Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Reddit raises more funding, Shopify expands payments to Facebook and a study suggests that the Apple Watch might be able to predict COVID diagnoses. This is your Daily Crunch for February 9, 2021.

The big story: Reddit raises $250M

This latest funding announcement comes after Reddit has returned to the headlines, with the WallStreetBets subreddit playing a crucial role in the spectacular rise and fall of GameStop shares (along with other stocks). The company also ran a five-second Super Bowl ad on Sunday, consisting of a single static image.

Reddit announced the round in a blog post that said the money comes from “existing and new investors” and will allow the company to “make strategic investments in Reddit including video, advertising, consumer products and expanding into international markets.”

The tech giants

Shopify expands its payment option, Shop Pay, to its merchants on Facebook and Instagram — This is the first time Shop Pay will be made available outside of Shopify’s own platform.

CD Projekt hit by ransomware attack, refuses to pay ransom — “We have already secured our IT infrastructure and begun restoring data,” the game company said.

Spotify confirms it’s (finally) testing a live lyrics feature in the US — Though the streaming music service today offers live lyrics in a number of markets, it has not done so in the U.S. for many years.

Startups, funding and venture capital

Swarm’s low-cost satellite data network is now available to commercial clients — One of the original startups that set out to create a low-Earth orbit satellite constellation to provide a data network here on Earth is now open for business.

Mighty Buildings nabs $40M Series B to 3D print your next house — The startup says it can 3D print a 350-square-foot studio apartment in just 24 hours.

Seed firm Eniac Ventures raises $125M for its fifth fund — The size of Eniac’s funds has grown dramatically over the past decade, from its $1.6 million first fund in 2010 to its $100 million fourth fund in 2017.

Advice and analysis from Extra Crunch

Decrypted: A hacker attempted to poison Florida town’s water supply — Oldsmar is a small town in Florida that became the center of the cyber world this week.

Are SAFEs obscuring today’s seed volume? — SAFEs are a quick and cheap method for raising capital.

(Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Everything else

Announcing the agenda for TC Sessions: Justice — Our second-ever dedicated event to diversity, equity, inclusion and labor in tech is coming up on March 3.

Mount Sinai study finds Apple Watch can predict COVID-19 diagnosis up to a week before testing — The investigation, dubbed the “Warrior Watch Study,” used a dedicated Apple Watch and iPhone app and included participants from Mount Sinai staff.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Powered by WPeMatico

LiveRamp has acquired DataFleets, a fresh young startup that made it possible to take advantage of large volumes of encrypted data without the risk or fuss of decrypting or transferring it. LiveRamp, an enterprise data connectivity platform itself, paid more than $68 million for the company, a huge multiple on DataFleet’s $4.5 million seed announced just last fall.

DataFleets saw the increasing need for sensitive data like medical or financial records to be analyzed or used to train machine learning models. Not only are such databases bulky and complex, making transfers difficult, but allowing them to be decrypted and used elsewhere opens the door to errors, abuse and hacks.

The company’s solution was essentially to have software on both sides of the equation, the data provider (perhaps a hospital or bank) and the client (an analyst or AI developer), and act as a secure go-between. Not for the sensitive data itself, but for the systems of analysis and machine learning models that the client wanted to set loose on the data. This allows the client to perform an automated task on the data, such as harvesting and comparing values or building an ML model, without ever having direct access to it.

Clearly this approach seemed valuable to LiveRamp, which provides a number of data connectivity services to major enterprise customers, household names in fact. They announced in their earnings statement last night that they paid $68 million up front for DataFleets, though that price does not reflect the various other incentives and deferred payments that many such deals involve, and in this case seem likely to remain private.

The deal will probably result in the retiring of the DataFleets brand (young as it was), but their various customers will probably make the trip to LiveRamp. The most recent of those is HCA Healthcare, a major national provider that just announced a COVID-19 data sharing consortium that would be using DataFleets’s services. That’s a pretty powerful validation for an approach just commercialized late last year, and a nice catch for LiveRamp to add to its healthcare client collection.

For its part LiveRamp plans to use its augmented services to expand its operations and offerings in Europe, Asia and Latin America over the coming year. The company has also called for a federal data privacy law, something that hopefully that will be achieved under the new administration.

Powered by WPeMatico

French startup Homa Games has raised a $15 million seed round led by e.ventures and Idinvest Partners. The company has built several in-house technologies that can take a game from prototype to App Store success. It partners with third-party game studios and has a few in-house game studios as well.

OneRagtime, Jean-Marie Messier, Vladimir Lasocki, John Cheng and Alexis Bonillo are also participating in today’s funding round. This is quite a big funding round, but Homa Games already has some impressive metrics.

For instance, the startup’s games have been downloaded 250 million times overall since the creation of the company in 2018. It has signed an IP partnership with Hasbro to launch a Nerf-themed game that has been working quite well. Other games include Sky Roller, Idle World and Tower Color.

Home Games has developed three products in particular to optimize mobile game creation. Homa Lab helps you learn more about the competitive landscape with market intelligence and testing tools. Homa Belly is an SDK that helps you iterate and manage your game. And Homa Data optimizes monetization using data for both in-app purchases and ads.

Third-party developers can submit their games and choose Homa Games as their publisher. Both companies agree on a revenue-sharing model.

In addition to third-party games, Homa Games has also acquired IRL Team in Toulouse and has in-house game development teams in Skopje, Lisbon and Paris. Overall, there are 80 people working for Homa Games.

Benoist Grossmann from Idinvest Partners and Jonathan Userovici from e.ventures are both joining the board of the company.

Powered by WPeMatico

SentinelOne, a late-stage security startup that helps customers make sense of security data using AI and machine learning, announced today that it is acquiring high-speed logging startup Scalyr for $155 million in stock and cash.

SentinelOne sorts through oodles of data to help customers understand their security posture, and having a tool that enables engineers to iterate rapidly in the data, and get to the root of the problem, is going to be extremely valuable for them, CEO and co-founder Tomer Weingarten explained. “We thought Scalyr would be just an amazing fit to our continued vision in how we secure data at scale for every enterprise [customer] out there,” he told me.

He said they spent a lot of time shopping for a company that could meet their unique scaling needs and when they came across Scalyr, they saw the potential pretty quickly with a company that has built a real-time data lake. “When we look at the scale of our technology, we obviously scoured the world to find the best data analytics technology out there. We [believe] we found something incredibly special when we found a platform that can ingest data, and make it accessible in real time,” Weingarten explained.

He believes the real time element is a game changer because it enables customers to prevent breaches, rather than just reacting to them. “If you’re thinking about mitigating attacks or reacting to attacks, if you can do that in real time and you can process data in real time, and find the anomalies in real time and then meet them, you’re turning into a system that can actually deflect the attacks and not just see them and react to them,” he explained.

The company sees Scalyr as a product they can integrate into the platform, but also one which will remain a standalone. That means existing customers should be able to continue using Scalyr as before, while benefiting from having a larger company contributing to its R&D.

While SentinelOne is not a public company, it is a pretty substantial private one, having raised over $695 million, according to Crunchbase data. The company’s most recent funding round came last November, a $267 million investment with a $3.1 billion valuation.

As for Scalyr, it was launched in 2011 by Steve Newman, who first built a word processor called Writely and sold it to Google in 2006. It was actually the basis for what became Google Docs. Newman stuck around and started building the infrastructure to scale Google Docs, and he used that experience and knowledge to build Scalyr. The startup raised $27 million along the way, according to Crunchbase data, including a $20 million Series A investment in 2017.

The deal will close this quarter, at which time Scalyr’s 45 employees will join SentinelOne.

Powered by WPeMatico

Late Friday, Oscar Health filed to go public, adding another company to today’s burgeoning IPO market. The New York-based health insurance unicorn has raised well north of $1 billion during its life, making its public debut a critical event for a host of investors.

Oscar Health lists a placeholder raise value of $100 million in its IPO filing, providing only directional guidance that its public offering will raise nine figures of capital.

Both Oscar and the high-profile SPAC for Clover Medical will prove to be a test for the venture capital industry’s faith in their ability to disrupt traditional healthcare companies.

The eight-year-old company, launched to capitalize on the sweeping health insurance reforms passed under the administration of President Barack Obama offers insurance products to individuals, families and small businesses. The company claimed 529,000 “members” as of January 31, 2021. Oscar Health touts that number as indicative of its success, with its growth since January 31 2017 “representing a compound annual growth rate, or CAGR, of 59%.”

However, while Oscar has shown a strong ability to raise private funds and scale the revenues of its neoinsurance business, like many insurance-focused startups that TechCrunch has covered in recent years, it’s a deeply unprofitable enterprise.

To understand Oscar Health we have to dig a bit into insurance terminology, but it’ll be as painless as we can manage. So, how did the company perform in 2020? Here are its 2020 metrics, and their 2019 comps:

Let’s walk through the numbers together. Oscar Health did a great job raising its total premium volume in 2020, or, in simpler terms, it sold way more insurance last year than it did in 2019. But it also ceded a lot more premium to reinsurance companies in 2020 than it did in 2019. So what? Ceding premiums is contra-revenue, but can serve to boost overall insurance margins.

As we can see in the net premium earned line, Oscar’s totals fell in 2020 compared to 2019 thanks to greatly expanded premium ceding. Indeed, its total revenue fell in 2020 compared to 2019 thanks to that effort. But the premium ceding seems to be working for the company, as its total insurance costs (our addition of its claims line item and “other insurance costs” category) fell from 2020 to 2019, despite selling far more insurance last year.

Sadly, all that work did not mean that the company’s total operating expenses fell. They did not, rising 16% or so in 2020 compared to 2019. And as we all know, more operating costs and fewer revenues mean that operating losses rose, and they did.

Oscar Health’s net losses track closely to its operating losses, so we spared you more data. Now to better understand the basic economics of Oscar Health’s insurance business, let’s get our hands dirty.

Powered by WPeMatico

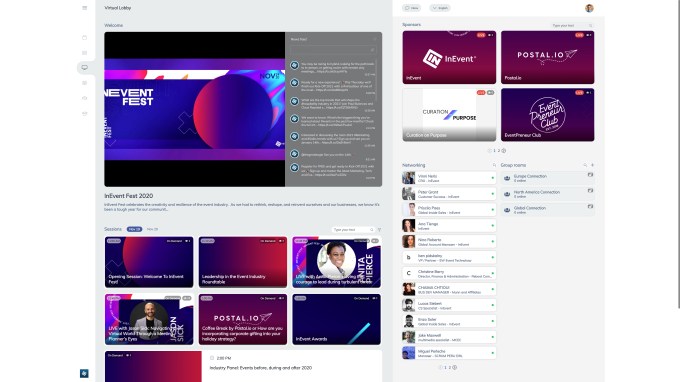

InEvent, a startup powering virtual and hybrid events, is announcing that it has raised $2 million in seed funding from Storm Ventures.

That’s just a tiny fraction of the $125 million that online events platform Hopin raised last fall — in fact, a recent Equity episode suggested that Hopin might be the fastest growth story of the current startup era.

CEO Pedro Góes told me that even in a world of more established and better-funded platforms, his team sees an opportunity to break out by focusing on business-to-business events.

“There’s an opening in the space for us to be the leader that we want on B2B,” Góes said. “We don’t intend to compete with platforms in the B2C market.”

Put another way, InEvent is less focused on replicating giant consumer events and more on helping businesses hold virtual events where they can connect with clients and partners. Góes said this is something that he and his co-founders Mauricio Giordano and Vinicius Neris saw in their previous work running a digital agency, where they were often asked to help with events in this vein.

“Since we had a lot of experience with events, we could see where the industry was broken and how to fix it,” he said.

Image Credits: InEvent

Góes suggested that two of the big needs for B2B events are customization and support, so InEvent has created what he described as a “really beautiful” product that can still be customized with the organizer’s branding, and the company also offers 24-hour support.

The platform is a virtual lobby where participants can browse all the programming, a video player, a registration system, the ability to create a conference mobile app and more. Góes said the goal was to build something that was “really flexible,” allowing organizers to run everything from within InEvent while also allowing them to incorporate outside tools, whether that’s video platforms like Zoom or CRM software like Salesforce, Marketo and HubSpot.

InEvent’s founders are from Brazil, but the startup is headquartered in Atlanta and has employees in 13 countries. It says it’s been used by more than 500 customers for global events, including DowDupont, Coca-Cola and Santander.

With the new funding, Góes told me the startup will be able to expand the team (he was proud to note the team’s diversity — 50% of its managers are women, and 50% of its managers come from a Latinx background). It also will continue to develop the product, for example by improving the video player and adding more marketing automation.

And when the pandemic ends and large-scale, in-person conferences become possible again, Góes predicts there will still be plenty of appetite for what InEvent can do, because more events will bring online and in-person elements together.

“We have different clients where we have a website, we have a mobile app, but we also have hardware [to] connect with in-person,” he said. After all, if you’re at a sprawling conference like CES, it might still be convenient to chat with another attendee through the mobile app, rather than traveling two miles to see them face-to-face. “For us, what we are building, the technology for virtual and in-person, is the same thing.”

Powered by WPeMatico

The IPO frenzy is not letting up, Bumble informed the world this morning.

Per a new SEC filing, the dating company raised its target IPO price range, indicating that its previous attempt to quantify its per-share value was an undershoot. This means we’ll need to calculate a host of new valuations and revenue multiples for the company.

But more than that, we have a question to answer: Is Bumble aiming for a Match.com price, despite not being as profitable as its already-public rival? The last time we covered the pair, Bumble’s implied revenue multiples were discounted compared to Match, but with this new price, has the smaller company gained ground?

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

And if so, does it mean that we’re seeing more public market enthusiasm for private companies? We’ll find out.

When it comes to the frenetic demand for IPO shares from public investors, I am reminded of a particular Dilbert. In this particular strip, Wally gets fired and is then hired back as a consultant. People outside the company appear smarter, he said, so he’s now back and getting paid more money than before.

This, but for private companies going public. Some companies appear to have huge promise while private, only to fizzle slowly while public. Or they manage huge price gains during their IPO process, only to cede those wins after they have a few trading months under their belt.

Is that what’s going to happen with Bumble?

Bumble targeted a $28 to $30 per-share IPO price when it first set a range, implying a greater than $1 billion raise. Now the company is selling more shares at an even higher price. From 34.5 million shares to 45 million, and at a new $37 to $39 per share price range, Bumble could raise $1.66 billion to $1.76 billion in its IPO.

And that’s not counting its underwriters’ option of 6.75 million shares, which might bring its total raise to $2.02 billion at the top end of its new pricing interval.

What is Bumble worth at those new prices? Using its simple, shares-outstanding post-IPO count of 112,745,301 — inclusive of its underwriters’ option — the company would be worth $4.17 billion to $4.4 billion.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and myself here — and be sure to check out last week’s main ep that dug into Robinhood, Miami and a host of other topics.

This morning we had a pile of news to get through. Here’s the rundown:

Equity drops every Monday at 7:00 a.m. PST and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Getaway CEO Jon Staff said that while the startup’s offerings weren’t designed with a pandemic in mind, they turned out to be well-suited for a time when people were eager to find safe ways to get off Zoom and out of their homes.

Founded in 2015, Getaway builds “Outposts” — collections of tiny cabins in rustic locations within a two-hour drive of major cities like Atlanta, Austin, Los Angeles and New York. Those cabins sound perfect for socially distanced retreats, with guests checking themselves in, each cabin built with its own fire pit and spaced 50 to 150 feet from the others, with no common areas.

Staff told me that rather than promoting traditional tourist activities, Getaway emphasizes disconnecting from all the stresses and distractions of modern life. So its cabins don’t include Wi-Fi, and they also have lockboxes where visitors can hide their phones for the duration of their visits.

“We try to get you to do nothing, quite literally,” he said. “How few moments are there in life when you really have enough free time that you could do nothing? And if not nothing, have a deep conversation with your partner, or take the time to cook a good meal and really enjoy the experience with people who are there sitting next to the campfire with you?”

Staff acknowledged that some investors were skeptical about Getaway’s insistence on building the cabins and Outposts itself. He recalled talking to tech-focused venture capitalists who would ask, “Why isn’t this a platform? Why isn’t it going to be worth $1 billon a year from now?” while potential investors from the real estate world would want to know, “How tall of a skyscraper do you want to build?”

“For a while, I had this anxiety that we don’t fit in any box,” he said. “But I learned to appreciate the benefits of not fitting in any box — that’s where innovation really lies.”

Image Credits: Getaway

And the Getaway approach seemed to resonate in 2020, with bookings increasing 150% year-over-year and the startup’s Outposts operating at nearly 100% occupancy. Today it’s announcing that it has raised $41.7 million in Series C funding — first revealed in a regulatory filing and led by travel and hospitality-focused firm Certares.

Getaway plans to use the funding to expand to at least 17 Outposts this year, up from 12 in 2020 and nine in 2019. The startup has now raised more than $81 million in total funding, according to Crunchbase.

Staff said that eventually, Getaway could also add other products and services, because, “The brand is not about tiny houses or tiny cabins, the brand is about [the fact that] the world is too noisy and too connected over the long haul. Getaway could be doing other things to solve that problem.”

At the same time, he said it’s crucial to remain clear and focused on the experience that Getaway wants to provide.

“We always try to remind ourselves that we are not creating the experience at Getaway,” he said. “You’re creating the experience and, if we’re doing it well, we’re facilitating it, we’re giving you everything you need and nothing you don’t … There’s a lot of freedom to make of it what you want as the guest, but there are also boundaries.”

For example, Staff said that there have been requests to offer Getaway Outposts for work retreats, but that’s not what they’re designed for: “We’re not going to police it, but we’re not going to put in Wi-Fi.”

Powered by WPeMatico

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. Want it in your inbox every Saturday morning? Sign up here.

Ready? Let’s talk money, startups and spicy IPO rumors.

It’s been a bizarre few weeks, with Robinhood raising a torrent of new funds to keep its zero-cost trading model afloat during turbulent market conditions, other neo-trading houses changing up their business model and more. But amidst all the moves in startup-land, something has been itching in the back of my head: Why are several rich people pumping crappy assets?

It’s fine for a retail investor to share trading ideas amongst themselves; it has happened, will happen, and will always happen. But we’ve seen folks like Elon Musk and Chamath Palihapitiya use their broad market imprint to encourage regular folks — directly and indirectly — to buy into some pretty silly trades that could lose the retail crowd lots of money that they may not be able to afford.

Think of Elon coming back to Twitter to pump Doge, a joke of a cryptocurrency that is highly volatile and mostly useless. Or Chamath putting money into GameStop publicly, a move that he is better equipped than most to get into and out of. Which he did. And made money. Most folks that played the GameStop casino have not been as lucky, and many have lost more than they can afford.

Caveat emptor and all that, but I do not love folks with savvy and capital leading regular people into risky trades or into assets that are not backed by long-term fundamentals, but instead a small shot at near-term returns. Yoof.

Finally, keeping up the theme of general annoyance, Senator Hawley is back in the news this week with an attention-focused announcement of an idea to block big tech companies from buying smaller companies. As you would expect from the insurrection-friendly Senator, it’s not an incredibly serious proposal, and it’s written so vaguely as to be nearly humorous.

But as I wrote here on my personal blog about all of this, what does matter out of the generally irksome pol is that there is bipartisan interest in limiting the ability of big tech companies to buy smaller companies. For startups, that is not good news; M&A exits are critical liquidity events for startups, and big companies have the most money.

It’s no sauté of my onions if startup valuations fall, but I think there’s been plenty of attention noting that some Democrats and some Republicans in the U.S want to undercut top-down tech M&A, and not nearly enough notice concerning what the effort might do to startup valuations and funding. And if those metrics dip, there could be fewer upstarts in the market actually working to take on the giants.

Food for thought.

The Exchange caught up once again with Unity CFO Kim Jabal. We did so not merely to make jokes with her about games that we like or don’t like, but to keep tabs on how Jabal thinks as the financial head of a company that was private when she joined, and public now. A few observations:

And speaking of startups, let’s talk about a company that I’ve had my eye on that recently raised more capital: Deepgram. I covered the company’s Series A, a $12 million round in March 2020. Now it has raised $25 million more, led by Tiger, so this is a fun case of big money investing early-stage, I think. Regardless, Deepgram was a bet on a particular model for speech recognition, and, then, its market. its new investment implies that both wagers came out the right way up.

And I was chatting with the CEO of Databricks recently (more here on its latest megaround), who mentioned the huge gains made in AI, and more specifically around generative adversarial networks (GANs) NLP, and more. Our read is that we should expect to see more Deepgram-ish rounds in the future as AI and similar methods of approaching data make their way into workflows.

And fintech player Payoneer is going public. Via a SPAC. You can read the investor presentation here. Payoneer is not a pre-revenue firm going out via a blank check; it did an expected $346 million in 2020 rev. I’m bringing it to you for two reasons. One, read the deck, and then ask yourself why all SPAC decks are so ugly. I don’t get it. And then ask yourself why isn’t it pursuing a traditional IPO? Numbers are on pages 32 and 40. I can’t figure it out. Let me know if you have a take. Best response gets Elon’s dogecoin.

Wrapping up this week, TechCrunch has a new newsletter coming out on apps that is going to rule. Sarah Perez is writing it. You can sign up here, it’s free!

And if you need a new tune, you could do worse than this one. Have a great weekend!

Powered by WPeMatico