fact, Grocery Outlet Ventura owner Eric Sawyer said that by using the app, he’s gone from hiring one person for every 10 interviews to hiring one person for every three interviews.

“My time spent on scheduling and performing interviews has been cut in half by utilizing the Landed app for most of my communications,” he said in a statement.

The new funding was led by Javelin Venture Partners, with participation from Y Combinator, Palm Drive Capital and various angel investors. Wang said this will allow Landed to continue expanding — the service is currently available in seven metro areas (Northern California; Southern California; Virginia Beach/Chesapeake, Virginia; Phoenix/Scottsdale, Arizona; Atlanta, Georgia; Reno, Nevada and Dallas-Ft. Worth, Texas), with a goal of tripling that number by the end of the year.

Wang added that eventually, she wants to provide other services to job applicants, such as loans (at a lower rate than payday lenders) and job training, turning Landed into a “lifestyle stability platform” that combines job stability, financial stability and educational “upskilling” for blue-collar workers.

Powered by WPeMatico